|

Official statistics offices across the world are warning about small sample sizes and disruptions to data collection, raising the real risk that economic information will begin to be interrupted. And this is already the case, at least initially as Italy's Istituto Nazionale di Statistica, citing operational issues caused by the covid emergency, suspended release on Friday of April's consumer and business confidence surveys. But, in contrast and relief, in areas hit less hard by the virus, agencies are pitching in extra work, including the Australian Bureau of Statistics which has introduced a range of new data, including weekly estimates on payrolls and advance reports on retail and international trade. Statistics Canada is also working overtime, having already released at mid-month an advance March projection for GDP (at 9 percent contraction). StatsCan is also taking a stab at how high unemployment will climb. In a rough estimate using crowdsourcing data not based on probability sampling, 28.2 percent of Canadian respondents are scared they're going to lose their job. How would such a rate compare with the Great Depression? Unemployment in Canada hit 30.0 percent in 1933 which would be roughly a similar outcome. And for comparison, unemployment in the US hit a high of 24.9 percent in 1933 and, in Germany, a high of 29.9 percent in 1932. But it's not with employment we start the week's rundown, but with April updates on general confidence where a badly needed silver lining may be seen.

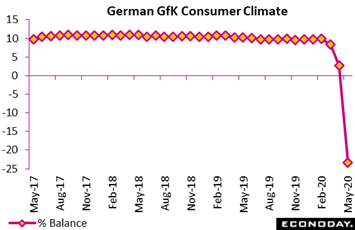

Germany has done well to contain the infection and announced in the week (on April 20) an easing in shutdown restrictions. This would appear certain to boost consumer confidence which ahead of the announcement was in deep decline. Having already slumped in the prior report, GfK's consumer climate index fell to minus 23.4 in its May outlook. This was well below expectations and a record low. Data for this report were collected in the first half of April when containment measures were in full force but, in a consistent theme seen across confidence reports, hopes for better times ahead were evident. Of the report's three components, economic expectations managed not to post a major loss, slipping only 2.2 points to minus 19.2. A negative reading for expectations isn't that great but this is still above the minus 26 low seen in the last crisis 12 years ago. Germany has done well to contain the infection and announced in the week (on April 20) an easing in shutdown restrictions. This would appear certain to boost consumer confidence which ahead of the announcement was in deep decline. Having already slumped in the prior report, GfK's consumer climate index fell to minus 23.4 in its May outlook. This was well below expectations and a record low. Data for this report were collected in the first half of April when containment measures were in full force but, in a consistent theme seen across confidence reports, hopes for better times ahead were evident. Of the report's three components, economic expectations managed not to post a major loss, slipping only 2.2 points to minus 19.2. A negative reading for expectations isn't that great but this is still above the minus 26 low seen in the last crisis 12 years ago.

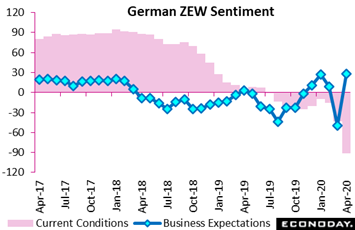

This same theme is evident in another German survey, the ZEW report which measures sentiment among financial analysts. The current conditions measure fell very sharply and, at minus 91.5 (red column of the graph), was a massive 48.4 points below March and only just above the low seen in the last crisis. Yet analysts clearly believe that government measures introduced to combat the coronavirus are working as the key expectations gauge (blue line) jumped a record 77.7 points to 28.2, and is actually sitting just above its long-term average. In April and May 2009 a similar pattern was seen when, despite very weak current economic data, analysts started to see light at the end of the tunnel. And Germany is not alone as divergence in US consumer sentiment, updated at week's end, showed the same pattern: record declines for current conditions and comparative resilience for expectations. This same theme is evident in another German survey, the ZEW report which measures sentiment among financial analysts. The current conditions measure fell very sharply and, at minus 91.5 (red column of the graph), was a massive 48.4 points below March and only just above the low seen in the last crisis. Yet analysts clearly believe that government measures introduced to combat the coronavirus are working as the key expectations gauge (blue line) jumped a record 77.7 points to 28.2, and is actually sitting just above its long-term average. In April and May 2009 a similar pattern was seen when, despite very weak current economic data, analysts started to see light at the end of the tunnel. And Germany is not alone as divergence in US consumer sentiment, updated at week's end, showed the same pattern: record declines for current conditions and comparative resilience for expectations.

