|

Whether or not the Bank of England hints at an easing bias – or perhaps even cut rates – the possibilities are the first interesting drama of the new decade. The odds of an early 2020 cut, for a central bank with a tightening bias currently in place, seemed less than immediate not too long ago, but have been swelling this month and were last at about 50-50 in the futures market. The reason for the shift, of course, is the UK's run of weak economic data, underscored by industrial production and GDP as well as retail sales in the prior week. But the results of the latest week don't tell quite the same story. Before turning to the UK and the BoE, however, we'll round up announcements from three banks where policy outlooks also vary: from wait and see, to let's hope for the best, to who knows what's next?

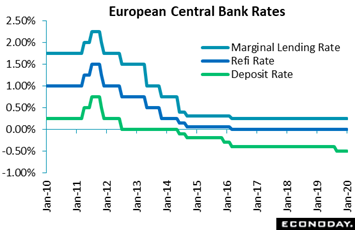

As universally expected, the European Central Bank left policy on hold at its Thursday meeting. Quantitative easing remained targeted at €20 billion per month with no fixed end date, while the refi, deposit and marginal lending rates were held at 0.00 percent, minus 0.50 percent and 0.25 percent respectively. Forward guidance still has the ECB expecting rates "to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2 percent within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics". In addition, the central bank again reiterated its commitment to fully reinvest principal payments from maturing securities purchased under its asset purchase programme. To underscore the lack of surprise, the official policy statement was (again) essentially identical to that of the previous meeting. As universally expected, the European Central Bank left policy on hold at its Thursday meeting. Quantitative easing remained targeted at €20 billion per month with no fixed end date, while the refi, deposit and marginal lending rates were held at 0.00 percent, minus 0.50 percent and 0.25 percent respectively. Forward guidance still has the ECB expecting rates "to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2 percent within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics". In addition, the central bank again reiterated its commitment to fully reinvest principal payments from maturing securities purchased under its asset purchase programme. To underscore the lack of surprise, the official policy statement was (again) essentially identical to that of the previous meeting.

Christine Lagarde's press conference likewise offered little new, although the overall tone was mildly more optimistic than in December. The central bank is clearly relieved, if not wholly convinced, by what seems to be a sustained bounce in underlying inflation, which through the second half of last year moved up nearly 1/2 percentage point to 1.3 percent (the flash HCIP for January will be posted in the coming week). Though officials are still cautious over the outlook, downside risks to the economy have eased since last time and the overall economic assessment was marginally more upbeat.

In sum, there was nothing out of the January deliberations to suggest any early shift in monetary policy. It may be that the chances of additional easing have declined somewhat in recent weeks but, given the splits on the Governing Council, any such move would have met with stiff resistance anyway. Consequently, while it contemplates how policy should be structured in the future, the ECB will be in wait-and-see mode, hoping that the economy gains momentum and, on the back of that, core inflation gradually nudges its way up back toward the 2 percent mark.

