|

Rather than the big V-recovery that is widely expected, a little v-recovery may be playing out. Monetary policy has already been exhausted and it may turn out that fiscal policy has also been exhausted, unless a deal in the US is reached to extend crisis benefits. For economic data, the easy comparisons against the depth's of April and May are in the past making for slowing month-over-month improvement and underscoring what was a week of less-than-spectacular reports.

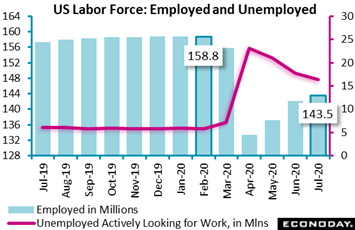

The US labor market extended its recovery into July though not all the details show acceleration, far from it. Nonfarm payrolls, up 1.763 million, beat expectations with government payrolls lifting the total by a sizable 301,000 excluding which private payrolls, at 1.462 million, came in below expectations. Though the unemployment rate, at 10.2 percent, came in 3 tenths better than Econoday's consensus, the number of employed, at 143.5 million, was still more than 15 million below February and still only 90 percent of its pre-crisis size. The participation rate reflects the lack of progress, down 1 tenth in July to 61.4 percent. The slowing wasn't anything like what ADP signaled on Wednesday, two days before the Friday report, with its estimate for private payroll growth of only 167,000 — but slowing was definitely the theme. Continued recovery for the US labor market will obviously depend on the course of infections and to what extent restrictions are lifted. The US labor market extended its recovery into July though not all the details show acceleration, far from it. Nonfarm payrolls, up 1.763 million, beat expectations with government payrolls lifting the total by a sizable 301,000 excluding which private payrolls, at 1.462 million, came in below expectations. Though the unemployment rate, at 10.2 percent, came in 3 tenths better than Econoday's consensus, the number of employed, at 143.5 million, was still more than 15 million below February and still only 90 percent of its pre-crisis size. The participation rate reflects the lack of progress, down 1 tenth in July to 61.4 percent. The slowing wasn't anything like what ADP signaled on Wednesday, two days before the Friday report, with its estimate for private payroll growth of only 167,000 — but slowing was definitely the theme. Continued recovery for the US labor market will obviously depend on the course of infections and to what extent restrictions are lifted.

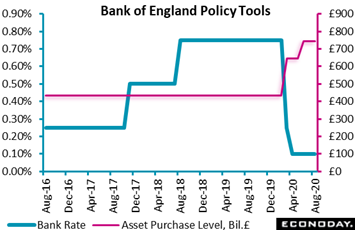

How infections play out will be the test for monetary policy, especially if they play out poorly and force central banks to dig deeper into their already depleted tool boxes. Expectations for additional policy moves right now are limited, focusing attention instead on economic forecasts. The Bank of England was a little less downbeat at its August meeting but still very cautious. The bank continues to expect the UK economy to have contracted in excess of 20 percent last quarter compared with fourth-quarter 2019, but July consumption was estimated to have been down less than 10 percent from the start of the year. Activity in the housing market was described as close to normal despite some tightening in credit standards. Yet business investment and investment intentions remained ominously weak and perceived risks to the economic outlook were on the downside. Inflation was seen falling further below target due to virus effects on demand as well as the impact of a temporary cut in value-added taxes which took effect in July. Even so, based on market prices, the CPI was seen back around (but still short of) its 2 percent medium-term target within two years' time. How infections play out will be the test for monetary policy, especially if they play out poorly and force central banks to dig deeper into their already depleted tool boxes. Expectations for additional policy moves right now are limited, focusing attention instead on economic forecasts. The Bank of England was a little less downbeat at its August meeting but still very cautious. The bank continues to expect the UK economy to have contracted in excess of 20 percent last quarter compared with fourth-quarter 2019, but July consumption was estimated to have been down less than 10 percent from the start of the year. Activity in the housing market was described as close to normal despite some tightening in credit standards. Yet business investment and investment intentions remained ominously weak and perceived risks to the economic outlook were on the downside. Inflation was seen falling further below target due to virus effects on demand as well as the impact of a temporary cut in value-added taxes which took effect in July. Even so, based on market prices, the CPI was seen back around (but still short of) its 2 percent medium-term target within two years' time.

