|

Employment reports have been the one positive for the global economy. How quickly GDP snaps back, however, is another story. GDP data are mostly reported by the quarter, a release schedule that not only washes out month-to-month changes but also delays publication until well after the end of the quarter, in late July in our case. But this is not true for the UK where, unfortunately, the monthly report for April was so bad that we all better hope it was the low point of the crisis. Since it's bad luck to start with bad news, we'll begin instead with the big positive theme: employment.

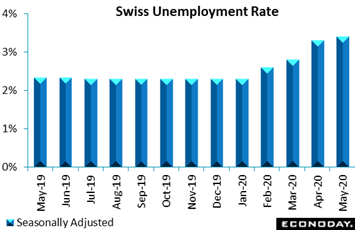

In contrast to North America, employment in Europe has yet to show much shock from the virus. The unemployment rate in Switzerland rose just 0.1 percentage point in May to 3.4 percent, much better than expectations though still a 3-1/2 year high. Yet there is damage: the number of jobless in the country, at an adjusted 159,925, was up 9.8 percent on the month; and the number of vacancies continued to decline, down a monthly 12.2 percent. Though May's update provides additional evidence of virus damage, it also suggests that the easing of lockdown restrictions together with the government's shorter working-hour scheme, one aimed at avoiding fresh layoffs, are helping to lessen the blow. That said, the steep decline in new job offers suggests that deterioration in the Swiss labor market has still some way to go. In contrast to North America, employment in Europe has yet to show much shock from the virus. The unemployment rate in Switzerland rose just 0.1 percentage point in May to 3.4 percent, much better than expectations though still a 3-1/2 year high. Yet there is damage: the number of jobless in the country, at an adjusted 159,925, was up 9.8 percent on the month; and the number of vacancies continued to decline, down a monthly 12.2 percent. Though May's update provides additional evidence of virus damage, it also suggests that the easing of lockdown restrictions together with the government's shorter working-hour scheme, one aimed at avoiding fresh layoffs, are helping to lessen the blow. That said, the steep decline in new job offers suggests that deterioration in the Swiss labor market has still some way to go.

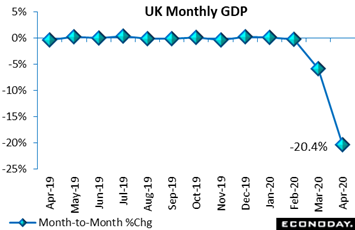

Employment in Europe may be holding up but the same definitely cannot be said about GDP. In an early indication of what to expect for the second quarter, UK data for the month of April imploded. Real GDP contracted 20.4 percent on the month, much more than expected and almost ten times larger than the steepest pre-Covid-19 decline. Services were down 19.0 percent versus March and industrial production 20.3 percent, within which manufacturing fell 24.3 percent. Construction was hit even harder, sliding 40.1 percent. Looking ahead, business surveys have pointed to some improvement in May in the sense that the rate of decline in activity at least eased. Even so, with the move out of lockdown being phased in only gradually, UK GDP will remain severely depressed for some time yet. This report will increase speculation about additional QE from the Bank of England at their upcoming meeting. Employment in Europe may be holding up but the same definitely cannot be said about GDP. In an early indication of what to expect for the second quarter, UK data for the month of April imploded. Real GDP contracted 20.4 percent on the month, much more than expected and almost ten times larger than the steepest pre-Covid-19 decline. Services were down 19.0 percent versus March and industrial production 20.3 percent, within which manufacturing fell 24.3 percent. Construction was hit even harder, sliding 40.1 percent. Looking ahead, business surveys have pointed to some improvement in May in the sense that the rate of decline in activity at least eased. Even so, with the move out of lockdown being phased in only gradually, UK GDP will remain severely depressed for some time yet. This report will increase speculation about additional QE from the Bank of England at their upcoming meeting.

