|

The impact of the coronavirus on global human health is still playing out in contrast to its impact on the financial markets which, unfortunately, is already severe. Its impact on economic data is just beginning to emerge with little beyond delivery delays evident; its impact on economic policy has yet to emerge with global authorities jawboning but still reluctant to intervene. Against expectations, the Bank of Korea did not cut rates at its Thursday meeting despite its own warnings that the South Korean economy faces contraction because of the virus. And on Friday, Jerome Powell issued a statement saying that the virus is an evolving risk to an otherwise strong US economy. And neither the Reserve Bank of Australia nor the Bank of Canada are expected to act in the coming week. Whether and how long central banks stay on the sidelines will depend on whether market turmoil deepens and whether economic data begin to sink. Global trade has been the center of focus for the past couple of years and attention on this sector will only be intensifying as clues to virus effects are sought.

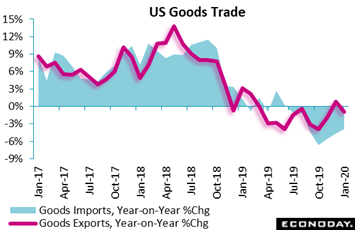

Going into the coronavirus, cross border trade in the US was still in contraction. The deficit in goods trade, at $65.5 billion in January, was heavy but still smaller than expected and made for a good start to first-quarter net exports. Not favorable, however, was 1.0 percent monthly contraction in goods exports that put year-on-year contraction also at 1.0 percent for the ninth contraction of the last 10 months. Imports were no better, down 2.2 percent in January with yearly contraction here at 3.9 percent for the seventh straight negative score. Yet exports did show some life in January led by a 4.5 percent monthly rise in foods, feeds, & beverages with the yearly rate for this closely watched category up 2.1 percent. But the biggest exports for the US are capital goods and these fell 2.2 percent on the month for 3.9 percent annual contraction. The import side of the report showed significant contraction for vehicles, down 2.3 percent on the month and down 8.3 percent on the year, as well as capital goods, down 1.4 percent on the month and down 3.2 percent on the year. These point to weak domestic demand, both consumer and business. Yet given the phase one trade agreement between the US and China, January was an auspicious month for global trade, and it remains so however much the virus outbreak clouds the outlook. Nevertheless, all issues aside, entering 2020, US trade was still in contraction. Going into the coronavirus, cross border trade in the US was still in contraction. The deficit in goods trade, at $65.5 billion in January, was heavy but still smaller than expected and made for a good start to first-quarter net exports. Not favorable, however, was 1.0 percent monthly contraction in goods exports that put year-on-year contraction also at 1.0 percent for the ninth contraction of the last 10 months. Imports were no better, down 2.2 percent in January with yearly contraction here at 3.9 percent for the seventh straight negative score. Yet exports did show some life in January led by a 4.5 percent monthly rise in foods, feeds, & beverages with the yearly rate for this closely watched category up 2.1 percent. But the biggest exports for the US are capital goods and these fell 2.2 percent on the month for 3.9 percent annual contraction. The import side of the report showed significant contraction for vehicles, down 2.3 percent on the month and down 8.3 percent on the year, as well as capital goods, down 1.4 percent on the month and down 3.2 percent on the year. These point to weak domestic demand, both consumer and business. Yet given the phase one trade agreement between the US and China, January was an auspicious month for global trade, and it remains so however much the virus outbreak clouds the outlook. Nevertheless, all issues aside, entering 2020, US trade was still in contraction.

