|

The global economy is climbing yet given the hole's enormous depth, only about half of the depth has been scaled at the very most. Yet the pace of the climb is respectable enough and raises the prospect that what was lost to the virus can be made up sooner than later. That's one possibility but another is a second wave of the virus taking hold that results in renewed shutdowns which could kick the global economy back to the bottom. The second possibility is of course conjecture, but an exploration of the first is what we'll attempt.

Sizable monthly increases are the themes of the latest economic reports, yes the result of easy comparisons with spring lows but nevertheless suggestive of extended gains into the summer months. German manufacturers reported a 10.4 percent monthly jump in orders during May, a big gain tracked in the blue column of the graph but only a small fraction of the 17.5 percent plunge in April and the 15.2 percent plunge in March. Compared to the pre-virus level of February, orders were still 1/3 lower, down 30.8 percent. The depth of the hole is also tracked by the red line of the year-on-year rate which etched its low at 37.0 percent in April and which improved to 29.4 percent in May. There's still a long way to go but the German manufacturing sector is nevertheless heading higher. Sizable monthly increases are the themes of the latest economic reports, yes the result of easy comparisons with spring lows but nevertheless suggestive of extended gains into the summer months. German manufacturers reported a 10.4 percent monthly jump in orders during May, a big gain tracked in the blue column of the graph but only a small fraction of the 17.5 percent plunge in April and the 15.2 percent plunge in March. Compared to the pre-virus level of February, orders were still 1/3 lower, down 30.8 percent. The depth of the hole is also tracked by the red line of the year-on-year rate which etched its low at 37.0 percent in April and which improved to 29.4 percent in May. There's still a long way to go but the German manufacturing sector is nevertheless heading higher.

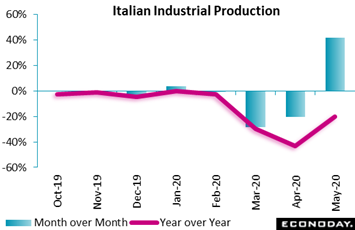

The gain in German orders will be a plus for German industrial production in June where gains would help limit second-quarter contraction. German production in May was released during the week and a 7.8 percent bounce higher was promising but was outmatched by Italy, a country that was hit much more severely by covid than Germany. Goods production in Italy rebounded in style in May, soaring a record 42.1 percent in a monthly leap that was more than double market expectations and the first increase since January. Year-on-year growth climbed from minus 43.4 percent to minus 20.3 percent, which matches closely with the February-to-May decline of 19.2 percent. The monthly jump in May was sweeping, led by capital goods at a monthly 65.8 percent and including consumer goods at 30.8 percent. Italian industry, like that of Germany, appears to be on the mend. The gain in German orders will be a plus for German industrial production in June where gains would help limit second-quarter contraction. German production in May was released during the week and a 7.8 percent bounce higher was promising but was outmatched by Italy, a country that was hit much more severely by covid than Germany. Goods production in Italy rebounded in style in May, soaring a record 42.1 percent in a monthly leap that was more than double market expectations and the first increase since January. Year-on-year growth climbed from minus 43.4 percent to minus 20.3 percent, which matches closely with the February-to-May decline of 19.2 percent. The monthly jump in May was sweeping, led by capital goods at a monthly 65.8 percent and including consumer goods at 30.8 percent. Italian industry, like that of Germany, appears to be on the mend.

