|

When separate reports are telling different stories about the economy, it may well suggest that the truth lies somewhere in the middle. Conflicting signals during a time of slow growth should not be a surprise, in contrast to times of sharp growth or sharp contraction when all the differing economic data point in the same direction. We'll explore some of the contrasts playing out on the economic calendar right now in a holiday shortened week that was dominated by US news. But first we'll start with China.

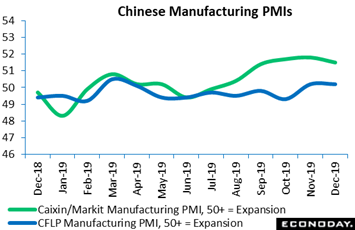

Each and every month, the global calendar opens with two separate Chinese reports on manufacturing activity for the month just ended: Markit Economics' Caixin PMI and China's official CFLP (China Federation of Logistics and Purchasing). Unlike the US and its rival manufacturing PMIs, these two indexes, though diverging over the degree of growth, are at least telling roughly the same story, and that is steady improvement. The Caixin PMI eased very slightly from 51.8 in November, its best rate of plus-50 growth since December 2016, to 51.5 in December. The marginal dip reflected slightly slower growth rates for output, new orders, and new export orders. Respondents also reported that payrolls were broadly stable as was confidence about the 12-month outlook. The survey indicated that price pressures remained weak, with input costs reported to have risen only slightly and selling prices only modestly. This theme of slight slowing was broadly in line with the official CFLP manufacturing PMI that showed its headline index unchanged at 50.2 in December, and just barely holding over breakeven 50. Reports out of China, and especially these, will be interesting to watch in the months ahead for indications on the impact of easing trade tensions with the US and also any tangible impact from the People's Bank of China move at midweek to lower bank reserve requirements by 50 basis points, in the Chinese government's latest move to stimulate demand. Each and every month, the global calendar opens with two separate Chinese reports on manufacturing activity for the month just ended: Markit Economics' Caixin PMI and China's official CFLP (China Federation of Logistics and Purchasing). Unlike the US and its rival manufacturing PMIs, these two indexes, though diverging over the degree of growth, are at least telling roughly the same story, and that is steady improvement. The Caixin PMI eased very slightly from 51.8 in November, its best rate of plus-50 growth since December 2016, to 51.5 in December. The marginal dip reflected slightly slower growth rates for output, new orders, and new export orders. Respondents also reported that payrolls were broadly stable as was confidence about the 12-month outlook. The survey indicated that price pressures remained weak, with input costs reported to have risen only slightly and selling prices only modestly. This theme of slight slowing was broadly in line with the official CFLP manufacturing PMI that showed its headline index unchanged at 50.2 in December, and just barely holding over breakeven 50. Reports out of China, and especially these, will be interesting to watch in the months ahead for indications on the impact of easing trade tensions with the US and also any tangible impact from the People's Bank of China move at midweek to lower bank reserve requirements by 50 basis points, in the Chinese government's latest move to stimulate demand.

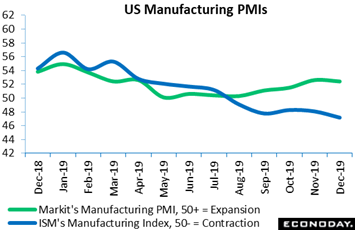

US economic policy has also been stimulative, whether heavy spending by federal as well as state and local governments or the Federal Reserve's three rate cuts in the second half of last year. Though all this stimulus may be increasing expectations among economists for manufacturing improvement, one report, perhaps the most closely tracked of any manufacturing report whether anecdotal or definitive, has remained in the dumps. The ISM (Institute For Supply Management) came in well below Econoday's consensus forecasts which were nearly all calling for improvement in December, that is an easing rate of monthly contraction for this sample. Yet against November's disappointing 48.1, December managed only 47.2 (blue line). This compares with a median forecast of 49.1 and was the sixth straight month that the ISM has missed Econoday's consensus. In contrast, Markit Economics' PMI (green line) has been slowly posting faster rates of growth, at a welcome 52.4 in its December report that, however, is overshadowed by the long established ISM. US economic policy has also been stimulative, whether heavy spending by federal as well as state and local governments or the Federal Reserve's three rate cuts in the second half of last year. Though all this stimulus may be increasing expectations among economists for manufacturing improvement, one report, perhaps the most closely tracked of any manufacturing report whether anecdotal or definitive, has remained in the dumps. The ISM (Institute For Supply Management) came in well below Econoday's consensus forecasts which were nearly all calling for improvement in December, that is an easing rate of monthly contraction for this sample. Yet against November's disappointing 48.1, December managed only 47.2 (blue line). This compares with a median forecast of 49.1 and was the sixth straight month that the ISM has missed Econoday's consensus. In contrast, Markit Economics' PMI (green line) has been slowly posting faster rates of growth, at a welcome 52.4 in its December report that, however, is overshadowed by the long established ISM.

