|

After a heavy run of rate cuts last year, central banks appear to have taken the sidelines. Despite all the stimulus, inflation has yet to show much underlying lift, at least yet. What is moving is consumer confidence, and that's higher. The coronavirus outbreak is still unfolding and it's too early to say what effects it may or may not have. The very latest economic data coming out of January, whether from the US, Europe, or China, aren't' showing any visible virus impact, with no headlines to report so far anyway. And headlines were also hard to find from the week's central bank meetings, where wait-and-see is the watchword.

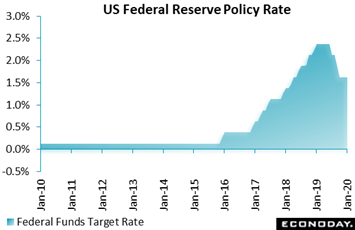

The Federal Reserve as expected held its federal funds rate unchanged within a range of 1.50 to 1.75 percent for an implied midpoint of 1.625 percent, where it has been since their 25 basis point cut back in October. The Fed's general economic assessment was slightly weaker than December. The labor market does remain strong, job gains remain solid and economic growth continues at a moderate pace. But wording on inflation was changed slightly in what amounts to a small downgrade: policy is now consistent with "returning" inflation to the 2 percent target from running "near" the 2 percent target in the prior statement. And household spending clearly got a downgrade, from rising at a strong pace to rising at only a moderate pace. Both business investment and exports remain weak. Also unchanged is what the Fed is watching with care: global developments and lack of inflation. The vote for this meeting, which includes a shuffling among four regional banks, was the same as it was at the last: 10 to 0. The Federal Reserve as expected held its federal funds rate unchanged within a range of 1.50 to 1.75 percent for an implied midpoint of 1.625 percent, where it has been since their 25 basis point cut back in October. The Fed's general economic assessment was slightly weaker than December. The labor market does remain strong, job gains remain solid and economic growth continues at a moderate pace. But wording on inflation was changed slightly in what amounts to a small downgrade: policy is now consistent with "returning" inflation to the 2 percent target from running "near" the 2 percent target in the prior statement. And household spending clearly got a downgrade, from rising at a strong pace to rising at only a moderate pace. Both business investment and exports remain weak. Also unchanged is what the Fed is watching with care: global developments and lack of inflation. The vote for this meeting, which includes a shuffling among four regional banks, was the same as it was at the last: 10 to 0.

Regarding repos, where five months of Fed support following a liquidity scare in September has coincided with a rally in the stock market, Jerome Powell repeated that the Fed will conduct term and overnight repos at least through April and will consider altering or ending the program sometime in the second quarter. He stressed that the Fed does not regard its buttressing of the money markets (coming to nearly $375 billion in purchases of Treasuries so far) as part of its monetary policy, only a procedure to establish a floor for bank reserves regardless of seasonal volatility.

On coronavirus, Powell said is too soon to know what effect the epidemic will have on China's economy, but he noted that the US is relatively insulated as 85 percent of GDP is tied to domestic purchases and not trade. On domestic wages, Powell conceded that current growth is unexpectedly weak, noting that the natural rate of unemployment, which was historically central for Fed policy, maybe lower that thought. On trade, he said uncertainty remains given substantial tariffs that are still in place and more negotiations to come. Overall Powell broke no new ground, leaving the impression he and his colleagues are perfectly happy with their no-action stance. Speaking with unusual care throughout the press conference, he provided no hint at when it will be time to go in a new direction other than to repeat it would take a "material" change in economic conditions.

