|

Infection rates, whether in the US or the UK or Japan, are not subsiding and are raising the risk that bounce back from April's lows may be interrupted. The global economy has in fact been recovering strongly and at a V-rate pace, led by consumer demand which has bounced back in many economies but held down by production and also international trade, the latter deeply weak going into the crisis. Employment, on the other hand, has been playing out less evenly so far, with North America showing enormous and persistent dislocation but much less so in Asia and also Europe.

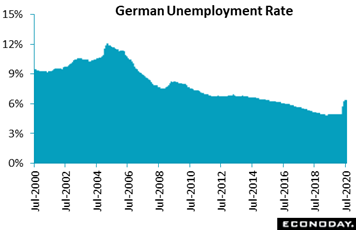

The Germany labor market, boosted by dissipating infections and government business loans, again outperformed expectations in July. Following a 68,000 increase in June, the number of people out of work actually fell 18,000 to 2.923 million. This was the first decline since March and left the unemployment rate unchanged at 6.4 percent, a modest level compared to the double-digit rates in the US and Canada yet nevertheless a 4-year high. On the downside, however, vacancies continued to fall, though July's 5,000 decline to 558,000 was less than a fraction of June's 21,000 drop and the smallest since January. Germany's report is surprisingly good but the risk remains that as government support is withdrawn, unemployment will start to rise and perhaps quickly. That said, even if this is the case, the increase will at least be from a low base. The Germany labor market, boosted by dissipating infections and government business loans, again outperformed expectations in July. Following a 68,000 increase in June, the number of people out of work actually fell 18,000 to 2.923 million. This was the first decline since March and left the unemployment rate unchanged at 6.4 percent, a modest level compared to the double-digit rates in the US and Canada yet nevertheless a 4-year high. On the downside, however, vacancies continued to fall, though July's 5,000 decline to 558,000 was less than a fraction of June's 21,000 drop and the smallest since January. Germany's report is surprisingly good but the risk remains that as government support is withdrawn, unemployment will start to rise and perhaps quickly. That said, even if this is the case, the increase will at least be from a low base.

Second-quarter GDP reports, historic for their weakness, filled the week and included a 32.9 percent rate of annual contraction for the US. Headline data from Europe are not annualized though quarter-to-quarter change offers a similar reading, down 10.1 percent for German GDP to indicate a roughly 40 percent rate of annual contraction that contrasts very sharply with the resilience seen in the country's labor market. German GDP, not helped by declining exports, was weak going into the crisis with the second-quarter plunge following 2.2 percent contraction in the first quarter and putting the nation into technical recession. The graph tracks German GDP on a year-over-year basis over the past 20 years which indicates the great depth of the second quarter's results. Details in Germany's first estimate are limited but did show broad-based weakness with huge quarterly declines in capital formation and household consumption as well as exports and imports. Not surprisingly, the only increase was posted by government consumption that reflected efforts to battle the coronavirus and its effects. French GDP was also released in the week as was overall Eurozone GDP, both showing slightly deeper rates of contraction than Germany. Second-quarter GDP reports, historic for their weakness, filled the week and included a 32.9 percent rate of annual contraction for the US. Headline data from Europe are not annualized though quarter-to-quarter change offers a similar reading, down 10.1 percent for German GDP to indicate a roughly 40 percent rate of annual contraction that contrasts very sharply with the resilience seen in the country's labor market. German GDP, not helped by declining exports, was weak going into the crisis with the second-quarter plunge following 2.2 percent contraction in the first quarter and putting the nation into technical recession. The graph tracks German GDP on a year-over-year basis over the past 20 years which indicates the great depth of the second quarter's results. Details in Germany's first estimate are limited but did show broad-based weakness with huge quarterly declines in capital formation and household consumption as well as exports and imports. Not surprisingly, the only increase was posted by government consumption that reflected efforts to battle the coronavirus and its effects. French GDP was also released in the week as was overall Eurozone GDP, both showing slightly deeper rates of contraction than Germany.

