|

May certainly and June as well are destined for the history books, posting a series of record high scores that were, however, not the result of strength at all but of very easy comparisons against the shutdown months of March and April. Based on flash PMI reports that dominated the week, June looks to have been a positive month of recovery for much but not all of the global economy. The biggest news from June will be in the coming week with the US employment report where Econoday's consensus is calling for exceptional gains. July, however, is suddenly another story; how it turns out hinges entirely on infections rates and the risk of new shutdowns.

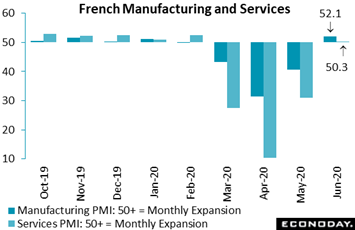

PMI indexes are beginning to move from the very bottom of their range to the no-change 50 line. This movement indicates – not that business activity has already climbed out of the cave-in – but that the rate of contraction relative to the cave-in is stabilizing. The smaller the columns in the accompanying graph, the smaller the monthly change. This is key so let's repeat it for emphasis! PMI indexes, which are based on respondents' own assessments of monthly change at their firms, track change on a month-to-month basis only. Now, let's look at June's star PMI performer: France, where monthly change, at 52.1 for manufacturing and 50.3 for services, has already gotten back above the 50 line. This means that after severe contraction in March, even more severe contraction in April, followed by still heavy in contraction in May, France's PMI samples in June reported a bit of growth relative to May. This is not growth relative to the happy month of February and against which June's comparisons would in fact shrivel. Remember, it's only about month-to-immediate-month: respondents are asked whether business is better than last month, unchanged from last month, or worse than last month. Details in June's report from France included the best monthly growth in manufacturing production in more than two years and the best overall sentiment readings of the crisis. PMI indexes are beginning to move from the very bottom of their range to the no-change 50 line. This movement indicates – not that business activity has already climbed out of the cave-in – but that the rate of contraction relative to the cave-in is stabilizing. The smaller the columns in the accompanying graph, the smaller the monthly change. This is key so let's repeat it for emphasis! PMI indexes, which are based on respondents' own assessments of monthly change at their firms, track change on a month-to-month basis only. Now, let's look at June's star PMI performer: France, where monthly change, at 52.1 for manufacturing and 50.3 for services, has already gotten back above the 50 line. This means that after severe contraction in March, even more severe contraction in April, followed by still heavy in contraction in May, France's PMI samples in June reported a bit of growth relative to May. This is not growth relative to the happy month of February and against which June's comparisons would in fact shrivel. Remember, it's only about month-to-immediate-month: respondents are asked whether business is better than last month, unchanged from last month, or worse than last month. Details in June's report from France included the best monthly growth in manufacturing production in more than two years and the best overall sentiment readings of the crisis.

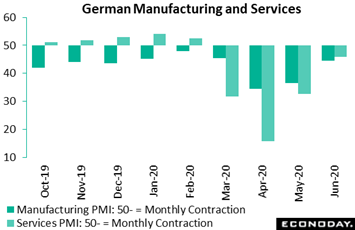

Unlike France, Germany's PMI isn't yet back up to the surface, isn't yet indicating the beginning of recovery, but it is showing smaller rates of monthly contraction. And this is definitely very good news! June's manufacturing flash climbed 7 points from May to 44.6 while services rose nearly 13 points to 45.8: both readings indicating the smallest degree of monthly contraction of the crisis. And expectations, like in France, have turned positive for the first time of the crisis. Germany's easing of lockdown restrictions are definitely helping yet, unlike France, manufacturing production was still in contraction during June with backlogs dropping, payrolls down, and selling prices being discounted. Unlike France, Germany's PMI isn't yet back up to the surface, isn't yet indicating the beginning of recovery, but it is showing smaller rates of monthly contraction. And this is definitely very good news! June's manufacturing flash climbed 7 points from May to 44.6 while services rose nearly 13 points to 45.8: both readings indicating the smallest degree of monthly contraction of the crisis. And expectations, like in France, have turned positive for the first time of the crisis. Germany's easing of lockdown restrictions are definitely helping yet, unlike France, manufacturing production was still in contraction during June with backlogs dropping, payrolls down, and selling prices being discounted.