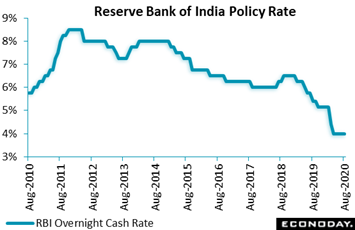

Like the BoE, there were hints of upgrades in the Reserve Bank of India's outlook. Highlighting signs that the domestic economy is beginning to recover, the RBI kept its policy rate unchanged at 4.00 percent. The bank said conditions in the agricultural sector, in particular, have strengthened in response to favorable rainfall patterns, that service sector indicators have improved, and the pace of contraction in the manufacturing sector has moderated. Officials noted that the growth outlook does remain highly uncertain and dependent on progress in monsoonal rainfall, global market volatility, and of course curbing the virus. Turning to consumer inflation, officials noted a lack of information (CPI reports for both April and May were scrapped) but did cite a 3 tenths rise from March to June to 6.1 percent, just above the bank's 2.0 percent to 6.0 percent target range. In contrast to most other central banks that are struggling against disinflation, and the RBI warned that inflation in India could move higher in coming months, particularly fuel and also food prices, the latter making up nearly 1/2 of all consumer costs in India. Having already cut policy rates aggressively since early 2019, the bank concluded that policy rates should be left on hold for now and that officials will be looking for a "durable reduction" in inflation to provide an opportunity to reduce rates further. Like the BoE, there were hints of upgrades in the Reserve Bank of India's outlook. Highlighting signs that the domestic economy is beginning to recover, the RBI kept its policy rate unchanged at 4.00 percent. The bank said conditions in the agricultural sector, in particular, have strengthened in response to favorable rainfall patterns, that service sector indicators have improved, and the pace of contraction in the manufacturing sector has moderated. Officials noted that the growth outlook does remain highly uncertain and dependent on progress in monsoonal rainfall, global market volatility, and of course curbing the virus. Turning to consumer inflation, officials noted a lack of information (CPI reports for both April and May were scrapped) but did cite a 3 tenths rise from March to June to 6.1 percent, just above the bank's 2.0 percent to 6.0 percent target range. In contrast to most other central banks that are struggling against disinflation, and the RBI warned that inflation in India could move higher in coming months, particularly fuel and also food prices, the latter making up nearly 1/2 of all consumer costs in India. Having already cut policy rates aggressively since early 2019, the bank concluded that policy rates should be left on hold for now and that officials will be looking for a "durable reduction" in inflation to provide an opportunity to reduce rates further.

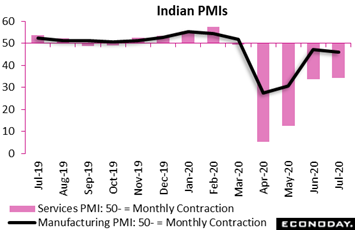

In contrast (and sometimes sharp contrast) to the RBI's note of improvement, recovery in the country's purchasing manager indexes has stalled. India's services sector, reflecting the national lockdown, continued to contract sharply in July, at 34.2 in July and only 5 tenths less severe than June. New orders declined sharply as did employment with little sign of recovery in prospect and amid continued pessimism over the year-ahead outlook. Less weak than services but still weak, India's manufacturing index fell further below breakeven 50, from 47.2 to 46.0. Output and new orders fell at a faster pace than they did in June, though less severely than they did during the initial stages of the pandemic in April and May. Contraction in factory employment extended to July though the year-ahead outlook for this sample, in contrast to services, improved for a second straight month. Price readings in both the manufacturing and services reports, in another contrast to the RBI's assessments, were flat to lower. In contrast (and sometimes sharp contrast) to the RBI's note of improvement, recovery in the country's purchasing manager indexes has stalled. India's services sector, reflecting the national lockdown, continued to contract sharply in July, at 34.2 in July and only 5 tenths less severe than June. New orders declined sharply as did employment with little sign of recovery in prospect and amid continued pessimism over the year-ahead outlook. Less weak than services but still weak, India's manufacturing index fell further below breakeven 50, from 47.2 to 46.0. Output and new orders fell at a faster pace than they did in June, though less severely than they did during the initial stages of the pandemic in April and May. Contraction in factory employment extended to July though the year-ahead outlook for this sample, in contrast to services, improved for a second straight month. Price readings in both the manufacturing and services reports, in another contrast to the RBI's assessments, were flat to lower.

