|

There was good news in the week centered in Europe, outside of which, however, the numbers did not always shape up that well including from Japan where falling trade numbers magnify one of covid's central and universal effects. Having perhaps the greatest economic implications, of course, is the high rate of US infection made evident in the nation's latest unemployment data; unlike Europe and Asia, the United States is painfully struggling to keep its workforce in place.

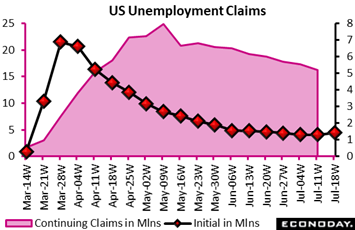

Enormous dislocation continues to impact the US labor market underscored decisively by the first weekly increase in initial jobless claims since the seismic collapse in March. Claims rose 109,000 in the July 18 week to a 1.416 million level that ended 15 straight weeks of declines and which raises the question whether weekly claims will now begin to settle in the 1-1/2 million range. Such a rate would come out to 6 million job losses each month. Continuing claims, where data lag, extended their downward trend, falling 1.1 million in the July 11 week to 16.2 million and pulling the unemployment rate for insured workers 7 tenths lower to a still extremely elevated 11.1 percent. Continuing claims peaked in early May at 24.9 million but continuing declines are clearly not guaranteed. Turning back to initial claims, the sharpest increases were in Florida at 65,890, Georgia at 33,292 and California at 20,123, all three suffering heightened infection rates. Yet initial claims in Texas, another state being hit hard by the virus, fell 11,583. One week is only one week but the headline climb in initial claims, and its indication that many employers continue to cut back and continue to go out of business, has heightened the degree of urgency in Washington for another round of fiscal support. Enormous dislocation continues to impact the US labor market underscored decisively by the first weekly increase in initial jobless claims since the seismic collapse in March. Claims rose 109,000 in the July 18 week to a 1.416 million level that ended 15 straight weeks of declines and which raises the question whether weekly claims will now begin to settle in the 1-1/2 million range. Such a rate would come out to 6 million job losses each month. Continuing claims, where data lag, extended their downward trend, falling 1.1 million in the July 11 week to 16.2 million and pulling the unemployment rate for insured workers 7 tenths lower to a still extremely elevated 11.1 percent. Continuing claims peaked in early May at 24.9 million but continuing declines are clearly not guaranteed. Turning back to initial claims, the sharpest increases were in Florida at 65,890, Georgia at 33,292 and California at 20,123, all three suffering heightened infection rates. Yet initial claims in Texas, another state being hit hard by the virus, fell 11,583. One week is only one week but the headline climb in initial claims, and its indication that many employers continue to cut back and continue to go out of business, has heightened the degree of urgency in Washington for another round of fiscal support.

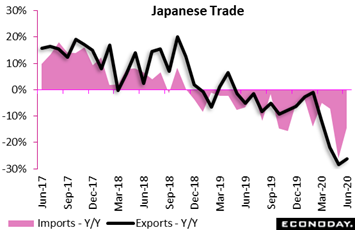

One area of the global economy where all regions are suffering is trade, and the numbers are not improving. Japanese trade continued to contract very sharply in June, down 14.4 percent for imports compared to June last year and down 26.2 percent for exports. Exports to the US were particularly weak, dropping 46.6 percent on the year in June, while those to the European Union were down 28.4 percent. Exports to China did stabilize, down just 0.2 percent on the year, but Japanese exports to other Asian trading partners declined sharply. On the import side, contraction was centered with the US and EU. Japan, traditionally a great exporter, posted a ¥268.8 billion deficit in June, far wider than expectations for ¥35.8 billion. One area of the global economy where all regions are suffering is trade, and the numbers are not improving. Japanese trade continued to contract very sharply in June, down 14.4 percent for imports compared to June last year and down 26.2 percent for exports. Exports to the US were particularly weak, dropping 46.6 percent on the year in June, while those to the European Union were down 28.4 percent. Exports to China did stabilize, down just 0.2 percent on the year, but Japanese exports to other Asian trading partners declined sharply. On the import side, contraction was centered with the US and EU. Japan, traditionally a great exporter, posted a ¥268.8 billion deficit in June, far wider than expectations for ¥35.8 billion.