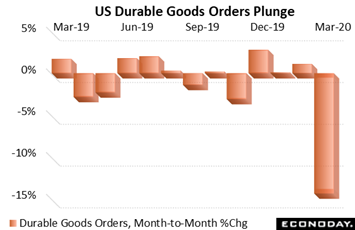

Hard definitive data on the month of April are still elusive with March data still coming in. In the US, the advance durable goods report for March was released and here, however, it's hard to find any silver linings. Order cancellations for civilian aircraft pulled durable goods orders sharply lower, down 14.4 percent in March compared to February. Orders for nondefense aircraft swung into contraction, to minus $16.3 billion in what may be a building pattern given, not only the failure of the Boeing 737, but global travel lockdowns as well. Aircraft isn't the only mode of transportation that's suffering as orders for motor vehicles fell 18.4 percent to $49.0 billion. Though orders excluding transportation fell only 0.2 percent in March, the weakness for aircraft and vehicles is severe and alarming and will soon be joined by contraction for energy equipment in the wake of this month's collapse in oil prices. Hard definitive data on the month of April are still elusive with March data still coming in. In the US, the advance durable goods report for March was released and here, however, it's hard to find any silver linings. Order cancellations for civilian aircraft pulled durable goods orders sharply lower, down 14.4 percent in March compared to February. Orders for nondefense aircraft swung into contraction, to minus $16.3 billion in what may be a building pattern given, not only the failure of the Boeing 737, but global travel lockdowns as well. Aircraft isn't the only mode of transportation that's suffering as orders for motor vehicles fell 18.4 percent to $49.0 billion. Though orders excluding transportation fell only 0.2 percent in March, the weakness for aircraft and vehicles is severe and alarming and will soon be joined by contraction for energy equipment in the wake of this month's collapse in oil prices.

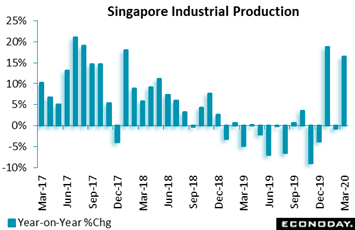

In a much welcome positive note, let's turn to industrial production in Singapore which proved surprisingly strong in March at a 16.5 percent year-on-year rise. Though Statistics Singapore warned that the global pandemic will weigh on industrial production significantly in coming months, output from the country's biochemical industry, which includes pharmaceuticals and makes up nearly 1/5 of manufacturing production, was up 91.4 percent! And though activity outside of biomedical was weak, officials noted significant increases in the production of active pharmaceutical ingredients and biological products, with medical technology products also growing strongly in March. In a much welcome positive note, let's turn to industrial production in Singapore which proved surprisingly strong in March at a 16.5 percent year-on-year rise. Though Statistics Singapore warned that the global pandemic will weigh on industrial production significantly in coming months, output from the country's biochemical industry, which includes pharmaceuticals and makes up nearly 1/5 of manufacturing production, was up 91.4 percent! And though activity outside of biomedical was weak, officials noted significant increases in the production of active pharmaceutical ingredients and biological products, with medical technology products also growing strongly in March.

