|

The reason why many global central banks have been cutting rates and why governments have increased spending or may be planning to is because the economic strength of 2019, including inflation pressures, generally softened compared to 2018. The positive effects from 2019's rate cuts and fiscal actions are still latent and unfolding, and this requires patience for policy makers and economic observers and pushes back any immediate conclusions. Manufacturing orders remain a central weak spot of the global economy with cross-border trade, however, perhaps showing early signs of stability and possible recovery. The whole story of the week, in fact, is a mix of the good with the bad, the strong with the soft, and it's this latter side where we'll start the week's rundown.

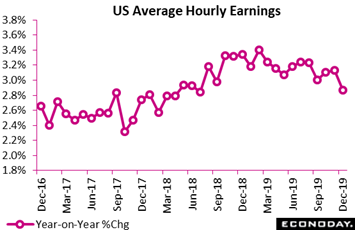

Soft but not alarming is a fair description of December's US employment report, headlined by a 145,000 rise in nonfarm payrolls that was on the low side of Econoday's consensus range. This was also the lowest total in seven months though it did follow a revised 256,000 jump in November that was the highest in 10 months. Yet a second set of headlines was perhaps even softer as average hourly earnings edged a puny 0.1 percent higher on the month for a 2.9 percent year-on-year rate; both of these readings were below the consensus range. A 0.1 percent monthly rise was last posted in April with the 2.9 percent yearly rate the lowest since July 2018. For the Federal Reserve which is trying to give inflation a lift, these results tilt policy chances away from neutral and toward a rate cut. Another soft reading in December's report was the workweek, coming in at 34.3 hours which again was below the consensus range with November revised lower and now also at 34.3 hours. These readings point to a general lack of economic punch going into year-end. Soft but not alarming is a fair description of December's US employment report, headlined by a 145,000 rise in nonfarm payrolls that was on the low side of Econoday's consensus range. This was also the lowest total in seven months though it did follow a revised 256,000 jump in November that was the highest in 10 months. Yet a second set of headlines was perhaps even softer as average hourly earnings edged a puny 0.1 percent higher on the month for a 2.9 percent year-on-year rate; both of these readings were below the consensus range. A 0.1 percent monthly rise was last posted in April with the 2.9 percent yearly rate the lowest since July 2018. For the Federal Reserve which is trying to give inflation a lift, these results tilt policy chances away from neutral and toward a rate cut. Another soft reading in December's report was the workweek, coming in at 34.3 hours which again was below the consensus range with November revised lower and now also at 34.3 hours. These readings point to a general lack of economic punch going into year-end.

Yet despite the softness and in a very important offset, the unemployment rate in the US held at an extremely low 3.5 percent which doesn't point to any slack in the labor market. But high levels of employment still have yet to trigger increasing wage pressure in what is the great puzzle of this expansion and one possibly tied, perhaps, to lack of collective power in the labor force where people are just happy to have jobs. Other readings included a 12,000 decline in manufacturing payrolls which, however, followed a 58,000 November surge tied to the end of the GM strike. Professional and business services, where payrolls had been on a sharp climb, rose only 10,000 which, like the workweek, points to overall December moderation. Two industries where payrolls rose sharply were construction, up 20,000 for a sector that is getting a boost from new home spending, and also retail which rose 41,000 in the holiday shopping month which for this sector, where payrolls have been on the decline, is a positive surprise.

The week's various data on manufacturing were generally mixed, but not the most important factor of all – new orders. Prospects for an early turnaround in German goods production took a turn for the worse in November. Although October's initial 0.4 percent monthly decline was revised sharply higher to a 0.2 percent increase, November's orders unexpectedly fell 1.3 percent versus expectations for a small gain. This put annual contraction at minus 6.5 percent and deeper than October's contraction of 5.7 percent. One sliver of good news was a much needed rise in domestic orders which were up a monthly 1.6 percent, although even this still failed to offset a 3.0 percent slump in the prior month. Foreign demand was down a monthly 3.1 percent, led by a 3.3 percent decrease with the rest of the Eurozone, which more than reversed October's 2.4 percent gain. Within total orders, intermediates advanced 0.2 percent but consumer goods were only flat and capital goods were off fully 2.1 percent. November's orders leave average total orders in October and November unchanged from their third quarter mean with November alone at the lowest level since September 2016. German manufacturing looks set to remain in recession for a while longer yet. The week's various data on manufacturing were generally mixed, but not the most important factor of all – new orders. Prospects for an early turnaround in German goods production took a turn for the worse in November. Although October's initial 0.4 percent monthly decline was revised sharply higher to a 0.2 percent increase, November's orders unexpectedly fell 1.3 percent versus expectations for a small gain. This put annual contraction at minus 6.5 percent and deeper than October's contraction of 5.7 percent. One sliver of good news was a much needed rise in domestic orders which were up a monthly 1.6 percent, although even this still failed to offset a 3.0 percent slump in the prior month. Foreign demand was down a monthly 3.1 percent, led by a 3.3 percent decrease with the rest of the Eurozone, which more than reversed October's 2.4 percent gain. Within total orders, intermediates advanced 0.2 percent but consumer goods were only flat and capital goods were off fully 2.1 percent. November's orders leave average total orders in October and November unchanged from their third quarter mean with November alone at the lowest level since September 2016. German manufacturing looks set to remain in recession for a while longer yet.