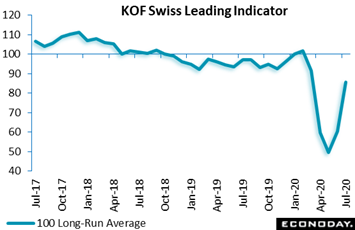

Though definitely ones for the history books, the week's GDP reports were already old news, especially since the great bulk of the contraction was lopsided at the beginning of the quarter during April. Given reopenings, however uneven and perhaps limited they prove to be, and given the very easy comparisons with the second quarter's depth, GDP data for the third quarter generally look to claw back into the positive zone. Hinting at this is the leading economic indicator for Switzerland which, as seen in the graph, offers the classic V-shape we want. From 60.6 in June, the headline climbed more than 25 points to 85.7, its second successive rise and its highest level since February. That said, the latest reading was still some way short of its long-run average (100). The monthly gain mainly reflected improved performances in manufacturing and foreign demand with smaller contributions made by consumption, construction and financial services while only food and accommodation weighed down the advance. The July update suggests that the Swiss economy is moving in the right direction but the pace of growth itself, putting aside comparisons with the virus's depth, continues to look subdued. Though definitely ones for the history books, the week's GDP reports were already old news, especially since the great bulk of the contraction was lopsided at the beginning of the quarter during April. Given reopenings, however uneven and perhaps limited they prove to be, and given the very easy comparisons with the second quarter's depth, GDP data for the third quarter generally look to claw back into the positive zone. Hinting at this is the leading economic indicator for Switzerland which, as seen in the graph, offers the classic V-shape we want. From 60.6 in June, the headline climbed more than 25 points to 85.7, its second successive rise and its highest level since February. That said, the latest reading was still some way short of its long-run average (100). The monthly gain mainly reflected improved performances in manufacturing and foreign demand with smaller contributions made by consumption, construction and financial services while only food and accommodation weighed down the advance. The July update suggests that the Swiss economy is moving in the right direction but the pace of growth itself, putting aside comparisons with the virus's depth, continues to look subdued.

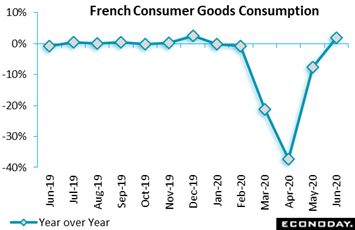

Consumers have been doing their share as spending from North America, to Asia, to Europe has largely recovered. France is one example as household spending on manufactured goods, boosted by relaxed lockdowns, rose 10.6 percent in June following an even greater surge in May. This lifted annual growth, as tracked in the graph, from minus 7.6 percent to plus 1.9 percent. France's statistics bureau focuses its comparisons against February's pre-crisis levels and on this basis, sales now show a rise of 2.4 percent and, in theory, full recovery from the virus. Household durables were notably robust and there was also positive growth for textiles and clothing as well as transport equipment. Food was marginally higher and energy slightly lower in June. July also appears to have been a positive month for the French consumer with more stores having reopened and with consumer confidence climbing to a post-virus high. Even so, recent increases in new Covid-19 cases and the risk of rising joblessness leave France's outlook as clouded as the rest. Consumers have been doing their share as spending from North America, to Asia, to Europe has largely recovered. France is one example as household spending on manufactured goods, boosted by relaxed lockdowns, rose 10.6 percent in June following an even greater surge in May. This lifted annual growth, as tracked in the graph, from minus 7.6 percent to plus 1.9 percent. France's statistics bureau focuses its comparisons against February's pre-crisis levels and on this basis, sales now show a rise of 2.4 percent and, in theory, full recovery from the virus. Household durables were notably robust and there was also positive growth for textiles and clothing as well as transport equipment. Food was marginally higher and energy slightly lower in June. July also appears to have been a positive month for the French consumer with more stores having reopened and with consumer confidence climbing to a post-virus high. Even so, recent increases in new Covid-19 cases and the risk of rising joblessness leave France's outlook as clouded as the rest.