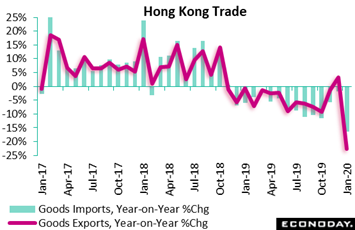

Hong Kong's trade picture looks much the same as the US: growth breaking down in 2018 and turning into contraction in 2019 and now into 2020 as well. Like the US, Hong Kong's goods deficit narrowed in January, to HK$30.6 billion from HK$32.5 billion in December. But also like the US, both exports and imports were in the red, down 22.7 percent on the year for the former and down 16.4 percent for the latter. Exports to mainland China fell 21.4 percent on the year in January, while imports from mainland China fell 25.1 percent. Exports and imports to and from the US and Japan also fell sharply. Contraction aside, any initial effects from the virus are difficult to gauge given shifting calendar effects surrounding the lunar new year. Chinese merchandise trade, which will combine both January and February together to help neutralize the new year effects, will be a highlight of the coming week. Hong Kong's trade picture looks much the same as the US: growth breaking down in 2018 and turning into contraction in 2019 and now into 2020 as well. Like the US, Hong Kong's goods deficit narrowed in January, to HK$30.6 billion from HK$32.5 billion in December. But also like the US, both exports and imports were in the red, down 22.7 percent on the year for the former and down 16.4 percent for the latter. Exports to mainland China fell 21.4 percent on the year in January, while imports from mainland China fell 25.1 percent. Exports and imports to and from the US and Japan also fell sharply. Contraction aside, any initial effects from the virus are difficult to gauge given shifting calendar effects surrounding the lunar new year. Chinese merchandise trade, which will combine both January and February together to help neutralize the new year effects, will be a highlight of the coming week.

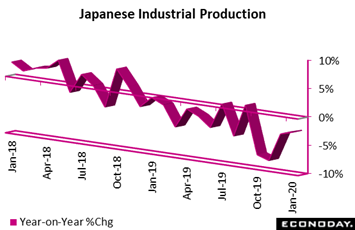

Contraction in goods trade has spelled trouble for global industrial production which has likewise fallen into contraction. Japan has been a prominent victim. Despite a 0.8 percent monthly rise, annual contraction remained deep at 2.5 percent in January and this pre-dates any effects from the virus. Output of production machinery, electronic parts & devices, as well as business machinery all declined. On the plus side, vehicle output and transport equipment increased. Japanese officials do not see much virus effect for February, forecasting a monthly 5.3 percent increase in the month. But for March, they see production dropping by 6.9 percent. Contraction in goods trade has spelled trouble for global industrial production which has likewise fallen into contraction. Japan has been a prominent victim. Despite a 0.8 percent monthly rise, annual contraction remained deep at 2.5 percent in January and this pre-dates any effects from the virus. Output of production machinery, electronic parts & devices, as well as business machinery all declined. On the plus side, vehicle output and transport equipment increased. Japanese officials do not see much virus effect for February, forecasting a monthly 5.3 percent increase in the month. But for March, they see production dropping by 6.9 percent.

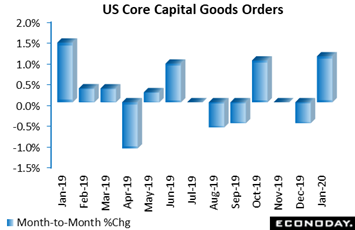

US industrial production has also been in long contraction, since July of last year. Yet there was a very good signal for business investment in durable goods data that, however, also pre-date any virus effects. New orders for core capital goods (nondefense ex-aircraft) jumped 1.1 percent in January to help reverse a prior run of weakness, while related shipments, which will be inputs into first-quarter nonresidential fixed investment, also rose 1.1 percent. This gets the factory sector off to a good start in the first quarter and will help offset any component snags or lost sales in the coming months. January was filled with good news as orders that feed into capital goods turned higher: primary metals up a monthly 2.2 percent, fabrications up 1.2 percent, machinery up 2.1 percent, and computers & electronics up 0.3 percent. US industrial production has also been in long contraction, since July of last year. Yet there was a very good signal for business investment in durable goods data that, however, also pre-date any virus effects. New orders for core capital goods (nondefense ex-aircraft) jumped 1.1 percent in January to help reverse a prior run of weakness, while related shipments, which will be inputs into first-quarter nonresidential fixed investment, also rose 1.1 percent. This gets the factory sector off to a good start in the first quarter and will help offset any component snags or lost sales in the coming months. January was filled with good news as orders that feed into capital goods turned higher: primary metals up a monthly 2.2 percent, fabrications up 1.2 percent, machinery up 2.1 percent, and computers & electronics up 0.3 percent.

