|

The week's data were highlighted by better-than-expected strength at the consumer level, specifically in Europe and specifically excluding Japan where data on the demand-side are doing as poorly as data on the supply-side. Sentiment measures across the global calendar are improving but not dramatically, certainly not nearly as dramatically as the latest US employment report or the latest data on US housing. The European consumer is where we'll start.

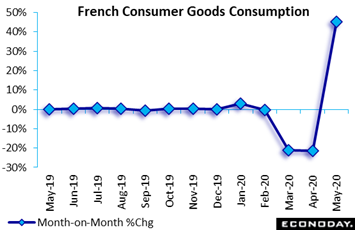

Household spending in France staged a dramatic rebound in May, boosted by less aggressive lockdown restrictions. Spending on manufactured goods surged a monthly 45.1 percent after having slumped 21.3 percent in April and 21.0 percent in March. This lifted annual growth sharply from minus 37.3 percent to minus 8.9 percent. The National Institute of Statistics and Economic Studies which publishes the report concentrated on comparisons with February's pre-crisis level and on this basis, sales were down 7.2 percent for a big improvement from April's minus 32.0 percent. Gains were recorded for transport, household durables, textiles and clothing as well as food and energy. May's results were surprisingly good and prospects for June appear positive too with more stores having reopened and consumer confidence on the climb. Even so, there is still some way to go before household spending in France gets back to normal levels. Household spending in France staged a dramatic rebound in May, boosted by less aggressive lockdown restrictions. Spending on manufactured goods surged a monthly 45.1 percent after having slumped 21.3 percent in April and 21.0 percent in March. This lifted annual growth sharply from minus 37.3 percent to minus 8.9 percent. The National Institute of Statistics and Economic Studies which publishes the report concentrated on comparisons with February's pre-crisis level and on this basis, sales were down 7.2 percent for a big improvement from April's minus 32.0 percent. Gains were recorded for transport, household durables, textiles and clothing as well as food and energy. May's results were surprisingly good and prospects for June appear positive too with more stores having reopened and consumer confidence on the climb. Even so, there is still some way to go before household spending in France gets back to normal levels.

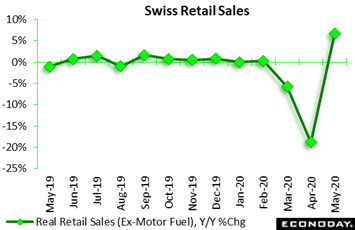

Consumers in Switzerland were also shopping in May as retail sales rebounded in style. Jumping back into positive ground, sales were up 6.6 percent from May last year which compares with April's virus low of minus 18.8 percent. This means that the level of sales is now fully back above its pre-virus level, 5.5 percent higher from February. This remarkable recovery was dominated by discretionary buying where volumes (excluding auto fuel) surged more than 60 percent on the month. Food, drink and tobacco also posted a strong gain. Sales in May and April were only 4.6 percent below their mean level in the first quarter. Absent revisions, this leaves June requiring a monthly rise of 1.7 percent to keep the second quarter flat – a seemingly impossible result even just a month ago. That said, May's jump could turn out to be just a reflection of pent-up demand that proves short-lived. Strong buying in June is certainly not guaranteed. Consumers in Switzerland were also shopping in May as retail sales rebounded in style. Jumping back into positive ground, sales were up 6.6 percent from May last year which compares with April's virus low of minus 18.8 percent. This means that the level of sales is now fully back above its pre-virus level, 5.5 percent higher from February. This remarkable recovery was dominated by discretionary buying where volumes (excluding auto fuel) surged more than 60 percent on the month. Food, drink and tobacco also posted a strong gain. Sales in May and April were only 4.6 percent below their mean level in the first quarter. Absent revisions, this leaves June requiring a monthly rise of 1.7 percent to keep the second quarter flat – a seemingly impossible result even just a month ago. That said, May's jump could turn out to be just a reflection of pent-up demand that proves short-lived. Strong buying in June is certainly not guaranteed.