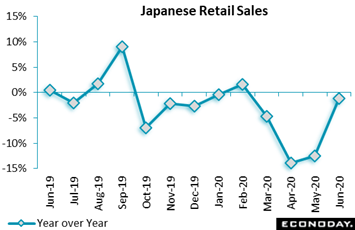

Japanese retail sales were depressed going into the crisis, never really recovering from a fourth-quarter sales-tax hike that pulled sales steeply forward into September. But the latest report for June was much better than expected as year-over-year sales were down only 1.2 percent versus 12.5 contraction in May, suggesting that the pandemic's impact on the consumer moderated in the month. Growth improved across all categories, including a stronger increase in spending on food and beverages and smaller declines in spending on vehicles and fuel. June's results clearly benefited from the month's easing of public health restrictions though the risk of new restrictions tied to an ongoing rise in infections makes Japan's outlook no more certain than any other. Japanese retail sales were depressed going into the crisis, never really recovering from a fourth-quarter sales-tax hike that pulled sales steeply forward into September. But the latest report for June was much better than expected as year-over-year sales were down only 1.2 percent versus 12.5 contraction in May, suggesting that the pandemic's impact on the consumer moderated in the month. Growth improved across all categories, including a stronger increase in spending on food and beverages and smaller declines in spending on vehicles and fuel. June's results clearly benefited from the month's easing of public health restrictions though the risk of new restrictions tied to an ongoing rise in infections makes Japan's outlook no more certain than any other.

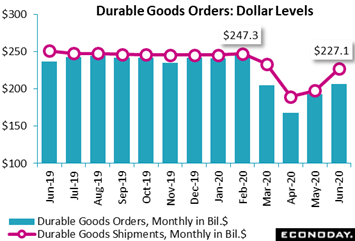

Lagging the demand side in the global economy is recovery on the supply side. Durable goods shipments in the US totaled $227.1 billion in June, well up from April's low of $189.7 billion but, compared to February's $247.3 billion, still down 8.2 percent. Orders for durable goods in June were still 16.0 percent below the virus starting point though vehicles continued to revive, up $24.3 billion to help offset continued cancellations for commercial aircraft where orders, down $10.3 billion, contracted for the third time in four months. Excluding vehicles and aircraft and all other transportation equipment, orders rose a sizable 3.3 percent as also did core capital goods orders in a welcome sign of life for business investment. US factories continued to come back on line but, on net, were still digging themselves out of the covid hole in June. Lagging the demand side in the global economy is recovery on the supply side. Durable goods shipments in the US totaled $227.1 billion in June, well up from April's low of $189.7 billion but, compared to February's $247.3 billion, still down 8.2 percent. Orders for durable goods in June were still 16.0 percent below the virus starting point though vehicles continued to revive, up $24.3 billion to help offset continued cancellations for commercial aircraft where orders, down $10.3 billion, contracted for the third time in four months. Excluding vehicles and aircraft and all other transportation equipment, orders rose a sizable 3.3 percent as also did core capital goods orders in a welcome sign of life for business investment. US factories continued to come back on line but, on net, were still digging themselves out of the covid hole in June.