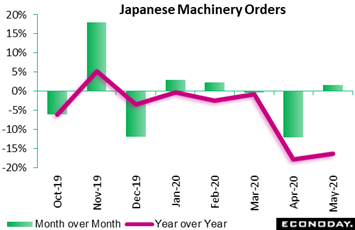

Europe has been at the front of the uphill charge in contrast to Japan which has been struggling at the bottom. Japan's private sector machinery orders (excluding volatile items) did rise 1.7 percent on the month in May, a modest gain but rebounding from a decline of 12.0 percent in April which does suggest that parts the Japanese economy have begun to stabilize. Yet the year-on-year rate is not showing much progress at all, up only 1.4 percentage points to minus 16.3 percent. And what improvement there was didn't include manufacturing where orders fell 15.5 percent on the month which was far deeper than April's 2.6 percent decline. Yet orders from non-manufacturers have continued to come in, up 17.7 percent and supporting official projections that total Japanese orders will end up declining only 0.9 percent in the second quarter as a whole. Europe has been at the front of the uphill charge in contrast to Japan which has been struggling at the bottom. Japan's private sector machinery orders (excluding volatile items) did rise 1.7 percent on the month in May, a modest gain but rebounding from a decline of 12.0 percent in April which does suggest that parts the Japanese economy have begun to stabilize. Yet the year-on-year rate is not showing much progress at all, up only 1.4 percentage points to minus 16.3 percent. And what improvement there was didn't include manufacturing where orders fell 15.5 percent on the month which was far deeper than April's 2.6 percent decline. Yet orders from non-manufacturers have continued to come in, up 17.7 percent and supporting official projections that total Japanese orders will end up declining only 0.9 percent in the second quarter as a whole.

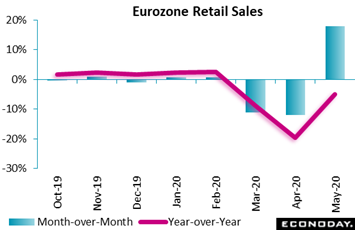

Though shallower than others, Japan's growth trend is consistent with the general lot: monthly rates above the zero line in contrast to yearly rates that are still below. But less below is the indication for the demand-side of the global economy which appears to be rebounding faster than production. Retail sales in Europe surged 17.8 percent by volume in May to take this year-on-year reading from minus 19.6 percent to only minus 5.1 percent and only at minus 7.4 percent when compared to February. The European consumer is getting very close to the top of the crater. All major categories posted May gains especially textiles, clothing and footwear which rose 147 percent to more than reverse the cumulative 100 percent slide seen in March and April combined. Computer equipment was another gainer as was auto fuel as Europeans took back to the roads. All reporting member states recorded monthly increases including France, up 25.6 percent, Germany up 13.9 percent, and Spain up 18.0 percent. Though shallower than others, Japan's growth trend is consistent with the general lot: monthly rates above the zero line in contrast to yearly rates that are still below. But less below is the indication for the demand-side of the global economy which appears to be rebounding faster than production. Retail sales in Europe surged 17.8 percent by volume in May to take this year-on-year reading from minus 19.6 percent to only minus 5.1 percent and only at minus 7.4 percent when compared to February. The European consumer is getting very close to the top of the crater. All major categories posted May gains especially textiles, clothing and footwear which rose 147 percent to more than reverse the cumulative 100 percent slide seen in March and April combined. Computer equipment was another gainer as was auto fuel as Europeans took back to the roads. All reporting member states recorded monthly increases including France, up 25.6 percent, Germany up 13.9 percent, and Spain up 18.0 percent.

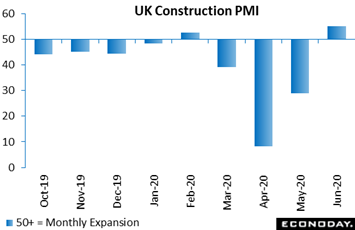

Anecdotal surveys of purchasing managers are used to produce advance indications on immediate conditions, and one report from the UK offered some of the week's best news. At 55.3 in June, the construction sector was both much stronger than expected and, crucially, back above the 50-expansion threshold. Though gains for commercial work and civil engineering activity were rather softer, residential building had a strong month with 46 percent of respondents reporting an increase in activity compared to May and only 27 percent a reduction. This was the construction's best month in nearly five years. Note that the latest column in the graph is similar to the monthly percentage gains in the prior graphs, underscoring the month-to-month methodology of the PMI reports. Anecdotal surveys of purchasing managers are used to produce advance indications on immediate conditions, and one report from the UK offered some of the week's best news. At 55.3 in June, the construction sector was both much stronger than expected and, crucially, back above the 50-expansion threshold. Though gains for commercial work and civil engineering activity were rather softer, residential building had a strong month with 46 percent of respondents reporting an increase in activity compared to May and only 27 percent a reduction. This was the construction's best month in nearly five years. Note that the latest column in the graph is similar to the monthly percentage gains in the prior graphs, underscoring the month-to-month methodology of the PMI reports.