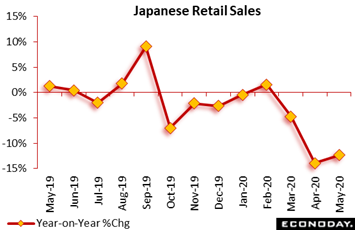

But May wasn't a universally strong month for the consumer, at least not in Japan. Retail sales here were down 12.3 percent on the year in May after dropping 13.9 percent in April. The fall in April was the biggest year-on-year decline since 1998 and May's decline was only slightly less pronounced, highlighting the ongoing impact of the pandemic on economic activity. Weakness in May reflected another set of large declines for key categories including general merchandise, vehicles, fuel, and clothing. This was only partly offset by an increase in food sales from year-on-year growth of 0.3 percent to 2.2 percent. Japan's household spending report will be a highlight of the coming week's calendar. But May wasn't a universally strong month for the consumer, at least not in Japan. Retail sales here were down 12.3 percent on the year in May after dropping 13.9 percent in April. The fall in April was the biggest year-on-year decline since 1998 and May's decline was only slightly less pronounced, highlighting the ongoing impact of the pandemic on economic activity. Weakness in May reflected another set of large declines for key categories including general merchandise, vehicles, fuel, and clothing. This was only partly offset by an increase in food sales from year-on-year growth of 0.3 percent to 2.2 percent. Japan's household spending report will be a highlight of the coming week's calendar.

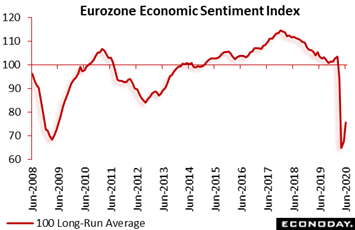

Also not doing so well, or at least not recovering to a dramatic extent, are most sentiment measures. The economic sentiment index from the European Commission, which tracks both businesses and consumers, clawed back further ground in June. Following a 2.9 point rise in May, the headline measure climbed a more marked 8.2 points to 75.7. Yet this undershot market expectations and, although a 3-month high, left the ESI with a 24.3 point shortfall versus its long-run average. But June did see a broad-based pick-up in morale. Sentiment in industry increased from minus 27.5 to minus 21.7 and among consumers from minus 18.8 to minus 14.7. Services, retail, and construction all made fresh gains too. And national ESIs pointed to less pessimistic morale in France, Germany, Italy, and Spain. That said, all four member states remained historically weak. Overall, the June data are in line with a gradual pick-up in economic activity as the ongoing easing of lockdown restrictions provides a boost to both supply-side and demand-side respondents. Also not doing so well, or at least not recovering to a dramatic extent, are most sentiment measures. The economic sentiment index from the European Commission, which tracks both businesses and consumers, clawed back further ground in June. Following a 2.9 point rise in May, the headline measure climbed a more marked 8.2 points to 75.7. Yet this undershot market expectations and, although a 3-month high, left the ESI with a 24.3 point shortfall versus its long-run average. But June did see a broad-based pick-up in morale. Sentiment in industry increased from minus 27.5 to minus 21.7 and among consumers from minus 18.8 to minus 14.7. Services, retail, and construction all made fresh gains too. And national ESIs pointed to less pessimistic morale in France, Germany, Italy, and Spain. That said, all four member states remained historically weak. Overall, the June data are in line with a gradual pick-up in economic activity as the ongoing easing of lockdown restrictions provides a boost to both supply-side and demand-side respondents.

