|

Driven by actual effects as well perhaps as concerns of possible effects, many respondents in this month's flash PMIs cited the outbreak of coronavirus as a significant issue. Whether this translates to actual weakness for hard economic data remains to be seen. Diffusion indexes in general, like the PMIs, offer quick but only cursory indications on any month's general trajectory – whether up, flat, or down. And down is generally the signal in the latest PMI round, and one centered in an area that usually doesn't get a lot of attention in the economic data.

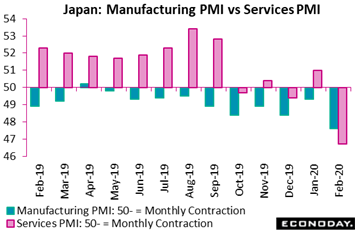

Services, not manufacturing, is being hardest hit in Japan. In early indications of the regional impact of the virus, the flash estimate for Japan's services index is down more than 4 points this month to 46.7. This is the weakest level in 6 years with many respondents citing the impact of the outbreak as a major factor. Respondents reported declines in output, new orders, and new export orders in February after these had all risen in January. The survey's measures of employment growth and business sentiment also weakened. Services, not manufacturing, is being hardest hit in Japan. In early indications of the regional impact of the virus, the flash estimate for Japan's services index is down more than 4 points this month to 46.7. This is the weakest level in 6 years with many respondents citing the impact of the outbreak as a major factor. Respondents reported declines in output, new orders, and new export orders in February after these had all risen in January. The survey's measures of employment growth and business sentiment also weakened.

The manufacturing side of Japan's PMI sample has been reporting contraction all along, for nearly the last year and now at a steepening rate. The manufacturing index fell more than 1 point to 47.6 and a new low (the deepest since 2012). Output, new orders, and new export orders all fell in January and at a steeper pace than in December. Respondents also reported weaker growth in payrolls and less positive sentiment about the 12-month outlook. Input costs are increasing at a slower pace with selling prices now moving lower.

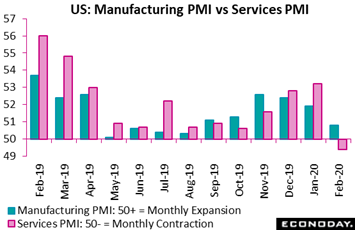

The trouble for the US samples was less severe but still very noticeable and also centered in services. The services PMI has suddenly fallen to 4-year lows, dropping roughly 4 points to 49.4 as respondents in February, citing the virus, reported greater customer hesitancy to place orders. Contraction in orders is fractional but still the deepest in 10 years of records. Hiring has slowed this month and price pressures, for both inputs and outputs, have eased. The manufacturing sample reported less trouble than services with this index down only 1 point and still, by contrast with services, above 50 at 50.8. Both production and new orders have slowed this month with respondents also citing delivery delays tied to the virus. But it's too early make many conclusions, at least for US manufacturing. Based on the separate results of two other diffusion surveys, Empire State and the Philadelphia Fed, the virus may well have no effect whatsoever as these two reports jolted sharply higher, not lower, in February. The trouble for the US samples was less severe but still very noticeable and also centered in services. The services PMI has suddenly fallen to 4-year lows, dropping roughly 4 points to 49.4 as respondents in February, citing the virus, reported greater customer hesitancy to place orders. Contraction in orders is fractional but still the deepest in 10 years of records. Hiring has slowed this month and price pressures, for both inputs and outputs, have eased. The manufacturing sample reported less trouble than services with this index down only 1 point and still, by contrast with services, above 50 at 50.8. Both production and new orders have slowed this month with respondents also citing delivery delays tied to the virus. But it's too early make many conclusions, at least for US manufacturing. Based on the separate results of two other diffusion surveys, Empire State and the Philadelphia Fed, the virus may well have no effect whatsoever as these two reports jolted sharply higher, not lower, in February.