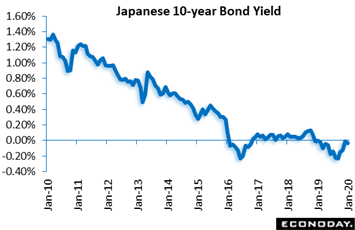

Also as expected, the Bank of Japan's Monetary Policy Board left monetary policy settings unchanged on Tuesday. The BoJ's short-term policy rate for excess reserves was held at minus 0.1 percent while the target level for the long-term 10-year yield remained at around zero percent. Adjusting direct purchases to keep this yield near zero is also part of the bank's policy framework, with this pace continuing to be pegged at ¥80 trillion per year. Forward guidance was also unchanged; officials reaffirmed their commitment to keeping policy rates at or below current levels for "as long as it is necessary to pay close attention to the possibility that the momentum toward achieving the price stability target will be lost". And should signs grow that momentum is being lost, officials once again indicated they would not hesitate to ease policy further. For now, they describe the improvement in inflation as "maintained" but "but not yet sufficiently firm", and they warn that price developments "warrant careful attention". And underscoring the threat to the improvement, the bank lowered its forecasts for consumer inflation, from 0.5 percent to 0.4 percent for the March 2020 fiscal year, from 1.0 percent to 0.9 percent and from 1.5 percent to 1.4 percent for the subsequent two fiscal years. Speaking at the post-meeting press conference, Governor Haruhiko Kuroda argued that the revisions to inflation forecasts were minor and that the underlying trend for inflation has not changed and remained "solid". He also noted that external downside risks to the Japanese economy had eased in recent weeks, citing the US-China trade deal and the UK election results. Also as expected, the Bank of Japan's Monetary Policy Board left monetary policy settings unchanged on Tuesday. The BoJ's short-term policy rate for excess reserves was held at minus 0.1 percent while the target level for the long-term 10-year yield remained at around zero percent. Adjusting direct purchases to keep this yield near zero is also part of the bank's policy framework, with this pace continuing to be pegged at ¥80 trillion per year. Forward guidance was also unchanged; officials reaffirmed their commitment to keeping policy rates at or below current levels for "as long as it is necessary to pay close attention to the possibility that the momentum toward achieving the price stability target will be lost". And should signs grow that momentum is being lost, officials once again indicated they would not hesitate to ease policy further. For now, they describe the improvement in inflation as "maintained" but "but not yet sufficiently firm", and they warn that price developments "warrant careful attention". And underscoring the threat to the improvement, the bank lowered its forecasts for consumer inflation, from 0.5 percent to 0.4 percent for the March 2020 fiscal year, from 1.0 percent to 0.9 percent and from 1.5 percent to 1.4 percent for the subsequent two fiscal years. Speaking at the post-meeting press conference, Governor Haruhiko Kuroda argued that the revisions to inflation forecasts were minor and that the underlying trend for inflation has not changed and remained "solid". He also noted that external downside risks to the Japanese economy had eased in recent weeks, citing the US-China trade deal and the UK election results.

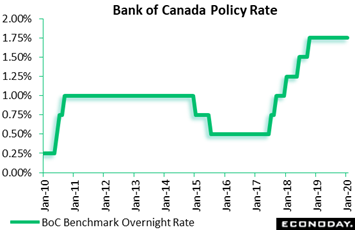

In a third as-expected decision, the Bank of Canada kept policy steady at its Wednesday meeting with the target for the benchmark overnight rate staying at 1.75 percent. The bank repeated its December assessment that the global economy is showing signs of stabilization and that recent trade developments have been positive, yet it also warned that uncertainty remains including geo-political tensions. On the domestic front, the bank said the economy has been resilient though recent indicators have been mixed, as strong levels of residential investment are being offset by a slowdown in hiring and softness in consumer confidence and consumer spending. Special factors are also at play: strikes, poor weather, and inventory adjustments. As a result, the bank said near term growth will be weaker and the output gap wider than projected in its October forecasts. Fourth quarter growth is now estimated at 0.3 percent and 1.3 percent for the first quarter. Looking ahead, the bank projects a pickup in household spending, supported by population and income growth and also by a recent cut in federal income taxes. Canadian business investment and exports are also expected to contribute to growth, but modestly. Whether the BoC is leaning this way or that is hard to tell, but a little dovish bias is easy find. Governor Stephen Poloz expressed concern about the slow 0.3 percent fourth-quarter growth rate, and he cited evidence that global trade tensions are causing consumers to hold back spending. In a third as-expected decision, the Bank of Canada kept policy steady at its Wednesday meeting with the target for the benchmark overnight rate staying at 1.75 percent. The bank repeated its December assessment that the global economy is showing signs of stabilization and that recent trade developments have been positive, yet it also warned that uncertainty remains including geo-political tensions. On the domestic front, the bank said the economy has been resilient though recent indicators have been mixed, as strong levels of residential investment are being offset by a slowdown in hiring and softness in consumer confidence and consumer spending. Special factors are also at play: strikes, poor weather, and inventory adjustments. As a result, the bank said near term growth will be weaker and the output gap wider than projected in its October forecasts. Fourth quarter growth is now estimated at 0.3 percent and 1.3 percent for the first quarter. Looking ahead, the bank projects a pickup in household spending, supported by population and income growth and also by a recent cut in federal income taxes. Canadian business investment and exports are also expected to contribute to growth, but modestly. Whether the BoC is leaning this way or that is hard to tell, but a little dovish bias is easy find. Governor Stephen Poloz expressed concern about the slow 0.3 percent fourth-quarter growth rate, and he cited evidence that global trade tensions are causing consumers to hold back spending.