If orders are a leading indicator, industrial production is no more than a coincident indicator. And despite this second tier status, the news out of Germany, in contrast to orders, was positive in the week. Following a 1.0 percent monthly fall in October, production in November climbed 1.1 percent which was better than expected. This was also the first increase since August and only the second rise in the last six months. As a result, annual growth moved up from minus 4.7 percent to minus 2.7 percent which, however, is still not so great. The monthly gain was led by capital goods which advanced 2.4 percent and supported by consumer goods which were up 0.5 percent. However, intermediates were down 0.5 percent. Elsewhere, energy contracted 0.8 percent but construction increased 2.6 percent. Despite the surprising buoyancy of November's report, production was still at its third weakest level since December 2016. Indeed, average output in October and November was 0.6 percent below its mean level in the third quarter when it shrank 1.2 percent versus April through June. This leaves December needing a monthly increase of at least 1.4 percent (possible revisions aside) just to hold the fourth quarter flat. As such, the sector remains on course to end 2019 in technical recession. If orders are a leading indicator, industrial production is no more than a coincident indicator. And despite this second tier status, the news out of Germany, in contrast to orders, was positive in the week. Following a 1.0 percent monthly fall in October, production in November climbed 1.1 percent which was better than expected. This was also the first increase since August and only the second rise in the last six months. As a result, annual growth moved up from minus 4.7 percent to minus 2.7 percent which, however, is still not so great. The monthly gain was led by capital goods which advanced 2.4 percent and supported by consumer goods which were up 0.5 percent. However, intermediates were down 0.5 percent. Elsewhere, energy contracted 0.8 percent but construction increased 2.6 percent. Despite the surprising buoyancy of November's report, production was still at its third weakest level since December 2016. Indeed, average output in October and November was 0.6 percent below its mean level in the third quarter when it shrank 1.2 percent versus April through June. This leaves December needing a monthly increase of at least 1.4 percent (possible revisions aside) just to hold the fourth quarter flat. As such, the sector remains on course to end 2019 in technical recession.

Whether the US factory sector ended last year in recession is still playing out in the data but based on the accompanying graph, which tracks annual change in orders (dark blue) along with annual change in shipments (light blue) a negative outcome should not be a shock. Factory orders fell as expected in November, down 0.7 percent and reflecting a 2.1 percent dip in durables orders (revised from the prior week's initial 2.0 percent decline) that more than offset a 0.6 percent rise in orders for nondurable goods (which were the new data in the factory orders report). The best fundamental indication in November was only modestly so, a 0.2 percent rise in orders for core capital goods (nondefense ex-aircraft) that followed a sharp 1.0 percent rise in October but, before that, a series of weak showings including deep contraction in prior months. This reading for shipments, which will be an input into fourth-quarter business investment, was negative, falling 0.3 percent in November versus, however, a 0.7 percent rise in October. Total unfilled orders were a negative in the report, down 0.4 percent and reflecting, though only in part, a third straight 0.3 percent decline in commercial aircraft which is a category getting special attention during the grounding of the 737 Max. The US factory sector has had a tough, flat run that largely reflects slowing global demand and slowing demand for US exports. Yet international trade data in the week offered hints of improvement. Whether the US factory sector ended last year in recession is still playing out in the data but based on the accompanying graph, which tracks annual change in orders (dark blue) along with annual change in shipments (light blue) a negative outcome should not be a shock. Factory orders fell as expected in November, down 0.7 percent and reflecting a 2.1 percent dip in durables orders (revised from the prior week's initial 2.0 percent decline) that more than offset a 0.6 percent rise in orders for nondurable goods (which were the new data in the factory orders report). The best fundamental indication in November was only modestly so, a 0.2 percent rise in orders for core capital goods (nondefense ex-aircraft) that followed a sharp 1.0 percent rise in October but, before that, a series of weak showings including deep contraction in prior months. This reading for shipments, which will be an input into fourth-quarter business investment, was negative, falling 0.3 percent in November versus, however, a 0.7 percent rise in October. Total unfilled orders were a negative in the report, down 0.4 percent and reflecting, though only in part, a third straight 0.3 percent decline in commercial aircraft which is a category getting special attention during the grounding of the 737 Max. The US factory sector has had a tough, flat run that largely reflects slowing global demand and slowing demand for US exports. Yet international trade data in the week offered hints of improvement.

