|

The surge of spontaneous funds being generated by global central banks ultimately needs to be balanced against a revival in output, otherwise the risk of substantial financial imbalances (more cash chasing around fewer goods and services) would appear certain to rise, to say the least. Though the great economic hole is proving very deep, the outlook for its length would appear to be shortening given global reopenings that are already underway or about to start. But this assessment is all about the virus, not about new risks of instability and whether China's about to annex Hong Kong. But first things first and that's the supply side of the global economy.

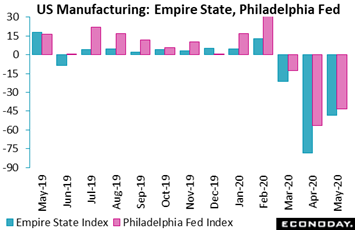

The first indications of May conditions in the US manufacturing sector came in the prior week from the Empire State index that showed steep contraction, at minus 48.5, that was only moderately less disastrous than the minus 78.2 in April. A second regional Fed report in the latest week confirmed this indication as the Philadelphia Fed's manufacturing index crawled a bit out of the hole to minus 43.1 for a 13.5 point improvement from April's total collapse. Yet 15 percent of the sample in May did report an outright month-to-month increase in general activity which does raise hope that at least the very worst may be over. And some the sample (9 percent) is actually hiring this month compared to no hiring at all last month. Hope springs eternal and however bad the numbers remain, 62 percent of Philadelphia's sample sees conditions improving over the next six months compared to only 13 percent who sees declines. If May marks a beginning of a trend, then April will have proven, at least perhaps for the US, to be the worst of the virus crisis. The first indications of May conditions in the US manufacturing sector came in the prior week from the Empire State index that showed steep contraction, at minus 48.5, that was only moderately less disastrous than the minus 78.2 in April. A second regional Fed report in the latest week confirmed this indication as the Philadelphia Fed's manufacturing index crawled a bit out of the hole to minus 43.1 for a 13.5 point improvement from April's total collapse. Yet 15 percent of the sample in May did report an outright month-to-month increase in general activity which does raise hope that at least the very worst may be over. And some the sample (9 percent) is actually hiring this month compared to no hiring at all last month. Hope springs eternal and however bad the numbers remain, 62 percent of Philadelphia's sample sees conditions improving over the next six months compared to only 13 percent who sees declines. If May marks a beginning of a trend, then April will have proven, at least perhaps for the US, to be the worst of the virus crisis.

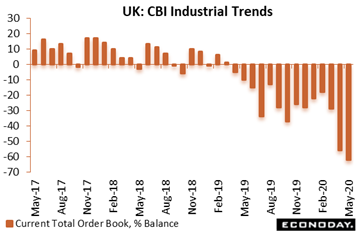

The very worst may also be over for UK manufacturing as well but conditions right now are nevertheless horrible, evident in the May survey from the Confederation of British Industry. The headline orders index slipped further to minus 62 percent from minus 56 percent in April for the weakest showing since all the way back in October 1981. Past output (minus 54 percent after minus 21 percent) posted a new all-time low as production collapsed for motor vehicles & transport and food, drink & tobacco. Expectations for the coming quarter (minus 49 percent after minus 67 percent) did show improvement but were still among the most pessimistic on record. Reflecting the lack of demand, expected prices were cut even further and, down 9 percentage points to minus 20, are now seen falling at the fastest pace since April 2009. For manufacturers, however much the worst of the coronavirus effects may or may not be over – near-term prospects are still grim. The very worst may also be over for UK manufacturing as well but conditions right now are nevertheless horrible, evident in the May survey from the Confederation of British Industry. The headline orders index slipped further to minus 62 percent from minus 56 percent in April for the weakest showing since all the way back in October 1981. Past output (minus 54 percent after minus 21 percent) posted a new all-time low as production collapsed for motor vehicles & transport and food, drink & tobacco. Expectations for the coming quarter (minus 49 percent after minus 67 percent) did show improvement but were still among the most pessimistic on record. Reflecting the lack of demand, expected prices were cut even further and, down 9 percentage points to minus 20, are now seen falling at the fastest pace since April 2009. For manufacturers, however much the worst of the coronavirus effects may or may not be over – near-term prospects are still grim.