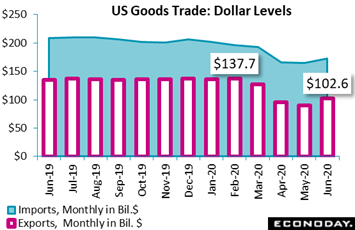

The fewer the goods produced, the fewer the goods available for cross-border purchase. And trade data, like production data, generally have yet to recover from the virus including the US where goods exports, offering a measure of foreign demand, totaled only $102.6 billion in June, up from May but down a very steep 25.5 percent from February' $137.7 billion. Imports, in a measure of US demand, totaled $173.2 billion in June for virus contraction relative to February of 11.9 percent. The easing of restrictions during June did give a lift to US trade, but only a limited one. The fewer the goods produced, the fewer the goods available for cross-border purchase. And trade data, like production data, generally have yet to recover from the virus including the US where goods exports, offering a measure of foreign demand, totaled only $102.6 billion in June, up from May but down a very steep 25.5 percent from February' $137.7 billion. Imports, in a measure of US demand, totaled $173.2 billion in June for virus contraction relative to February of 11.9 percent. The easing of restrictions during June did give a lift to US trade, but only a limited one.

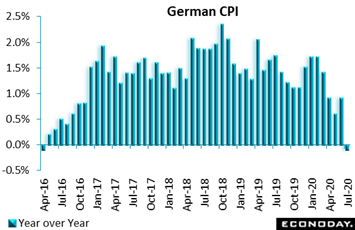

Government support not only has an effect on demand, that is driving it higher, but also on prices which in two cases in the week drove the results lower. Australia's CPI posted the largest quarterly drop in 70 years of records, falling 1.6 percentage points in the second quarter to only plus 0.3 percent. The downturn was due to lower fuel prices but also full subsidization of child care and pre-school education in response to the virus. In Germany, the special factor is a 3 percentage point cut in value-added taxes that started in July and which contributed to a 0.1 percent year-over-year decline and the CPI's first sub-zero score since April 2016. Goods prices fell to minus 1.4 percent from plus 0.2 percent in June with both food and energy lower on the month. As policy currently stands, the VAT cut will be reversed at the start of 2021. Government support not only has an effect on demand, that is driving it higher, but also on prices which in two cases in the week drove the results lower. Australia's CPI posted the largest quarterly drop in 70 years of records, falling 1.6 percentage points in the second quarter to only plus 0.3 percent. The downturn was due to lower fuel prices but also full subsidization of child care and pre-school education in response to the virus. In Germany, the special factor is a 3 percentage point cut in value-added taxes that started in July and which contributed to a 0.1 percent year-over-year decline and the CPI's first sub-zero score since April 2016. Goods prices fell to minus 1.4 percent from plus 0.2 percent in June with both food and energy lower on the month. As policy currently stands, the VAT cut will be reversed at the start of 2021.

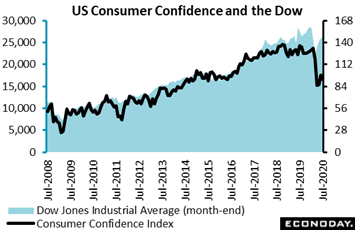

For the US, lack of new stimulus efforts may become an emerging negative factor for confidence measures which were already depressed at the end of July. The consumer sentiment index from the University of Michigan edged lower in the last half of the month to 72.5 versus 73.2 at mid-month. Splitting the difference, the final implies a reading in the high 71 area over the last two weeks which was where it was during the depth of the crisis in April and May. Consumer confidence as measured by the Conference Board fell a sharp 5.7 points to 92.6 which, like consumer sentiment, was at the low end of expectations. Sizable declines were posted in Florida, Texas, and California, three very large states that covid hit hard in the month. Both reports showed easing optimism (rising pessimism) over the outlook, not surprising given high infection rates and reports of restrictions being put back in place. The accompanying graph tracks the confidence index against the Dow, showing increasing dislocation over the past several years (confidence is low while stock prices are high). For the US, lack of new stimulus efforts may become an emerging negative factor for confidence measures which were already depressed at the end of July. The consumer sentiment index from the University of Michigan edged lower in the last half of the month to 72.5 versus 73.2 at mid-month. Splitting the difference, the final implies a reading in the high 71 area over the last two weeks which was where it was during the depth of the crisis in April and May. Consumer confidence as measured by the Conference Board fell a sharp 5.7 points to 92.6 which, like consumer sentiment, was at the low end of expectations. Sizable declines were posted in Florida, Texas, and California, three very large states that covid hit hard in the month. Both reports showed easing optimism (rising pessimism) over the outlook, not surprising given high infection rates and reports of restrictions being put back in place. The accompanying graph tracks the confidence index against the Dow, showing increasing dislocation over the past several years (confidence is low while stock prices are high).