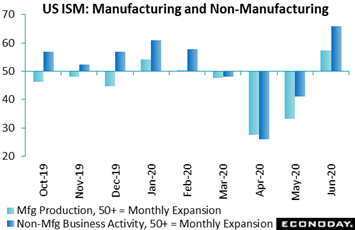

Exceeding the 55.3 reading for UK construction was a 57.1 score from the non-manufacturing sample of the US Institute For Supply Management (ISM). The bottom of the hole appears to be in the past for this indicator highlighted especially by a searing 66.0 score for business activity, a sub-index that measures the sample's output as tracked in the graph. New orders were right behind at 61.6 which again is a monthly comparison against May, not to pre-virus levels back in February. Nevertheless, the news is very good and included a similar score for new export orders, at 58.9, and even an incremental plus-50 build in total backlog orders at 51.9. The light columns in the graph track production in the ISM's manufacturing survey which was released in the prior week and where June's score was also favorable, at 57.3 in what hopefully is the beginning of a consistent run into the 60s should the recovery gain steam. Exceeding the 55.3 reading for UK construction was a 57.1 score from the non-manufacturing sample of the US Institute For Supply Management (ISM). The bottom of the hole appears to be in the past for this indicator highlighted especially by a searing 66.0 score for business activity, a sub-index that measures the sample's output as tracked in the graph. New orders were right behind at 61.6 which again is a monthly comparison against May, not to pre-virus levels back in February. Nevertheless, the news is very good and included a similar score for new export orders, at 58.9, and even an incremental plus-50 build in total backlog orders at 51.9. The light columns in the graph track production in the ISM's manufacturing survey which was released in the prior week and where June's score was also favorable, at 57.3 in what hopefully is the beginning of a consistent run into the 60s should the recovery gain steam.

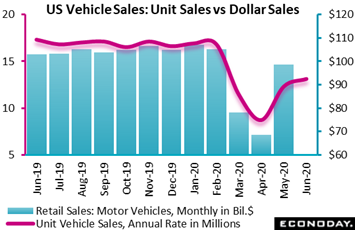

Monthly and yearly readings aside, what measure best captures where we are right now? The answer is actual levels of production or sales or, in this case, US unit sales as reported by auto makers. Unit vehicle sales back in May shot higher from a 8.7 million annual rate to a 12.3 million rate, a jump that Fed Chairman Jerome Powell cited at the time as a reason for optimism and that made, in separate data released later by the government, for a 44.1 percent surge in dollar sales of vehicles to consumers. Unit sales extended their gain in June to a 13.1 million rate which is a favorable signal that dollar sales, if they do understandably fall back after May's great surge, won't fall back that much. Forecasters see US retail sales, a highlight of the coming week's global calendar, rising 5.3 percent in June. Monthly and yearly readings aside, what measure best captures where we are right now? The answer is actual levels of production or sales or, in this case, US unit sales as reported by auto makers. Unit vehicle sales back in May shot higher from a 8.7 million annual rate to a 12.3 million rate, a jump that Fed Chairman Jerome Powell cited at the time as a reason for optimism and that made, in separate data released later by the government, for a 44.1 percent surge in dollar sales of vehicles to consumers. Unit sales extended their gain in June to a 13.1 million rate which is a favorable signal that dollar sales, if they do understandably fall back after May's great surge, won't fall back that much. Forecasters see US retail sales, a highlight of the coming week's global calendar, rising 5.3 percent in June.