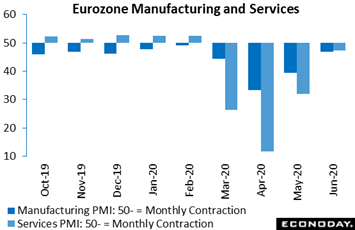

Germany in fact is lagging its European partners a bit, evident in the Eurozone PMI which tracks eight countries and where the headlines are a couple of points better than Germany, at 46.9 for manufacturing and 47.3 for services. New orders and backlogs for both the manufacturing and service samples declined at a slower rate with manufacturing production only slightly below 50. And expectations for future Eurozone production were up sharply amid hopes that lockdowns would be lifted. June's results hold out hope that the continent will emerge from the catastrophe a little sooner than later, though with so much output already lost to the virus, PMI readings will need to move sizably above the 50 mark before GDP begins to approach its pre-crisis levels. Germany in fact is lagging its European partners a bit, evident in the Eurozone PMI which tracks eight countries and where the headlines are a couple of points better than Germany, at 46.9 for manufacturing and 47.3 for services. New orders and backlogs for both the manufacturing and service samples declined at a slower rate with manufacturing production only slightly below 50. And expectations for future Eurozone production were up sharply amid hopes that lockdowns would be lifted. June's results hold out hope that the continent will emerge from the catastrophe a little sooner than later, though with so much output already lost to the virus, PMI readings will need to move sizably above the 50 mark before GDP begins to approach its pre-crisis levels.

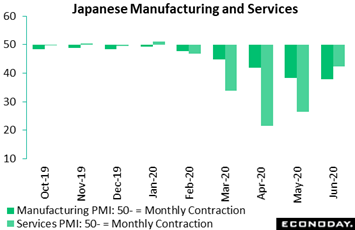

Also published in the week were June flashes for Japan which were visibly weaker than those in Europe. Japan's manufacturing PMI actually moved deeper into contraction, to 37.8 from May's 38.4. Manufacturing respondents reported a steepening rate of monthly contraction in both output and employment, with new orders dropping at a slightly slower but still sharp pace. And in sharp contrast to Europe, Japanese manufacturers are increasingly pessimistic over the outlook with the survey's measure of business sentiment weakening further. In a positive note, the service side, in contrast to manufacturing, showed sizable improvement, up nearly 16 points to what nevertheless is a sharply contractionary reading at 42.3. Service respondents reported smaller declines in output, new orders, new export orders, and an increase in employment and some improvement in business sentiment. Also published in the week were June flashes for Japan which were visibly weaker than those in Europe. Japan's manufacturing PMI actually moved deeper into contraction, to 37.8 from May's 38.4. Manufacturing respondents reported a steepening rate of monthly contraction in both output and employment, with new orders dropping at a slightly slower but still sharp pace. And in sharp contrast to Europe, Japanese manufacturers are increasingly pessimistic over the outlook with the survey's measure of business sentiment weakening further. In a positive note, the service side, in contrast to manufacturing, showed sizable improvement, up nearly 16 points to what nevertheless is a sharply contractionary reading at 42.3. Service respondents reported smaller declines in output, new orders, new export orders, and an increase in employment and some improvement in business sentiment.

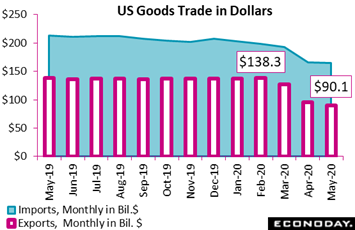

Now let's shift from monthly change and look at actual levels of actual activity. Unlike the graphs of diffusion indexes which look like they've nearly recovered, levels remain far below the pre-virus world. International trade in the US offers an example: goods exports to the US fell to $90.1 billion in May for the third straight decline and for a 34.9 percent collapse from February's $138.3 billion of exports. When extending February's level to each subsequent month, $106 billion of exports have evaporated. This is a straightforward level-to-level measurement of covid's destruction for the three months of March, April and May. Export details have shown wide declines including for agriculture, capital goods and especially autos and industrial supplies. Imports have also been down, falling to $164.4 billion in May for 17 percent contraction from February. Vehicle imports have been plummeting with capital-goods imports also weak as business investment erodes. The much smaller contraction for imports than for exports deepened the US monthly goods deficit by $3.6 billion in May to $74.3 billion. Now let's shift from monthly change and look at actual levels of actual activity. Unlike the graphs of diffusion indexes which look like they've nearly recovered, levels remain far below the pre-virus world. International trade in the US offers an example: goods exports to the US fell to $90.1 billion in May for the third straight decline and for a 34.9 percent collapse from February's $138.3 billion of exports. When extending February's level to each subsequent month, $106 billion of exports have evaporated. This is a straightforward level-to-level measurement of covid's destruction for the three months of March, April and May. Export details have shown wide declines including for agriculture, capital goods and especially autos and industrial supplies. Imports have also been down, falling to $164.4 billion in May for 17 percent contraction from February. Vehicle imports have been plummeting with capital-goods imports also weak as business investment erodes. The much smaller contraction for imports than for exports deepened the US monthly goods deficit by $3.6 billion in May to $74.3 billion.

