|

Global recession is the signal right now from the financial markets. The stock market is an aggregate of individual expectations of future performance – company by company. And its signal, one that has a self-fulfilling quality given its effects on company finances, is certainly worrying to say the least. No less worrying has been the rush into government bond markets, instability for corporate bonds and swings in currency values. But let's put the markets aside and look just at the latest economic data for possible clues on the virus' initial effects on the consumer and where the global economy stood when the virus hit.

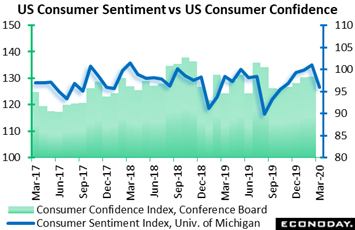

Sentiment surveys are one of the first places to look. They're produced quickly and are always timely and though their correlation with the definitive data that follow is often loose, they nevertheless give us some indication of what's brewing underneath. One of the earliest readings so far this month is the US consumer sentiment report posted on March 13, and its results are not dismal at all, in fact offer some reassurance. The index, tracked in the blue line of the graph, did fall 5.1 points to 95.9 but, as you can see, the result is right in line with the trend over the last 3 years. There are two components to this index: expectations, which fell 4.8 points to 85.3, and current conditions, down 2.3 points to 112.5. The decline within expectations was centered in the year-ahead outlook in contrast to the 5-year outlook which actually improved, suggesting perhaps that consumers generally see the virus as more of a near-term event than a long lasting one. The report also notes that March's overall dip is less severe than that heading into the financial crisis of 2008. Germany's ZEW survey, which tracks analyst opinions, will be posted Tuesday of the coming week and will be worth watching. Note that the green columns of the graph track the US consumer confidence report, a market-moving indicator that will be posted at month end and which was also very strong going into March. Sentiment surveys are one of the first places to look. They're produced quickly and are always timely and though their correlation with the definitive data that follow is often loose, they nevertheless give us some indication of what's brewing underneath. One of the earliest readings so far this month is the US consumer sentiment report posted on March 13, and its results are not dismal at all, in fact offer some reassurance. The index, tracked in the blue line of the graph, did fall 5.1 points to 95.9 but, as you can see, the result is right in line with the trend over the last 3 years. There are two components to this index: expectations, which fell 4.8 points to 85.3, and current conditions, down 2.3 points to 112.5. The decline within expectations was centered in the year-ahead outlook in contrast to the 5-year outlook which actually improved, suggesting perhaps that consumers generally see the virus as more of a near-term event than a long lasting one. The report also notes that March's overall dip is less severe than that heading into the financial crisis of 2008. Germany's ZEW survey, which tracks analyst opinions, will be posted Tuesday of the coming week and will be worth watching. Note that the green columns of the graph track the US consumer confidence report, a market-moving indicator that will be posted at month end and which was also very strong going into March.

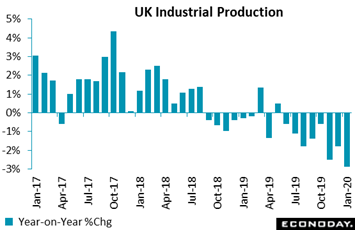

The steady reading for consumer sentiment does hint at less-than-catastrophic declines ahead for consumer spending which was generally moderate to solid across the globe going into the virus. Industrial production, however, was generally not that healthy; in fact trade frictions took their toll throughout 2019. And the early showings this year have not shown much improvement, with the sector in the UK starting the year weaker than expected. Overall production dipped 0.1 percent in January to cut annual growth, as tracked in the graph, from minus 1.8 percent to a multi-year low of minus 2.9 percent. The manufacturing component of this report saw yearly growth dropping from minus 2.5 percent to minus 3.6 percent, also a multi-year low; the principal negative here came from machinery and equipment which, importantly, points to weakness in business investment. The steady reading for consumer sentiment does hint at less-than-catastrophic declines ahead for consumer spending which was generally moderate to solid across the globe going into the virus. Industrial production, however, was generally not that healthy; in fact trade frictions took their toll throughout 2019. And the early showings this year have not shown much improvement, with the sector in the UK starting the year weaker than expected. Overall production dipped 0.1 percent in January to cut annual growth, as tracked in the graph, from minus 1.8 percent to a multi-year low of minus 2.9 percent. The manufacturing component of this report saw yearly growth dropping from minus 2.5 percent to minus 3.6 percent, also a multi-year low; the principal negative here came from machinery and equipment which, importantly, points to weakness in business investment.

