|

Definitive data on May are beginning to come in and are mostly pointing to no greater deterioration from April. Employment outside of North America has been holding up, but not consumer spending which is on a deep global decline. Cross-border trade and global industrial production are stuck in deep contraction, though here and there actual positives can be found in some of the data. We'll start, however, with an assessment of April which of all the months of recorded economic history looks to have been the very worst ever.

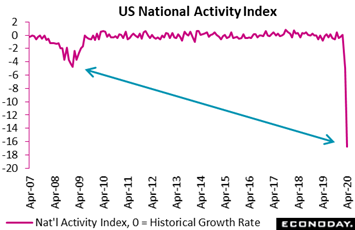

How deep the great hole will prove is anybody's guess. One indication from the United States suggests it may be much deeper than anyone thought. Following March's minus 4.19 when shutdowns first got underway, the national activity index plunged to minus 16.74 during the full-virus impact of April. This is already 16 points below the minus 0.7 recession line and raises the question whether the Chicago Fed, which publishes this index, has worked out yet where the depression line should be. Data for this index, which is a giant composite of 85 separate indexes, goes back to 1967 and no month was ever as bad as April, not even close. Back in 1974 the index skirted along the minus 5 line and nearly so again in 2008 and 2009. This report suggests that second-quarter forecasts may need to be marked down. How deep the great hole will prove is anybody's guess. One indication from the United States suggests it may be much deeper than anyone thought. Following March's minus 4.19 when shutdowns first got underway, the national activity index plunged to minus 16.74 during the full-virus impact of April. This is already 16 points below the minus 0.7 recession line and raises the question whether the Chicago Fed, which publishes this index, has worked out yet where the depression line should be. Data for this index, which is a giant composite of 85 separate indexes, goes back to 1967 and no month was ever as bad as April, not even close. Back in 1974 the index skirted along the minus 5 line and nearly so again in 2008 and 2009. This report suggests that second-quarter forecasts may need to be marked down.

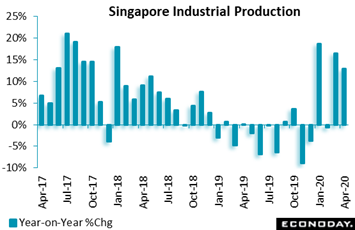

There are of course many more losers than winners when it comes to production, though winners can be spotted here and there. Singapore's output of biochemicals and pharmaceutical ingredients is on fire, up 100 percent on the year in April and providing a key lift to overall industrial production which was up 13 percent on the year. Conditions elsewhere the in manufacturing sector, however, were generally weak with electronics output up only 0.8 percent. Singapore also updated GDP in the week and thanks to biochemicals, the first quarter was revised sharply higher from contraction of 10.6 percent to contraction of 4.7 percent. There are of course many more losers than winners when it comes to production, though winners can be spotted here and there. Singapore's output of biochemicals and pharmaceutical ingredients is on fire, up 100 percent on the year in April and providing a key lift to overall industrial production which was up 13 percent on the year. Conditions elsewhere the in manufacturing sector, however, were generally weak with electronics output up only 0.8 percent. Singapore also updated GDP in the week and thanks to biochemicals, the first quarter was revised sharply higher from contraction of 10.6 percent to contraction of 4.7 percent.