Yet the weakness for ISM's December report should have been less of a surprise, telegraphed in November as it was by both new orders which fell to 47.2 and backlog orders down at 43.0. Judging by December's results for these two key readings – 46.8 and 43.3 – January's report this time next month doesn't look very promising. A big headline from ISM's report was employment which fell 1.5 points to a deep sub-50 low of 45.1 that indicates ISM's sample, for a fifth month in a row, continued to cut their staffs. Contraction in production, down nearly 6 points to 43.2 and another deep low, underscores the lack of urgency for new hiring.

Turning back to ISM orders, weakness in exports was 2019's unwelcome theme for the US manufacturing sector as a whole and the new export reading in this report, at 47.3 and a 6 tenths decline into deeper contraction territory, perhaps best sums up the month's results. For Federal Reserve officials, who are focused on the health of US manufacturing and who often cite the ISM by name, the latest results will, for now, likely tilt their policy bias, however long range and however much at the margin, away from neutral and toward another rate cut.

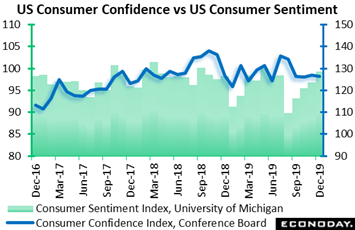

Like ISM and Markit in the US, rival reports on the US consumer are also telling different stories. The consumer confidence index, published by the Conference Board, has been flat (blue line) for the last four months while the University of Michigan's consumer sentiment index has been climbing (green columns). The confidence index, at 126.5 in December, came in near the lower end of Econoday's consensus range. For holiday spending, the results do not point to accelerating consumer enthusiasm nor do they hint at much upside surprise for December retail sales. For economists forecasting December's payroll growth and unemployment rate, the Conference Board's results, which in contrast to the consumer sentiment report are weighted toward job assessments, point mostly to moderation. Like ISM and Markit in the US, rival reports on the US consumer are also telling different stories. The consumer confidence index, published by the Conference Board, has been flat (blue line) for the last four months while the University of Michigan's consumer sentiment index has been climbing (green columns). The confidence index, at 126.5 in December, came in near the lower end of Econoday's consensus range. For holiday spending, the results do not point to accelerating consumer enthusiasm nor do they hint at much upside surprise for December retail sales. For economists forecasting December's payroll growth and unemployment rate, the Conference Board's results, which in contrast to the consumer sentiment report are weighted toward job assessments, point mostly to moderation.

The most watched detail in the Conference Board's confidence data is jobs-hard-to-get which rose 7 tenths to 13.1 percent and hints at a little less strength in the jobs market. A counter signal, however, is a 3 percentage point rise in those saying jobs are plentiful to a very healthy 47.0 percent. But the outlook for jobs slipped back, with fewer saying there will be more jobs six months out (15.3 versus 16.5 percent) and more saying there will be fewer (14.9 versus 13.4 percent). This lack of building optimism is underscored by income expectations where, in another unfavorable clue for shopping enthusiasm, fewer see their income rising (21.1 versus 22.9 percent) and more see their income falling (7.7 versus 6.2 percent).

Income expectations, especially those in the higher brackets, are tied not only to the jobs market but also to the stock market and here, despite the market's rally into year-end, optimism is less strong than in November: bulls slipped (37.7 versus 39.8 percent) and bears gained (29.0 versus 26.3 percent). A general indication that spirits are contained is falling inflation expectations, down 1 tenth in December to 4.4 percent which for this particular reading in this particular report is very low, the lowest since February. Federal Reserve officials who are looking to give inflation a boost will take note of this, as well as similar indications of sagging inflation expectations in the University of Michigan's report, both of which, at the margin, tilt the chances toward a rate cut versus a rate hike. The confidence report hit peaks during the summer, at index levels of 135.8 in July and 134.2 in August, and then, reacting apparently at the time to what were building trade tensions, flattened out and has stayed flat since, this despite easing trade tensions and high levels of employment. For the consumer sentiment index, it has moved from just below 90 back in August to end the year just below 100.

