|

Virus recounts announced in China and Spain highlight, during a period of crisis and isolation, the difficulty of getting accurate data that medical researchers need. Data accuracy is also an unfolding question for economists and their efforts at measuring the depth of this recession and forecasting its length. Global statistics bureaus, while citing low sample rates, continue to stand by the reliability of their reports and have so far stuck to existing release schedules. Whether economic data remain clean or begin to become clouded will in itself, for historians, be a measure the severity of this crisis.

The reliability of Chinese data, economic or otherwise, is always a question in many readers' minds. Economic data outside of China, for instance, go up and down in a variety of patterns that have sometimes been absent in China where GDP, as seen in the graph, slowed incrementally across an eerie 10-year trendline of consistency. And even during virus dislocation, the latest result proved pretty close to expectations. Economists were forecasting first-quarter GDP contraction of 6.0 percent and 6.8 percent was the official verdict. And the news was bad enough – the steepest fall and the first annual contraction since the mid-1970s. On a quarter-to-quarter basis, a comparison that highlights the suddenness of the drop, GDP fell 9.8 percent. The reliability of Chinese data, economic or otherwise, is always a question in many readers' minds. Economic data outside of China, for instance, go up and down in a variety of patterns that have sometimes been absent in China where GDP, as seen in the graph, slowed incrementally across an eerie 10-year trendline of consistency. And even during virus dislocation, the latest result proved pretty close to expectations. Economists were forecasting first-quarter GDP contraction of 6.0 percent and 6.8 percent was the official verdict. And the news was bad enough – the steepest fall and the first annual contraction since the mid-1970s. On a quarter-to-quarter basis, a comparison that highlights the suddenness of the drop, GDP fell 9.8 percent.

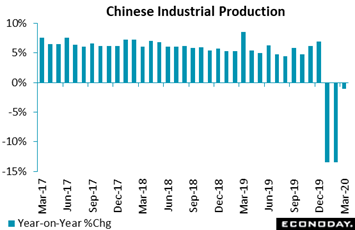

The Chinese story is actually fundamentally positive, that is improvement in the month of March following the virus crisis of February and January. Fixed asset investment, retail sales, and industrial production – released together with quarterly GDP – all confirm this month-to-month profile. Fixed investment and retail sales both posted small monthly gains and slower year-on-year contraction in March while industrial production posted a very large monthly gain and very significant yearly improvement, the latter tracked in the graph. Output of chemicals and communication equipment and at mines rose in March while declines in textiles, electrical machinery, and general equipment eased. Chinese production is key to global manufacturing which, suffering from lack of Chinese-made inputs, began to show related cracks as early as February. And though China's strength in March is promising, a negative for April and future months will be the vast shutdown underway among some of its best customers: manufacturers in Europe and North America. The Chinese story is actually fundamentally positive, that is improvement in the month of March following the virus crisis of February and January. Fixed asset investment, retail sales, and industrial production – released together with quarterly GDP – all confirm this month-to-month profile. Fixed investment and retail sales both posted small monthly gains and slower year-on-year contraction in March while industrial production posted a very large monthly gain and very significant yearly improvement, the latter tracked in the graph. Output of chemicals and communication equipment and at mines rose in March while declines in textiles, electrical machinery, and general equipment eased. Chinese production is key to global manufacturing which, suffering from lack of Chinese-made inputs, began to show related cracks as early as February. And though China's strength in March is promising, a negative for April and future months will be the vast shutdown underway among some of its best customers: manufacturers in Europe and North America.

