|

Unprecedented doesn't really describe the extent of the economic catastrophe that is taking place, at least in North America. The numbers coming in aren't really a surprise but are still numbing when you see them, especially employment where the level of decimation reasonably raises the question of social reaction. The pressure for reopenings, virus or not, can only build. Yet the markets, at least in the US, had another good week? Extended wage subsidies from the government and hot money tied to central bank stimulus – neither of which can go on forever – are certainly major factors that are helping stocks and are feeding what very well may be, given stubbornly high infection rates, a less-than-rational assessment of future profit growth. Yet there was actually some good news in the week, centered in Asia where infection rates appear to be down. But that's not where we'll start.

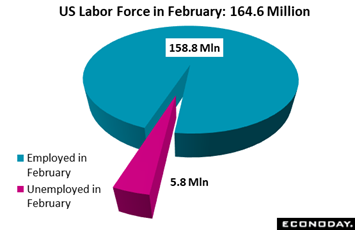

The mass destruction of the US labor market was about as expected in April with nonfarm payrolls falling 20.5 million versus Econoday's consensus for 21.5 million. The unemployment rate didn't rise quite as much as expected, but at 14.7 percent and a 10.3 percentage point surge it really can't be called good news. And this rate would have been closer to 20 percent if not for hairsplitting on how some of the losses are classified (as temporary or not). Before the virus hit, the US labor market, as tracked in the first graph, totaled 164.6 million, split between 158.8 million with jobs and 5.8 million actively looking for jobs making for a 3.5 percent unemployment rate (ironically, a 50-year low). The mass destruction of the US labor market was about as expected in April with nonfarm payrolls falling 20.5 million versus Econoday's consensus for 21.5 million. The unemployment rate didn't rise quite as much as expected, but at 14.7 percent and a 10.3 percentage point surge it really can't be called good news. And this rate would have been closer to 20 percent if not for hairsplitting on how some of the losses are classified (as temporary or not). Before the virus hit, the US labor market, as tracked in the first graph, totaled 164.6 million, split between 158.8 million with jobs and 5.8 million actively looking for jobs making for a 3.5 percent unemployment rate (ironically, a 50-year low).

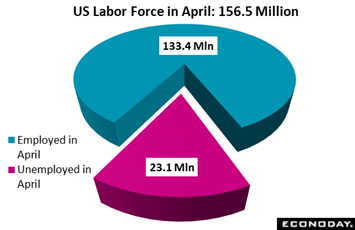

In April, tracked in this graph, the total pie shrunk to 156.5 million with 133.4 million people still with jobs and 23.1 million looking for one. The 9 million plus missing from February have either retired, died, or have yet to pound the pavement. And the outlook for May isn't any better. April's sample was taken at mid-month and initial jobless claims filed over the past two weeks have totaled more than 7 million. Massive job losses and another sharp rise in the unemployment rate (limited reopenings in a number of states aside) will also be the story of the May report. And is the outlook for June any better? Not if the virus is spreading and shutdowns are still in place. Another fact of this catastrophe is that it is strongly centered in the most vulnerable area of the labor force, evident especially in wages as average hourly earnings, inflated by the absence of low wage jobs, surged 4.7 percent on the month. The story is the same for Canada which also reported its employment data for April: contraction of 2.0 million jobs for an official unemployment rate of 13.0 percent and an unofficial one of 17.8 percent (excluding special virus definitions). In April, tracked in this graph, the total pie shrunk to 156.5 million with 133.4 million people still with jobs and 23.1 million looking for one. The 9 million plus missing from February have either retired, died, or have yet to pound the pavement. And the outlook for May isn't any better. April's sample was taken at mid-month and initial jobless claims filed over the past two weeks have totaled more than 7 million. Massive job losses and another sharp rise in the unemployment rate (limited reopenings in a number of states aside) will also be the story of the May report. And is the outlook for June any better? Not if the virus is spreading and shutdowns are still in place. Another fact of this catastrophe is that it is strongly centered in the most vulnerable area of the labor force, evident especially in wages as average hourly earnings, inflated by the absence of low wage jobs, surged 4.7 percent on the month. The story is the same for Canada which also reported its employment data for April: contraction of 2.0 million jobs for an official unemployment rate of 13.0 percent and an unofficial one of 17.8 percent (excluding special virus definitions).