A very clear signal in the week came from an area of traditional concern: US net exports. After sharp improvement in October and now another month of sharp improvement in November, goods trade is set to add significantly to fourth-quarter GDP. The US goods deficit in November came in at a three-year low of $63.2 billion and far better than Econoday's consensus for $69.5 billion, reflecting both a sizable 0.7 percent monthly gain in exports and a 1.3 percent decline in imports. November exports showed wide gains including autos (up 3.4 percent), consumer goods (up 2.6 percent), capital goods (up 1.3 percent) and also foods, feeds & beverages (up 2.0 percent) which of course is a closely watched category at the center of US trade negotiations. The decline in imports reflected declines in consumer goods (down 2.2 percent), capital goods (down 2.0 percent), industrial supplies (down 1.5 percent), and also food, feeds & beverages (down 1.3 percent). Imports of autos, however, rose 3.7 percent in November though were down 5.9 percent from November last year which compares with a 5.6 percent overall decline in year-on-year imports. Yearly exports, despite November's improvement, were nevertheless down 1.5 percent in a reminder of the yearlong contraction underway in US cross-border goods trade. Yet November and October mark substantial improvement in exports relative to imports and will be big positives for fourth-quarter GDP. Country data are not available in the advance report but will be posted with the full international trade report on Tuesday, January 7. A very clear signal in the week came from an area of traditional concern: US net exports. After sharp improvement in October and now another month of sharp improvement in November, goods trade is set to add significantly to fourth-quarter GDP. The US goods deficit in November came in at a three-year low of $63.2 billion and far better than Econoday's consensus for $69.5 billion, reflecting both a sizable 0.7 percent monthly gain in exports and a 1.3 percent decline in imports. November exports showed wide gains including autos (up 3.4 percent), consumer goods (up 2.6 percent), capital goods (up 1.3 percent) and also foods, feeds & beverages (up 2.0 percent) which of course is a closely watched category at the center of US trade negotiations. The decline in imports reflected declines in consumer goods (down 2.2 percent), capital goods (down 2.0 percent), industrial supplies (down 1.5 percent), and also food, feeds & beverages (down 1.3 percent). Imports of autos, however, rose 3.7 percent in November though were down 5.9 percent from November last year which compares with a 5.6 percent overall decline in year-on-year imports. Yearly exports, despite November's improvement, were nevertheless down 1.5 percent in a reminder of the yearlong contraction underway in US cross-border goods trade. Yet November and October mark substantial improvement in exports relative to imports and will be big positives for fourth-quarter GDP. Country data are not available in the advance report but will be posted with the full international trade report on Tuesday, January 7.

Trade is not only trying to steady itself in the US but also in economies across Asia, especially Hong Kong where improvement was also November's theme. Hong Kong's merchandise trade deficit narrowed from HK$30.6 billion in October to HK$26.2 billion in November. Exports did fall 1.4 percent on the year but this was an improvement from a 9.2 percent drop in October. Imports fell 5.8 percent after an October decrease of 11.5 percent. The improvement in headline exports growth was largely driven by a rebound in demand from mainland China, with exports to that market up 5.2 percent on the year in November after falling 7.3 percent in October. Officials, however, noted that stronger yearly growth in exports to China was largely driven by base effects, with exports at a low level 12 months earlier. Exports to other major markets, including Japan and the US, were again weak in November. Trade is not only trying to steady itself in the US but also in economies across Asia, especially Hong Kong where improvement was also November's theme. Hong Kong's merchandise trade deficit narrowed from HK$30.6 billion in October to HK$26.2 billion in November. Exports did fall 1.4 percent on the year but this was an improvement from a 9.2 percent drop in October. Imports fell 5.8 percent after an October decrease of 11.5 percent. The improvement in headline exports growth was largely driven by a rebound in demand from mainland China, with exports to that market up 5.2 percent on the year in November after falling 7.3 percent in October. Officials, however, noted that stronger yearly growth in exports to China was largely driven by base effects, with exports at a low level 12 months earlier. Exports to other major markets, including Japan and the US, were again weak in November.