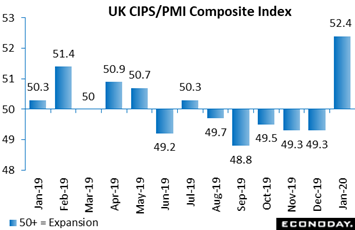

The Bank of England will take the stage on Thursday and what looked like a strong chance for a rate cut, in the wake of soft data posted in the prior week, looks a little less likely now. Based on the CIPS/PMI report, the UK economy began 2020 on a significantly brighter note than it ended 2019. The composite flash for January jumped more than 3 points to 52.4 and a 16-month high. Note that the 50 level is the breakeven score for this index, as it is for many diffusion indexes. Readings above 50 indicate monthly growth in general activity while readings below 50 indicate contraction, as depicted in the accompanying graph where plus 50 scores stand above the breakeven axis and sub 50 scores below. The Bank of England will take the stage on Thursday and what looked like a strong chance for a rate cut, in the wake of soft data posted in the prior week, looks a little less likely now. Based on the CIPS/PMI report, the UK economy began 2020 on a significantly brighter note than it ended 2019. The composite flash for January jumped more than 3 points to 52.4 and a 16-month high. Note that the 50 level is the breakeven score for this index, as it is for many diffusion indexes. Readings above 50 indicate monthly growth in general activity while readings below 50 indicate contraction, as depicted in the accompanying graph where plus 50 scores stand above the breakeven axis and sub 50 scores below.

The surprisingly sharp headline gain reflected stronger growth in both manufacturing and services. After December's 47.5, the manufacturing flash in January jumped to 49.8, a 9-month peak that is close enough to the 50 mark to suggest broadly stable activity. The services counterpart weighed in at 52.9, a nearly 3 point rise from the previous month. Positives were led by solid increases in new orders, despite weak export markets for manufacturers, as well as gains in hiring. And here prospects are being boosted by business optimism which climbed to its highest level since June 2015. Meanwhile, input cost inflation was the most marked in four months due to faster growth of salaries and rising commodity prices. As a result, average prices charged saw their fastest rise since May 2019.

January's findings were surprisingly upbeat and will not be wasted by the BoE. Crucially, the data suggest that reduced political uncertainty following the general election has had a positive impact on both business and consumer activity. This will be exactly what the BoE wants to hear having signaled at its December meeting expectations for just such a response. As a result, speculation about a cut in Bank Rate has taken a serious knock. The MPC can either opt to ease in response to weakness in prior data or pin its hopes on PMI survey data that are pointing to a first quarter rebound.

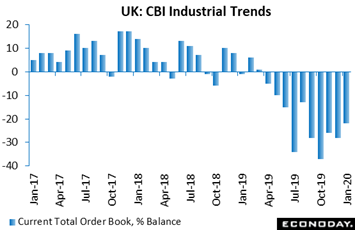

And let's face it. Survey data are based on small samples in a loose methodology and are not definitive. And different survey reports can be signaling different things. The CBI's January trends survey was mixed, for instance, indicating that UK manufacturing activity remains weak yet, at the same, also holding out the hope for some improvement over coming months and quarters. The headline orders index weighed in at minus 22 percent, up from minus 28 percent in December, slightly stronger than market expectations and a 5-month high. However, it was still among the weakest readings seen in the last five years with recent output, at minus 15 percent, still in the doldrums and notably so in the auto industry. And expected prices, at 2 percent after 6 percent, were only soft. Yet the broader quarterly survey found a sizeable improvement in business optimism in the three months to January. At 23 percent, optimism is up 67 percentage points from October, its highest score since the three months ending April 2014 and its steepest rise on record (since 1958). The election result, some clarity over Brexit and hopes for higher government investment spending were key factors. Like the PMI, this report points to a post-election bounce in business activity and one less reason to cut rates. And let's face it. Survey data are based on small samples in a loose methodology and are not definitive. And different survey reports can be signaling different things. The CBI's January trends survey was mixed, for instance, indicating that UK manufacturing activity remains weak yet, at the same, also holding out the hope for some improvement over coming months and quarters. The headline orders index weighed in at minus 22 percent, up from minus 28 percent in December, slightly stronger than market expectations and a 5-month high. However, it was still among the weakest readings seen in the last five years with recent output, at minus 15 percent, still in the doldrums and notably so in the auto industry. And expected prices, at 2 percent after 6 percent, were only soft. Yet the broader quarterly survey found a sizeable improvement in business optimism in the three months to January. At 23 percent, optimism is up 67 percentage points from October, its highest score since the three months ending April 2014 and its steepest rise on record (since 1958). The election result, some clarity over Brexit and hopes for higher government investment spending were key factors. Like the PMI, this report points to a post-election bounce in business activity and one less reason to cut rates.