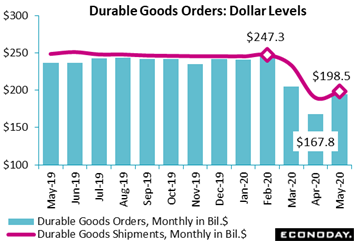

Showing less level-to-level weakness are the May indications for the US factory sector. Here a turn higher from April appears, tracked in durable goods shipments which rose sharply to $198.5 billion in May for total crisis contraction, when compared to February's $247.3 billion, of 19.7 percent. This is an improvement from the 32.1 percent of contraction from February to April's $167.8 billion. May was a constructive month of recovery for US shipments as vehicle production ramped back up and with core capital goods showing gains for both shipments and new orders. Still when adding up the damage so far, again extending February's level out, $170.3 billion of US shipments have been lost, or if not lost then hopefully still to come. Showing less level-to-level weakness are the May indications for the US factory sector. Here a turn higher from April appears, tracked in durable goods shipments which rose sharply to $198.5 billion in May for total crisis contraction, when compared to February's $247.3 billion, of 19.7 percent. This is an improvement from the 32.1 percent of contraction from February to April's $167.8 billion. May was a constructive month of recovery for US shipments as vehicle production ramped back up and with core capital goods showing gains for both shipments and new orders. Still when adding up the damage so far, again extending February's level out, $170.3 billion of US shipments have been lost, or if not lost then hopefully still to come.

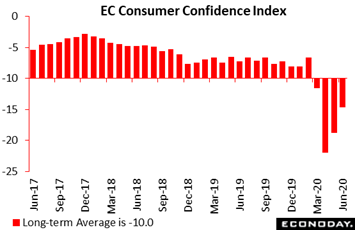

Let's turn to the demand side of the global economy with the Eurozone's consumer confidence index which, as seen in the graph, improved to minus 14.7 in June from May's minus 18.8 and April's minus 22.7. The pattern of this graph is very similar to those of US exports and durable goods, on the climb but still well short of February. The week's other sentiment reports from Europe also showed improvement including Germany's GfK overall climate indicator which rose to minus 9.6 for July's outlook versus minus 18.6 in June and minus 23.1 in May. Even so, July's forecast would still be, next to June and May, the third weakest ever in the series. Nevertheless, the Germany household sector is responding to the ongoing reopening and appears increasingly confident that the government's measures to contain the virus will be successful. Yet the week's reintroduction of localized lockdowns in two districts of North Rhine-Westphalia, if widened, could definitely prove a test for July's sentiment. Let's turn to the demand side of the global economy with the Eurozone's consumer confidence index which, as seen in the graph, improved to minus 14.7 in June from May's minus 18.8 and April's minus 22.7. The pattern of this graph is very similar to those of US exports and durable goods, on the climb but still well short of February. The week's other sentiment reports from Europe also showed improvement including Germany's GfK overall climate indicator which rose to minus 9.6 for July's outlook versus minus 18.6 in June and minus 23.1 in May. Even so, July's forecast would still be, next to June and May, the third weakest ever in the series. Nevertheless, the Germany household sector is responding to the ongoing reopening and appears increasingly confident that the government's measures to contain the virus will be successful. Yet the week's reintroduction of localized lockdowns in two districts of North Rhine-Westphalia, if widened, could definitely prove a test for July's sentiment.