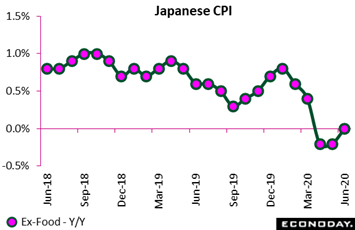

Another tradition of the Japanese economy, and one that unfortunately is still in place, is lack of inflation. The core CPI, which excludes fresh food, was dead flat on the year in June after falling 0.2 percent in both May and April. The headline CPI eked out a 0.1 percent yearly gain in June as it did in May. Food price inflation slowed from May's 2.1 percent to 1.5 percent while housing and utility costs were little changed. Transportation and communication prices were down 0.5 percent which was an improvement from May's 1.7 percent contraction. Bank of Japan officials continue to repeat that policy rates will be held at or below current levels until progress is made toward, not only full employment, but also 2.0 percent inflation. This target seems even more implausibly distant than ever, strengthening the case for additional policy measures. The BoJ's next policy meeting is scheduled for mid-September. Another tradition of the Japanese economy, and one that unfortunately is still in place, is lack of inflation. The core CPI, which excludes fresh food, was dead flat on the year in June after falling 0.2 percent in both May and April. The headline CPI eked out a 0.1 percent yearly gain in June as it did in May. Food price inflation slowed from May's 2.1 percent to 1.5 percent while housing and utility costs were little changed. Transportation and communication prices were down 0.5 percent which was an improvement from May's 1.7 percent contraction. Bank of Japan officials continue to repeat that policy rates will be held at or below current levels until progress is made toward, not only full employment, but also 2.0 percent inflation. This target seems even more implausibly distant than ever, strengthening the case for additional policy measures. The BoJ's next policy meeting is scheduled for mid-September.

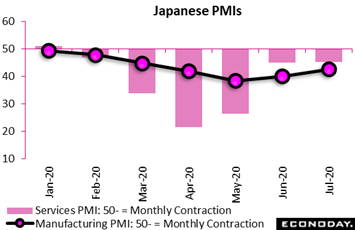

Let's turn to one of the highlights of the week, that is purchasing manager indexes where wide strength, however, did not include Japan. Flash PMIs for July indicate that covid impact on the country's economy is easing but still substantial, especially for manufacturers where the index edged higher but only to 42.6 and the 16th straight sub-50 showing (any reading below 50 indicates month-to-month contraction and the further below 50, the deeper the contraction). Contraction is a bit less severe for Japanese service providers, at 45.2 in July for marginal improvement from June. Service providers reported smaller declines in output and new orders but bigger declines in new export orders and employment along with weaker business sentiment. Input costs were reported to be steady but selling prices fell at a sharper pace —which is not a good signal for Japan's CPI in July. Let's turn to one of the highlights of the week, that is purchasing manager indexes where wide strength, however, did not include Japan. Flash PMIs for July indicate that covid impact on the country's economy is easing but still substantial, especially for manufacturers where the index edged higher but only to 42.6 and the 16th straight sub-50 showing (any reading below 50 indicates month-to-month contraction and the further below 50, the deeper the contraction). Contraction is a bit less severe for Japanese service providers, at 45.2 in July for marginal improvement from June. Service providers reported smaller declines in output and new orders but bigger declines in new export orders and employment along with weaker business sentiment. Input costs were reported to be steady but selling prices fell at a sharper pace —which is not a good signal for Japan's CPI in July.