April's sharp decline in UK industrial production, coming to 24.4 percent on a yearly basis, was indicative of April contraction elsewhere in Europe: 34.2 percent on the year in France, 25.3 percent in Germany, and 28.0 percent in Europe overall. Production in Italy has been hit especially hard, down 42.5 percent (excluding construction) compared to last April. Weakness was widespread in April including capital goods and also consumer goods where durables especially nosedived. In April comparisons outside of Europe, industrial production in Japan contracted a yearly 14.4 percent and in the US by 15.0 percent while, in what hopefully foreshadows improvement elsewhere, production turned higher in China, up 3.9 percent. The virus swept China first of course, sending production down 13.5 percent in the combined months of January and February. April's sharp decline in UK industrial production, coming to 24.4 percent on a yearly basis, was indicative of April contraction elsewhere in Europe: 34.2 percent on the year in France, 25.3 percent in Germany, and 28.0 percent in Europe overall. Production in Italy has been hit especially hard, down 42.5 percent (excluding construction) compared to last April. Weakness was widespread in April including capital goods and also consumer goods where durables especially nosedived. In April comparisons outside of Europe, industrial production in Japan contracted a yearly 14.4 percent and in the US by 15.0 percent while, in what hopefully foreshadows improvement elsewhere, production turned higher in China, up 3.9 percent. The virus swept China first of course, sending production down 13.5 percent in the combined months of January and February.

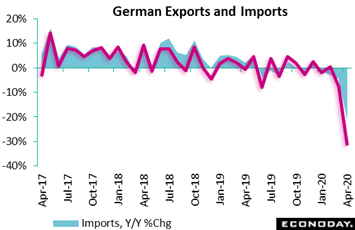

Equally severe as the contraction in goods production has been contraction underway in global trade, including for Germany. Imports were down 21.6 percent on the year in April for an 11-year low. Exports fell 31.1 percent in April for (like so many readings everywhere) the worst reading ever. Given the greater drop in exports, Germany's merchandise trade surplus shrank to €3.2 billion, down sharply from €12.8 billion in March and the least black ink in 20 years. April's data put the surplus nearly 82 percent below its first-quarter average and warn of a probable and sizeable hit to second-quarter GDP. As a country heavily reliant on overseas sales, the global trade collapse looks to have a disproportionately large impact on the German economy. Equally severe as the contraction in goods production has been contraction underway in global trade, including for Germany. Imports were down 21.6 percent on the year in April for an 11-year low. Exports fell 31.1 percent in April for (like so many readings everywhere) the worst reading ever. Given the greater drop in exports, Germany's merchandise trade surplus shrank to €3.2 billion, down sharply from €12.8 billion in March and the least black ink in 20 years. April's data put the surplus nearly 82 percent below its first-quarter average and warn of a probable and sizeable hit to second-quarter GDP. As a country heavily reliant on overseas sales, the global trade collapse looks to have a disproportionately large impact on the German economy.

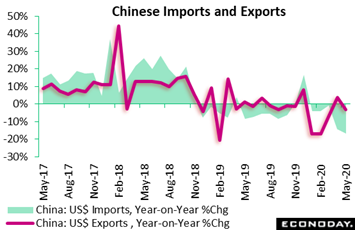

China is likewise subject to an outsized impact from trade. Exports did recover in April but in data for May they fell back, down 3.3 percent on the year. And imports are beginning to fall more steeply, down 16.7 percent in May and reflecting lower prices for commodities. China's exports to the US were down 1.2 percent on the year in May, weakening from growth of 2.2 percent in April, while imports from the US fell 13.5 percent after dropping 11.1 percent previously. This pushed China's bilateral trade surplus with the US up from $22.87 billion in April to $27.89 billion in May, with the year-to-date surplus now at $86 billion. Yet in a twist for the headline balance, the much greater contraction for overall imports lifted China's trade surplus from US$45.3 billion in April to $62.93 billion in May. This is the biggest monthly surplus in 39 years of records. China is likewise subject to an outsized impact from trade. Exports did recover in April but in data for May they fell back, down 3.3 percent on the year. And imports are beginning to fall more steeply, down 16.7 percent in May and reflecting lower prices for commodities. China's exports to the US were down 1.2 percent on the year in May, weakening from growth of 2.2 percent in April, while imports from the US fell 13.5 percent after dropping 11.1 percent previously. This pushed China's bilateral trade surplus with the US up from $22.87 billion in April to $27.89 billion in May, with the year-to-date surplus now at $86 billion. Yet in a twist for the headline balance, the much greater contraction for overall imports lifted China's trade surplus from US$45.3 billion in April to $62.93 billion in May. This is the biggest monthly surplus in 39 years of records.

