|

The coronavirus is beginning to make its unwanted appearance in global economic data, and the longer the epidemic lasts the deeper its effects are certain to be. The production shutdown of the Boeing 737 Max also made its appearance in what is a narrower threat to the US. The virus and the 737 are certain to hold down first-quarter GDP statistics but neither can help explain what happened with the fourth quarter in Europe.

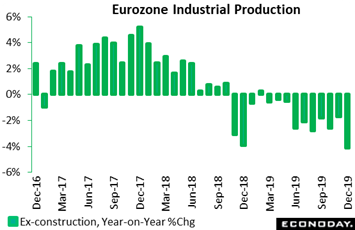

December was one of the worst months on record for Eurozone goods production. Excluding construction, yearly production nosedived 4.1 percent as tracked in the graph, well below contraction of 1.7 percent in November for the worst showing since the great crisis 10 years ago. On the month, production fell 2.1 percent, also a 10 year low. Capital goods, down a monthly 4.0 percent, dominated the decline but all major categories posted significant losses. Germany (minus 2.5 percent on the month) did much of the damage with annual contraction here at a numbing 7.2 percent. And not far behind were France (at a monthly minus 2.9 percent), Italy (minus 2.7 percent) and Spain (minus 1.5 percent). December's update puts fourth quarter Eurozone industrial production a sizeable 1.4 percent below its level in the third quarter when it decreased 0.8 percent. With the second quarter having fallen 0.8 percent, the recession extended through year-end and leaves a very soft platform for the first quarter of 2020. Manufacturing in Europe, even before the coronavirus hit the supply chain, was having big problems. December was one of the worst months on record for Eurozone goods production. Excluding construction, yearly production nosedived 4.1 percent as tracked in the graph, well below contraction of 1.7 percent in November for the worst showing since the great crisis 10 years ago. On the month, production fell 2.1 percent, also a 10 year low. Capital goods, down a monthly 4.0 percent, dominated the decline but all major categories posted significant losses. Germany (minus 2.5 percent on the month) did much of the damage with annual contraction here at a numbing 7.2 percent. And not far behind were France (at a monthly minus 2.9 percent), Italy (minus 2.7 percent) and Spain (minus 1.5 percent). December's update puts fourth quarter Eurozone industrial production a sizeable 1.4 percent below its level in the third quarter when it decreased 0.8 percent. With the second quarter having fallen 0.8 percent, the recession extended through year-end and leaves a very soft platform for the first quarter of 2020. Manufacturing in Europe, even before the coronavirus hit the supply chain, was having big problems.

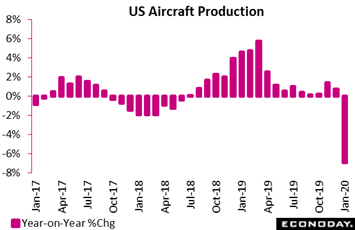

In the US, manufacturing is having big problems right now, that is a specific breakdown for aircraft and wider questions for capital goods as well. The shutdown of the Boeing 737 Max tripped a 6.9 percent yearly plunge in aircraft production, and this together with another drop in utility production due to unseasonably warm weather pulled industrial production down by 0.3 percent in January. Production in manufacturing, reflecting the 737 shutdown, fell 0.1 percent, but when excluding the 737 effect, manufacturing rose 0.3 percent which isn't bad. But utility production fell a very steep 4.0 percent in January following an even steeper 6.2 percent decline in December, in what are tangible effects of this year's warm US winter. Mining output jumped 1.2 percent in the month and follows a 1.5 percent rise in December; this sector, which had been sagging, now shows a 3.1 percent year-on-year rise in volumes. But industrial volumes overall were down a year-on-year 0.8 percent in January with manufacturing also down 0.8 percent. And an important indication on business investment in January's report is not positive at all, as machinery production fell 1.1 percent on the month. The durable goods report, which is separate from industrial production data, showed a big decline for machinery orders in December together with the wider category of capital goods (January's durables report will be posted at month end and will be important to watch). In the US, manufacturing is having big problems right now, that is a specific breakdown for aircraft and wider questions for capital goods as well. The shutdown of the Boeing 737 Max tripped a 6.9 percent yearly plunge in aircraft production, and this together with another drop in utility production due to unseasonably warm weather pulled industrial production down by 0.3 percent in January. Production in manufacturing, reflecting the 737 shutdown, fell 0.1 percent, but when excluding the 737 effect, manufacturing rose 0.3 percent which isn't bad. But utility production fell a very steep 4.0 percent in January following an even steeper 6.2 percent decline in December, in what are tangible effects of this year's warm US winter. Mining output jumped 1.2 percent in the month and follows a 1.5 percent rise in December; this sector, which had been sagging, now shows a 3.1 percent year-on-year rise in volumes. But industrial volumes overall were down a year-on-year 0.8 percent in January with manufacturing also down 0.8 percent. And an important indication on business investment in January's report is not positive at all, as machinery production fell 1.1 percent on the month. The durable goods report, which is separate from industrial production data, showed a big decline for machinery orders in December together with the wider category of capital goods (January's durables report will be posted at month end and will be important to watch).