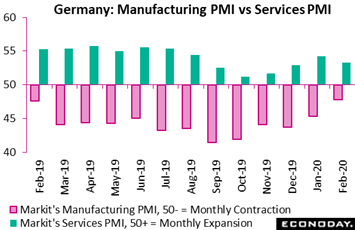

And the virus took only a modest bite out of the European PMIs including those from Germany. The services flash weighed in at 53.3 for February, down only about a point from January's 54.2. At 47.8, its manufacturing counterpart remained in sub-50 territory though it did post a solid 2.5 point improvement and also a 13-month best. For the fourth time in the last five months, the rate of decline in manufacturing production eased, while total new orders for both manufacturing and services rose for a second month in a row, though the pace was subdued and even slower than January. Exports fell quite sharply, again in part due to the coronavirus, while selling prices slowed to a 3-1/2 low. Yet overall, the initial virus impact looks limited in Europe, though it may yet become important over coming months and must be seen as adding to downside risks. And the virus took only a modest bite out of the European PMIs including those from Germany. The services flash weighed in at 53.3 for February, down only about a point from January's 54.2. At 47.8, its manufacturing counterpart remained in sub-50 territory though it did post a solid 2.5 point improvement and also a 13-month best. For the fourth time in the last five months, the rate of decline in manufacturing production eased, while total new orders for both manufacturing and services rose for a second month in a row, though the pace was subdued and even slower than January. Exports fell quite sharply, again in part due to the coronavirus, while selling prices slowed to a 3-1/2 low. Yet overall, the initial virus impact looks limited in Europe, though it may yet become important over coming months and must be seen as adding to downside risks.

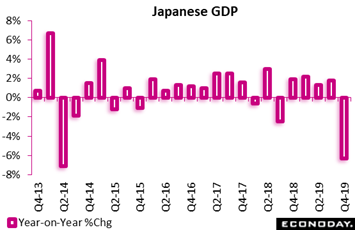

But Asia, not Europe or the US, is subject to the greatest economic risk from the virus. And the week's data opened with an unwelcome indication of regional weakness going into the virus effects. Japan's economy contracted in the fourth quarter, at a stinging 6.3 percent annualized rate as tracked in the graph. The drop wasn't completely unexpected given a tax consumption hike that took effect in October and pulled sales into the third quarter at the expense of the fourth. Household consumption did decline sharply, down 3.0 percent on quarterly basis, though other areas of the report were also weak. Private non-residential investment fell 3.7 percent on the quarter while growth in private residential investment weakened from an increase of 1.2 percent to a decline of 2.7 percent. On the plus side, public demand grew 0.4 percent while net exports added 0.5 percentage points to headline GDP. But Asia, not Europe or the US, is subject to the greatest economic risk from the virus. And the week's data opened with an unwelcome indication of regional weakness going into the virus effects. Japan's economy contracted in the fourth quarter, at a stinging 6.3 percent annualized rate as tracked in the graph. The drop wasn't completely unexpected given a tax consumption hike that took effect in October and pulled sales into the third quarter at the expense of the fourth. Household consumption did decline sharply, down 3.0 percent on quarterly basis, though other areas of the report were also weak. Private non-residential investment fell 3.7 percent on the quarter while growth in private residential investment weakened from an increase of 1.2 percent to a decline of 2.7 percent. On the plus side, public demand grew 0.4 percent while net exports added 0.5 percentage points to headline GDP.

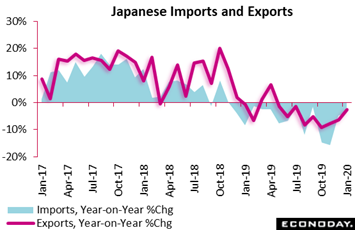

Though net exports did improve in the fourth quarter, how strong Japan's trade was going into the virus remains in question. Exports in January were down 2.6 percent on the year which, however, was an improvement from a 6.3 percent drop in December. Imports were down 3.6 percent versus 4.9 percent contraction in December. Japan's merchandise trade deficit widened from ¥152.5 billion in December to ¥1,312.6 billion in January. The decline in exports was the 14th in a row and broadly in line with data released from Singapore that also showed a yearly drop in January exports. Demand was weak across most major trading partners. Exports to China fell 6.4 percent on the year in January after advancing 0.8 percent in December, while exports to both the US and European Union also fell on the year, though to a lesser extent than in December. Though net exports did improve in the fourth quarter, how strong Japan's trade was going into the virus remains in question. Exports in January were down 2.6 percent on the year which, however, was an improvement from a 6.3 percent drop in December. Imports were down 3.6 percent versus 4.9 percent contraction in December. Japan's merchandise trade deficit widened from ¥152.5 billion in December to ¥1,312.6 billion in January. The decline in exports was the 14th in a row and broadly in line with data released from Singapore that also showed a yearly drop in January exports. Demand was weak across most major trading partners. Exports to China fell 6.4 percent on the year in January after advancing 0.8 percent in December, while exports to both the US and European Union also fell on the year, though to a lesser extent than in December.