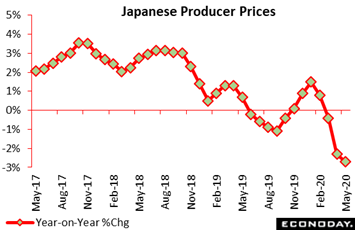

Virus effects on prices are for the most part increasingly negative, including for Japanese producer prices which fell 2.7 percent on the year in May after falling 2.3 percent in April. This is the third consecutive year-on-year decline in producer prices and the biggest since 2016. On the upside, food prices showed pressure in May, up 1.0 percent on the year and picking up from 0.7 percent in April. But elsewhere the data were weak with petroleum & coal prices down 36.7 percent after dropping 30.1 percent in April. Producer prices were also released in the US, showing some improvement but still down 0.8 percent on the year. Virus effects on prices are for the most part increasingly negative, including for Japanese producer prices which fell 2.7 percent on the year in May after falling 2.3 percent in April. This is the third consecutive year-on-year decline in producer prices and the biggest since 2016. On the upside, food prices showed pressure in May, up 1.0 percent on the year and picking up from 0.7 percent in April. But elsewhere the data were weak with petroleum & coal prices down 36.7 percent after dropping 30.1 percent in April. Producer prices were also released in the US, showing some improvement but still down 0.8 percent on the year.

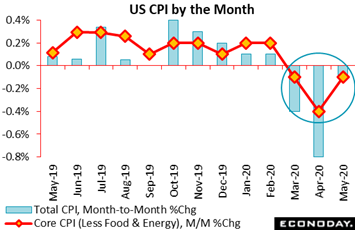

Consumer prices are likewise tilting downward. The core CPI fell 0.1 percent on the month in May to mark the first time in 63 years of records that this central reading, which excludes food and energy, has fallen for three straight months. Total prices also fell 0.1 percent in May following declines of 0.4 percent in March and 0.8 percent in April. Deflationary pressures are centered in energy, down 1.8 percent for a fifth straight decline. Apparel has also been falling sharply, down 2.3 percent on the month, while transportation services, reflecting steep declines underway in airfares and auto insurance, fell 3.6 percent. But prices of food are going the other way, up 0.7 percent with food at home up 1.0 percent for a fourth straight virus-driven climb. Beef prices in May surged 10.8 percent for a record high in this report. Medical care has also been going up, rising 0.6 percent following two prior increases of 0.5 percent. But gains for food and medical care are the exceptions. The overall year-on-year rate came in at minus 0.1 percent, for a 5-year low, and at 1.2 percent for the core which, though still safely above the zero line, is nevertheless a 9-year low. Consumer prices are likewise tilting downward. The core CPI fell 0.1 percent on the month in May to mark the first time in 63 years of records that this central reading, which excludes food and energy, has fallen for three straight months. Total prices also fell 0.1 percent in May following declines of 0.4 percent in March and 0.8 percent in April. Deflationary pressures are centered in energy, down 1.8 percent for a fifth straight decline. Apparel has also been falling sharply, down 2.3 percent on the month, while transportation services, reflecting steep declines underway in airfares and auto insurance, fell 3.6 percent. But prices of food are going the other way, up 0.7 percent with food at home up 1.0 percent for a fourth straight virus-driven climb. Beef prices in May surged 10.8 percent for a record high in this report. Medical care has also been going up, rising 0.6 percent following two prior increases of 0.5 percent. But gains for food and medical care are the exceptions. The overall year-on-year rate came in at minus 0.1 percent, for a 5-year low, and at 1.2 percent for the core which, though still safely above the zero line, is nevertheless a 9-year low.

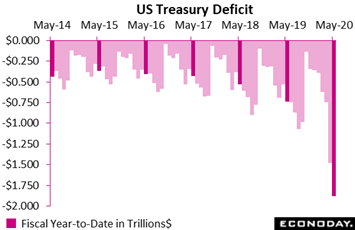

If the outlook for inflation is somewhat mixed, the outlook for government spending isn't. The US Treasury deficit came to $398.8 billion in May, not quite half as deep as April's $737.9 billion shortfall but nearly twice as deep as $207.7 billion in May last year. With eight months in the books for the government's fiscal 2020 year, the deficit is already at $1.880 trillion for an increase of 91 percent from the same period in fiscal 2019. Outlays are up 29.4 percent to $3.900 trillion with receipts down 11.2 percent to $2.019 trillion. Stimulus payments lead the outlay side followed by health and general government outlays. Smaller proportional increases, though very large in absolute terms, are seen for national defense and social security. Receipts are steeply lower, whether from individual or corporate taxes. If the outlook for inflation is somewhat mixed, the outlook for government spending isn't. The US Treasury deficit came to $398.8 billion in May, not quite half as deep as April's $737.9 billion shortfall but nearly twice as deep as $207.7 billion in May last year. With eight months in the books for the government's fiscal 2020 year, the deficit is already at $1.880 trillion for an increase of 91 percent from the same period in fiscal 2019. Outlays are up 29.4 percent to $3.900 trillion with receipts down 11.2 percent to $2.019 trillion. Stimulus payments lead the outlay side followed by health and general government outlays. Smaller proportional increases, though very large in absolute terms, are seen for national defense and social security. Receipts are steeply lower, whether from individual or corporate taxes.

