|

Employment data in Europe and Asia have held remarkably stable, showing for the most part only limited erosion from shutdowns. And though rates of infection in the US have slowed and reopenings have begun, employment hasn't shown any meaningful improvement at all. The Federal Reserve reported in the week that 3 in 10 Americans can't cover their monthly expenses right now even when drawing on savings and credit. This of course points to cascading effects whether for landlords or businesses in what are building risks tied to still catastrophic levels of job losses.

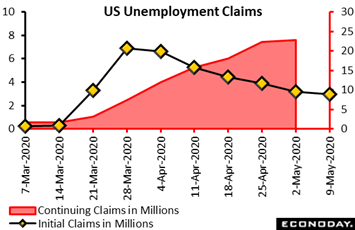

The biggest and most troubling news in the week was initial jobless claims in the US. At 3.0 million in the May 9 week, claims exceeded Econoday's high forecast for 2.6 million though, compared to the prior week, they did fall 195,000 for their sixth straight decline. Over the past eight weeks, 36.5 million Americans have filed initial claims. Showing a bit more improvement were continuing claims which, in lagging data for the May 2 week, came in at 22.8 million and though this is 456,000 higher than the April 25 week it is by far the smallest increase of the shutdown run. The unemployment rate for insured workers rose 3 tenths to 15.7 percent. This report points to a vast gully that continues to be carved out in the US labor market – and no relief is seen at least yet; the consensus for initial claims in the coming week's report are an increase of 2.4 million. The biggest and most troubling news in the week was initial jobless claims in the US. At 3.0 million in the May 9 week, claims exceeded Econoday's high forecast for 2.6 million though, compared to the prior week, they did fall 195,000 for their sixth straight decline. Over the past eight weeks, 36.5 million Americans have filed initial claims. Showing a bit more improvement were continuing claims which, in lagging data for the May 2 week, came in at 22.8 million and though this is 456,000 higher than the April 25 week it is by far the smallest increase of the shutdown run. The unemployment rate for insured workers rose 3 tenths to 15.7 percent. This report points to a vast gully that continues to be carved out in the US labor market – and no relief is seen at least yet; the consensus for initial claims in the coming week's report are an increase of 2.4 million.

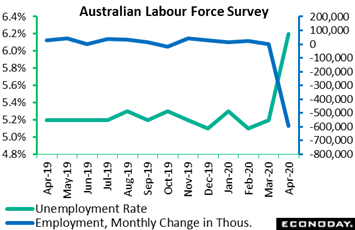

A standard shape that is appearing in the graphs is a hard cross between employment levels going down and unemployment rates going up. Australia's labour survey offers the latest example; employment fell 594,300 in April at the same time that the unemployment rate jumped a full percentage point to 6.2 percent. The active jobless (looking for a job) are counted as part of the labour force, the total size of which contracted 490,000 in the month; this pulled down Australia's participation rate by a steep 2.5 percentage points to 63.5 percent, a level not seen since 2004. And those with a job worked far less in April than March as aggregate hours dropped 9.2 percent. Government wage subsidies have helped limit the damage, but conditions in the labour market are likely to remain very weak until public health measures allow an easing of restrictions. A standard shape that is appearing in the graphs is a hard cross between employment levels going down and unemployment rates going up. Australia's labour survey offers the latest example; employment fell 594,300 in April at the same time that the unemployment rate jumped a full percentage point to 6.2 percent. The active jobless (looking for a job) are counted as part of the labour force, the total size of which contracted 490,000 in the month; this pulled down Australia's participation rate by a steep 2.5 percentage points to 63.5 percent, a level not seen since 2004. And those with a job worked far less in April than March as aggregate hours dropped 9.2 percent. Government wage subsidies have helped limit the damage, but conditions in the labour market are likely to remain very weak until public health measures allow an easing of restrictions.