Massive job destruction has yet to appear in other regions and may, at least for the Asia-Pacific region, never appear, based on recent data including visible improvement in Chinese exports. Exports from China rose 3.5 percent on the year in April following virus-related contraction of 6.6 percent in March and 17.2 percent in January and February combined. The strength was centered in regional Asian trade as exports to Japan and southeast Asian countries rose solidly. Exports to the US slowed in April with exports to the European Union improving but still down. Yet not all the news is good as Chinese imports in April were down 14.2 percent on the year, reflecting broad-based declines across major trading partners with lower commodity prices and currency depreciation contributing to the drop. Imports, however, were weak, down 6.9 percent on the year. Massive job destruction has yet to appear in other regions and may, at least for the Asia-Pacific region, never appear, based on recent data including visible improvement in Chinese exports. Exports from China rose 3.5 percent on the year in April following virus-related contraction of 6.6 percent in March and 17.2 percent in January and February combined. The strength was centered in regional Asian trade as exports to Japan and southeast Asian countries rose solidly. Exports to the US slowed in April with exports to the European Union improving but still down. Yet not all the news is good as Chinese imports in April were down 14.2 percent on the year, reflecting broad-based declines across major trading partners with lower commodity prices and currency depreciation contributing to the drop. Imports, however, were weak, down 6.9 percent on the year.

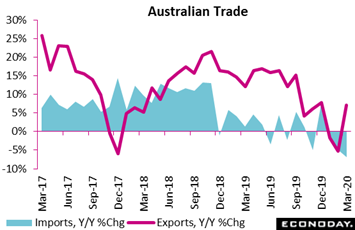

Australia is another positive coming out of Asia. In data for March, which in Asia was a month of heavy virus effects, exports were up 7.1 percent on the year benefitting from stronger growth for both rural and non-rural goods. Gains in iron ore exports and non-monetary gold were special positives. Imports, however, were not positive, down 6.9 percent on the year after dropping 5.0 percent in February. The Reserve Bank of Australia has been one of the less downbeat central banks, issuing a statement on monetary policy in the week that sees recovery, based on public health measures and social restrictions, beginning in the second half of the year and extending into 2021. The RBA also scaled back quantitative easing in the week. Australia is another positive coming out of Asia. In data for March, which in Asia was a month of heavy virus effects, exports were up 7.1 percent on the year benefitting from stronger growth for both rural and non-rural goods. Gains in iron ore exports and non-monetary gold were special positives. Imports, however, were not positive, down 6.9 percent on the year after dropping 5.0 percent in February. The Reserve Bank of Australia has been one of the less downbeat central banks, issuing a statement on monetary policy in the week that sees recovery, based on public health measures and social restrictions, beginning in the second half of the year and extending into 2021. The RBA also scaled back quantitative easing in the week.

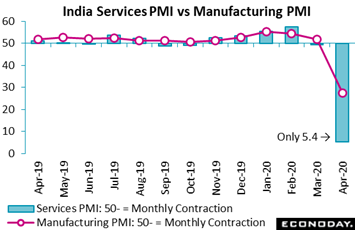

India is not part of Asia's recovery story. Here the virus effects seem at least as bad as in Europe and in North America. The country's services PMI plunged to only 5.4 in April. This is not a misprint. This basically means that nearly all the firms sampled said activity in April was lower than in March. New orders, including those for export, as well as employment all fell at the fastest pace in the survey's 15-year history. India's manufacturing PMI also fell in April, from 51.8 in March to a 27.4 level that a few months ago would have been shocking enough but follows similar levels coming out of Europe and the US. Here, however, there is some good news as manufacturers in India's sample are hopeful for recovery over the next year. India is not part of Asia's recovery story. Here the virus effects seem at least as bad as in Europe and in North America. The country's services PMI plunged to only 5.4 in April. This is not a misprint. This basically means that nearly all the firms sampled said activity in April was lower than in March. New orders, including those for export, as well as employment all fell at the fastest pace in the survey's 15-year history. India's manufacturing PMI also fell in April, from 51.8 in March to a 27.4 level that a few months ago would have been shocking enough but follows similar levels coming out of Europe and the US. Here, however, there is some good news as manufacturers in India's sample are hopeful for recovery over the next year.