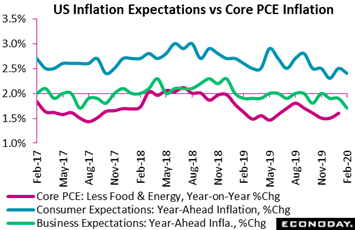

Yet one month is only one month and should capital goods not hold up, central banks would have one more reason to initiate new stimulus. And ever subdued rates of inflation would be no obstacle for any emergency stimulus, including from the US Federal Reserve. The core PCE price index – the most important price index for Fed policy – came in at the bottom end of Econoday's consensus ranges: at only plus 0.1 percent for January's monthly rate and at 1.6 percent for the yearly rate. Though the yearly rate did rise 1 tenth, the showing is still tangibly below the Fed's general 2 percent target. Also released in the week were year-ahead inflation expectations at the consumer level which, in data tracked by the University of Michigan, edged 1 tenth lower to 2.4 percent and back at the bottom of trend. Also at the bottom of trend are year-ahead inflation expectations at the business level, which in data tracked by the Atlanta Fed and released in the prior week fell 2 tenths to 1.7 percent. The possible impact of virus effects on inflation are mixed and hard to call; price pressures for inputs could rise due to shortages but pressures for final goods and services could ease if consumer and business demand begin to fall. In any case, going into these effects inflation in January was subdued. Yet one month is only one month and should capital goods not hold up, central banks would have one more reason to initiate new stimulus. And ever subdued rates of inflation would be no obstacle for any emergency stimulus, including from the US Federal Reserve. The core PCE price index – the most important price index for Fed policy – came in at the bottom end of Econoday's consensus ranges: at only plus 0.1 percent for January's monthly rate and at 1.6 percent for the yearly rate. Though the yearly rate did rise 1 tenth, the showing is still tangibly below the Fed's general 2 percent target. Also released in the week were year-ahead inflation expectations at the consumer level which, in data tracked by the University of Michigan, edged 1 tenth lower to 2.4 percent and back at the bottom of trend. Also at the bottom of trend are year-ahead inflation expectations at the business level, which in data tracked by the Atlanta Fed and released in the prior week fell 2 tenths to 1.7 percent. The possible impact of virus effects on inflation are mixed and hard to call; price pressures for inputs could rise due to shortages but pressures for final goods and services could ease if consumer and business demand begin to fall. In any case, going into these effects inflation in January was subdued.

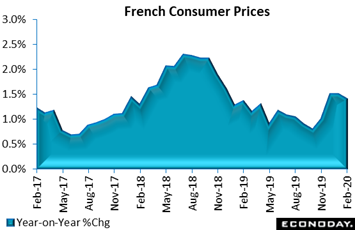

And an initial inflation reading for the month of February is likewise subdued, at least in France where headline consumer prices were unchanged and slightly weaker than expected. The yearly inflation rate came in at 1.4 percent, a tick short of January's and the first step backwards since last September and further below the 2 percent target. Yet the dip was due to the more volatile subsectors and probably masked a slightly stronger underlying picture: energy inflation fell from 4.5 percent to 1.1 percent while the annual rate for food was 0.2 percentage points lower at 1.8 percent. In contrast, manufactured goods finally moved back into positive territory at 0.3 percent, up from minus 0.3 percent, and services advanced a tick to 1.4 percent. Details aside, February's report from France does suggest that virus effects on prices have so far been limited. And an initial inflation reading for the month of February is likewise subdued, at least in France where headline consumer prices were unchanged and slightly weaker than expected. The yearly inflation rate came in at 1.4 percent, a tick short of January's and the first step backwards since last September and further below the 2 percent target. Yet the dip was due to the more volatile subsectors and probably masked a slightly stronger underlying picture: energy inflation fell from 4.5 percent to 1.1 percent while the annual rate for food was 0.2 percentage points lower at 1.8 percent. In contrast, manufactured goods finally moved back into positive territory at 0.3 percent, up from minus 0.3 percent, and services advanced a tick to 1.4 percent. Details aside, February's report from France does suggest that virus effects on prices have so far been limited.