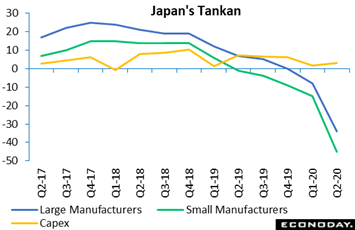

The Tankan survey focuses on supply-side respondents and, like Japanese retail sales, suggests that recovery in Japan is off to a slow start. Business sentiment deteriorated sharply in the manufacturing sector during the second quarter, clearly reflecting the ongoing impact of the virus and associated restrictions. The business conditions index for large manufacturers fell from minus 8 in the first quarter to minus 34 for the weakest level since 2009. The equivalent index for small manufacturers fell from minus 15 to minus 45. But there is a ray of light in the report! Firms expect their capital expenditures to begin improving, rising by 3.2 percent in the Japanese fiscal year ending March 2021. This is up from an initial forecast made three months earlier of only 1.8 percent. The Tankan survey focuses on supply-side respondents and, like Japanese retail sales, suggests that recovery in Japan is off to a slow start. Business sentiment deteriorated sharply in the manufacturing sector during the second quarter, clearly reflecting the ongoing impact of the virus and associated restrictions. The business conditions index for large manufacturers fell from minus 8 in the first quarter to minus 34 for the weakest level since 2009. The equivalent index for small manufacturers fell from minus 15 to minus 45. But there is a ray of light in the report! Firms expect their capital expenditures to begin improving, rising by 3.2 percent in the Japanese fiscal year ending March 2021. This is up from an initial forecast made three months earlier of only 1.8 percent.

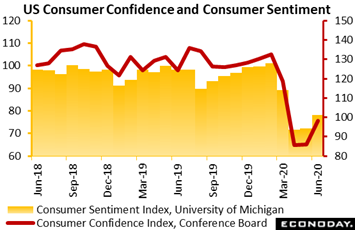

Recovery in confidence readings for the US consumer have also been less than dramatic. The consumer confidence index did rebound more than 12 points to a better-than-expected 98.1 in June but remained far short of its February peak at 132.6. June's gain was centered in the present situation component and reflected tangible improvement in the assessment of the labor market, results that were confirmed later in the week by the US employment report. Fewer respondents said jobs were hard to get (23.8 percent versus May's 29.2 percent) and more say jobs were plentiful (20.8 versus 16.5 percent). The expectations component also improved with fewer seeing job losses six month out. Strength in the stock market, like recovery in employment, has been a general strength for consumer confidence. Bulls widened their lead over bears yet, at 42.3 versus 28.6 percent, the separation wasn't dramatic. Buying plans were also mostly favorable especially for homes, at 6.5 percent of the sample and among the very best readings over the last year. Recovery in confidence readings for the US consumer have also been less than dramatic. The consumer confidence index did rebound more than 12 points to a better-than-expected 98.1 in June but remained far short of its February peak at 132.6. June's gain was centered in the present situation component and reflected tangible improvement in the assessment of the labor market, results that were confirmed later in the week by the US employment report. Fewer respondents said jobs were hard to get (23.8 percent versus May's 29.2 percent) and more say jobs were plentiful (20.8 versus 16.5 percent). The expectations component also improved with fewer seeing job losses six month out. Strength in the stock market, like recovery in employment, has been a general strength for consumer confidence. Bulls widened their lead over bears yet, at 42.3 versus 28.6 percent, the separation wasn't dramatic. Buying plans were also mostly favorable especially for homes, at 6.5 percent of the sample and among the very best readings over the last year.