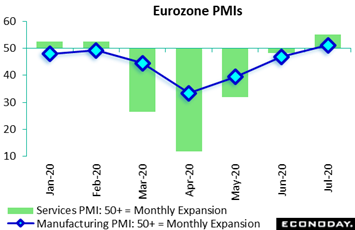

Finally some good news and that's the PMIs outside of Japan. Eurozone business activity appears to have picked up quite strongly this month, led by services at a very healthy 55.1 for a nearly 7-point gain and the best reading in more than two years. Manufacturing also expanded, at 51.1 for a nearly 4-point gain and with the production reading showing particular acceleration at 54.0. New orders for both sectors posted their first increases since February though, like data from Japan, export demand was down once again. And backlogs were worked down once again, though more slowly than June, and headcount was trimmed for a fifth straight month, notably in manufacturing. That said, business sentiment about the year ahead was more optimistic, reaching its highest level in five months in both sectors. Inflation pressures remained light. Regionally, France led the way once again with a composite score of 57.6 and with Germany also showing a lot of spunk at 55.5; activity through the rest of the region posted more modest upticks. July's flashes were surprisingly respectable and put real GDP on track for solid growth in third quarter. Finally some good news and that's the PMIs outside of Japan. Eurozone business activity appears to have picked up quite strongly this month, led by services at a very healthy 55.1 for a nearly 7-point gain and the best reading in more than two years. Manufacturing also expanded, at 51.1 for a nearly 4-point gain and with the production reading showing particular acceleration at 54.0. New orders for both sectors posted their first increases since February though, like data from Japan, export demand was down once again. And backlogs were worked down once again, though more slowly than June, and headcount was trimmed for a fifth straight month, notably in manufacturing. That said, business sentiment about the year ahead was more optimistic, reaching its highest level in five months in both sectors. Inflation pressures remained light. Regionally, France led the way once again with a composite score of 57.6 and with Germany also showing a lot of spunk at 55.5; activity through the rest of the region posted more modest upticks. July's flashes were surprisingly respectable and put real GDP on track for solid growth in third quarter.

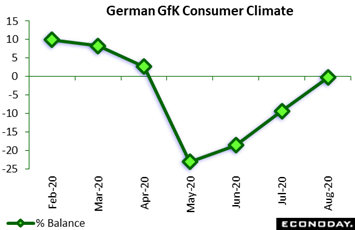

Europe has generally done a respectable job containing infections especially Germany where consumer sentiment, in contrast especially with the US, is staging a remarkable recovery. GfK's consumer climate index came in at minus 9.4 in July with consumers projecting an August score only just below the zero line, at minus 0.3 which was well above consensus expectations, Economic expectations posted their best result in more than a year, income expectations jumped on government promises of child-bonus payments, while the sharpest increase came from the propensity to buy which is getting a boost from a cut in value-added taxes that took effect this month and which will last through year-end. Overall sentiment in Germany has now risen nearly 25 points from March's low and GfK is now talking about a possible V-shaped recovery for consumer spending. Europe has generally done a respectable job containing infections especially Germany where consumer sentiment, in contrast especially with the US, is staging a remarkable recovery. GfK's consumer climate index came in at minus 9.4 in July with consumers projecting an August score only just below the zero line, at minus 0.3 which was well above consensus expectations, Economic expectations posted their best result in more than a year, income expectations jumped on government promises of child-bonus payments, while the sharpest increase came from the propensity to buy which is getting a boost from a cut in value-added taxes that took effect this month and which will last through year-end. Overall sentiment in Germany has now risen nearly 25 points from March's low and GfK is now talking about a possible V-shaped recovery for consumer spending.