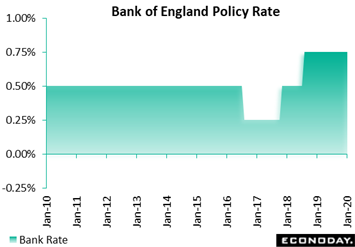

It was against such a backdrop of a material change in conditions, or at least early concern over late year trouble for retail sales and GDP, that raised significant speculation for a possible cut in the UK. But the Bank of England kicked off 2020 by announcing no change to policy: Bank Rate stayed at 0.75 percent and QE remained capped at £445 billion, within which gilts are £435 billion. Having voted 7 to 2 to maintain the status quo back in December, the January decision was passed by the same majority, a clearer cut outcome than most expected. Jonathan Haskel and Michael Saunders were again the only dissenters asking for an immediate 25 basis point cut. Nonetheless, it was a close call and the minutes hint that an ease could yet be in the wings. The monetary policy board still thinks, should the recovery evolve as it expects, that further ahead "some modest tightening of policy may be needed to maintain inflation sustainably at the target". However, at the same time, it also pointed out, in reference to January improvement in anecdotal survey data, that an ease might be needed "should the more positive signals from recent indicators of global and domestic activity not be sustained or should indicators of domestic prices remain relatively weak.'' This underscores a high level of uncertainty among MPC members. It was against such a backdrop of a material change in conditions, or at least early concern over late year trouble for retail sales and GDP, that raised significant speculation for a possible cut in the UK. But the Bank of England kicked off 2020 by announcing no change to policy: Bank Rate stayed at 0.75 percent and QE remained capped at £445 billion, within which gilts are £435 billion. Having voted 7 to 2 to maintain the status quo back in December, the January decision was passed by the same majority, a clearer cut outcome than most expected. Jonathan Haskel and Michael Saunders were again the only dissenters asking for an immediate 25 basis point cut. Nonetheless, it was a close call and the minutes hint that an ease could yet be in the wings. The monetary policy board still thinks, should the recovery evolve as it expects, that further ahead "some modest tightening of policy may be needed to maintain inflation sustainably at the target". However, at the same time, it also pointed out, in reference to January improvement in anecdotal survey data, that an ease might be needed "should the more positive signals from recent indicators of global and domestic activity not be sustained or should indicators of domestic prices remain relatively weak.'' This underscores a high level of uncertainty among MPC members.

Still, the relatively comfortable vote suggests that, on balance, the MPC is more relieved by the apparent pick-up in economic activity implied by a number of the January business surveys, such as the CIPS/PMI composite or CBI industrial trends report, than it is concerned about the weakness shown in the hard fourth quarter data. This is consistent with its year-end justification for leaving policy on hold – and, indeed, retaining a gentle tightening bias under its central case scenario – which was in part based upon an expected post-election boost to confidence.

Pending a boost or not, however, the bank's monetary policy report, released along with policy announcement, painted a pretty dismal picture of UK growth prospects and still shows inflation, assuming interest rates remain unchanged, just barely skimming the edge of the 2 percent target at the end of the forecast period. For 2020 GDP, the outlook was cut from 1.25 percent in the November report to just 0.75 percent and from 1.75 percent to only 1.5 percent in 2021. In large part this is due to the Bank's weak assessment of the UK's productive potential, which has been downgraded significantly. Potential supply growth is now put at a lowly 1.1 percent, down from 1.5 percent previously and reflecting a mix of hits from Brexit and the lower growth trend seen since the financial crisis. On inflation, the CPI is seen at 1.44 percent in the first quarter next year before rising to 1.87 percent a year later and 1.99 percent in the same quarter of 2023. This increase, however gradual and modest, provides the justification for the latest rate decision. Assuming one 25 basis point cut over the entire period, inflation for the same dates rises from 1.53 percent to 2.01 percent and then 2.15 percent. So a cut would be expected to push inflation above target.

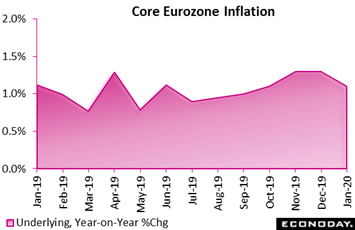

But above target is only dreaming when you look at most consumer price data. January's provisional report from the Eurozone does show headline inflation increasing for a third successive month, yet underlying elements tell a different story. Even the headline, at an annual 1.4 percent rate, was up only 1 tenth from a final 1.3 percent rate in December and was on the soft side of market expectations, albeit at its highest level since April 2019. More importantly anyway, January's headline pick-up was wholly attributable to the more volatile categories. In particular, energy inflation jumped from 0.2 percent to 1.8 percent while the rate for food, drink and tobacco advanced from 2.0 percent to 2.2 percent. Excluding these subsectors, the narrow core rate actually fell 0.2 percentage points to a surprisingly soft 1.1 percent (red area in graph), fully reversing its November and December bounce and equaling a 4-month low. Omitting just energy and unprocessed food, inflation also dipped a tick to 1.3 percent. Elsewhere, the non-industrial goods rate was steady at 0.5 percent while its services counterpart declined 0.3 percentage points to 1.5 percent. The ECB must have been disappointed by January's update. Hopes that core inflation was finally starting to creep higher have been proved wrong and essentially the underlying picture now looks no different than it did a year ago. Additional monetary easing is still not in the cards any time soon but the prospect of a hike in interest rates would seem further away than ever. But above target is only dreaming when you look at most consumer price data. January's provisional report from the Eurozone does show headline inflation increasing for a third successive month, yet underlying elements tell a different story. Even the headline, at an annual 1.4 percent rate, was up only 1 tenth from a final 1.3 percent rate in December and was on the soft side of market expectations, albeit at its highest level since April 2019. More importantly anyway, January's headline pick-up was wholly attributable to the more volatile categories. In particular, energy inflation jumped from 0.2 percent to 1.8 percent while the rate for food, drink and tobacco advanced from 2.0 percent to 2.2 percent. Excluding these subsectors, the narrow core rate actually fell 0.2 percentage points to a surprisingly soft 1.1 percent (red area in graph), fully reversing its November and December bounce and equaling a 4-month low. Omitting just energy and unprocessed food, inflation also dipped a tick to 1.3 percent. Elsewhere, the non-industrial goods rate was steady at 0.5 percent while its services counterpart declined 0.3 percentage points to 1.5 percent. The ECB must have been disappointed by January's update. Hopes that core inflation was finally starting to creep higher have been proved wrong and essentially the underlying picture now looks no different than it did a year ago. Additional monetary easing is still not in the cards any time soon but the prospect of a hike in interest rates would seem further away than ever.