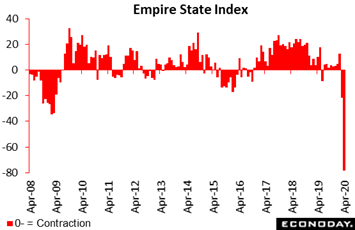

Final data on March's virus crisis outside of China have been mostly limited to employment reports from the US and Canada, where the catastrophe for retail and service labor is still unfolding. Before turning to US retail sales let's stick with production and look at two closely watched regional manufacturing reports where losses are hard to describe. Empire State, a report produced by the New York Federal Reserve, saw its headline diffusion index fall to minus 78.2 in what was the first major indication of US manufacturing activity for the month of April. A reading like this is produced when the great bulk of the sample (85 percent in this case) is reporting month-to-month declines and very very few (7 percent) are reporting month-to-month gains. The prior low for the headline index (where data go back to 2001) was a modest looking minus 34.3 during the Great Recession. Yet, in a reminder that hope springs eternal and infection rates do appear to be slowing, the index for future business conditions rose 6 points to a favorable looking 7.0. Final data on March's virus crisis outside of China have been mostly limited to employment reports from the US and Canada, where the catastrophe for retail and service labor is still unfolding. Before turning to US retail sales let's stick with production and look at two closely watched regional manufacturing reports where losses are hard to describe. Empire State, a report produced by the New York Federal Reserve, saw its headline diffusion index fall to minus 78.2 in what was the first major indication of US manufacturing activity for the month of April. A reading like this is produced when the great bulk of the sample (85 percent in this case) is reporting month-to-month declines and very very few (7 percent) are reporting month-to-month gains. The prior low for the headline index (where data go back to 2001) was a modest looking minus 34.3 during the Great Recession. Yet, in a reminder that hope springs eternal and infection rates do appear to be slowing, the index for future business conditions rose 6 points to a favorable looking 7.0.

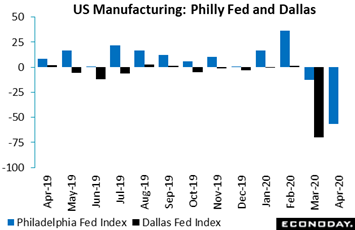

A second US report released later in the week also offered a look at April: the Philadelphia Fed's manufacturing headline slumped to minus 56.6, barely less worse than Empire State and a 40-year low (data for this series go back to 1968). This report was marked by an extraordinary score within the report that tells the story of the shutdown. New orders came in at minus 70.9 with details showing no respondents – that's right zero – reporting a month-to-month increase. New business for Philadelphia's sample has simply come to a standstill. A few in the sample reported monthly increases in shipments but they were outmatched by an overwhelming bulk reporting decreases as this index came in at minus 74.1. Unfilled orders are contracting (minus 13.5), employment is in a nose dive (minus 46.7) as is the workweek (minus 54.5) and inventories (minus 10.2). Prices are falling for both inputs (minus 9.3) and finished goods (minus 10.6). The accompanying graph tracks this index in blue along with the Dallas Fed's manufacturing index in black, the latter last updated for March a couple of weeks back and offering its own early signal of grief, this one keyed on the energy sector. Based on early indications, US manufacturing is more or less lying motionless in a deep trough. A second US report released later in the week also offered a look at April: the Philadelphia Fed's manufacturing headline slumped to minus 56.6, barely less worse than Empire State and a 40-year low (data for this series go back to 1968). This report was marked by an extraordinary score within the report that tells the story of the shutdown. New orders came in at minus 70.9 with details showing no respondents – that's right zero – reporting a month-to-month increase. New business for Philadelphia's sample has simply come to a standstill. A few in the sample reported monthly increases in shipments but they were outmatched by an overwhelming bulk reporting decreases as this index came in at minus 74.1. Unfilled orders are contracting (minus 13.5), employment is in a nose dive (minus 46.7) as is the workweek (minus 54.5) and inventories (minus 10.2). Prices are falling for both inputs (minus 9.3) and finished goods (minus 10.6). The accompanying graph tracks this index in blue along with the Dallas Fed's manufacturing index in black, the latter last updated for March a couple of weeks back and offering its own early signal of grief, this one keyed on the energy sector. Based on early indications, US manufacturing is more or less lying motionless in a deep trough.