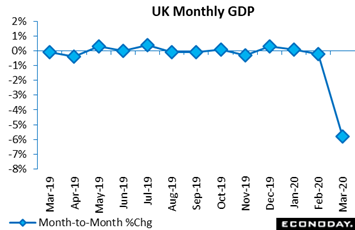

Employment is the most essential measure of an economy followed by GDP, and forecasts of what to expect for the second quarter, across global economies, vary widely though vast contraction is assured. Led by a 5.8 percent monthly fall in March, real GDP in the UK contracted at a 2.0 percent quarterly rate, in line with market expectations and the steepest decline since the fourth quarter of 2008. Compared with a year ago, total output was down 1.6 percent, its largest fall since the fourth quarter of 2009. Among the main expenditure components, private and government consumption as well as net foreign trade subtracted from quarterly growth leaving only gross capital formation to make a positive contribution. Household consumption dropped 1.7 percent as higher spending on food and other essentials was more than offset by decreases elsewhere. Gross fixed capital formation was down 1.0 percent with business investment flat. General government consumption was off 2.6 percent, in large part due to reduced expenditures on health and education. Exports collapsed 10.8 percent or more than double the 5.3 percent fall posted by imports, as net foreign trade subtracted nearly 2.0 percentage points. Employment is the most essential measure of an economy followed by GDP, and forecasts of what to expect for the second quarter, across global economies, vary widely though vast contraction is assured. Led by a 5.8 percent monthly fall in March, real GDP in the UK contracted at a 2.0 percent quarterly rate, in line with market expectations and the steepest decline since the fourth quarter of 2008. Compared with a year ago, total output was down 1.6 percent, its largest fall since the fourth quarter of 2009. Among the main expenditure components, private and government consumption as well as net foreign trade subtracted from quarterly growth leaving only gross capital formation to make a positive contribution. Household consumption dropped 1.7 percent as higher spending on food and other essentials was more than offset by decreases elsewhere. Gross fixed capital formation was down 1.0 percent with business investment flat. General government consumption was off 2.6 percent, in large part due to reduced expenditures on health and education. Exports collapsed 10.8 percent or more than double the 5.3 percent fall posted by imports, as net foreign trade subtracted nearly 2.0 percentage points.

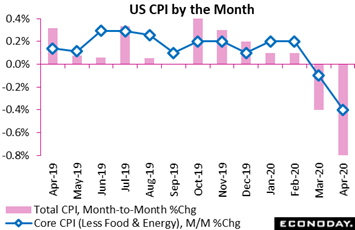

Though employment and GDP are key measures, inflation data – or rather deflation data nowadays – offer their own indisputable measures of demand, or its lack thereof. US consumer prices fell an as-expected 0.8 percent in April while the core rate, which excludes food and energy, dropped an unexpected 0.4 percent. This is an unusually steep decline for this core reading -- in fact the steepest decline in 63 years of records. Gasoline, falling 20.6 percent compared to March, pulled the results down the most and that was just the tip of the iceberg. Apparel, vehicle insurance, airline fares, used vehicles, recreation, and lodging away from home all fell sharply as well. What's moving up is food at home which started its price climb in February and which, up a monthly 2.6 percent in April, posted its sharpest increase since the inflation run of 1974. All six major grocery store readings increased at least 1.5 percent on the month. Less choppy were shelter costs which, outside of lodging, posted stable gains of 0.2 percent for both rent and homeowners. Medical care services, at the frontline of the pandemic, have also been on the rise, posting a second straight monthly 0.5 percent increase with the yearly rate at 5.8 percent. Yearly rates elsewhere, however, are increasingly shrinking, at only plus 0.3 percent overall and a 9-year low of plus 1.4 percent for the core, which for policy makers, is the most important price reading of all. Though employment and GDP are key measures, inflation data – or rather deflation data nowadays – offer their own indisputable measures of demand, or its lack thereof. US consumer prices fell an as-expected 0.8 percent in April while the core rate, which excludes food and energy, dropped an unexpected 0.4 percent. This is an unusually steep decline for this core reading -- in fact the steepest decline in 63 years of records. Gasoline, falling 20.6 percent compared to March, pulled the results down the most and that was just the tip of the iceberg. Apparel, vehicle insurance, airline fares, used vehicles, recreation, and lodging away from home all fell sharply as well. What's moving up is food at home which started its price climb in February and which, up a monthly 2.6 percent in April, posted its sharpest increase since the inflation run of 1974. All six major grocery store readings increased at least 1.5 percent on the month. Less choppy were shelter costs which, outside of lodging, posted stable gains of 0.2 percent for both rent and homeowners. Medical care services, at the frontline of the pandemic, have also been on the rise, posting a second straight monthly 0.5 percent increase with the yearly rate at 5.8 percent. Yearly rates elsewhere, however, are increasingly shrinking, at only plus 0.3 percent overall and a 9-year low of plus 1.4 percent for the core, which for policy makers, is the most important price reading of all.