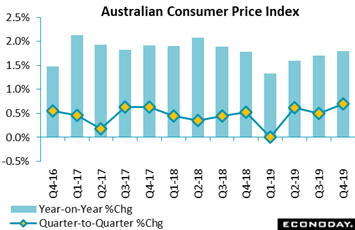

There's no hint of a hike coming out of Australia either. The Reserve Bank of Australia, after a round of cuts last year, has yet to lift consumer prices to the 2 percent level, but here at least conditions are not going in reverse. The headline consumer price index increased 1.8 percent on the year in the three months to December, slightly better than expected and up a notch from 1.7 percent in the September quarter and closer to the RBA's target range of 2 to 3 percent. Inflation has now been below this range for six consecutive quarters. On the quarter, headline prices increased 0.7 percent from 0.5 percent previously. Measures of core inflation, which exclude the impact of volatile price changes, were steady. The trimmed mean CPI inflation advanced 0.4 percent on the quarter, as it did previously, with the year-on-year increase steady at 1.6 percent. The weighted mean CPI inflation measure advanced 0.4 percent on the quarter after increasing 0.3 percent previously with this annual rate picking up slightly from 1.2 percent to 1.3 percent. The report's limited increases are broadly in line with the assessment made by RBA officials at their most recent policy meeting in early December. Officials then forecast that inflation would pick up gradually and be close to 2 percent in 2020 and 2021 in both headline and underlying terms. The bank will hold its first policy meeting for 2020 and publish updated economic forecasts in the coming week. No rate action is expected and neither, by the way, is any action expected by the Reserve Bank of India which also meets in the coming week. Australia and India were both out in front in last year's rate-cut run but in contrast to Australia, inflation in India has indeed picked up and perhaps too much, moving from just under 2 percent at the beginning of 2019 and ending just under 7-1/2 percent by December and above the RBI's 2 to 6 percent target range. There's no hint of a hike coming out of Australia either. The Reserve Bank of Australia, after a round of cuts last year, has yet to lift consumer prices to the 2 percent level, but here at least conditions are not going in reverse. The headline consumer price index increased 1.8 percent on the year in the three months to December, slightly better than expected and up a notch from 1.7 percent in the September quarter and closer to the RBA's target range of 2 to 3 percent. Inflation has now been below this range for six consecutive quarters. On the quarter, headline prices increased 0.7 percent from 0.5 percent previously. Measures of core inflation, which exclude the impact of volatile price changes, were steady. The trimmed mean CPI inflation advanced 0.4 percent on the quarter, as it did previously, with the year-on-year increase steady at 1.6 percent. The weighted mean CPI inflation measure advanced 0.4 percent on the quarter after increasing 0.3 percent previously with this annual rate picking up slightly from 1.2 percent to 1.3 percent. The report's limited increases are broadly in line with the assessment made by RBA officials at their most recent policy meeting in early December. Officials then forecast that inflation would pick up gradually and be close to 2 percent in 2020 and 2021 in both headline and underlying terms. The bank will hold its first policy meeting for 2020 and publish updated economic forecasts in the coming week. No rate action is expected and neither, by the way, is any action expected by the Reserve Bank of India which also meets in the coming week. Australia and India were both out in front in last year's rate-cut run but in contrast to Australia, inflation in India has indeed picked up and perhaps too much, moving from just under 2 percent at the beginning of 2019 and ending just under 7-1/2 percent by December and above the RBI's 2 to 6 percent target range.