Data from Europe in the week saw significant declines in manufacturing, contributing to 17.3 percent annual contraction in French industrial production and 11.4 percent contraction in German production. These data were for March when virus effects first hit and based on the month's manufacturing orders, industrial production in Germany looks to have collapsed even more severely in April. Manufacturers' orders, which have been very weak for nearly two years, fell 15.8 percent in March reflecting weakness in both domestic and overseas demand. The former shrank 14.8 percent and the latter 16.1 percent within which new orders from the rest of the Eurozone were down 17.9 percent. And in a specially ominous sign for business investment, March's declines were led by capital goods. Data from Europe in the week saw significant declines in manufacturing, contributing to 17.3 percent annual contraction in French industrial production and 11.4 percent contraction in German production. These data were for March when virus effects first hit and based on the month's manufacturing orders, industrial production in Germany looks to have collapsed even more severely in April. Manufacturers' orders, which have been very weak for nearly two years, fell 15.8 percent in March reflecting weakness in both domestic and overseas demand. The former shrank 14.8 percent and the latter 16.1 percent within which new orders from the rest of the Eurozone were down 17.9 percent. And in a specially ominous sign for business investment, March's declines were led by capital goods.

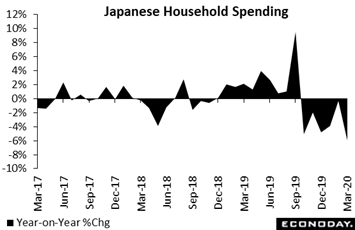

The Japanese consumer has never really reappeared after a buying surge in September that was tied to an October sales-tax hike. Household spending in Japan fell an inflation-adjusted 6.0 percent on the year in March, extending contraction to a weary six straight months. Spending on food was down 2.4 percent and was down 1.0 percent for utilities. A measure of core household spending – which excludes housing, vehicles and other volatile items and which tends to track more closely the consumption component of gross domestic product – fell 7.2 percent on the year in March after dropping 1.8 percent in February. With virus closings taking more and more effect, the outlook for the Japanese consumer isn't that great. The Japanese consumer has never really reappeared after a buying surge in September that was tied to an October sales-tax hike. Household spending in Japan fell an inflation-adjusted 6.0 percent on the year in March, extending contraction to a weary six straight months. Spending on food was down 2.4 percent and was down 1.0 percent for utilities. A measure of core household spending – which excludes housing, vehicles and other volatile items and which tends to track more closely the consumption component of gross domestic product – fell 7.2 percent on the year in March after dropping 1.8 percent in February. With virus closings taking more and more effect, the outlook for the Japanese consumer isn't that great.

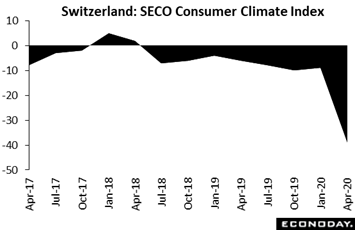

When turning to Europe, the outlook is nothing less than grim, and this despite cautious easing underway in some restrictions. Switzerland's State Secretariat for Economic Affairs (SECO) publishes a quarterly consumer climate index which, in the latest edition for April, fell 30 points to minus 39, with both the change and the level unwanted records. These results are also much worse than seen during the global financial crisis when the climate indicator bottomed at minus 22. Expectations have been showing some strength in many consumer reports but not this one, down more than 70 points to minus 78, easily another all-time low. Readings on employment, personal finances, and especially buying intentions were also sharply lower. These results conform to the bleak picture of consumer activity painted by comparable surveys elsewhere across Europe. When turning to Europe, the outlook is nothing less than grim, and this despite cautious easing underway in some restrictions. Switzerland's State Secretariat for Economic Affairs (SECO) publishes a quarterly consumer climate index which, in the latest edition for April, fell 30 points to minus 39, with both the change and the level unwanted records. These results are also much worse than seen during the global financial crisis when the climate indicator bottomed at minus 22. Expectations have been showing some strength in many consumer reports but not this one, down more than 70 points to minus 78, easily another all-time low. Readings on employment, personal finances, and especially buying intentions were also sharply lower. These results conform to the bleak picture of consumer activity painted by comparable surveys elsewhere across Europe.