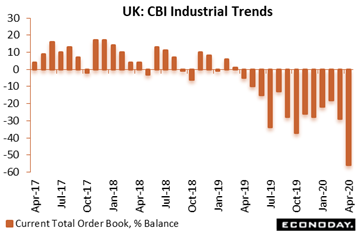

Though medicine will help limit contraction in Singapore, for other economies other factors will prove too severe. In an indication of the degree of contraction underway in the UK, April's CBI industrial trends index slumped from minus 29 percent to minus 56 percent, its weakest mark since July 2009. And the report's forecast, at minus 78 percent forecast for May, signals what looks to be the worst month ever coming up. The details speak for themselves: past output fell at the sharpest rate since August 2009 and is expected to drop at a record pace over the coming quarter; manufacturers anticipate reducing headcount over the coming three months more rapidly than at any time since 1980; business sentiment plunged at a record pace and, not surprisingly, expected prices are weak. Though medicine will help limit contraction in Singapore, for other economies other factors will prove too severe. In an indication of the degree of contraction underway in the UK, April's CBI industrial trends index slumped from minus 29 percent to minus 56 percent, its weakest mark since July 2009. And the report's forecast, at minus 78 percent forecast for May, signals what looks to be the worst month ever coming up. The details speak for themselves: past output fell at the sharpest rate since August 2009 and is expected to drop at a record pace over the coming quarter; manufacturers anticipate reducing headcount over the coming three months more rapidly than at any time since 1980; business sentiment plunged at a record pace and, not surprisingly, expected prices are weak.

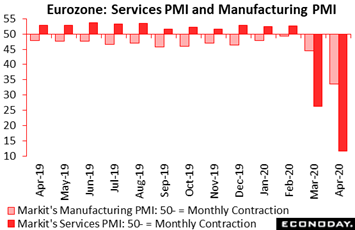

April PMIs were out in force across the globe in the week and the results are dismally similar: deepening and unprecedented contraction. April's flash manufacturing index for the Eurozone fell to 33.6, a nearly 11 point drop from March and an 11-year trough with the output component especially weak. April's services flash fell an even steeper 14.7 points to 11.7, its weakest reading since data were first compiled in 1998. A number of the report's major components declined to levels never seen before, including aggregate new orders and employment. Business optimism did deteriorate only marginally though pessimism in manufacturing intensified. Inflation developments were almost as soft with overall input costs falling at the steepest rate in nearly 11 years and output prices decreasing more quickly than in any month since June 2009. In terms of composite output, both France (11.2) and Germany (17.1) recorded new series lows and the rest of the region (11.5) fared no better. Taken together, the results point to quarterly contraction in Eurozone real GDP of around 7.5 percent. This would compares with the 3.2 percent decline recorded during the worst of the global financial crisis (Q4 2008). April PMIs were out in force across the globe in the week and the results are dismally similar: deepening and unprecedented contraction. April's flash manufacturing index for the Eurozone fell to 33.6, a nearly 11 point drop from March and an 11-year trough with the output component especially weak. April's services flash fell an even steeper 14.7 points to 11.7, its weakest reading since data were first compiled in 1998. A number of the report's major components declined to levels never seen before, including aggregate new orders and employment. Business optimism did deteriorate only marginally though pessimism in manufacturing intensified. Inflation developments were almost as soft with overall input costs falling at the steepest rate in nearly 11 years and output prices decreasing more quickly than in any month since June 2009. In terms of composite output, both France (11.2) and Germany (17.1) recorded new series lows and the rest of the region (11.5) fared no better. Taken together, the results point to quarterly contraction in Eurozone real GDP of around 7.5 percent. This would compares with the 3.2 percent decline recorded during the worst of the global financial crisis (Q4 2008).