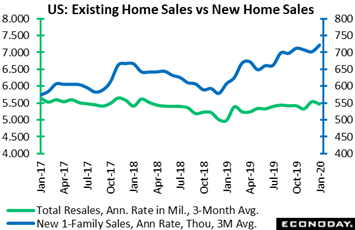

How heavy the virus impact will be on housing markets, like everything else, is also uncertain. Going into any effects, the US new home market, driven by low mortgage rates and high levels of employment, was accelerating as sharply as any sector anywhere. New home sales surged in January, up 7.9 percent in the month to a 13-year high. The graph tracks 3-month rates which, given monthly volatility in housing data, are important to watch, and the average confirms the strength, up 2.8 percent on the month to a 721,000 annual rate and up 18.7 percent on the year. And the sales surge did not come at the expense of discounting. Far from it, as the median jumped 7.4 percent to a record $348,200 for year-on-year growth of 14.0 percent. Limited supply (not to mention strong demand) was a key factor behind the price strength; new homes on the market were roughly steady in January at 324,000 but relative to sales, supply fell sharply, to 5.1 months from 5.5 months. In contrast to new home sales, sales of existing homes (green line) have yet to respond with anything close to similar gains. How heavy the virus impact will be on housing markets, like everything else, is also uncertain. Going into any effects, the US new home market, driven by low mortgage rates and high levels of employment, was accelerating as sharply as any sector anywhere. New home sales surged in January, up 7.9 percent in the month to a 13-year high. The graph tracks 3-month rates which, given monthly volatility in housing data, are important to watch, and the average confirms the strength, up 2.8 percent on the month to a 721,000 annual rate and up 18.7 percent on the year. And the sales surge did not come at the expense of discounting. Far from it, as the median jumped 7.4 percent to a record $348,200 for year-on-year growth of 14.0 percent. Limited supply (not to mention strong demand) was a key factor behind the price strength; new homes on the market were roughly steady in January at 324,000 but relative to sales, supply fell sharply, to 5.1 months from 5.5 months. In contrast to new home sales, sales of existing homes (green line) have yet to respond with anything close to similar gains.

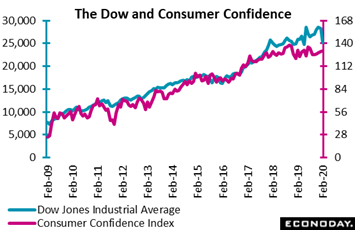

We end the week's data run with consumer confidence which, despite the immediacy of the sampling, has yet to show much of any visible reaction to the virus spread, whether in Europe or the US. At 130.7, February's US consumer confidence index rose 3 tenths and is still within easy striking distance of 2018's historic highs near 140. A solid positive in the report was income expectations with optimists up 0.4 percentage points to 22.0 percent and pessimists down 1.3 points to 6.7 percent. Buying plans were also positive, especially for appliances but including autos and also homes. If there was a negative in the report it was the assessment of February's labor market which showed more saying jobs were hard to get (14.8 percent) and fewer saying that jobs were plentiful (44.6 percent). Still the spread between these two readings is very favorable and points to another month of solid payroll growth for the US economy. Yet however solid confidence has been, its slope of improvement has been shallower over the past couple of years than the slope for the Dow industrials. Tracked together in the graph, they show a separation that is now being dramatically narrowed. We end the week's data run with consumer confidence which, despite the immediacy of the sampling, has yet to show much of any visible reaction to the virus spread, whether in Europe or the US. At 130.7, February's US consumer confidence index rose 3 tenths and is still within easy striking distance of 2018's historic highs near 140. A solid positive in the report was income expectations with optimists up 0.4 percentage points to 22.0 percent and pessimists down 1.3 points to 6.7 percent. Buying plans were also positive, especially for appliances but including autos and also homes. If there was a negative in the report it was the assessment of February's labor market which showed more saying jobs were hard to get (14.8 percent) and fewer saying that jobs were plentiful (44.6 percent). Still the spread between these two readings is very favorable and points to another month of solid payroll growth for the US economy. Yet however solid confidence has been, its slope of improvement has been shallower over the past couple of years than the slope for the Dow industrials. Tracked together in the graph, they show a separation that is now being dramatically narrowed.