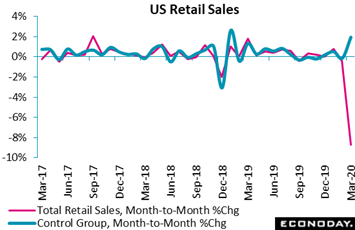

The dives seen at the far right of the week's graphs so far extend to US consumer spending. Yet the 8.7 percent month drop in March, though a record in data going back 1992, was well within Econoday's consensus range while an important non-discretionary reading actually rose sharply. But first the bad news. Vehicle sales in March plunged 25.6 percent compared to February, gasoline sales plunged 17.2 percent, and food services (restaurants) fell 26.5 percent. Among smaller components: electronics & appliances, sporting goods, miscellaneous stores and especially clothing stores (down 50.5 percent) all fell in the double digits. Now the good news which is led by food & beverage stores (groceries) where, inflated by consumer stockpiling, sales surged 25.6 percent. Sales at health & personal stores rose 4.3 percent while general merchandise stores (despite a 19.7 percent plunge for the department store subcomponent) gained a very strong 6.4 percent. These are all large components as is nonstore retailers (e-commerce) where sales rose a monthly 3.1 percent. Another component that rose was building materials, excluding which, while also excluding vehicles, gas, and restaurants, retail sales rose 1.9 percent in the month. This latter reading is called the control group and is a direct input into GDP's consumer spending component. But strength in essentials may prove a brief and limited plus that may well ebb as stockpiling eases; in any case, the near-term outlook for auto dealers, gas stations, and restaurants is dark. The dives seen at the far right of the week's graphs so far extend to US consumer spending. Yet the 8.7 percent month drop in March, though a record in data going back 1992, was well within Econoday's consensus range while an important non-discretionary reading actually rose sharply. But first the bad news. Vehicle sales in March plunged 25.6 percent compared to February, gasoline sales plunged 17.2 percent, and food services (restaurants) fell 26.5 percent. Among smaller components: electronics & appliances, sporting goods, miscellaneous stores and especially clothing stores (down 50.5 percent) all fell in the double digits. Now the good news which is led by food & beverage stores (groceries) where, inflated by consumer stockpiling, sales surged 25.6 percent. Sales at health & personal stores rose 4.3 percent while general merchandise stores (despite a 19.7 percent plunge for the department store subcomponent) gained a very strong 6.4 percent. These are all large components as is nonstore retailers (e-commerce) where sales rose a monthly 3.1 percent. Another component that rose was building materials, excluding which, while also excluding vehicles, gas, and restaurants, retail sales rose 1.9 percent in the month. This latter reading is called the control group and is a direct input into GDP's consumer spending component. But strength in essentials may prove a brief and limited plus that may well ebb as stockpiling eases; in any case, the near-term outlook for auto dealers, gas stations, and restaurants is dark.

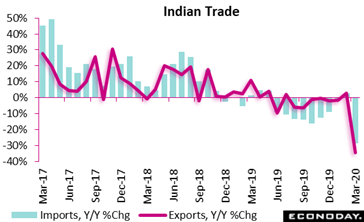

Data on the virus effects on North American and European trade have yet to be reported though Chinese data, where of course the virus first hit, have been in sharp contraction, with imports and especially exports falling deeply in January and February though a little less so in March. The worst for India, which began to shutdown several weeks ago, is undoubtedly underway right now and a look at March shows what to expect. Exports and imports both fell into deep annual contraction, to minus 34.6 percent and minus 28.7 percent respectively in declines that reflect not only initial virus effects but also the weak trade environment going into the pandemic. Twenty-nine of the 30 major items in both the export and import baskets posted decreases in March leaving just iron ore exports and transport equipment imports to register positive growth. When taken together as is done when calculating GDP, India's trade deficit actually narrowed slightly, to $9.76 billion in March from $9.85 billion in February. Data on the virus effects on North American and European trade have yet to be reported though Chinese data, where of course the virus first hit, have been in sharp contraction, with imports and especially exports falling deeply in January and February though a little less so in March. The worst for India, which began to shutdown several weeks ago, is undoubtedly underway right now and a look at March shows what to expect. Exports and imports both fell into deep annual contraction, to minus 34.6 percent and minus 28.7 percent respectively in declines that reflect not only initial virus effects but also the weak trade environment going into the pandemic. Twenty-nine of the 30 major items in both the export and import baskets posted decreases in March leaving just iron ore exports and transport equipment imports to register positive growth. When taken together as is done when calculating GDP, India's trade deficit actually narrowed slightly, to $9.76 billion in March from $9.85 billion in February.