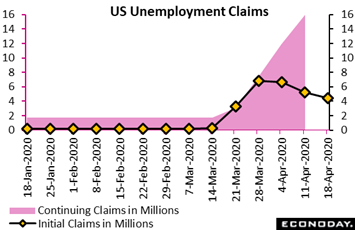

Let's return to jobs and ask whether the worst is still underway or has already passed. In the US, the level of layoffs remains staggering but the direction, which is slowly moving south, is favorable. Initial claims fell 810,000 in the April 18 week to 4.427 million which, in a possible sign of increasing predictability, was roughly in line with Econoday's consensus for 4.250 million. Initial claims peaked in the March 28 week at 6.867 million and have moved lower in each of the three subsequent weeks. The unemployment rate for insured workers, which before the virus was consistently steady at 1.2 percent, is now at 11.0 percent and a record high. Continuing claims, where data lag initial claims, rose 4.064 million in the April 11 week to 15.976 million which is another unwanted record. Initial claims over the past six weeks, when virus effects first emerged, have totaled 26.7 million from a total labor force (last measured in March) of 162.9 million. Job losses have been centered in services though commentaries from individual states are increasingly citing manufacturing as well. Let's return to jobs and ask whether the worst is still underway or has already passed. In the US, the level of layoffs remains staggering but the direction, which is slowly moving south, is favorable. Initial claims fell 810,000 in the April 18 week to 4.427 million which, in a possible sign of increasing predictability, was roughly in line with Econoday's consensus for 4.250 million. Initial claims peaked in the March 28 week at 6.867 million and have moved lower in each of the three subsequent weeks. The unemployment rate for insured workers, which before the virus was consistently steady at 1.2 percent, is now at 11.0 percent and a record high. Continuing claims, where data lag initial claims, rose 4.064 million in the April 11 week to 15.976 million which is another unwanted record. Initial claims over the past six weeks, when virus effects first emerged, have totaled 26.7 million from a total labor force (last measured in March) of 162.9 million. Job losses have been centered in services though commentaries from individual states are increasingly citing manufacturing as well.

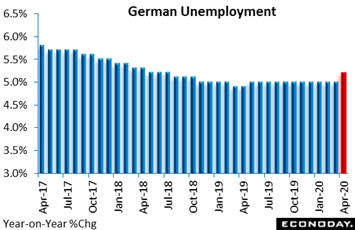

Hard data on Europe's labor market during the covid crunch have been very scarce but will get an update on Thursday by Germany's Statistisches Bundesamt which will report unemployment for the month of April. Germany's unemployment rate has long been fixed at the 5.0 percent level and is only expected to edge 2 tenths higher in April's report. Virus damage in Germany, at least based on infection and death rates, has been much less severe than for many other countries, and the reopening that is beginning to emerge, if sustained and widened further, would hint at the seemingly impossible: Only limited structural impact on the economy. Hard data on Europe's labor market during the covid crunch have been very scarce but will get an update on Thursday by Germany's Statistisches Bundesamt which will report unemployment for the month of April. Germany's unemployment rate has long been fixed at the 5.0 percent level and is only expected to edge 2 tenths higher in April's report. Virus damage in Germany, at least based on infection and death rates, has been much less severe than for many other countries, and the reopening that is beginning to emerge, if sustained and widened further, would hint at the seemingly impossible: Only limited structural impact on the economy.

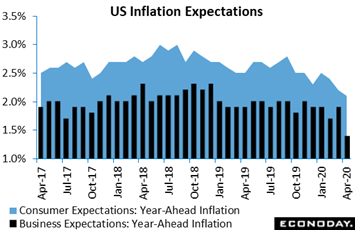

We'll wind up the week's data run with a look at where inflation stands, or is slumping. Much of the global data, which preceded this month's colossal collapse in oil prices, were already moving lower, whether consumer prices in Europe or North America or Asia. Actually, the virus hit the global economy during an extended period of persistent disinflation. Inflation expectations are generally considered to be self-fulfilling barometers for future inflation, as consumers and businesses pull back (during deflation) or speed up (during inflation) their spending plans based on the expected direction of prices. The news out of the US isn't favorable at least in the short-term. Year-ahead inflation expectations among US businesses (black columns in graph) fell a very abrupt 5 tenths to 1.4 percent in results sampled by the Atlanta Fed before oil's sub-zero dive. Expectations for US consumers (blue area in graph) are down 1 tenth this month to 2.1 percent for the University of Michigan's measure, which is exceptionally low for this reading and which did capture at least some of oil's collapse. Yet in a teasing note of hope in line with the separation between current conditions and expectations in the confidence surveys, 5-year inflation expectations actually improved 2 tenths to 2.5 percent. We'll wind up the week's data run with a look at where inflation stands, or is slumping. Much of the global data, which preceded this month's colossal collapse in oil prices, were already moving lower, whether consumer prices in Europe or North America or Asia. Actually, the virus hit the global economy during an extended period of persistent disinflation. Inflation expectations are generally considered to be self-fulfilling barometers for future inflation, as consumers and businesses pull back (during deflation) or speed up (during inflation) their spending plans based on the expected direction of prices. The news out of the US isn't favorable at least in the short-term. Year-ahead inflation expectations among US businesses (black columns in graph) fell a very abrupt 5 tenths to 1.4 percent in results sampled by the Atlanta Fed before oil's sub-zero dive. Expectations for US consumers (blue area in graph) are down 1 tenth this month to 2.1 percent for the University of Michigan's measure, which is exceptionally low for this reading and which did capture at least some of oil's collapse. Yet in a teasing note of hope in line with the separation between current conditions and expectations in the confidence surveys, 5-year inflation expectations actually improved 2 tenths to 2.5 percent.

