|

More and more indicators are now filling out the upside of the 'V'-shaped recovery, right as infection rates in the US are on the rise again. Additional stimulus to finish the 'V' and avoid any relapse is focused on government action, whether the US extending unemployment benefits and issuing new stimulus checks or the European Union and its pending announcement on how talks between its Northern neighbors and Southern neighbors have concluded. But conclusions aren't something we rush to in this article which begins with the US consumer.

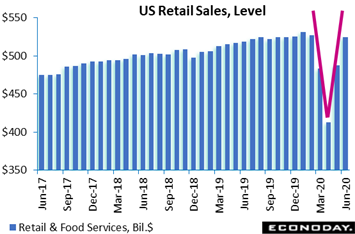

The demand-side of the US economy, way back in the distant month of June, had just about climbed back to where it was before the crisis hit. Retail sales jumped 7.5 percent in the month with the year-on-year rate at 1 percent in June for the first positive reading since February. And, decisively, June's level of $524.3 billion as tracked in the graph is pretty close to February's $527.3 billion (all data are adjusted for seasonal and calendar effects). The variety of breakdowns in the report confirmed the recovery, all rising in the mid-to-high single digits on the month and all returning, and some even now exceeding, their pre-crisis levels. And vehicle sales continue to be a leading factor in the climb, up 8.2 percent in June and up 7.5 percent on the year. June's report confirms the initial success of aggressive easing and lending moves by the Federal Reserve and especially the hefty unemployment benefits and consumer payouts from the government. What happens if these benefits are not extended is another question, especially as the labor market has yet to show the same pace of recovery that spending has. The demand-side of the US economy, way back in the distant month of June, had just about climbed back to where it was before the crisis hit. Retail sales jumped 7.5 percent in the month with the year-on-year rate at 1 percent in June for the first positive reading since February. And, decisively, June's level of $524.3 billion as tracked in the graph is pretty close to February's $527.3 billion (all data are adjusted for seasonal and calendar effects). The variety of breakdowns in the report confirmed the recovery, all rising in the mid-to-high single digits on the month and all returning, and some even now exceeding, their pre-crisis levels. And vehicle sales continue to be a leading factor in the climb, up 8.2 percent in June and up 7.5 percent on the year. June's report confirms the initial success of aggressive easing and lending moves by the Federal Reserve and especially the hefty unemployment benefits and consumer payouts from the government. What happens if these benefits are not extended is another question, especially as the labor market has yet to show the same pace of recovery that spending has.

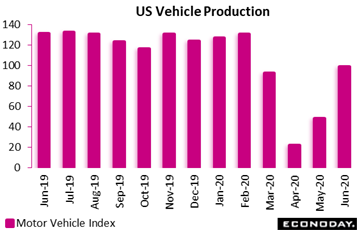

Production in the US, unlike retail sales, has yet to close out the right side of the 'V'. Industrial production did jump 5.4 percent in June with the manufacturing component rising an even sharper 7.2 percent as motor vehicle output doubled. Yet unlike retail sales, industrial production hasn't yet gotten itself out of the hole. Total production was still down a sizable 10.8 percent from last June and compared to February, production was down virtually the same, 10.9 percent lower. And in contrast to the 7.5 percent year-on-year rise in vehicle sales, vehicle production's on-year showing was still 24.6 percent in the red. Production in the US, unlike retail sales, has yet to close out the right side of the 'V'. Industrial production did jump 5.4 percent in June with the manufacturing component rising an even sharper 7.2 percent as motor vehicle output doubled. Yet unlike retail sales, industrial production hasn't yet gotten itself out of the hole. Total production was still down a sizable 10.8 percent from last June and compared to February, production was down virtually the same, 10.9 percent lower. And in contrast to the 7.5 percent year-on-year rise in vehicle sales, vehicle production's on-year showing was still 24.6 percent in the red.