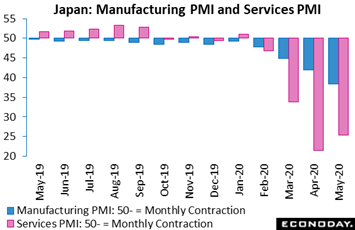

Direct virus effects in Japan, where closings are only beginning, had been less visible than other countries. The PMI flashes for May showed increasing contraction for manufacturing (blue bars) but slightly easing though extremely deep contraction for services (red bars). The manufacturing flash fell another 2.5 points to 38.4 to extend a run of contraction that has been deepening steadily and significantly since February. Respondents reported that output, new orders, and new export orders all fell in May at a steeper pace than in April, with employment and business sentiment also indicating further weakness. But if Japanese manufacturers are still falling into the hole, Japanese service providers may have at least found a bottom. The services flash rose nearly 4 points to a still deeply contractionary 25.3. Here respondents reported smaller but still steep declines in output, new orders, and business sentiment and an increasing decline for employment. Direct virus effects in Japan, where closings are only beginning, had been less visible than other countries. The PMI flashes for May showed increasing contraction for manufacturing (blue bars) but slightly easing though extremely deep contraction for services (red bars). The manufacturing flash fell another 2.5 points to 38.4 to extend a run of contraction that has been deepening steadily and significantly since February. Respondents reported that output, new orders, and new export orders all fell in May at a steeper pace than in April, with employment and business sentiment also indicating further weakness. But if Japanese manufacturers are still falling into the hole, Japanese service providers may have at least found a bottom. The services flash rose nearly 4 points to a still deeply contractionary 25.3. Here respondents reported smaller but still steep declines in output, new orders, and business sentiment and an increasing decline for employment.

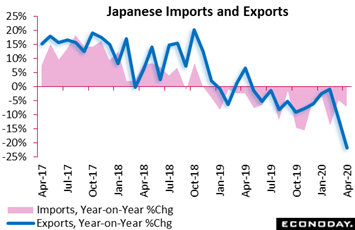

Contraction underway in manufacturing and services does not look to be contained by improvement in cross-border trade, rather the opposite amid general xenophobia tied to the virus, already established trade tensions (whether US-China or UK-Europe) and the risk of new and greater tensions given China's intentions for Hong Kong. Japan's merchandise trade balance shifted from a surplus of ¥5.4 billion in March to a deficit of ¥930 billion in April, much deeper than the consensus for a deficit of ¥400 billion. Exports fell 21.9 percent on the year in April after dropping 11.7 percent in March, with demand once again weak across most major trading partners especially the US, the European Union, and south-east Asian countries. Japanese imports fell 7.2 percent on the year in April after dropping 5.0 percent previously, driven down by a much bigger fall in both the volume and value of petroleum imports. Contraction underway in manufacturing and services does not look to be contained by improvement in cross-border trade, rather the opposite amid general xenophobia tied to the virus, already established trade tensions (whether US-China or UK-Europe) and the risk of new and greater tensions given China's intentions for Hong Kong. Japan's merchandise trade balance shifted from a surplus of ¥5.4 billion in March to a deficit of ¥930 billion in April, much deeper than the consensus for a deficit of ¥400 billion. Exports fell 21.9 percent on the year in April after dropping 11.7 percent in March, with demand once again weak across most major trading partners especially the US, the European Union, and south-east Asian countries. Japanese imports fell 7.2 percent on the year in April after dropping 5.0 percent previously, driven down by a much bigger fall in both the volume and value of petroleum imports.

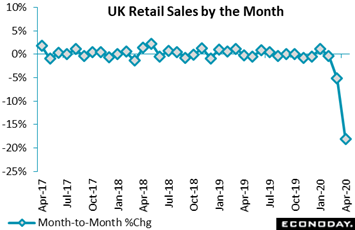

Global trade is an in-between area in the distinction of supply versus demand; some imports and exports are components for final products while some are final products themselves. Let's turn to the consumption of final consumer products and the latest from the UK where the news, like elsewhere, is uniformly bad. Having already nosedived in March, retail volumes collapsed a record 18.1 percent on the month during April. Excluding auto fuel, the story was much the same with sales down 15.2 percent. And in contrast to March when overall sales found some support from panic buying of essentials, weakness in April was broad-based: food down 4.1 percent, household goods down 45.4 percent, textiles & clothing down 50.2 percent. The proportion of total sales attributed to online purchases rose to 30.7 percent, easily the highest on record and more than 11 percentage points above its level a year ago. The limited easing of some restrictions in the UK should provide a small boost to May, offset however by rapidly rising unemployment and trouble ahead for household finances. Global trade is an in-between area in the distinction of supply versus demand; some imports and exports are components for final products while some are final products themselves. Let's turn to the consumption of final consumer products and the latest from the UK where the news, like elsewhere, is uniformly bad. Having already nosedived in March, retail volumes collapsed a record 18.1 percent on the month during April. Excluding auto fuel, the story was much the same with sales down 15.2 percent. And in contrast to March when overall sales found some support from panic buying of essentials, weakness in April was broad-based: food down 4.1 percent, household goods down 45.4 percent, textiles & clothing down 50.2 percent. The proportion of total sales attributed to online purchases rose to 30.7 percent, easily the highest on record and more than 11 percentage points above its level a year ago. The limited easing of some restrictions in the UK should provide a small boost to May, offset however by rapidly rising unemployment and trouble ahead for household finances.