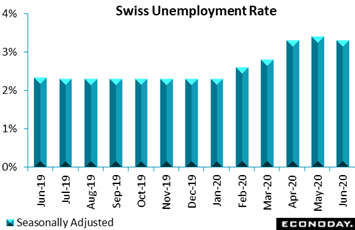

And extending this theme of optimism, let us move to Switzerland where damage from the virus has been very limited. The country's adjusted jobless rate actually fell 1 tenth in June to 3.3 percent as the number of unemployed remained limited at 155,200 and as job prospects improved with vacancies up 1.0 percent on the month. The June data were unexpectedly positive and bolster hopes for a relatively rapid recovery in Swiss economic activity. This would be consistent with the jump seen in the country's retail sales in May that more than reversed their slump in March and April. The ongoing easing of lockdown restrictions and the government's shorter working hour scheme aimed at avoiding fresh layoffs are clearly providing support. While early days yet, the signs are that second-quarter Swiss GDP could be significantly less negative than originally thought. And extending this theme of optimism, let us move to Switzerland where damage from the virus has been very limited. The country's adjusted jobless rate actually fell 1 tenth in June to 3.3 percent as the number of unemployed remained limited at 155,200 and as job prospects improved with vacancies up 1.0 percent on the month. The June data were unexpectedly positive and bolster hopes for a relatively rapid recovery in Swiss economic activity. This would be consistent with the jump seen in the country's retail sales in May that more than reversed their slump in March and April. The ongoing easing of lockdown restrictions and the government's shorter working hour scheme aimed at avoiding fresh layoffs are clearly providing support. While early days yet, the signs are that second-quarter Swiss GDP could be significantly less negative than originally thought.

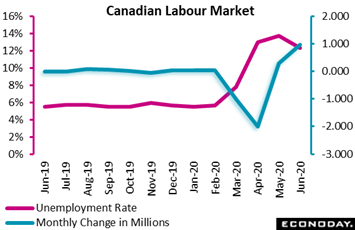

Employment never buckled in Switzerland during the crisis nor anywhere in Europe for that matter, at least compared to the North America where vast unemployment for low wage workers was the story of March and April. But May and June have been solid recovery months underscored by employment in Canada which accelerated faster than expected in June, adding 953,000 jobs after May's 290,000 increase and shrinking the overall jobs decline from pre-virus levels to around 1.8 million. The unemployment rate fell from May's record high 13.7 percent to 12.3 percent, also a better than expected improvement, while the labor force participation rate increased by 2.4 percentage points to 63.8 percent. Lower wage workers in Canada, like those in the US, continue to bear a disproportionate share of the virus impact, as jobs for this group have recovered only 78.8 percent of their February level versus 96.7 percent for higher wage workers. The number of Canadians working from home, which rose by an estimated 3 million to 5 million in April and held steady in May, fell by about 400,000 in June as more workplaces re-opened. Employment never buckled in Switzerland during the crisis nor anywhere in Europe for that matter, at least compared to the North America where vast unemployment for low wage workers was the story of March and April. But May and June have been solid recovery months underscored by employment in Canada which accelerated faster than expected in June, adding 953,000 jobs after May's 290,000 increase and shrinking the overall jobs decline from pre-virus levels to around 1.8 million. The unemployment rate fell from May's record high 13.7 percent to 12.3 percent, also a better than expected improvement, while the labor force participation rate increased by 2.4 percentage points to 63.8 percent. Lower wage workers in Canada, like those in the US, continue to bear a disproportionate share of the virus impact, as jobs for this group have recovered only 78.8 percent of their February level versus 96.7 percent for higher wage workers. The number of Canadians working from home, which rose by an estimated 3 million to 5 million in April and held steady in May, fell by about 400,000 in June as more workplaces re-opened.

