|

Central bankers may be citing risks that the coronavirus poses to their twin towers of policy: full employment and stable inflation. But the real trigger for the week's sudden and aggressive policy pivot toward total stimulus is the collapse underway in the markets and the risk that entails to financial stability. The prior week ended with a Jerome Powell statement saying the Federal Reserve would "act as appropriate" to support the economy which by Tuesday (only a short span really) was followed by an all-out rate cut and an unscheduled press conference; only the tip of the iceberg in a week filled with a multitude of central bank actions.

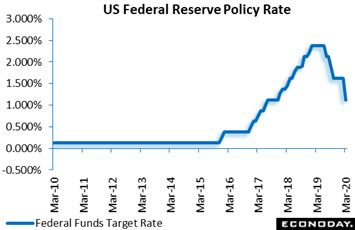

"Changed materially" was Jerome Powell's assessment of the economic outlook at an unscheduled press conference following an unexpected 50 basis point rate cut in the Fed's policy target rate to 1.125 percent. The move precedes a scheduled meeting in the coming week which, if the markets keep swinging around, could produce yet another rate cut (if not perhaps some more government bond buying as well). Powell said the effects of the virus so far have been limited, noting trouble appearing in anecdotal surveys but not yet in definitive data. Though he said the rate cut wouldn't "fix a broken supply chain", it would he said provide a "meaningful boost to the economy", help protect financial stability, and generally boost confidence. Powell said the Fed is in active discussion with central banks around the world and that high level coordination is ongoing, and he wasn't kidding. "Changed materially" was Jerome Powell's assessment of the economic outlook at an unscheduled press conference following an unexpected 50 basis point rate cut in the Fed's policy target rate to 1.125 percent. The move precedes a scheduled meeting in the coming week which, if the markets keep swinging around, could produce yet another rate cut (if not perhaps some more government bond buying as well). Powell said the effects of the virus so far have been limited, noting trouble appearing in anecdotal surveys but not yet in definitive data. Though he said the rate cut wouldn't "fix a broken supply chain", it would he said provide a "meaningful boost to the economy", help protect financial stability, and generally boost confidence. Powell said the Fed is in active discussion with central banks around the world and that high level coordination is ongoing, and he wasn't kidding.

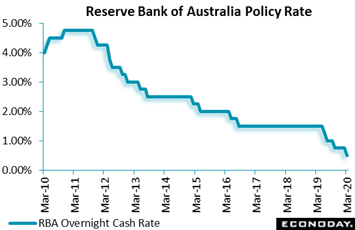

The week actually kicked off with a new round of bond buying by the Bank of Japan followed on Tuesday by a surprise 25 basis point cut by the Reserve Bank of Australia whose policy rate, at only 0.50 percent, looks to be zeroing in on the zero line. The RBA cited the need to support Australia's economy in response to the coronavirus outbreak which has "clouded" the outlook and will cut "noticeably" into first-quarter GDP. Officials said the outbreak is likely to delay progress toward their employment and inflation goals though how large and long-lasting the effects will be are difficult to predict. However low the policy rate already is, the bank said it is prepared to ease monetary policy further in coming months if necessary. The week actually kicked off with a new round of bond buying by the Bank of Japan followed on Tuesday by a surprise 25 basis point cut by the Reserve Bank of Australia whose policy rate, at only 0.50 percent, looks to be zeroing in on the zero line. The RBA cited the need to support Australia's economy in response to the coronavirus outbreak which has "clouded" the outlook and will cut "noticeably" into first-quarter GDP. Officials said the outbreak is likely to delay progress toward their employment and inflation goals though how large and long-lasting the effects will be are difficult to predict. However low the policy rate already is, the bank said it is prepared to ease monetary policy further in coming months if necessary.