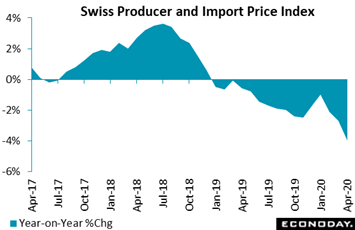

Producer price reports don't often get much attention but they may as deflation concerns build. The combined producer and import price index for Switzerland fell 1.3 percent on the month in April following a 0.3 percent drop in March. April's decline steepened the annual rate from minus 2.7 percent to 4.0 percent as tracked in the graph, reflecting lower prices for both domestic and imported goods. The domestic PPI was down 0.6 percent versus March, trimming its yearly rate by 0.6 percentage points to minus 2.0 percent. At the same time, its import counterpart declined a sizeable 2.9 percent, reducing its annual rate from minus 5.2 percent to minus 7.8 percent. The monthly change in the PPI was dominated by petrol where prices slumped 31.0 percent and alone subtracted nearly 0.3 percentage points. Apart from waste and recycling (minus 9.7 percent), most other categories were relatively stable and, despite the virus, food and tobacco charges were only flat. Producer price reports don't often get much attention but they may as deflation concerns build. The combined producer and import price index for Switzerland fell 1.3 percent on the month in April following a 0.3 percent drop in March. April's decline steepened the annual rate from minus 2.7 percent to 4.0 percent as tracked in the graph, reflecting lower prices for both domestic and imported goods. The domestic PPI was down 0.6 percent versus March, trimming its yearly rate by 0.6 percentage points to minus 2.0 percent. At the same time, its import counterpart declined a sizeable 2.9 percent, reducing its annual rate from minus 5.2 percent to minus 7.8 percent. The monthly change in the PPI was dominated by petrol where prices slumped 31.0 percent and alone subtracted nearly 0.3 percentage points. Apart from waste and recycling (minus 9.7 percent), most other categories were relatively stable and, despite the virus, food and tobacco charges were only flat.

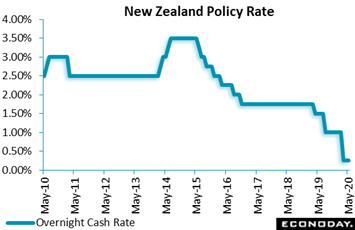

Monetary policy has not been a major market mover in recent weeks following the complete deluge of stimulus efforts unleashed by global central banks back in March. But there was news in the week from Jerome Powell who ruled out the possibility of negative rates, saying all 17 members of the Fed's board believe sub-zero policy is ineffective, hurting banking profits and limiting credit flow to borrowers. Like the Fed, the Reserve Bank of New Zealand is also keeping its policy rate in the plus column, at 0.25 percent. The bank held the rate steady on Tuesday but nearly doubled the upper limit its asset purchase program from NZ$33 billion to NZ$60 billion. Officials said the pandemic's impact on the domestic economy has already been severe and is expected to persist. Monetary policy has not been a major market mover in recent weeks following the complete deluge of stimulus efforts unleashed by global central banks back in March. But there was news in the week from Jerome Powell who ruled out the possibility of negative rates, saying all 17 members of the Fed's board believe sub-zero policy is ineffective, hurting banking profits and limiting credit flow to borrowers. Like the Fed, the Reserve Bank of New Zealand is also keeping its policy rate in the plus column, at 0.25 percent. The bank held the rate steady on Tuesday but nearly doubled the upper limit its asset purchase program from NZ$33 billion to NZ$60 billion. Officials said the pandemic's impact on the domestic economy has already been severe and is expected to persist.