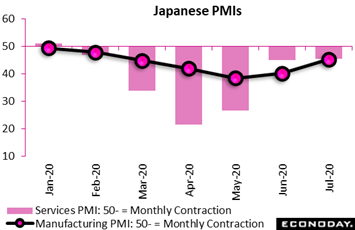

Other PMIs in Asia, that is outside of China, also came in weak in July including Singapore at 45.6 and Hong Kong at 44.5. The PMIs for Japan proved no better, at 45.2 for manufacturing and 45.4 for services. July's results suggest the pandemic is continuing to weigh on activity though perhaps to a lesser extent than June and May. Japanese manufacturers reported small declines in output, new orders, new export orders and a fifth consecutive decline in staffing. Service providers reported easing contraction in new orders and only a slight decline in staffing. Outlooks for both surveys were the brightest since February in optimism perhaps justified by July's PMIs in China which, settling into solid post-crisis growth rates, ran in the low to mid-50s across various surveys. Other PMIs in Asia, that is outside of China, also came in weak in July including Singapore at 45.6 and Hong Kong at 44.5. The PMIs for Japan proved no better, at 45.2 for manufacturing and 45.4 for services. July's results suggest the pandemic is continuing to weigh on activity though perhaps to a lesser extent than June and May. Japanese manufacturers reported small declines in output, new orders, new export orders and a fifth consecutive decline in staffing. Service providers reported easing contraction in new orders and only a slight decline in staffing. Outlooks for both surveys were the brightest since February in optimism perhaps justified by July's PMIs in China which, settling into solid post-crisis growth rates, ran in the low to mid-50s across various surveys.

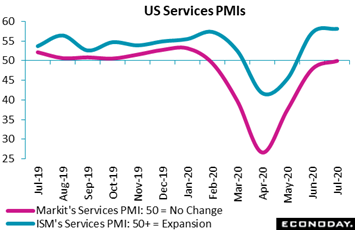

Where the PMIs are running in the US depends on where you look. ISM's services index may be sporting a new name (no longer non-manufacturing index) but its results are consistent as always -- much greater strength compared to the rival services PMI from Markit Economics. That PMI posted a flat 50.0 score in contrast to ISM's 58.1 that easily exceeded Econoday's consensus forecast. New orders contracted in Markit's report but not in ISM, not at all with this reading surging another 6.1 points to an eye-popping 67.7. Business activity (production) was likewise sky high at 67.2 while backlogs kept building, up 4 points to a very positive 55.9. Though Markit's report did end five straight scores under 50, the two reports don't sync up at all, suggesting perhaps that conditions are somewhere in between, that is growing at a moderate pace off deep crisis lows. Note that the name for ISM's report has been changed but not the composite of industries covered which still include two non-service industries: construction which was one of 15 reporting monthly composite growth and mining which was one of three reporting composite contraction. Where the PMIs are running in the US depends on where you look. ISM's services index may be sporting a new name (no longer non-manufacturing index) but its results are consistent as always -- much greater strength compared to the rival services PMI from Markit Economics. That PMI posted a flat 50.0 score in contrast to ISM's 58.1 that easily exceeded Econoday's consensus forecast. New orders contracted in Markit's report but not in ISM, not at all with this reading surging another 6.1 points to an eye-popping 67.7. Business activity (production) was likewise sky high at 67.2 while backlogs kept building, up 4 points to a very positive 55.9. Though Markit's report did end five straight scores under 50, the two reports don't sync up at all, suggesting perhaps that conditions are somewhere in between, that is growing at a moderate pace off deep crisis lows. Note that the name for ISM's report has been changed but not the composite of industries covered which still include two non-service industries: construction which was one of 15 reporting monthly composite growth and mining which was one of three reporting composite contraction.