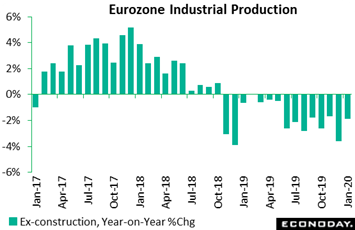

The UK's separation from Europe has been an important source of global trade frictions, raising issues that have not been a positive for industrial production in the Eurozone. Following one of the worst months on record in December, Eurozone goods production (ex-construction) did rebound in January but the year-on-year rate, at minus 1.9 percent, nevertheless extended a long run of contraction. But, turning now to month-to-month comparisons, January definitely did see improvement led by capital goods which rose 2.6 percent in what, in contrast to the UK's production data, is a good indication for business investment. Regionally, Germany (up 2.7 percent on the month) did much of the heavy lifting with both France (1.2 percent) and Italy (3.7 percent) also recording solid advances while growth in Spain (0.1 percent) was at least positive. Yet the volatility of the December/January data does hint at seasonal adjustment problems which are common for the winter months when volumes are lower. Taking December and January together gives a better guide to the underlying trend and this shows 1.0 percent monthly contraction for the region as a whole. The UK's separation from Europe has been an important source of global trade frictions, raising issues that have not been a positive for industrial production in the Eurozone. Following one of the worst months on record in December, Eurozone goods production (ex-construction) did rebound in January but the year-on-year rate, at minus 1.9 percent, nevertheless extended a long run of contraction. But, turning now to month-to-month comparisons, January definitely did see improvement led by capital goods which rose 2.6 percent in what, in contrast to the UK's production data, is a good indication for business investment. Regionally, Germany (up 2.7 percent on the month) did much of the heavy lifting with both France (1.2 percent) and Italy (3.7 percent) also recording solid advances while growth in Spain (0.1 percent) was at least positive. Yet the volatility of the December/January data does hint at seasonal adjustment problems which are common for the winter months when volumes are lower. Taking December and January together gives a better guide to the underlying trend and this shows 1.0 percent monthly contraction for the region as a whole.

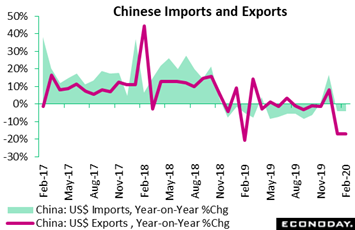

Contraction in the production of goods has been the result of contraction in the export of goods. Nowhere is this more far reaching, and nowhere has the virus contributed more to the existing weakness, than in China. Exports fell 17.2 percent on the year for January and February combined, down sharply from year-on-year growth of 7.9 percent in December. Imports fell a yearly 4.0 percent in the two months after December's brief 16.5 percent increase, one that followed a long run of contraction. As far as the virus is concerned, the latest trade data provide clear evidence of disruptions associated with factory closures, transport restrictions, quarantine measures and other steps taken by Chinese authorities to counter the coronavirus outbreak. Contraction in the production of goods has been the result of contraction in the export of goods. Nowhere is this more far reaching, and nowhere has the virus contributed more to the existing weakness, than in China. Exports fell 17.2 percent on the year for January and February combined, down sharply from year-on-year growth of 7.9 percent in December. Imports fell a yearly 4.0 percent in the two months after December's brief 16.5 percent increase, one that followed a long run of contraction. As far as the virus is concerned, the latest trade data provide clear evidence of disruptions associated with factory closures, transport restrictions, quarantine measures and other steps taken by Chinese authorities to counter the coronavirus outbreak.