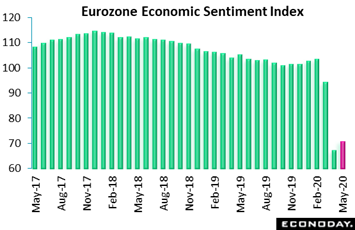

Sentiment data in the past week included Germany's ZEW survey of financial experts that showed a little greater severity in contraction. But that's not the expectation for a heavy run of sentiment readings slated for the coming week including the EC's economic sentiment index on Thursday. This sample is a mix of both businesses and consumers and here the consensus, as highlighted by the red column in the graph, is for slight improvement to 70.5 from April's 67.0. Results in April were the weakest in Spain, followed by France, and then Germany. Italy wasn't computed because the relevant data, due to lockdowns, couldn't be gathered. Sentiment data in the past week included Germany's ZEW survey of financial experts that showed a little greater severity in contraction. But that's not the expectation for a heavy run of sentiment readings slated for the coming week including the EC's economic sentiment index on Thursday. This sample is a mix of both businesses and consumers and here the consensus, as highlighted by the red column in the graph, is for slight improvement to 70.5 from April's 67.0. Results in April were the weakest in Spain, followed by France, and then Germany. Italy wasn't computed because the relevant data, due to lockdowns, couldn't be gathered.

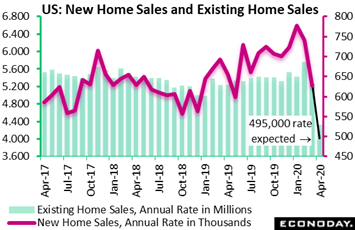

And there are hints of demand-side hope also coming out of the US housing sector. "Demand is still out there" was in fact the conclusion of the National Association of Realtors whose existing home sales report, though showing a nearly 18 percent monthly drop in April sales, still showed significant life. April's 4.330 million annual rate was right on Econoday's consensus for 4.325 million, and though this was the lowest rate in nearly 9 years it does confirm that a significant number of deals are being done. And prices really showed that there's life with the median up 2.2 percent in the month to a record high $286,800. Virus or not, sellers weren't conceding anything in April. The number of resales on the market did fall 1.3 percent to 1.470 million but relative to sales, at 4.1 months versus March's 3.4 months, supply indicates that there are plenty of choices right now for prospective buyers to choose from, which will be a plus for May sales. And there are hints of demand-side hope also coming out of the US housing sector. "Demand is still out there" was in fact the conclusion of the National Association of Realtors whose existing home sales report, though showing a nearly 18 percent monthly drop in April sales, still showed significant life. April's 4.330 million annual rate was right on Econoday's consensus for 4.325 million, and though this was the lowest rate in nearly 9 years it does confirm that a significant number of deals are being done. And prices really showed that there's life with the median up 2.2 percent in the month to a record high $286,800. Virus or not, sellers weren't conceding anything in April. The number of resales on the market did fall 1.3 percent to 1.470 million but relative to sales, at 4.1 months versus March's 3.4 months, supply indicates that there are plenty of choices right now for prospective buyers to choose from, which will be a plus for May sales.

Hong Kong is in the cross hairs right now and its economy was, like others, already staggering. Yet inflation there, as in China, was still posting higher rates of yearly growth than others. Yet consumer prices in Hong Kong did slow to a 1.9 percent year-on-year rise in April, down from 2.3 percent in March as tracked in the graph. Excluding the impact of various government measures, mainly aimed at providing rent and fuel support to low-income households, Hong Kong's underlying inflation rate fell from 2.6 percent in March to 2.3 percent in April. Officials in Hong Kong expect inflation to moderate further in coming months given weakness in domestic and external activity and prior currency appreciation which, of course, was limited by a strict exchange rate mechanism that keeps the Hong Kong dollar within a narrow HK$7.75-7.85 band against the dollar. As China's clamp down begins, Hong Kong's currency peg along with its status as a global financial center are certain to be tested. Hong Kong is in the cross hairs right now and its economy was, like others, already staggering. Yet inflation there, as in China, was still posting higher rates of yearly growth than others. Yet consumer prices in Hong Kong did slow to a 1.9 percent year-on-year rise in April, down from 2.3 percent in March as tracked in the graph. Excluding the impact of various government measures, mainly aimed at providing rent and fuel support to low-income households, Hong Kong's underlying inflation rate fell from 2.6 percent in March to 2.3 percent in April. Officials in Hong Kong expect inflation to moderate further in coming months given weakness in domestic and external activity and prior currency appreciation which, of course, was limited by a strict exchange rate mechanism that keeps the Hong Kong dollar within a narrow HK$7.75-7.85 band against the dollar. As China's clamp down begins, Hong Kong's currency peg along with its status as a global financial center are certain to be tested.

