|

Monetary policy is well in place but fiscal policy is still falling into place. Also playing out is the acceleration of the virus and the resulting acceleration in economic damage. The week marked the initial hit to economic data in North America and Europe, and however severe the results, the prospect of an accelerated recovery, boosted by public policy, points certainly to better days ahead.

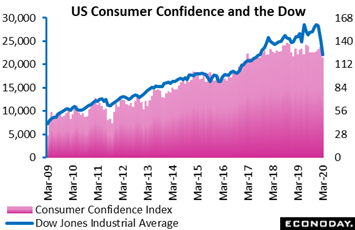

The economic question in everyone's mind is how deep will the crater be. A gauge to judge this will be confidence surveys; these are updated frequently and cover both the consumer and business sectors. An early indication on the actual damage to morale comes from the US consumer confidence report which fell sharply in March but not as sharply as expected, down 12.6 points to 120.0 which was at the very top of Econoday's consensus range. Cut-off date for the survey was March 19 when virus-related layoffs were already underway (it was the March 21 week that saw the first big jump, to 3.3 million, in US jobless claims). Nevertheless, respondents in the sample remained upbeat about the labor market with those describing jobs as hard to get at only 13.9 percent, which was unchanged from February. Those who described jobs as plentiful fell only modestly, down only 1.6 percentage points to a still favorable 44.9 percent. And though income prospects did ease, optimists still led pessimists (20.7 percent to 8.8 percent) by more than 2 to 1. These results contrast sharply with the Labor Department's employment report which showed deep contraction in March. Yet March's confidence results shouldn't be dismissed. The report, produced by the Conference Board, is based on a very sizable sample, targeted at 3,000 completed questionnaires each month. Maybe the contrast between the two reports suggests that losses in jobs are not having a proportional impact on confidence. The economic question in everyone's mind is how deep will the crater be. A gauge to judge this will be confidence surveys; these are updated frequently and cover both the consumer and business sectors. An early indication on the actual damage to morale comes from the US consumer confidence report which fell sharply in March but not as sharply as expected, down 12.6 points to 120.0 which was at the very top of Econoday's consensus range. Cut-off date for the survey was March 19 when virus-related layoffs were already underway (it was the March 21 week that saw the first big jump, to 3.3 million, in US jobless claims). Nevertheless, respondents in the sample remained upbeat about the labor market with those describing jobs as hard to get at only 13.9 percent, which was unchanged from February. Those who described jobs as plentiful fell only modestly, down only 1.6 percentage points to a still favorable 44.9 percent. And though income prospects did ease, optimists still led pessimists (20.7 percent to 8.8 percent) by more than 2 to 1. These results contrast sharply with the Labor Department's employment report which showed deep contraction in March. Yet March's confidence results shouldn't be dismissed. The report, produced by the Conference Board, is based on a very sizable sample, targeted at 3,000 completed questionnaires each month. Maybe the contrast between the two reports suggests that losses in jobs are not having a proportional impact on confidence.

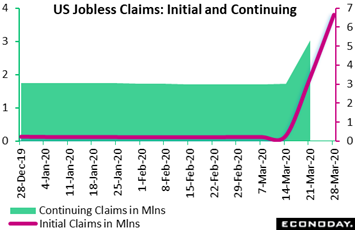

The US is the first major economy to post significant virus-related job losses. Labor market destruction from the virus roughly doubled in the March 28 week, as initial claims (red line in graph) totaled 6.6 million following 3.3 million in the March 21 week. Services are the hardest hit area, specifically accommodation and food services. Continuing claims (green line) are now also climbing, up 1.245 million in lagging data for the March 21 week to 3.0 million. The monthly employment report for March, a separate report sampled in the March 14 week, tracked the early part of the month and captured only part of the layoffs evident in the initial claims data. Losses of payroll jobs came to only 710,000 in the monthly report, a nonfarm total that excludes the self-employed and that appears certain to already be well into the millions. The US is the first major economy to post significant virus-related job losses. Labor market destruction from the virus roughly doubled in the March 28 week, as initial claims (red line in graph) totaled 6.6 million following 3.3 million in the March 21 week. Services are the hardest hit area, specifically accommodation and food services. Continuing claims (green line) are now also climbing, up 1.245 million in lagging data for the March 21 week to 3.0 million. The monthly employment report for March, a separate report sampled in the March 14 week, tracked the early part of the month and captured only part of the layoffs evident in the initial claims data. Losses of payroll jobs came to only 710,000 in the monthly report, a nonfarm total that excludes the self-employed and that appears certain to already be well into the millions.