After a surprisingly strong retail sales report, chances for a V-recovery in the UK also look favorable. On top of a 12.3 percent monthly jump in May, consumer volumes climbed an unexpectedly sharp 13.9 percent in June. This boosted the annual rate from minus 12.9 percent to minus 1.6 percent and, compared to February, was only 0.6 percent lower. Gains were dominated by the non-food sector where purchases surged 43.5 percent. Within this, textiles and clothing leaped 70.2 percent and household goods 46.8 percent. By contrast, food demand dipped 0.1 percent and non-store retailing advanced a comparatively moderate 1.1 percent. Auto fuel, reflecting reopenings, jumped 21.5 percent. Openings or not, the proportion of online spending eased only slightly from May's 33.3 percent record to 31.8 percent and was still well above the 20.0 percent seen in February. The June update leaves second-quarter retail sales down 9.5 percent versus the first quarter, a much smaller decline than seemed likely during the worst of the virus. Indeed, excluding auto fuel, the fall was only 6.6 percent. June's results should reduce the likelihood of any further stimulus from the Bank of England at their August meeting. After a surprisingly strong retail sales report, chances for a V-recovery in the UK also look favorable. On top of a 12.3 percent monthly jump in May, consumer volumes climbed an unexpectedly sharp 13.9 percent in June. This boosted the annual rate from minus 12.9 percent to minus 1.6 percent and, compared to February, was only 0.6 percent lower. Gains were dominated by the non-food sector where purchases surged 43.5 percent. Within this, textiles and clothing leaped 70.2 percent and household goods 46.8 percent. By contrast, food demand dipped 0.1 percent and non-store retailing advanced a comparatively moderate 1.1 percent. Auto fuel, reflecting reopenings, jumped 21.5 percent. Openings or not, the proportion of online spending eased only slightly from May's 33.3 percent record to 31.8 percent and was still well above the 20.0 percent seen in February. The June update leaves second-quarter retail sales down 9.5 percent versus the first quarter, a much smaller decline than seemed likely during the worst of the virus. Indeed, excluding auto fuel, the fall was only 6.6 percent. June's results should reduce the likelihood of any further stimulus from the Bank of England at their August meeting.

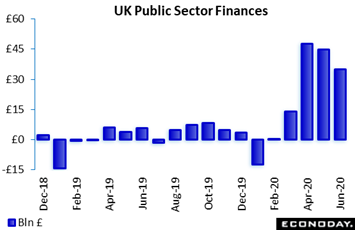

Prior BoE stimulus is of course one factor behind the British spending splurge as is fiscal stimulus. Government finances in the UK remained deeply in the red in June. Public sector borrowing totaled £34.80 billion in June, down from £44.74 in May but still high, and when excluding public sector banks, the red ink was £35.53 billion which also down versus May but about five times higher than June 2019. The June data put underlying borrowing in the first quarter of the current financial year at £127.89 billion, a remarkable £103.94 billion higher than in the same period a year ago and more than double the entire FY2019/20 total. As a percent of GDP, debt at the end of June was 99.6 percent, a nearly 19 percentage point increase from a year ago and the highest ratio since the financial year ending March 1961. Huge borrowing figures, part of the cost of fighting the virus, will doubtlessly be the norm for some time to come. Prior BoE stimulus is of course one factor behind the British spending splurge as is fiscal stimulus. Government finances in the UK remained deeply in the red in June. Public sector borrowing totaled £34.80 billion in June, down from £44.74 in May but still high, and when excluding public sector banks, the red ink was £35.53 billion which also down versus May but about five times higher than June 2019. The June data put underlying borrowing in the first quarter of the current financial year at £127.89 billion, a remarkable £103.94 billion higher than in the same period a year ago and more than double the entire FY2019/20 total. As a percent of GDP, debt at the end of June was 99.6 percent, a nearly 19 percentage point increase from a year ago and the highest ratio since the financial year ending March 1961. Huge borrowing figures, part of the cost of fighting the virus, will doubtlessly be the norm for some time to come.

