|

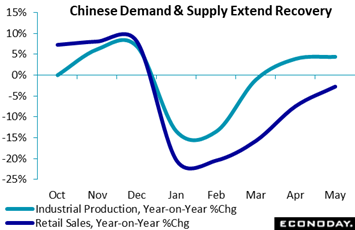

Right from the very beginning of the pandemic, the pattern of downturn and recovery in China was seen as the model for what to expect in Europe and North America. What we know so far looks encouraging in a recovery that hopefully will play out likewise across other economies. We'll start the rundown looking at the play between demand and supply in two reports that opened the week: retail sales in China and industrial production in China.

Chinese retail sales contracted 2.8 percent in May which was a less severe year-on-year decline than April's 7.5 percent and far less severe than the 20.5 percent contraction in the combined months of January and February. Improvements in May were wide spread and included autos, household goods, home appliances and also furniture. Helped in part by improved domestic demand, industrial production in China has already recovered from the virus based at least on government data, rising at a year-on-year 4.4 percent pace in May and well above the opening year low of minus 13.5 percent. Exports, of course, are China's special strength, and though they've softened this year they haven't softened very much, at only 3.3 percent contraction in May in data released in the prior week. Though the recovery path for China isn't quite sharp enough to qualify for a 'V', it's definitely not a 'U' either. Chinese retail sales contracted 2.8 percent in May which was a less severe year-on-year decline than April's 7.5 percent and far less severe than the 20.5 percent contraction in the combined months of January and February. Improvements in May were wide spread and included autos, household goods, home appliances and also furniture. Helped in part by improved domestic demand, industrial production in China has already recovered from the virus based at least on government data, rising at a year-on-year 4.4 percent pace in May and well above the opening year low of minus 13.5 percent. Exports, of course, are China's special strength, and though they've softened this year they haven't softened very much, at only 3.3 percent contraction in May in data released in the prior week. Though the recovery path for China isn't quite sharp enough to qualify for a 'V', it's definitely not a 'U' either.

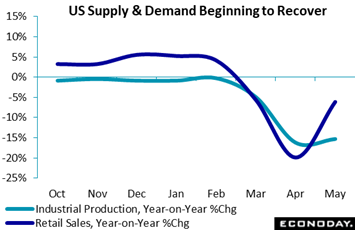

In the US, the recovery path is still unfolding and though a 'V' may be in the cards, production will definitely have to pick up its pace. Helping the consumer side have been generous stimulus checks which fed, along with pent-up demand, a stunning surge in retail sales during May. Yet the gain wasn't enough to lift the year-on-year pace out of the negative column; nevertheless May's 6.1 percent contraction was only a fraction of April's 19.9 percent. Sales were growing at a roughly 5 percent pace going into the virus and at May's torrid pace, full recovery could arrive much sooner than later. Production is another story, having been flat going into the virus then falling at a 16.2 percent pace in April and 15.3 percent in May. Unlike China, the US isn't benefiting from foreign demand, quite the contrary as exports fell at a more than 10 percent pace in March and nearly 30 percent in April after having fizzled throughout last year. In the US, the recovery path is still unfolding and though a 'V' may be in the cards, production will definitely have to pick up its pace. Helping the consumer side have been generous stimulus checks which fed, along with pent-up demand, a stunning surge in retail sales during May. Yet the gain wasn't enough to lift the year-on-year pace out of the negative column; nevertheless May's 6.1 percent contraction was only a fraction of April's 19.9 percent. Sales were growing at a roughly 5 percent pace going into the virus and at May's torrid pace, full recovery could arrive much sooner than later. Production is another story, having been flat going into the virus then falling at a 16.2 percent pace in April and 15.3 percent in May. Unlike China, the US isn't benefiting from foreign demand, quite the contrary as exports fell at a more than 10 percent pace in March and nearly 30 percent in April after having fizzled throughout last year.