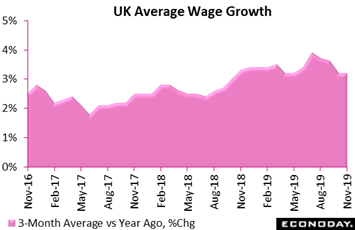

One set of data that is not anecdotal and may be the most pivotal of all for central bank policy is wages, and here the news from the UK offers space for the doves. Wages in the latest labour market report remained relatively subdued, at 3.2 percent average annual growth for the three months ending November. This is the lowest level in more than a year and was unchanged from the October reading. Excluding bonuses, the rate actually dipped from 3.5 percent to 3.4 percent. Yet though wages are soft, ILO employment data in the report were particularly strong, at a very solid 208,000 increase over three months to stand at a record high of 32.90 million. This was large enough to lift the employment rate by 0.4 percentage points to 76.3 percent, also a new peak. Vacancies in the fourth quarter did decline but by only 11,000, the smallest drop since July-September. Compared with the June-August period, the ILO data showed the number of people out of work sliding 17,000 to 1.280 million in the three months to November. This left the unemployment rate unchanged at 3.8 percent. Given the strength of the employment data, this report probably offers as much for the hawks as it does for the doves, allowing the former to argue that lack of wage growth may only be temporary. One set of data that is not anecdotal and may be the most pivotal of all for central bank policy is wages, and here the news from the UK offers space for the doves. Wages in the latest labour market report remained relatively subdued, at 3.2 percent average annual growth for the three months ending November. This is the lowest level in more than a year and was unchanged from the October reading. Excluding bonuses, the rate actually dipped from 3.5 percent to 3.4 percent. Yet though wages are soft, ILO employment data in the report were particularly strong, at a very solid 208,000 increase over three months to stand at a record high of 32.90 million. This was large enough to lift the employment rate by 0.4 percentage points to 76.3 percent, also a new peak. Vacancies in the fourth quarter did decline but by only 11,000, the smallest drop since July-September. Compared with the June-August period, the ILO data showed the number of people out of work sliding 17,000 to 1.280 million in the three months to November. This left the unemployment rate unchanged at 3.8 percent. Given the strength of the employment data, this report probably offers as much for the hawks as it does for the doves, allowing the former to argue that lack of wage growth may only be temporary.

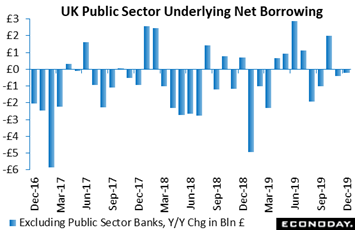

We wind up the week's UK sweep with a report that looks to get more attention in the future, based that is on prospects for a rise in government spending. Public sector finances were more upbeat than expected in December. Overall net borrowing (PSNB) weighed in at £4.04 billion, little changed from £4.20 billion in November but, more importantly, down £0.29 billion from a year ago. Excluding public sector banks (PSNB-X), the deficit stood at £4.77 billion, a £0.21 billion drop from December 2018 as tracked in the accompany graph. However, despite the monthly improvement, cumulative PSNB-X borrowing over the fiscal year to date now stands at £54.6 billion, up some £4.0 billion versus the same period in FY2018/19. The deterioration reflects a 5.0 percent jump in government spending on goods and services, the sharpest increase since the data were first compiled in 1997. This is particularly ominous as a significant boost to spending over coming quarters is already in the pipeline given the government's pre-election promises. Also of note, the corporate tax take declined 3.4 percent over the same period, its steepest drop since 2012 and further evidence of sluggish business activity. Should the UK economy slow and not accelerate, future borrowing data could turn grim. We wind up the week's UK sweep with a report that looks to get more attention in the future, based that is on prospects for a rise in government spending. Public sector finances were more upbeat than expected in December. Overall net borrowing (PSNB) weighed in at £4.04 billion, little changed from £4.20 billion in November but, more importantly, down £0.29 billion from a year ago. Excluding public sector banks (PSNB-X), the deficit stood at £4.77 billion, a £0.21 billion drop from December 2018 as tracked in the accompany graph. However, despite the monthly improvement, cumulative PSNB-X borrowing over the fiscal year to date now stands at £54.6 billion, up some £4.0 billion versus the same period in FY2018/19. The deterioration reflects a 5.0 percent jump in government spending on goods and services, the sharpest increase since the data were first compiled in 1997. This is particularly ominous as a significant boost to spending over coming quarters is already in the pipeline given the government's pre-election promises. Also of note, the corporate tax take declined 3.4 percent over the same period, its steepest drop since 2012 and further evidence of sluggish business activity. Should the UK economy slow and not accelerate, future borrowing data could turn grim.