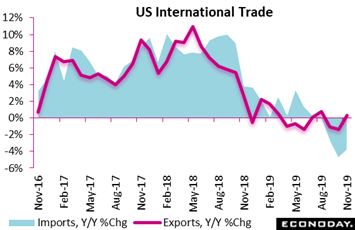

Fourth-quarter GDP in the US looks to be getting a significant lift from net exports following a surprisingly narrow $43.1 billion deficit in November and a downward revised $46.9 billion deficit in October. These are the best back-to-back showings in two years with November led by a 0.7 percent monthly rise in exports to $208.6 billion complemented by a 1.0 percent decline in imports to $251.7 billion. A special highlight for November was a sharp narrowing in the goods gap with China, which is at the center of US-China trade negotiations and which fell nearly $5 billion in the month to $25.6 billion. This is among the narrowest readings in 2-1/2 years. Exports showed wide gains including capital goods, consumer goods, autos and total services. On the import side, vehicles and services were both higher though imports of capital goods, consumer goods and industrial supplies all declined. Both exports and imports were in monthly and yearly contraction through much of last year, in line with many other economies that reflected trade tensions and slowing global growth. Yet November's US report definitely hints at improvement, especially for exports which compared to November last year were up 0.3 percent (red line in graph) versus contraction of 1.4 and 1.0 percent in the prior two months. Imports (blue area in graph) were still in contraction, down 3.8 percent from November last year in what is not good news for US trading partners. Fourth-quarter GDP in the US looks to be getting a significant lift from net exports following a surprisingly narrow $43.1 billion deficit in November and a downward revised $46.9 billion deficit in October. These are the best back-to-back showings in two years with November led by a 0.7 percent monthly rise in exports to $208.6 billion complemented by a 1.0 percent decline in imports to $251.7 billion. A special highlight for November was a sharp narrowing in the goods gap with China, which is at the center of US-China trade negotiations and which fell nearly $5 billion in the month to $25.6 billion. This is among the narrowest readings in 2-1/2 years. Exports showed wide gains including capital goods, consumer goods, autos and total services. On the import side, vehicles and services were both higher though imports of capital goods, consumer goods and industrial supplies all declined. Both exports and imports were in monthly and yearly contraction through much of last year, in line with many other economies that reflected trade tensions and slowing global growth. Yet November's US report definitely hints at improvement, especially for exports which compared to November last year were up 0.3 percent (red line in graph) versus contraction of 1.4 and 1.0 percent in the prior two months. Imports (blue area in graph) were still in contraction, down 3.8 percent from November last year in what is not good news for US trading partners.