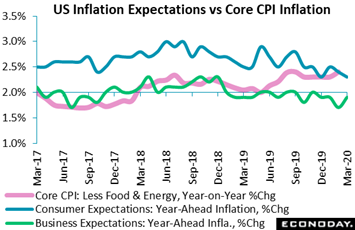

Another area where the virus will impose itself will be in prices. Rates of global inflation were generally subdued going into 2020 and are not likely to improve in the months ahead. Core inflation in the US, as tracked by the red line, was up 2.4 percent on the year in February which was a tenth better than January. And there are indications of pre-buying of groceries based on a 0.5 percent price jump in food at home, the largest increase in 6 years; otherwise readings were mostly flat with energy down 2.0 percent led by a 3.4 percent decline for gasoline. Whatever price traction supermarkets and discount stores may be seeing on essential basics, gasoline stations are certain to face significant pricing trouble given this month's dramatic drop in oil prices. Separate data for March on inflation expectations also remain subdued: consumer data tracked by the blue line (University of Michigan), business by the green line (Atlanta Fed). Keeping inflation up, however, is only a side concern right now for the US Federal Reserve which, in an effort to contain instability in the financial markets, issued an emergency rate cut in the prior week, added significant liquidity to the banking system in the latest week, and may well cut rates sharply again in the coming week. Another area where the virus will impose itself will be in prices. Rates of global inflation were generally subdued going into 2020 and are not likely to improve in the months ahead. Core inflation in the US, as tracked by the red line, was up 2.4 percent on the year in February which was a tenth better than January. And there are indications of pre-buying of groceries based on a 0.5 percent price jump in food at home, the largest increase in 6 years; otherwise readings were mostly flat with energy down 2.0 percent led by a 3.4 percent decline for gasoline. Whatever price traction supermarkets and discount stores may be seeing on essential basics, gasoline stations are certain to face significant pricing trouble given this month's dramatic drop in oil prices. Separate data for March on inflation expectations also remain subdued: consumer data tracked by the blue line (University of Michigan), business by the green line (Atlanta Fed). Keeping inflation up, however, is only a side concern right now for the US Federal Reserve which, in an effort to contain instability in the financial markets, issued an emergency rate cut in the prior week, added significant liquidity to the banking system in the latest week, and may well cut rates sharply again in the coming week.

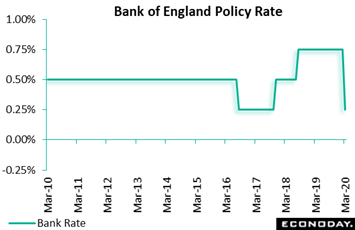

Economic policy is where we'll now turn, first with central banks which are shooting up what little ammo they have left. The Bank of England announced a rare inter-meeting move in the week, cutting its benchmark Bank Rate by 50 basis points to match a record low of 0.25 percent. If there was any dissension it wasn't reflected in the vote which was 9-0. The bank held direct purchases of UK government bonds steady at £435 billion, but to improve the pass-through of the rate cut to borrowers, it added new incentives for banks to lend to small and medium-sized businesses. The BoE's move was part of a coordinated effort with the UK Treasury which issued its own set of aggressive stimulus moves in the week. Only time will tell if this unified approach works. Economic policy is where we'll now turn, first with central banks which are shooting up what little ammo they have left. The Bank of England announced a rare inter-meeting move in the week, cutting its benchmark Bank Rate by 50 basis points to match a record low of 0.25 percent. If there was any dissension it wasn't reflected in the vote which was 9-0. The bank held direct purchases of UK government bonds steady at £435 billion, but to improve the pass-through of the rate cut to borrowers, it added new incentives for banks to lend to small and medium-sized businesses. The BoE's move was part of a coordinated effort with the UK Treasury which issued its own set of aggressive stimulus moves in the week. Only time will tell if this unified approach works.