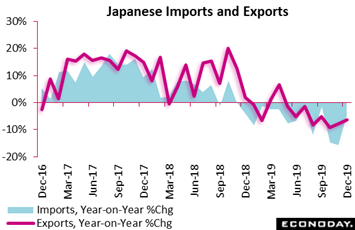

Many trade reports have been looking less grim but barely so for Japan in a reminder that global trade going into 2020, and before any benefits from the phase one trade deal between the US and China, was not showing much progress. Japan's merchandise trade deficit widened from ¥85.2 billion in November to a largely as expected ¥152.5 billion in December. Exports (red line in graph) fell 6.3 percent on the year in December after dropping 7.9 percent in November, deeper than the consensus forecast for a drop of 4.2 percent. Imports (blue area) fell 4.9 percent on the year after dropping an especially deep 15.7 percent previously. The year-on-year decline in Japan's exports in December was the 14th in a row and contrasts with previously released data from China and Singapore that showed year-on-year growth in exports during December. Japanese performance was somewhat mixed across major trading partners. Exports to China rose 0.8 percent on the year in December after dropping 5.4 percent, but exports to the US weakened from a drop of 12.9 percent to a fall of 14.9 percent, and exports to the European Union fell 8.1 percent on the year after falling 7.5 percent previously. Many trade reports have been looking less grim but barely so for Japan in a reminder that global trade going into 2020, and before any benefits from the phase one trade deal between the US and China, was not showing much progress. Japan's merchandise trade deficit widened from ¥85.2 billion in November to a largely as expected ¥152.5 billion in December. Exports (red line in graph) fell 6.3 percent on the year in December after dropping 7.9 percent in November, deeper than the consensus forecast for a drop of 4.2 percent. Imports (blue area) fell 4.9 percent on the year after dropping an especially deep 15.7 percent previously. The year-on-year decline in Japan's exports in December was the 14th in a row and contrasts with previously released data from China and Singapore that showed year-on-year growth in exports during December. Japanese performance was somewhat mixed across major trading partners. Exports to China rose 0.8 percent on the year in December after dropping 5.4 percent, but exports to the US weakened from a drop of 12.9 percent to a fall of 14.9 percent, and exports to the European Union fell 8.1 percent on the year after falling 7.5 percent previously.

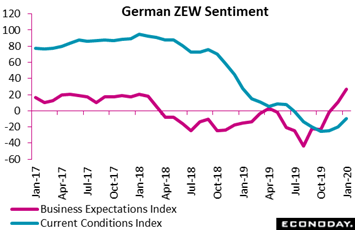

We end the week with a decidedly upbeat result: big gains once again in sentiment that echo rising optimism in the UK outlook data. According to the latest ZEW findings, analysts have become notably less pessimistic about the state of the German economy. The current conditions (blue line) rose more than 10 points to minus 9.5 in January, their fourth consecutive increase and the best result since last July. At the same time, expectations (red line) were up 16.0 points at 26.7. This was their third straight gain and their best performance since the middle of 2015. It's hard to escape the welcome conclusion that the surprisingly sharp increases in both measures may well reflect hopes that easing trade tensions will provide the platform for generally stronger global trade in 2020. We end the week with a decidedly upbeat result: big gains once again in sentiment that echo rising optimism in the UK outlook data. According to the latest ZEW findings, analysts have become notably less pessimistic about the state of the German economy. The current conditions (blue line) rose more than 10 points to minus 9.5 in January, their fourth consecutive increase and the best result since last July. At the same time, expectations (red line) were up 16.0 points at 26.7. This was their third straight gain and their best performance since the middle of 2015. It's hard to escape the welcome conclusion that the surprisingly sharp increases in both measures may well reflect hopes that easing trade tensions will provide the platform for generally stronger global trade in 2020.

