|

Industrial production continues to slump and struggle, but there are bright spots in the data. Signs of demand pressure are in fact clearly surfacing, whether for new housing in the US or consumer prices in India. But first we'll look at what may be headline territory for the week after next, that is news out of the UK amid emerging expectations that the Bank of England may soon be following others down the easing trail.

Retail sales in the UK were surprisingly weak in December. A 0.6 percent monthly fall in the holiday month followed a steeper revised 0.8 percent drop in November and left volumes at their lowest level since December 2018. This was the fourth decrease in the last five months, a run that has pulled year-on-year growth down to only 0.8 percent and 0.9 percent the last two months. Excluding auto fuel, purchases were down 0.8 percent versus November and up 0.7 percent on the year. The monthly setback reflected a 1.3 percent drop in food sales, their second consecutive fall. Looking at non-food demand excluding auto fuel, sales were down a sharper 0.9 percent, their third straight decline. Within this, textiles and clothing (minus 2.0 percent) and non-specialized stores (minus 1.8 percent) were especially weak while non-store retailing (plus 1.0 percent) posted the only rise of any real magnitude. Retail sales in the UK were surprisingly weak in December. A 0.6 percent monthly fall in the holiday month followed a steeper revised 0.8 percent drop in November and left volumes at their lowest level since December 2018. This was the fourth decrease in the last five months, a run that has pulled year-on-year growth down to only 0.8 percent and 0.9 percent the last two months. Excluding auto fuel, purchases were down 0.8 percent versus November and up 0.7 percent on the year. The monthly setback reflected a 1.3 percent drop in food sales, their second consecutive fall. Looking at non-food demand excluding auto fuel, sales were down a sharper 0.9 percent, their third straight decline. Within this, textiles and clothing (minus 2.0 percent) and non-specialized stores (minus 1.8 percent) were especially weak while non-store retailing (plus 1.0 percent) posted the only rise of any real magnitude.

And inflation was again very weak. The yearly change in the overall deflator was unchanged at just 0.3 percent while the ex-auto fuel rate dropped 0.3 percentage points to only 0.2 percent, its lowest reading since May. December's report puts total fourth quarter sales down 1.0 percent versus the previous period and non-auto fuel volumes off 1.1 percent. The month's data may well have been compiled too soon to incorporate any post-election bounce, but the weakness of the underlying trend is clear enough. As such, speculation about a cut in Bank Rate at the month-end BoE meeting may have risen another notch.

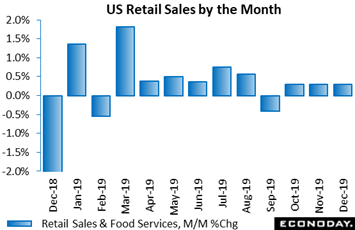

December's retail news was more upbeat for the US than the UK, but really not by much and clearly not for online merchants. Retail sales rose 0.3 percent in a December gain that was held back by a sharp 1.3 percent drop for autos, a setback correctly signaled by a drop in previously reported unit vehicle sales. Excluding autos, retail sales surged 0.7 percent though this gain does follow no change in November. Gasoline sales, getting a lift from higher prices, were strong in both December and November, and when excluding these sales along with autos – a reading that offers a clearer view of holiday demand – retail sales rose 0.5 percent. But here too, a downward revision to an already weak November, now at minus 0.2 percent, sobers the assessment. December's retail news was more upbeat for the US than the UK, but really not by much and clearly not for online merchants. Retail sales rose 0.3 percent in a December gain that was held back by a sharp 1.3 percent drop for autos, a setback correctly signaled by a drop in previously reported unit vehicle sales. Excluding autos, retail sales surged 0.7 percent though this gain does follow no change in November. Gasoline sales, getting a lift from higher prices, were strong in both December and November, and when excluding these sales along with autos – a reading that offers a clearer view of holiday demand – retail sales rose 0.5 percent. But here too, a downward revision to an already weak November, now at minus 0.2 percent, sobers the assessment.