Coronavirus has not been a major topic yet for central bankers, and its effects have yet to appear in the economic data. One effect it could have is on trade which in general showed global improvement at year end. Trade data from Asia took the hardest hit of any last year and Hong Kong was no exception, yet rates of import and export change swung higher in both November and December as tracked in the graph. December imports did fall 1.9 percent from a year earlier but this is compared to a 5.8 percent drop in November and even steeper declines in the long dismal run that stretched through 2019. Hong Kong exports actually popped into the plus column for the first time in a year, rising 3.3 percent in December after dropping 1.4 percent in November. The export rebound was largely driven by stronger demand from mainland China, with exports to that market up 15.7 percent on the year in December after advancing 5.2 percent in November. Officials, however, noted that stronger year-on-year growth in exports to China was largely driven by base effects, with exports at a low level 12 months earlier. Exports to other major markets, including Japan and the US, were again weak in December. Officials also cautioned that the outlook for external demand is hard to predict, citing a change in US-China trade relations but also noting the potential economic impact of the coronavirus outbreak. Hong Kong runs a deficit overall, at HK$32.5 billion in December versus HK$26.2 billion in November. Coronavirus has not been a major topic yet for central bankers, and its effects have yet to appear in the economic data. One effect it could have is on trade which in general showed global improvement at year end. Trade data from Asia took the hardest hit of any last year and Hong Kong was no exception, yet rates of import and export change swung higher in both November and December as tracked in the graph. December imports did fall 1.9 percent from a year earlier but this is compared to a 5.8 percent drop in November and even steeper declines in the long dismal run that stretched through 2019. Hong Kong exports actually popped into the plus column for the first time in a year, rising 3.3 percent in December after dropping 1.4 percent in November. The export rebound was largely driven by stronger demand from mainland China, with exports to that market up 15.7 percent on the year in December after advancing 5.2 percent in November. Officials, however, noted that stronger year-on-year growth in exports to China was largely driven by base effects, with exports at a low level 12 months earlier. Exports to other major markets, including Japan and the US, were again weak in December. Officials also cautioned that the outlook for external demand is hard to predict, citing a change in US-China trade relations but also noting the potential economic impact of the coronavirus outbreak. Hong Kong runs a deficit overall, at HK$32.5 billion in December versus HK$26.2 billion in November.

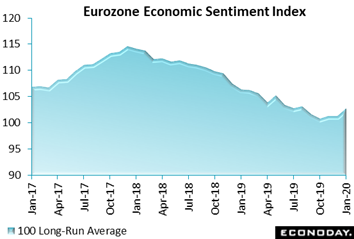

Going into the virus outbreak, consumer sentiment seems to have been on the mend including in the Eurozone. At 102.8, the EC economic sentiment index (ESI) rose 1.5 points in January to mark its highest reading since August. While gains have generally been quite small, this nevertheless was the third straight increase in a streak not matched since October to December 2017. The latest advance came courtesy of industry, where confidence climbed 2 full points to minus 7.3, still negative but a 5-month peak. Construction, up 1.2 points to 6.9, was also more optimistic, while morale for households was flat and eased slightly for both services and retail. Regionally, the national ESIs made up ground in France (104.1 after 102.6) and Germany (101.8 after 99.8) which saw its first break above the 100 long-run average since August. However, Italy (101.5 after 101.6) was essentially flat and Spain (102.0 after 103.0) unwound much of December's bounce. Going into the virus outbreak, consumer sentiment seems to have been on the mend including in the Eurozone. At 102.8, the EC economic sentiment index (ESI) rose 1.5 points in January to mark its highest reading since August. While gains have generally been quite small, this nevertheless was the third straight increase in a streak not matched since October to December 2017. The latest advance came courtesy of industry, where confidence climbed 2 full points to minus 7.3, still negative but a 5-month peak. Construction, up 1.2 points to 6.9, was also more optimistic, while morale for households was flat and eased slightly for both services and retail. Regionally, the national ESIs made up ground in France (104.1 after 102.6) and Germany (101.8 after 99.8) which saw its first break above the 100 long-run average since August. However, Italy (101.5 after 101.6) was essentially flat and Spain (102.0 after 103.0) unwound much of December's bounce.

Inflation developments were positive: selling prices in manufacturing (3.0 after 2.1) crept up to a 7-month high and equaled a 10-month peak in services (10.3 after 8.4). At the same time, inflation expectations in the household sector (20.7 after 20.5) were also a little firmer. The ECB pays significant attention to this report and it may have been quietly content with the results. The economy is hardly booming but there is increasing evidence that the slowdown may be over and inflation expectations seem to be reversing earlier declines. Monetary tightening may still be a long way off but the possibility of additional easing appears to be more unlikely.