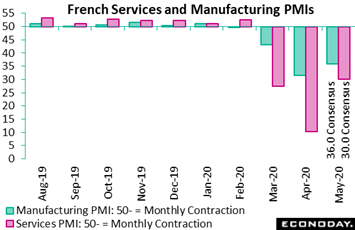

The coming week's highlights will be on Thursday with a host of purchasing managers reports that will offer early indications on May. Expectations are generally looking for slight improvement but at still deeply contractionary levels. An exception is France, where significant improvement is seen for the services PMI, at a consensus 30.0 which of course is very low but would be well up from April's frightfully low 10.4 score. Services have fared the worst in these reports reflecting sweeping declines in restaurants, accommodation, and retail. The coming week's highlights will be on Thursday with a host of purchasing managers reports that will offer early indications on May. Expectations are generally looking for slight improvement but at still deeply contractionary levels. An exception is France, where significant improvement is seen for the services PMI, at a consensus 30.0 which of course is very low but would be well up from April's frightfully low 10.4 score. Services have fared the worst in these reports reflecting sweeping declines in restaurants, accommodation, and retail.

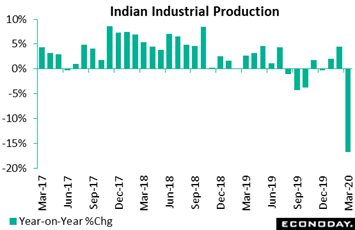

One great positive of the PMIs is that, not only are they released late in the month for the current month, but that they've continued to be released, at least so far, without interruption. The same can't be said for India as the nation's statistics office, the Ministry of Statistics and Programme Implementation, failed to post both the consumer price and wholesale price reports. Yet industrial production was released, falling 16.7 percent on the year in March versus growth of 4.5 percent in February as the pandemic began to take hold. Manufacturing output, which accounts for the bulk of the index, slumped 20.6 percent on the year after February's 3.2 percent rise. Previously released PMI data for April showed sharp contraction for manufacturing. The Reserve Bank of India, like others, is on the record saying it will do "whatever is necessary" to help the economy. One great positive of the PMIs is that, not only are they released late in the month for the current month, but that they've continued to be released, at least so far, without interruption. The same can't be said for India as the nation's statistics office, the Ministry of Statistics and Programme Implementation, failed to post both the consumer price and wholesale price reports. Yet industrial production was released, falling 16.7 percent on the year in March versus growth of 4.5 percent in February as the pandemic began to take hold. Manufacturing output, which accounts for the bulk of the index, slumped 20.6 percent on the year after February's 3.2 percent rise. Previously released PMI data for April showed sharp contraction for manufacturing. The Reserve Bank of India, like others, is on the record saying it will do "whatever is necessary" to help the economy.