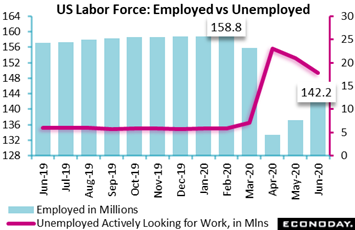

Buying plans in the US are getting a boost from fiscal and monetary stimulus, a flood that, along with easing restrictions during June, fed a 4.8 million rise in nonfarm payrolls, above Econoday's consensus for 3.0 million. The unemployment rate also did better than expectations, falling 2.2 percentage points to 11.1 percent. The graph tracks the number of employed and the number of unemployed actively looking for jobs (it's these two groups together that comprise the US labor market). Like France's statistics agency, the US Labor Department is stressing the necessity to compare the latest results, not with the prior month, but against the pre-virus month of February. At 142.2 million in June, there were compared to February 16.6 million fewer Americans employed. This is a key gauge to measure both the extent of the crisis and the progress of recovery. Looking at the unemployed, this number is up 12.0 million from February to 17.8 million. These numbers do show improvement, but more in line with sentiment numbers and less in line with sky-high retail sales numbers. Yet there is no doubt that June's employment report was filled with positives, including a 356,000 jump in manufacturing payrolls as vehicle and aircraft plants reopened and a 158,000 rise in construction. Buying plans in the US are getting a boost from fiscal and monetary stimulus, a flood that, along with easing restrictions during June, fed a 4.8 million rise in nonfarm payrolls, above Econoday's consensus for 3.0 million. The unemployment rate also did better than expectations, falling 2.2 percentage points to 11.1 percent. The graph tracks the number of employed and the number of unemployed actively looking for jobs (it's these two groups together that comprise the US labor market). Like France's statistics agency, the US Labor Department is stressing the necessity to compare the latest results, not with the prior month, but against the pre-virus month of February. At 142.2 million in June, there were compared to February 16.6 million fewer Americans employed. This is a key gauge to measure both the extent of the crisis and the progress of recovery. Looking at the unemployed, this number is up 12.0 million from February to 17.8 million. These numbers do show improvement, but more in line with sentiment numbers and less in line with sky-high retail sales numbers. Yet there is no doubt that June's employment report was filled with positives, including a 356,000 jump in manufacturing payrolls as vehicle and aircraft plants reopened and a 158,000 rise in construction.

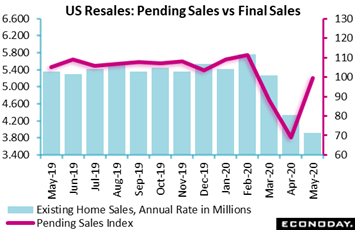

Housing has easily led all sectors of the US economy during the crisis, showing limited contraction in residential spending and especially limited contraction for new home sales. Sales of existing homes had been trailing but not any more. The pending home sales index, which tracks initial signings for resales, surged 44.3 percent in May; this was far better than expected and points to sharp gains for final sales in the months of June and July. The National Association of Realtors, which publishes the report, described the results as "spectacular" noting that listings have also been climbing which will offer buyers more choices and which should give a further boost to sales. Housing has easily led all sectors of the US economy during the crisis, showing limited contraction in residential spending and especially limited contraction for new home sales. Sales of existing homes had been trailing but not any more. The pending home sales index, which tracks initial signings for resales, surged 44.3 percent in May; this was far better than expected and points to sharp gains for final sales in the months of June and July. The National Association of Realtors, which publishes the report, described the results as "spectacular" noting that listings have also been climbing which will offer buyers more choices and which should give a further boost to sales.

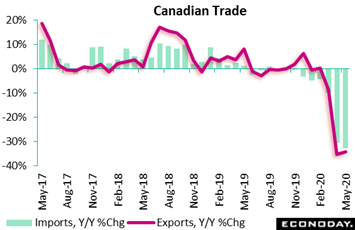

We end the week's data run, however, not on a positive note but rather a troubling one. Outside of China, there have yet to be indications of recovery in cross-border trade. Canada offers the latest example, posting annual contraction of 34.1 percent in exports during May and 32.6 percent for imports. Despite some improvement, Canadian imports of industrial supplies have been very weak while exports of vehicles were down 80 percent on the year. US trade data for May were also released during the week, showing similar results with exports down 32.1 percent on the year and imports down 24.6 percent. Of all the different economic categories subject to long-term consequences from the virus, international trade looks to be most at risk. We end the week's data run, however, not on a positive note but rather a troubling one. Outside of China, there have yet to be indications of recovery in cross-border trade. Canada offers the latest example, posting annual contraction of 34.1 percent in exports during May and 32.6 percent for imports. Despite some improvement, Canadian imports of industrial supplies have been very weak while exports of vehicles were down 80 percent on the year. US trade data for May were also released during the week, showing similar results with exports down 32.1 percent on the year and imports down 24.6 percent. Of all the different economic categories subject to long-term consequences from the virus, international trade looks to be most at risk.