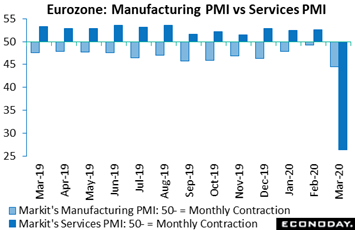

Another set of data that's offering a handle on the unfolding events are purchasing managers surveys. First we'll look at one that has just fallen, from the Eurozone. The flash indexes released in the prior week were marked lower in the final readings, ending down a sizable 26.2 points from February for services (dark column) and down 5.7 points for manufacturing to 44.5 (light column). New business for both sectors fell at a steep pace as did backlog orders. Business expectations for the year ahead deteriorated significantly. Input costs were down, in large part reflecting the drop in oil prices, while selling prices fell by the greatest extent since the last economic crisis, in November 2009. Headcount from the services sample was trimmed for the first time in more than five years and by the most on record. Regionally, the best performer on a composite basis was Ireland (37.3), ahead of Germany (35.0), France (28.9), Spain (26.7) and Italy (20.2). Of note, the Italian service sector PMI was only 17.4, extremely low for a diffusion index. For all intents and purposes, recession in the Eurozone has already arrived. Another set of data that's offering a handle on the unfolding events are purchasing managers surveys. First we'll look at one that has just fallen, from the Eurozone. The flash indexes released in the prior week were marked lower in the final readings, ending down a sizable 26.2 points from February for services (dark column) and down 5.7 points for manufacturing to 44.5 (light column). New business for both sectors fell at a steep pace as did backlog orders. Business expectations for the year ahead deteriorated significantly. Input costs were down, in large part reflecting the drop in oil prices, while selling prices fell by the greatest extent since the last economic crisis, in November 2009. Headcount from the services sample was trimmed for the first time in more than five years and by the most on record. Regionally, the best performer on a composite basis was Ireland (37.3), ahead of Germany (35.0), France (28.9), Spain (26.7) and Italy (20.2). Of note, the Italian service sector PMI was only 17.4, extremely low for a diffusion index. For all intents and purposes, recession in the Eurozone has already arrived.

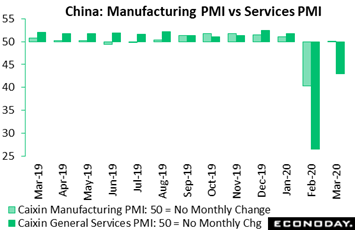

But what goes down will eventually have to come up, at least to the water line when referring to 50-based diffusion readings. PMIs out of China dived in February, a month before those from the US and Europe followed. But though they've popped back up in China, they're still not indicating growth, only stability at no better than February's depressed levels (a sobering reality to keep in mind when assessing the results). The Caixan China general services index improved an impressive looking 16.5 points in March, but the 43.0 result was still far below breakeven 50 line, a line that indicates no monthly change and which it is still trying to reach. As it is, significantly more of the sample reported composite contraction in March than expansion even though relative to February, when many many more reported contraction, the results aren't that bad. Caixan's reading for China's manufacturing sector – like other diffusion reports from other countries – has been better than services, clawing back 10 points of February's decline to 50.1 in March. This is better than breakeven 50 but only by one increment. The composite, which combines services and manufacturing, jumped nearly 20 points but at 46.7 was still on the wrong side of 50 and signaling contraction. Nevertheless, March's results out of China are very welcome, in that they indicate the worst may have been deep but, thankfully, isn't getting much deeper. But what goes down will eventually have to come up, at least to the water line when referring to 50-based diffusion readings. PMIs out of China dived in February, a month before those from the US and Europe followed. But though they've popped back up in China, they're still not indicating growth, only stability at no better than February's depressed levels (a sobering reality to keep in mind when assessing the results). The Caixan China general services index improved an impressive looking 16.5 points in March, but the 43.0 result was still far below breakeven 50 line, a line that indicates no monthly change and which it is still trying to reach. As it is, significantly more of the sample reported composite contraction in March than expansion even though relative to February, when many many more reported contraction, the results aren't that bad. Caixan's reading for China's manufacturing sector – like other diffusion reports from other countries – has been better than services, clawing back 10 points of February's decline to 50.1 in March. This is better than breakeven 50 but only by one increment. The composite, which combines services and manufacturing, jumped nearly 20 points but at 46.7 was still on the wrong side of 50 and signaling contraction. Nevertheless, March's results out of China are very welcome, in that they indicate the worst may have been deep but, thankfully, isn't getting much deeper.