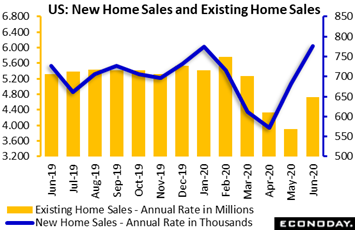

Reflecting stimulus in general, especially low mortgage rates, US housing is on fire right now. "Red hot" is how the National Association of Realtors describes the housing market, highlighted by a record 20.7 percent jump in existing home sales to a 4.720 million annual rate in June. And the sales surge isn't being driven by price concessions, on the contrary as the overall median rose $10,700 on the month to $295,300 for annual appreciation of 3.5 percent which is nearly 15 percentage points above the yearly sales rate. And far outmatching resales have been new home sales which are already back to where they were before the crisis started, up 13.8 percent on the month in June and slightly above January's 774,000 rate. June's showing, in fact, is the best since the subprime bust a dozen years ago. And like resellers, home builders are not having to discount at all as the new home median surged $19,000 to $329,200. Yet the results for housing do raise the question (especially for policy makers) whether gains are concentrated among the well-to-do while those most affected by virus shutdowns -- lower wage workers who are suffering the highest rates of unemployment -- are being left out in the cold. Reflecting stimulus in general, especially low mortgage rates, US housing is on fire right now. "Red hot" is how the National Association of Realtors describes the housing market, highlighted by a record 20.7 percent jump in existing home sales to a 4.720 million annual rate in June. And the sales surge isn't being driven by price concessions, on the contrary as the overall median rose $10,700 on the month to $295,300 for annual appreciation of 3.5 percent which is nearly 15 percentage points above the yearly sales rate. And far outmatching resales have been new home sales which are already back to where they were before the crisis started, up 13.8 percent on the month in June and slightly above January's 774,000 rate. June's showing, in fact, is the best since the subprime bust a dozen years ago. And like resellers, home builders are not having to discount at all as the new home median surged $19,000 to $329,200. Yet the results for housing do raise the question (especially for policy makers) whether gains are concentrated among the well-to-do while those most affected by virus shutdowns -- lower wage workers who are suffering the highest rates of unemployment -- are being left out in the cold.

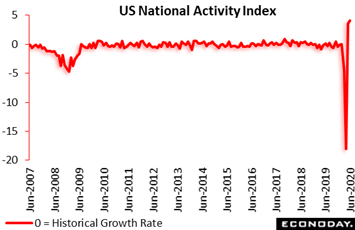

The gains for new home sales point to relative strength for residential investment which, however, may be the only good news in the coming GDP report. Econoday's US consensus for second-quarter GDP is mind-numbing annual contraction of 35 percent, a more than whopping collapse that is actually being signaled by the Chicago Fed's national activity index. This index did shoot 4.11 points higher in June and 3.50 points in May but made up only a small portion of the staggering 18.09 loss during April's shutdown. Yet the sequence is the silver lining: however much GDP did fall, the drop was entirely centered at the beginning of the quarter. The accompanying graph offers a useful view of this contraction relative to the financial crisis: much deeper in depth but hopefully much shorter in duration. June's results were based on 50 of 85 indicators that the index tracks. The gains for new home sales point to relative strength for residential investment which, however, may be the only good news in the coming GDP report. Econoday's US consensus for second-quarter GDP is mind-numbing annual contraction of 35 percent, a more than whopping collapse that is actually being signaled by the Chicago Fed's national activity index. This index did shoot 4.11 points higher in June and 3.50 points in May but made up only a small portion of the staggering 18.09 loss during April's shutdown. Yet the sequence is the silver lining: however much GDP did fall, the drop was entirely centered at the beginning of the quarter. The accompanying graph offers a useful view of this contraction relative to the financial crisis: much deeper in depth but hopefully much shorter in duration. June's results were based on 50 of 85 indicators that the index tracks.