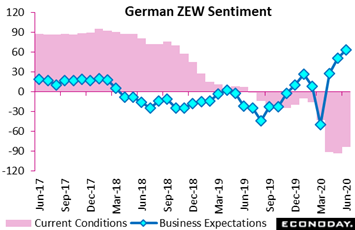

If demand precedes production, sentiment precedes demand. And here the general trend has been mixed across economies, with the assessment of current conditions still lagging in contrast to expectations which in some reports are beginning to spike. ZEW's June survey found analysts slightly less pessimistic about the current state of the German economy and notably more optimistic about the second half of the year. Expectations in fact jumped to a 14-year high in June's report, up 12.4 points to 63.4, far outpacing current conditions which nevertheless did move off May's record low with a 10.4 point rise to what is a still deeply negative 83.1. Though the results together suggest that analysts are increasingly confident that the worst of the Covid-19 crisis has passed, the specific outlook for German production is less favorable reflecting analyst concerns over foreign demand. If demand precedes production, sentiment precedes demand. And here the general trend has been mixed across economies, with the assessment of current conditions still lagging in contrast to expectations which in some reports are beginning to spike. ZEW's June survey found analysts slightly less pessimistic about the current state of the German economy and notably more optimistic about the second half of the year. Expectations in fact jumped to a 14-year high in June's report, up 12.4 points to 63.4, far outpacing current conditions which nevertheless did move off May's record low with a 10.4 point rise to what is a still deeply negative 83.1. Though the results together suggest that analysts are increasingly confident that the worst of the Covid-19 crisis has passed, the specific outlook for German production is less favorable reflecting analyst concerns over foreign demand.

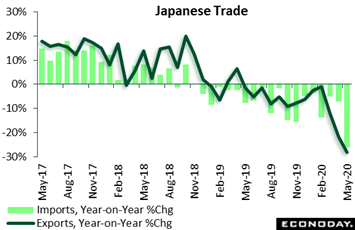

Cross-border trade was already in contraction going into the virus and the story most everywhere so far is now extreme contraction. Japanese exports fell 28.3 percent on the year in May after dropping 21.9 percent in April, while imports fell 26.2 percent after dropping 7.1 percent. Exports to the US were especially weak in May as they were to the European Union and also South Korea as well as Japan's trading partners in Southeast Asia. Exports to China did improve but were still in contraction at 1.9 percent. Japan's contribution to its trading partners was likewise broadly weak with petroleum imports, both in volume and value, posting big declines. Cross-border trade was already in contraction going into the virus and the story most everywhere so far is now extreme contraction. Japanese exports fell 28.3 percent on the year in May after dropping 21.9 percent in April, while imports fell 26.2 percent after dropping 7.1 percent. Exports to the US were especially weak in May as they were to the European Union and also South Korea as well as Japan's trading partners in Southeast Asia. Exports to China did improve but were still in contraction at 1.9 percent. Japan's contribution to its trading partners was likewise broadly weak with petroleum imports, both in volume and value, posting big declines.

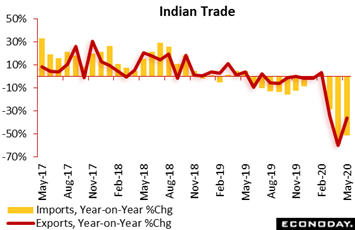

No country is posting weaker trade data than India whose economy as well as statistics offices have at times ground to a halt during the crisis. Indian exports were down 36.5 percent on the year in May reflecting contraction in petroleum, textiles, engineering, gems and gold; imports were down an even sharper 51.1 percent with petroleum down 72.0 percent and gold down 98.4 percent. The covid crisis in India appears to be more protracted than for others, which doesn't point to much chance of a jump in the country's June data and won't be contributing much at all to June's recovery for its trading partners. No country is posting weaker trade data than India whose economy as well as statistics offices have at times ground to a halt during the crisis. Indian exports were down 36.5 percent on the year in May reflecting contraction in petroleum, textiles, engineering, gems and gold; imports were down an even sharper 51.1 percent with petroleum down 72.0 percent and gold down 98.4 percent. The covid crisis in India appears to be more protracted than for others, which doesn't point to much chance of a jump in the country's June data and won't be contributing much at all to June's recovery for its trading partners.