For those of us who track economic data, the coronavirus is bad news waiting to happen. And some of it is beginning to surface. Consumer prices in China rose a much sharper-than-expected 5.4 percent in January, driven higher by stockpiling of food in response to the epidemic. Ongoing disruptions in pork supply along with calendar effects tied to the new year holidays also drove up prices. Food prices rose 20.6 percent on the year in January, up from 17.4 percent in December with pork prices more than doubling from a year ago. Yet outside of food, prices rose only 0.3 percentage points to 1.6 percent which may allow officials to hold onto their roughly 3 percent inflation goal when economic targets are set at next month's National People's Congress. Regarding other economic data, Chinese officials, concerned over possible distortions tied to the virus outbreak, announced that previously scheduled merchandise trade data for January would be delayed and will be combined with February as it traditionally is for industrial production, retail sales, and fixed asset investment (to smooth out new year distortions). For those of us who track economic data, the coronavirus is bad news waiting to happen. And some of it is beginning to surface. Consumer prices in China rose a much sharper-than-expected 5.4 percent in January, driven higher by stockpiling of food in response to the epidemic. Ongoing disruptions in pork supply along with calendar effects tied to the new year holidays also drove up prices. Food prices rose 20.6 percent on the year in January, up from 17.4 percent in December with pork prices more than doubling from a year ago. Yet outside of food, prices rose only 0.3 percentage points to 1.6 percent which may allow officials to hold onto their roughly 3 percent inflation goal when economic targets are set at next month's National People's Congress. Regarding other economic data, Chinese officials, concerned over possible distortions tied to the virus outbreak, announced that previously scheduled merchandise trade data for January would be delayed and will be combined with February as it traditionally is for industrial production, retail sales, and fixed asset investment (to smooth out new year distortions).

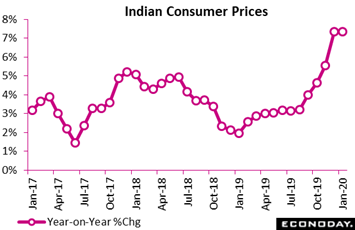

Food prices have also been jumping in India where the consumer price index came in at a year-on-year 7.35 percent in January, unchanged from December and matching its highest level since 2014. Headline inflation has been on the climb and, for the second straight month, is above the Reserve Bank of India's target range of 2.0 percent to 6.0 percent. The last time inflation was above the RBI's target was back in 2016. The RBI left its main benchmark rate unchanged at a nine-year low of 5.15 percent at its policy review held in the prior week after having cut rates by more than 100 basis points in 2019. Officials noted several risks to the near-term growth outlook and warned that the inflation outlook is highly uncertain. If food prices do, however, moderate in the coming months, officials could find scope to ease policy further and provide additional support to economic activity. Food prices have also been jumping in India where the consumer price index came in at a year-on-year 7.35 percent in January, unchanged from December and matching its highest level since 2014. Headline inflation has been on the climb and, for the second straight month, is above the Reserve Bank of India's target range of 2.0 percent to 6.0 percent. The last time inflation was above the RBI's target was back in 2016. The RBI left its main benchmark rate unchanged at a nine-year low of 5.15 percent at its policy review held in the prior week after having cut rates by more than 100 basis points in 2019. Officials noted several risks to the near-term growth outlook and warned that the inflation outlook is highly uncertain. If food prices do, however, moderate in the coming months, officials could find scope to ease policy further and provide additional support to economic activity.