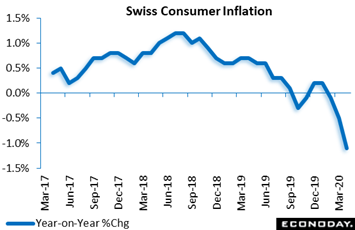

We wind up the week's data run with a look at prices. And keeping with the Swiss, outright deflation is already underway. Consumer prices were significantly weaker than expected in April, down 0.4 percent on the month and, as tracked in the graph, down 1.1 percent on the year for a third straight sub-zero result. Like March, the latest decline reflected some softening in domestic prices but mainly sharply lower import costs where the annual deflation rate, pulled lower by oil, is 3.9 percent. These results will not sit well with the Swiss National Bank and will increase pressure for some additional monetary accommodation at the next policy meeting on the 18th June (if not before). We wind up the week's data run with a look at prices. And keeping with the Swiss, outright deflation is already underway. Consumer prices were significantly weaker than expected in April, down 0.4 percent on the month and, as tracked in the graph, down 1.1 percent on the year for a third straight sub-zero result. Like March, the latest decline reflected some softening in domestic prices but mainly sharply lower import costs where the annual deflation rate, pulled lower by oil, is 3.9 percent. These results will not sit well with the Swiss National Bank and will increase pressure for some additional monetary accommodation at the next policy meeting on the 18th June (if not before).

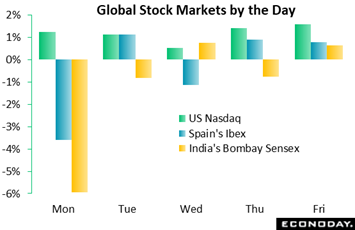

Looking at the Nasdaq, you would never know that US infection rates really aren't slowing that much and the US economy has been totally gutted. The index has been on fire, posting gains all five sessions of the week for a weekly gain of 6.0 percent. The index is up 14.7 percent from this time last year, leading the globe's major indexes by far. Yes, a world of shutdowns and increased use of computers and communication equipment may prove to be profitable for many tech firms, but that good? I don't know about exuberance or not, but the word irrational comes to mind. The Federal Reserve is pouring money into the financial markets and the Nasdaq is certainly getting its share. The Fed's balance sheet is going straight up, to $6.7 trillion at last count for $2.5 trillion in newly printed money. India's Bombay Sensex and Spain's Ibex are two countries trending more along the average for the global stock markets: the former down 18.9 percent over the last year and down 6.2 percent in the latest week, and the latter down 2.0 percent in the week and 18.9 percent lower on the year. All three countries -- the US, India, and Spain -- continue to face persistent infection rates, though Spain's has been slowing and tentative economic reopening is underway. But so far, unlike the Nasdaq, the Ibex hasn't shown much improvement. Looking at the Nasdaq, you would never know that US infection rates really aren't slowing that much and the US economy has been totally gutted. The index has been on fire, posting gains all five sessions of the week for a weekly gain of 6.0 percent. The index is up 14.7 percent from this time last year, leading the globe's major indexes by far. Yes, a world of shutdowns and increased use of computers and communication equipment may prove to be profitable for many tech firms, but that good? I don't know about exuberance or not, but the word irrational comes to mind. The Federal Reserve is pouring money into the financial markets and the Nasdaq is certainly getting its share. The Fed's balance sheet is going straight up, to $6.7 trillion at last count for $2.5 trillion in newly printed money. India's Bombay Sensex and Spain's Ibex are two countries trending more along the average for the global stock markets: the former down 18.9 percent over the last year and down 6.2 percent in the latest week, and the latter down 2.0 percent in the week and 18.9 percent lower on the year. All three countries -- the US, India, and Spain -- continue to face persistent infection rates, though Spain's has been slowing and tentative economic reopening is underway. But so far, unlike the Nasdaq, the Ibex hasn't shown much improvement.

The bottom has fallen out of the US and Canadian economies and though unemployment in Europe has yet to spike, it may yet begin to especially if infection rates remain high and reopenings limited. The hope right now rests with China and other economies in Asia for a region that appears to have handled the coronavirus, at least so far, much better than others.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The coming week will see key data out of China, and clues whether recovery there is continuing, and also the US where the level of devastation is still unfolding. Consumer prices in China will be posted on Tuesday followed on Friday with industrial production and retail sales, the latter to be carefully watched to see whether the Chinese public has or has not bounced back from the virus. US data will open with the CPI on Tuesday followed on Thursday by initial jobless claims and the latest update on the level of carnage still taking place in the labor market. Retail sales and industrial production will be posted on Friday amid expectations for double-digit monthly declines. Other data in the week include industrial production from Italy on Monday, GDP from the UK on Wednesday, and employment data from Australia on Thursday.