But there is a lift apparent in many reports including German manufacturers' orders which continued to climb very sharply in June. Following a 10.4 percent monthly bounce in May, orders jumped a surprisingly sharp 27.9 percent in June, although this still left an 11.3 percent shortfall versus February. Year-over-year growth improved from minus 29.4 percent to minus 10.2 percent. Gains were led by domestic demand which expanded 35.3 percent on the month with overseas orders up 22.0 percent (Eurozone 22.3 percent). New orders in the automotive industry surged 66.5 percent but were still 12.2 percent lower than February. The results point to a second month of gains coming up for German industrial production which, in other data released in the week, posted a stronger-than-expected June rise of 8.9 percent. But there is a lift apparent in many reports including German manufacturers' orders which continued to climb very sharply in June. Following a 10.4 percent monthly bounce in May, orders jumped a surprisingly sharp 27.9 percent in June, although this still left an 11.3 percent shortfall versus February. Year-over-year growth improved from minus 29.4 percent to minus 10.2 percent. Gains were led by domestic demand which expanded 35.3 percent on the month with overseas orders up 22.0 percent (Eurozone 22.3 percent). New orders in the automotive industry surged 66.5 percent but were still 12.2 percent lower than February. The results point to a second month of gains coming up for German industrial production which, in other data released in the week, posted a stronger-than-expected June rise of 8.9 percent.

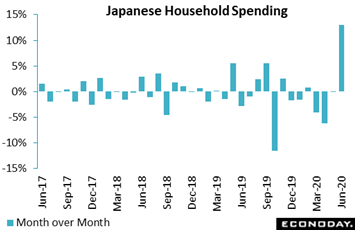

Much more so than production, the global consumer sector, directly reflecting aggressive fiscal efforts, was the first to recover from crisis lows. Japan had been an exception, until June's data on household spending which far surpassed expectations, rising 13.0 percent on the month following three months of declines. Virus restrictions were eased in June, releasing significant pent-up consumer demand, yet downside risks remain given rising infection rates in some parts of the country, including Tokyo. June's spending climb was broad-based with very strong increases for clothing and footwear, furniture and household items, culture and recreation, and also housing, and solid increases as well for food, transportation and communication, and medical care. Much more so than production, the global consumer sector, directly reflecting aggressive fiscal efforts, was the first to recover from crisis lows. Japan had been an exception, until June's data on household spending which far surpassed expectations, rising 13.0 percent on the month following three months of declines. Virus restrictions were eased in June, releasing significant pent-up consumer demand, yet downside risks remain given rising infection rates in some parts of the country, including Tokyo. June's spending climb was broad-based with very strong increases for clothing and footwear, furniture and household items, culture and recreation, and also housing, and solid increases as well for food, transportation and communication, and medical care.

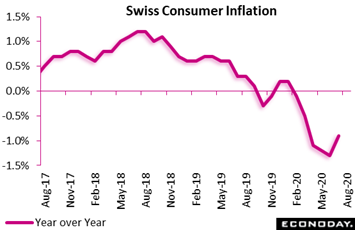

Inflation news was limited in the week though the RBI's concern over higher prices contrasts with data elsewhere that generally show, so far, a deflationary pull from the crisis. But perhaps an easing pull with Switzerland offering an example in July when consumer prices did fall but not as much as expected, down 0.2 percent on the month to shave 4 tenths off of year-over-year contraction to 0.9 percent for the first monthly improvement since November. Even so, this was still the sixth consecutive sub-zero showing in as many months. The main downward pressure came from clothing and footwear where prices dropped 7.2 percent with communications falling 1.1 percent. The core CPI was also down 0.2 percent versus June, lifting this inflation rate from minus 0.8 percent to minus 0.4 percent, its first improvement since October. That said, core prices have now been running at a negative yearly rate for the last five months which won't be easing deflationary concerns very much at the Swiss National Bank. Inflation news was limited in the week though the RBI's concern over higher prices contrasts with data elsewhere that generally show, so far, a deflationary pull from the crisis. But perhaps an easing pull with Switzerland offering an example in July when consumer prices did fall but not as much as expected, down 0.2 percent on the month to shave 4 tenths off of year-over-year contraction to 0.9 percent for the first monthly improvement since November. Even so, this was still the sixth consecutive sub-zero showing in as many months. The main downward pressure came from clothing and footwear where prices dropped 7.2 percent with communications falling 1.1 percent. The core CPI was also down 0.2 percent versus June, lifting this inflation rate from minus 0.8 percent to minus 0.4 percent, its first improvement since October. That said, core prices have now been running at a negative yearly rate for the last five months which won't be easing deflationary concerns very much at the Swiss National Bank.