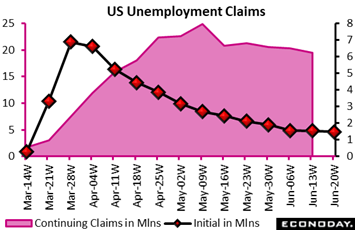

The big news in the coming week will be the US employment report on Friday, a report that last month showed totally unexpected nonfarm payroll growth of 2.509 million. For June, Econoday's consensus is calling for an even greater gain of 2.900 million, a rise that would not be consistent at all with the signal from jobless claims which are at very high levels. Initial claims did fall 60,000 in the June 20 week but the 1.480 million level was 100,000 above Econoday's consensus. Since mid-March when virus effects first took hold, 47.5 million initial claims have been filed. Like initial claims, continuing claims also remain very high, though they did fall 767,000 in lagging data for the June 13 week to 19.522 million. This was the first level under 20 million since mid-April. The unemployment rate for insured workers also improved, down 5 tenths to 13.4 percent. Yet however much claims data are easing and however much payrolls may be rising, job destruction in the labor market is ongoing and enormous. The big news in the coming week will be the US employment report on Friday, a report that last month showed totally unexpected nonfarm payroll growth of 2.509 million. For June, Econoday's consensus is calling for an even greater gain of 2.900 million, a rise that would not be consistent at all with the signal from jobless claims which are at very high levels. Initial claims did fall 60,000 in the June 20 week but the 1.480 million level was 100,000 above Econoday's consensus. Since mid-March when virus effects first took hold, 47.5 million initial claims have been filed. Like initial claims, continuing claims also remain very high, though they did fall 767,000 in lagging data for the June 13 week to 19.522 million. This was the first level under 20 million since mid-April. The unemployment rate for insured workers also improved, down 5 tenths to 13.4 percent. Yet however much claims data are easing and however much payrolls may be rising, job destruction in the labor market is ongoing and enormous.

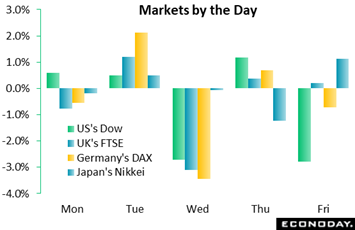

Concern over accelerating infection rates in the US and Germany offset gains for tech stocks to make for a muted Monday. There was talk for another US stimulus package, possibly to include extensions of unemployment benefits. On the trade front, President Trump tweeted late Monday that the US-China trade pact remained "fully intact," which reassured investors after White House trade adviser Peter Navarro said the deal was "over." Markets extended gains to Tuesday helped by better-than-expected purchasing manager indexes across Europe as well as Boris Johnson's announcement that pubs, restaurants, and hair salons in the UK can reopen on July 4, comments that would by week's end contrast with news from the US. Another headline in Tuesday's session came from US Treasury Secretary Mnuchin who again downplayed the possibility that the US would shut down again even if infections continue to rise. And it was new cases and hospitalizations, mostly in the US, that pulled down Wednesday's results with Europe also hit by a report that the US is considering additional tariffs on EU goods. Thursday's news, including a suspended reopening in Texas, wasn't any better though stocks generally rose. On Friday, Asia posted gains while Europe held firm boosted after ECB President Lagarde said the worst of the pandemic may have passed. But a fading pandemic wasn't Friday's news in the US as both Florida and Texas closed their bars and Texas imposed outdoor restrictions, news that sent the Dow down 2.8 percent for a weekly loss of 3.3 percent. Concern over accelerating infection rates in the US and Germany offset gains for tech stocks to make for a muted Monday. There was talk for another US stimulus package, possibly to include extensions of unemployment benefits. On the trade front, President Trump tweeted late Monday that the US-China trade pact remained "fully intact," which reassured investors after White House trade adviser Peter Navarro said the deal was "over." Markets extended gains to Tuesday helped by better-than-expected purchasing manager indexes across Europe as well as Boris Johnson's announcement that pubs, restaurants, and hair salons in the UK can reopen on July 4, comments that would by week's end contrast with news from the US. Another headline in Tuesday's session came from US Treasury Secretary Mnuchin who again downplayed the possibility that the US would shut down again even if infections continue to rise. And it was new cases and hospitalizations, mostly in the US, that pulled down Wednesday's results with Europe also hit by a report that the US is considering additional tariffs on EU goods. Thursday's news, including a suspended reopening in Texas, wasn't any better though stocks generally rose. On Friday, Asia posted gains while Europe held firm boosted after ECB President Lagarde said the worst of the pandemic may have passed. But a fading pandemic wasn't Friday's news in the US as both Florida and Texas closed their bars and Texas imposed outdoor restrictions, news that sent the Dow down 2.8 percent for a weekly loss of 3.3 percent.