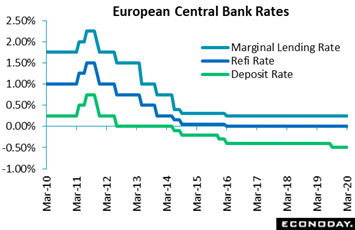

But one economic zone, and quite a significant one, where full policy coordination has yet to take hold is Europe. EU Commission President Ursula von Leyen signaled on Friday that the Eurozone is getting ready to deliver a fiscal response to the virus: €37 billion to be invested in the region’s economy and a further €8 billion in loans to boost the struggling services sector. Yet the European Central Bank, on the preceding day, failed to budge, at least on interest rates. Key rates were left unchanged: the deposit rate stayed at minus 0.5 percent; the refi rate at 0.00 percent and the rate on the marginal lending facility at 0.25 percent. But the bank did open the taps on QE, adding net asset purchases of €120 billion through year-end together with changes to its longer-term refinancing operations (LTROs) aimed at stimulating lending to borrowers. Next up will be a March 16 meeting of Eurozone finance ministers who may well loosen or even abandon sovereign borrowing constraints laid down in the Growth and Stability Pact. But one economic zone, and quite a significant one, where full policy coordination has yet to take hold is Europe. EU Commission President Ursula von Leyen signaled on Friday that the Eurozone is getting ready to deliver a fiscal response to the virus: €37 billion to be invested in the region’s economy and a further €8 billion in loans to boost the struggling services sector. Yet the European Central Bank, on the preceding day, failed to budge, at least on interest rates. Key rates were left unchanged: the deposit rate stayed at minus 0.5 percent; the refi rate at 0.00 percent and the rate on the marginal lending facility at 0.25 percent. But the bank did open the taps on QE, adding net asset purchases of €120 billion through year-end together with changes to its longer-term refinancing operations (LTROs) aimed at stimulating lending to borrowers. Next up will be a March 16 meeting of Eurozone finance ministers who may well loosen or even abandon sovereign borrowing constraints laid down in the Growth and Stability Pact.

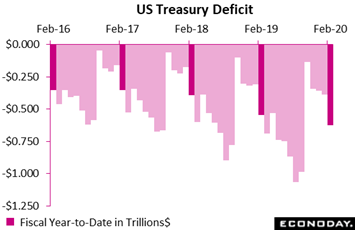

But the Eurozone, in contrast to others, goes into the crisis as comparatively conservative when it comes to spending. Less so with the US where politicians are still trying to reach agreement on a fiscal package to fight the virus. The US government's deficit has been deepening noticeably the last three years, to $624.5 billion through the first five months of the government's fiscal year. This is 14.8 percent deeper than the same time in the prior fiscal year. The deepening has been led by an 18.7 percent increase in Medicare outlays, a 7.3 percent increase for defense, and a 5.2 percent rise in net interest to fund the government's debt. But receipts have also been on the rise: individual income taxes up 7.1 percent, corporate taxes up 24.8 percent, and custom duties up 16.1 percent. The gain in income is a positive but whether it will continue during the virus has yet to play out. But the Eurozone, in contrast to others, goes into the crisis as comparatively conservative when it comes to spending. Less so with the US where politicians are still trying to reach agreement on a fiscal package to fight the virus. The US government's deficit has been deepening noticeably the last three years, to $624.5 billion through the first five months of the government's fiscal year. This is 14.8 percent deeper than the same time in the prior fiscal year. The deepening has been led by an 18.7 percent increase in Medicare outlays, a 7.3 percent increase for defense, and a 5.2 percent rise in net interest to fund the government's debt. But receipts have also been on the rise: individual income taxes up 7.1 percent, corporate taxes up 24.8 percent, and custom duties up 16.1 percent. The gain in income is a positive but whether it will continue during the virus has yet to play out.