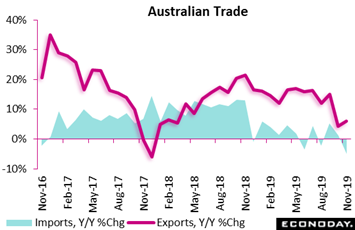

Australia is one economy where, like others, rates were cut aggressively last year but, unlike others, never really showed substantial deterioration in trade, at least in terms of export growth. Australia's trade surplus widened from A$4.1 billion in October to A$5.8 billion in November which was well above the consensus for a surplus of A$4.2 billion. Exports strengthened while imports weakened sharply. On a monthly basis, the value of exports rose 1.8 percent in November after falling 4.6 percent in October. The export rebound was largely driven by non-rural goods (around 60 percent of the total), up 2.8 percent on the month after dropping 5.2 percent previously, and services (around 20 percent of the total), which increased 1.1 percent after no change in October. Exports of rural goods (around 15 percent of the total) rose 0.2 percent on the month, slowing from growth of 3.1 percent previously. Year-on-year growth in total exports (red line in graph) picked up from an already respectable 4.2 percent in October to 6.0 percent in November. Turning to imports, they fell a monthly 2.8 percent with this yearly rate (blue area in graph) down 5.0 percent. Imports of consumption goods, capital goods, and intermediate and other merchandise goods all recorded weaker monthly growth, partly offset by a smaller decline in imports of services. Australia is one economy where, like others, rates were cut aggressively last year but, unlike others, never really showed substantial deterioration in trade, at least in terms of export growth. Australia's trade surplus widened from A$4.1 billion in October to A$5.8 billion in November which was well above the consensus for a surplus of A$4.2 billion. Exports strengthened while imports weakened sharply. On a monthly basis, the value of exports rose 1.8 percent in November after falling 4.6 percent in October. The export rebound was largely driven by non-rural goods (around 60 percent of the total), up 2.8 percent on the month after dropping 5.2 percent previously, and services (around 20 percent of the total), which increased 1.1 percent after no change in October. Exports of rural goods (around 15 percent of the total) rose 0.2 percent on the month, slowing from growth of 3.1 percent previously. Year-on-year growth in total exports (red line in graph) picked up from an already respectable 4.2 percent in October to 6.0 percent in November. Turning to imports, they fell a monthly 2.8 percent with this yearly rate (blue area in graph) down 5.0 percent. Imports of consumption goods, capital goods, and intermediate and other merchandise goods all recorded weaker monthly growth, partly offset by a smaller decline in imports of services.

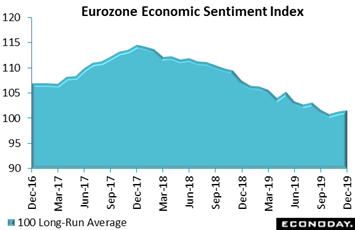

One indicator where the trend, like for trade, may be improving, at least modestly, is the EU Commission's economic sentiment index (ESI). At 101.5, the headline index in December was up 0.3 points versus November and on the firm side of market expectations. It was also the highest reading since September and made for the first back-to-back rise since November and December 2017. The latest bounce, though limited, was largely attributable to services where morale was up a solid 2.2 points at 11.4, the best result since May. Construction and retail were also positive contributors. However, confidence in industry (minus 9.3 after minus 9.1) dipped further and households (minus 8.1 after minus 7.2) were notably more cautious. Regionally, the national ESI was up in Germany (100.0 after 99.6), Italy (101.6 after 99.6) and Spain (103.3 after 101.9), but a little lower in France (103.0 after 103.2) where the national strike may be having a negative effect. Even so, for the first time since August, all of the four larger countries posted readings at least equal to their 100 common long-run average. At the same time, expected selling prices for manufacturers recorded their first increase in four months and services hit their highest level since August. Household inflation expectations were also slightly stronger. December's results were really nothing to write home about but the European Central Bank must still be pleased that one of its preferred indicators of economic activity is showing increasing signs of having bottomed out. The higher inflation figures will also be a positive for the ECB. Yet the results still lack balance and until manufacturing turns the corner, prospects for the Eurozone economy as a whole remain clouded. One indicator where the trend, like for trade, may be improving, at least modestly, is the EU Commission's economic sentiment index (ESI). At 101.5, the headline index in December was up 0.3 points versus November and on the firm side of market expectations. It was also the highest reading since September and made for the first back-to-back rise since November and December 2017. The latest bounce, though limited, was largely attributable to services where morale was up a solid 2.2 points at 11.4, the best result since May. Construction and retail were also positive contributors. However, confidence in industry (minus 9.3 after minus 9.1) dipped further and households (minus 8.1 after minus 7.2) were notably more cautious. Regionally, the national ESI was up in Germany (100.0 after 99.6), Italy (101.6 after 99.6) and Spain (103.3 after 101.9), but a little lower in France (103.0 after 103.2) where the national strike may be having a negative effect. Even so, for the first time since August, all of the four larger countries posted readings at least equal to their 100 common long-run average. At the same time, expected selling prices for manufacturers recorded their first increase in four months and services hit their highest level since August. Household inflation expectations were also slightly stronger. December's results were really nothing to write home about but the European Central Bank must still be pleased that one of its preferred indicators of economic activity is showing increasing signs of having bottomed out. The higher inflation figures will also be a positive for the ECB. Yet the results still lack balance and until manufacturing turns the corner, prospects for the Eurozone economy as a whole remain clouded.