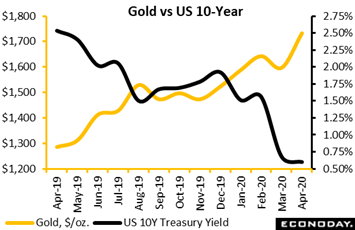

The reaction to the covid calamity has been starkly opposite between oil and gold, the latter, instead of testing the zero line, having climbed steadily from $1,600 a month ago to nearly $1,750 at last look. Of course gold's advantage is its ancestral tradition of monetary exchange which is absent in oil where value is tied to consumption. Gold is also benefiting from the drop in global bond yields which is making investment in the US 10-year Treasury note, for instance, less and less attractive. Gold doesn't pay a yield and the lower yields go, the less disadvantage there is to hold gold. Storage, however, as it is for oil, is also a cost for holding gold, but to a comparatively marginal degree. How much gold has been gaining or stands to gain from the plethora of fiscal and monetary stimulus underway is up for debate. Though these plans will work to dilute the psychological standing of paper currencies, stimulus efforts are proving to be roughly universal with all countries in the same boat. The reaction to the covid calamity has been starkly opposite between oil and gold, the latter, instead of testing the zero line, having climbed steadily from $1,600 a month ago to nearly $1,750 at last look. Of course gold's advantage is its ancestral tradition of monetary exchange which is absent in oil where value is tied to consumption. Gold is also benefiting from the drop in global bond yields which is making investment in the US 10-year Treasury note, for instance, less and less attractive. Gold doesn't pay a yield and the lower yields go, the less disadvantage there is to hold gold. Storage, however, as it is for oil, is also a cost for holding gold, but to a comparatively marginal degree. How much gold has been gaining or stands to gain from the plethora of fiscal and monetary stimulus underway is up for debate. Though these plans will work to dilute the psychological standing of paper currencies, stimulus efforts are proving to be roughly universal with all countries in the same boat.

More hopeful than certain is an underlying theme from much of the survey data where outlooks have been falling but not cratering as they are for current assessments. The final degree of the crisis will ultimately be determined by unemployment where lockdown damage is still unfolding and the prospect of post-lockdown recovery just emerging.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

A full slate of economic data begins Monday with an April update out of Texas and how much deeper the state's manufacturing sector is now contracting. Distributive trades on Tuesday will offer April indications on spending retrenchment in the UK and the consumer confidence index in the US, also on Tuesday, will track how low spirits have sunk. Between the virus and oil, deflationary forces have been unleashed with Germany's preliminary CPI, posted on Wednesday, to offer some of the very first hard data on April price conditions. Virus effects on employment were very evident in the US, which will update jobless claims on Thursday, but are comparatively unknown in Europe where Germany's unemployment rate, also released Thursday, is expected to rise only moderately. Other data will include first-quarter GDP reports from the US and the Eurozone, on Wednesday and Thursday, as well as several announcements from central banks all of which, however, have already played their cards. Of special note will be international trade in goods in the US and whether port closures were already stifling cross-border trade.

Dallas Fed General Activity Index for April (Mon 14:30 GMT; Mon 10:30 EDT)

Consensus Forecast: -80.0

Consensus Range: -85.0 to -60.0

How low can a diffusion index go? The Dallas Fed's general activity index was already at minus 70.0 back in March, before the price of oil dived into the minus column in April. Expectations are minus 80.0 for April's headline index.