Very sobering was unusual weakness for nonstore retailers, a category dominated by e-commerce and which managed only a 0.2 percent December gain that followed no change in November. Stores that did show strength in December included clothing (up 1.6 percent), building materials (up 1.4 percent), sporting goods (up 0.9 percent), electronics & appliances (up 0.6 percent) and also general merchandise (up 0.6 percent). A closely watched subset of general merchandise is department stores, a group that fell a sizable 0.8 percent in both December and also November and which apparently did not benefit any from the nonstore weakness.

Looking at the year-on-year rate, total retail spending in the US was 5.8 percent higher in December for the best showing since August 2018. But as you can see in the graph, this December comparison got a very fat boost from last year's very sharp drop. Retail spending had been moderate to strong through most of 2019 and ended, not with an exclamation point but still solidly enough. For the fourth-quarter as a whole, unless service spending proves unexpectedly weak, consumer spending may well be a positive contributor to GDP once again.

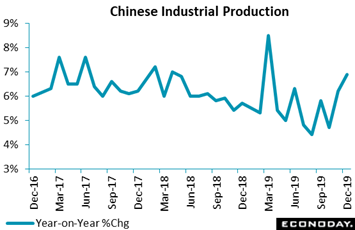

Retail sales out of China held steady at 8.0 percent year-on-year growth in December, but this is still down from 10 percent rates a couple of years ago. Other Chinese data included 6.0 percent growth in fourth-quarter GDP, which was unchanged from the third quarter but still the very lowest in nearly 30 years of data. Yet fixed asset investment improved again, and the country posted jumps in both imports and exports during December in what may be early positives tied to easing trade tensions. And perhaps the best news was industrial production, advancing 6.9 percent on the year in December, picking up from 6.2 percent growth in November and well above the forecasts. Manufacturing, which is always the key component in any industrial production report, posted a 7.0 percent yearly gain following 6.3 percent in November. Key areas of December strength included autos, steel, and communication equipment. Outside of manufacturing, mining slowed slightly to growth of 5.6 percent with utilities up slightly to 6.8 percent. Retail sales out of China held steady at 8.0 percent year-on-year growth in December, but this is still down from 10 percent rates a couple of years ago. Other Chinese data included 6.0 percent growth in fourth-quarter GDP, which was unchanged from the third quarter but still the very lowest in nearly 30 years of data. Yet fixed asset investment improved again, and the country posted jumps in both imports and exports during December in what may be early positives tied to easing trade tensions. And perhaps the best news was industrial production, advancing 6.9 percent on the year in December, picking up from 6.2 percent growth in November and well above the forecasts. Manufacturing, which is always the key component in any industrial production report, posted a 7.0 percent yearly gain following 6.3 percent in November. Key areas of December strength included autos, steel, and communication equipment. Outside of manufacturing, mining slowed slightly to growth of 5.6 percent with utilities up slightly to 6.8 percent.

But unlike China, not much strength at all is evident in other industrial production reports. In the US, industrial production fell 0.3 percent in December following a downwardly revised but still outsized gain of 0.8 percent in November. Year-on-year, as tracked in graph, production volumes were down 1.0 percent. But manufacturing volumes, which were expected to slip 0.2 percent, instead rose 0.2 percent following their outsized November gain of 1.0 percent that was skewed higher by the end of the GM strike and an easy comparison with a strike-filled October. Pulling down headline production was output at utilities which, likely reflecting unseasonable weather, fell a sharp 5.6 percent, which not only offset the small rise for manufacturing but also a 1.3 percent rise for mining. But unlike China, not much strength at all is evident in other industrial production reports. In the US, industrial production fell 0.3 percent in December following a downwardly revised but still outsized gain of 0.8 percent in November. Year-on-year, as tracked in graph, production volumes were down 1.0 percent. But manufacturing volumes, which were expected to slip 0.2 percent, instead rose 0.2 percent following their outsized November gain of 1.0 percent that was skewed higher by the end of the GM strike and an easy comparison with a strike-filled October. Pulling down headline production was output at utilities which, likely reflecting unseasonable weather, fell a sharp 5.6 percent, which not only offset the small rise for manufacturing but also a 1.3 percent rise for mining.

