|

A jump in US employment highlighted not the strengths but the unevenness of global indicators. Wages, in contrast to payrolls in the US, once again proved subdued, while to describe industrial production in Europe as shockingly weak would be no exaggeration at all. And as for Asia, the data are offering few clues yet on what to expect from the coronavirus. All together the week's results point to an extension of highly stimulative monetary policy – which won't be holding back rising demand for risk-bearing assets.

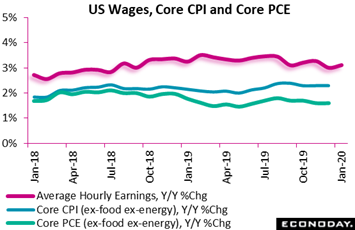

Indications of US labor market stress from a strong showing for nonfarm payrolls and a rising participation rate are, for Federal Reserve monetary policy, offset by still lifeless pressure in average hourly earnings. Nonfarm payrolls rose 225,000 in January to easily exceed Econoday's consensus range with construction surging 44,000 to underscore the sharp acceleration underway in residential construction. The labor participation rate likewise showed pressure, up 2 tenths to 63.4 percent to also exceed the consensus range and reflecting new job seekers coming into the labor market. Yet average hourly earnings rose only a modest 0.2 percent to miss expectations and follow an even more subdued 0.1 percent rise in December. Year-on-year earnings did improve to a 3.1 percent rate but this is no better than prior months and tangibly lower than the 3.5 percent peak back in August and July last year. The accompanying graph tracks the red line of average hourly earnings along with core CPI and core PCE prices, all of which are flat. And underscoring what are stagnant conditions in manufacturing, the sector that policy markers specifically focus on for clues to overall economic direction, payrolls here declined 12,000 to miss the low end of expectations, a drop centered in motor vehicles where sales for the last year have been flat. Indications of US labor market stress from a strong showing for nonfarm payrolls and a rising participation rate are, for Federal Reserve monetary policy, offset by still lifeless pressure in average hourly earnings. Nonfarm payrolls rose 225,000 in January to easily exceed Econoday's consensus range with construction surging 44,000 to underscore the sharp acceleration underway in residential construction. The labor participation rate likewise showed pressure, up 2 tenths to 63.4 percent to also exceed the consensus range and reflecting new job seekers coming into the labor market. Yet average hourly earnings rose only a modest 0.2 percent to miss expectations and follow an even more subdued 0.1 percent rise in December. Year-on-year earnings did improve to a 3.1 percent rate but this is no better than prior months and tangibly lower than the 3.5 percent peak back in August and July last year. The accompanying graph tracks the red line of average hourly earnings along with core CPI and core PCE prices, all of which are flat. And underscoring what are stagnant conditions in manufacturing, the sector that policy markers specifically focus on for clues to overall economic direction, payrolls here declined 12,000 to miss the low end of expectations, a drop centered in motor vehicles where sales for the last year have been flat.