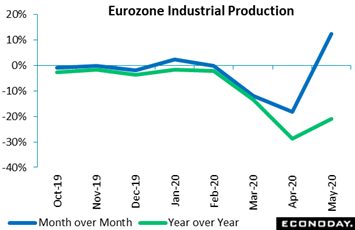

Definitive data on European production has yet to be posted for June, but May's report was very positive. Nevertheless, a record 12.4 percent monthly rebound (blue line in graph) failed to reverse April's 18.2 percent slump with annual contraction still severe at 20.9 percent (green line). May's recovery was at least broad-based and generally widespread as factories began to reopen across the region. Most reporting members posted sizeable monthly gains including the largest members: Germany up 9.7 percent, France up 20.0 percent, Italy 42.1 percent, and Spain 15.1 percent. Goods production snapped back in May and was already on the path to recovery but, nonetheless, was still nearly 19 percent below its pre-virus level. And near-term prospects remain clouded, not only by the risk of a second wave but also by a lack of new orders as producers keep busy working down their declining backlogs. Definitive data on European production has yet to be posted for June, but May's report was very positive. Nevertheless, a record 12.4 percent monthly rebound (blue line in graph) failed to reverse April's 18.2 percent slump with annual contraction still severe at 20.9 percent (green line). May's recovery was at least broad-based and generally widespread as factories began to reopen across the region. Most reporting members posted sizeable monthly gains including the largest members: Germany up 9.7 percent, France up 20.0 percent, Italy 42.1 percent, and Spain 15.1 percent. Goods production snapped back in May and was already on the path to recovery but, nonetheless, was still nearly 19 percent below its pre-virus level. And near-term prospects remain clouded, not only by the risk of a second wave but also by a lack of new orders as producers keep busy working down their declining backlogs.

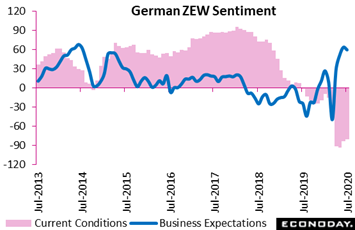

Sentiment indicators were a feature of the week's data run and showed separation between Germany, where infection rates are mostly stable and low, and the US where infection rates are not stable and low. Expectations among analysts did slip 4.1 points but the 59.3 level (blue line) is still historically high, in fact a 6-year high. The current conditions index moved further off all-time lows to minus 80.9 in June which is nevertheless one of the weakest readings on record and may reflect the recent virus outbreak at a meat-processing plant in North Rhine-Westphalia. In sum, analysts expect to see positive third-quarter growth for German GDP though any recovery is expected to be no better than gradual at best. Sentiment indicators were a feature of the week's data run and showed separation between Germany, where infection rates are mostly stable and low, and the US where infection rates are not stable and low. Expectations among analysts did slip 4.1 points but the 59.3 level (blue line) is still historically high, in fact a 6-year high. The current conditions index moved further off all-time lows to minus 80.9 in June which is nevertheless one of the weakest readings on record and may reflect the recent virus outbreak at a meat-processing plant in North Rhine-Westphalia. In sum, analysts expect to see positive third-quarter growth for German GDP though any recovery is expected to be no better than gradual at best.