Turning back to manufacturing: construction supplies were a special positive, up 1.6 percent in the month and underscoring the strength in US housing. Business equipment output, including machinery, was flat in the month while consumer goods fell. Motor vehicle production was also a negative, falling 4.7 percent after, however, surging 12.8 percent in November, again following the end of the GM strike. December's modest gain for manufacturing, especially on top of November's big jump, is probably a positive for the economic outlook. The sector, and its vulnerability to foreign demand, is a chief concern of the Federal Reserve and a major reason behind last year's three straight rate cuts. And a look at year-on-year manufacturing volumes, down 1.3 percent in December, still underscores this concern.

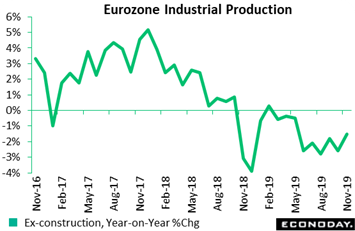

In data for November, industrial production also expanded in Europe but not by much and following a sharp downward revision to October. Output (ex-construction) rose a slightly smaller than expected 0.2 percent on the month, only denting the previous period's 0.9 percent decline. This put annual growth at minus 1.5 percent as tracked in the graph, up from minus 2.6 percent but mainly due to a particularly weak period in November 2018. The modest monthly increase was attributable to capital goods, which climbed 1.2 percent after a 2.5 percent nosedive in October, and energy, which advanced 0.8 percent. By contrast, intermediates declined 0.5 percent, durable consumer goods 0.8 percent and consumer non-durables 0.7 percent. Regionally, a much needed 0.9 percent increase in Germany did most of the work but there were gains too in France (0.3 percent) and Spain (1.1 percent). Consequently, it was the smaller member states that were largely responsible for holding back overall production. And with average output in October and November 0.6 percent below its third quarter mean, it looks very likely that the sector will end the year in recession. Absent revisions, December would need an improbably large monthly rise of at least 1.6 percent just to hold the fourth quarter flat. The European Central Bank will be hoping for something a good deal better this quarter. In data for November, industrial production also expanded in Europe but not by much and following a sharp downward revision to October. Output (ex-construction) rose a slightly smaller than expected 0.2 percent on the month, only denting the previous period's 0.9 percent decline. This put annual growth at minus 1.5 percent as tracked in the graph, up from minus 2.6 percent but mainly due to a particularly weak period in November 2018. The modest monthly increase was attributable to capital goods, which climbed 1.2 percent after a 2.5 percent nosedive in October, and energy, which advanced 0.8 percent. By contrast, intermediates declined 0.5 percent, durable consumer goods 0.8 percent and consumer non-durables 0.7 percent. Regionally, a much needed 0.9 percent increase in Germany did most of the work but there were gains too in France (0.3 percent) and Spain (1.1 percent). Consequently, it was the smaller member states that were largely responsible for holding back overall production. And with average output in October and November 0.6 percent below its third quarter mean, it looks very likely that the sector will end the year in recession. Absent revisions, December would need an improbably large monthly rise of at least 1.6 percent just to hold the fourth quarter flat. The European Central Bank will be hoping for something a good deal better this quarter.