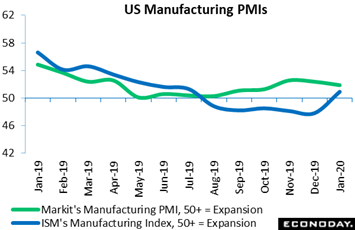

Yet the drop in manufacturing payrolls should have been less than a surprise given a poor showing for the ISM's employment index which preceded the jobs report. At 46.6, ISM's employment index did rise more than a point but remained decidedly on the wrong side of the breakeven 50 line. And another weak point in the ISM report was order backlogs, also improving slightly but also well below 50 at 45.7. These two readings – employment and backlogs – were similarly weak in the rival PMI manufacturing report, results which are a reminder that manufacturing held back the US economy in 2019. Will manufacturing employment and backlogs hold back the economy in 2020 as well? Perhaps less so based on new orders in the ISM report which jumped 4.4 points and back above 50 to what, however, is a still modest 52.0. And production in the ISM report did surge nearly 10 points giving a boost to the composite index which posted a better-than-expected 50.9, the first plus 50 headline since July. Yet the jump in production may well have reflected little more than the working down of backlogs, a possibility hinted at by the weakness in employment. The graph tracks the headline indexes from the ISM and PMI which, though offering perhaps a hint of hope, looked mixed at best. Yet the drop in manufacturing payrolls should have been less than a surprise given a poor showing for the ISM's employment index which preceded the jobs report. At 46.6, ISM's employment index did rise more than a point but remained decidedly on the wrong side of the breakeven 50 line. And another weak point in the ISM report was order backlogs, also improving slightly but also well below 50 at 45.7. These two readings – employment and backlogs – were similarly weak in the rival PMI manufacturing report, results which are a reminder that manufacturing held back the US economy in 2019. Will manufacturing employment and backlogs hold back the economy in 2020 as well? Perhaps less so based on new orders in the ISM report which jumped 4.4 points and back above 50 to what, however, is a still modest 52.0. And production in the ISM report did surge nearly 10 points giving a boost to the composite index which posted a better-than-expected 50.9, the first plus 50 headline since July. Yet the jump in production may well have reflected little more than the working down of backlogs, a possibility hinted at by the weakness in employment. The graph tracks the headline indexes from the ISM and PMI which, though offering perhaps a hint of hope, looked mixed at best.

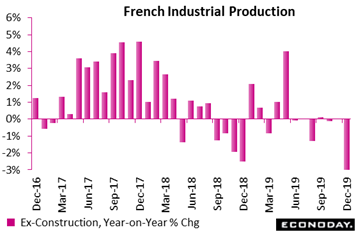

The ISM and PMI are anecdotal surveys that offer advance hints on what to expect for definitive data that aren't posted until several weeks later. Such data are coming out right now from Europe and the results are not favorable at all, actually they're down right horrible. Year-on-year industrial production in France (as tracked in the graph) was down a very steep 3.0 percent in December for a 5-1/2 year low, while the monthly nosedive of 2.8 percent was the second worst performance in the last 10 years. What modest gains were made in recent months have now been fully reversed. December's setback included a 2.6 percent monthly fall in manufacturing within which machinery & equipment goods, a central component for business investment, fell 5.2 percent. Transport equipment, another area of business investment, wasn't any better, down a monthly 3.5 percent. December's data left fourth-quarter industrial production 0.6 percent below its level in the third quarter when it fell 1.1 percent. Back to back quarterly declines mean that French goods production is now in recession. Note that November's general strike in France made for some downside bias to the fourth quarter data and anecdotal surveys in January have certainly been more upbeat. Consequently, 2020 could well start off on a much less pessimistic note. Even so, along with an even sharper drop in German output which we'll turn to next, December Eurozone industrial production is shaping up to be one of the worst in recent memory. The ISM and PMI are anecdotal surveys that offer advance hints on what to expect for definitive data that aren't posted until several weeks later. Such data are coming out right now from Europe and the results are not favorable at all, actually they're down right horrible. Year-on-year industrial production in France (as tracked in the graph) was down a very steep 3.0 percent in December for a 5-1/2 year low, while the monthly nosedive of 2.8 percent was the second worst performance in the last 10 years. What modest gains were made in recent months have now been fully reversed. December's setback included a 2.6 percent monthly fall in manufacturing within which machinery & equipment goods, a central component for business investment, fell 5.2 percent. Transport equipment, another area of business investment, wasn't any better, down a monthly 3.5 percent. December's data left fourth-quarter industrial production 0.6 percent below its level in the third quarter when it fell 1.1 percent. Back to back quarterly declines mean that French goods production is now in recession. Note that November's general strike in France made for some downside bias to the fourth quarter data and anecdotal surveys in January have certainly been more upbeat. Consequently, 2020 could well start off on a much less pessimistic note. Even so, along with an even sharper drop in German output which we'll turn to next, December Eurozone industrial production is shaping up to be one of the worst in recent memory.