And talk of new stimulus would certainly seem warranted in Europe which is where we return our attention, specifically Germany which was stagnant at the end of 2019. Year-on-year adjusted growth as tracked in the graph slipped from 0.6 percent to just 0.4 percent, while quarterly growth came in at zero and followed a 0.2 percent fall in the third quarter and only a 0.2 percent rise in the second quarter. This means that total German output has been essentially flat for the last three quarters. The only other information provided in the first estimate of the fourth quarter indicated sharp deceleration in both household and government consumption; investment was mixed with machinery and equipment, in echoes of the US, declining quite steeply but construction and other fixed assets continuing to expand. Net foreign trade had a negative impact as exports fell and imports rose. Germany avoided recession in 2019 but only just, and weakness here was a key factor in the nearly equally sluggish performance by the Eurozone as a whole, at only plus 0.1 percent on the quarter and plus 0.9 percent on the year in second estimates updated at week's end. And talk of new stimulus would certainly seem warranted in Europe which is where we return our attention, specifically Germany which was stagnant at the end of 2019. Year-on-year adjusted growth as tracked in the graph slipped from 0.6 percent to just 0.4 percent, while quarterly growth came in at zero and followed a 0.2 percent fall in the third quarter and only a 0.2 percent rise in the second quarter. This means that total German output has been essentially flat for the last three quarters. The only other information provided in the first estimate of the fourth quarter indicated sharp deceleration in both household and government consumption; investment was mixed with machinery and equipment, in echoes of the US, declining quite steeply but construction and other fixed assets continuing to expand. Net foreign trade had a negative impact as exports fell and imports rose. Germany avoided recession in 2019 but only just, and weakness here was a key factor in the nearly equally sluggish performance by the Eurozone as a whole, at only plus 0.1 percent on the quarter and plus 0.9 percent on the year in second estimates updated at week's end.

However much global growth and business investment have been slowing and however much special factors are beginning to take their toll, global employment remains little touched – and in fact it generally continues to improve. Joblessness in France fell surprisingly sharply in the fourth quarter. In metropolitan France, the rate dropped 0.3 percentage points from a downwardly revised 8.2 percent in the previous period to 7.9 percent as seen in the graph, its lowest mark since the fourth quarter of 2008. Including overseas territories, the rate stood at 8.1 percent, a 0.4 percentage point drop from its third quarter level. On the mainland, the improvement reflected a 0.3 percentage point decline in the male rate to 8.0 percent and a 0.5 percentage point fall in the female rate to 7.7 percent. However, youth joblessness was up 0.6 percentage points at 19.4 percent, its highest reading since the third quarter of 2018 and its second successive increase. Youth employment aside, this was a surprisingly good report. However much global growth and business investment have been slowing and however much special factors are beginning to take their toll, global employment remains little touched – and in fact it generally continues to improve. Joblessness in France fell surprisingly sharply in the fourth quarter. In metropolitan France, the rate dropped 0.3 percentage points from a downwardly revised 8.2 percent in the previous period to 7.9 percent as seen in the graph, its lowest mark since the fourth quarter of 2008. Including overseas territories, the rate stood at 8.1 percent, a 0.4 percentage point drop from its third quarter level. On the mainland, the improvement reflected a 0.3 percentage point decline in the male rate to 8.0 percent and a 0.5 percentage point fall in the female rate to 7.7 percent. However, youth joblessness was up 0.6 percentage points at 19.4 percent, its highest reading since the third quarter of 2018 and its second successive increase. Youth employment aside, this was a surprisingly good report.