Bank of Japan Announcement (Any time Tuesday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

Though the Bank of Japan kept its policy rate unchanged at minus 0.1 percent in March, it did add to QE and began to actively purchase exchange-traded funds and real-estate investment trusts. For April, forecasters see no change for the policy rate.

UK CBI Distributive Trades for April (Tue 10:00 GMT; Tue 11:00 BST; Tue 06:00 EDT)

Consensus Forecast: -20%

CBI distributive trades, in the first survey covering the full effects of the lockdown on the UK retail sector, are expected to fall sharply, to a consensus minus 20 versus March's minus 3.

US International Trade In Goods for March (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -$51.5 billion

Forecasters see sharp narrowing in March for the US goods trade gap, to a consensus $51.5 billion versus $59.9 billion in February. This report may or may not be affected by virus shutdowns.

US Consumer Confidence Index for April (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 95.0

Econoday's April consensus is calling for a 25-point fall to 95.0 for the US consumer confidence index. In a March report that didn't capture the month's full virus impact, this index fell more than 12 points.

German Preliminary CPI for April (Wed 12:00 GMT; Wed 14:00 CEST; Wed 08:00 EDT)

Consensus Forecast, Month-to-Month: 0.3%

Consensus Forecast, Year-over-Year: 1.1%

How deflationary are virus and oil effects proving to be? Preliminary CPI from Germany will offer some initial clues with the monthly rate seen rising 0.3 percent in April but the year-on-year rate falling to 1.1 percent from 1.4 percent.

US GDP: First Quarter, First Estimate, Q/Q SAAR (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast: -3.8%

US Real Personal Consumption Expenditures

Consensus Forecast: -1.5%

Stricken by the initial effects of the virus outbreak, US GDP is expected to have fallen at an annualized 3.8 percent pace in the first quarter. Consumer spending is seen falling at a 1.5 percent pace. The GDP price index is expected to hold steady at 1.3 percent.

US Federal Reserve Policy Announcement (Wed 18:00 GMT; Wed 14:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Policy Range: 0.0% to 0.25%

With the bottom of the Federal Reserve's narrow target range already at zero, no change in the federal funds rate is expected. And having already opened the spigots wide open on direct bond buying, the Fed seems to be out of major moves.

German Unemployment Rate for April (Thu 07:55 GMT; Thu 09:55 CEST; Thu 03:55 EDT)

Consensus Forecast: 5.2%

For the month of April and reflecting the virus outbreak, Germany's unemployment rate is expected to rise a less-than-severe 2 tenths to 5.2 percent.

Eurozone GDP First-Quarter Preliminary Flash (Thu 09:00 GMT; Thu 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast: Quarter-to-Quarter: -3.1%

Consensus Forecast, Year-over-Year: -3.0%

First-quarter Eurozone GDP is expected to move into contraction at a quarterly pace of minus 3.1 percent versus a fractional 0.1 percent increase in the fourth quarter. The year-on-year rate is seen at minus 3.0 percent versus fourth-quarter growth of 1.0 percent.

US Initial Jobless Claims for April 25 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 3.5 million

Consensus Range: 2.0 million to 4.9 million

Initial claims have totaled a staggering 26.7 million since mid-March but week-to-week readings, which peaked at 6.867 million in late March, have slowed in the each of the subsequent weeks during April. And further slowing is the call for the April 25 week, with Econoday's consensus at 3.5 million versus 4.427 million in the April 18 week.

European Central Bank Policy Announcement (Thu 11:45 GMT; Thu 13:45 CEST; Thu 07:45 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

The European Central Bank did not cut rates in March but did increase in QE and announced an emergency €750 billion stimulus package. No change in the policy rate, which is already at zero, is expected.

US: ISM Manufacturing Index for April (Fri 14:00 GMT; Fri 10:00 EDT)

Consensus Forecast: 39.0

Skewed higher by delivery times that masked substantial erosion in orders and a fall in employment, the ISM manufacturing index held near breakeven 50 in March, at 49.1. For April, forecasters see the ISM coming in substantially lower, at 39.0.

|