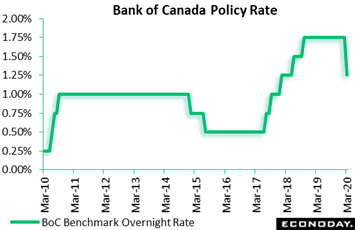

Wednesday was another day and the turn for the Bank of Canada to cuts its target rate by 50 basis points, which is now at 1.25 percent. The move by the BoC, which hadn't cut rates in a long time, was less unexpected than the RBA's but still twice as much as the 25 point consensus. The statement said the virus is disrupting business activity and supply chains, and is also pulling down commodity prices and the Canadian dollar. As the virus spreads, business and consumer confidence will likely deteriorate and further depress activity, according to the bank. The BoC said the outlook is now clearly weaker than it was and it stands ready to adjust monetary policy further if required. Wednesday was another day and the turn for the Bank of Canada to cuts its target rate by 50 basis points, which is now at 1.25 percent. The move by the BoC, which hadn't cut rates in a long time, was less unexpected than the RBA's but still twice as much as the 25 point consensus. The statement said the virus is disrupting business activity and supply chains, and is also pulling down commodity prices and the Canadian dollar. As the virus spreads, business and consumer confidence will likely deteriorate and further depress activity, according to the bank. The BoC said the outlook is now clearly weaker than it was and it stands ready to adjust monetary policy further if required.

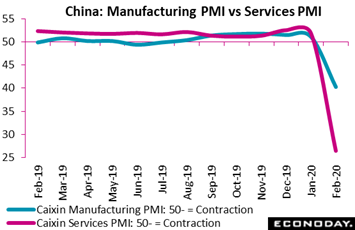

Maybe what changed everyone's mind from the prior week, or at least contributed to changing their mind, was a frightful run of weakness in Chinese business surveys, the first on Saturday as the official CFLP manufacturing PMI fell more than 14 points to a far weaker than expected 35.7 followed on Monday by the Caixan manufacturing PMI which fell nearly 11 points to 40.3 and was also much weaker than expected. China basically shut down its manufacturing sector in February, based on these results. Yet a hint of hope comes from confidence measures which, given the easy comparisons from the shutdown, appear certain to lift activity in the coming months. The virus' hit to manufacturing, apart from its severity, isn't really a shock but its greater effects on the services sector, especially in China, may well be. Caixan's services PMI, which followed on Wednesday, dived more than 25 points to 26.5 in February. Scores in the 20s are extremely rare for diffusion indexes, the result of substantially more respondents, very substantially more, saying conditions are contracting than expanding. Maybe what changed everyone's mind from the prior week, or at least contributed to changing their mind, was a frightful run of weakness in Chinese business surveys, the first on Saturday as the official CFLP manufacturing PMI fell more than 14 points to a far weaker than expected 35.7 followed on Monday by the Caixan manufacturing PMI which fell nearly 11 points to 40.3 and was also much weaker than expected. China basically shut down its manufacturing sector in February, based on these results. Yet a hint of hope comes from confidence measures which, given the easy comparisons from the shutdown, appear certain to lift activity in the coming months. The virus' hit to manufacturing, apart from its severity, isn't really a shock but its greater effects on the services sector, especially in China, may well be. Caixan's services PMI, which followed on Wednesday, dived more than 25 points to 26.5 in February. Scores in the 20s are extremely rare for diffusion indexes, the result of substantially more respondents, very substantially more, saying conditions are contracting than expanding.

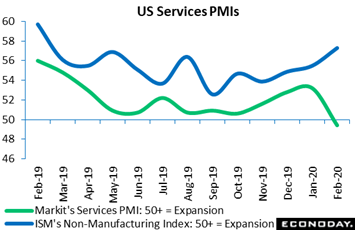

But PMIs outside of Asia and specifically China haven't completely collapsed, at least not yet. And far from it for the ISM's US non-manufacturing index which unexpectedly rose 2 points to a 57.3 level that easily beat expectations and was led by a surge in new orders and a build for backlogs. The report's employment measure posted a sharp gain that correctly forecast what on Friday would prove to be a giant increase in US nonfarm payrolls and a downtick in the unemployment rate. Commentary regarding the virus was surprisingly subdued in the ISM sample. Yet a rival report, Markit's US services PMI, did in fact show weakness, falling 4 points to an expectedly low 49.4. Foreign orders for this sample contracted in the month, employment growth slowed, and business confidence was subdued; price indications slowed and output contracted. When two samples tell two different stories, the truth probably lies in the middle (note that the ISM includes two goods producing sectors not covered in services: mining and what is a very strong US construction sector). But PMIs outside of Asia and specifically China haven't completely collapsed, at least not yet. And far from it for the ISM's US non-manufacturing index which unexpectedly rose 2 points to a 57.3 level that easily beat expectations and was led by a surge in new orders and a build for backlogs. The report's employment measure posted a sharp gain that correctly forecast what on Friday would prove to be a giant increase in US nonfarm payrolls and a downtick in the unemployment rate. Commentary regarding the virus was surprisingly subdued in the ISM sample. Yet a rival report, Markit's US services PMI, did in fact show weakness, falling 4 points to an expectedly low 49.4. Foreign orders for this sample contracted in the month, employment growth slowed, and business confidence was subdued; price indications slowed and output contracted. When two samples tell two different stories, the truth probably lies in the middle (note that the ISM includes two goods producing sectors not covered in services: mining and what is a very strong US construction sector).