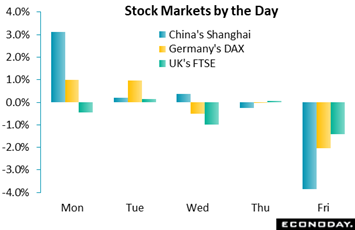

The week started strong driven by movement among European leaders toward a fiscal stimulus package and also by China's central bank which left its loan prime rate unchanged at 3.85 percent, hinting that officials are comfortable with the country's virus comeback. But Monday also saw a hint of what would hurt the market by week's end: rising tensions over China's security move as UK suspended its extradition agreement with Hong Kong. News that EU leaders successfully clinched their €750 billion deal helped Tuesday's session as did building anticipation for a covid vaccine as developers in Europe and the US reported success. Hurting Wednesday's session, however, was building infection levels in the US as well as President Trump's admission that the pandemic is getting worse, not better. Wednesday's sentiment was also hurt by news that the US had abruptly told China to shut its Houston consulate. And UK shares were specifically hit by gloomy headlines on prospects for a UK-EU trade deal as Brexit nears. Thursday proved quiet but not Friday after China ordered US to close its consulate in Chengdu. On the week the Shanghai lost 0.5 percent, Germany's DAX 0.6 percent and the FTSE a noticeable 2.6 percent. The week started strong driven by movement among European leaders toward a fiscal stimulus package and also by China's central bank which left its loan prime rate unchanged at 3.85 percent, hinting that officials are comfortable with the country's virus comeback. But Monday also saw a hint of what would hurt the market by week's end: rising tensions over China's security move as UK suspended its extradition agreement with Hong Kong. News that EU leaders successfully clinched their €750 billion deal helped Tuesday's session as did building anticipation for a covid vaccine as developers in Europe and the US reported success. Hurting Wednesday's session, however, was building infection levels in the US as well as President Trump's admission that the pandemic is getting worse, not better. Wednesday's sentiment was also hurt by news that the US had abruptly told China to shut its Houston consulate. And UK shares were specifically hit by gloomy headlines on prospects for a UK-EU trade deal as Brexit nears. Thursday proved quiet but not Friday after China ordered US to close its consulate in Chengdu. On the week the Shanghai lost 0.5 percent, Germany's DAX 0.6 percent and the FTSE a noticeable 2.6 percent.

Government support schemes are phasing out and posing risks across the global economy, less so for China and Europe but more so for the US and Japan. And non-economic tensions and the efforts to address them, whether over China's move on Hong Kong or racial unrest in the US, are adding further challenges to a most difficult time.

The week's most important data will be on Thursday with US GDP where staggering contraction of 35.0 percent is Econoday's consensus. GDP for France and the Eurozone follow on Friday amid expectations for low double-digit contraction. Components of US GDP will be updated early in the week: durable goods on Monday and goods trade on Wednesday. Germany will post two very important reports with the July unemployment rate on Thursday followed on Friday by June retail sales. Japanese data will include retail sales on Thursday, which are not expected to improve, and industrial production on Friday which is. Little change at marginal growth is once again the call for Friday's CFLP manufacturing PMI from China. Sentiment indicators can often move markets and they will also be a feature of the week, opening with Germany's Ifo report on Monday, US consumer confidence on Tuesday and also Eurozone economic sentiment on Thursday. Monetary policy is also in the mix, specifically a Federal Reserve statement and press conference on Wednesday where the bank's official support of the corporate bond market is a likely topic.

German Ifo Business Climate Indicator for July (Mon 08:00 GMT; Mon 10:00 CEST; Mon 04:00 EDT)

Consensus Forecast: 89.3

After posting better-than-expected rebounds in May and June from a record low in April, Ifo's economic sentiment for July is expected to improve further to 89.3 versus June's 86.2

US Durable Goods Orders for June (Mon 12:30 GMT; Mon 08:30 EDT)

Consensus Forecast, Month over Month: 6.5%

Consensus Forecast, Ex-Transportation: 3.5%

Durable goods orders for June are expected to rise 6.5 percent on top of May's 15.7 percent rebound (revised from 15.8 percent) that of course followed steep declines in April and March. Excluding transportation equipment, orders are expected to rise 3.5 percent in June.