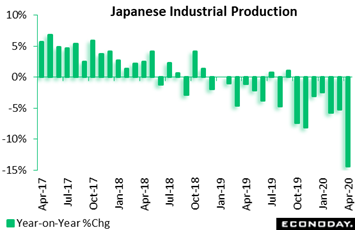

In sharp contrast to Singapore, industrial production in Japan fell very steeply in April, at an annual 14.4 percent versus contraction of 5.2 percent in March. The drop underscores the negative impact of the Covid-19 pandemic on a sector that was already weak at the start of the year. April declines in the output of motor vehicles, transport equipment, and iron, steel & non-ferrous metals outweighed increases in production machinery. Officials last month were actually forecasting that production would rise in April; so for what it's worth they see a sharp fall in May followed by a sharp rebound in June. Previously released PMI survey data suggested that Japanese manufacturing weakened further in May. In sharp contrast to Singapore, industrial production in Japan fell very steeply in April, at an annual 14.4 percent versus contraction of 5.2 percent in March. The drop underscores the negative impact of the Covid-19 pandemic on a sector that was already weak at the start of the year. April declines in the output of motor vehicles, transport equipment, and iron, steel & non-ferrous metals outweighed increases in production machinery. Officials last month were actually forecasting that production would rise in April; so for what it's worth they see a sharp fall in May followed by a sharp rebound in June. Previously released PMI survey data suggested that Japanese manufacturing weakened further in May.

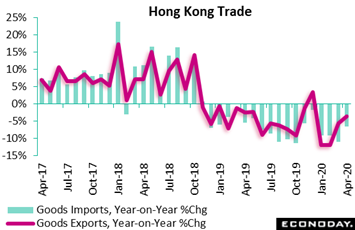

Hong Kong's economy was in contraction going into China's security move, though compared to other economies there have been spots of good news. Hong Kong's merchandise trade deficit narrowed from HK$34.7 billion in March to HK$23.3 billion in April with contraction easing for both exports, down 3.7 percent, and imports, down 6.7 percent. Improved growth in exports reflected year-on-year increases in exports to mainland China, Japan, and Taiwan helping to offset continued weakness in demand from the US and the European Union. Citing virus effects, Hong Kong officials expect exports to remain "under pressure" in coming months. And another factor, civil unrest, may also impact economic activity. Hong Kong's economy was in contraction going into China's security move, though compared to other economies there have been spots of good news. Hong Kong's merchandise trade deficit narrowed from HK$34.7 billion in March to HK$23.3 billion in April with contraction easing for both exports, down 3.7 percent, and imports, down 6.7 percent. Improved growth in exports reflected year-on-year increases in exports to mainland China, Japan, and Taiwan helping to offset continued weakness in demand from the US and the European Union. Citing virus effects, Hong Kong officials expect exports to remain "under pressure" in coming months. And another factor, civil unrest, may also impact economic activity.

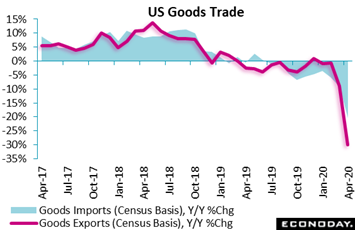

Perhaps no country is suffering as badly on trade as the US. Virus effects caused extreme contraction in both the export and import of goods in April, down 25.2 percent and 14.3 percent on the month respectively and, as tracked in the graph, down 29.9 percent and 20.6 percent year-on-year. Exports showed broad declines across categories especially vehicles. Food exports outperformed, falling only slightly in the month. Imports also posted wide declines, again especially for vehicles. In contrast to the collapse in cross-border flows, the net change in the goods balance was not dramatic, at a deficit of $69.7 billion versus $65.0 billion in March and $71.8 billion in April last year. Perhaps no country is suffering as badly on trade as the US. Virus effects caused extreme contraction in both the export and import of goods in April, down 25.2 percent and 14.3 percent on the month respectively and, as tracked in the graph, down 29.9 percent and 20.6 percent year-on-year. Exports showed broad declines across categories especially vehicles. Food exports outperformed, falling only slightly in the month. Imports also posted wide declines, again especially for vehicles. In contrast to the collapse in cross-border flows, the net change in the goods balance was not dramatic, at a deficit of $69.7 billion versus $65.0 billion in March and $71.8 billion in April last year.