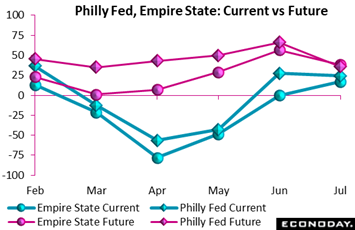

Business sentiment data were also posted in the US, specifically for manufacturing with the Philadelphia Fed and Empire State reports for July. Current conditions in these reports are, like US industrial production itself, filling out the upside of the 'V' though the results are clouded by sharp declines underway in expectations. In contrast to the general current conditions index which only edged lower to 24.1, the 6-month outlook in Philadelphia's sample fell 30.3 points to 36. The size of this decline is the fourth steepest in 53 years of records and is three times as deep then March when the crisis first took hold. Likewise, Empire State's current conditions index came in at 17.2, roughly the same level of strength as Philadelphia, with this 6-month outlook down 18.1 points to 38.4 to nearly match Philadelphia's reading. This decline is also among the steepest on record and only slightly less than March's 21.7-point drop. What, pray tell, could possibly be behind these readings? The Federal Reserve's Beige Book offered the answer, saying in the week that business confidence remains "highly uncertain" given questions over the path of the pandemic and its economic implications. Business sentiment data were also posted in the US, specifically for manufacturing with the Philadelphia Fed and Empire State reports for July. Current conditions in these reports are, like US industrial production itself, filling out the upside of the 'V' though the results are clouded by sharp declines underway in expectations. In contrast to the general current conditions index which only edged lower to 24.1, the 6-month outlook in Philadelphia's sample fell 30.3 points to 36. The size of this decline is the fourth steepest in 53 years of records and is three times as deep then March when the crisis first took hold. Likewise, Empire State's current conditions index came in at 17.2, roughly the same level of strength as Philadelphia, with this 6-month outlook down 18.1 points to 38.4 to nearly match Philadelphia's reading. This decline is also among the steepest on record and only slightly less than March's 21.7-point drop. What, pray tell, could possibly be behind these readings? The Federal Reserve's Beige Book offered the answer, saying in the week that business confidence remains "highly uncertain" given questions over the path of the pandemic and its economic implications.

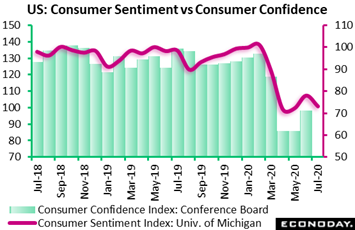

Sentiment data on the US consumer were also released in the week, showing that the psychological impact of rising infection rates is having a much bigger impact than forecasters had been expecting. The consumer sentiment index for preliminary July lost nearly 5 points to 73.2 to fall nearly 6 points below Econoday's consensus and nearly 3 points below the lowest estimate. This index had been trending near the 100 line before the crisis erupted, then fell as low as 71.8 in April and 72.3 in May. Like US business sentiment, expectations are taking the biggest hit, down more than 6 points to 66.2 which is right back at crisis lows. Current conditions, in contrast, fell less severely, down 2.9 points to 84.2. The text of the report was not looking for silver linings, warning that "another plunge" for sentiment may be around the corner if Washington fails to renew relief packages, especially for the most vulnerable households which have suffered the brunt of the downturn. Sentiment data on the US consumer were also released in the week, showing that the psychological impact of rising infection rates is having a much bigger impact than forecasters had been expecting. The consumer sentiment index for preliminary July lost nearly 5 points to 73.2 to fall nearly 6 points below Econoday's consensus and nearly 3 points below the lowest estimate. This index had been trending near the 100 line before the crisis erupted, then fell as low as 71.8 in April and 72.3 in May. Like US business sentiment, expectations are taking the biggest hit, down more than 6 points to 66.2 which is right back at crisis lows. Current conditions, in contrast, fell less severely, down 2.9 points to 84.2. The text of the report was not looking for silver linings, warning that "another plunge" for sentiment may be around the corner if Washington fails to renew relief packages, especially for the most vulnerable households which have suffered the brunt of the downturn.