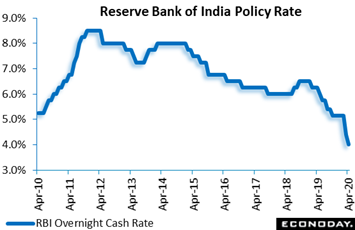

A sign of the mounting stress in Asia was unscheduled central bank activity at week's end including new stimulus from the Bank of Japan which, to encourage additional lending to borrowers, will be providing an additional ¥30 trillion ($280 billion) to financial institutions at zero interest. This was followed by the Reserve Bank of India which cut its main policy rate by 40 basis points to 4.0 percent reflecting the bank's assessment that the economic impact of Covid-19 has already been more severe than expected. Officials cited monthly data showing a significant contraction in both production and demand. Although officials in India believe that recent policy measures could result in a "gradual revival" in economic activity, they also consider risks to be high and skewed to the downside. A sign of the mounting stress in Asia was unscheduled central bank activity at week's end including new stimulus from the Bank of Japan which, to encourage additional lending to borrowers, will be providing an additional ¥30 trillion ($280 billion) to financial institutions at zero interest. This was followed by the Reserve Bank of India which cut its main policy rate by 40 basis points to 4.0 percent reflecting the bank's assessment that the economic impact of Covid-19 has already been more severe than expected. Officials cited monthly data showing a significant contraction in both production and demand. Although officials in India believe that recent policy measures could result in a "gradual revival" in economic activity, they also consider risks to be high and skewed to the downside.

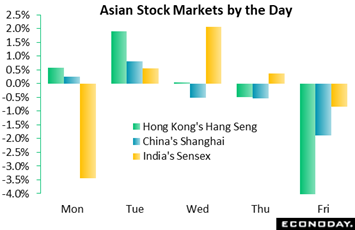

China's initial move to impose social order on Hong Kong adds a thick layer of risk to a global outlook where risks were already unprecedented. Even with unlimited fiscal and monetary stimulus from all directions, could this be good news for Asian stock markets? Hong Kong's Hang Seng fell 3.6 percent in the week that included an understandable 5.6 percent plunge on Friday after China made its intentions known. China's Shanghai also fell on Friday, down 1.9 percent to equal the full week's decline for this index. Year-to-date, the Hang Seng is near the very bottom of the global stock indexes with a 18.7 percent drop. But showing even greater weakness is India's Sensex which is down 25.6 percent year-to-date following the current week's 1.4 percent decline. The Hang Seng, due to China, and the Sensex, due to the coronavirus, are areas of general concern for the stability of the global financial markets. China's initial move to impose social order on Hong Kong adds a thick layer of risk to a global outlook where risks were already unprecedented. Even with unlimited fiscal and monetary stimulus from all directions, could this be good news for Asian stock markets? Hong Kong's Hang Seng fell 3.6 percent in the week that included an understandable 5.6 percent plunge on Friday after China made its intentions known. China's Shanghai also fell on Friday, down 1.9 percent to equal the full week's decline for this index. Year-to-date, the Hang Seng is near the very bottom of the global stock indexes with a 18.7 percent drop. But showing even greater weakness is India's Sensex which is down 25.6 percent year-to-date following the current week's 1.4 percent decline. The Hang Seng, due to China, and the Sensex, due to the coronavirus, are areas of general concern for the stability of the global financial markets.