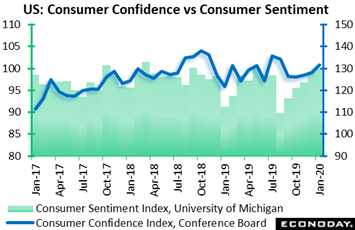

Additional easing isn't the question right now for the Fed which is currently out of play, but whatever chance there is probably got smaller following signs that the US consumer is in a healthy mood. In the best score since August, the Conference Board's US consumer confidence index, at 131.6 in January (blue line in graph) easily beat expectations with the month's strength concentrated at the best possible place: in employment. Those saying jobs are currently hard to get fell a very sharp 1.4 percentage points to 11.6 percent. This is a very low level for a reading that gets special attention among forecasters and which, like the month's run of jobless claims issued by the Labor Department, supports a bullish view for the January employment report (data that will highlight the coming week). Those describing jobs as plentiful rose a sharp 2.5 percentage points to 49.0 percent which yet again was a very strong score. Readings on the stock market were also favorable – favorable that is if you're not a contrarian. Bulls surged more than 5 percentage points in January to 43.1 percent, which was yet another of the report's stand-out readings. At the same time, the percentage of bears fell very sharply, down more than 6 points to 22.2 which is very low for this reading. A separate report, issued not monthly but every two weeks, suggests that spirits peaked in the second half of the month, based on the University of Michigan's consumer sentiment index which ended January at a higher-than-expected 99.8 (green columns). Compared to the mid-month result of 99.1, the final reading offers an implied score of roughly 100.5 which would be the best result for any single month in more than two years. The sentiment index complements the consumer confidence report and based on the two, strength in the January employment report should come as no surprise nor should strength perhaps in the January retail sales report as well. Additional easing isn't the question right now for the Fed which is currently out of play, but whatever chance there is probably got smaller following signs that the US consumer is in a healthy mood. In the best score since August, the Conference Board's US consumer confidence index, at 131.6 in January (blue line in graph) easily beat expectations with the month's strength concentrated at the best possible place: in employment. Those saying jobs are currently hard to get fell a very sharp 1.4 percentage points to 11.6 percent. This is a very low level for a reading that gets special attention among forecasters and which, like the month's run of jobless claims issued by the Labor Department, supports a bullish view for the January employment report (data that will highlight the coming week). Those describing jobs as plentiful rose a sharp 2.5 percentage points to 49.0 percent which yet again was a very strong score. Readings on the stock market were also favorable – favorable that is if you're not a contrarian. Bulls surged more than 5 percentage points in January to 43.1 percent, which was yet another of the report's stand-out readings. At the same time, the percentage of bears fell very sharply, down more than 6 points to 22.2 which is very low for this reading. A separate report, issued not monthly but every two weeks, suggests that spirits peaked in the second half of the month, based on the University of Michigan's consumer sentiment index which ended January at a higher-than-expected 99.8 (green columns). Compared to the mid-month result of 99.1, the final reading offers an implied score of roughly 100.5 which would be the best result for any single month in more than two years. The sentiment index complements the consumer confidence report and based on the two, strength in the January employment report should come as no surprise nor should strength perhaps in the January retail sales report as well.

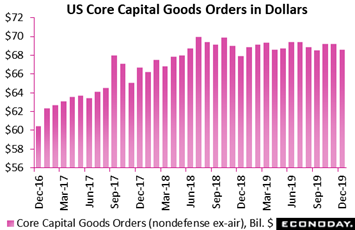

But not all the week's data were as upbeat as consumer sentiment. Conditions in the industrial economy continue to sag below the consumer sector, evident in US GDP data where headline fourth-quarter growth, at a moderate 2.1 percent, was pulled back by a third straight downturn in business investment. And contraction in core capital goods orders, a low light of the durables goods report, points to further trouble ahead. Core orders (nondefense ex-aircraft) fell a very steep 0.9 percent in December following gains of 0.1 and 1.0 percent in the prior two months to round out what was a flat quarter. Industries that contribute to the capital goods sector saw declines: primary metals down 0.6 percent, electrical equipment also down 0.6 percent, and machinery, which is at the very heart of the group, down 1.1 percent. The graph tracks monthly orders in dollar totals (in distinction to percentage change). And the trend, stuck in a tight $68 and $70 billion range, has not shown any improvement for the last year. The phase one trade deal with China came too late to help capital goods orders in December. Whether the deal triggers any enthusiasm for business investment in January, as perhaps indicated by some of January's anecdotal data, has yet to confirmed. But not all the week's data were as upbeat as consumer sentiment. Conditions in the industrial economy continue to sag below the consumer sector, evident in US GDP data where headline fourth-quarter growth, at a moderate 2.1 percent, was pulled back by a third straight downturn in business investment. And contraction in core capital goods orders, a low light of the durables goods report, points to further trouble ahead. Core orders (nondefense ex-aircraft) fell a very steep 0.9 percent in December following gains of 0.1 and 1.0 percent in the prior two months to round out what was a flat quarter. Industries that contribute to the capital goods sector saw declines: primary metals down 0.6 percent, electrical equipment also down 0.6 percent, and machinery, which is at the very heart of the group, down 1.1 percent. The graph tracks monthly orders in dollar totals (in distinction to percentage change). And the trend, stuck in a tight $68 and $70 billion range, has not shown any improvement for the last year. The phase one trade deal with China came too late to help capital goods orders in December. Whether the deal triggers any enthusiasm for business investment in January, as perhaps indicated by some of January's anecdotal data, has yet to confirmed.