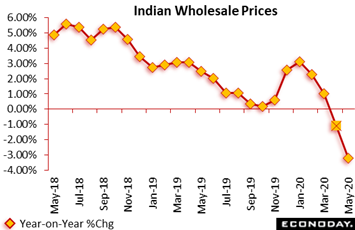

Due to the lockdown, India's Ministry of Statistics and Programme Implementation has had to cancel several reports so far, but not wholesale prices for May! The wholesale index fell a year-on-year 3.21 percent in May, pulled down by a lower inflation rate for food, at 1.13 percent on the year in May, and especially by fuel prices which were down 19.83 percent. Prices of manufactured goods, which account for nearly two-thirds of the index, were down 0.42 percent on the year. May's report compares with more limited price contraction in March where the decline was 1.00 percent. Wait! What happened you ask to April? The data were never published creating a hole in the historical series. Yet this virus hole is limited to only month so far compared to two for consumer prices where data weren't published for either April or May. Due to the lockdown, India's Ministry of Statistics and Programme Implementation has had to cancel several reports so far, but not wholesale prices for May! The wholesale index fell a year-on-year 3.21 percent in May, pulled down by a lower inflation rate for food, at 1.13 percent on the year in May, and especially by fuel prices which were down 19.83 percent. Prices of manufactured goods, which account for nearly two-thirds of the index, were down 0.42 percent on the year. May's report compares with more limited price contraction in March where the decline was 1.00 percent. Wait! What happened you ask to April? The data were never published creating a hole in the historical series. Yet this virus hole is limited to only month so far compared to two for consumer prices where data weren't published for either April or May.

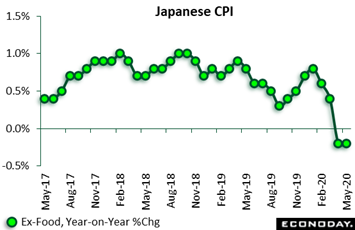

Deflationary effects may well accelerate should the global covid crisis continue and should reopenings prove limited. Consumer prices in Japan have already fallen to the zero line for most readings, at a year-on-year 0.1 percent overall in May and, as tracked in the graph, at minus 0.2 percent for a second straight month when excluding food. Until inflation picks up, the Bank of Japan is committed to aggressive stimulus and keeping its policy rate, now at minus 0.1 percent, at or below this level. The BoJ left its policy settings on hold at its meeting on Monday but the latest consumer inflation data indicate that progress has stalled which may begin to point to additional policy measures at the bank's July meeting. Deflationary effects may well accelerate should the global covid crisis continue and should reopenings prove limited. Consumer prices in Japan have already fallen to the zero line for most readings, at a year-on-year 0.1 percent overall in May and, as tracked in the graph, at minus 0.2 percent for a second straight month when excluding food. Until inflation picks up, the Bank of Japan is committed to aggressive stimulus and keeping its policy rate, now at minus 0.1 percent, at or below this level. The BoJ left its policy settings on hold at its meeting on Monday but the latest consumer inflation data indicate that progress has stalled which may begin to point to additional policy measures at the bank's July meeting.

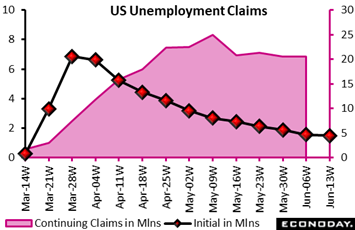

The BoJ focuses on inflation and not employment which in Japan has remained very strong as it is traditionally is. This contrast could be no greater than with the US where the Federal Reserve is concerned pretty much exclusively, not on the need to lift inflation but on the need to restore employment. Of all the economic reports on the global calendar, none are as depressing to read as weekly unemployment claims in the US. Initial claims did fall 58,000 in the June 13 week, but this isn't very much at all given that the level is still in the millions, at 1.508 million which was much worse than expected. Continuing claims, in lagging data for the June 6 week, also edged lower but remained over 20 million at 20.544 million, keeping the unemployment rate for insured workers, in another showing that lacks improvement, unchanged at 14.1 percent. Since mid-March when virus effects first appeared in the labor market, 46.0 million initial claims have been filed. The BoJ focuses on inflation and not employment which in Japan has remained very strong as it is traditionally is. This contrast could be no greater than with the US where the Federal Reserve is concerned pretty much exclusively, not on the need to lift inflation but on the need to restore employment. Of all the economic reports on the global calendar, none are as depressing to read as weekly unemployment claims in the US. Initial claims did fall 58,000 in the June 13 week, but this isn't very much at all given that the level is still in the millions, at 1.508 million which was much worse than expected. Continuing claims, in lagging data for the June 6 week, also edged lower but remained over 20 million at 20.544 million, keeping the unemployment rate for insured workers, in another showing that lacks improvement, unchanged at 14.1 percent. Since mid-March when virus effects first appeared in the labor market, 46.0 million initial claims have been filed.