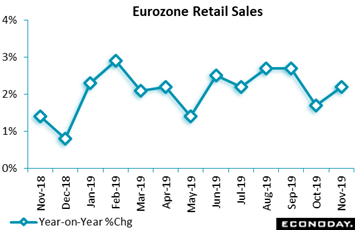

Retail sales results from December will begin to unroll in the coming week including from the UK and also the US, where a respectable showing for the latter is the expectation. Global data on November are still coming in and the general results have been flat to mixed though a bright spot was the Eurozone where volumes rose a significantly larger than expected 1.0 percent, only their second monthly increase since June. Annual growth as tracked in the graph climbed from 1.7 percent to 2.2 percent. Promisingly, the headline monthly gain was led by the non-food sector where, excluding auto fuel, demand increased a hefty 1.4 percent on the month, easily more than reversing October's 0.7 percent drop. Gains here were broad-based and included notable advances in mail order, textiles and clothing as well as electrical goods and furniture. Elsewhere, the food, drink and tobacco subsector was up 0.7 percent leaving auto fuel, at minus 1.0 percent, posting the only decline. Regionally, the monthly headline bounce was dominated by Germany where purchases expanded some 2.1 percent and so comfortably eclipsed October's 1.3 percent slump. Elsewhere, France (1.1 percent) also enjoyed a very good period as did Spain (0.7 percent). This bullish update put average Eurozone sales in October and November 0.3 percent above their mean level in the third quarter. This implies that, absent any revisions, December would need to post a monthly decline of at least 1.4 percent for the retail sector not to make a positive contribution to real GDP growth in the fourth quarter. Domestic demand, however soft manufacturing is, may have ended the year on a firmer note than expected. Retail sales results from December will begin to unroll in the coming week including from the UK and also the US, where a respectable showing for the latter is the expectation. Global data on November are still coming in and the general results have been flat to mixed though a bright spot was the Eurozone where volumes rose a significantly larger than expected 1.0 percent, only their second monthly increase since June. Annual growth as tracked in the graph climbed from 1.7 percent to 2.2 percent. Promisingly, the headline monthly gain was led by the non-food sector where, excluding auto fuel, demand increased a hefty 1.4 percent on the month, easily more than reversing October's 0.7 percent drop. Gains here were broad-based and included notable advances in mail order, textiles and clothing as well as electrical goods and furniture. Elsewhere, the food, drink and tobacco subsector was up 0.7 percent leaving auto fuel, at minus 1.0 percent, posting the only decline. Regionally, the monthly headline bounce was dominated by Germany where purchases expanded some 2.1 percent and so comfortably eclipsed October's 1.3 percent slump. Elsewhere, France (1.1 percent) also enjoyed a very good period as did Spain (0.7 percent). This bullish update put average Eurozone sales in October and November 0.3 percent above their mean level in the third quarter. This implies that, absent any revisions, December would need to post a monthly decline of at least 1.4 percent for the retail sector not to make a positive contribution to real GDP growth in the fourth quarter. Domestic demand, however soft manufacturing is, may have ended the year on a firmer note than expected.

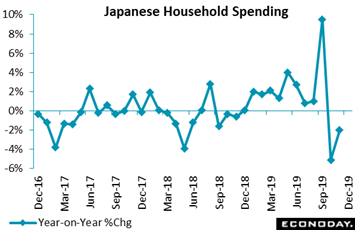

One economy where retail distortions, to the disadvantage of the fourth quarter, are at play is Japan. Household spending in Japan, in real terms, fell 2.0 percent on the year in November as tracked in the graph, picking up from a decline of 5.1 percent in October and close to the consensus forecast for a drop of 1.8 percent. Monthly spending rose an adjusted 2.6 percent in November after slumping 11.5 percent in October. Weakness in October was largely a reaction to the surge in spending that took place in September ahead of an increase in consumption tax rates at the start of October. Improved headline year-on-year growth in November was broad-based: spending on food rose 0.2 percent after falling 3.9 percent, spending on utilities fell 1.5 percent after dropping 4.6 percent, and spending on housing declined 4.1 percent versus October's drop of 12.7 percent. A measure of core household spending – which excludes housing, motor vehicles and other volatile items and tends to track more closely the consumption component of gross domestic product – also picked up in November, down 1.9 percent on the year after falling 6.5 percent in October. One economy where retail distortions, to the disadvantage of the fourth quarter, are at play is Japan. Household spending in Japan, in real terms, fell 2.0 percent on the year in November as tracked in the graph, picking up from a decline of 5.1 percent in October and close to the consensus forecast for a drop of 1.8 percent. Monthly spending rose an adjusted 2.6 percent in November after slumping 11.5 percent in October. Weakness in October was largely a reaction to the surge in spending that took place in September ahead of an increase in consumption tax rates at the start of October. Improved headline year-on-year growth in November was broad-based: spending on food rose 0.2 percent after falling 3.9 percent, spending on utilities fell 1.5 percent after dropping 4.6 percent, and spending on housing declined 4.1 percent versus October's drop of 12.7 percent. A measure of core household spending – which excludes housing, motor vehicles and other volatile items and tends to track more closely the consumption component of gross domestic product – also picked up in November, down 1.9 percent on the year after falling 6.5 percent in October.