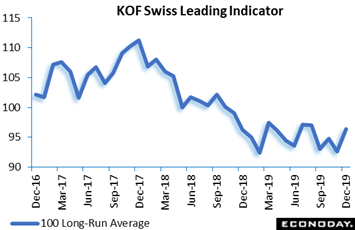

A consistent theme among all global economic data, whether from the US or Hong Kong or Switzerland, is a falloff in growth rates over the past year, sometimes falling below zero and sometimes holding just above. For the KOF Swiss leading indicator the long-term level of 100 remains a line to high, at least by a bit. The index posted a sharp 3.8 point rise to 96.4 in December and, though December's reading was the best since April last year, it was still well short of the 100 line and so only indicative of continued below trend growth over the coming months. The improvement was largely attributable to manufacturing with notable gains posted by the electrical, paper and printing and metal and wood industries. Elsewhere, foreign demand made a useful positive contribution and there were smaller advances in other services as well as private consumption. December's report points to some improvement in economic momentum going into the new year but not much more than that. A consistent theme among all global economic data, whether from the US or Hong Kong or Switzerland, is a falloff in growth rates over the past year, sometimes falling below zero and sometimes holding just above. For the KOF Swiss leading indicator the long-term level of 100 remains a line to high, at least by a bit. The index posted a sharp 3.8 point rise to 96.4 in December and, though December's reading was the best since April last year, it was still well short of the 100 line and so only indicative of continued below trend growth over the coming months. The improvement was largely attributable to manufacturing with notable gains posted by the electrical, paper and printing and metal and wood industries. Elsewhere, foreign demand made a useful positive contribution and there were smaller advances in other services as well as private consumption. December's report points to some improvement in economic momentum going into the new year but not much more than that.

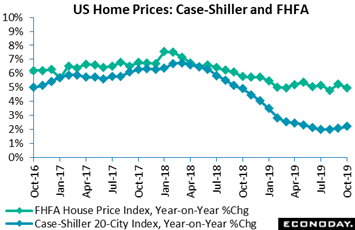

There was far more economic data out of the US in the week than any place on the global calendar, which is no surprise from a culture where business is king and vacations are short. One big positive factor for the 2020 US economy looks to be a major pick up for the housing sector, specifically new home activity going into the new year. Yet the resale market has failed to respond so far, and lack of punch for resales was evident in two house price indexes: Case-Shiller (blue line) and FHFA (green line). Case-Shiller came in modest to moderate as expected, rising a monthly 0.4 percent in October on an adjusted monthly basis which hit Econoday's consensus. Year-on-year growth of 2.2 percent, as tracked in the graph, has been flat for a long time, slowing through the early part of last year then flattening near the 2 percent level beginning at mid-year. FHFA's index was likewise tame, rising only 0.2 percent in October to come in at the lower end of Econoday's consensus range. Year-on-year price growth, at 5.0 percent, edged 1 tenth lower from September and like Case-Shiller has been flat. Though FHFA's index skirted the 5 percent growth line throughout last year the outlook for this year, given not only gains underway in new home sales but also favorable mortgage rates and a strong jobs market as well as easy comparisons, do point to improvement. There was far more economic data out of the US in the week than any place on the global calendar, which is no surprise from a culture where business is king and vacations are short. One big positive factor for the 2020 US economy looks to be a major pick up for the housing sector, specifically new home activity going into the new year. Yet the resale market has failed to respond so far, and lack of punch for resales was evident in two house price indexes: Case-Shiller (blue line) and FHFA (green line). Case-Shiller came in modest to moderate as expected, rising a monthly 0.4 percent in October on an adjusted monthly basis which hit Econoday's consensus. Year-on-year growth of 2.2 percent, as tracked in the graph, has been flat for a long time, slowing through the early part of last year then flattening near the 2 percent level beginning at mid-year. FHFA's index was likewise tame, rising only 0.2 percent in October to come in at the lower end of Econoday's consensus range. Year-on-year price growth, at 5.0 percent, edged 1 tenth lower from September and like Case-Shiller has been flat. Though FHFA's index skirted the 5 percent growth line throughout last year the outlook for this year, given not only gains underway in new home sales but also favorable mortgage rates and a strong jobs market as well as easy comparisons, do point to improvement.