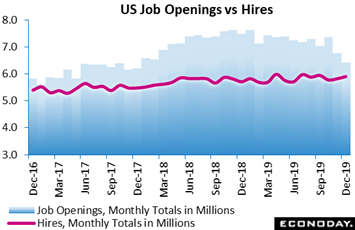

January's US jobs report, where payroll growth far exceeded expectations, was the prior week's highlight. Whether, however, future reports will prove as strong could be in doubt, at least based on job openings. Federal Reserve Chair Jerome Powell told lawmakers in the week that job openings in the US remain plentiful, but what he didn't highlight is they are sitting at a 2-year low. At a much lower-than-expected 6.42 million in December, openings were only 670,000 out in front of the 5.75 million unemployed who were actively seeking work during the month. Relative to hires, at 5.91 million, the spread with openings has also been narrowing, to 516,000 in December which, as seen in the graph, is a 2-1/2 year low. Demand for labor relative to supply for labor has been easing in the US, and for a Fed that is trying to lift inflation, the latest JOLTS data are not pointing to any acceleration for wage growth. January's US jobs report, where payroll growth far exceeded expectations, was the prior week's highlight. Whether, however, future reports will prove as strong could be in doubt, at least based on job openings. Federal Reserve Chair Jerome Powell told lawmakers in the week that job openings in the US remain plentiful, but what he didn't highlight is they are sitting at a 2-year low. At a much lower-than-expected 6.42 million in December, openings were only 670,000 out in front of the 5.75 million unemployed who were actively seeking work during the month. Relative to hires, at 5.91 million, the spread with openings has also been narrowing, to 516,000 in December which, as seen in the graph, is a 2-1/2 year low. Demand for labor relative to supply for labor has been easing in the US, and for a Fed that is trying to lift inflation, the latest JOLTS data are not pointing to any acceleration for wage growth.

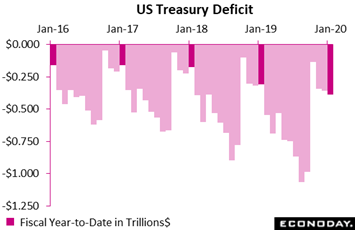

Lack of wage growth in the US can't be blamed on the Fed, at least through the second half of last year when officials cut rates three times, and it certainly can't be blamed on fiscal stimulus which has been accelerating for the last three years. The Treasury's shortfall in January, at an unexpectedly deep $32.6 billion, drove the deficit for the first four months of fiscal 2020 to $389.2 billion as tracked in the far right column of the graph. This is 25.4 percent deeper than in the same period for fiscal 2019. Outlays for the first four months of fiscal 2020 rose 10.3 percent year-on-year to $1.567 trillion, easily outpacing a 6.1 percent rise in receipts to $1.179 trillion. The year-on-year rise in total outlays for the first four months was led by a 23.3 percent surge in Medicare expenditures to $252.6 billion and an 8.9 percent rise in outlays for national defense to $249.8 billion. Outlays for veterans benefits and services jumped by 19.0 percent to $80.0 billion. Social Security outlays lagged in pace though not in magnitude, rising 5.6 percent to $356.9 million. Lack of wage growth in the US can't be blamed on the Fed, at least through the second half of last year when officials cut rates three times, and it certainly can't be blamed on fiscal stimulus which has been accelerating for the last three years. The Treasury's shortfall in January, at an unexpectedly deep $32.6 billion, drove the deficit for the first four months of fiscal 2020 to $389.2 billion as tracked in the far right column of the graph. This is 25.4 percent deeper than in the same period for fiscal 2019. Outlays for the first four months of fiscal 2020 rose 10.3 percent year-on-year to $1.567 trillion, easily outpacing a 6.1 percent rise in receipts to $1.179 trillion. The year-on-year rise in total outlays for the first four months was led by a 23.3 percent surge in Medicare expenditures to $252.6 billion and an 8.9 percent rise in outlays for national defense to $249.8 billion. Outlays for veterans benefits and services jumped by 19.0 percent to $80.0 billion. Social Security outlays lagged in pace though not in magnitude, rising 5.6 percent to $356.9 million.