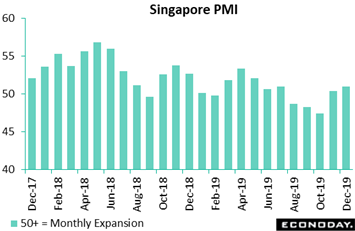

We end the week's data run on a clearly positive note, and that is a second straight month of recovery for Singapore's PMI which after three straight months of contraction rose from 50.4 in November to 51.0 in December. Although GDP growth is likely to be subdued in the December quarter, the data do support the view of officials at the Monetary Authority of Singapore (MAS) who, at their semi-annual policy review held in October, agreed that the Singapore economy would likely pick up "modestly" in 2020. The MAS announced a slight easing of policy in October by targeting a slightly slower pace of appreciation in the exchange rate. For December, PMI respondents reported a rise in output for the first time since July with new orders rising at the fastest pace in five months. Yet the survey's measure of new export orders was not a positive, falling to the lowest level since data for this measure was first collected seven years ago. Payrolls and business confidence also weakened, and respondents reported slower growth for both input costs and selling prices in December. Still, with monetary policy supportive, the outlook for Singapore may be more positive than negative. We end the week's data run on a clearly positive note, and that is a second straight month of recovery for Singapore's PMI which after three straight months of contraction rose from 50.4 in November to 51.0 in December. Although GDP growth is likely to be subdued in the December quarter, the data do support the view of officials at the Monetary Authority of Singapore (MAS) who, at their semi-annual policy review held in October, agreed that the Singapore economy would likely pick up "modestly" in 2020. The MAS announced a slight easing of policy in October by targeting a slightly slower pace of appreciation in the exchange rate. For December, PMI respondents reported a rise in output for the first time since July with new orders rising at the fastest pace in five months. Yet the survey's measure of new export orders was not a positive, falling to the lowest level since data for this measure was first collected seven years ago. Payrolls and business confidence also weakened, and respondents reported slower growth for both input costs and selling prices in December. Still, with monetary policy supportive, the outlook for Singapore may be more positive than negative.