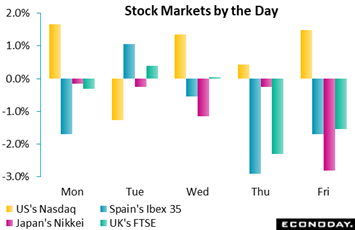

Rising infection levels triggered new quarantine rules for those traveling from Spain, making for flat to lower markets on Monday. Yet immune if not seemingly benefiting from virus concern is the US Nasdaq amid perceptions, supported by recommendations all week from analysts, that the pandemic is accelerating trends favorable for the mega caps. Underperforming were Japanese shares as auto-makers dropped sharply including Mitsubishi which said it expects to post a large operating loss. No let-up in the Federal Reserve's accommodative stance helped US markets at mid-week though Europe was held back by talk of a second wave, this time voiced by Boris Johnson. Voicing support for a delay in the US presidential election was Donald Trump in a tweet on Thursday that, however, was met with quick rejection by both parties. Apple, Amazon and Facebook all posted stronger-than-expected earnings after Thursday's close helping the Nasdaq on Friday but not much else as news continued to build of rising infections, this time in Japan and once again the UK, both of which postponed reopenings. Rising infection levels triggered new quarantine rules for those traveling from Spain, making for flat to lower markets on Monday. Yet immune if not seemingly benefiting from virus concern is the US Nasdaq amid perceptions, supported by recommendations all week from analysts, that the pandemic is accelerating trends favorable for the mega caps. Underperforming were Japanese shares as auto-makers dropped sharply including Mitsubishi which said it expects to post a large operating loss. No let-up in the Federal Reserve's accommodative stance helped US markets at mid-week though Europe was held back by talk of a second wave, this time voiced by Boris Johnson. Voicing support for a delay in the US presidential election was Donald Trump in a tweet on Thursday that, however, was met with quick rejection by both parties. Apple, Amazon and Facebook all posted stronger-than-expected earnings after Thursday's close helping the Nasdaq on Friday but not much else as news continued to build of rising infections, this time in Japan and once again the UK, both of which postponed reopenings.

Narrowing contraction for production across many economies matches against full but perhaps temporary recovery on the demand side. Temporary, at least in the US, should talks for a new stimulus package continue to fizzle. If congressional efforts do fall apart, the virus's unrestrained economic effects could become quickly apparent.

**Jeremy Hawkins, Brian Jackson, and Mace News contributed to this article

Canadian and US employment updates on Friday will be the week's key but sharing the highlights will be ISM manufacturing on Monday, German manufacturers' orders on Thursday as well as a run of industrial production reports from Italy on Thursday and France and Germany on Friday. Consumer readings will be offered on Wednesday with Eurozone retail sales and on Friday with Japanese household spending. Central bank meetings may be short on drama when it comes to policy moves (which are mostly full throttle) but their economic outlooks are worth tracking; the Reserve Bank of Australia meets on Tuesday and the Bank of India, which does have room to cut rates, on Thursday. Expectations for Friday's North American data point to substantial but slowing gains in employment for both the US and Canada together with significant drops in unemployment rates.

Swiss CPI for July (Mon 06:30 GMT; Mon 08:30 CEST; Mon 02:30 EDT)

Consensus Forecast, M/M: 0.1%

Consensus Forecast, Y/Y: -1.2%

A consensus 0.1 percent increase for the CPI is expected for July with the year-on-year rate, at minus 1.3 percent in both June and May, seen at minus 1.2 percent.