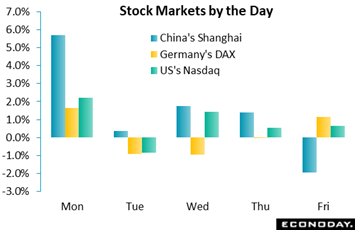

The week was one of official comments and cheap funding doing their work. Monday opened with strong gains after an editorial in the state-controlled China Securities Journal advocated for a "healthy bull market" for domestic shares. The editorial boosted confidence that Chinese officials will be supportive of further share-market gains as part of efforts to drive economic recovery after the covid downturn. Markets stepped back on Tuesday amid warnings from Fed officials that rising infections in the US are prompting consumers and businesses to retrench, risking a leveling off in the recovery. Wednesday's news included speculation that the US could, in retaliation for China's security move, try to undermine Hong Kong's dollar peg as well as a report that the Trump administration may impose new restrictions on companies doing business with Huawei. News later in the week included record infection rates across much of the US including new shutdowns for several states including Texas. Friday's shares got a lift from Gilead whose remdesivir drug was said to significantly improve recovery and reduce the risk of covid death. Good news or bad news, the Nasdaq, steaming with hot money and cheap funding, rallied through the week for a 4.0 percent gain, surpassed only by Shanghai's 7.3 percent surge. The week was one of official comments and cheap funding doing their work. Monday opened with strong gains after an editorial in the state-controlled China Securities Journal advocated for a "healthy bull market" for domestic shares. The editorial boosted confidence that Chinese officials will be supportive of further share-market gains as part of efforts to drive economic recovery after the covid downturn. Markets stepped back on Tuesday amid warnings from Fed officials that rising infections in the US are prompting consumers and businesses to retrench, risking a leveling off in the recovery. Wednesday's news included speculation that the US could, in retaliation for China's security move, try to undermine Hong Kong's dollar peg as well as a report that the Trump administration may impose new restrictions on companies doing business with Huawei. News later in the week included record infection rates across much of the US including new shutdowns for several states including Texas. Friday's shares got a lift from Gilead whose remdesivir drug was said to significantly improve recovery and reduce the risk of covid death. Good news or bad news, the Nasdaq, steaming with hot money and cheap funding, rallied through the week for a 4.0 percent gain, surpassed only by Shanghai's 7.3 percent surge.

Whether gains in the stock market will help the global economy to recover or, in contrast, risk a financial reversal that could deepen the hole is a question for policy makers, whether monetary or fiscal. As of right now, and barring a second wave taking hold, the path to recovery led by consumer spending appears plausible enough.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week will be dominated by China, beginning Monday with merchandise trade followed on Thursday by the whole slate: retail sales, industrial production and GDP. Expectations for the run point to tangible but nevertheless limited improvement for the Chinese economy. US data will also be very heavy including industrial production on Wednesday, where June's consensus is for a second month of strong recovery, and retail sales on Thursday where expectations are also upbeat. Not favorable at all, however, are expectations for initial US jobless claims on Thursday with Econoday's consensus, not only well above 1 million, but also calling for the first rise since the beginning of the crisis. Other data to watch will be monthly GDP from the UK where an actual gain is expected, Germany's ZEW Survey also on Tuesday where mixed results are seen, Australian unemployment on Thursday where improvement is the call, as well as consumer prices from the US and the UK on Tuesday and Wednesday with traction, at least overall for the US, expected.

Chinese Merchandise Trade Balance for June (Estimated for Tuesday, Release Time Not Set)

Consensus Forecast: US58.6$ billion

Imports, Year-on-Year: -10.0%

Exports, Year-on-Year: -1.5%

China's trade surplus hit a record $US62.9 billion in May, reflecting a deep drop in imports but masking contraction in exports as well. For June, the consensus surplus is $58.6 billion with imports seen down a year-on-year 10.0 percent and exports down 1.5 percent.

UK GDP for May (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, Month-to-Month: 5.0%

GDP in the UK fell 5.8 percent in the initial virus impact of March then swooned 20.4 percent in April. Expectations for May GDP, in what will fill out general estimates for second-quarter GDP elsewhere, is a bounce-back rise of 5.0 percent.

Germany: ZEW Survey for July (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Business Expectations: 61.0

Consensus Forecast, Current Conditions: -61.0

The July ZEW survey is seen signaling a slower pace of decline in current conditions, at a minus 61.0 consensus versus minus 83.1 in June, together with a steady reading for expectations, at a plus 61.0 consensus versus 63.4.