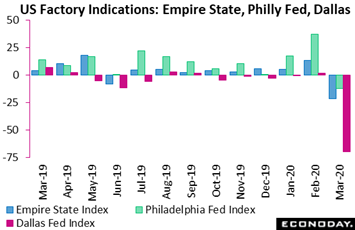

PMIs are expressed with a 50 base line while other diffusion reports, using the exact same methodology, express their results with a zero baseline. Regional manufacturing reports from the Federal Reserve system are prominent examples of these reports and have been showing mixed results. Two that tracked the first half of March, Empire State (blue columns) and Philadelphia Fed (green columns), fell sharply but nothing really for the history books. Dallas's index (red columns) is in fact one for the records, however. This report included the latter part of the month in its sampling and also the dramatic plunge in oil prices, a special factor for the Texas-area economy. The general activity index fell a staggering 71.2 points to minus 70.0 to indicate that very few of the month's 110 respondents reported better conditions and a very great many reported worse conditions. The bright side is that March will prove to be one of the easiest comparisons of all time; the sooner conditions stabilize, the sooner this index will move back to the zero line. PMIs are expressed with a 50 base line while other diffusion reports, using the exact same methodology, express their results with a zero baseline. Regional manufacturing reports from the Federal Reserve system are prominent examples of these reports and have been showing mixed results. Two that tracked the first half of March, Empire State (blue columns) and Philadelphia Fed (green columns), fell sharply but nothing really for the history books. Dallas's index (red columns) is in fact one for the records, however. This report included the latter part of the month in its sampling and also the dramatic plunge in oil prices, a special factor for the Texas-area economy. The general activity index fell a staggering 71.2 points to minus 70.0 to indicate that very few of the month's 110 respondents reported better conditions and a very great many reported worse conditions. The bright side is that March will prove to be one of the easiest comparisons of all time; the sooner conditions stabilize, the sooner this index will move back to the zero line.

How prices behave will be an essential test of how rapid economic conditions stabilize. Price dislocations for oil have already appeared but are related in part to OPEC politics. Food prices, beginning back in February, began to show isolated pressure across the global CPI reports and have continued to do so for March data, but still only to a limited degree. Consumer prices in Italy provisionally edged up 0.1 percent on the month in March for a year-on-year rate, as tracked in the graph, also at 0.1 percent. This is just about as flat as inflation can be. The drop in annual inflation was mainly driven by non-regulated energy products and also services. Partial offsets came from increases for processed food (1.2 percent after 0.4 percent) and tobacco (2.5 percent after minus 1.5 percent). Yet it's important to remember that compilation of the report, which is issued by Istituto Nazaionale di Statistica, was hindered by the Covid-19 crisis and the data may not be as reliable as usual. How prices behave will be an essential test of how rapid economic conditions stabilize. Price dislocations for oil have already appeared but are related in part to OPEC politics. Food prices, beginning back in February, began to show isolated pressure across the global CPI reports and have continued to do so for March data, but still only to a limited degree. Consumer prices in Italy provisionally edged up 0.1 percent on the month in March for a year-on-year rate, as tracked in the graph, also at 0.1 percent. This is just about as flat as inflation can be. The drop in annual inflation was mainly driven by non-regulated energy products and also services. Partial offsets came from increases for processed food (1.2 percent after 0.4 percent) and tobacco (2.5 percent after minus 1.5 percent). Yet it's important to remember that compilation of the report, which is issued by Istituto Nazaionale di Statistica, was hindered by the Covid-19 crisis and the data may not be as reliable as usual.

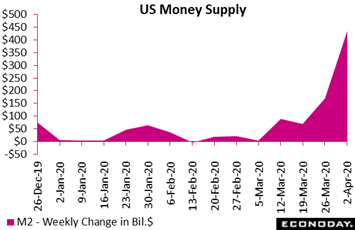

Money measures are often volatile and difficult to read at any time let alone these. But they are certainly going to get a resurgence of attention in the wake of massive stimulus efforts that are underway across the globe. In the US, money supply is already soaring. M2, an inclusive measure that includes savings deposits and retail money funds, rose $436.1 billion after jumping $170.1 billion in the prior week. How high this reading will go is only one question, how fast is another. Money measures are often volatile and difficult to read at any time let alone these. But they are certainly going to get a resurgence of attention in the wake of massive stimulus efforts that are underway across the globe. In the US, money supply is already soaring. M2, an inclusive measure that includes savings deposits and retail money funds, rose $436.1 billion after jumping $170.1 billion in the prior week. How high this reading will go is only one question, how fast is another.