US: ISM Manufacturing Index for July (Mon 14:00 GMT; Mon 10:00 EDT)

Consensus Forecast: 53.5

June's ISM report on manufacturing was much better than expected, headlined by a 52.6 composite score and with mid-to-high 50s for new orders and production. For July's headline, forecasters are looking for further strength to 53.5.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEST; Tue 00:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Reserve Bank of Australia will offer an assessment of rising infection rates on the nation's outlook. No rate action is expected.

Eurozone Retail Sales for June (Wed 09:00 GMT; Wed 11:00 CEST; Wed 05:00 EDT)

Consensus Forecast, M/M: 5.0%

Retail sales in the Eurozone surged a record 17.8 percent in May after, however, falling a record 12.1 percent in April. A 5.0 percent increase is the expectation for June.

Reserve Bank of India Policy Announcement (Any Time Thursday IST: Release Time Not Set)

Consensus Change: 25 basis points

Consensus Level: 3.75%

The Reserve Bank of India will assess the breadth of ongoing economic damage from the virus and the outlook for recovery. At its last meeting in May, the RBI cut its policy rate by 40 points to 4.00 percent with a cut of 25 points to 3.75 percent the expectation for August.

German Manufacturers' Orders for June (Thu 06:00 GMT; Thu 08:00 CEST; Thu 02:00 EDT)

Consensus Forecast, M/M: 12.0%

German orders jumped a monthly 10.4 percent in May but followed a 26.2 percent plunge in April. For June, forecasters see an increase of 12.0 percent.

Italian Industrial Production for June (Thu 08:00 GMT; Thu 10:00 CEST; Thu 04:00 EDT)

Consensus Forecast, M/M: 7.8%

Italian industrial production is expected to rise 7.8 percent in June on top of an unexpectedly sharp 42.1 percent surge in May.

US Initial Jobless Claims for August 1 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.442 million

Since early June, initial jobless claims in the US have settled into a monstrous weekly range of 1.3 to 1.6 million. Econoday's consensus for the August 1 week is 1.442 million.

Japanese Household Spending for June (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast, Y/Y: -7.4%

Household spending is expected to be down 7.4 percent on the year in June versus contraction of 16.2 percent in May.

Chinese Merchandise Trade Balance for July (Friday, Release Time Not Set)

Consensus Forecast: US$42.5 billion

Consensus Exports, Y/Y: -0.6%

Consensus Imports, Y/Y: 1.0%

Sharper improvement in imports than exports narrowed China's merchandise trade deficit by more than US$15 billion in June to $46.42 billion. Imports rose a year-on-year 2.7 percent for the first increase of the year while exports rose 0.5 percent. For July, the consensus surplus is $42.5 billion with imports seen down 0.6 percent and exports up 1.0 percent.

German Industrial Production for June (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, M/M: 7.5%

A 7.5 percent monthly increase is expected for German industrial production in June versus a 7.8 percent rebound in May that followed a 17.5 percent collapse in April.

French Industrial Production for June (Fri 06:45 GMT; Fri 08:45 CEST; Fri 02:45 EDT)

Consensus Forecast, M/M: 11.4%

Industrial production rebounded 19.6 percent in May but was still 21.1 percent below its pre-virus level. For June, an 11.4 percent increase is expected.

Canadian Labour Force Survey for July (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 400,000

Consensus Forecast: Unemployment Rate: 11.0%

Recovery moved faster than expected in June when employment rose 953,000 and the unemployment rate fell 1.4 percentage points to 12.3 percent. July's increase is seen at 400,000 with the unemployment rate easing sharply to 11.0 percent.

US Employment Report for July (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Nonfarm Payrolls Change: 2.0 million

Consensus Forecast: Unemployment Rate: 10.5%

After gains of 2.7 million in May and 4.8 million in June, nonfarm payrolls are expected to rise 2.0 million in July. The unemployment rate is expected to fall to 10.5 percent versus June's 11.1 percent.

|