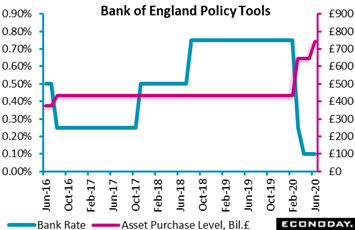

Another central bank dealing with employment risk is the Bank of England where policy makers dug still deeper into their toolbox with another boost to QE. Having been increased by £200 billion to £645 billion in March, June's 8-1 vote saw the asset purchase ceiling raised by a further £100 billion to £745 billion. Andrew Haldane, the BoE's chief economist, was the sole dissenter opting to leave QE at its existing level. The vote to keep Bank Rate at just 0.10 percent was 9-0 despite chatter that the BoE might consider the option of negative rates. The BoE's employment assessment remained gloomy but on the plus side it cited signs of a pick-up in consumer spending and services output as well as housing activity following the partial easing of virus restrictions. It also expects that easier monetary and fiscal policy will help to support the recovery. With regards to inflation, the BoE largely attributed sub-target rates to the effects of the pandemic and the collapse in global oil prices. Another central bank dealing with employment risk is the Bank of England where policy makers dug still deeper into their toolbox with another boost to QE. Having been increased by £200 billion to £645 billion in March, June's 8-1 vote saw the asset purchase ceiling raised by a further £100 billion to £745 billion. Andrew Haldane, the BoE's chief economist, was the sole dissenter opting to leave QE at its existing level. The vote to keep Bank Rate at just 0.10 percent was 9-0 despite chatter that the BoE might consider the option of negative rates. The BoE's employment assessment remained gloomy but on the plus side it cited signs of a pick-up in consumer spending and services output as well as housing activity following the partial easing of virus restrictions. It also expects that easier monetary and fiscal policy will help to support the recovery. With regards to inflation, the BoE largely attributed sub-target rates to the effects of the pandemic and the collapse in global oil prices.

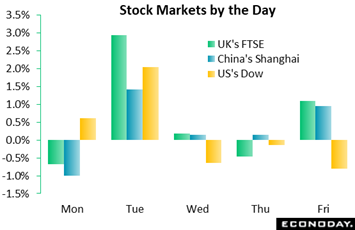

Global stock markets opened the week in uncertain fashion, boosted ultimately on Monday after the Federal Reserve launched its corporate bond buying facility. Earlier, markets dropped on concerns about a new global wave of the coronavirus, with new hotspots in Beijing and rising infection rates in India renewing concerns about a possible second virus wave. Reports on Tuesday that the Trump administration is preparing a $1 trillion infrastructure plan gave stocks a boost as did reports suggesting a scaling back in US-China tensions over Huawei. Stocks ended flat to lower Wednesday on a warning from market pundit Jeremy Grantham that the markets are in a bubble, though sentiment was supported by news that a steroid drug, dexamethasone, had delivered positive results for Covid-19 patients in a UK clinical trial. Risk appetite also eroded Thursday as the accelerating spread of the virus in several US states added to worries that the economic recovery may be delayed. And Friday's market was held back by news that Apple would temporarily shut close 11 stores in the US in Florida, Arizona, South Carolina and North Carolina as virus cases continue to rise, again raising concern of a second wave. Global stock markets opened the week in uncertain fashion, boosted ultimately on Monday after the Federal Reserve launched its corporate bond buying facility. Earlier, markets dropped on concerns about a new global wave of the coronavirus, with new hotspots in Beijing and rising infection rates in India renewing concerns about a possible second virus wave. Reports on Tuesday that the Trump administration is preparing a $1 trillion infrastructure plan gave stocks a boost as did reports suggesting a scaling back in US-China tensions over Huawei. Stocks ended flat to lower Wednesday on a warning from market pundit Jeremy Grantham that the markets are in a bubble, though sentiment was supported by news that a steroid drug, dexamethasone, had delivered positive results for Covid-19 patients in a UK clinical trial. Risk appetite also eroded Thursday as the accelerating spread of the virus in several US states added to worries that the economic recovery may be delayed. And Friday's market was held back by news that Apple would temporarily shut close 11 stores in the US in Florida, Arizona, South Carolina and North Carolina as virus cases continue to rise, again raising concern of a second wave.