US Consumer Confidence Index for July (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 95.7

Econoday's consensus for July consumer confidence is new erosion to 95.7 versus 98.1 in a June report that, at the time, showed mostly positive assessments of the jobs market.

US International Trade In Goods for June (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: -$74.3 billion

The US goods deficit is expected to narrow to $74.3 billion in June versus $75.3 billion in May. Exports and imports of goods were down 34.9 percent and 22.5 percent on the year in May.

US Federal Reserve Policy Announcement (Wed 18:00 GMT; Wed 14:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Policy Range: 0.0% to 0.25%

The Federal Reserve announced at its June meeting that it expects to hold the target range for the federal funds rate unchanged at 0 to 0.25 percent at least through 2022. The Fed also repeated in June that it would ramp up quantitative easing as much as necessary. Questions over the Fed's support of the markets, including corporate bonds, will be an inevitable theme at Jerome Powell's press conference.

Japanese Retail Sales for June (Wed 23:50 GMT: Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Year over Year: -6.5%

Retail sales fell 12.3 percent on the year in May and 13.9 percent in April. Forecasters see continued covid effects in June with the consensus at minus 6.5 percent.

German Unemployment Rate for July (Thu 07:55 GMT; Thu 09:55 CEST; Thu 03:55 EDT)

Consensus Forecast: 6.5%

Labor losses are not expected to accelerate much in Germany with July expectations at 6.5 percent for the unemployment rate versus June's 6.4 percent.

Eurozone: Economic Sentiment for July (Thu 09:00 GMT; Thu 11:00 CEST; Thu 05:00 EDT)

Consensus Forecast: 81.5

The European Commission's economic sentiment index is expected to come in at 81.5 for July versus June's 8.2-point gain to 75.7 which, however, was short of expectations for 80.

US Second-Quarter GDP, First Estimate (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Annual Rate: -35.0%

US Real Personal Consumption Expenditures

Consensus Forecast, Annual Rate: -33.0%

Mauled by the virus, US GDP is expected to fall an 35.0 annualized percent in the second quarter versus first-quarter contraction of 5.0 percent. Consumer spending, which fell at a 6.8 percent pace in the first quarter, is seen falling 33.0 percent.

US Initial Jobless Claims for July 25 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.388 million

US initial jobless claims in the July 18 week posted their first increase since March, up 109,000 to 1.416 million and are expected to ease slightly to 1.388 million in the July 25 week.

Japanese Industrial Production for June (Thu 23:50 GMT: Fri 08:50 JST; Thu 19:50 EDT)

Consensus Forecast, Month over Month: 1.2%

Industrial production in Japan fell 8.4 percent on the month in May with declines widespread. Boosted by this easy comparison, the consensus for June is a monthly increase of 1.2 percent.

China: CFLP Manufacturing PMI for July (Fri 01:00 GMT; Fri 09:00 CST; Thu 21:00 EDT)

Consensus Forecast: 51.0

China's CFLP manufacturing PMI has held steady since March, coming in at 50.9 in June with 51.0 the consensus for July.

German Retail Sales for June (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: -2.5%

German retail sales, which jumped 13.9 percent in May, are expected to fall 2.5 percent in June.

French Second-Quarter GDP, First Estimate (Fri 05:30 GMT; Fri 07:30 CEST; Fri 01:30 EDT)

Consensus Forecast, Quarter over Quarter: -15.6%

First-quarter GDP in France is expected to contract a quarterly 15.6 percent versus contraction of 5.3 percent in the initial covid effects of the first quarter (revised from preliminary contraction of 5.8 percent).

Eurozone Second-Quarter GDP, First Estimate (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast, Quarter over Quarter: -11.2%

Consensus Forecast, Year over Year: -13.9%

Second-quarter Eurozone GDP is expected to contract a quarterly 11.2 percent versus 3.6 percent contraction in the first quarter (revised from minus 3.8 percent). The year-on-year rate in the second quarter is seen at minus 13.9 percent.

|