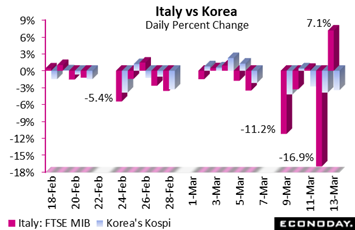

Up sharply one day and down sharply the next day is the hallmark of panicked markets. What the markets need is a run of smaller movements, one that would point to the formation of a bottom the response to which would hopefully be an extended round of consistent and steady buying. Certainly, efforts by central banks together with increasing efforts by sovereign governments will go into future textbooks as historical policy moves. Yet the week itself was, unfortunately, also one for the text books: Spain's Ibex down 20.8 percent, Germany's DAX down 20.0 percent, and Japan's Nikkei down 16.0 percent. Two countries hit especially hard by the virus – South Korea and Italy – also posted steep declines: the Kospi at 13.2 percent and Italy's FTSE MIB down 23.3 percent. But Italy's index did trim the losses on Friday, rallying a very sizable 7.1 percent which, however, followed very steep daily losses of 11.2 on Monday and 16.9 percent on Thursday. In any case, hope springs eternal and disasters through history are traditionally followed by the green shoots of recovery. Up sharply one day and down sharply the next day is the hallmark of panicked markets. What the markets need is a run of smaller movements, one that would point to the formation of a bottom the response to which would hopefully be an extended round of consistent and steady buying. Certainly, efforts by central banks together with increasing efforts by sovereign governments will go into future textbooks as historical policy moves. Yet the week itself was, unfortunately, also one for the text books: Spain's Ibex down 20.8 percent, Germany's DAX down 20.0 percent, and Japan's Nikkei down 16.0 percent. Two countries hit especially hard by the virus – South Korea and Italy – also posted steep declines: the Kospi at 13.2 percent and Italy's FTSE MIB down 23.3 percent. But Italy's index did trim the losses on Friday, rallying a very sizable 7.1 percent which, however, followed very steep daily losses of 11.2 on Monday and 16.9 percent on Thursday. In any case, hope springs eternal and disasters through history are traditionally followed by the green shoots of recovery.

Policy instituted to end the financial crisis 12 years ago is, at least for central banks, limiting present resources to fight off the coronavirus. Policy rates are near or already below zero; quantitative easing has already been massive with central-bank balance sheets significantly higher than they were at this time in the last cycle. Can central banks across the world print money to buy their government bonds all at once? And can all governments cut taxes all at once? If so, then lifting yourself up by your bootstraps may not be that farfetched.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

A week dominated by central bank announcements opens Monday with key data out of China, led by industrial production which will cover the virus-torn months of January and February. The virus' widening outbreak is expected to pull down German business sentiment very sharply as measured by ZEW's latest survey on Tuesday, though not US retail sales for the month of February when the virus was yet to be a critical issue in America. February's retail sales report will, nevertheless, offer a baseline to measure the forthcoming effects of the virus, as will Canadian manufacturing sales for January and US industrial production for February, both to be released on Wednesday. Whether the virus may slow the new home market is a special question for the US where housing starts on Wednesday will update what has arguably been the strongest sector of any kind in the global economy. Japanese consumer prices, where improvement has been minimal, will be posted on Thursday and will precede the Bank of Japan's policy announcement on Wednesday, one that will follow an emergency bond buying plan announced earlier in the month. The Federal Reserve, which cut rates by 50 basis points at its own emergency meeting on March 3, is expected to extend its efforts with another 50 point cut on Wednesday. The Swiss National Bank follows on Thursday for a bank that is not only struggling with virus effects but the burden of a sharply appreciating currency that looks to limit the nation's exports.

Chinese Industrial Production for January and February (Mon 02:00 GMT; Mon 10:00 CST; Sun 22:00 EDT)

Consensus Forecast: 1.5%

Industrial production in China rose a much stronger-than-expected 6.9 percent in the pre-virus month of December. Expectations for the combined months of January and February is sharply lower, at 1.5 percent growth.