A second wave is only a risk right now and one that does not appear to be holding back, at least very much so far, national efforts across the globe to reopen their economies. What is playing out in the economic data is how global economies are recovering from the first and hopefully only shutdown. The outlook so far based on China and initial progress in the US is favorable for what may not be a snapback recovery but at least one that won't be too drawn out.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Tuesday and Thursday will be the key days of the week. Tuesday will see the release of June PMIs which are expected to show another month of tangible easing in the rate of business contraction. Thursday will see three key reports from the US: the latest on trade with advance goods data, the latest on the factory sector with the durable goods report, and the weekly update on the labor market with unemployment claims. Though a sharp headline gain is the call for durable goods, another week of very severe job losses is the call for claims. Sentiment will also be the week's theme with the French business climate report on Wednesday as well as Germany's Ifo survey also on Wednesday followed on Thursday by Germany's GfK consumer climate report. Like the PMIs, the extension of general improvement is the call for the sentiment reports.

French PMI Composite Flash for June (Tue 07:15 GMT; Tue 09:15 CEST; Tue 03:15 EDT)

Consensus Forecast, Manufacturing: 46.0

Consensus Forecast, Services: 42.0

At a consensus 42.0, France's PMI services flash for June is expected to improve very sharply from May's depressed 31.1. June's manufacturing flash is also seen sharply higher, at 46.0 versus 40.6.

German PMI Composite Flash for June (Tue 07:30 GMT; Tue 09:30 CEST; Tue 03:30 EDT)

Consensus Forecast, Manufacturing: 41.0

Consensus Forecast, Services: 40.0

Germany's services PMI is expected to continue to emerge from deep contraction, with the June flash consensus at 40.0 versus 32.6 in May. The manufacturing flash is also seen higher, at 41.0.

UK: CIPS/PMI Composite Flash for June (Tue 08:30 GMT; Tue 09:30 BST; Tue 04:30 EDT)

Consensus Forecast, Manufacturing: 45.3

Consensus Forecast, Services: 39.5

Contraction eased sharply in May but still remained very severe, at a final 29.0. For June, services are expected at 39.5 with manufacturing at 45.3.

US PMI Composite Flash for June (Tue 13:45 GMT; Tue 09:45 EDT)

Consensus Forecast, Manufacturing: 44.2

Consensus Forecast, Services: 44.0

PMI's sample in May reported severe but less extreme contraction than April. Much of the same is the expectation for June were the consensus is for slight improvement, to 44.2 for manufacturing (versus 39.8) and 44.0 services (versus 37.5).

US New Home Sales for May (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast, Annualized Rate: 630,000

New home sales incredibly have shown virtually no effects from the virus. Consensus for the month is a 630,000 annual rate that would compare with April's much higher-than-expected 623,000 rate.

French Business Climate Indicator for June (Wed 06:45 GMT; Wed 08:45 CEST; Wed 02:45 EDT)

Consensus Forecast, Manufacturing: 78

On INSEE's measure, sentiment in manufacturing in June is seen at 78 which would follow 70 in April and March's deep low of 67.

German Ifo Economic Sentiment for June (Wed 08:00 GMT; Wed 10:00 CEST; Wed 04:00 EDT)

Consensus Forecast: 84.8

After posting a better-than-expected bounce, Germany's Ifo economic for June is expected to further improve to 84.8 versus May's 79.5 and April's record low 74.2.

Germany: GfK Consumer Climate for July (Thu 06:00 GMT; Thu 08:00 CEST; Thu 02:00 EDT)

Consensus Forecast: -14.2

A second month of improvement to minus 14.2 is the call for July's Gfk survey which in June rose to minus 18.9 from May's deep low of minus 23.4.

US Durable Goods Orders for May (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Month-to-Month Change: 8.5%

Consensus Forecast: Ex-Transportation: 1.8%

Consensus Forecast: Core Capital Goods Orders: 0.1%

Durable goods orders for May are expected to rebound 8.5 percent following April's 17.7 percent plunge (revised from 17.2 percent) that followed March's 16.7 percent drop and reflected, for a second month in a row, aircraft cancellations and steep contraction for vehicles. Excluding transportation equipment, orders are expected to rise 1.8 percent in May. Core capital goods orders are seen at plus 0.1 percent.

US International Trade In Goods for May (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Month-to-Month Change: -$68.8 billion

The US goods deficit is expected to narrow to $68.8 billion in May versus $70.7 billion in April. Exports and imports of goods, which were approaching year-on-year double-digit contraction going into the virus, were down 27.7 percent 22.4 percent in April.

US Jobless Claims for June 20 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.340 million

Econoday's consensus for the June 20 week is for 1.340 million initial unemployment claims versus what was a much higher-than-expected 1.508 million in the June 13 week. Since mid-March, when virus effects first took hold, 46.0 million initial claims have been filed.

|