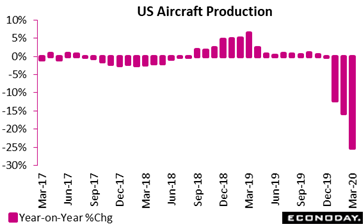

If cross-border trade was a pre-virus weakness for the global economy, then suspension of Boeing 737 production was a special weakness for US manufacturing. US aircraft production opened the year in staggering contraction: down a yearly 12.2 percent in January by volume, that deepened to 15.7 percent in February and then fell to 25.3 percent in March. These are details from the US industrial production report where the headline fell a monthly 5.4 percent with this yearly rate nearly the same, at minus 5.5 percent. Late in the week good news came from Boeing which said it plans to restart commercial aircraft production in its home state of Washington, yet how solvent airlines remain and how much they want to keep buying aircraft are serious questions for the US factory sector. Turning back to the question of data quality, industrial production is one of the week's reports where the data issuer, here the Federal Reserve, offered assurance that the numbers were reliable, despite modified procedures including "stay-at-home" sampling. A key report in the coming week will be durable goods which is compiled by the US Commerce Department, a report that will track March dollar totals for orders, shipments, inventories, as well as unfilled orders, the latter category the key place to watch for Boeing cancellations. If cross-border trade was a pre-virus weakness for the global economy, then suspension of Boeing 737 production was a special weakness for US manufacturing. US aircraft production opened the year in staggering contraction: down a yearly 12.2 percent in January by volume, that deepened to 15.7 percent in February and then fell to 25.3 percent in March. These are details from the US industrial production report where the headline fell a monthly 5.4 percent with this yearly rate nearly the same, at minus 5.5 percent. Late in the week good news came from Boeing which said it plans to restart commercial aircraft production in its home state of Washington, yet how solvent airlines remain and how much they want to keep buying aircraft are serious questions for the US factory sector. Turning back to the question of data quality, industrial production is one of the week's reports where the data issuer, here the Federal Reserve, offered assurance that the numbers were reliable, despite modified procedures including "stay-at-home" sampling. A key report in the coming week will be durable goods which is compiled by the US Commerce Department, a report that will track March dollar totals for orders, shipments, inventories, as well as unfilled orders, the latter category the key place to watch for Boeing cancellations.