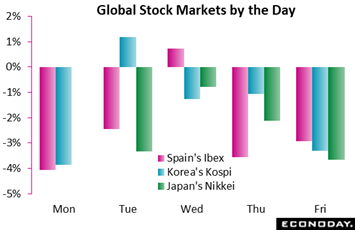

In the worst run since the financial collapse more than 10 years ago, stock markets across the globe posted double-digit or near double-digit declines in the week. The graph tracks indexes from three countries where reports of infections have been building: Spain's Ibex down 11.8 percent in the week, Korea's Kospi down 8.1 percent, Japan's Nikkei down 9.6 percent. The long heavy losses are not the only critical point of the graph; the lack of any meaningful counter rally is also of note. Selling likely fed on itself in the week, the result of margin calls leading to forced selling of speculative positions. Gold, opening the week near $1,700, ended the week near $1,580 as positions were perhaps liquidated to meet margin calls in the stock market. Oil also had a very bad week, starting Monday near $59 for Brent and ending below $52. Margin effects tied to the stock market may also have been at play here as well. Where is the money going? It's going into sovereign bonds especially US Treasuries where the yield on the 10-year note, now under 1.20 percent, fell 30 basis points in the week. In the worst run since the financial collapse more than 10 years ago, stock markets across the globe posted double-digit or near double-digit declines in the week. The graph tracks indexes from three countries where reports of infections have been building: Spain's Ibex down 11.8 percent in the week, Korea's Kospi down 8.1 percent, Japan's Nikkei down 9.6 percent. The long heavy losses are not the only critical point of the graph; the lack of any meaningful counter rally is also of note. Selling likely fed on itself in the week, the result of margin calls leading to forced selling of speculative positions. Gold, opening the week near $1,700, ended the week near $1,580 as positions were perhaps liquidated to meet margin calls in the stock market. Oil also had a very bad week, starting Monday near $59 for Brent and ending below $52. Margin effects tied to the stock market may also have been at play here as well. Where is the money going? It's going into sovereign bonds especially US Treasuries where the yield on the 10-year note, now under 1.20 percent, fell 30 basis points in the week.

The signal is clear: the steep drop underway in stock markets together with the steep drop underway in bond rates are signaling a recession. Whether a global recession does emerge or is underway already is not yet clear. Most of the data that have come out of the major economies pre-date the virus and are merely determining economic levels going into its impact. Whether the markets are right or whether central banks can continue to hold the sidelines will play out day-by-day in the coming weeks.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week is sandwiched between key Chinese indicators: manufacturing PMIs on Saturday and Monday followed by merchandise trade on the following Saturday. The early effects from the coronavirus on the supply of Chinese goods are likely to be given some clarity. Reports from the US manufacturing sector have been mixed to positive with early virus effects not a major issue, at least so far; yet Monday will see the key ISM reading on February conditions along with the sample's related commentary. Central bank announcements will include the Reserve Bank of Australia on Tuesday followed on Wednesday by the Bank of Canada, and forecasters, despite global virus jitters, see neither bank cutting rates. Eurozone data will include the February HICP inflation flash on Tuesday followed by January retail sales on Wednesday with German manufacturing orders for January to be closely watched on Friday. From Japan, Friday will see household spending which has yet to recover from an October tax hike. February employment reports from both Canada and the US will also be posted Friday and moderate results are the expectations.

China: Caixin Manufacturing PMI for February (Mon 01:45 GMT; Mon 09:45 CST; Sun 20:45 EST)

Consensus Forecast: 46.6

The Caixin PMI has been on a six-month winning streak, a subdued one however that took the index in January to only 51.8. For February, with the coronavirus in full swing, the consensus is 46.6.

US: ISM Manufacturing Index for February (Mon 15:00 GMT; Mon 10:00 EST)

Consensus Forecast: 50.4

After a long run of disappointing sub-50 scores, the ISM manufacturing index broke out with a 3.1 point gain in January to a higher-than-expected but still moderate level of 50.9. New orders were very strong in January but not backlogs which were drawn down nor employment which continued to contract. Expectations for February's headline are modest slippage to 50.4 with respondent commentary on the coronavirus certain to be a focus of the report.