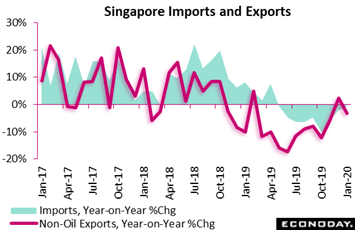

The graph tracking Singapore's trade is very similar to that of Japan, not to mention a host of other nations. Import and export growth slowed through 2018 then moved into outright contraction in 2019. Initial 2020 trade data from Singapore, like Japan, were generally weak, with January exports down a year-on-year 3.3 percent and with imports down 0.8 percent. Electronics exports were down 13.0 percent which is, however, an improvement from the prior month's 21.3 percent year-on-year drop. But non-electronics exports did not improve, down 0.1 percent after advancing 11.5 percent previously. Regional data showed weak demand among several key trading partners: Hong Kong, Japan, Taiwan, Indonesia, and Malaysia. Exports to the European Union also fell sharply in January. The graph tracking Singapore's trade is very similar to that of Japan, not to mention a host of other nations. Import and export growth slowed through 2018 then moved into outright contraction in 2019. Initial 2020 trade data from Singapore, like Japan, were generally weak, with January exports down a year-on-year 3.3 percent and with imports down 0.8 percent. Electronics exports were down 13.0 percent which is, however, an improvement from the prior month's 21.3 percent year-on-year drop. But non-electronics exports did not improve, down 0.1 percent after advancing 11.5 percent previously. Regional data showed weak demand among several key trading partners: Hong Kong, Japan, Taiwan, Indonesia, and Malaysia. Exports to the European Union also fell sharply in January.

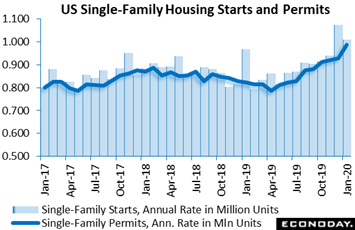

With global trade in a bad run, domestic markets are of increasing importance for national economies. And the hottest numbers anywhere are being posted right now by US residential construction, an area boosted by low financing rates and very high levels of employment. Housing starts posted a far stronger-than-expected annual rate of 1.567 million in January with December revised further higher to an expansion high of 1.626 million. Permits followed suit, coming in at 1.551 million that, like starts, also exceeded the consensus range. Single-family homes, which are key for the residential component of GDP, are on a sharp climbing slope; the 3-month average for starts is 1.008 million and well beyond what were already sharp levels of 900,000 through the second half of last year. Permits are keeping pace, averaging 945,000 in January which is the best since August 2007. Residential construction in the US ended a long dormant run in the second half of last year and is now poised to be a substantial plus for first quarter GDP. With global trade in a bad run, domestic markets are of increasing importance for national economies. And the hottest numbers anywhere are being posted right now by US residential construction, an area boosted by low financing rates and very high levels of employment. Housing starts posted a far stronger-than-expected annual rate of 1.567 million in January with December revised further higher to an expansion high of 1.626 million. Permits followed suit, coming in at 1.551 million that, like starts, also exceeded the consensus range. Single-family homes, which are key for the residential component of GDP, are on a sharp climbing slope; the 3-month average for starts is 1.008 million and well beyond what were already sharp levels of 900,000 through the second half of last year. Permits are keeping pace, averaging 945,000 in January which is the best since August 2007. Residential construction in the US ended a long dormant run in the second half of last year and is now poised to be a substantial plus for first quarter GDP.