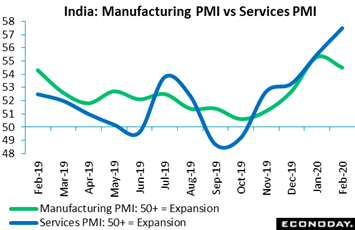

And not weak or even mixed but outright refreshing were PMI readings in India. Markit's PMI for February's services sector rose 2 points to 57.5 for the fifth straight increase and the best reading in seven years. Growth in new orders, including export orders, is climbing fast as is the 12-month outlook. The PMI for India's manufacturing sector held near 8-year highs, coming in 54.5 in February for only an 8 tenths decrease. Here too both domestic and foreign orders were strong though employment and business confidence sagged. Compared perhaps with other countries, India is relatively less exposed to shifts in global trade flows, suggesting that disruptions to regional supply chains and weaker external demand associated with the virus will have a more gradual and subdued impact. And not weak or even mixed but outright refreshing were PMI readings in India. Markit's PMI for February's services sector rose 2 points to 57.5 for the fifth straight increase and the best reading in seven years. Growth in new orders, including export orders, is climbing fast as is the 12-month outlook. The PMI for India's manufacturing sector held near 8-year highs, coming in 54.5 in February for only an 8 tenths decrease. Here too both domestic and foreign orders were strong though employment and business confidence sagged. Compared perhaps with other countries, India is relatively less exposed to shifts in global trade flows, suggesting that disruptions to regional supply chains and weaker external demand associated with the virus will have a more gradual and subdued impact.

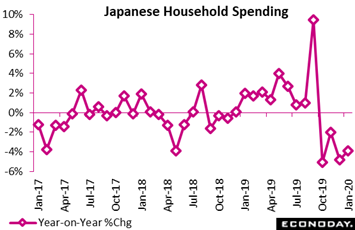

One economy that is highly exposed to global flows is Japan and though February's manufacturing and services PMIs showed only limited weakness, its consumer sector was already in a visible downturn going into the virus. Household spending in Japan, in real inflation-adjusted terms, fell 3.9 percent on the year in January after falling 4.8 percent in December. On the month, spending was down 1.6 percent after December's 1.7 percent dip. Weakness was broad-based with spending on food, utilities, and housing all down. Japanese spending has yet to recover from a consumption tax imposed in October, one that pulled consumer buying into September. One economy that is highly exposed to global flows is Japan and though February's manufacturing and services PMIs showed only limited weakness, its consumer sector was already in a visible downturn going into the virus. Household spending in Japan, in real inflation-adjusted terms, fell 3.9 percent on the year in January after falling 4.8 percent in December. On the month, spending was down 1.6 percent after December's 1.7 percent dip. Weakness was broad-based with spending on food, utilities, and housing all down. Japanese spending has yet to recover from a consumption tax imposed in October, one that pulled consumer buying into September.

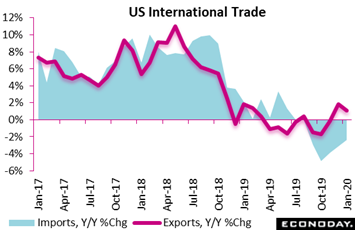

One area to watch for virus effects will be international trade reports which presumably will begin to show sharp dislocations tied to China. Trade reports generally lag other data but going into the effects trade was subdued, at least for the US where January exports were flat, up 1.1 percent on the year but down 0.4 percent on the month, while imports were down 2.4 percent on the year and down 1.6 percent on the month. The US trade gap with China, which will be watched for phase-one trade effects as well virus effects, came in at $26.1 billion in January, up slightly from $24.8 billion in December but well down from $34.5 billion in January last year. China will kick off the next business week even before it begins, posting merchandise trade data for the combined months of January and February on Saturday, March 7. One area to watch for virus effects will be international trade reports which presumably will begin to show sharp dislocations tied to China. Trade reports generally lag other data but going into the effects trade was subdued, at least for the US where January exports were flat, up 1.1 percent on the year but down 0.4 percent on the month, while imports were down 2.4 percent on the year and down 1.6 percent on the month. The US trade gap with China, which will be watched for phase-one trade effects as well virus effects, came in at $26.1 billion in January, up slightly from $24.8 billion in December but well down from $34.5 billion in January last year. China will kick off the next business week even before it begins, posting merchandise trade data for the combined months of January and February on Saturday, March 7.