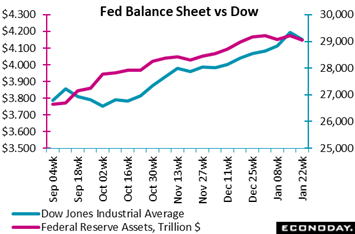

Jerome Powell has been adamant that emergency liquidity added since the repo scare in September has no policy significance, that it is not a move to add extra stimulus to the economy but only a technical adjustment to bring reserves in line with banking demand following an extended period of balance sheet contraction. Yet the rise in the balance sheet is in fact the result of additional buying of Treasuries – direct buying by the central bank that has put extra cash in the hands of banks and investors. And where is this cash going? Perhaps into the stock market as tracked in the graph, which compares the red line of the Fed's balance sheet, rising from under $3.8 trillion in September to just over $4.1 trillion now, against the blue line of the Dow, rising from just under 27,000 to nearly 29,000 over this same period. In an interview with Market News International, former Dallas Fed President Richard Fisher said the rise between the stock market and the balance sheet is "almost a hundred percent correlation". In the prior week, Dallas President Robert Kaplan described the Fed's repo move as a "derivative of QE", an assessment with which Fisher agrees. The Fed, at least at last notice, planned to extend its roughly $60 billion of T-bill purchases through the second quarter which, at least through mid-year, is a promising prospect for the stock market. The conclusion: Go by what the Fed is doing, not what it's saying. Jerome Powell has been adamant that emergency liquidity added since the repo scare in September has no policy significance, that it is not a move to add extra stimulus to the economy but only a technical adjustment to bring reserves in line with banking demand following an extended period of balance sheet contraction. Yet the rise in the balance sheet is in fact the result of additional buying of Treasuries – direct buying by the central bank that has put extra cash in the hands of banks and investors. And where is this cash going? Perhaps into the stock market as tracked in the graph, which compares the red line of the Fed's balance sheet, rising from under $3.8 trillion in September to just over $4.1 trillion now, against the blue line of the Dow, rising from just under 27,000 to nearly 29,000 over this same period. In an interview with Market News International, former Dallas Fed President Richard Fisher said the rise between the stock market and the balance sheet is "almost a hundred percent correlation". In the prior week, Dallas President Robert Kaplan described the Fed's repo move as a "derivative of QE", an assessment with which Fisher agrees. The Fed, at least at last notice, planned to extend its roughly $60 billion of T-bill purchases through the second quarter which, at least through mid-year, is a promising prospect for the stock market. The conclusion: Go by what the Fed is doing, not what it's saying.

The upbeat survey data from the UK followed similarly upbeat PMI data during the week from Germany and also Europe as well as Japan. For the Bank of England, strength outside of the UK will support arguments that global risks are easing, or at least not getting worse. The data will likewise ease concerns at the Federal Reserve over global risks where the coming week's FOMC does not look to be contentious at all, that is for policy rates. Debate, however, over what is policy and what is not policy when it comes to balance sheet expansion may well be contentious, a point of debate that is certain to be a highlight of Jerome Powell's press conference.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Business sentiment in Germany has been improving while new homes are very hot right now in the US; updates on Monday that will lead off what looks to a mostly upbeat weak of economic news. Yet Tuesday may see a run of subdued reports: CBI distributive trade that follows December's big retail sales flop in the UK; as well as US consumer confidence and US durable goods on Tuesday, two sets of data that have been flat. Wednesday the focus will be the Federal Reserve and whether US policy makers, however much against expectations, signal any hint away from their wait-and-see mode. Big news will also be posted in the US on Thursday with the first estimate of fourth-quarter GDP, a report that may very well be highlighted, if not by the consumer, then by residential investment and net exports. Fourth-quarter flash GDP data will also be posted in France and the Eurozone on Friday. But the week's most awaited news will be posted on Thursday by the Bank of England and whether, after a run of mixed to weak economic data, policy suddenly turns dovish. Turning to inflation, consumer prices at midweek may put the Reserve Bank of Australia in focus and whether, should pressures prove mostly flat as expected, another rate cut may be in store. Other CPI reports include January's preliminary data from Germany on Thursday followed on Friday by France and the Eurozone. Data will also be heavy out of Japan, mostly on Thursday with industrial production and retail sales.

German Ifo Economic Sentiment for January (Mon 09:00 GMT; Mon 10:00 CET; Mon 04:00 EST)

Consensus Forecast: 97.1

For January, German economic sentiment is expected to rise to 97.1 versus a better-than-expected and 6-month high of 96.3 in December.

US New Home Sales for December (Mon 15:00 GMT; Mon 10:00 EST)

Consensus Forecast, Annualized Rate: 728,000

New home sales have been rising strongly and are at their best level of the expansion. Econoday's consensus for December's annual new home rate is 728,000 versus 719,000 in November.

UK CBI Distributive Trades for January (Tue 11:00 GMT; Tue 06:00 EST)

Consensus Forecast: 2

CBI's December distributive trades survey, at a zero headline in the December report which was posted on the 19th of that month, pointed to a worryingly soft period for retail sales in the key run-up to Christmas. For January, which will include Christmas, the consensus is for improvement to plus 2.