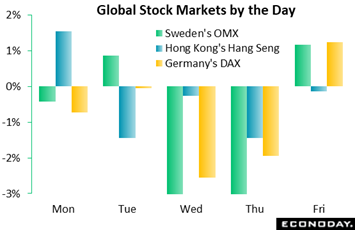

Infection rates aren't always correlating with stock market movements. Stocks in Sweden, where lockdown provisions are minimal, have been outperforming other countries, with a year-on-year decline of only 6.3 percent though the OMX did post a 4.5 percent decline in the week. But infections in Sweden have been climbing steadily and may explain at least part of the weekly loss. Hong Kong is doing among the best of any in controlling the virus though the Hang Seng, so far, is performing only slightly better than others, down 14.9 percent from this time last year including a 1.8 percent decline in the latest week. Another index to watch is Germany's DAX, down 13.5 percent on the year and down 4.0 percent on the week as the country has begun limited reopenings. German virus cases have continued to climb though the rate of increase has generally slowed over the past month. How the country's infection rate moves over the next several weeks will be key to more than just the stock markets; it will be key on whether and how fast other countries also reopen. Infection rates aren't always correlating with stock market movements. Stocks in Sweden, where lockdown provisions are minimal, have been outperforming other countries, with a year-on-year decline of only 6.3 percent though the OMX did post a 4.5 percent decline in the week. But infections in Sweden have been climbing steadily and may explain at least part of the weekly loss. Hong Kong is doing among the best of any in controlling the virus though the Hang Seng, so far, is performing only slightly better than others, down 14.9 percent from this time last year including a 1.8 percent decline in the latest week. Another index to watch is Germany's DAX, down 13.5 percent on the year and down 4.0 percent on the week as the country has begun limited reopenings. German virus cases have continued to climb though the rate of increase has generally slowed over the past month. How the country's infection rate moves over the next several weeks will be key to more than just the stock markets; it will be key on whether and how fast other countries also reopen.

Japanese Prime Minister Shinzo Abe didn't mince words in the week, saying the global economy is facing a "once-in-a-century crisis" that dwarfs the Lehman shock a dozen years ago. He warned that the world's multinational corporations are being hurt badly, in turn raising the risk of cascading bankruptcies. Yet fiscal and monetary policy across the world, including Japan, has been ramped up quickly to limit such risks. And however much the world has failed to hold back the pandemic, at least economic policy makers have done their share.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Big news of the week will be early indications on May activity from a Thursday run of purchasing managers surveys, first from Japan followed by France, Germany, the Eurozone and the US. These will offer initial evidence on the economic effects of limited reopenings underway in some countries including France and Germany. US housing data will also be worth watching to see how badly April shutdowns pulled starts and permits lower on Tuesday and existing home sales down on Thursday. April damage in the UK will also be posted with the labour market report on Tuesday and retail sales on Thursday; April damage in Japan will include merchandise trade on Thursday and consumer prices on Friday. But the biggest news of all will be the usual: US jobless claims on Thursday amid expectations for yet another week of paralyzing losses.

Japanese GDP First Quarter Advance (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Quarter-over-Quarter: -1.2%

The advance estimate for first-quarter GDP is expected to fall a quarterly 1.2 percent versus a 1.8 percent decline in the final estimate for the fourth quarter (revised from minus 1.6 percent in the advance report).

UK Labour Market Report (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, Claimant Count for April: 100,000

Consensus Forecast, ILO Unemployment Rate for March: 4.4%

Claimant count joblessness for April, when coronavirus effects made their full appearance, are expected to total 100,000 versus March's much lower-than-expected increase of 12,100. The ILO employment rate, in data for the three months to March, is expected at 4.4 percent versus 4.0 percent in the last report.

US Housing Starts for April (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Annual Rate: 0.968 million

US Building Permits

Consensus Forecast: 1.033 million

March ended a long run of strong growth for residential construction and April is expected to show a deep trough. Starts are expected to come in at a 0.968 million annual rate versus March's 1.216 million with permits seen at 1.033 million versus 1.353 million.

Japanese Merchandise Trade for April (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast: -¥400 billion

Consensus Forecast, Imports Year-over-Year: -13.0%

Consensus Forecast, Exports Year-over-Year: -23.0%

Both Japanese imports and exports, which were already in deep contraction long before the coronavirus, fell deeper into contraction on the virus's first effects. After falling a year-on-year 11.7 percent in March, exports in April are expected to fall 23.0 percent with imports, which in March were down 5.0 percent, expected to fall 13.0 percent. A deficit of ¥400 billion is expected for April versus a surplus of ¥4.9 billion in February.