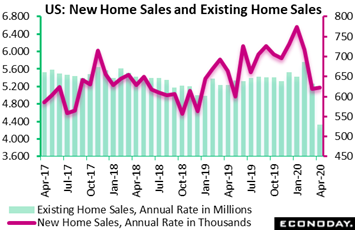

But there is at least one area in the US where you would barely know there was any virus impact at all. New home sales in the US actually rose in April to an unexpected 623,000 annual rate versus 619,000 in the initial virus month of March. Yet this report is notoriously volatile and there's always the risk, especially now, of sizable revisions in the next report for May. And home builders were giving concessions in April as the median price fell sharply to $309,900 from $326,900 in March which compares to a February peak of $331,400 going into the virus. Also in question is the resale market which hasn't held its ground nearly so well, though April's 4.330 million rate was respectable enough given all the trouble. A big positive underway right now in housing, whether new or existing, is a surge in weekly purchase applications submitted to mortgage bankers, now up 9 percent on the year! But there is at least one area in the US where you would barely know there was any virus impact at all. New home sales in the US actually rose in April to an unexpected 623,000 annual rate versus 619,000 in the initial virus month of March. Yet this report is notoriously volatile and there's always the risk, especially now, of sizable revisions in the next report for May. And home builders were giving concessions in April as the median price fell sharply to $309,900 from $326,900 in March which compares to a February peak of $331,400 going into the virus. Also in question is the resale market which hasn't held its ground nearly so well, though April's 4.330 million rate was respectable enough given all the trouble. A big positive underway right now in housing, whether new or existing, is a surge in weekly purchase applications submitted to mortgage bankers, now up 9 percent on the year!

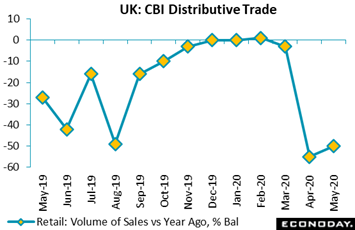

For most economic readings May looks to have been an "in between" month; steady following the collapse of April and steady going into the reopenings and recovery of June. The distributive trades survey from the Confederation of British Industry suggests that conditions were less worse in May than April. At minus 50 percent, the balance of respondents reporting higher volume sales than a year ago was just 5 percentage points above the April low. The CBI's call for June is a cautious improvement to minus 41 percent. Special questions regarding the virus effects found that supply disruptions worsened in May: more retailers now face shortages of some goods (58 percent), increased cost pressures (64 percent), shipping delays (44 percent) and capacity constraints (60 percent). In addition, some 80 percent still indicate cash-flow difficulties although this at least was down from 96 percent in April. The UK government has announced that all retail establishments can reopen on June 15. This of course should provide a boost to sales although the combination of strict social distancing and a probable change in consumer behavior will no doubt put a cap on growth. For most economic readings May looks to have been an "in between" month; steady following the collapse of April and steady going into the reopenings and recovery of June. The distributive trades survey from the Confederation of British Industry suggests that conditions were less worse in May than April. At minus 50 percent, the balance of respondents reporting higher volume sales than a year ago was just 5 percentage points above the April low. The CBI's call for June is a cautious improvement to minus 41 percent. Special questions regarding the virus effects found that supply disruptions worsened in May: more retailers now face shortages of some goods (58 percent), increased cost pressures (64 percent), shipping delays (44 percent) and capacity constraints (60 percent). In addition, some 80 percent still indicate cash-flow difficulties although this at least was down from 96 percent in April. The UK government has announced that all retail establishments can reopen on June 15. This of course should provide a boost to sales although the combination of strict social distancing and a probable change in consumer behavior will no doubt put a cap on growth.