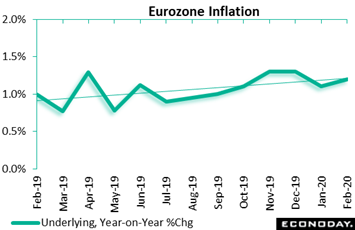

One area that isn't that high on the radar for virus effects is inflation which central bankers generally see, outside of isolated shortages, easing in line with slowing in general activity. Going into the virus, most inflation reports (China and India excluded) have been subdued. At 1.2 percent in February, the Eurozone's flash annual rate was down a couple of ticks from January's 1.4 percent for the first decline since last October. Yet the underlying core measure, which excludes energy, food, drink and tobacco, edged up from 1.1 percent to 1.2 percent. The headline dip was attributable to energy where inflation slid from 1.9 percent to minus 0.3 percent. Readings remain uncomfortably low and, despite the upward tilt for underlying inflation, weakening in the global economy may well make for downside price risk for the Eurozone. One area that isn't that high on the radar for virus effects is inflation which central bankers generally see, outside of isolated shortages, easing in line with slowing in general activity. Going into the virus, most inflation reports (China and India excluded) have been subdued. At 1.2 percent in February, the Eurozone's flash annual rate was down a couple of ticks from January's 1.4 percent for the first decline since last October. Yet the underlying core measure, which excludes energy, food, drink and tobacco, edged up from 1.1 percent to 1.2 percent. The headline dip was attributable to energy where inflation slid from 1.9 percent to minus 0.3 percent. Readings remain uncomfortably low and, despite the upward tilt for underlying inflation, weakening in the global economy may well make for downside price risk for the Eurozone.

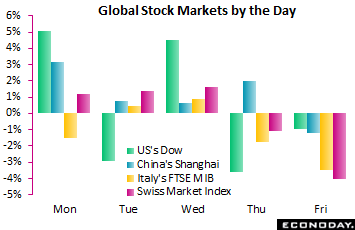

Jerome Powell at his press conference said defaults are not yet appearing in the banking system – but you wouldn't know it looking at the stock market. Fitful surges followed by fitful plunges made this yet another week better to forget. The Dow in the US tells the story: surging 5.1 percent on Monday then 4.5 percent on Wednesday for the plus side; but also plunging 2.9 percent on Tuesday, 3.6 percent on Thursday, then dipping 1.0 percent on Friday for the down side. Yet China's Shanghai Index may be signaling good news: a strong 5.4 percent weekly gain which, when we look back, could prove to be an early indication that the worst was already over. One index that is still feeling the effects of the virus is Italy's FTSE MIB which, in direct contrast to the Shanghai, fell 5.4 percent on the week punctuated by a 3.5 percent nosedive on Friday. One index that has been holding up better than others is the Swiss Market Index which had been higher on the week before Friday's 4.0 percent plunge. Jerome Powell at his press conference said defaults are not yet appearing in the banking system – but you wouldn't know it looking at the stock market. Fitful surges followed by fitful plunges made this yet another week better to forget. The Dow in the US tells the story: surging 5.1 percent on Monday then 4.5 percent on Wednesday for the plus side; but also plunging 2.9 percent on Tuesday, 3.6 percent on Thursday, then dipping 1.0 percent on Friday for the down side. Yet China's Shanghai Index may be signaling good news: a strong 5.4 percent weekly gain which, when we look back, could prove to be an early indication that the worst was already over. One index that is still feeling the effects of the virus is Italy's FTSE MIB which, in direct contrast to the Shanghai, fell 5.4 percent on the week punctuated by a 3.5 percent nosedive on Friday. One index that has been holding up better than others is the Swiss Market Index which had been higher on the week before Friday's 4.0 percent plunge.