Industrial production data may or may not be improving which is also the case for trade data, this despite improvement in China and also Italy which we'll look at now. Italy's seasonally adjusted trade balance returned a €4.7 billion surplus in November, down from October's €6.5 billion but still among the best results of the last three years. November's dip was entirely due to exports which fell 4.2 percent on the month to €34.8 billion, their first drop since July and a 3-month low. The decline was broad-based but dominated by capital goods, which nosedived 10.6 percent. Consumer goods were down 0.1 percent, intermediates 1.6 percent and energy 3.9 percent. Imports were flat at €34.8 billion having contracted in both September and October. Yet despite the slowing and given the strength of October, the trade surplus is on course to show a useful improvement over the quarter and, having subtracted 0.4 percentage points in the September quarter, looks to make a positive contribution to fourth quarter GDP. Industrial production data may or may not be improving which is also the case for trade data, this despite improvement in China and also Italy which we'll look at now. Italy's seasonally adjusted trade balance returned a €4.7 billion surplus in November, down from October's €6.5 billion but still among the best results of the last three years. November's dip was entirely due to exports which fell 4.2 percent on the month to €34.8 billion, their first drop since July and a 3-month low. The decline was broad-based but dominated by capital goods, which nosedived 10.6 percent. Consumer goods were down 0.1 percent, intermediates 1.6 percent and energy 3.9 percent. Imports were flat at €34.8 billion having contracted in both September and October. Yet despite the slowing and given the strength of October, the trade surplus is on course to show a useful improvement over the quarter and, having subtracted 0.4 percentage points in the September quarter, looks to make a positive contribution to fourth quarter GDP.

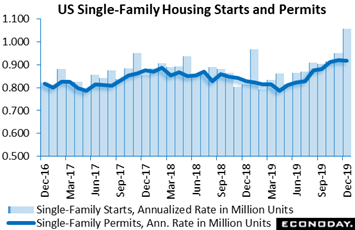

Flat out good news is coming from the housing market in the US where residential construction is literally booming. Housing starts in December surged a monthly 16.9 percent to a 1.608 million annual rate while building permits, though dipping 3.9 percent in the month, came in at a very strong 1.416 million. This is the best rate for starts since December 2006 and, outside of November's 1.474 million, is the best rate for permits since May 2007. And these are no flukes but the result of low mortgage rates and high levels of employment and are confirmed by 3-month averages, at 12-year highs for both starts and permits. Flat out good news is coming from the housing market in the US where residential construction is literally booming. Housing starts in December surged a monthly 16.9 percent to a 1.608 million annual rate while building permits, though dipping 3.9 percent in the month, came in at a very strong 1.416 million. This is the best rate for starts since December 2006 and, outside of November's 1.474 million, is the best rate for permits since May 2007. And these are no flukes but the result of low mortgage rates and high levels of employment and are confirmed by 3-month averages, at 12-year highs for both starts and permits.

Starts for single-family homes, which are a driving force for residential investment in the GDP accounts, rose a monthly 11.2 in December to a 1.055 million rate. And housing completions, which are especially important for current home sales, rose 5.1 percent to 1.215 million. Year-on-year rates really indicate the degree of acceleration at year-end, rising 40.8 percent for starts and a comparatively modest but still very useful 5.8 percent for permits. For residential investment, the move higher for starts not only points to a second straight positive contribution to quarterly GDP but, for the construction sector, also raises the risk of labor and material shortages. The new home market, including sales, was certainly the US highlight of the fourth quarter and perhaps the country's entire 2019 economy.