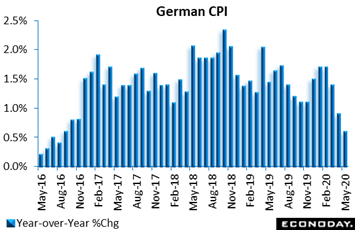

Price behavior is a wild card for the crisis; economists expect to see deflation and consumers increasingly expect to see the opposite, inflation. At least for now, definitive data remain mostly stable though economists seem to be right. German consumer prices dipped 0.1 percent in May versus April, matching expectations and reducing the annual inflation rate from 0.9 percent to 0.6 percent and a 4-year low. Most of the slide in the annual rate, like in April, was due to energy where prices slumped from minus 5.8 percent to minus 8.5 percent. Reflecting this, overall goods inflation turned negative, falling 0.7 percentage points to minus 0.4 percent. By contrast, services were steady at 1.3 percent, within which rents were also unchanged at 1.4 percent. Food, which before the crisis in February was up only 2.3 percent, rose 4.5 percent in May after 4.8 percent in April. But apart from oil and food, the core rates look broadly stable. Price behavior is a wild card for the crisis; economists expect to see deflation and consumers increasingly expect to see the opposite, inflation. At least for now, definitive data remain mostly stable though economists seem to be right. German consumer prices dipped 0.1 percent in May versus April, matching expectations and reducing the annual inflation rate from 0.9 percent to 0.6 percent and a 4-year low. Most of the slide in the annual rate, like in April, was due to energy where prices slumped from minus 5.8 percent to minus 8.5 percent. Reflecting this, overall goods inflation turned negative, falling 0.7 percentage points to minus 0.4 percent. By contrast, services were steady at 1.3 percent, within which rents were also unchanged at 1.4 percent. Food, which before the crisis in February was up only 2.3 percent, rose 4.5 percent in May after 4.8 percent in April. But apart from oil and food, the core rates look broadly stable.

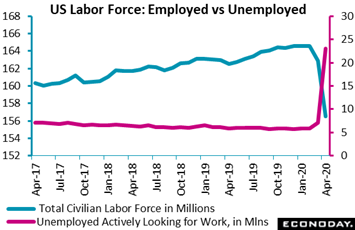

The most important news in the coming week will be employment reports on Friday from the two countries that have suffered by far the worst labor contraction: Canada and the United States. Econoday's May consensus for US nonfarm payroll contraction is 7.725 million, which would be significantly less staggering than April's contraction of 20.5 million. The unemployment rate is seen jumping more than 5 percentage points to a depression-looking 19.8 percent. With reopenings underway, will May's reading prove the worst of it? Turning to the graph and the labor force in April, 4-1/2 years of growth was wiped out in one stroke as the American jobs pie shriveled, falling by 6.4 million to 156.5 million as tracked in the blue line of the graph. Within in this total, the red line breaks out the number of unemployed actively looking for jobs, surging 16.0 million in April to 23.1 million. The most important news in the coming week will be employment reports on Friday from the two countries that have suffered by far the worst labor contraction: Canada and the United States. Econoday's May consensus for US nonfarm payroll contraction is 7.725 million, which would be significantly less staggering than April's contraction of 20.5 million. The unemployment rate is seen jumping more than 5 percentage points to a depression-looking 19.8 percent. With reopenings underway, will May's reading prove the worst of it? Turning to the graph and the labor force in April, 4-1/2 years of growth was wiped out in one stroke as the American jobs pie shriveled, falling by 6.4 million to 156.5 million as tracked in the blue line of the graph. Within in this total, the red line breaks out the number of unemployed actively looking for jobs, surging 16.0 million in April to 23.1 million.