If French production was horrible, German production was disastrous. Annual growth in German industrial production fell to minus 6.7 percent to roundly punctuate a dismal year-long stretch as seen in the graph. Monthly production slumped 3.5 percent, a much steeper than expected decline and to make matters worse, the slide reflected broad-based losses among major product categories: consumer goods down 2.0 percent, intermediates down 2.6 percent, capital goods down 3.5 percent to leave overall manufacturing off 2.9 percent. Elsewhere, energy did rise, up 2.0 percent, but not construction which plunged 8.7 percent. December's dreadful results put quarterly industrial production at minus 1.9 percent. Following respective declines of 1.6 percent and 0.9 percent in the second and third quarters, Germany's industrial sector is not entering but instead is mired in recession. Immediate prospects don't look much better with manufacturing orders at 5-year lows and still trending down, which is our next destination. If French production was horrible, German production was disastrous. Annual growth in German industrial production fell to minus 6.7 percent to roundly punctuate a dismal year-long stretch as seen in the graph. Monthly production slumped 3.5 percent, a much steeper than expected decline and to make matters worse, the slide reflected broad-based losses among major product categories: consumer goods down 2.0 percent, intermediates down 2.6 percent, capital goods down 3.5 percent to leave overall manufacturing off 2.9 percent. Elsewhere, energy did rise, up 2.0 percent, but not construction which plunged 8.7 percent. December's dreadful results put quarterly industrial production at minus 1.9 percent. Following respective declines of 1.6 percent and 0.9 percent in the second and third quarters, Germany's industrial sector is not entering but instead is mired in recession. Immediate prospects don't look much better with manufacturing orders at 5-year lows and still trending down, which is our next destination.

Sinking to 8.6 percent yearly contraction, the extended decline in German manufacturers' orders is even longer and deeper than the decline in German industrial production. On a monthly basis, orders fell 2.1 percent for the worst performance in nearly a year that follows a 0.8 percent decline in November. And what could be a poster child for global trade, overseas demand fell a monthly 4.5 percent with demand in the rest of Eurozone falling in the double digits, down 13.9 percent. By contrast, and in a welcome note of hope, domestic orders rose 1.4 percent for their second successive monthly advance. Within total orders, intermediates also increased 1.4 percent but this gain was more than offset by falls in capital goods (3.9 percent) and consumer goods (3.8 percent). The December update puts overall German orders down 0.6 percent in the fourth quarter versus the third quarter when they shrank 0.8 percent. Yes, the underlying trend remains unfavorable and, indeed, December alone saw the weakest level in orders in four years. How long will German industry remain in recession? Based on orders, specifically foreign orders, maybe quite a while yet. Sinking to 8.6 percent yearly contraction, the extended decline in German manufacturers' orders is even longer and deeper than the decline in German industrial production. On a monthly basis, orders fell 2.1 percent for the worst performance in nearly a year that follows a 0.8 percent decline in November. And what could be a poster child for global trade, overseas demand fell a monthly 4.5 percent with demand in the rest of Eurozone falling in the double digits, down 13.9 percent. By contrast, and in a welcome note of hope, domestic orders rose 1.4 percent for their second successive monthly advance. Within total orders, intermediates also increased 1.4 percent but this gain was more than offset by falls in capital goods (3.9 percent) and consumer goods (3.8 percent). The December update puts overall German orders down 0.6 percent in the fourth quarter versus the third quarter when they shrank 0.8 percent. Yes, the underlying trend remains unfavorable and, indeed, December alone saw the weakest level in orders in four years. How long will German industry remain in recession? Based on orders, specifically foreign orders, maybe quite a while yet.