US CPI for June (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month-to-Month Change: 0.5%

Consensus Forecast, Year-over-Year Change: 0.6%

US CPI Core, Less Food & Energy

Consensus Forecast, Month-to-Month Change: 0.1%

Consensus Forecast, Year-over-Year Change: 1.2%

For the first time in 63 years of records and reflecting the impact of virus effects, the core CPI in May posted a third straight decline, down 0.1 percent with Econoday's consensus for June at plus 0.1 percent. Total prices also fell 0.1 percent in May with June's consensus at an energy-boosted plus 0.5 percent.

UK CPI for June (Wed 08:30 GMT; Wed 09:30 BST; Wed 04:30 EDT)

Consensus Forecast, Month-to-Month: 0.0%

Consensus Forecast, Year-over-Year: 0.5%

Consumer prices are seen unchanged on the month in June, holding annual inflation at May's 0.5 percent.

US Industrial Production for June (Wed 13:15 GMT; Wed 09:15 EDT)

Consensus Forecast, Month-to-Month: 4.3%

US Manufacturing Production

Consensus Forecast, Month-to-Month: 5.5%

US industrial production rebounded 1.4 percent in May but barely made a dent in April's 12.5 percent decline. For June, Econoday's consensus is a strong 4.3 percent increase overall with manufacturing seen up 5.5 percent.

Australian Labour Force Survey for June (Thu 00:30 GMT; Thu 11:30 AEST; Wed 21:30 EDT)

Consensus Forecast, Unemployment Rate: 7.0%

Consensus Forecast, Employment: -100,000

Employment in Australia fell 227,700 in May which was less severe than 607,400 in April. With restrictions having been eased further in May, employment is seen falling 100,000 in June. The unemployment rate is expected to edge lower to 7.0 percent versus May's 7.1 percent.

Chinese Second-Quarter GDP (Estimated for Thursday, Release Time Not Set)

Consensus Forecast, Year-on-Year: 2.3%

In snap-back from steep virus contraction of 6.8 percent in the first quarter, second-quarter GDP in China is expected to post year-on-year growth of 2.3 percent.

Chinese Fixed Asset Investment for June (Thu 02:00 GMT; Thu 10:00 CST; Wed 22:00 EDT)

Consensus Forecast, Month-to-Month: -3.3%

Chinese fixed asset investment has been improving from the year-opening collapse. Expectations for year-to-date June are minus 3.3 percent versus minus 6.3 percent in May.

Chinese Industrial Production for June (Thu 02:00 GMT; Thu 10:00 CST; Wed 22:00 EDT)

Consensus Forecast: 4.6%

Industrial production is expected to continue to recover in June, rising at a year-on-year 4.6 percent pace following May's 4.4 percent which missed expectations for 4.9 percent.

Chinese Retail Sales for June (Thu 02:00 GMT; Thu 10:00 CST; Wed 22:00 EDT)

Consensus Forecast, Year-over-Year: 0.4%

At plus 0.4 percent, Chinese retail sales in June are expected to improve from year-on-year contraction of 2.8 percent in May which was weaker than expectations for minus 2.3 percent. Sales contraction was as deep as 20.5 percent when the virus struck China at the outset of the year.

US Initial Jobless Claims for July 11 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.323 million

US initial jobless claims are expected to end 14 straight weeks of decline, rising to 1.323 million in the July 11 week from 1.314 million in the July 4 week.

Retail Sales for June (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Month-to-Month: 5.3%

Consensus Forecast, Ex-Autos, Ex-Gas: 4.6%

Consensus Forecast, Control Group: 3.3%

Retail sales soared past expectations in May with a 17.7 percent monthly surge, one fed by government subsidies to consumers. For June, Econoday's consensus is calling for a 5.3 percent increase with ex-auto ex-gas seen rising 4.6 percent and the control group rising 3.3 percent.

|