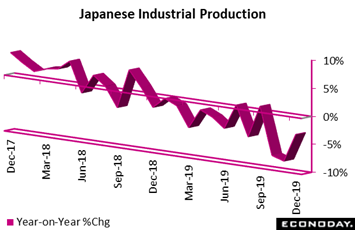

If the US-China trade deal proves to be a positive for January, then coronavirus is likely to be a negative. But how much of a negative? The first place to watch will be Asia where industrial activity was already in a downtrend. Yet going into the outbreak there was improvement underway, at least for Japan where industrial production rose a monthly 1.3 percent to reverse a 1.0 percent drop in November. In year-on-year terms as tracked in the graph, the index was still in the negative column at minus 3.0 percent which, nevertheless, is up from 8.1 and 7.4 percent contraction in November and October. Increases in the output of production machinery, electronic parts & devices, and general-purpose & business oriented machinery outweighed declines for motor vehicles & transport equipment. The month-on-month increase was broadly in line with forecasts from Japanese officials who for January, showing no virus jitters at all, expect industrial output to jump 3.5 percent and then a further 4.1 percent in February. If the US-China trade deal proves to be a positive for January, then coronavirus is likely to be a negative. But how much of a negative? The first place to watch will be Asia where industrial activity was already in a downtrend. Yet going into the outbreak there was improvement underway, at least for Japan where industrial production rose a monthly 1.3 percent to reverse a 1.0 percent drop in November. In year-on-year terms as tracked in the graph, the index was still in the negative column at minus 3.0 percent which, nevertheless, is up from 8.1 and 7.4 percent contraction in November and October. Increases in the output of production machinery, electronic parts & devices, and general-purpose & business oriented machinery outweighed declines for motor vehicles & transport equipment. The month-on-month increase was broadly in line with forecasts from Japanese officials who for January, showing no virus jitters at all, expect industrial output to jump 3.5 percent and then a further 4.1 percent in February.

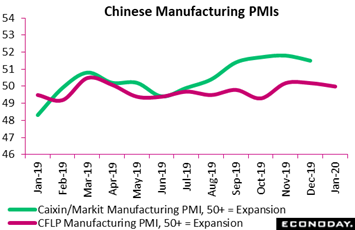

Key data in the coming week start early in the week, on Monday morning Chinese time when industrial profits and the Caixin manufacturing PMI will be released. And don't expect much strength for Caixin if the CFLP manufacturing index is any indication. The CFLP fell from 50.2 to dead even 50.0 in January to indicate no change in activity from December. This index has indicated stagnant conditions for Chinese manufacturing throughout 2019 which has now extended into 2020. In a less painful performance, the Caixan index suffered through 2019 in the low 50s to indicate only modest growth. In any case, these two reports are likely to be among the very first to offer indications from Asia on the effects of the phase-one trade deal for manufacturers and the extent of any effects from the virus outbreak. Key data in the coming week start early in the week, on Monday morning Chinese time when industrial profits and the Caixin manufacturing PMI will be released. And don't expect much strength for Caixin if the CFLP manufacturing index is any indication. The CFLP fell from 50.2 to dead even 50.0 in January to indicate no change in activity from December. This index has indicated stagnant conditions for Chinese manufacturing throughout 2019 which has now extended into 2020. In a less painful performance, the Caixan index suffered through 2019 in the low 50s to indicate only modest growth. In any case, these two reports are likely to be among the very first to offer indications from Asia on the effects of the phase-one trade deal for manufacturers and the extent of any effects from the virus outbreak.

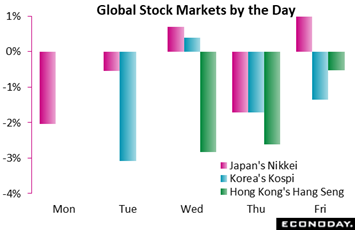

The Caixan PMI won't be the only news coming out of China Monday morning. Chinese markets will get their first chance to trade after being closed for a week in observance of lunar new year. And judging by Asian markets that were trading in the latest week, a very sizable drop for Shanghai index shouldn't be a shock. Japan's Nikkei lost 2.6 percent in the week, out done by Hong Kong's Hang Seng and South Korea's Kospi which both dropped 5.7 percent in the week. And losses for each of these indexes were especially severe on the first day of trading: the Nikkei dropping 2.0 percent on Monday, the Kospi 3.1 percent on Tuesday, and the Hang Seng 2.8 percent on Wednesday. How long the declines will continue in Asia is one question (and for the Nikkei they may already be ending), while the resulting reversal and rebound is another question. The Caixan PMI won't be the only news coming out of China Monday morning. Chinese markets will get their first chance to trade after being closed for a week in observance of lunar new year. And judging by Asian markets that were trading in the latest week, a very sizable drop for Shanghai index shouldn't be a shock. Japan's Nikkei lost 2.6 percent in the week, out done by Hong Kong's Hang Seng and South Korea's Kospi which both dropped 5.7 percent in the week. And losses for each of these indexes were especially severe on the first day of trading: the Nikkei dropping 2.0 percent on Monday, the Kospi 3.1 percent on Tuesday, and the Hang Seng 2.8 percent on Wednesday. How long the declines will continue in Asia is one question (and for the Nikkei they may already be ending), while the resulting reversal and rebound is another question.