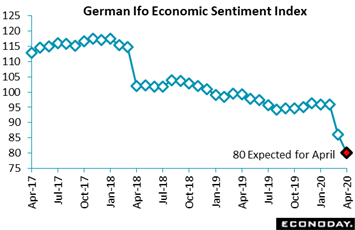

European data mostly lag in their timeliness compared to North American data, especially compared to the US but also Canada which pre-announced in the week quarterly contraction of 2.6 percent in first-quarter GDP, the result of 9.0 percent monthly contraction in March. Again, this is the non-China monthly profile: steady growth in January and February followed by complete collapse in March. This has also been the profile for European confidence where Ifo's economic sentiment index will cap off a heavy week of April surveys. The question for the economic outlook isn't whether April will be a cavernous hole for European and North American activity (it of course will be), but whether any glimpse of improvement should be expected for May or June. This may turn on levels of confidence in April which in turn will depend on virus shutdowns and whether they are about to ease. Germany's Ifo index in March posted its sharpest drop in 30 years, down nearly 10 points to 86.1, but for April forecasters see a less severe 6 point decline to 80. But Germany, together with a handful of other European nations, have announced limited reopenings that will include industry as well as retail shops. Watch to see whether less pessimistic expectations slow the slide in confidence, at least in Germany. European data mostly lag in their timeliness compared to North American data, especially compared to the US but also Canada which pre-announced in the week quarterly contraction of 2.6 percent in first-quarter GDP, the result of 9.0 percent monthly contraction in March. Again, this is the non-China monthly profile: steady growth in January and February followed by complete collapse in March. This has also been the profile for European confidence where Ifo's economic sentiment index will cap off a heavy week of April surveys. The question for the economic outlook isn't whether April will be a cavernous hole for European and North American activity (it of course will be), but whether any glimpse of improvement should be expected for May or June. This may turn on levels of confidence in April which in turn will depend on virus shutdowns and whether they are about to ease. Germany's Ifo index in March posted its sharpest drop in 30 years, down nearly 10 points to 86.1, but for April forecasters see a less severe 6 point decline to 80. But Germany, together with a handful of other European nations, have announced limited reopenings that will include industry as well as retail shops. Watch to see whether less pessimistic expectations slow the slide in confidence, at least in Germany.

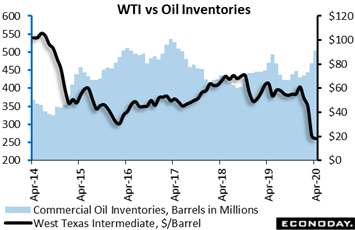

If virus and virus shutdowns weren't bad enough for the global economy, the price collapse in oil that's still unfolding is special bad news for the energy sector. Baker-Hughes' North American rig count has been falling sharply (to 559 in mid-April from 1,040 in mid-January), yet commercial oil inventories in the US continue to rise, up an outsized 19.2 million barrels in the April 10 week to 503.6 million and 10.6 percent higher than a year ago as tracked by the US Energy Information Administration. This is a substantial amount of overhang that has to be absorbed, not to mention during a time of severe restrictions on travel and production. And gasoline inventories are even more bloated, up 15 percent on the year at the same time that demand for gasoline, as measured by the EIA, is down 18.5 percent. This is all sober news not only for gasoline stations and refineries but for oilfield service companies and makers of energy equipment whether pumps or pipes. Refinery production is slowing dramatically, down 6.5 percentage points in the latest week to 69.1 percent, this compared to January rates in the 90s. The price of West Texas Intermediate broke below $20 on Wednesday's inventory data, and this despite repeated headlines all through the week of major cutbacks being agreed to by all the big producers. For the US, energy may well prove to be the hardest hit of any of the nation's sectors in 2020. The Dallas Fed's manufacturing index, which plunged a full month before other regional reports, will updated next at month end, on April 27 in a regional report that will be worth watching. If virus and virus shutdowns weren't bad enough for the global economy, the price collapse in oil that's still unfolding is special bad news for the energy sector. Baker-Hughes' North American rig count has been falling sharply (to 559 in mid-April from 1,040 in mid-January), yet commercial oil inventories in the US continue to rise, up an outsized 19.2 million barrels in the April 10 week to 503.6 million and 10.6 percent higher than a year ago as tracked by the US Energy Information Administration. This is a substantial amount of overhang that has to be absorbed, not to mention during a time of severe restrictions on travel and production. And gasoline inventories are even more bloated, up 15 percent on the year at the same time that demand for gasoline, as measured by the EIA, is down 18.5 percent. This is all sober news not only for gasoline stations and refineries but for oilfield service companies and makers of energy equipment whether pumps or pipes. Refinery production is slowing dramatically, down 6.5 percentage points in the latest week to 69.1 percent, this compared to January rates in the 90s. The price of West Texas Intermediate broke below $20 on Wednesday's inventory data, and this despite repeated headlines all through the week of major cutbacks being agreed to by all the big producers. For the US, energy may well prove to be the hardest hit of any of the nation's sectors in 2020. The Dallas Fed's manufacturing index, which plunged a full month before other regional reports, will updated next at month end, on April 27 in a regional report that will be worth watching.