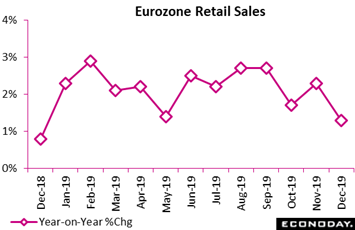

If French and German goods producers suffered through December, their misery at least was shared by Eurozone retailers who also had a terrible end to 2019. Annual growth in volumes fell 1 percentage point in December to 1.3 percent for, as tracked in the graph, one of the worst showings of the last three years. On a monthly basis, volume sales slumped a much steeper than expected 1.6 percent, their fourth decline in the last six months for the worst performance in nearly 12 years. December's weakness was broad-based with only a sizeable monthly gain in mail order & internet (2.0 percent) preventing an even sharper setback. Textiles, clothing & footwear (minus 2.8 percent) and computer equipment & books (minus 2.1 percent) had a particularly poor holiday month but not much better off were electrical goods & furniture (minus 1.2 percent) and pharmaceutical & medical goods (minus 1.0 percent). By country, Germany (minus 3.3 percent) did most of the damage but both France (minus 1.4 percent) and Spain (minus 1.3 percent) also suffered hefty losses. December's update leaves fourth quarter Eurozone sales essentially flat, down from 0.5 percent growth in the third quarter. This report together with the industrial production reports won't be lifting estimates for the coming week's second estimate of fourth quarter Eurozone GDP, which in the first estimate managed only a 0.1 percent quarterly gain. If French and German goods producers suffered through December, their misery at least was shared by Eurozone retailers who also had a terrible end to 2019. Annual growth in volumes fell 1 percentage point in December to 1.3 percent for, as tracked in the graph, one of the worst showings of the last three years. On a monthly basis, volume sales slumped a much steeper than expected 1.6 percent, their fourth decline in the last six months for the worst performance in nearly 12 years. December's weakness was broad-based with only a sizeable monthly gain in mail order & internet (2.0 percent) preventing an even sharper setback. Textiles, clothing & footwear (minus 2.8 percent) and computer equipment & books (minus 2.1 percent) had a particularly poor holiday month but not much better off were electrical goods & furniture (minus 1.2 percent) and pharmaceutical & medical goods (minus 1.0 percent). By country, Germany (minus 3.3 percent) did most of the damage but both France (minus 1.4 percent) and Spain (minus 1.3 percent) also suffered hefty losses. December's update leaves fourth quarter Eurozone sales essentially flat, down from 0.5 percent growth in the third quarter. This report together with the industrial production reports won't be lifting estimates for the coming week's second estimate of fourth quarter Eurozone GDP, which in the first estimate managed only a 0.1 percent quarterly gain.

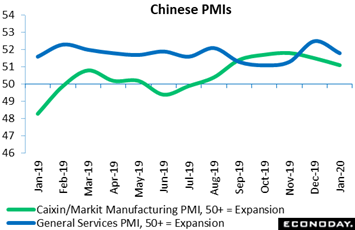

Now let's shift from the Eurozone to Asia where economic weakness has not been as dramatic, at least that is before the coronavirus hit. Manufacturing PMIs from China, whether from manufacturing or services, showed some weakness in January going into the virus effects. Markit's manufacturing PMI fell from 51.5 in December to 51.1 in January, its lowest level in five months. The decline reflected slowing growth for output and new orders as well as declines in new export orders and payrolls. Yet, citing the impact of reduced US-China trade tensions, respondents were more confident about the 12-month outlook than they have been in nearly two years. Markit's services PMI likewise slipped, down 7 tenths to 51.8 in January and roughly in line with manufacturing. Service sector respondents reported weaker growth in new orders, stable payrolls, and somewhat stronger growth in new export orders in January, with the survey's measure of business confidence, like that for manufacturing, increasing noticeably to a 16-month high. Improved services sentiment no doubt reflected progress on US-China trade negotiations, though this may quickly reverse following the coronavirus outbreak. Now let's shift from the Eurozone to Asia where economic weakness has not been as dramatic, at least that is before the coronavirus hit. Manufacturing PMIs from China, whether from manufacturing or services, showed some weakness in January going into the virus effects. Markit's manufacturing PMI fell from 51.5 in December to 51.1 in January, its lowest level in five months. The decline reflected slowing growth for output and new orders as well as declines in new export orders and payrolls. Yet, citing the impact of reduced US-China trade tensions, respondents were more confident about the 12-month outlook than they have been in nearly two years. Markit's services PMI likewise slipped, down 7 tenths to 51.8 in January and roughly in line with manufacturing. Service sector respondents reported weaker growth in new orders, stable payrolls, and somewhat stronger growth in new export orders in January, with the survey's measure of business confidence, like that for manufacturing, increasing noticeably to a 16-month high. Improved services sentiment no doubt reflected progress on US-China trade negotiations, though this may quickly reverse following the coronavirus outbreak.