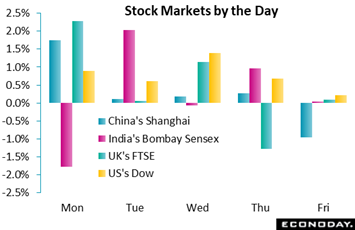

Justifying the imposing gains for stocks are imposing gains for profits, at least in the US where the second-quarter earnings season, according to Reuters, is beating expectations by a record 22.5 percent. The week opened with the Shanghai jumping 1.8 percent following PMI data that showed further improvement for the Chinese manufacturing sector, in contrast to India's manufacturing PMI where significant contraction continued and which contributed to a 1.8 percent drop for the Bombay Sensex. The FTSE rallied 2.3 percent on Monday on talk that the European Union may soften its position to reach a Brexit deal; Italy's FTSE MIB was another big Monday gainer, rising 1.5 percent after the European Commission approved a new round of Italian state subsidies to Italian businesses and data showed heavy ECB purchases of Italian government debt. On Tuesday, Australia's All Ordinaries rose 1.9 percent after the Reserve Bank reiterated its commitment to keep monetary policy highly accommodative, underscoring the recent surge in Covid-19 cases in Victoria as a major risk to the outlook. Stocks in the US faded late Tuesday on reports that the negotiations in Washington over new virus relief could last two more weeks, reports which then reversed on Wednesday saying Republicans and Democrats were aiming to clinch a deal by week's end. The FTSE fell 1.3 percent on Thursday after the Bank of England left its policy unchanged, at a very thin 0.10 percent, with markets ending Friday mixed to lower, not benefiting from the mixed US employment report and after President Trump banned WeChat and TikTok, raising tensions further with China. Justifying the imposing gains for stocks are imposing gains for profits, at least in the US where the second-quarter earnings season, according to Reuters, is beating expectations by a record 22.5 percent. The week opened with the Shanghai jumping 1.8 percent following PMI data that showed further improvement for the Chinese manufacturing sector, in contrast to India's manufacturing PMI where significant contraction continued and which contributed to a 1.8 percent drop for the Bombay Sensex. The FTSE rallied 2.3 percent on Monday on talk that the European Union may soften its position to reach a Brexit deal; Italy's FTSE MIB was another big Monday gainer, rising 1.5 percent after the European Commission approved a new round of Italian state subsidies to Italian businesses and data showed heavy ECB purchases of Italian government debt. On Tuesday, Australia's All Ordinaries rose 1.9 percent after the Reserve Bank reiterated its commitment to keep monetary policy highly accommodative, underscoring the recent surge in Covid-19 cases in Victoria as a major risk to the outlook. Stocks in the US faded late Tuesday on reports that the negotiations in Washington over new virus relief could last two more weeks, reports which then reversed on Wednesday saying Republicans and Democrats were aiming to clinch a deal by week's end. The FTSE fell 1.3 percent on Thursday after the Bank of England left its policy unchanged, at a very thin 0.10 percent, with markets ending Friday mixed to lower, not benefiting from the mixed US employment report and after President Trump banned WeChat and TikTok, raising tensions further with China.

And what is the status of new fiscal stimulus in the US? That was progressing late Friday according to reports with both sides said to be wanting a deal. Without a deal, progress in the US economy may do more than slow, in turn risking secondary effects for Europe and Asia.

**Jeremy Hawkins, Brian Jackson, and Mace News contributed to this article

A heavy run of data from the UK will fill mid-week on Wednesday including second-quarter GDP (that will include a monthly breakdown for June) and also industrial production. Chinese data for July will bookend the week: CPI on Monday and industrial production and retail sales on Friday with the latter two expected to show increasing traction. US data will be concentrated on Friday with retail sales and industrial production amid similar expectations for extending recovery. US data will also be posted Wednesday with July's CPI and Thursday with US jobless claims which posted their lowest total of the crisis in the prior week. Other data to watch will be the Swiss unemployment rate for July on Monday and Germany's ZEW report on Tuesday. If the week's results unfold as expected, the outlook for the global economy and recovery from the crisis will have improved.

Chinese CPI for July (Mon 01:30 GMT; Mon 09:30 CST; Sun 21:30 EDT)

Consensus Forecast, Year over Year: 2.7%

Chinese consumer prices are expected to increase 2.7 percent on the year in July as they did in June.