Acceleration for consumer sentiment is a good way to open a new year, though levels do remain modest. January's consumer confidence index in the US, for instance, was still well short of its 2018 October peak. And coronavirus does pose a risk to February sentiment, as it does to a global economy where growth is no better than moderate and inflation flat. Yet a good jobs report from the US in the coming week, signaled as it is by consumer confidence, would be a good way to start the year.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Slight slowing looks to start the week as China's Caixin manufacturing PMI is expected to follow last week's CFLP report and post a dip. Big news from the US will also be coming out on Monday with ISM manufacturing, a report that has been struggling and where sub-50 territory is January's call. The Reserve Bank of Australia meets on Tuesday and a rate cut, given only slow improvement in inflation and troubles with bushfires, would not be a complete shock. UK anecdotal data following December's election have been indicating strength though only limited improvement is expected for PMI construction, also released on Tuesday. German manufacturers' orders will be a Thursday highlight, but it may be the Reserve Bank of India that gets the most focus and how it handles an emerging spike in inflation. French and German industrial production data will also be released Thursday, and strength is not the expectation. Following on Friday is Japanese household spending which, in another report that has been struggling, has yet to post convincing numbers following the October tax hike. The week winds up with employment reports from Canada and the US, with expectations for both moderately favorable and a bounce in monthly wage growth a possible highlight for the latter.

China: Caixin Manufacturing PMI for January (Mon 01:45 GMT; Mon 09:45 CST; Sun 20:45 EST)

Consensus Forecast: 51.2

The Caixin PMI has been on a five-month win streak, a subdued one however that took the index in December to only 51.8. For January, the consensus is a step back to 51.2.

Switzerland: SVME Purchasing Managers' Index for January (Mon 08:30 GMT; Mon 09:30 CET: Mon 3:30 EST)

Consensus Forecast: 49.4

After a long run in sub-50 ground, the SVME purchasing managers' index jumped 1.4 points to a much stronger-than-expected 50.2 that, nevertheless, indicated flat conditions. For January, the consensus is 49.4.

US: ISM Manufacturing Index for January (Mon 15:00 GMT; Mon 10:00 EST)

Consensus Forecast: 48.7

Despite repeated expectations for improvement, the ISM manufacturing index has missed Econoday's consensus forecast for the last six months in a row. Both new orders and backlog orders have been unusually weak. After 47.2 in December, the consensus for January is 48.7.

Reserve Bank of Australia Announcement (Tue 03:30 GMT; Tue 14:30 AEDT; Mon 22:30 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.75%

After cutting rates three times in 2019, the Reserve Bank of Australia is expected to hold its policy rate steady at 0.75 percent for a third meeting in a row. Though the bank noted in their last statement in December that downside risks had "lessened", February's announcement may well cite the economic impact of bushfires and potential impact of coronavirus.

UK: PMI Construction for January (Tue 09:30 GMT; Tue 04:30 EST)

Consensus Forecast: 44.8

Despite improving clarity over Brexit, PMI construction didn't show any improvement in December, falling nearly a point to 44.4 and an eighth straight reading below 50. At 44.8, January's consensus is for only a modest gain.

Eurozone PPI for December (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST))

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: -0.7%

Eurozone producer prices have been flat on a monthly basis and negative year-over-year. December's consensus is plus 0.2 percent for the monthly rate but minus 0.7 percent for the yearly rate.

Italian CPI for Preliminary January (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: 0.6%

Italian consumer prices are expected to rise a preliminary 0.2 percent on the month in January versus an energy driven 0.2 percent rise in December. Year-on-year, preliminary January is expected to come in at plus 0.6 percent versus December's plus 0.5 percent.

Switzerland: SECO Consumer Climate for January (Wed 06:45 GMT; Wed 07:45 CET; Wed 01:45 EST)

Consensus Forecast, Level: -6

Swiss consumer confidence has been on the decline. After a lower-than-expected, 10-year low of minus 10 in the last report which was for October, forecasters see the SECO consumer climate index coming in at minus 6 for January's report.