Quivering is not a bad word to describe the markets right now, in what is a very consequential reaction to a newly unfolding health threat. Though the global economy was on solid footing going into the outbreak, selling in the financial markets both foretells economic weakness ahead and at the same time contributes to the weakness.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Saturday March 7 is the estimated release date for Chinese merchandise trade, a report that will track both January and February and will offer initial indications on the severity of the coronavirus. But it's February more than January that's the month to watch in the coming week, and here China will also post monthly updates on consumer and producer prices, both on Tuesday. February data that aren't likely to show any coronavirus effects but, nevertheless, will provide baselines for future reports are US consumer prices and the US Treasury Budget, both on Wednesday. Thursday is an especially important day to watch with a policy statement to be issued by the hamstrung European Central Bank whose rates are already near or below zero with nowhere to go. January updates on industrial production will be spread through the week with data from Germany on Monday and, the most important, from the Eurozone on Thursday. Also note that on Sunday March 8, clocks in Washington, DC (home of US statistical agencies) will be moved ahead one hour.

Chinese Merchandise Trade Balance for January and February (Estimated for Saturday, Release Time Not Set)

Consensus Forecast: US$12.5 billion

Imports, Year-on-Year: -9.0%

Exports, Year-on-Year: -8.0%

The consensus for China's merchandise trade balance, which will be combined for both January and February, is a surplus of US$12.5 billion following a $46.79 billion surplus in December. Imports in the two-month period are seen falling a year-on-year 9.0 percent in US dollar terms following December's single-month 16.3 percent gain while exports are expected to decrease 8.0 percent versus a 7.6 percent increase in December.

German Industrial Production for January (Mon 07:00 GMT; Mon 08:00 CET; Mon 03:00 EDT)

Consensus Forecast, Month-to-Month: 1.6%

A 1.6 percent rebound is expected in January following December's unexpected and very sharp 3.5 percent decline. Year-on-year, German industrial production was down 6.7 percent in December.

Chinese CPI for February (Tue 01:30 GMT; Tue 09:30 CST; Mon 21:30 EDT)

Consensus Forecast, Year-over-Year: 5.2%

Consumer prices in China have been rising at the fastest pace in 9 years, due to virus-related stockpiling of food by consumers and also disruptions in pork supply. After January's higher-than-expected 5.4 percent year-on-year rate, forecasters see 5.2 percent for February.

Chinese PPI for February (Tue 01:30 GMT; Tue 09:30 CST; Mon 21:30 EDT)

Consensus Forecast, Year-over-Year: -0.3%

In contrast to consumer prices in China which have been surging, producer price pressures have been negligible. Year-on-year producer prices were unchanged in January with forecasters calling for minus 0.3 percent in the virus-hit month of February.

UK GDP for January (Wed 09:30 GMT; Wed 05:30 EDT)

Consensus Forecast, Month-to-Month: 0.2%

Supported by services and including respectable growth in manufacturing, GDP in the UK rose a higher-than-expected 0.3 percent in December with January's expectations at plus 0.2 percent.

US CPI for February (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Forecast, Year-over-Year Change: 2.3%

US CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.2%

Consensus Forecast, Year-over-Year Change: 2.3%

US consumer prices in January were soft on a monthly basis, up 0.1 percent overall and 0.2 percent for the core, and mixed on a yearly basis, up 2 tenths overall to 2.5 percent but unchanged for the core at 2.3 percent. For February forecasters see monthly rates inching 0.1 percent higher overall and 0.2 percent for the core making for yearly rates of 2.3 percent for both.

US Treasury Budget for February (Wed 18:00 GMT; Wed 14:00 EDT)

Consensus Forecast: -$239.0 billion

Consensus Range: -$240.0 billion to -$11.5 billion

February's federal deficit is expected to come in at $239.0 billion versus a deficit of $234.0 billion in February last year. Four months into the 2020 fiscal year in January, the government's deficit was running 25.4 percent deeper than fiscal 2019.

Eurozone Industrial Production for January (Thu 10:00 GMT; Thu 11:00 CET; Thu 06:00 EDT)

Consensus Forecast, Month-to-Month: 1.2%

Consensus Forecast, Year-over-Year: -3.4%

Eurozone industrial production had already been soft before literally plunging in December, down a far deeper-than-expected 2.1 percent on the month and 4.1 percent on the year. Given an easy comparison against December's weakness, forecasters see a monthly bounce of 1.2 percent for January and a year-on-year rate of minus 3.4 percent.

European Central Bank Policy Announcement (Thu 12:45 GMT; Thu 13:45 CET; Thu 08:45 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

Despite the significant impact of the coronavirus especially in Italy, the European Central Bank is not expected to make any major adjustments in its policy stance at its March meeting. At its last meeting in January, the bank held policy steady: the refi rate at zero percent, the deposit rate at minus 0.50 percent, and QE net asset purchases of €20 billion per month.

|