The global economy is likely in the deepest part of the ditch right now and won't go deeper provided that lockdowns begin to lighten up. The downturn may begin to reverse by mid-year though the resulting composition of the global economy will have changed, with autos and aircraft pushed down, retail service industries sharply cut back and employment deeply depressed. But chocking off the economy during this crisis is only one side of the coin; the other of course is saving lives which is the colossal give-and-take drama now playing out.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Confidence and PMI reports will provide a heavy run of timely April updates in the week. Confidence data from Germany will include ZEW on Tuesday and GfK on Thursday and then on Friday the closely watched Ifo survey. Wednesday will see both France's business climate indicator and the European Commission's consumer confidence flash while on Friday, the business and consumer confidence report will be posted in Italy as will as April's final reading on US consumer sentiment where further trouble is expected. Purchasing manager flashes for April are set for Thursday and will measure the business impact on the services and manufacturing sectors, beginning in order with Japan, France, Germany, the Eurozone, the UK, and the US. Opening the week will be Japanese international trade on Monday with US durable goods posted on Friday, both for March. Also closely watched, of course, will be US weekly jobless claims on Thursday, which have been slowing but still coming in at unprecedented levels.

Japanese Merchandise Trade for March (Mon 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast: ¥454.6 billion

Consensus Forecast, Imports Year-over-Year: -9.9%

Consensus Forecast, Exports Year-over-Year: -5.5%

A surplus deficit of ¥454.6 billion is expected for the March merchandise trade report versus a surplus of ¥1,109.8 billion in February. Both Japanese imports and exports were in deep contraction long before the coronavirus, and more of the same is expected in March: down 9.9 percent on the year for imports and down 5.5 percent for exports.

Germany: ZEW Survey for April (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Business Expectations: -55.5

Consensus Forecast, Current Conditions: -80.0

ZEW sentiment fell much more sharply than expected during March's coronavirus outbreak and lockdown, down from plus 8.7 to minus 49.5 for business expectations and from minus 15.7 to minus 43.1 for current conditions. Forecasters see deeper contraction for April, to minus 55.5 for expectations and minus 80.0 for current conditions.

French Business Climate Indicator for April (Wed 06:45 GMT; Wed 08:45 CEST; Wed 02:45 EDT)

Consensus Forecast, Manufacturing: 86

On INSEE's measure, sentiment in manufacturing in April is seen at 86 which would follow what was a better-than-expected 98 in March when virus effects first escalated.

Eurozone: EC Consumer Confidence Flash for April (Wed 14:00 GMT; Wed 16:00 CEST; Wed 10:00 EDT)

Consensus Forecast: -17.5

After falling 5 points to minus 11.6 in March, forecasters see April's consumer confidence flash falling nearly 6 more points to minus 17.5.

Japanese PMI Manufacturing Flash for April (Thu 00:30 GMT; Thu 09:30 JST; Wed 20:30 EDT)

Consensus Forecast, Manufacturing: 42.0

Forecasters see Japan's manufacturing PMI slipping 2.8 points to 42.0 in April after falling a limited 3 points in March. In contrast, services in March fell 13 points to a final 33.8 (revised up from a 32.7 flash).

Germany: GfK Consumer Climate for May (Thu 06:00 GMT; Thu 08:00 CEST; Thu 02:00 EST)

Consensus Forecast: -2.7

Further deterioration is the call for May's Gfk consumer climate index which in April fell more sharply than expected, down more than 7 points to plus 2.7 and an 11-year low.