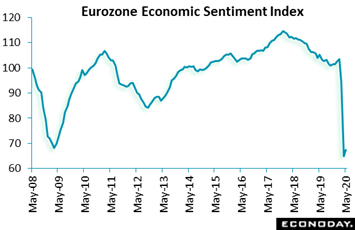

If making back ground will prove to be May's theme, the Europe's economic sentiment index (ESI) didn't make up very much. Following a record 29.3 point slump in April to 64.9, the index clawed back 2.6 points to stand at 67.5. The limited improvement was largely driven by industry, where sentiment rose from minus 32.5 to minus 27.5, and also households which recorded a 3.2 point advance to minus 18.8. Retail and construction showed limited change at deeply negative levels while services, down 5 points to minus 43.6, posted fresh declines. Regionally, national ESIs pointed to less pessimistic morale in France (58.2 after 47.9), Germany (81.7 after 78.7) and Spain (78.0 after 64.7). Italy was unable to compute a value for April due to Covid-19 issues but at 81.0 in May, the country's index didn't compare well to March's 88.1. If making back ground will prove to be May's theme, the Europe's economic sentiment index (ESI) didn't make up very much. Following a record 29.3 point slump in April to 64.9, the index clawed back 2.6 points to stand at 67.5. The limited improvement was largely driven by industry, where sentiment rose from minus 32.5 to minus 27.5, and also households which recorded a 3.2 point advance to minus 18.8. Retail and construction showed limited change at deeply negative levels while services, down 5 points to minus 43.6, posted fresh declines. Regionally, national ESIs pointed to less pessimistic morale in France (58.2 after 47.9), Germany (81.7 after 78.7) and Spain (78.0 after 64.7). Italy was unable to compute a value for April due to Covid-19 issues but at 81.0 in May, the country's index didn't compare well to March's 88.1.

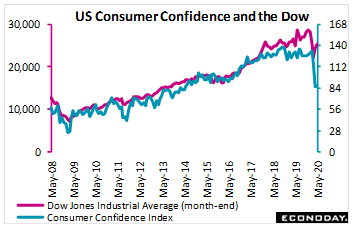

Confidence measures have not shown the same kind of rebirth that the stock market has. Before the ongoing separation, US confidence as measured by the Conference Board closely tracked the path of the Dow Jones industrial average. The Dow crumbled in March, ending the month near 22,200 but was already rallying in April and rallied further in May to end this month at just over 24,400. The confidence index also crumbled in March but then plunged in April to a deep low of 85.7 where it held steady in May at 86.6. The visible gap between the Dow and consumer confidence will likely fill back into trend, but which way: confidence catching up with the Dow? the Dow moving back toward confidence? or a little of both? Certainly, the vast global stimulus efforts that are underway, especially direct buying of financial securities by central banks, may be one very important factor behind the rally, stirring up more froth in stock markets than raising confidence among consumers. Confidence measures have not shown the same kind of rebirth that the stock market has. Before the ongoing separation, US confidence as measured by the Conference Board closely tracked the path of the Dow Jones industrial average. The Dow crumbled in March, ending the month near 22,200 but was already rallying in April and rallied further in May to end this month at just over 24,400. The confidence index also crumbled in March but then plunged in April to a deep low of 85.7 where it held steady in May at 86.6. The visible gap between the Dow and consumer confidence will likely fill back into trend, but which way: confidence catching up with the Dow? the Dow moving back toward confidence? or a little of both? Certainly, the vast global stimulus efforts that are underway, especially direct buying of financial securities by central banks, may be one very important factor behind the rally, stirring up more froth in stock markets than raising confidence among consumers.

Deep contraction in trade and production should be no surprise given the global shutdown restrictions that swept North America, Europe and much of Asia in April and May. But a major contrast in the global data are employment numbers where losses, outside of North America, have been limited. Japan's unemployment rate edged up only 1 tenth in April to 2.6 percent while Germany's unemployment rate in May, which will posted on Wednesday of the coming week, is expected to rise only 4 tenths to a pretty contained looking 6.2 percent. Inflation is also showing contrasts, with actual data moving lower but inflation expectations among consumers, including in the University of Michigan's May report, surging dramatically. Which way will the numbers go at this most critical of times? Stay tuned for next week's report.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Labor will be the week's major theme including Germany's unemployment rate on Thursday followed on Friday by monthly employment reports from Canada and the US, both having suffered the greatest job losses of the major economies. And US jobless claims on Thursday will offer the first look at what to expect for employment conditions in June. Consumer readings will include Eurozone retail sales on Thursday followed on Friday by household spending in Japan which was already stubbornly weak even before the virus hit. Manufacturing will get anecdotal updates on Monday with both the CFLP report from China and the ISM report from the US, followed on Friday by a definitive orders update from German manufacturers. Other news of note will be led by the Hong Kong PMI at midweek and also consumer prices in Switzerland on Thursday and how deflationary the pandemic is proving to be. Central banks, whose guns are overheated and ammunition depleted, will also be on the schedule headlined by the European Central Bank on Thursday.