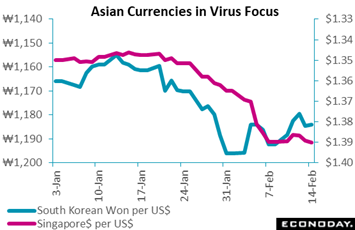

The risk that the coronavirus may prove to be on the severe side of expectations fairly raises questions over sovereign policy responses. Devaluation is being voiced across the global markets and also now in the US; Judy Shelton, President Trump's nominee to the Federal Reserve Board, arrived on Capitol Hill during the week with a reputation for wanting the Fed to devalue the dollar if needed. However profane this may sound given the hush-hush tradition of US dollar policy, the thought is in keeping with the more transparent currency policies at other central banks. The Monetary Authority of Singapore, for example, which formally ties its monetary policy to the value of the Singapore dollar, said earlier this month that the nation's currency could move lower within an established band to offset negative virus effects. Sacrilegious or just basic common sense? Still, devaluations, even perhaps incremental ones, do carry risks for the greater community at large. Looking back at history, the 1997 financial crisis was triggered by the collapse of the baht after the Thai government, unable to maintain the peg to the US dollar, floated the currency. The baht's collapse, in an example of cascading effects, was followed by a drop in the price of oil and in turn by a financial crisis in Russia and subsequently by the collapse of Long-Term Capital Management, the indigent US hedge fund that was immediately bailed out, of course, by the Federal Reserve. But really, after the subsequent cascading spiral of the 2008 collapse, bailouts and quantitative easing on the most massive scales are causes now for far less astonishment. In fact, Jerome Powell voiced support in the week for "aggressive" QE should the US fall into recession. The graph tracks a couple of Asian currencies whose values, if they begin to sink sharply, would lift the dollar to the disadvantage of US exporters and in turn would pressure the Fed (whether it would publicly admit or not) to pull the dollar lower. The risk that the coronavirus may prove to be on the severe side of expectations fairly raises questions over sovereign policy responses. Devaluation is being voiced across the global markets and also now in the US; Judy Shelton, President Trump's nominee to the Federal Reserve Board, arrived on Capitol Hill during the week with a reputation for wanting the Fed to devalue the dollar if needed. However profane this may sound given the hush-hush tradition of US dollar policy, the thought is in keeping with the more transparent currency policies at other central banks. The Monetary Authority of Singapore, for example, which formally ties its monetary policy to the value of the Singapore dollar, said earlier this month that the nation's currency could move lower within an established band to offset negative virus effects. Sacrilegious or just basic common sense? Still, devaluations, even perhaps incremental ones, do carry risks for the greater community at large. Looking back at history, the 1997 financial crisis was triggered by the collapse of the baht after the Thai government, unable to maintain the peg to the US dollar, floated the currency. The baht's collapse, in an example of cascading effects, was followed by a drop in the price of oil and in turn by a financial crisis in Russia and subsequently by the collapse of Long-Term Capital Management, the indigent US hedge fund that was immediately bailed out, of course, by the Federal Reserve. But really, after the subsequent cascading spiral of the 2008 collapse, bailouts and quantitative easing on the most massive scales are causes now for far less astonishment. In fact, Jerome Powell voiced support in the week for "aggressive" QE should the US fall into recession. The graph tracks a couple of Asian currencies whose values, if they begin to sink sharply, would lift the dollar to the disadvantage of US exporters and in turn would pressure the Fed (whether it would publicly admit or not) to pull the dollar lower.

The dramatic weakness in year-end European data is reason enough to raise the prospect of determined stimulus from the European Central Bank, a possibility further underscored by the coronavirus and its supply-chain hits on global manufacturing. For the US, the suspension of 737 production is a one-time hit to manufacturing in possible contrast to the virus which may or may not pack a one-time punch. But underneath all of this is a far-reaching and fundamental negative: declines underway in machinery and capital goods point to the risk of an extending 2020 slump in global business investment.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week looks to open with fourth-quarter contraction in Japanese GDP, a result that could well focus on what to expect for the first quarter and its virus effects. Solid results are the call for the UK labour market report on Tuesday after which a heavy week begins to unfold including German business sentiment with the ZEW report and Canadian manufacturing sales, also both on Tuesday. Japanese machine orders, which are always volatile, open Wednesday's session with Japanese trade and CPI to follow. CPI data will also be posted in the UK and Canada at midweek, with consumer confidence reports scheduled for the Eurozone and Germany on Thursday. Data from the US will be light and centered in housing, a key area of strength with the week's reports to include housing starts and existing home sales. But the biggest news likely comes at week's end on Friday with flash PMIs out of Europe where a general lack of improvement in February, following solid January results, should be no surprise.