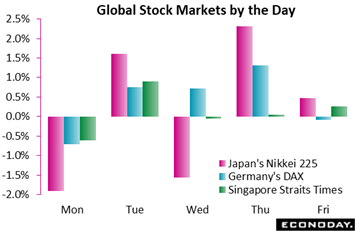

In an example of news driven (not data driven) swings, Japan's Nikkei 225 opened the week falling 1.9 percent in belated reaction to Friday's US strike against Iran in the prior week when Asian markets had already closed. But then on Tuesday, helped by reports that the US and China are set to sign a phase-one trade pace on January 15 of the coming week, the index bounced back 1.6 percent before, however, surrendering that 1.6 percent the very next day in reaction to Iran's missile retaliation. By Thursday, when fears of an all out US-Iran clash had faded, the average posted a 2.3 percent rise before adding another 0.5 percent on Friday to close the week with a useful 0.8 percent increase. In between, however, Japan's services fell into sub-50 contraction (down 9 tenths to 49.4) and its manufacturing PMI fell deeper into contraction (down 5 tenths to 48.4). In Europe, many markets had a flat to negative week but not Germany's DAX which gained 2.0 percent and was led by a 1.3 percent rally on Thursday that was helped in part by the strength of German industrial production. By the way, German manufacturers' orders didn't hold down the DAX the day before when, despite the sharp and unexpected drop which points to production weakness ahead, the index posted a 0.7 percent gain. And however weak the Germany manufacturing sector may be and however much it sits in recession, the weakness hasn't been hurting the DAX which ended the week 24.6 percent higher than a year ago. In contrast, Singapore's Straits Times is at the very bottom end of the year-on-year ladder, up only 2.3 percent and falling 0.6 percent on Monday following the favorable PMI data. So much for tying economic data to daily moves in the stock market. In an example of news driven (not data driven) swings, Japan's Nikkei 225 opened the week falling 1.9 percent in belated reaction to Friday's US strike against Iran in the prior week when Asian markets had already closed. But then on Tuesday, helped by reports that the US and China are set to sign a phase-one trade pace on January 15 of the coming week, the index bounced back 1.6 percent before, however, surrendering that 1.6 percent the very next day in reaction to Iran's missile retaliation. By Thursday, when fears of an all out US-Iran clash had faded, the average posted a 2.3 percent rise before adding another 0.5 percent on Friday to close the week with a useful 0.8 percent increase. In between, however, Japan's services fell into sub-50 contraction (down 9 tenths to 49.4) and its manufacturing PMI fell deeper into contraction (down 5 tenths to 48.4). In Europe, many markets had a flat to negative week but not Germany's DAX which gained 2.0 percent and was led by a 1.3 percent rally on Thursday that was helped in part by the strength of German industrial production. By the way, German manufacturers' orders didn't hold down the DAX the day before when, despite the sharp and unexpected drop which points to production weakness ahead, the index posted a 0.7 percent gain. And however weak the Germany manufacturing sector may be and however much it sits in recession, the weakness hasn't been hurting the DAX which ended the week 24.6 percent higher than a year ago. In contrast, Singapore's Straits Times is at the very bottom end of the year-on-year ladder, up only 2.3 percent and falling 0.6 percent on Monday following the favorable PMI data. So much for tying economic data to daily moves in the stock market.

Economic momentum appeared to be uneven going into 2020, yet whether this prompts a new round of rate cuts from global central banks is still too early to call. Though cross-border trade may be improving, at least no longer deteriorating, it will be the holiday shopping season that will be the special focus of the coming weeks with current trends in the global retail sector, despite improvement in Europe and hopes for the US, generally as uneven as economic data in general have been.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

China will be one of the headliners in the week's data capped by industrial production and also GDP, both out on Friday and both expected to slow. Data will also be heavy out of the UK beginning with industrial production and merchandise trade on Monday in data, however, for November which was before December's victory for the Tories and a time when Brexit uncertainty was especially heightened. Holiday retail sales results will be posted in the US on Thursday amid what forecasters see as tangible improvement versus what proved to be a very flat November. US data will also include the Treasury budget on Monday, and with it the latest update on US fiscal stimulus, along with housing starts and industrial production on Friday, the former posting a run of very sharp gains in contrast to the latter where manufacturing, at least on trend, has been flat. And strength for this report is not expected. The health of manufacturing will also be in focus on Wednesday with Eurozone industrial production and on Thursday with Japanese machine orders.

Chinese Merchandise Trade Balance for December (Estimated for Monday, Release Time Not Set)

Consensus Forecast: US$48.0 billion

Exports, Year-on-Year: 8.5%

Imports, Year-on-Year: 2.4%

The December consensus for China's merchandise trade balance is a surplus of US$48.0 billion following a $38.73 billion surplus in November. Imports in December are seen rising a year-on-year 8.5 percent in US dollar terms following November's 0.3 percent gain while exports are expected to increase 2.4 percent versus a decline of 1.1 percent in November.

UK Industrial Production for November (Mon 09:30 GMT; Mon 04:30 EST)

Consensus Forecast, Month-to-Month: -0.2%

Manufacturing Production

Consensus Forecast, Month-to-Month: -0.3%

Forecasters are calling for a 0.2 percent decrease in November industrial production and a 0.3 percent dip for the manufacturing component. October, at plus 0.1 percent overall and plus 0.2 percent for manufacturing, did show improvement but yearly rates remained well into contraction, at minus 1.3 percent and minus 1.2 percent respectively.

UK Merchandise Trade for November (Mon 09:30 GMT; Mon 04:30 EST)

Consensus Forecast, Month-to-Month: -£12.0 billion

A deficit of £12.0 billion is expected for November merchandise trade versus October's deficit of £14.49 billion. Imports as well as exports have both risen sharply the last two reports.

US Treasury Budget for December

Consensus Forecast: -$15.0 billion

Consensus Range: -$42.0 billion to $10.0 billion

December's federal deficit is expected to come in at $15.0 billion versus a deficit of $13.5 billion in December last year. Two months into the 2020 fiscal year in November, the government's deficit was running 12.3 percent deeper than fiscal 2019.