China: CFLP Manufacturing PMI for May (Mon 01:00 GMT; Mon 09:00 CST; Sun 21:00 EDT)

Consensus Forecast: 49.6

China's PMIs have been recovering from this year's opening plunge, holding mostly steady in March and April. Expectations for May's CFLP manufacturing PMI is 49.6 versus April's 50.8.

US: ISM Manufacturing Index for May (Mon 14:00 GMT; Mon 10:00 EDT)

Consensus Forecast: 42.7

Skewed higher by delivery times that masked 20 scores for new orders, production, and employment, the ISM manufacturing index was in the 40s in March, at 41.5. For May, forecasters see the ISM coming in at 42.7.

Hong Kong PMI for May (Wed 00:30 GMT; Wed 08:30 HKT; Tue 20:30 EDT)

Consensus Forecast: No consensus

May's PMI will offer the early indications of the initial effects of China's move to extend its security reach into Hong Kong. April's PMI was depressed at 36.9.

German Unemployment Rate for May (Wed 07:55 GMT; Wed 09:55 CEST; Wed 03:55 EDT)

Consensus Forecast: 6.2%

Labor losses in Germany have been limited, with April's unemployment of 5.8 percent up a comparatively low 8 tenths. For May the expectation is 6.2 percent.

Swiss CPI for May (Thu 06:30 GMT; Thu 08:30 CEST; Thu 02:30 EDT)

Consensus Forecast, Month-to-Month: -0.1%

Consensus Forecast, Year-over-Year: -1.4%

Inflation is expected to have fallen a little deeper into negative territory in May. A consensus 0.1 percent decrease for the CPI is expected for May with the year-on-year rate, at minus 1.1 percent in April, seen at minus 1.4 percent.

Eurozone Retail Sales for April (Thu 09:00 GMT; Thu 11:00 CEST; Thu 05:00 EDT)

Consensus Forecast, Month-to-Month: -18.0%

April retail sales, expected to fall 18.0 percent on the month, will show how deeply the European consumer went underground, and will follow 11.2 percent monthly contraction in March.

European Central Bank Policy Announcement (Thu 11:45 GMT; Thu 13:45 CEST; Thu 07:45 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0%

With rates at zero and QE in high gear, the European Central Bank looks to be at a loss for major new policy efforts.

US Initial Jobless Claims for May 30 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.790 million

Levels of initial claims have remained staggering and have been barely slowing. Econoday's consensus for the May 30 week is 1.790 million versus 2.123 million in the May 23 week.

Japanese Household Spending for April (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast, Month-to-Month: -10.0%

Consensus Forecast, Year-over-Year: -14.5%

How deeply did the virus shut down the Japanese consumer? Household spending for April is expected to fall a month-to-month 10.0 percent versus 4.0 percent contraction in March with the year-on-year rate seen at minus 14.5 percent versus 6.0 percent contraction in March.

German Manufacturers' Orders for April (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month-to-Month: -20.0%

Contraction for German orders is expected to deepen in April. A month-on-month 20.0 percent drop is expected versus 15.6 percent contraction in March.

Canadian Labour Force Survey for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 1.6 million

Consensus Forecast: Unemployment Rate: 16.2%

Another 1.6 million Canadian jobs are expected to be lost in the May labour force survey; this would follow nearly 2 million in April. The unemployment rate is expected to rise to 16.2 percent following April's more than 6 point jump to 13.0 percent.

US Employment Report for May (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Nonfarm Payrolls Change: -7.725 million

Consensus Forecast: Unemployment Rate: 19.8%

After April's 20.5 million contraction in nonfarm payrolls, contraction of another 7.725 million is Econoday's consensus for May. Manufacturing is expected to lose 530,000 payroll jobs. The US unemployment is expected to rise to 19.8 percent versus 14.7 percent in April. Average hourly earnings, which surged in April as low wage workers suffered the brunt of the labor destruction, are seen rising 0.9 percent on the month but falling 9 tenths on the year to 7.0 percent.

|