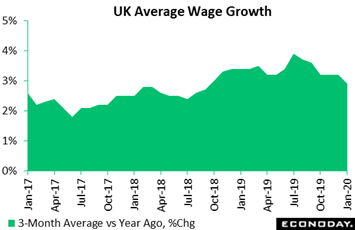

But the outlook for first-quarter US GDP is still up in the air given uneven showings in January and February retail sales. In contrast, the outlook for the UK has improved following a 0.9 percent monthly jump in January retail sales and, in other data posted in the week, solid PMI showings for February where the composite CIPS flash rose 1/2 point to 53.3, a moderate rate but well ahead of most others. And the labour market report (with the usual exception) proved surprisingly robust. The number of people out of work in ILO data fell by 16,000 to 1.290 million in the fourth quarter. This compared with a 23,000 drop in the third quarter and left the jobless rate steady at 3.8 percent. There was also good news on employment which climbed 180,000 over the same period to lift its rate by 0.4 percentage points to 76.5 percent, a new high. Job prospects improved as well as vacancies, in data for the three months to January, increased to 810,000 from the fourth quarter's 803,000. Yet despite the buoyant signals, wage developments were soft again. Average annual earnings growth for last quarter was only 2.9 percent, down from 3.2 percent and the weakest showing since June to August 2018. Excluding bonuses, regular pay saw a 3.2 percent rate, a couple of ticks short of last time, their fifth successive decline and also the slowest outturn in a year-and-a-half. But the outlook for first-quarter US GDP is still up in the air given uneven showings in January and February retail sales. In contrast, the outlook for the UK has improved following a 0.9 percent monthly jump in January retail sales and, in other data posted in the week, solid PMI showings for February where the composite CIPS flash rose 1/2 point to 53.3, a moderate rate but well ahead of most others. And the labour market report (with the usual exception) proved surprisingly robust. The number of people out of work in ILO data fell by 16,000 to 1.290 million in the fourth quarter. This compared with a 23,000 drop in the third quarter and left the jobless rate steady at 3.8 percent. There was also good news on employment which climbed 180,000 over the same period to lift its rate by 0.4 percentage points to 76.5 percent, a new high. Job prospects improved as well as vacancies, in data for the three months to January, increased to 810,000 from the fourth quarter's 803,000. Yet despite the buoyant signals, wage developments were soft again. Average annual earnings growth for last quarter was only 2.9 percent, down from 3.2 percent and the weakest showing since June to August 2018. Excluding bonuses, regular pay saw a 3.2 percent rate, a couple of ticks short of last time, their fifth successive decline and also the slowest outturn in a year-and-a-half.

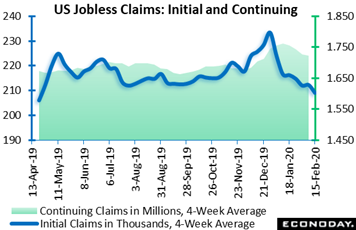

As long as wage growth remains low and overall prices soft, central banks will be free (at least in theory) to increase stimulus no matter how strong labor markets may grow. And a stronger labor market in the US is definitely the indication from jobless claims which are coming down noticeably. The February 15 week was the sample week for February's US employment report and a comparison with the January 18 sample week of the January report shows sizable improvement: down 15,000 for initial claims on the week to 202,000 and, as tracked by the blue line of the graph, down 7,250 for the 4-week average which at 209,000 is at its lowest level since early last year. The 4-week average for continuing claims, in lagging data for the February 8 week, also continued to decline, down 5,250 to 1.723 million. Nonfarm payrolls back in January, up 225,000, rose far beyond expectations and the indications from jobless claims will have forecasters marking up their estimates for February's results. By the way, the unemployment rate for insured workers is only 1.2 percent, a level not pointing to much excess supply of available labor. As long as wage growth remains low and overall prices soft, central banks will be free (at least in theory) to increase stimulus no matter how strong labor markets may grow. And a stronger labor market in the US is definitely the indication from jobless claims which are coming down noticeably. The February 15 week was the sample week for February's US employment report and a comparison with the January 18 sample week of the January report shows sizable improvement: down 15,000 for initial claims on the week to 202,000 and, as tracked by the blue line of the graph, down 7,250 for the 4-week average which at 209,000 is at its lowest level since early last year. The 4-week average for continuing claims, in lagging data for the February 8 week, also continued to decline, down 5,250 to 1.723 million. Nonfarm payrolls back in January, up 225,000, rose far beyond expectations and the indications from jobless claims will have forecasters marking up their estimates for February's results. By the way, the unemployment rate for insured workers is only 1.2 percent, a level not pointing to much excess supply of available labor.