Other economic data to watch for virus effects are those from Hong Kong which was already struggling. In an extending recession, Hong Kong's economy contracted for the third consecutive quarter, dropping 2.9 percent on an annual basis in the fourth quarter to match the rate of contraction in the third quarter. This is Hong Kong's worst showing in 10 years. Year-on-year contraction reflected sharp declines in consumption, investment spending, and exports, only partly offset by a strong increase in government spending. Officials cited the impact of serious civil unrest during the quarter and an ongoing "difficult external environment" as the main factors weighing on growth; they cautioned that the outlook for the economy in 2020 remains highly uncertain, citing of course the coronavirus outbreak as a new risk to sentiment and activity. Other economic data to watch for virus effects are those from Hong Kong which was already struggling. In an extending recession, Hong Kong's economy contracted for the third consecutive quarter, dropping 2.9 percent on an annual basis in the fourth quarter to match the rate of contraction in the third quarter. This is Hong Kong's worst showing in 10 years. Year-on-year contraction reflected sharp declines in consumption, investment spending, and exports, only partly offset by a strong increase in government spending. Officials cited the impact of serious civil unrest during the quarter and an ongoing "difficult external environment" as the main factors weighing on growth; they cautioned that the outlook for the economy in 2020 remains highly uncertain, citing of course the coronavirus outbreak as a new risk to sentiment and activity.

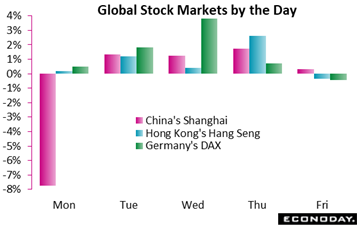

Is the worst over for the coronavirus? Perhaps so looking at weekly results in the European and US stock markets which posted strong gains in the week. Asian markets also posted gains with the notable exception that is of China's Shanghai index which fell a weekly 3.4 percent. True, the decline reflected a 7.7 percent plunge on Monday when the market, which was closed in the prior week for the lunar new year, belatedly matched declines in other markets. And though the index did recover following Monday's plunge, Friday's 0.3 percent gain was less than emphatic. Hong Kong's Hang Seng also fizzled on Friday, falling 0.3 percent but following gains earlier in the week. Altogether, the Hang Seng put in a good performance and a 4.1 percent weekly rise. Germany's Dax also eased on Friday, down 0.4 percent yet, like the Hang Seng, posted a 4.1 percent rise on the week. Apparently the dismal data on industrial production and manufacturers' orders had no effect, suggesting that weakness in fourth-quarter economic data has already been fully discounted and perhaps raising the very bullish question whether expectations for a dovish tilt in European Central Bank policy may be simmering. Is the worst over for the coronavirus? Perhaps so looking at weekly results in the European and US stock markets which posted strong gains in the week. Asian markets also posted gains with the notable exception that is of China's Shanghai index which fell a weekly 3.4 percent. True, the decline reflected a 7.7 percent plunge on Monday when the market, which was closed in the prior week for the lunar new year, belatedly matched declines in other markets. And though the index did recover following Monday's plunge, Friday's 0.3 percent gain was less than emphatic. Hong Kong's Hang Seng also fizzled on Friday, falling 0.3 percent but following gains earlier in the week. Altogether, the Hang Seng put in a good performance and a 4.1 percent weekly rise. Germany's Dax also eased on Friday, down 0.4 percent yet, like the Hang Seng, posted a 4.1 percent rise on the week. Apparently the dismal data on industrial production and manufacturers' orders had no effect, suggesting that weakness in fourth-quarter economic data has already been fully discounted and perhaps raising the very bullish question whether expectations for a dovish tilt in European Central Bank policy may be simmering.