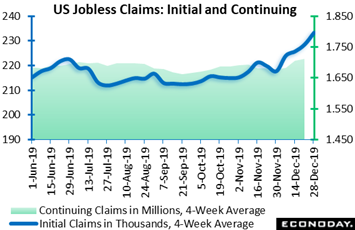

However positive the outlook for US housing may be, the outlook for US employment, as underscored in the consumer confidence report, seems less certain. Job growth remained solid through 2019, especially at year end, yet initial jobless claims, which are key indications setting up expectations for monthly employment data, may now be pointing to slowing. Initial jobless claims held little changed in December 28 week at 222,000 though the 4-week average, as tracked in the blue line and reflecting prior increases, did rise a noticeable 4,750 to a 233,250 level. This is a two-year high and is nearly 15,000 above the level of late November. Continuing claims (green columns), where data lag by a week, rose 5,000 to 1.728 million with this 4-week average also on the climb, up 7,250 to 1.712 million. The unemployment rate for insured workers, despite the increases, remained unchanged at 1.2 percent. Claims results have likely held back expectations for the December employment report where Econoday's consensus for nonfarm payroll growth is 160,000, a healthy rate of growth but far below November's very strong 266,000. However positive the outlook for US housing may be, the outlook for US employment, as underscored in the consumer confidence report, seems less certain. Job growth remained solid through 2019, especially at year end, yet initial jobless claims, which are key indications setting up expectations for monthly employment data, may now be pointing to slowing. Initial jobless claims held little changed in December 28 week at 222,000 though the 4-week average, as tracked in the blue line and reflecting prior increases, did rise a noticeable 4,750 to a 233,250 level. This is a two-year high and is nearly 15,000 above the level of late November. Continuing claims (green columns), where data lag by a week, rose 5,000 to 1.728 million with this 4-week average also on the climb, up 7,250 to 1.712 million. The unemployment rate for insured workers, despite the increases, remained unchanged at 1.2 percent. Claims results have likely held back expectations for the December employment report where Econoday's consensus for nonfarm payroll growth is 160,000, a healthy rate of growth but far below November's very strong 266,000.

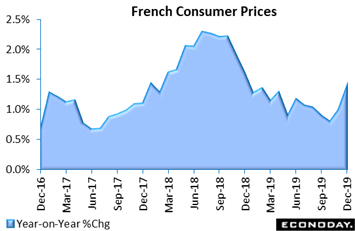

Military action in the Middle East, this time a US strike against Iran, always focuses attention on the price of oil which, in 2019, held relatively steady in the mid $60 area for Brent and the high $50 to low $60 area for West Texas Intermediate. Oil did firm going into year-end which gave a lift to consumer prices across many countries including France. Consumer prices here climbed a sizeable 0.4 percent on the month in provisional data for December. This was enough to lift annual inflation from November's 1.0 percent to 1.4 percent, its strongest mark since December 2018. France's flash HICP followed suit with a 0.5 percent monthly spurt that raised this yearly rate by also 0.4 percentage points to 1.6 percent. Military action in the Middle East, this time a US strike against Iran, always focuses attention on the price of oil which, in 2019, held relatively steady in the mid $60 area for Brent and the high $50 to low $60 area for West Texas Intermediate. Oil did firm going into year-end which gave a lift to consumer prices across many countries including France. Consumer prices here climbed a sizeable 0.4 percent on the month in provisional data for December. This was enough to lift annual inflation from November's 1.0 percent to 1.4 percent, its strongest mark since December 2018. France's flash HICP followed suit with a 0.5 percent monthly spurt that raised this yearly rate by also 0.4 percentage points to 1.6 percent.

The jump in annual CPI inflation was largely attributable to energy where the rate increased from minus 0.6 percent to 2.6 percent, alone adding nearly 0.3 percentage points. Elsewhere, food was stable (2.1 percent) while services (1.4 percent after 1.3 percent) saw a small rise and deflation in overall manufactured products (0.2 percent after 0.6 percent) eased. German consumer prices were also posted in the week and likewise showed a pop higher in December, up 4 tenths on the yearly rate to 1.5 percent. Early December inflation data point to upside risk to the full Eurozone HICP report due on Tuesday, January 7, but any increase in the underlying rate, that is excluding energy, looks likely to be small at most.