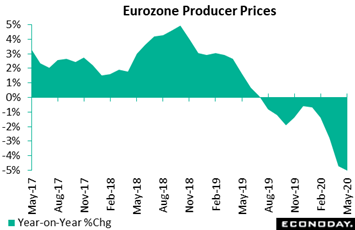

Another area at risk is price inflation, or rather deflation which is deepening right now at the producer level. Eurozone producer prices fell in May for a fourth time in as many months, 5 tenths deeper into annual contraction at 5.0 percent for the worst showing since October 2009. It was again energy that posted the steepest decline but even excluding this category, the underlying rate dropped from an annual minus 0.3 percent to minus 0.6 percent, only its second sub-zero reading since September 2016. Elsewhere, intermediates and consumer non-durables were down while capital goods and consumer non-durables were flat. Pipeline price pressures have fizzled due to the crisis and, for the European Central Bank which is sticking with its lofty 2 percent inflation goal, the situation is certainly a major concern. Another area at risk is price inflation, or rather deflation which is deepening right now at the producer level. Eurozone producer prices fell in May for a fourth time in as many months, 5 tenths deeper into annual contraction at 5.0 percent for the worst showing since October 2009. It was again energy that posted the steepest decline but even excluding this category, the underlying rate dropped from an annual minus 0.3 percent to minus 0.6 percent, only its second sub-zero reading since September 2016. Elsewhere, intermediates and consumer non-durables were down while capital goods and consumer non-durables were flat. Pipeline price pressures have fizzled due to the crisis and, for the European Central Bank which is sticking with its lofty 2 percent inflation goal, the situation is certainly a major concern.

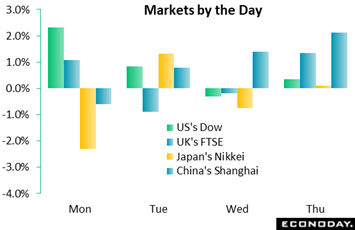

Outside of Japan, it was a good week for the global stock markets. Economic data made their impact beginning on Monday with the surge in pending home sales along with a massive 43 point recovery in the Dallas Fed's manufacturing index helping to give the Dow a lift. The rise in the EC's economic sentiment index helped Monday's session in Europe in contrast to the drop in Japanese retail sales which pressured the Nikkei. Helping the Shanghai on Tuesday were gains for the CFLP PMIs to 50.9 for manufacturing that indicates slight plus-50 growth and 54.4 for non-manufacturing to indicate outright solid growth. The Nikkei was held down on Wednesday by the weakness of the second-quarter Tankan report, which contrasted with a surprisingly solid ISM manufacturing report from the US where new orders and production are now suddenly in the mid-to-high 50 area. Pfizer was a big gainer on Wednesday after it said a vaccine it is developing with German biotech BioNTech produces antibodies in humans and is well tolerated. The vaccine news carried over strongly into Thursday's European session where solid gains were posted. Markets in Europe and the US were also given a lift by Thursday's better-than-expected results for US employment. Outside of Japan, it was a good week for the global stock markets. Economic data made their impact beginning on Monday with the surge in pending home sales along with a massive 43 point recovery in the Dallas Fed's manufacturing index helping to give the Dow a lift. The rise in the EC's economic sentiment index helped Monday's session in Europe in contrast to the drop in Japanese retail sales which pressured the Nikkei. Helping the Shanghai on Tuesday were gains for the CFLP PMIs to 50.9 for manufacturing that indicates slight plus-50 growth and 54.4 for non-manufacturing to indicate outright solid growth. The Nikkei was held down on Wednesday by the weakness of the second-quarter Tankan report, which contrasted with a surprisingly solid ISM manufacturing report from the US where new orders and production are now suddenly in the mid-to-high 50 area. Pfizer was a big gainer on Wednesday after it said a vaccine it is developing with German biotech BioNTech produces antibodies in humans and is well tolerated. The vaccine news carried over strongly into Thursday's European session where solid gains were posted. Markets in Europe and the US were also given a lift by Thursday's better-than-expected results for US employment.