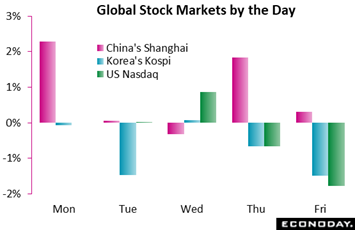

Reports of rising coronavirus cases pulled down many Asian stock markets during the week. But China's Shanghai was not held back, jumping sharply after the People's Bank of China lowered its benchmark rate a notch to reassure everyone that China stands ready to add liquidity as needed to fight the effects of the outbreak. But other markets didn't hold up so well especially the Kospi in South Korea where reports of virus cases are suddenly appearing. The Kospi lost 3.6 percent on the week, the most of any of the major Asian indexes. Down 1.6 percent on the week and 1.8 percent Friday alone, the high flying US Nasdaq also had a bad week, one in which Apple, citing virus effects on Chinese production, issued an earnings warning. Some of the Nasdaq's loss on Friday could also have been tied to the weak PMI performances in Japan and the US, a reminder that economic data, now that it's rolling in for February, will begin to assume an increasing roll in the assessment of the crisis. Reports of rising coronavirus cases pulled down many Asian stock markets during the week. But China's Shanghai was not held back, jumping sharply after the People's Bank of China lowered its benchmark rate a notch to reassure everyone that China stands ready to add liquidity as needed to fight the effects of the outbreak. But other markets didn't hold up so well especially the Kospi in South Korea where reports of virus cases are suddenly appearing. The Kospi lost 3.6 percent on the week, the most of any of the major Asian indexes. Down 1.6 percent on the week and 1.8 percent Friday alone, the high flying US Nasdaq also had a bad week, one in which Apple, citing virus effects on Chinese production, issued an earnings warning. Some of the Nasdaq's loss on Friday could also have been tied to the weak PMI performances in Japan and the US, a reminder that economic data, now that it's rolling in for February, will begin to assume an increasing roll in the assessment of the crisis.

Though weakness is narrowly centered so far in Japan and perhaps the US, February's PMI results are raising an alarm that China's virus outbreak may in fact have a tangibly negative impact, at least for February, on the global economy. A greater-than-expected virus effect would no doubt increase the chances for a general extension of monetary and fiscal stimulus, stimulus that would not be blocked by concerns over inflation.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week’s most pressing data won’t be coming out during the week at all, that is the workweek; CFLP manufacturing for February, a report that could well outline the magnitude of the coronavirus effect, won’t be posted until Saturday morning Chinese time on February 29th, or well into Friday evening Eastern Time. Other hard data in the week will further update the condition of the global economy heading into the outbreak including Hong Kong GDP, which will be data on Thursday for the hard hit fourth quarter, and January reports on industrial production and retail sales from Japan, both on Friday and likely to keep this country in the headlines following the prior week's drop in GDP. The coronavirus isn't the only unpleasant special factor in the news; the shutdown of the Boeing 737 scaled back the prior week's US industrial production report and, coming up, January data on US durable goods will offer the next indications of the impact. Inflation updates will be led by Eurozone HICP on Friday with EC economic sentiment also posted late in the week along with the leading indicators index from Switzerland. India GDP on Friday will also be worth watching as will goods trade in the US where the last update was favorable. One of the hottest reports on any calendar will also be released – US new home sales on Wednesday which are expected to give back some of their strong gains.

German Ifo Economic Sentiment for February (Mon 09:00 GMT; Mon 10:00 CET; Mon 04:00 EST)

Consensus Forecast: 95.1

German economic sentiment is expected to fall 8 tenths in February to 95.1 versus a limited but still unexpected 4 tenths decline in January to 95.9 that ended four straight months of improvement.