Japanese GDP Advance Fourth Quarter (Sun 23:50 GMT; Mon 08:50 JST; Sun 18:50 EST)

Consensus Forecast, Quarter-over-Quarter: -0.9%

Consensus Forecast, Annualized: -3.7%

Advance GDP in the fourth quarter is expected to fall a quarterly 0.9 percent versus a 0.4 percent rise in the final estimate for the third quarter (revised from a 0.1 percent increase in the advance report). The annual rate in the fourth quarter is seen at minus 3.7 percent versus a final 1.8 percent increase in the third quarter. Back in the third quarter, both residential and non-residential investment were the main contributors to growth.

UK Labour Market Report (Tue 09:30 GMT; Tue 04:30 EST)

Consensus Forecast, Claimant Count for January: 22,600

Consensus Forecast, ILO Unemployment Rate for December: 3.8%

Consensus Forecast, Average Weekly Earnings for December, Year-on-Year: 3.2%

Claimant count unemployment rose 14,900 in both November and December and is expected to accelerate to 22,600 in January. The ILO unemployment rate is expected to hold unchanged in the three months to December at 3.8 percent. The call for average hourly earnings is 3.2 percent which would be unchanged from November.

Germany: ZEW Survey for February (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Business Expectations: 20.0

Consensus Forecast, Current Conditions: -9.0

Both business expectations and current conditions improved going into year-end and posted surprisingly large gains in January. For February, expectations are seen coming back to 20.0 versus January's 26.7 with current conditions at minus 9.0 versus minus 9.5.

Canadian Manufacturing Sales for December (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month-to-Month: 0.5%

Railway disruptions pulled down manufacturing sales by an unexpected 0.6 percent in November with a 0.5 percent rebound the consensus for December.

Japanese Machine Orders for December (Tue 23:50 GMT; Wed 08:50 JST; Tue 18:50 EST)

Consensus Forecast, Month-to-Month: -5.0%

At a month-to-month minus 5.0 percent, forecasters see Japanese machine orders in December reversing only some of November's surprisingly strong 18.0 percent jump, a rebound that ended four prior months of consecutive declines.

Japanese Merchandise Trade for January (Tue 23:50 GMT; Wed 08:50 JST; Tue 18:50 EST)

Consensus Forecast: -455.0¥ billion

A deficit of ¥455.0 billion is expected for the January merchandise trade report versus what was a mostly as-expected deficit of ¥152.5 billion in December. Both Japanese imports and exports have been in long and deep contraction, at year-on-year minus 4.9 percent in December for imports and minus 6.3 percent for exports.

UK CPI for January (Wed 09:30 GMT; Wed 04:30 EST)

Consensus Forecast, Month-to-Month: -0.3%

Consensus Forecast, Year-over-Year: 1.4%

After an unexpectedly weak showing in December, consumer prices in the UK are not expected to show much strength in January. The consensus for the monthly rate is a 0.3 percent dip (versus November's no change) and a yearly rate of plus 1.4 percent (versus 1.3 percent).

US Housing Starts for January (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast, Annual Rate: 1.420 million

US Building Permits

Consensus Forecast: 1.453 million

Starts have been accelerating very sharply to expansion highs, and a significant step back is the consensus for January, at a 1.420 million annual pace versus December's 1.608 million. The consensus for permits is 1.453 million versus 1.420 million in December (revised from an initial 1.416 million).

Canadian CPI for January (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast, Month-to-Month: 0.2%

Consensus Forecast, Year-over-Year: 2.4%

Headline consumer prices were unchanged on the month in December and up 2.2 percent on the year. For January the consensus forecasts are plus 0.2 percent for the monthly rate and 2.4 percent annually.

Australian Labour Force Survey for January (Thu 00:30 GMT; Thu 11:30 AEDT; Wed 19:30 EST)

Consensus Forecast, Unemployment Rate: 5.2%

Consensus Forecast, Employment: 10,000

Consensus Forecast, Participation Rate: 66.0%

Employment growth increased a higher-than-expected 28,900 in December with a 10,000 increase expected in January. The unemployment rate is seen at 5.2 percent, versus 5.1 percent in December, with the participation rate steady at 66.0 percent.