Reopenings were just getting underway in May and picked up pace in June, helping both months to mark the beginning of what hopefully will be a brisk recovery up a very steep hill. But news of rising infections rates in the US was the week's unwanted headline, which if repeated in the coming week could begin to completely overshadow what looks to be a positive run of pending economic data for the month of June.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Sentiment indications open a busy week led by June's EC economic sentiment index on Monday and US consumer confidence on Tuesday; both are expected to show improvement but still at deep lows. In contrast, sentiment among Japanese manufacturers is not expected to show improvement in Wednesday's Tankan survey for the second quarter, and continued contraction is the call for Japanese industrial production scheduled for Monday. Manufacturing PMIs will include China's CLFP for June also on Monday, as well as Switzerland's SVME and the US's ISM both on Wednesday. On inflation, the first look at June consumer prices will come from Germany on Monday followed on Tuesday by the Eurozone's HICP flash, also for June. But the week's central news will be June updates on employment, starting Wednesday with Germany's unemployment rate for June followed on Thursday by two reports from the US: initial jobless claims on Thursday and the monthly employment report moved to Thursday from Friday due to the July 4th Independence Day. The former is expected to show continued job losses in contrast to the latter where a 2.9 million nonfarm payroll gain is Econoday's consensus.

Eurozone: EC Economic Sentiment for June (Mon 09:00 GMT; Mon 11:00 CEST; Mon 05:00 EDT)

Consensus Forecast: 82.5

The European Commission's economic sentiment index is expected to come in at 82.5 for June and well up from 67.5 in May.

German Preliminary CPI for June (Mon 12:00 GMT; Mon 14:00 CEST; Mon 08:00 EDT)

Consensus Forecast, Month-to-Month: -0.2%

Consensus Forecast, Year-over-Year: 0.4%

Consumer prices in Germany have been moving lower yet have been broadly stable. For June, forecasters see consumer prices falling 0.2 percent on the month versus a 0.1 percent decline in May. Year-over-year, the rate is seen falling to plus 0.4 percent from plus 0.6 percent.

Japanese Industrial Production for May (Mon 23:50 GMT: Tue 08:50 JST; Mon 19:50 EDT)

Consensus Forecast, Month-to-Month: -5.1%

Industrial production in Japan fell 9.1 percent on the month in April with a fall of 5.1 percent the call for May .

China: CFLP Manufacturing PMI for June (Tue 01:00 GMT; Tue 09:00 CST; Mon 21:00 EDT)

Consensus Forecast: 50.5

China's PMIs have been recovering from this year's opening plunge, holding mostly steady from March to May. Expectations for June's CFLP manufacturing PMI is 50.5 versus May's 50.6.

Eurozone HICP Flash for June (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Year-over-Year: -0.1%

Headline inflation in the Eurozone is expected to ease further in June, to a year-on-year consensus decline of 0.1 percent versus plus 0.1 percent in May.

US Consumer Confidence Index for June (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 90.0

Consumer confidence proved resilient in May, edging higher to 86.6 after a 40-point collapse in April to 85.7. Job assessments were mixed to improved in May, not quite in line with what proved to be an extraordinarily strong May employment report. Headline consensus for June is further improvement to 90.0.

Japanese Tankan for Second Quarter (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Large Manufacturers: -30

Consensus Forecast, Small Manufacturers: -37

The Tankan survey is expected to show further deterioration in manufacturing sentiment, at a minus 30 consensus for large manufacturers and minus 37 for small manufacturers, which would compare with first-quarter readings of minus 8 and minus 15.

Switzerland: SVME PMI for June (Wed 07:30 GMT; Wed 09:30 CEST: Wed 3:30 EDT)

Consensus Forecast: 45.3

The June reading on Swiss manufacturing activity is expected to improve, to 45.3 for the SVME PMI versus May's virus low of 42.1.

German Unemployment Rate for June (Wed 07:55 GMT; Wed 09:55 CEST; Wed 03:55 EDT)

Consensus Forecast: 6.6%

Labor losses in Germany have been limited, with May's unemployment of 6.3 percent up a comparatively moderate 5 tenths from April and 1.3 percentage points from March. For June the expectation is 6.6 percent.

US: ISM Manufacturing Index for June (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast: 48.0

Skewed higher by delivery times that masked low 30 scores for new orders, production, and employment, the ISM manufacturing index has been coming in the low 40s, at 41.5 in April and 43.1 in May. For June, forecasters see the ISM coming in at 48.0.

US Employment Report for June (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: Nonfarm Payrolls Change: 2.900 million

Consensus Forecast: Unemployment Rate: 12.3%

After May's shocking 2.509 million rise in nonfarm payrolls, an even greater gain of 2.900 million is Econoday's consensus for June. The unemployment rate is expected to fall to 12.3 percent versus May's far lower-than-expected 13.3 percent.

Thu Jul-02 12:30 GMT

US Initial Jobless Claims for June 27 Week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.341 million

However strong or weak June's employment report may prove to be, US initial jobless claims have been pointing to enormous weakness in the labor market. Econoday's consensus for the June 27 week is for 1,341 million initial unemployment claims versus 1.480 million in the June 20 week.

|