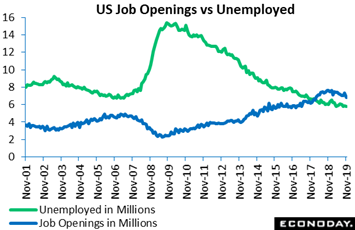

Yet the bad often follows the good as we know, which is how we'll wind down the week's economic run. The labor market has been a leading strength of the US economy, though this may be coming to an end based on job openings in November's JOLTS report. Openings fell to a two-year low of 6.8 million, down 7.6 percent from October's 7.4 million and down 10.8 percent from November last year. This is the fifth straight year-on-year decline and the most severe of the expansion, since December 2009. The graph compares the blue line of job openings with the green line of unemployed Americans actively looking for work, at 5.8 million in November. The visible slump in openings at the right of the graph has yet to make for a rise in the number of unemployed but, based on history, such as 2007 and 2008, it soon may. And if nothing else, declining openings are not likely to give much lift at all to wages, where growth slumped badly in the December employment report. For the Federal Reserve, the JOLTS data offer an incremental argument for, however much in the distance, a move off the sidelines and a resumption of rate cuts. Yet the bad often follows the good as we know, which is how we'll wind down the week's economic run. The labor market has been a leading strength of the US economy, though this may be coming to an end based on job openings in November's JOLTS report. Openings fell to a two-year low of 6.8 million, down 7.6 percent from October's 7.4 million and down 10.8 percent from November last year. This is the fifth straight year-on-year decline and the most severe of the expansion, since December 2009. The graph compares the blue line of job openings with the green line of unemployed Americans actively looking for work, at 5.8 million in November. The visible slump in openings at the right of the graph has yet to make for a rise in the number of unemployed but, based on history, such as 2007 and 2008, it soon may. And if nothing else, declining openings are not likely to give much lift at all to wages, where growth slumped badly in the December employment report. For the Federal Reserve, the JOLTS data offer an incremental argument for, however much in the distance, a move off the sidelines and a resumption of rate cuts.

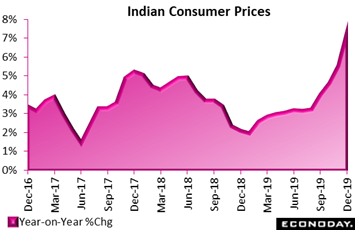

It was a run of rate cuts from the Reserve Bank of India that opened the 2019 central bank year, beginning in February and extending through October for a substantial 1.35 basis points of traditional stimulus. In the old days before the new economy and the disappearance of traditional cause and effect, more stimulus was equated with higher inflation. That of course is a complete non sequitur now, whether in Japan, or Europe, or the US. But what about India? India's consumer price index increased by 7.35 percent on the year in December, up sharply from 5.54 percent in November, and is now at its highest level since 2014. Headline inflation has risen in each of the last five months and is now above, that's right actually above, the RBI's target range of 2 percent to 6 percent for the first time since 2016. As in recent months, the increase was mainly driven by stronger growth in food and beverage prices, up 12.16 percent on the year in December after increasing 8.66 percent previously. Housing costs posted slightly weaker growth, up 4.30 percent compared with 4.49 percent previously, while the change in fuel and light charges rebounded from a fall of 0.93 percent to an increase of 0.70 percent. Inflation in urban areas picked up from 5.76 percent in November to 7.46 percent in December, while inflation in rural areas rose from 5.27 percent to 7.26 percent. It was a run of rate cuts from the Reserve Bank of India that opened the 2019 central bank year, beginning in February and extending through October for a substantial 1.35 basis points of traditional stimulus. In the old days before the new economy and the disappearance of traditional cause and effect, more stimulus was equated with higher inflation. That of course is a complete non sequitur now, whether in Japan, or Europe, or the US. But what about India? India's consumer price index increased by 7.35 percent on the year in December, up sharply from 5.54 percent in November, and is now at its highest level since 2014. Headline inflation has risen in each of the last five months and is now above, that's right actually above, the RBI's target range of 2 percent to 6 percent for the first time since 2016. As in recent months, the increase was mainly driven by stronger growth in food and beverage prices, up 12.16 percent on the year in December after increasing 8.66 percent previously. Housing costs posted slightly weaker growth, up 4.30 percent compared with 4.49 percent previously, while the change in fuel and light charges rebounded from a fall of 0.93 percent to an increase of 0.70 percent. Inflation in urban areas picked up from 5.76 percent in November to 7.46 percent in December, while inflation in rural areas rose from 5.27 percent to 7.26 percent.

The RBI left its main benchmark rate unchanged at a 9-year low of 5.15 percent at its last policy review in December. Officials concluded then that it was appropriate to "pause" their policy easing but still argued that there was "space" for further rate cuts in the future. Space or not, the further increase underway in headline inflation, food driven or not, will likely reinforce the case to extend this pause at the RBI's next policy meeting in February.