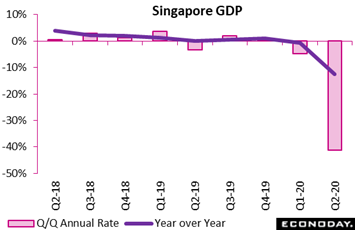

Moving to Asia, data in the week were mostly favorable including a 3.2 percent yearly rate for second-quarter Chinese GDP, up from first-quarter contraction of 6.8 percent; Chinese industrial production and retail sales also improved which we'll turn to in a minute. But not all of Asia's news was favorable as the advance second-quarter estimate for Singapore GDP showed extraordinarily sharp contraction. Weak external demand, supply chain disruptions, travel restrictions, and strict curbs on social and business activity all combined to drag quarterly GDP down at an annualized rate of 41.2 percent. This followed a 3.3 percent drop in the first quarter. The collapse was broad-based across major sectors of Singapore's economy: manufacturing output, which rose strongly on biomedical production in the first quarter, fell 23.1 percent; services output slumped 37.7 percent after falling 13.4 percent, while construction fell a startling 95.6 percent to indicate almost no activity at all. Overall growth also dropped sharply in year-on-year terms, from a decline of 0.3 percent to 12.6 percent contraction. Moving to Asia, data in the week were mostly favorable including a 3.2 percent yearly rate for second-quarter Chinese GDP, up from first-quarter contraction of 6.8 percent; Chinese industrial production and retail sales also improved which we'll turn to in a minute. But not all of Asia's news was favorable as the advance second-quarter estimate for Singapore GDP showed extraordinarily sharp contraction. Weak external demand, supply chain disruptions, travel restrictions, and strict curbs on social and business activity all combined to drag quarterly GDP down at an annualized rate of 41.2 percent. This followed a 3.3 percent drop in the first quarter. The collapse was broad-based across major sectors of Singapore's economy: manufacturing output, which rose strongly on biomedical production in the first quarter, fell 23.1 percent; services output slumped 37.7 percent after falling 13.4 percent, while construction fell a startling 95.6 percent to indicate almost no activity at all. Overall growth also dropped sharply in year-on-year terms, from a decline of 0.3 percent to 12.6 percent contraction.

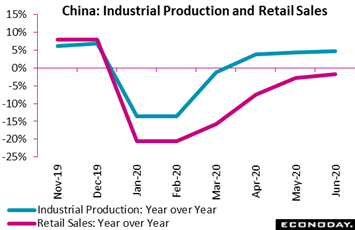

Unlike Singapore, the news from China was actually good though not spectacular. Industrial production data indicate that activity continued to recover, up a monthly 1.30 percent in June after increase of 1.53 percent in May and, as tracked in the graph, up 4.8 percent on the year after advancing 4.4 percent previously, Manufacturing output rose 5.1 percent on the year to nearly match May's 5.2 percent rate, with stronger year-on-year increases in the output of autos, steel products, communication equipment, and chemicals. Utilities output rose 5.5 percent after increasing 3.6 percent previously, while year-on-year growth in mining output picked up from 1.1 percent to 1.7 percent. Looking at retail sales, they rose 1.34 percent on the month after increasing 0.84 percent in May, but were down 1.8 percent on the year after dropping 2.8 percent previously. Still, there was improvement in several spending categories, including communications equipment, home appliances, and clothing. Year-on-year growth in rural retail sales picked up from a fall of 3.2 percent in May to a fall of 1.2 percent in June, while urban retail sales also fell less sharply, down 2.0 after dropping 2.8 percent. Unlike Singapore, the news from China was actually good though not spectacular. Industrial production data indicate that activity continued to recover, up a monthly 1.30 percent in June after increase of 1.53 percent in May and, as tracked in the graph, up 4.8 percent on the year after advancing 4.4 percent previously, Manufacturing output rose 5.1 percent on the year to nearly match May's 5.2 percent rate, with stronger year-on-year increases in the output of autos, steel products, communication equipment, and chemicals. Utilities output rose 5.5 percent after increasing 3.6 percent previously, while year-on-year growth in mining output picked up from 1.1 percent to 1.7 percent. Looking at retail sales, they rose 1.34 percent on the month after increasing 0.84 percent in May, but were down 1.8 percent on the year after dropping 2.8 percent previously. Still, there was improvement in several spending categories, including communications equipment, home appliances, and clothing. Year-on-year growth in rural retail sales picked up from a fall of 3.2 percent in May to a fall of 1.2 percent in June, while urban retail sales also fell less sharply, down 2.0 after dropping 2.8 percent.