US Durable Goods Orders for December (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month-to-Month Change: 0.5%

Consensus Forecast: Ex-Transportation: 0.2%

Consensus Forecast: Core Capital Goods Orders: 0.2%

Up-and-down headlines have been masking flat results underneath for US durable goods orders where the headline in December is expected to rise 0.5 percent versus an unexpectedly weak 2.1 percent drop in November (revised from an initial 2.0 percent decline). December orders excluding transportation equipment are expected to increase 0.2 percent as are orders for core capital goods.

US Consumer Confidence Index for January (Tue 15:00 GMT; Tue 10:00 EST)

Consensus Forecast: 127.8

The consumer confidence index ended 2019 in a series of flat readings with December's report marked by mostly moderating assessments of the labor market. For January's index, Econoday's consensus is 127.8 in what would be moderate gain versus December's 126.5.

Australian Fourth-Quarter CPI (Wed 00:30 GMT; Wed 11:30 AEDT; Tue 19:30 EST)

Consensus Forecast, Quarter-to-Quarter: 0.6%

Consensus Forecast, Year-over-Year: 1.7%

Fourth-quarter consumer prices are expected to rise a quarterly 0.6 percent versus a 0.5 percent increase in the third quarter. Year-on-year, fourth-quarter CPI is expected to hold unchanged at 1.7 percent and extend to six the number of quarters below the Reserve Bank of Australia's 2 to 3 percent target range.

Germany: GfK Consumer Climate for February (Wed 07:00 GMT; Wed 08:00 CET; Wed 02:00 EST)

Consensus Forecast: 9.7

A rise to 9.7 is the call for February's Gfk survey which in January dipped 1 tenth to 9.6 and back to a 3-1/2 year low.

Eurozone M3 Money Supply for December (Wed 09:00 GMT; Wed 10:00 CET; Wed 04:00 EST)

Consensus Forecast, Year-over-Year: 5.5%

M3 money supply has been stable at expansion highs though no further acceleration is expected for December where the year-on-year consensus for three-month average growth is 5.5 percent which would compare with 5.6 percent in November.

Italian Business and Consumer Confidence for January (Wed 09:00 GMT; Wed 10:00 CET; Wed 04:00 EST)

Consensus Forecast, Manufacturing Confidence: 99.4

Consensus Forecast, Consumer Confidence: 104.5

Consumer confidence in Italy improved sharply in December, up 2.2 points to a much better-than-expected 110.8, offset to a degree by only minimal improvement in manufacturing confidence to what was a lower-than-expected 99.1. For January, consumer confidence is seen dipping back to 104.5 with manufacturing confidence slightly higher at 99.4.

US International Trade In Goods for December (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast, Month-to-Month Change: -$66.9 billion

Forecasters see widening for the December goods trade gap, at a consensus $66.9 billion versus an unusually low $63.0 billion in November (revised from an initial $63.2 billion). Goods exports improved in November while imports slowed.

US Federal Reserve Policy Announcement (Wed 19:00 GMT; Wed 14:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Policy Range: 1.50% to 1.75%

No change is the call for the January policy meeting with the federal funds rate expected to hold at a range of 1.50 to 1.75 percent. After three straight incremental 25-basis-point rate cuts ending in October last year, the Fed in December moved to a wait-and-see approach.

Eurozone: EC Economic Sentiment for January (Thu 10:00 GMT; Thu 11:00 CET; Thu 05:00 EST)

Consensus Forecast: 101.9

After an especially poor showing in October, the European Commission's economic sentiment index beat expectations in both November and December for the first back-to-back rise in two years. At 101.5 in December, forecasters see January's index rising further to 101.9.

Bank of England Announcement (Thu 12:00 GMT; Thu 07:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.75%

Consensus Forecast: Asset Purchase Level: £435 billion

No change is once again the consensus for Bank of England monetary policy which however, despite a gentle bias in place toward tightening, could turn dovish following a run of weak year-end data. Still, Bank Rate is expected to stay at 0.75 percent and the QE ceiling at £435 billion.

German Preliminary CPI for January (Thu 13:00 GMT; Thu 14:00 CET; Thu 08:00 EST)

Consensus Forecast, Month-to-Month: -0.7%

Consensus Forecast, Year-over-Year: 1.7%

After a sharper-than-expected 0.5 percent rise in December, consumer prices in Germany are expected to fall 0.7 percent in January. Year-on-year, however, the call is for progress, to 1.7 percent versus December's 1.5 percent.