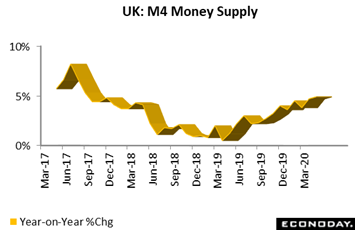

In the UK, M4 broad money was on the climb going into the crisis, at 4.9 percent annual growth in data for February and a multi-year high. The key lending counterpart also had a good month, 5.2 percent above its level in February 2019 and a 6-month peak. Net secured lending held firm at £4.00 billion, though overall consumer credit eased from £1.11 billion to £0.88 billion. Details on housing were positive. The Bank of England last month cut rates to a record low of 0.1 percent and lifted its ceiling on quantitative easing, while the UK government announced support for both businesses and for workers who are no longer getting paid. In the UK, M4 broad money was on the climb going into the crisis, at 4.9 percent annual growth in data for February and a multi-year high. The key lending counterpart also had a good month, 5.2 percent above its level in February 2019 and a 6-month peak. Net secured lending held firm at £4.00 billion, though overall consumer credit eased from £1.11 billion to £0.88 billion. Details on housing were positive. The Bank of England last month cut rates to a record low of 0.1 percent and lifted its ceiling on quantitative easing, while the UK government announced support for both businesses and for workers who are no longer getting paid.

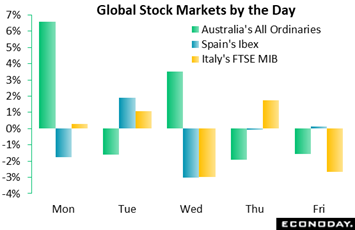

The All Ordinaries rose nearly 5 percent in the week after opening Monday with a 6.6 percent surge on news of a major new wage subsidy package from the Australian government worth around A$80 billion. The wage subsidy will be available for up to six months for around 6 million workers and be worth around 70 percent of the national median wage. The cumulative total virus assistance from the government and the Reserve Bank of Australia now totals A$190 billion, or just over 16 percent of Australia's GDP. In contrast, both the Ibex and the FTSE MIB, from hard-hit Spain and Italy, posted declines in the week, but not dramatic ones, both under 3 percent. Both countries have been pushing for greater financial support from their European partners which they have yet to receive in a controversy that could build, given the current tempo of events, into an existential crisis for the union if policy makers aren't careful. EU finance ministers will be meeting on Tuesday of the coming week. The All Ordinaries rose nearly 5 percent in the week after opening Monday with a 6.6 percent surge on news of a major new wage subsidy package from the Australian government worth around A$80 billion. The wage subsidy will be available for up to six months for around 6 million workers and be worth around 70 percent of the national median wage. The cumulative total virus assistance from the government and the Reserve Bank of Australia now totals A$190 billion, or just over 16 percent of Australia's GDP. In contrast, both the Ibex and the FTSE MIB, from hard-hit Spain and Italy, posted declines in the week, but not dramatic ones, both under 3 percent. Both countries have been pushing for greater financial support from their European partners which they have yet to receive in a controversy that could build, given the current tempo of events, into an existential crisis for the union if policy makers aren't careful. EU finance ministers will be meeting on Tuesday of the coming week.

However deep the global recession proves to be, it could also prove to be short. Though some of the data such as US consumer confidence appear reassuring, other data coming out are really quite frightening, and this following a year of trade friction and struggling growth. Hopefully what's in store will look like China's PMI data: a deep break lower followed by stability and a predictable view for recovery.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Data that will pick up March's virus effects will be packed at the end of the week. German manufacturers' orders for February open the week on Monday and weakness going into the crisis is expected. Japanese household spending has also been consistently weak, and further contraction in February is the call. On Tuesday the Reserve Bank of Australia will make a scheduled announcement, one that isn't expected to lead to any further rate cuts. Japanese machine orders will be posted on Wednesday and February weakness is expected. Thursday will see the latest jobless claims report from the US amid expectations for yet another giant jump. Canada's labour market report for March will follow on Thursday while Friday's key data will be consumer and producer prices from China and the latest indications on economic conditions in the country. Note that due to virus disruptions, the UK National Statistics Office is bringing forward release time for market-sensitive releases, to 7:00 a.m. local time from 9:30 a.m. This effects monthly GDP and industrial production, both for Thursday.