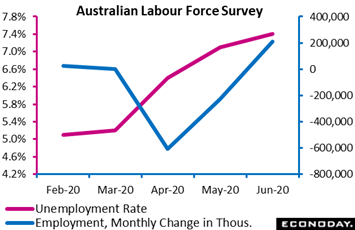

Employment in Asia has held up very well during the crisis, as it has in Europe and in numbing contrast to the great contraction suffered in North America. Australia's labour market showed signs of improvement in June as business and social restrictions began to ease. The number of employed (blue line) rose 210,800 in June after dropping 277,700 in May, though full-time employment fell by more than 38,000 versus a rise of 249,000 for part-time employment. Though employment rose, the unemployment rate (red line) rose along with it as large numbers of Australians entered the workforce looking for a job. The outlook for July is uncertain as tighter restrictions are being reimposed in some parts of the country as virus cases rise, suggesting that a recovery in employment to pre-pandemic levels will be a slow process. Employment in Asia has held up very well during the crisis, as it has in Europe and in numbing contrast to the great contraction suffered in North America. Australia's labour market showed signs of improvement in June as business and social restrictions began to ease. The number of employed (blue line) rose 210,800 in June after dropping 277,700 in May, though full-time employment fell by more than 38,000 versus a rise of 249,000 for part-time employment. Though employment rose, the unemployment rate (red line) rose along with it as large numbers of Australians entered the workforce looking for a job. The outlook for July is uncertain as tighter restrictions are being reimposed in some parts of the country as virus cases rise, suggesting that a recovery in employment to pre-pandemic levels will be a slow process.

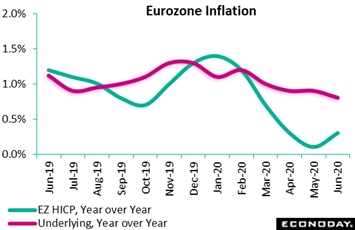

We end the week's data run with a look at how inflation is moving, or not moving, during the crisis. In the Eurozone, headline harmonised inflation (green line) rose a yearly 0.3 percent, up 2 tenths and fully reversing May's dip to 0.1 percent. Yet June was still 1.1 percentage points short of its level at the start of the year. In contrast to May, the energy component provided the main boost offsetting 2 tenths of slowing for food, drink and tobacco to plus 3.2 percent. Excluding both components, the underlying rate came in at 0.8 percent, down from May's 0.9 percent. More generally, non-energy industrial goods inflation was flat at 0.2 percent while services slipped from 1.3 percent to 1.2 percent. The rise in headline inflation will certainly not displease the European Central Bank which, following its monthly policy meeting on Thursday, was more than a little concerned about the marked weakness of prices in recent months. However, the ECB will certainly be disappointed with the dip in the core. The trend for both measures remains essentially flat but current readings are still toward the lower end of the recent range. More of the same over coming months could make inflation expectations slide further with the potential to trigger second-round effects on the underlying rate. We end the week's data run with a look at how inflation is moving, or not moving, during the crisis. In the Eurozone, headline harmonised inflation (green line) rose a yearly 0.3 percent, up 2 tenths and fully reversing May's dip to 0.1 percent. Yet June was still 1.1 percentage points short of its level at the start of the year. In contrast to May, the energy component provided the main boost offsetting 2 tenths of slowing for food, drink and tobacco to plus 3.2 percent. Excluding both components, the underlying rate came in at 0.8 percent, down from May's 0.9 percent. More generally, non-energy industrial goods inflation was flat at 0.2 percent while services slipped from 1.3 percent to 1.2 percent. The rise in headline inflation will certainly not displease the European Central Bank which, following its monthly policy meeting on Thursday, was more than a little concerned about the marked weakness of prices in recent months. However, the ECB will certainly be disappointed with the dip in the core. The trend for both measures remains essentially flat but current readings are still toward the lower end of the recent range. More of the same over coming months could make inflation expectations slide further with the potential to trigger second-round effects on the underlying rate.