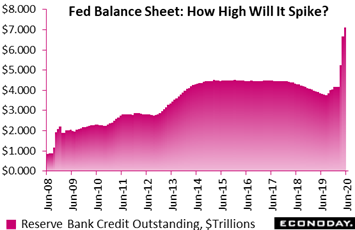

With $2 trillion in fiscal stimulus already being doled out and more possibly on the way, it's a fair question to ask who's going to finance it all? Well, the Federal Reserve is certainly doing its share. The Fed said in its Wednesday announcement that it will continue to increase, at least at the current pace, its holdings of Treasuries (currently at $80 billion per month) and residential and commercial mortgage-backed securities (currently at $40 billion per month). And as Jerome Powell underscored in his press conference, QE won't be going "any lower". But how much of this stimulus, aimed at preventing a cascade of individual and corporate bankruptcies, is finding its way to the roulette table? Powell side stepped a question whether Fed stimulus is contributing to the stock market's 3-month rally. He said targeting levels of asset prices is not the goal of Fed policy makers, rather their most important singular goal, on which they are "tightly focused," is supporting the labor market. Powell said it's the function of investors, not the Fed, to be pricing in risk for financial assets. And plenty of risk there is, with structural changes underway in the production of goods and services at the same time that a vaccine and effective treatment for the coronavirus are still elusive. And if the stock market does begin to seriously crack again, who knows if the Fed (in what would be the biggest buy signal of all time) won't seek authorization from Congress to buy stocks directly. With $2 trillion in fiscal stimulus already being doled out and more possibly on the way, it's a fair question to ask who's going to finance it all? Well, the Federal Reserve is certainly doing its share. The Fed said in its Wednesday announcement that it will continue to increase, at least at the current pace, its holdings of Treasuries (currently at $80 billion per month) and residential and commercial mortgage-backed securities (currently at $40 billion per month). And as Jerome Powell underscored in his press conference, QE won't be going "any lower". But how much of this stimulus, aimed at preventing a cascade of individual and corporate bankruptcies, is finding its way to the roulette table? Powell side stepped a question whether Fed stimulus is contributing to the stock market's 3-month rally. He said targeting levels of asset prices is not the goal of Fed policy makers, rather their most important singular goal, on which they are "tightly focused," is supporting the labor market. Powell said it's the function of investors, not the Fed, to be pricing in risk for financial assets. And plenty of risk there is, with structural changes underway in the production of goods and services at the same time that a vaccine and effective treatment for the coronavirus are still elusive. And if the stock market does begin to seriously crack again, who knows if the Fed (in what would be the biggest buy signal of all time) won't seek authorization from Congress to buy stocks directly.

Massive stimulus efforts underway are building up 'V'-shaped hopes for the global economy, though how far the bottom of the 'V' will extend is still anyone's guess. Yet May in general looks to have been no worse and very likely a little less worse than April. Clouding this conclusion, however, are questions over data quality, whether discrepancies in US employment or anything out of India which, because of the shutdowns, canceled both its CPI and industrial production reports in the week.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

If expectations for May retail sales and industrial production data are any indication, April will have proven to be the deepest part of the hole at least for China and the US. China will post both reports on Monday with the US posting its reports on Tuesday; substantial improvement is the general call especially for US retail sales. Key employment data in the week will be posted in the UK on Tuesday with Australia on Thursday, amid expectations for easing rates of damage. How severely Japan has been hit by the virus will be updated on Tuesday with May's merchandise trade report followed on Friday with consumer prices were deflation is expected to hold. The week will see several central bank announcements including from the Swiss National Bank and also the Bank of England where expectations are calling for more QE.