Japanese Composite PMI Flash for May (Thu 00:30 GMT; Thu 09:30 JST; Wed 20:30 EDT)

Consensus Forecast, Manufacturing: 32.4

Consensus Forecast, Services: 22.1

Forecasters see Japan's PMIs in May showing no improvement from April's deep virus-driven contraction: manufacturing at a 32.4 consensus versus 41.9 in April (revised from 37.8 flash) and the services consensus at 22.1 versus 21.5 (revised from 22.8 flash).

UK Retail Sales for April (Thu 06:00 GMT; Thu 07:00 BST; Thu 02:00 EDT)

Consensus Forecast, Month-to-Month: -12.0%

In the stricken month of April, UK retail sales are expected to fall a monthly 12.0 percent after dropping 5.1 percent in March on the initial effects of the virus.

UK: CIPS/PMI Composite Flash for May (Thu 08:30 GMT; Thu 09:30 BST; Thu 04:30 EDT)

Consensus Forecast, Manufacturing: 33.0

Consensus Forecast, Services: 15.0

Services in the UK's CIPS/PMI report, like those from other countries, have fallen into a much deeper trough than manufacturing. And only marginally less contraction for services is expected for May where the consensus is 15.0 versus April's 12.3 with contraction in manufacturing expected at 33.0 versus 32.9.

French PMI Composite Flash for May (Thu 07:15 GMT; Thu 09:15 CEST; Thu 03:15 EDT)

Consensus Forecast, Manufacturing: 36.0

Consensus Forecast, Services: 30.0

At a consensus 30.0, France's PMI services flash for May is expected to improve sharply from April's astonishingly depressed 10.4 (revised from 10.4 flash). The manufacturing flash in May is seen slightly higher 36.0 versus April's 31.5.

German PMI Composite Flash for May (Thu 07:30 GMT; Thu 09:30 CEST; Thu 03:30 EDT)

Consensus Forecast, Manufacturing: 41.0

Consensus Forecast, Services: 26.0

Germany's services PMI is expected to improve but remain well under the breakeven 50 level, to a consensus 26.0 versus April's very depressed 15.9. The manufacturing PMI, which has deteriorated severely but still much less so than services, is seen at 41.0 versus 34.4.

Eurozone PMI Composite Flash for May (Thu 08:00 GMT; Thu 10:00 CEST; Thu 04:00 EDT)

Consensus Forecast, Manufacturing: 38.0

Consensus Forecast, Services: 25.0

The Eurozone's services sample reported overwhelming contraction in April, at an index level of only 11.7. Manufacturing contracted less severely at 33.6. For May, forecasters see services at 25.0 and manufacturing at 38.0.

US Initial Jobless Claims for May 16 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 2.375 million

Levels of initial claims have been staggering and barely slowing. Econoday's consensus for the May 16 week is for 2.375 million versus 2.981 million in the May 16 week.

US PMI Composite Flash for May (Thu 13:45 GMT; Thu 09:45 EDT)

Consensus Forecast, Manufacturing: 37.5

Consensus Forecast, Services: 30.0

Components across the PMI report showed unprecedented weakness in April with outlooks the most pessimistic on record. For May, forecasters are looking for an index of 30.0 for services versus April's 26.7 (revised from a 27.0 flash) with manufacturing seen at 37.5 versus 36.1 in April (revised from a 36.9 flash).

US Existing Home Sales for April (Thu 14:00 GMT; Thu 10:00 EDT)

Consensus Forecast, Annual Rate: 4.325 million

Existing home sales in the US fell 8.5 percent in the initial virus effects of March and are expected to fall 17.9 percent to a 4.325 million annual rate in the full effects of April.

Japanese Consumer Price Index for April (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast Ex-Food, Year-on-Year: -0.1%

Deflationary pressures are expected to appear, though only marginally, in the virus month of April. Consensus for year-on-year consumer prices is seen at minus 0.1 percent versus plus 0.4 percent in both March and February. |