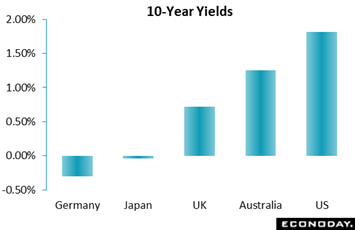

Economic growth among the major global economies moved in sync throughout 2019: strong labor markets and solid rates of consumer spending on the plus side with cross-border trade, business investment, and inflation on the weak side. This conformity in turn led to synchronized actions in monetary policy: rounds of rate cuts by several major central banks including the Federal Reserve and Reserve Bank of Australia as well as clear easing biases among others including the European Central Bank and the Bank of Japan. The relative growth among the differing economies will likely determine the relative movement among sovereign yields during 2020: weaker (stronger) growth for one economy and resulting accommodative (restrictive) policies would spell lower (higher) yields for that nation's government bonds. Should, however, 2020 prove as economically similar as 2019 – roughly uniform movements across economic factors – than spreads between differing sovereign bonds would likely hold more constant than they would vary. Fiscal policy of course is a wild card and here, in contrast to monetary policy, differing nation's are showing variation. Yet whether aggressive fiscal policy and the greater issuance of sovereign bonds would act to lift yields is, however reasonable, uncertain, at least based on the US example as a rising federal government deficit, climbing at a 30 percent clip last year, did little to push up rates. Economic growth among the major global economies moved in sync throughout 2019: strong labor markets and solid rates of consumer spending on the plus side with cross-border trade, business investment, and inflation on the weak side. This conformity in turn led to synchronized actions in monetary policy: rounds of rate cuts by several major central banks including the Federal Reserve and Reserve Bank of Australia as well as clear easing biases among others including the European Central Bank and the Bank of Japan. The relative growth among the differing economies will likely determine the relative movement among sovereign yields during 2020: weaker (stronger) growth for one economy and resulting accommodative (restrictive) policies would spell lower (higher) yields for that nation's government bonds. Should, however, 2020 prove as economically similar as 2019 – roughly uniform movements across economic factors – than spreads between differing sovereign bonds would likely hold more constant than they would vary. Fiscal policy of course is a wild card and here, in contrast to monetary policy, differing nation's are showing variation. Yet whether aggressive fiscal policy and the greater issuance of sovereign bonds would act to lift yields is, however reasonable, uncertain, at least based on the US example as a rising federal government deficit, climbing at a 30 percent clip last year, did little to push up rates.

Contrasting movements in economic data often betray less-than-robust conditions, which is a fair assessment of the global economy right now. Global manufacturing and the effects of slowing global trade are central concerns of policy makers; whether goods production improves may well determine whether 2020 will show more economic strength than 2019.

**Jeremy Hawkins and Brian Jackson contributed to this article as did Mace News

The big market mover of the week comes on Friday, January 10: the monthly employment report from the US. November's employment report was unusually strong and the expectation for December is less strength but at a still sound level of growth, one that would not be soft enough to tilt expectations any further toward a Federal Reserve rate cut. Early in the week a focus will be the Eurozone's HICP Flash for December where no visible improvement, at least for the underlying rate, is expected. Retail sales and the outlook for holiday shopping results will be another theme, but the week's stream of data will be, not for December, but for November, data that will include the Eurozone on Tuesday and Australia on Friday. Cross-border trade may also make headlines, including data from both Canada and the US on Tuesday.

Swiss CPI for December (Tue 07:30 GMT; Tue 08:30 CET; Tue 02:30 EST)

Consensus Forecast, Month-to-Month: -0.1%

Consensus Forecast, Year-over-Year: 0.0%

The CPI for December is expected to slip a monthly 0.1 percent and match a 0.1 percent decline in November. Year-over-year, the CPI is expected to come in unchanged versus November's minus 0.1 percent.

Eurozone HICP Flash for December (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Year-over-Year: 1.3%

Eurozone Underlying HICP Flash

Consensus Forecast, Year-over-Year: 1.3%

Overall Eurozone inflation is expected to move higher in December, to a year-on-year consensus of 1.3 percent versus 1.0 percent in November. November's key (narrow) core rate is also expected to come in at 1.3 percent which, however, would be unchanged versus November's 1.3 percent.