Germany: ZEW Survey for March (Tue 10:00 GMT; Tue 11:00 CET; Tue 06:00 EDT)

Consensus Forecast, Business Expectations: -22.5

Consensus Forecast, Current Conditions: -25.0

Both business expectations and current conditions weakened more than expected in February and further deterioration is expected for March. German business expectations are seen at minus 22.5 versus February's plus 8.7 with current conditions expected at minus 25.0 versus minus 15.7.

US Retail Sales for February (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month-to-Month: 0.1%

Consensus Forecast, Ex-Autos: 0.2%

Consensus Forecast, Ex-Autos & Gas: 0.3%

Consensus Forecast, Control Group: 0.3%

Retail sales in the US have been no better than moderate with similar results expected for February where the headline consensus is a monthly gain of only 0.1 percent versus a 0.3 percent gain in January. Unit vehicle sales edged lower in February which may give a small relative boost to ex-auto sales which are expected to rise 0.2 percent. Core readings are expected to show better growth. Ex-autos & ex-gasoline sales are expected at plus 0.3 percent with the control group, which was unusually flat in January, also at plus 0.3 percent.

Canadian Manufacturing Sales for January (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month-to-Month: -0.8%

Manufacturing sales in Canada have been flat to negative the past half year and no rebound is expected for January where the consensus is a monthly decrease of 0.8 percent versus December's 0.7 percent decline, which was the fourth monthly drop in a row.

US Industrial Production for February (Tue 13:15 GMT; Tue 09:15 EDT)

Consensus Forecast, Month-to-Month: 0.4%

US Manufacturing Production

Consensus Forecast, Month-to-Month: 0.1%

US Capacity Utilization Rate

Consensus Forecast: 77.0%

Shutdown of Boeing 737 production together with a second straight weather-related drop in utilities' output pulled down industrial production by 0.3 percent in January with manufacturing slipping by 0.1 percent. A rebound at the headline level is the expectation for February, at plus 0.4 percent, though the gain for manufacturing is expected to be no better than 0.1 percent. Capacity utilization is expected to increase 0.2 percentage points to 77.0 percent.

Bank of Japan Announcement (Any time Wednesday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

After announcing an additional ¥500 million in government bond buying at the beginning of the month to contain turbulence in the financial markets, the Bank of Japan is expected to keep its policy rate steady at minus 0.1 percent at its regularly scheduled meeting on Wednesday.

US Housing Starts for February (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Annual Rate: 1.524 million

US Building Permits

Consensus Forecast: 1.485 million

Residential construction has been booming to expansion highs and easily exceeded expectations in January: at a 1.567 million annual pace for starts and 1.551 million for permits. Given the surge, forecasters are once again calling for give back, to a 1.524 million pace for starts and 1.485 million for permits.

US Federal Reserve Policy Announcement (Wed 18:00 GMT; Wed 14:00 EDT)

Consensus Forecast, Change: -50 basis points

Consensus Forecast, Policy Range: 0.50% to 0.75%

A 50 basis point rate, on top of an emergency 50 point cut earlier in the month, is the forecast for the Federal Reserve which is in emergency mode to stem the economic and especially the financial effects of the coronavirus. Another 50 point move would take the federal funds mid-point target that much closer to zero, to 0.625 percent.

Japanese Consumer Price Index for February (Wed 23:30 GMT; Thu 08:30 JST; Wed 19:30 EDT)

Consensus Forecast Ex-Food, Year-on-Year: 0.6%

Easing pressure is the expectation for Japanese consumer prices in February, at a consensus year-on-year increase of 0.6 percent versus 0.8 percent in January.

Swiss National Bank Monetary Policy Assessment (Thu 8:30 GMT; Thu 09:30 CET; Thu 04:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.75%

Despite the wave of central bank rate cuts underway and despite the recent jump in the value of the Swiss franc, the Swiss National Bank is expected to keep its key deposit rate unchanged at minus 0.75 percent.

|