German Manufacturers' Orders for February (Mon 06:00 GMT; Mon 08:00 CEST; Mon 02:00 EDT)

Consensus Forecast, Month-to-Month: -1.9%

In data for February and before the emergence of virus effects, a monthly 1.9 percent fall for German manufacturers' orders is expected versus January's 5.5 percent jump. On a year-on-year basis, orders have been in contraction since August last year.

Japanese Household Spending for February (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast, Year-over-Year: -3.9%

Household spending for February is expected to fall a year-on-year 3.9 percent to match January's rate of contraction.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEDT; Tue 00:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Reserve Bank of Australia cut rates by 50 basis points in March making two 25 basis points cuts: one in a scheduled meeting and one in an emergency meeting that also produced QE and special banking facilities. For April's meeting, no further change in rates is expected.

German Industrial Production for February (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast, Month-to-Month: -0.9%

A 0.9 percent monthly decrease is expected in February following January's unexpected 3.0 percent rise. Year-on-year, German industrial production was down 1.7 percent in January.

Japanese Machine Orders for February (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Month-to-Month: -2.7%

At a month-to-month minus 2.7 percent for the pre-virus month of February, forecasters see don't see Japanese machine orders adding onto January's 2.9 percent rise.

UK GDP for February (Thu 06:00 GMT; Thu 07:00 BST; Thu 02:00 EDT)

Consensus Forecast, Month-to-Month: 0.1%

GDP was already dead flat going into coronavirus effects. Expectations for February GDP is 0.1 percent growth.

Italian Industrial Production for February (Thu 08:00 GMT; Thu 10:00 CEST; Thu 04:00 EDT)

Consensus Forecast, Month-to-Month: -1.5%

Before the nationwide lockdown to fight the coronavirus, industrial production in Italy is expected to fall a monthly 1.5 percent in February versus what was once an auspicious 3.7 percent jump in January.

US Initial Jobless Claims for April 4 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 5.0 million

Consensus Range: 3.0 million to 7.95 million

After spiking to records of 6.648 million and 3.307 million in the two prior weeks, initial jobless claims for the April 4 week are expected to come in at 5.0 million. The rush in claims, which before the virus held tightly near 200,000 per week, has been centered in services, specifically accommodation and restaurants.

Canadian Labour Force Survey for March (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: Employment Change: -300,000

Consensus Forecast: Unemployment Rate: 6.6%

Employment is expected to fall 300,000 in March with the unemployment rate expected to come in at 6.6 percent versus February's 5.6 percent.

Chinese CPI for March (Fri 01:30 GMT; Fri 09:30 CST; Thu 21:30 EDT)

Consensus Forecast, Year-over-Year: 4.9%

Consumer prices in China have been rising at the fastest pace in 9 years though they did ease slightly in February, down 2 tenths to a year-on-year 5.2 percent that reflected a drop in transportation costs tied to virus-related travel restrictions. For March, forecasters see year-on-year inflation easing to 4.9 percent.

Chinese PPI for March (Fri 01:30 GMT; Fri 09:30 CST; Thu 21:30 EDT)

Consensus Forecast, Year-over-Year: -1.1%

In contrast to consumer prices in China which have been on a sharp climb, producer prices have been sinking. Year-on-year producer prices fell 0.4 percent in February with forecasters calling for minus 1.1 percent in March.

US CPI for March (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -0.3%

US CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.1%

Will consumer prices in the US begin to show immediate effects from the coronavirus? Forecasters don't think so with the consensus, at plus 0.1 percent for the core, little changed from prior months. Prices overall, reflecting cuts in oil, are expected to fall 0.3 percent.

US Treasury Budget for March (Fri 18:00 GMT; Fri 14:00 EDT)

Consensus Forecast: -$150.0 billion

March's federal deficit is expected to come in at $150.0 billion versus a deficit of $146.9 billion in March last year. Five months into the 2020 fiscal year in February and before the coronavirus, the government's deficit was running 14.8 percent deeper than fiscal 2019.

|