US New Home Sales for January (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Annualized Rate: 708,000

Consensus Range: 695,000 to 727,000

New home sales have been rising strongly and are at their best level of the expansion. Econoday's consensus for January's annual new home sales rate is 708,000 versus 694,000 in December.

Hong Kong Fourth-Quarter GDP (Thursday, Time Not Set)

Consensus Forecast, Quarter-to-Quarter: -0.4%

Consensus Forecast, Year-on-Year: -3.0%

In a period beset by civil unrest and international trade tensions, fourth-quarter Hong Kong GDP is expected to decrease 0.4 percent on a quarter-to-quarter basis and fall 3.0 percent on a year-on-year basis.

Eurozone: EC Economic Sentiment for February (Thu 10:00 GMT; Thu 11:00 CET; Thu 05:00 EST)

Consensus Forecast: 101.8

The European Commission's economic sentiment index has posted three straight increases for the first time in two years. Yet following January's 102.8, forecasters see February's index breaking the string and falling a point to 101.8.

US Durable Goods Orders for January (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month-to-Month Change: -0.9%

Consensus Forecast: Ex-Transportation: 0.2%

Consensus Forecast: Core Capital Goods Orders: 0.3%

Durable goods orders are expected to fall 0.9 percent in January versus an unexpectedly strong 2.4 percent gain in December. January orders excluding transportation equipment are expected to increase 0.2 percent with core capital goods expected to rebound 0.3 percent following December's very steep 0.9 percent decline. Data on shipments and unfilled orders will also be watched in this report for indications on Boeing 737 effects.

Japanese Industrial Production for January (Thu 23:50 GMT: Fri 08:50 JST; Thu 18:50 EST)

Consensus Forecast, Month-to-Month: 0.1%

Industrial production in December rose a better-than-expected 1.3 percent on the month and but is expected to edge only 0.1 percent higher in January. Japanese production in Japan has been trending into year-on-year contraction, at minus 3.0 percent in December.

Japanese Retail Sales for January (Thu 23:50 GMT: Fri 08:50 JST; Thu 18:50 EST)

Consensus Forecast, Year-over-Year: -1.2%

Retail sales have been swinging sharply after an increase in consumption taxes in October. January's consensus is a year-on-year decline of 1.2 percent versus a 2.6 percent drop in December.

Switzerland: KOF Swiss Leading Indicator for February (Fri 08:00 GMT; Fri 09:00 CET; Fri 03:00 EST)

Consensus Forecast: 97.5%

The KOF Swiss leading indicator is expected to slip to 97.5 percent in February after rising sharply in January to 100.1 percent and further off multi-year lows.

Eurozone HICP Flash for February (Fri 10:00 GMT; Fri 11:00 CET; Fri 05:00 EST)

Consensus Forecast, Year-over-Year: 1.3%

Eurozone inflation is expected to slow slightly in February, to a year-on-year consensus of 1.3 percent versus 1.4 percent in January (revised from 1.3 percent in the flash).

Indian Fourth-Quarter GDP (Fri 12:00 GMT; Fri 17:30 IST; 07:00 EST)

Consensus Forecast, Year-over-Year: 4.7%

Forecasters see fourth-quarter GDP coming in at year-on-year growth of 4.7 percent versus 4.5 percent in the third quarter which was the fifth straight quarter of slowing and the weakest showing in nearly seven years.

US International Trade In Goods for January (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast, Month-to-Month Change: -$68.7 billion

Consensus Range: -$72.9 to -$66.2 billion

Forecasters see narrowing for the January goods trade gap, to a consensus $68.7 billion versus $69.7 billion in December (revised from an initial $68.3 billion). The rise in goods imports in December was greater than the rise in goods exports.

China: CFLP Manufacturing PMI for February (Sat 01:00 GMT; Sat 09:00 CST; Fri 20:00 EST)

Consensus Forecast: 45.0

February's CFLP will offer an early and important look at the effects of the coronavirus, and the consensus points to a very sizable 5.0 point loss to 45.0. The manufacturing index broke into the 50 zone in November and held there in December and January.

|