French PMI Composite Flash for April (Thu 07:15 GMT; Thu 09:15 CEST; Thu 03:15 EDT)

Consensus Forecast, Composite: 26.0

Consensus Forecast, Manufacturing: 39.0

Consensus Forecast, Services: 24.0

At a consensus 24.0, France's PMI services flash for April is expected to further erode from March's deeply depressed 28.9 (revised from a 29.0 flash). The manufacturing flash in April is also seen lower, at 39.0 versus March's 43.2 with the composite seen at 26.0.

German PMI Composite Flash for April (Thu 07:30 GMT; Thu 09:30 CEST; Thu 03:30 EDT)

Consensus Forecast, Composite: 32.0

Consensus Forecast, Manufacturing: 40.0

Consensus Forecast, Services: 29.4

Germany's manufacturing PMI proved surprisingly resilient to early virus effects, ending March in line with its year-long trend at 45.4 (revised from a 45.7 flash). For April the consensus is 40.0 with services seen at 29.4 versus 31.7 in March (revised downward from a flash of 34.5).

Eurozone PMI Composite Flash for April (Thu 08:00 GMT; Thu 10:00 CEST; Thu 04:00 EDT)

Consensus Forecast, Composite: 26.0

Consensus Forecast, Manufacturing: 40.0

Consensus Forecast, Services: 24.0

The Eurozone's services sample reported severe slowing in March due to the coronavirus but no greater deterioration is expected for April, at a consensus 26.0 which would be little changed from 26.4 (revised from a 28.4 flash). Manufacturing is seen at 40.0 in April versus 44.5 in March (revised from a 44.8 flash).

UK: CIPS/PMI Composite Flash for April (Thu 08:30 GMT; Thu 09:30 BST; Thu 04:30 EDT)

Consensus Forecast, Composite: 31.0

Consensus Forecast, Manufacturing: 44.7

Consensus Forecast, Services: 30.0

Like other PMI composites, the services sample of the CIPS/PMI report reported significantly greater weakness in the virus-stricken month of March than the manufacturing sample. Further deterioration is expected for April's flashes: for manufacturing 44.7 versus March's 47.8 (revised from 48.0 flash), for services 30.0 versus 34.5 (revised from 36.0).

US Initial Jobless Claims for April 18 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 4.0 million

Consensus Range: 3.0 million to 4.5 million

After spiking by 22 million in four weeks and by more than 5 million in the prior week, initial claims are expected to continue to slow, to 4.0 million in the April 18 week. Initial claims peaked in the March 28 week at nearly 6.9 million.

US PMI Flashes for April (Thu 13:45 GMT; Thu 09:45 EDT)

Consensus Forecast, Manufacturing: 40.0

Consensus Forecast, Services: 35.0

The manufacturing PMI, skewed higher by a misleading reading for delivery times, appeared to hold up well in March but not services which suffered badly from virus effects especially for orders. For April, forecasters are looking for a services index of 35.0 versus March's 39.8 (revised from a 39.1 flash) with manufacturing seen at 40.0 versus March's 48.5 (revised from 49.2).

German Ifo Economic Sentiment for April (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast: 80.0

Falling 10 points for the steepest decline in nearly 30 years and to the lowest level in more than 10 years, the Ifo index in April is expected to 80.0.

Italian Business and Consumer Confidence for April (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Consumer Confidence: No consensus

Consumer confidence in Italy fell more than 10 points in March to 101.0. There is no consensus for April's reading. Business confidence in March fell more than 8 points to 81.7 with manufacturing confidence falling more than 11 points to 89.5.

US Durable Goods Orders for March (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -11.4%

Consensus Forecast: Ex-Transportation: -4.5%

Consensus Forecast: Core Capital Goods Orders: -5.0%

Reflecting coronavirus effects, durable goods orders for March are expected to fall 11.4 percent compared to the pre-virus month of February. Excluding transportation equipment where the auto sector was in shutdown, orders are expected to fall less steeply, down 4.5 percent. Core capital goods orders are expected to decline 5.0 percent.

|