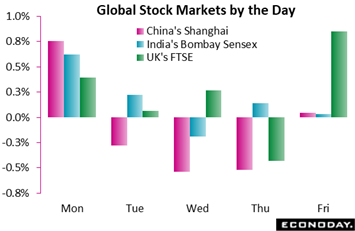

Stocks were mostly higher in the week with China's Shanghai index, however, an exception, falling 0.5 percent. This despite the signing of an initial trade agreement between the US and China not to mention the week's run of mostly favorable economic data. Yet the index is still up nicely compared to this time last year, at a gain of just over 20 percent. The impact of economic data on India's Bombay Sensex during the week is also less than evident. The index did flatten out at midweek following the jump in the CPI, one that may have curdled hopes for more rate cuts. And wholesale price data didn't help any, also showing a spike mostly related to food. Still, the index posted a 0.8 percent gain on the week for year-on-year appreciation of 15.3 percent. And we'll end where we started with the UK. The FTSE rose a solid 1.1 percent in a week that opened with a very weak industrial production report, down 1.2 percent on the month and 1.6 percent on the year, followed by unexpected and outright contraction in monthly GDP. These reports were for November and before the Conservative victory, yet the weak retail sales report at week's end was for December and has raised chatter for a BoE cut at month end. Chatter perhaps that would help explain Friday's 0.9 percent gain for the FTSE. Stocks were mostly higher in the week with China's Shanghai index, however, an exception, falling 0.5 percent. This despite the signing of an initial trade agreement between the US and China not to mention the week's run of mostly favorable economic data. Yet the index is still up nicely compared to this time last year, at a gain of just over 20 percent. The impact of economic data on India's Bombay Sensex during the week is also less than evident. The index did flatten out at midweek following the jump in the CPI, one that may have curdled hopes for more rate cuts. And wholesale price data didn't help any, also showing a spike mostly related to food. Still, the index posted a 0.8 percent gain on the week for year-on-year appreciation of 15.3 percent. And we'll end where we started with the UK. The FTSE rose a solid 1.1 percent in a week that opened with a very weak industrial production report, down 1.2 percent on the month and 1.6 percent on the year, followed by unexpected and outright contraction in monthly GDP. These reports were for November and before the Conservative victory, yet the weak retail sales report at week's end was for December and has raised chatter for a BoE cut at month end. Chatter perhaps that would help explain Friday's 0.9 percent gain for the FTSE.

The bad may be mixed with the good, but the bad is far outweighed by the good; the good of course being lower policy rates from global central banks, at least most if not the Reserve Bank of India and its possible struggle against what or what may not be the ghost of inflation. On net, the bias in the global economic data may be edging just slightly to the firm side, but the bias for most central banks may well be holding to the easing side; that is until the positive effects of prior rate cuts and ongoing fiscal stimulus take visible hold.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

There will be plenty of central bank announcements in the week but no changes are expected, whether from the Bank of Japan on Tuesday (where policy is soft), the Bank of Canada on Wednesday (where policy is firm), or the European Central Bank on Thursday (where policy is soft). Inflation data may be key in the week starting on Monday with German producer prices, which have been in outright contraction, followed on Wednesday by Canadian consumer prices which, unlike many countries, have been above the 2 percent target. And positive improvement is the call for Japanese consumer prices which will be posted on Friday. Manufacturing, like inflation, is another problem area of the global economy and the week's data will include manufacturing sales out of Canada and industrial trends out of the UK, and gains are expected for both. Expectations for sentiment indicators are mixed with French business climate seen flat but German ZEW data and EC consumer confidence both expected to improve. Other data will include employment out of the UK and Australia, with steady strength expected for both, and also existing home sales data from the US where emerging strength is once again expected. The week winds up on Friday with a run of January PMI flashes with continued contraction in manufacturing the consensus for both Japan and German but with France, though only modestly positive, expected to be the highlight.

German PPI for December (Mon 07:00 GMT; Mon 08:00 CET; Mon 02:00 EST)

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: -0.2%

German producer prices are at three-year lows. December's consensus is plus 0.2 percent for the monthly rate and minus 0.2 percent for the yearly rate which would compare with respective results in November of no change and minus 0.7 percent.