The first look at fourth-quarter German GDP will be posted on Friday of the coming week and contraction would not be much of a surprise, nor would it be in the second estimate of Eurozone GDP that will also be posted on Friday. Economic reports from China will be the most anticipated but will be growing more scarce, much of them pushed out to March as the government combines January and February releases due to the new year recess. Perhaps the report that best sums up the global outlook was US employment which offers the best of both worlds: accelerating job gains without the inflationary pressures that would inhibit extending accommodation from policy makers.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Chinese trade data open the week in a January report that won't include much of a coronavirus effect but could include early effects of easing US-Chinese trade tensions. Chinese consumer price data will also be out on Monday and pressure at an increasing rate, in contrast to other countries, is January's expectation. In Europe, Italy will post industrial production data on Monday with a December decline the call though one not nearly as severe as drops in France and Germany. GDP and industrial production data from the UK will follow on Tuesday and expectations are for flat to negative results. US data will be heavy in the week beginning Wednesday with the monthly Treasury budget and the latest on government spending, an issue that Federal Reserve Chairman Jerome Powell may well address as he testifies before the House financial services committee on Tuesday. Other news from the US will include consumer prices on Thursday followed by retail sales and industrial production on Friday; flat to moderate are the expectations in sum with outright weakness the call for US production. Weakness is also the expectation for Eurozone industrial production on Wednesday as well as the first estimate of German GDP on Friday where forecasters are calling for a gain, but of only 0.1 percent. Sandwiched in between at midweek will be a monetary policy announcement from the Bank of New Zealand which, like other central banks, was busy cutting rates last year.

Chinese Merchandise Trade Balance for January (Est. for Monday, Release Time Not Set)

Consensus Forecast: US$39.0 billion

Exports, Year-on-Year: -4.5%

Imports, Year-on-Year: -6.0%

The January consensus for China's merchandise trade balance is a surplus of US$39.0 billion following a $46.79 billion surplus in December. Imports in January are seen falling a year-on-year 4.5 percent in US dollar terms following December's 16.3 percent gain while exports are expected to decrease 6.0 percent versus a 7.6 percent increase in December.

Chinese CPI for January (Mon 01:30 GMT, Mon 09:30 CST; Sun 20:30 EST)

Consensus Forecast, Year-over-Year: 4.9%

Disruptions in pork supply have been driving Chinese consumer prices to 8-year highs with the uncertain effects of the coronavirus now in play. The year-on-year consensus forecast for January is 4.9 percent, versus 4.5 percent rates in both December and November.

Italian Industrial Production for December (Mon 09:00 GMT; Mon 10:00 CET; Mon 04:00 EST)

Consensus Forecast, Month-to-Month: -0.1%

Industrial production in November rose a slightly better-than-expected 0.1 percent in what was the first increase since August. A monthly slip of 0.1 percent is the forecast for December.

UK Fourth-Quarter Preliminary GDP (Tue 09:30 GMT; Tue 04:30 EST)

Consensus Forecast, Quarter-to-Quarter: 0.0%

Consensus Forecast, Year-over-Year: 1.0%

Boosted by net foreign trade that included a jump in exports and also supported by firmness in consumer spending, GDP in the UK rose a moderate 0.4 percent in the third quarter for modest year-on-year growth of 1.1 percent. The consensus for preliminary fourth-quarter GDP is no change for quarterly growth at a 1.0 percent yearly rate.