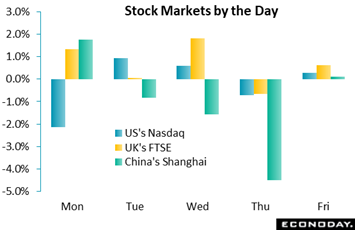

Despite rising US infection rates along with rising US-China tensions, markets mostly had an upbeat week. Monday saw US stocks rally only to reverse near the close on news that Southern California schools will start the September school year online, not in the classroom. Earlier, risk assets reacted favorably to news that the US Food and Drug Administration had fast-tracked vaccines being tested by Pfizer and BioNtech, the German biopharma. Investors also noted French Finance Minister Bruno Le Maire's promise of corporate tax cuts and new youth unemployment programs that would supplement a €750 billion package of European fiscal measures that was being hammered out at week's end. News of rising virus cases held stocks back in Europe and Asia on Tuesday but not in the US where solid gains were posted. Wednesday's sessions were lifted by positive clinical results for UK-Oxford's vaccine effort, plus similar upbeat news from vaccine trials under way at US biopharma Moderna. Thursday saw US-China tensions take center stage as US Secretary of State Mike Pompeo said the US administration would support territorial claims by China's neighbors in the South China Sea and would impose travel bans on Chinese technology companies deemed to be facilitating human rights violations by the Chinese government. Shanghai lost 4.5 percent on the day, ending the week 5.0 percent lower following the prior week's 7.3 percent surge. Markets on Friday drifted into the weekend awaiting Saturday's results from the EU summit. Despite rising US infection rates along with rising US-China tensions, markets mostly had an upbeat week. Monday saw US stocks rally only to reverse near the close on news that Southern California schools will start the September school year online, not in the classroom. Earlier, risk assets reacted favorably to news that the US Food and Drug Administration had fast-tracked vaccines being tested by Pfizer and BioNtech, the German biopharma. Investors also noted French Finance Minister Bruno Le Maire's promise of corporate tax cuts and new youth unemployment programs that would supplement a €750 billion package of European fiscal measures that was being hammered out at week's end. News of rising virus cases held stocks back in Europe and Asia on Tuesday but not in the US where solid gains were posted. Wednesday's sessions were lifted by positive clinical results for UK-Oxford's vaccine effort, plus similar upbeat news from vaccine trials under way at US biopharma Moderna. Thursday saw US-China tensions take center stage as US Secretary of State Mike Pompeo said the US administration would support territorial claims by China's neighbors in the South China Sea and would impose travel bans on Chinese technology companies deemed to be facilitating human rights violations by the Chinese government. Shanghai lost 4.5 percent on the day, ending the week 5.0 percent lower following the prior week's 7.3 percent surge. Markets on Friday drifted into the weekend awaiting Saturday's results from the EU summit.

US retail sales are now the flagship for the 'V' recovery; whether the gains can hold or not is another question. Central banks across the globe have already played their cards, leaving a new burst of fiscal action as the accepted alternative to keep activity moving in the right direction. And higher is certainly the projected path right now for the global economy as, unfortunately, are infection rates in the US.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week's big news will be at week's end when July PMIs will be posted across the globe: France is expected to remain out front in the mid-to-low 50s followed by the US and Germany at or near 50. Japanese data open the week, first June's trade update on Monday where deep cross-border contraction is the unsurprising call followed on Tuesday by June consumer prices in results that aren't expected to show any life. In contrast, Canadian consumer prices, posted Wednesday and benefiting from the upswing in energy, are expected to pop higher. A key feature of the week will be sentiment readings, all on Thursday: German Gfk consumer climate, French business climate, and Eurozone consumer confidence.

China Prime Rate Loan (Monday, Release Time Not Set)

Consensus Change: 0 basis points

Consensus Level: 3.85%

The People's Bank of China is not expected to change its one-year loan prime rate which, back in April, it cut by 20 basis points to 3.85 percent. No change would confirm that officials are comfortable that monetary policy is supporting domestic activity as the economy recovers from the initial impact of the Covid-19 pandemic.

Japanese Merchandise Trade for June (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast: -¥35.8 billion

Consensus Forecast, Imports Year-over-Year: -17.5%

Consensus Forecast, Exports Year-over-Year: -25.0%

Japanese trade has fallen into deep contraction during the virus crisis, at minus 26.2 percent for year-on-year imports in May and minus 28.3 percent for exports. Expectations for June are an import decline of 17.5 percent and an export decline of 25.0 percent. The net balance, versus a deficit of ¥833 billion in May, is seen in deficit at ¥35.8 billion.

Japanese Consumer Price Index for June (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast Ex-Food, Year-on-Year: -0.1%

Deflationary pressures are expected to ease but only very slightly in June. Consensus for ex-food consumer prices is year-on-year contraction of 0.1 percent versus May's contraction of 0.2 percent.