US GDP: 4th Quarter, 1st Estimate, Q/Q SAAR (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast: 2.1%

Real Personal Consumption Expenditures

Consensus Forecast: 1.9%

Fundamentally supported by consumer spending, fourth-quarter GDP is expected to rise at a 2.1 percent annual pace to match the third quarter's pace. Consumer spending in the US is seen slowing from a strong 3.2 percent third-quarter pace to a still useful 1.9 percent in the fourth. Net exports and residential investment are also likely to be positives for the quarter.

Japanese Industrial Production for December (Thu 23:50 GMT: Fri 08:50 JST; Thu 18:50 EST)

Consensus Forecast, Month-to-Month: 0.8%

Industrial production in Japan has been trending into contraction which deepened in November, at a year-on-year minus 8.1 percent. On a monthly basis, November production fell 0.9 percent but is expected to rise 0.8 percent in December.

Japanese Retail Sales for December (Thu 23:50 GMT: Fri 08:50 JST; Thu 18:50 EST)

Consensus Forecast, Year-over-Year: -1.8%

Retail sales have been swinging sharply, first higher in September in advance of an increase in consumption taxes than lower in November and especially October after the increase. December's consensus is a year-on-year decline of 1.8 percent.

China: CFLP Manufacturing PMI for January (Fri 01:00 GMT; Fri 09:00 CST; Thu 20:00 EST)

Consensus Forecast: 50.1

After eight straight months in contraction, the CFLP manufacturing PMI broke above 50 in November and December though just barely, at 50.2 in both months. For January, the consensus is 50.1.

French GDP Fourth-Quarter Flash, 1st Estimate (Fri 07:30 GMT; Fri 08:30 CET; Fri 01:30 EST)

Consensus Forecast, Quarter-to-Quarter: 0.2%

Fourth-quarter GDP in France is expected to expand a quarterly 0.2 percent versus 0.3 percent in the third quarter. Year-on-year, GDP grew 1.3 percent in the third quarter.

Eurozone GDP Fourth-Quarter Preliminary Flash (Fri 10:00 GMT; Fri 11:00 CET; Fri 05:00 EST)

Consensus Forecast: Quarter-to-Quarter: 0.2%

Consensus Forecast, Year-over-Year: 1.2%

Fourth-quarter Eurozone GDP is expected to hold steady at a 0.2 percent increase, matching the third-quarter rate. The year-on-year rate is seen at plus 1.2 percent which would also match the third-quarter reading (revised from a flash of 1.1 percent). Looking back at the third quarter, household spending improved while fixed capital formation slowed.

Eurozone HICP Flash for January (Fri 10:00 GMT; Fri 11:00 CET; Fri 05:00 EST)

Consensus Forecast, Year-over-Year: 1.5%

Eurozone Underlying HICP Flash

Consensus Forecast, Year-over-Year: 1.3%

Eurozone inflation for January is expected to rise to 1.5 percent versus 1.3 percent in December. January's key (narrow) core rate is expected to come in at 1.3 percent, unchanged from December.

US Employment Cost Index for Fourth Quarter (Fri 13:30 GMT, 08:30 EST)

Consensus Forecast, Quarter-to-Quarter Change: 0.7%

Steady pressure is expected for the employment cost index with Econoday's fourth-quarter consensus at a 0.7 percent rise. The third-quarter rate, at 0.7 percent, rose 1 tenth as did the year-on-year pace to 2.8 percent.

US Personal Income for December (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast, Month-to-Month Change: 0.3%

Consumer Spending

Consensus Forecast, Month-to-Month Change: 0.3%

Core PCE Price Index

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Forecast, Year-on-Year Change: 1.6%

Growth in income and spending had been soft but firmed in November, up 0.5 and 0.4 percent respectively. Econoday's consensus forecasts for December are plus 0.3 percent for both income and consumer spending. Core PCE inflation, which is specifically tracked by the Federal Reserve, has been flat and is not is expected to show any improvement in December, seen at plus 0.1 percent on a monthly basis (versus plus 0.1 percent in November) and at 1.6 percent year-on-year (versus 1.6 percent).

Canadian GDP for November (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast, Month-to-Month: 0.0%

No change is expected for November GDP versus October's 0.1 percent decrease that reflected contraction in manufacturing and the effects of the GM strike. Year-on-year, GDP growth in Canada was running at 1.2 percent in October.

|