US CPI for December (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month-to-Month Change: 0.3%

Consensus Forecast, Year-over-Year Change: 2.3%

CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Forecast, Year-over-Year Change: 2.3%

Consumer prices in the US were steady and moderate in November, rising 0.3 percent overall but only 0.2 percent for the ex-food and ex-energy core. Year-on-year rates were little changed at 2.1 percent and 2.3 percent for the core. Overall prices for December are expected to rise 0.3 percent on the month for a 2.3 percent gain on the year with the core seen at plus 0.2 percent on the month and, like the overall rate, at 2.3 percent on the year.

UK CPI for December (Wed 09:30 GMT; Wed 04:30 EST)

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: 1.5%

After an as-expected and subdued showing in November, consumer prices in the UK are not expected to pick up at all in December, at a 0.2 percent gain for the monthly rate (versus November's plus 0.2 percent) and a yearly rate of 1.5 percent (versus 1.5 percent).

Eurozone Industrial Production for November (Wed 10:00 GMT; Wed 11:00 CET; Wed 05:00 EST)

Consensus Forecast, Month-to-Month: 0.3%

Consensus Forecast, Year-over-Year: -1.3%

Eurozone industrial production has been on the decline since late last year. For November, forecasters see yearly contraction at 1.3 minus percent with monthly change at plus 0.3 percent.

Japanese Machine Orders for November (Wed 23:50 GMT; Thu 08:50 JST; Wed 18:50 EST)

Consensus Forecast, Month-to-Month: 2.5%

At a month-to-month plus 2.5 percent, forecasters see Japanese machine orders firming in November from October's unexpected monthly drop of 6.0 percent, one that followed monthly declines of 2.9 percent and 2.4 percent in the two prior months.

US Retail Sales for October (Thu 13:30 GMT; Thu 08:30 GMT)

Consensus Forecast, Month-to-Month: 0.3%

Consensus Forecast, Ex-Autos: 0.5%

Consensus Forecast, Ex-Autos & Ex-Gas: 0.4%

Consensus Forecast, Control Group: 0.4%

US retail sales have been slowing though some improvement is the call for December where Econoday's consensus sees a percent 0.3 increase versus a disappointing 0.2 percent November gain. Unit vehicle sales slowed in December which looks to give a relative boost to ex-auto sales which are expected to rise a strong 0.5 percent. Ex-auto & ex-gas sales are expected at a solid plus 0.4 percent as is the control group, also seen at 0.4 percent.

Chinese Fixed Asset Investment for December (Fri 02:00 GMT; Fri 10:00 CST; Thu 21:00 EST)

Consensus Forecast, Year-to-date: 5.2%

Fixed asset investment rose an as-expected 5.2 percent in November to match October's rate and which is also the expectation for December. This report trended gradually lower last year.

Chinese Fourth-Quarter GDP (Fri 02:00 GMT; Fri 10:00 CST; Thu 21:00 EST)

Consensus Forecast, Year-on-Year: 5.9%

Two tenths of slowing was the unexpected result for third-quarter GDP which came in at 6.0 percent. Expectations for fourth-quarter GDP is 1 tenth of slowing to 5.9 percent.

Chinese Industrial Production for December (Fri 02:00 GMT; Fri 10:00 CST; Thu 21:00 EST)

Consensus Forecast: 5.9%

After a very soft October, industrial production in November, boosted by both manufacturing and mining, jumped to much better-than-expected annual growth of 6.2 percent. For December, forecasters are looking for moderation to 5.9 percent.

Housing Starts for December (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast, Annual Rate: 1.373 million

Consensus Range: 1.300 to 1.400 million

Building Permits

Consensus Forecast: 1.458 million

Consensus Range: 1.320 to 1.475 million

Starts and permits have been accelerating sharply and convincingly in the US to expansion highs. And no step back is the consensus for December starts, at a 1.373 million annual pace versus November's 1.365 million. The consensus for permits is 1.458 million versus 1.482 million in November.

US Industrial Production for December (Fri 14:15 GMT; Fri 09:15 EST)

Consensus Forecast, Month-to-Month: -0.3%

Manufacturing Production

Consensus Forecast, Month-to-Month: -0.2%

Capacity Utilization Rate

Consensus Forecast: 77.1%

Industrial production and specifically manufacturing production bounced back strongly in November after two months of sharp contraction during the GM strike. Forecasters, however, do not see continued strength for December, at monthly declines of 0.3 percent overall and 0.2 percent for manufacturing. Capacity utilization is expected to decrease 2 tenths to 77.1 percent.

|