Not measured in the week's data are the unfolding effects of a rising infection rate in the US, one that clouds what would otherwise be positive indications for a 'V' recovery. How much a return of restrictions could affect the US is certain to be key for the whole global recovery, underscored by the week's minutes from the June FOMC where staff economists, citing the possibility of a second wave, warned that pessimistic projections were no less plausible than the Fed's favorable baseline forecasts.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Surprise demand-side strength was the surprise of the prior week and will be updated on Monday with Eurozone retail sales which are expected to rise sharply in contrast, however, to Japanese household spending on Tuesday which is expected to fall sharply. The week's supply-side highlight will be a run of May industrial production reports led by Germany on Tuesday where significant improvement is expected. German manufacturers' orders for May will be posted on Monday, setting up expectations for German production in June. Japanese machine orders for May, like Japanese household spending, are expected to remain weak in data posted on Thursday. Updates on employment will include Thursday's claims data from the US, which have been holding stubbornly over 1 million per week, and Canada's labour force survey for June which will close the week on Friday.

German Manufacturers' Orders for May (Mon 06:00 GMT; Mon 08:00 CEST; Mon 02:00 EDT)

Consensus Forecast, Month-to-Month: 13.0%

Contraction for German orders is expected to reverse in May. A 13.0 percent monthly jump is expected versus 25.8 percent contraction in April.

Eurozone Retail Sales for May (Mon 09:00 GMT; Mon 11:00 CEST; Mon 05:00 EDT)

Consensus Forecast, Month-to-Month: 15.0%

Retail sales in the Eurozone fell 11.7 percent in April and 11.1 percent in March with a monthly increase of 15.0 percent the consensus for May.

Japanese Household Spending for May (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast, Month-to-Month: -6.0%

Consensus Forecast, Year-over-Year: -15.0%

Household spending for May is expected to fall a monthly 6.0 percent, little improved from a 6.2 percent decline in April, with the year-on-year rate seen deepening to minus 15.0 percent versus April's minus 11.1 percent.

German Industrial Production for May (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast, Month-to-Month: 10.5%

A 10.5 percent jump is expected for German industrial production in May following contraction of 17.9 percent and 8.9 percent in April and March.

Japanese Machine Orders for May (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Month-to-Month: -9.0%

After a 12.0 percent monthly decline in April, forecasters see Japanese machine orders falling another 9.0 percent in May.

Chinese CPI for June (Thu 01:30 GMT; Thu 09:30 CST; Wed 21:30 EDT)

Consensus Forecast, Month-to-Month: -0.4%

Consensus Forecast, Year-over-Year: 2.7%

Consumer prices in China have been easing, falling 9 tenths on the year in May to a lower-than-expected 2.4 percent with, however, a rebound to 2.7 percent the expectation for June. The monthly rate is seen at minus 0.4 percent versus May's minus 0.8 percent.

US Initial Jobless Claims for July 4 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.330 million

Weekly initial jobless claims have remained over 1 million but have been going down week by week. Initial claims are expected at 1.330 million in the July 4 week versus 1.427 million in the June 27 week.

Canadian Labour Force Survey for June (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 500,000

Consensus Forecast: Unemployment Rate: 13.0%

After May's unexpected 290,000 rise, employment in June is expected to rise a further 500,000. The unemployment rate is expected to fall to 13.0 percent versus 13.7 percent in May.

|