Bank of Japan Announcement (Any time Tuesday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

No change is expected for the Bank of Japan's announcement with the short-term policy rate for excess reserves remaining at minus 0.1 percent and the target level for the long-term 10-year yield at around zero percent. At its last announcement in December, the BoJ reaffirmed its commitment to keeping policy rates low.

UK Labour Market Report for December (Tue 09:30 GMT; Tue 04:30 EST)

Consensus Forecast, Claimant Count: 24,500

Consensus Forecast, ILO Unemployment Rate: 3.8%

Consensus Forecast, Average Weekly Earnings, Year-on-Year: 3.1%

Claimant count unemployment rose 28,800 in November and is expected at 24,500 in December. The ILO unemployment rate is expected to hold unchanged in December at 3.8 percent. The call for average hourly earnings, which eased back in November to 3.2 percent, is 3.1 percent year-on-year.

Germany: ZEW Survey for January (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Business Expectations: 15.0

Consensus Forecast, Current Conditions: -14.0

Business expectations, seen at 15.0 in January, improved very sharply through the end of last year, coming in at a much higher-than-expected 10.7 in December. The assessment of current conditions, at a January consensus of minus 14.0, has been lagging but at minus 19.9 in December was still a 4-month best.

Canadian Manufacturing Sales for November (Tue 13:30 GMT; 08:30 EST)

Consensus Forecast, Month-to-Month: 0.3%

The US auto strike against GM pulled down manufacturing sales in Canada during both October and September and only a small bounce of 0.3 percent is the expectation for November.

French Business Climate Indicator for January (Wed 07:45 GMT; Wed 08:45 CET; Wed 02:45 EST)

Consensus Forecast, Manufacturing: 101

France's business climate indicator in December came in at a better-than-expected 102, to move above its long-term average of 100. For January, the consensus is a only a small step back to 101.

UK Public Sector Finances for December (Wed 09:30 GMT; Wed 04:30 EST)

Consensus Forecast PSNB: £3.8 billion

Public sector borrowing had been heavy, at £8.26 billion in October and £7.26 billion in September, but eased in November to a lower-than-expected £4.88 billion. For December the consensus is £3.80 billion.

UK: CBI Industrial Trends for January (Wed 11:00 GMT; Wed 06:00 EST)

Consensus Forecast: -16

CBI's industrial trends report has been signaling significant and extended weakness, yet with Brexit uncertainties clearing up and the general election over improvement may be in store. After minus 28 in December, forecasters see January's headline at minus 16.

Canadian CPI for December (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast, Month-to-Month: 0.0%

Consensus Forecast, Year-over-Year: 2.2%

Headline consumer prices fell 0.1 percent in November though year-on-year change rose 1 tenth to 2.2 percent and above the Bank of Canada's 2 percent target. For December, the consensus is no change on the month to hold the yearly rate at 2.2 percent.

Bank of Canada Announcement (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 1.75%

Underscoring that the global economy had stabilized, the Bank of Canada kept its policy rate steady at its last meeting in December. With employment having rebounded and inflation readings slightly above target, no change is also expected for the January meeting with the policy rate seen holding at 1.75 percent.

US Existing Home Sales for December (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Annual Rate: 5.430 million

At an annual rate of 5.350 million, existing home sales fell 1.7 percent in December and came in far below expectations in results that continued to contrast with very strong growth in new home sales. Sizable monthly improvement is expected for December with the consensus at 5.430 million.

Japanese Merchandise Trade for December (Wed 23:50 GMT; Thu 08:50 JST; Wed 18:50 EST)

Consensus Forecast: -¥150 billion

Consensus Forecast, Imports Year-over-Year: -3.4%

Consensus Forecast, Exports Year-over-Year: -4.2%

A deficit of ¥150 billion is expected for the December merchandise trade report versus what was a smaller-than-expected deficit of ¥82.1 billion in November. Both Japanese imports and exports have been in year-on-year contraction, at minus 15.7 percent in November for imports and minus 7.9 percent for exports.