Supply and demand in the global economy are in balance, both hit with the same sudden and catastrophic stroke and neither showing much reaction yet to the flood of stimulus underway. Should available supply such as seen in the oil market outstrip demand, deflation would be the expected outcome; should, however, demand begin to rise faster than supply, inflation of course would be the expectation, and here presumably inflation centered in food and essential supplies. The year 2020 will go down as a great calamity for everyone, and especially perhaps for those in Hong Kong.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Sentiment readings will fill a busy global calendar beginning Monday with the Ifo survey from Germany followed on Tuesday with US consumer confidence, on Wednesday by France's business climate indicator and Thursday with Eurozone economic sentiment. Modest improvement for all but at still greatly depressed levels is the general consensus. New home sales in the US will be worth watching on Tuesday following the prior week's resales report that, despite lockdowns, showed resilient levels of demand. May flashes on European consumer prices will be posted late in the week including for Germany on Thursday where, in what may become an emerging trend, monthly deflation and yearly disinflation are the calls. Late in the week will be key April manufacturing updates, first durable goods orders in the US then Japanese industrial production – substantial declines would no surprise. And a substantial decline is the call for German retail sales on Friday which will be followed by numbers on US goods trade where a steady gap could mask major declines on both sides of the import/export ledger. But the most important news of all is certain to be Thursday once again and how many millions of Americans continue to file initial jobless claims.

German Ifo Economic Sentiment for May (Mon 08:00 GMT; Mon 10:00 CEST; Mon 04:00 EDT)

Consensus Forecast: 79.0

Falling a record 11.6 points in April to a record low of 74.3, Germany's Ifo economic sentiment index is expected to improve to 79.0 in May's report.

US Consumer Confidence Index for May (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 88.3

Consumer confidence in the US did drop more than 30 points in April but the level, at 86.9, was still far higher than it was during the financial crisis 12 years ago, and the separation within the report between current conditions (very weak) and expectations (slightly weak) hinted at underlying optimism. For May the call is 88.3.

US New Home Sales for April (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast, Annualized Rate: 495,000

Going into the coronavirus, new home sales were as strong as any indicator on the US calendar, reaching an annual sales peak of 777,000 in January. Sales during the partial lockdown of March came in at a 627,000 rate with April, and a full month of lockdown, seen at 495,000.

French Business Climate Indicator for May (Wed 06:45 GMT; Wed 08:45 CEST; Wed 02:45 EDT)

Consensus Forecast, Manufacturing: 85

On INSEE's measure, French manufacturing sentiment in May is seen at 85 which would follow April's record 16 point plunge to 82.

Eurozone: EC Economic Sentiment for May (Thu 09:00 GMT; Thu 11:00 CEST; Thu 05:00 EDT)

Consensus Forecast: 70.5

After falling sharply in March to 94.2 and especially in April to 67.0, the European Commission's economic sentiment index is expected to come in at 70.5 for May.

German Preliminary CPI for May (Thu 12:00 GMT; Thu 14:00 CEST; Thu 08:00 EDT)

Consensus Forecast, Month-to-Month: -0.1%

Consensus Forecast, Year-over-Year: 0.6%

May consumer prices are expected to decrease 0.1 percent on the month in Germany versus a 0.4 percent rise in April. Year-over-year, the rate is seen falling to plus 0.6 percent from plus 0.9 percent.

US Durable Goods Orders for April (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -18.5%

Consensus Forecast: Ex-Transportation: -14.5%

Consensus Forecast: Core Capital Goods Orders: -8.5%

Reflecting a full month of virus effects, US durable goods orders for April are expected to fall 18.5 percent following March's 14.7 percent plunge (revised from 14.4 percent) that reflected aircraft cancellations and steep contraction for vehicles. Excluding transportation equipment, orders are expected to fall 14.5 percent. The expected monthly decline for core capital goods orders is 8.5 percent.

US Initial Jobless Claims for May 23 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 2.1 million

Levels of initial claims have remained staggering and have been barely slowing. Econoday's consensus for the May 23 week is for 2.1 million versus 2.4 million in the May 16 week.

Japanese Industrial Production for April (Thu 23:50 GMT: Fri 08:50 JST; Thu 19:50 EDT)

Consensus Forecast, Month-to-Month: -5.3%

Industrial production in Japan was already significantly weak even before the coronavirus hit. The month-to-month consensus for April is a decline of 5.3 percent versus a 3.7 percent decline in March. Year-on-year, Japanese industrial production was in 5.2 percent contraction in March.

German Retail Sales for April (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month-to-Month: -11.0%

April retail sales in Germany are expected to fall 11.0 percent versus a 5.6 percent drop in March.

US International Trade In Goods for April (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -$64.7 billion

Forecasters see little change for the April goods trade gap, at a consensus $64.7 billion versus $64.4 billion in March (revised from $64.2 billion). Exports and imports of US goods were approaching year-on-year double-digit contraction going into the full virus lockdown of April.

|