Eurozone Retail Sales for November (Tue 10:00 GMT; Tue 05:00 EST)

Consensus Forecast, Month-to-Month: 0.6%

Consensus Forecast, Year-over-Year: 1.5%

Eurozone retail sales in October came in much lower than expected with weakness centered in non-foods. For November, forecasters are calling for a 0.6 percent monthly increase versus October's 0.6 percent decline. Year-on-year the call is plus 1.5 percent which would compare with 1.4 percent growth in October.

Canadian Merchandise Trade for November (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast: -C$1.1 billion

A C$1.1 billion deficit is expected for Canadian merchandise trade in November which would match a deeper-than-expected C$1.1 billion deficit in October. Both sides of the ledger did show yearly growth in October, at 0.6 percent for imports but only 0.1 percent for exports.

US International Trade Balance for November (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast: -$43.9 billion

Sharp narrowing is the call for November's international trade deficit, at a consensus $43.9 billion versus $47.2 billion in October. Advance data for the goods portion of November's report showed a deficit of versus $63.2 billion versus $66.8 billion in October. Though goods exports did improve in November, year-on-year exports as well as year-on-year imports have been in contraction for most of the past year.

US ISM Non-Manufacturing Index for December (Tue 15:00 GMT; Tue 10:00 EST)

Consensus Forecast: 54.5

Consensus Range: 53.0 to 55.0

ISM's non-manufacturing has been on a slowing trend though November's report showed solid improvement for both new orders and also employment. Forecasters see December's index coming in 54.5 at versus November's 53.9.

German Manufacturers' Orders for November (Wed 07:00 GMT; Wed 08:00 CET; Wed 02:00 EST)

Consensus Forecast, Month-to-Month: 0.2%

Orders have been on a long decline for German manufacturers and were particularly disappointing in October, falling 0.4 percent on the month and 5.7 percent year-on-year. The monthly consensus for November is an increase of 0.2 percent.

Eurozone: EC Economic Sentiment for December (Wed 10:00 GMT; Wed 11:00 CET; Wed 05:00 EST)

Consensus Forecast: 101.4

After an especially poor showing in October, the European Commission's economic sentiment index beat expectations in November with a 5 tenths rise to 101.3. For December, the consensus is a steady showing at 101.4.

UK Halifax HPI for December (Wed 08:30 GMT; Wed 03:30 EST)

Consensus Forecast, Month-to-Month: -0.2%

Consensus Forecast, Year-over-Year: 1.6%

A 0.2 percent monthly decrease for year-on-year appreciation of 1.6 percent are the expectations for the Halifax house price index in December, which would compare with November's 1.0 percent monthly increase and yearly growth rate of 2.1 percent.

Thu Jan 09 07:00

German Industrial Production for November (Thu 07:00 GMT; Thu 08:00 CET; Thu 03:00 EST)

Consensus Forecast, Month-to-Month: 0.7%

Significant improvement is expected for industrial production in November, at a consensus monthly increase of 0.7 percent versus October's 1.7 percent decline. Year-on-year, German production was down 5.3 percent in October for a 12th straight month of contraction.

Australian Retail Sales for October (Fri 00:30 GMT; Fri 11:30 AEDT; Thu 19:30 EST)

Consensus Forecast, Month-to-Month: 0.3%

Retail sales in Australia are expected to increase 0.3 percent on the month in November following a lower-than-expected no change in October. Year-on-year growth in October was 2.7 percent.

US Employment Report for November (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Nonfarm Payrolls Change: 160,000

Consensus Forecast: Unemployment Rate: 3.5%

Consensus Forecast: Average Hourly Earnings M/M: 0.3%

Consensus Forecast: Average Hourly Earnings Y/Y: 3.1%

Solid but slower payroll growth is the expectation for December nonfarm payrolls, at a consensus 160,000 versus a much higher-than-expected and broad-based 266,000 increase in November. Manufacturing payrolls, after jumping 54,000 in November on the end of the GM strike, are expected to fall 1,000. The unemployment rate is expected to hold steady at 3.5 percent. Average hourly earnings are expected to rise a monthly 0.3 percent for a 3.1 percent yearly rate that would compare with November's 0.2 percent monthly and 3.1 percent yearly gains. Rounding out the consensus forecasts: private payrolls up 153,000, the workweek unchanged at 34.4 hours, and the participation rate unchanged at 63.2 percent.

|