UK Industrial Production for December (Tue 09:30 GMT; Tue 04:30 EST)

Consensus Forecast, Month-to-Month: -0.2%

Consensus Forecast, Year-over-Year: -2.2%

UK Manufacturing Production

Consensus Forecast, Month-to-Month: -0.1%

Consensus Forecast, Year-over-Year: -3.7%

Forecasters are calling for a 0.2 percent monthly increase in December industrial production and a 0.1 percent decrease for the manufacturing component. November, down 1.2 percent overall and down 1.7 percent for manufacturing, fell very sharply with the year-on-year rates at minus 1.6 percent and 2.0 percent.

NZ: Reserve Bank of New Zealand Announcement (Wed 01:00 GMT; Wed 14:00 NZDT; Tue 20:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 1.0%

Citing stimulus from prior rate cuts and expectations for improved economic growth, the Reserve Bank of New Zealand kept policy unchanged at their last meeting in November. For February's meeting, forecasters expect the bank to stand pat.

Eurozone Industrial Production for December (Wed 10:00 GMT; Wed 11:00 CET; Wed 05:00 EST)

Consensus Forecast, Month-to-Month: -0.4%

Consensus Forecast, Year-over-Year: -0.9%

Eurozone industrial production has been soft since late last year. For December, forecasters see monthly change at minus 0.4 percent for yearly contraction of minus 0.9 percent

US Treasury Budget for January (Wed 19:00 GMT; Wed 14:00 EST)

Consensus Forecast: +$11.5 billion

Consensus Range: $11.0 billion to $12.5 billion

January's federal budget is expected to come in at an $11.5 billion surplus versus a surplus of $8.7 billion in January last year. Three months into the 2020 fiscal year in December, the government's deficit was running 11.8 percent deeper than fiscal 2019.

US CPI for January (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Forecast, Year-over-Year Change: 2.4%

US CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Forecast, Year-over-Year Change: 2.2%

Consumer prices in December were soft on a monthly basis, up 0.2 percent overall and only 0.1 percent for the core, but steady and moderate on a yearly basis, both at 2.3 percent. For January, forecasters see monthly rates at 0.2 percent overall and for the core for respective yearly rates of 2.4 and 2.2 percent.

German GDP Fourth-Quarter Flash (Fri 07:00 GMT; Fri 08:00 CET; Fri 02:00 EST)

Consensus Forecast, Quarter-on-Quarter: 0.1%

Consensus Forecast, Year-over-Year: 0.4%

The flash estimate for fourth-quarter GDP is quarter-on-quarter growth of 0.1 percent and year-over-year growth of 0.4 percent. This would compare with 0.1 percent growth in the third quarter and a yearly growth rate of percent 0.5 percent.

US Retail Sales for January (Fri 13:30 GMT; Fri 08:30 GMT)

Consensus Forecast, Month-to-Month: 0.3%

Consensus Forecast, Ex-Autos: 0.3%

Consensus Forecast, Ex-Autos & Gas: 0.3%

Consensus Forecast, Control Group: 0.3%

Retail sales have posted three straight moderate-to-solid monthly gains of 0.3 percent with January's consensus looking for a fourth in a row. In fact, 0.3 percent monthly increases are expected across the major groupings: ex-auto, ex-auto ex-gas and the control group.

US Industrial Production for January (Fri 14:15 GMT; Fri 09:15 EST)

Consensus Forecast, Month-to-Month: -0.3%

US Manufacturing Production

Consensus Forecast, Month-to-Month: -0.2%

US Capacity Utilization Rate

Consensus Forecast: 76.8%

A weather-related drop in utilities output pulled industrial production down 0.3 percent in December and no rebound is expected for January where the consensus is for another 0.3 percent decline. Manufacturing output rose a modest 0.2 percent in December with a reversal the call for January, a 0.2 percent decline. Capacity utilization is expected to decrease 0.2 percentage points to 76.8 percent.

|