Australian Labour Force Survey for December (Thu 00:30 GMT; Thu 11:30 AEDT; Wed 19:30 EST)

Consensus Forecast, Unemployment Rate: 5.2%

Consensus Forecast, Employment: 15,000

Employment growth increased by 39,900 in November, more than reversing October's 19,000 decline and helping to lower the unemployment rate to 5.2 percent from 5.3 percent. For December, employment in Australia is expected to rise 15,000 with the unemployment rate seen steady at 5.2 percent.

European Central Bank Policy Announcement (Thu 12:45 GMT; Thu 13:45 CET; Thu 07:45 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

The European Central Bank is not expected to adjust its policy stance at its January meeting. At its last meeting in December, the bank held policy steady including the refi rate at zero percent and the deposit rate at minus 0.50 percent. QE net asset purchases of €20 billion per month started in November.

Eurozone: EC Consumer Confidence Flash for January (Thu 15:00 GMT; Thu 16:00 CET; Thu 10:00 EST)

Consensus Forecast: -7.6

Consumer confidence in the Eurozone had been improving but fell back to a weaker-than-expected minus 8.1 in December. For January the consensus is limited improvement to minus 7.6.

Japanese Consumer Price Index for December (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast Ex-Food, Year-on-Year: 0.7%

Continued strengthening is the consensus for ex-food consumer prices, at a year-on-year 0.7 percent pace in December following an improved 0.5 percent pace in November that, nevertheless, was well below the Bank of Japan's 2 percent target.

Japanese PMI Flash for January (Fri 00:30 GMT; Fri 09:30 JST; Thu 19:30 EST)

Consensus Forecast, Manufacturing: 48.6

Forecasters see Japan's manufacturing PMI, which has been struggling just below the 50 line since May, coming in at 48.6 for the January flash.

French PMI Flash for January (Fri 08:15 GMT; Fri 09:15 CET; Fri 03:15 EST)

Consensus Forecast, Manufacturing: 50.6

Consensus Forecast, Services: 52.1

Consensus Forecast, Composite: 52.0

At a consensus 50.6, France's PMI manufacturing flash for January is expected to show further but limited improvement versus December's 50.4 (revised from a 50.3 flash). The services flash in January is seen slightly lower at 52.1 with the composite at 52.0.

German PMI Flash for January (Fri 08:30 GMT; Fri 09:30 CET; Fri 03:30 EST)

Consensus Forecast, Manufacturing: 44.5

Consensus Forecast, Services: 53.1

Consensus Forecast, Composite: 50.5

Steep contraction in manufacturing failed to ease in December while growth in services did improve but remained modest. The manufacturing consensus for January's flash is 44.5 which would compare with December's final of 43.7 (revised from a 43.4 flash). Services in January are seen 53.1 at with the composite at 50.5.

Eurozone PMI Flash for January (Fri 09:00 GMT; Fri 10:00 CET; Fri 04:00 EST)

Consensus Forecast, Manufacturing: 46.8

Consensus Forecast, Services: 52.9

Consensus Forecast, Composite: 51.1

Manufacturing PMI has been in contraction for the past 11 months in a row and expectations for January, at a 46.8 consensus, are pointing to a 12th month in a row. Eurozone services, which have been improving, are expected at 52.9 with January's composite at 51.1.

UK: CIPS/PMI Flash for January (Fri 09:30 GMT; Fri 04:30 EST)

Consensus Forecast, Manufacturing: 48.6

Consensus Forecast, Services: 50.9

Consensus Forecast, Composite: 50.2

The CIPS/PMI manufacturing index has been in contraction since May though some improvement is expected for January, at a 48.6 consensus versus 47.6 in December (revised from an initial 47.4). Services have also been struggling but are likewise seen improving to 50.9 with the composite at 50.2.

Canadian Retail Sales for November (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast, Month-to-Month: 0.6%

Canadian retail sales in November are expected to increase 0.6 percent versus what was a very unexpected 1.2 percent monthly plunge in October that pulled year-on-year change into the negative column at minus 0.6 percent.

|