Canadian CPI for June (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month-to-Month: 0.4%

Consensus Forecast, Year-over-Year: 0.3%

Headline consumer prices, which fell to a 12-year low in May at annual contraction of minus 0.4 percent, are expected to improve in June, to a year-on-year plus 0.3 percent reflecting an expected monthly increase of 0.4 percent.

Germany: GfK Consumer Climate for August (Thu 06:00 GMT; Thu 08:00 CEST; Thu 02:00 EDT)

Consensus Forecast: -2.3

A third month of improvement to minus 2.3 is the call for August's Gfk survey which in July rose 9 points to minus 9.6 and well up from the deep virus bottom of minus 23.4 hit in May.

French Business Climate Indicator for July (Thu 06:45 GMT; Thu 08:45 CEST; Thu 02:45 EDT)

Consensus Forecast, Manufacturing: 82

On INSEE's measure, sentiment in manufacturing in July is seen at 82 which would follow June's 6-point improvement to a still deeply low 77.

US Initial Jobless Claims for July 18 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.350 million

US initial jobless claims, which have remained stubbornly over 1 million per week, are expected to increase to 1.350 million in the July 18 week versus 1.300 million in the July 11 week. This would be the first weekly increase since claims first spiked in March.

Eurozone: Consumer Confidence Flash for July (Thu 14:00 GMT; Thu 16:00 CEST; Thu 10:00 EDT)

Consensus Forecast: -12.0

Consumer confidence, at minus 14.7 in June, has been improving since bottoming out in April at minus 22.0. For July, the consensus is minus 12.0.

French PMI Composite Flash for July (Fri 07:15 GMT; Fri 09:15 CEST; Fri 03:15 EDT)

Consensus Forecast, Composite: 53.0

Consensus Forecast, Manufacturing: 53.0

Consensus Forecast, Services: 53.0

France's PMIs moved back to fractional growth following three months of severe contraction. For July, 53.0 is expected across the board, for manufacturing, services and also the composite.

German PMI Composite Flash for July (Fri 07:30 GMT; Fri 09:30 CEST; Fri 03:30 EDT)

Consensus Forecast, Composite: 50.3

Consensus Forecast, Manufacturing: 48.3

Consensus Forecast, Services: 50.4

Modest expansion at a consensus 50.3 is expected for July's German composite reflecting slight growth in services, at a consensus 50.4, offsetting modest contraction in manufacturing at 48.3.

Eurozone PMI Composite Flash for July (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Composite: 51.1

Consensus Forecast, Manufacturing: 49.5

Consensus Forecast, Services: 51.0

The Eurozone PMIs jumped out of severe contraction in June into modest contraction in the md-to-high 40s. Further improvement is expected for July, at 49.5 for manufacturing and 51.0 for services.

UK: CIPS/PMI Composite Flash for July (Fri 08:30 GMT; Fri 09:30 BST; Fri 04:30 EDT)

Consensus Forecast, Composite: 50.8

Consensus Forecast, Manufacturing: 52.0

Consensus Forecast, Services: 50.0

Modest expansion for manufacturing at a consensus 52.0 is expected for July with no change expected for services at a dead even 50.0. In June, manufacturing moved from sharp contraction to virtually no change while services moved from severe contraction to only moderate contraction.

US PMI Composite Flash for July (Fri 13:45 GMT; Fri 09:45 EDT)

Consensus Forecast, Composite: 50.3

Consensus Forecast, Manufacturing: 51.5

Consensus Forecast, Services: 50.0

PMI's sample for the US moved from steep contraction to only limited contraction in June especially for manufacturing which, at 49.8, came in near the breakeven 50 level. Econoday's consensus for July is continued improvement to 51.5 for manufacturing and 50.0 for services.

US New Home Sales for June (Fri 14:00 GMT; Fri 10:00 EDT)

Consensus Forecast, Annualized Rate: 700,000

New home sales in the US have been incredibly strong despite the crisis, easily beating expectations in May with a 676,000 annual rate. For June, the consensus is 700,000.

|