Chinese Industrial Production for May (Mon 02:00 GMT; Mon 10:00 CST; Sun 22:00 EDT)

Consensus Forecast: 4.9%

Industrial production is expected to continue to recover in May, rising at a 4.9 year-on-year pace following April's rise into the plus column at 3.9 percent.

Chinese Retail Sales for May (Mon 02:00 GMT; Mon 10:00 CST; Sun 22:00 EDT)

Consensus Forecast, Year-over-Year: 2.3%

At plus 2.3 percent, Chinese retail sales in May are expected to improve from year-on-year contraction of 7.5 percent in April. Sales contraction was as deep as 20.5 percent when the virus struck China at the outset of the year.

UK Labour Market Report (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, Claimant Count for May: 340,000

Consensus Forecast, ILO Unemployment Rate for April: 4.4%

Claimant count joblessness for May is expected to rise 340,000 versus April's 856,500. The ILO employment rate, in data for the three months to April, is seen at 4.4 percent versus 3.9 percent in the last report.

US Retail Sales for May (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month-to-Month: 7.5%

Consensus Forecast, Ex-Autos, Ex-Gas: 5.2%

Retail sales contracted 8.7 percent in March then 16.4 percent in April, making for an easy comparison in May with forecasters calling for a 7.5 percent rebound. Excluding autos, where unit sales jumped in May, and also excluding gas where prices rose, retail sales are seen rising 5.2 percent.

US Industrial Production for May (Tue 13:15 GMT; Tue 09:15 EDT)

Consensus Forecast, Month-to-Month: 2.9%

US Manufacturing Production

Consensus Forecast, Month-to-Month: 3.6%

Econoday's consensus for US industrial production in May, which will get a comparison boost against April, is for a monthly increase of 2.9 percent with the manufacturing component seen at plus 3.6 percent. Industrial production in April fell 11.2 percent for the largest monthly decline in 101 years of records.

Japanese Merchandise Trade for May (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast: -¥674 billion

Consensus Forecast, Exports Year-over-Year: -21.0%

Consensus Forecast, Imports Year-over-Year: -26.0%

Japanese exports and imports have been in steep contraction offering hard evidence of the virus impact in Asia. After falling a year-on-year 21.9 percent in April, exports are expected to decline 21.0 percent in May; imports were down 7.2 percent on the year in April and are expected to be down a very steep 26.0 percent in May.

US Housing Starts for May (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Annual Rate: 1.100 million

US Building Permits

Consensus Forecast: 1.250 million

The full virus effects of the month of April did not devastate either housing starts or permits which, though falling to 6-year lows, still came in at meaningful levels. May's expectations are for a major bounce, to an annual rate of 1.100 million for starts, versus 0.891 million in April, and 1.250 million for permits versus 1.074 million.

Australian Labour Force Survey for May (Thu 00:30 GMT; Thu 11:30 AEST; Wed 21:30 EDT)

Consensus Forecast, Unemployment Rate: 7.0%

Consensus Forecast, Employment: -175,000

Employment in Australia fell 594,300 in April with the loss for May expected to total a less severe 175,000. The unemployment rate shot full 1 percentage point higher to 6.2 percent in April with 7.0 percent seen for May.

Swiss National Bank Monetary Policy Assessment (Thu 7:30 GMT; Thu 09:30 CEST; Thu 03:30 EDT)

Consensus Forecast, Change: 0.0 basis points

Consensus Forecast, Level: -0.75%

The Swiss National Bank is expected to keep its key deposit rate at minus 0.75 percent. At its last meeting in March, as the coronavirus outbreak was escalating, the bank made no change in its policy rate but said that it had been intervening more heavily in the currency market to limit appreciation of the Swiss franc.

Bank of England Announcement (Thu 11:00 GMT, Thu 12:00 BST; Thu 07:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

Consensus Forecast: Asset Purchase Level: £745 billion

The BoE is expected to raise its QE ceiling by £100 billion to £745 billion with no change, at plus 0.1 percent, expected for Bank Rate.

US Initial Jobless Claims for June 13 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.220 million

Payroll gains were in the millions in May yet levels of initial unemployment claims remained staggering, also in the millions. Econoday's consensus for the June 13 week is for 1.220 million versus 1.542 million in the June 6 week.

Japanese Consumer Price Index for May (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast Ex-Food, Year-over-Year: -0.2%

Deflationary pressures are expected to hold in May's consumer price report. Consensus for the year-on-year CPI excluding food is minus 0.2 percent in what would match April's minus 0.2 percent.

|