Swiss Unemployment Rate for July (Mon 05:45 GMT; Mon 07:45 CEST; Mon 01:45 EDT)

Consensus Forecast, Adjusted: 3.4%

Consensus Forecast, Unadjusted: 3.5%

Unemployment in Switzerland has been very limited during the crisis: at 3.3 percent for the adjusted rate in June for only a 1 percentage point gain from the pre-virus month of February. For July, the consensus is 3.4 percent and 3.5 percent for the unadjusted rate.

UK Labour Market Report (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, ILO Unemployment Rate for June: 4.2%

The ILO employment rate, in data for the three months to June, is expected at 4.2 percent versus 3.9 percent in the three months to May.

Germany: ZEW Survey for August (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Business Expectations: 58

Consensus Forecast, Current Conditions: -70

The last ZEW survey didn't improve as much as expected with forecasters looking for mixed readings in August's sample, at 58 for business expectations which would be down from July's 59.3 but minus 70 for current conditions which would be an improvement from minus 80.9.

UK Second-Quarter GDP (Wed 06:00 GMT; Wed 07:00 BST; Wed 02:00 EDT)

Consensus Forecast, Quarter over Quarter: -21.5%

Consensus Forecast, Year over Year: -22.8%

UK June GDP, Month over Month: 7.8%

The consensus for preliminary second-quarter GDP and the full impact of the coronavirus on the UK economy is quarterly contraction of 21.5 percent for year-on-year contraction of 22.8 percent. Consensus for the separate month of June is a rise of 7.8 percent.

UK Industrial Production for June (Wed 06:00 GMT; Wed 07:00 BST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: 9.4%

After posting an as-expected 6.0 percent rise in May that followed 20.2 percent contraction in April, UK industrial production is expected to rise another 9.4 percent in June.

US CPI for July (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 0.8%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 1.1%

The core CPI ended a record low 3-month run in negative territory with a better-than-expected 0.2 percent rise in June that held the year-on-year rate at 1.2 percent. Econoday's consensus in July is a 0.2 percent monthly increase for a yearly core rate of 1.1 percent. The overall CPI is seen up 0.3 percent on the month for 0.8 percent annual growth.

US Initial Jobless Claims for August 8 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 1.160 million

In the lowest showing so far of the crisis, initial jobless claims fell 249,000 in the August 1 week to what was a lower-than-expected 1.186 million. Econoday's consensus for the August 8 week is further but only marginal improvement of 26,000 to 1.160 million.

Chinese Fixed Asset Investment for July (Fri 02:00 GMT; Fri 10:00 CST; Thu 22:00 EDT)

Consensus Forecast, Year to Date on Y/Y Basis: -1.6%

Chinese fixed asset investment has been consistently improving following the year-opening collapse. Expectations for year-to-date July are minus 1.6 percent versus minus 3.1 percent in June.

Chinese Industrial Production for July (Fri 02:00 GMT; Fri 10:00 CST; Thu 22:00 EDT)

Consensus Forecast, Year over Year: 5.1%

Industrial production is expected to continue to recover in July, rising at a year-on-year 5.1 percent pace following June's 4.8 percent which beat expectations for 4.6 percent.

Chinese Retail Sales for July (Fri 02:00 GMT; Fri 10:00 CST; Thu 22:00 EDT)

Consensus Forecast, Year over Year: 0.3%

At plus 0.3 percent, Chinese retail sales in July are expected to improve from year-on-year contraction of 1.8 percent in June which, for a second straight report, was weaker than expectations.

US Retail Sales for July (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 1.8%

Consensus Forecast, Ex-Autos, Ex-Gas: 1.0%

Retail sales fully recovered their pre-virus levels in June. For July, forecasters see sales extending their strong recovery pace, up a monthly 1.8 percent with ex-auto ex-gas seen up 1.0 percent.

US Industrial Production for July (Fri 13:15 GMT; Fri 09:15 EDT)

Consensus Forecast, Month over Month: 3.0%

US Manufacturing Production

Consensus Forecast, Month over Month: 3.0%

US industrial production rebounded in May and especially in June but was still more than 10 percent short of pre-crisis levels. For July, Econoday's consensus is a 3.0 percent monthly increase overall with manufacturing also seen up 3.0 percent.

|