Eurozone Retail Sales for December (Wed 10:00 GMT; Wed 05:00 EST)

Consensus Forecast, Month-to-Month: -0.4%

Eurozone retail sales in November came in better than expected with strength centered in non-foods. For December, forecasters are calling for a 0.4 percent monthly decrease versus November's 1.0 percent jump. Year-on-year the call is 2.6 percent which would compare with 2.2 percent growth in November.

US International Trade Balance for December (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast: -$48.1 billion

Sharp widening is the call for December's international trade deficit, at a consensus $48.1 billion versus a narrower-than-expected $43.1 billion in November. Advance data for the goods portion of December's report showed a deficit of $68.3 versus $63.0 billion in November.

US ISM Non-Manufacturing Index for January (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast: 55.2

ISM's non-manufacturing has steadied at solid rates of growth, though December's report did show slowing for new orders and contraction in backlogs. Forecasters see January's index coming at 55.2 versus December's 55.0.

Reserve Bank of India Policy Announcement (Any Time Thursday IST: Release Time Not Set)

Consensus Change: 0 basis points

Consensus Level: 5.15%

At their last meeting in December, the Reserve Bank of India, contrary to expectations for a cut, held its benchmark repurchase rate unchanged at 5.15 percent. For February, due to a jump in inflation and emerging concern that rates were cut too aggressively last year, no change is seen.

Australian Merchandise Trade for December (Thu 00:30 GMT; Thu 11:30 AEDT; Wed 19:30 EST)

Consensus Forecast: A$5.9 billion

Exports rose sharply in November at the same time that imports fell, making for a much stronger-than-expected trade surplus of A$5.8 billion. For December, Australia's trade surplus is estimated little changed at A$5.9 billion.

Australian Retail Sales for December (Thu 00:30 GMT; Thu 11:30 AEDT; Wed 19:30 EST)

Consensus Forecast, Month-to-Month: -0.2%

Retail sales in Australia are expected to decrease 0.2 percent on the month in December following a much higher-than-expected rise of 0.9 percent in November. Year-on-year growth in November was 2.7 percent.

German Manufacturers' Orders for December (Thu 07:00 GMT; Thu 08:00 CET; Thu 02:00 EST)

Consensus Forecast, Month-to-Month: 0.6%

Orders have been in annual contraction for German manufacturers since August last year with November's results down steeply, 1.3 percent lower on the month and 6.5 percent lower on the year. The monthly call for December is a increase of 0.6 percent.

Japanese Household Spending for December (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast, Month-to-Month: -0.1%

Consensus Forecast, Year-over-Year: -1.7%

Japanese household spending, which has been erratic surrounding a consumption tax hike in October, is expected to post a yearly decrease of 1.7 percent in December versus what was a weaker-than-expected 2.0 percent yearly decline in November. The monthly call for December is minus 0.1 percent.

German Industrial Production for December (Fri 07:00 GMT; Fri 08:00 CET; Fri 03:00 EST)

Consensus Forecast, Month-to-Month: -0.2%

No further improvement is expected for industrial production in December, at a consensus monthly decrease of 0.2 percent following November's 1.1 percent jump. Year-on-year, German production was down 2.7 percent in November, improved from 4.7 percent in October but still the 13th straight month of contraction.

French Industrial Production for December (Fri 07:45 GMT; Fri 08:45 CET; Fri 02:45 EST)

Consensus Forecast, Month-to-Month: -0.3%

Industrial production is expected to decrease a monthly 0.3 percent in December after rising a better-than-expected 0.3 percent in a November report that was one of the strongest of the year. Year-on-year industrial production was up 1.3 percent in November.

Canadian Employment for January (Fri 08:30 EST; Fri 12:30 GMT)

Consensus Forecast: 10,000

Consensus Forecast: Unemployment Rate: 5.7%

After rising a better-than-expected 35,200 in December, which however followed a very sharp 71,200 decline in November, employment is expected to rise 10,000 in January. The unemployment rate is expected to come in at 5.7 percent versus December's 5.6 percent.

US Employment Report for January (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Nonfarm Payrolls Change: 153,000

Consensus Forecast: Unemployment Rate: 3.5%

Consensus Forecast: Average Hourly Earnings M/M: 0.3%

Consensus Forecast: Average Hourly Earnings Y/Y: 3.0%

Steady growth is the expectation for January nonfarm payrolls, at a consensus 153,000 versus what was a modestly lower-than-expected but still respectable 145,000 increase in December. The unemployment rate is expected to hold steady at a very low 3.5 percent. Weakness in average hourly earnings was pronounced in December, rising only 0.1 percent on the month and 2.9 percent on the year with January's expectations at a 0.3 percent rise on the month but only 3.0 percent on the year. Rounding out the consensus forecasts: manufacturing payrolls, after falling 12,000 in December, are expected to fall a further 6,000; private payrolls are seen up 150,000; the workweek soft and unchanged at 34.3 hours; and the participation rate unchanged at 63.2 percent.

|