Reserve Bank of Australia Announcement (Tue 03:30 GMT; Tue 14:30 AEDT; Mon 22:30 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.75%

The Reserve Bank of Australia is expected to hold its policy rate steady at 0.75 percent for a fourth meeting in a row. In its February statement, when the coronavirus was just underway, the bank said the outlook for the global economy was stable and favorable and they expected inflation to gradually move toward their 2 percent target.

Eurozone HICP Flash for February (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Year-over-Year: 1.3%

Headline inflation is expected to slow slightly in February, to a year-on-year consensus of 1.3 percent versus 1.4 percent in January.

Eurozone Retail Sales for January (Wed 10:00 GMT; Wed 05:00 EST)

Consensus Forecast, Month-to-Month: 0.6%

Eurozone retail sales in December proved very weak, falling 1.6 percent and driving down year-on-year growth to 1.3 percent for the weakest showing since December 2018. Monthly expectations for January is an increase of 0.6 percent.

Bank of Canada Announcement (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 1.75%

Though upgrading its evaluation of the global economy, the Bank of Canada cited slowing in domestic employment and also consumer spending and kept its policy rate steady at its last meeting in January. And despite soft retail sales, soft factory sales, slowing GDP and virus risks, no change is also expected for the March meeting with the policy rate seen holding at 1.75 percent.

Japanese Household Spending for January (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast, Month-to-Month: 0.5%

Consensus Forecast, Year-over-Year: -3.0%

Japanese household spending, which has been erratic surrounding a consumption tax hike in October, is expected to rise a monthly 0.5 percent in January with the yearly rate seen at minus 3.0 percent versus December contraction of 4.8 percent.

German Manufacturers' Orders for January (Fri 07:00 GMT; Fri 08:00 CET; Fri 02:00 EST)

Consensus Forecast, Month-to-Month: 1.3%

Orders have been in contraction for German manufacturers since August last year but January's monthly call is positive, at a 1.3 percent gain that would follow a 2.1 percent December decline.

Canadian Labour Force Survey for February (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Employment Change: 10,000

Consensus Forecast: Unemployment Rate: 5.6%

Employment is expected to rise 10,000 in February following moderate increases of 34,500 and 35,200 in the two prior months. The unemployment rate is expected to come in at 5.6 percent versus January's 5.5 percent.

US Employment Report for February (Fri 13:30 GMT; Fri 08:30 EST)

Consensus Forecast: Nonfarm Payrolls Change: 175,000

Consensus Forecast: Unemployment Rate: 3.6%

Consensus Forecast: Average Hourly Earnings M/M: 0.3%

Consensus Forecast: Average Hourly Earnings Y/Y: 3.0%

Less robust but still solid payroll growth is the expectation for nonfarm payrolls in February, at a consensus 175,000 versus what was a much stronger-than-expected 225,000 increase in December. The unemployment rate is expected to hold steady at a very low 3.6 percent with the participation rate also steady at 63.4 percent. Average hourly earnings showed only modest pressure in January, up 0.1 percent on the month for a 3.1 percent year-on-year rise with February's expectations mixed, at 0.3 percent for a solid monthly showing but down 1 tenth at 3.0 percent for the yearly. Rounding out the consensus forecasts: manufacturing payrolls, after falling 12,000 in January, are expected to fall another 5,000; private payrolls are seen up 155,000; and the workweek steady at 34.3 hours.

Chinese Merchandise Trade Balance for January and February (Estimated for Saturday, Release Time Not Set)

Consensus Forecast: US$12.5 billion

Imports, Year-on-Year: -9.0%

Exports, Year-on-Year: -8.0%

The consensus for China's merchandise trade balance, which will be combined for both January and February, is a surplus of US$12.5 billion following a $46.79 billion surplus in December. Imports in the two-month period are seen falling a year-on-year 9.0 percent in US dollar terms following December's single-month 16.3 percent gain while exports are expected to decrease 8.0 percent versus a 7.6 percent increase in December.

|