Italian Industrial Production for March (Mon 08:00 GMT; Mon 10:00 CEST; Mon 04:00 EDT)

Consensus Forecast, Month-to-Month: 19.0%

Offering a glimpse of the shutdown's initial effect in Italy, industrial production is expected to fall 19.0 percent on the month in March. Production was contracting at a 2.4 percent annual rate going into the crisis in February.

Chinese CPI for April (Tue 01:30 GMT; Tue 09:30 CST; Mon 21:30 EDT)

Consensus Forecast, Year-over-Year: 3.7%

Consumer prices in China have been showing the most pressure in 9 years though they did moderate in March. For April, forecasters see year-on-year inflation at 3.7 percent versus 4.3 percent in March.

US CPI for April (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -0.8%

Consensus Forecast, Year-over-Year Change: 0.5%

US CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: -0.2%

Consensus Forecast, Year-over-Year Change: 1.8%

Consumer prices showed significant virus effects in March, which on net were deflationary. After March's 0.4 percent headline decline, consumer prices are expected to decrease 0.8 percent in April. The core, which posted a 0.1 percent decline in March for a 10-year low, is seen slipping 0.2 percent on the month. Year-on-year, total prices are expected to come in at 0.5 percent versus 1.5 percent in March with the core at 1.8 percent versus March's 2.1 percent.

UK GDP, First-Quarter Preliminary (Wed 06:00 GMT; Wed 07:00 BST; Wed 02:00 EDT)

Consensus Forecast, Quarter-to-Quarter: -2.0%

The consensus for preliminary first-quarter GDP and the initial impact of the coronavirus on the UK economy is quarterly contraction of 2.0 percent.

Australian Labour Force Survey for April (Thu 00:30 GMT; Thu 11:30 AEST; Wed 21:30 EDT)

Consensus Forecast, Unemployment Rate: 8.3%

Employment in Australia showed very little virus effects in March's report unlike April where forecasters see a sharp rise in the unemployment rate to 8.3 percent from 5.2 percent.

US Initial Jobless Claims for May 12 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 2.5 million

Levels of initial claims have been staggering but have been slowing. Further slowing is the call for the May 12 week, with Econoday's consensus at 2.5 million versus 3.2 million in the May 2 week.

Chinese Industrial Production for April (Fri 02:00 GMT; Fri 10:00 CST; Thu 22:00 EDT)

Consensus Forecast, Year-over-Year: 1.5%

After plunging in January and February, industrial production in China surged in March to trim yearly contraction to only 1.1 percent. For April, forecasters expect industrial production to move over the zero line and rise 1.5 percent on the year.

Chinese Retail Sales for April (Fri 02:00 GMT; Fri 10:00 CST; Thu 22:00 EDT)

Consensus Forecast, Year-over-Year: -7.5%

At minus 7.5 percent, Chinese retail sales in April are expected to improve from year-on-year contraction of 15.8 percent in March.

US Retail Sales for April (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month-to-Month: -11.2%

Consensus Forecast, Ex-Autos: -8.6%

Consensus Forecast, Ex-Autos, Ex-Gas: -7.6%

Consensus Forecast, Control Group: -3.7%

Retail sales plunged 8.7 percent in March though buying of staples helped the control group, at 1.9 percent, post a strong monthly gain. For April, with declines for autos, gasoline and restaurants assured, forecasters see total sales falling 11.2 percent with ex-auto sales down 8.6 percent and ex-auto ex-gas sales down 7.6 percent. For the control group, a 3.7 percent decrease is April's call.

US Industrial Production for April (Fri 13:15 GMT; Fri 09:15 EDT)

Consensus Forecast, Month-to-Month: -11.5%

US Manufacturing Production

Consensus Forecast, Month-to-Month: -11.4%

US Capacity Utilization Rate

Consensus Forecast: 64.1%

Industrial production during March, the first month of significant coronavirus effects, plunged 5.4 percent overall and 6.3 percent for manufacturing. Production for April, the second and more significant month of the effects, is expected to fall 11.5 percent overall and 11.4 percent for manufacturing. Capacity utilization is seen falling to 64.1 percent from 72.7 percent.

|