Germany: GfK Consumer Climate for March (Thu 07:00 GMT; Thu 08:00 CET; Thu 02:00 EST)

Consensus Forecast: 9.7

A dip to 9.7 is the call for March's Gfk survey which in February rose to an unexpectedly strong 9.9 and 2 tenths over expectations.

UK Retail Sales for January (Thu 09:30 GMT; Thu 04:30 EST)

Consensus Forecast, Month-to-Month: 0.4%

Retail sales are expected to rise a monthly 0.4 percent in January after coming in far below expectations for a second month in a row, at a 0.6 percent decline in December that also followed a 0.6 percent decline in November.

UK: CBI Industrial Trends for February (Thu 11:00 GMT; Thu 06:00 EST)

Consensus Forecast: -23%

CBI's industrial trends improved in January but, at minus 22, was still historically weak. Forecasters see February's headline at minus 23 percent.

Eurozone: EC Consumer Confidence Flash for February (Thu 15:00 GMT; Thu 16:00 CET; Thu 10:00 EST)

Consensus Forecast: -8.0

Consumer confidence in the Eurozone stalled at year end, falling to a 2-1/2-year low of minus 8.1 in both November and December. For February forecasters are calling for no significant improvement at minus 8.0.

Japanese Consumer Price Index for January (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast Ex-Food, Year-on-Year: 0.8%

Marginal pressure is the expectation for Japanese consumer prices in January, at a consensus year-on-year increase of 0.8 percent versus 0.7 percent in December.

French PMI Flash for February (Fri 08:15 GMT; Fri 09:15 CET; Fri 03:15 EST)

Consensus Forecast, Manufacturing: 50.5

Consensus Forecast, Services: 51.5

Consensus Forecast, Composite: 51.2

At a consensus 50.5, France's PMI manufacturing flash for February is expected to show slight erosion to a consensus 50.5 versus January's 51.0 (revised from a 51.0 flash). The services flash in February is seen slightly lower at 51.5 with the composite at 51.2.

German PMI Composite Flash for February (Fri 08:30 GMT; Fri 09:30 CET; Fri 03:30 EST)

Consensus Forecast, Manufacturing: 45.0

Consensus Forecast, Services: 54.0

Consensus Forecast, Composite: 51.2

January's PMIs in Germany showed improvement though, given manufacturing's extended and deep contraction at 45.3 (revised from 45.2 in the flash), composite growth remained subdued, at just over 51. Yet growth in services rose solidly in January, up more than a point to a final 54.2. For February's flash, the manufacturing consensus is 45.0 with services seen at 54.0 and the composite at 51.2.

Eurozone PMI Composite Flash for February (Fri 09:00 GMT; Fri 10:00 CET; Fri 04:00 EST)

Consensus Forecast, Manufacturing: 48.6

Consensus Forecast, Services: 52.2

Consensus Forecast, Composite: 50.8

Manufacturing PMI has been in contraction for the past 12 month in a row and expectations for February, at a sub-50 consensus of 48.6, are pointing to a 13th month in a row. Eurozone services, where growth has been moderate, are expected at 52.2 with January's composite at 50.8.

UK: CIPS/PMI Composite Flash for February (Fri 09:30 GMT; Fri 04:30 EST)

Consensus Forecast, Manufacturing: 50.1

Consensus Forecast, Services: 52.6

Consensus Forecast, Composite: 52.5

The CIPS/PMI indexes for January showed significant improvement, led by a strong gain for services and including a flat but still sharply improved showing for manufacturing. Expectations for February's flashes are 50.1 for manufacturing, 52.6 for services, and 52.5 for the composite.

Canadian Retail Sales for December (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast, Month-to-Month: 0.5%

Canadian retail sales in December are expected to increase 0.5 percent versus unexpected swings in the prior two months: up 0.9 percent in November and down 1.1 percent in October.

US Existing Home Sales for January (Fri 15:00 GMT; Fri 10:00 EST)

Consensus Forecast, Annual Rate: 5.450 million

At an annual rate of 5.450 million, existing home sales jumped 3.6 percent in December and came in well above expectations. Steady is the call for January with the consensus at December's 5.450 million rate.

|