|

There was plenty of conflicting economic data anywhere you looked this past week: some of it good if not very good but much it not so good. Minutes from the Federal Reserve's July meeting were part of the not-so-good news, echoing calls for additional fiscal stimulus amid an outlook that is being held back by Covid-19. Economists at the Fed did not, at least in July, see a complete recovery by year-end, though social distancing requirements were expected to "gradually" ease helping the economy next year and into 2022. Since it's always bad luck to start with the bad news, we'll start with the good news instead.

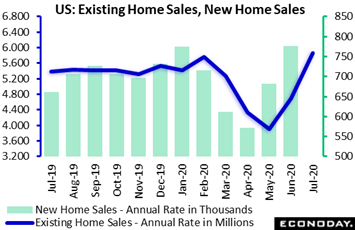

The great rush of stimulus unleashed during the crisis appears to be finding its way, and to a significant degree, into the US housing sector. Existing home sales are catching up with new home sales and are posting the best results since the sub-prime collapse a dozen years ago, at an annual rate of 5.860 million in July to easily exceed Econoday's consensus range. Up 8.7 percent on the year, resales have spiked up the last two reports and are back at the rising levels that were posted going into the virus. Also like new homes, resale gains are not coming at the expense of prices which are rising sharply, up 3.3 percent in July alone to a median $304,100. Year-on-year, the median is up 8.5 percent to nearly match the sales gain. And further acceleration for prices is indicated by supply which is bare, at only 3.1 months with just 1.5 million units on the market which is down 21.1 percent from a year ago. The National Association of Realtors reports that "heavy" buyer competition is taking out listings "quickly". Low interest rates and record prices in the stock market, along with comparatively steady rates of employment for higher wage earners, are all feeding this year's surprise housing boom. The great rush of stimulus unleashed during the crisis appears to be finding its way, and to a significant degree, into the US housing sector. Existing home sales are catching up with new home sales and are posting the best results since the sub-prime collapse a dozen years ago, at an annual rate of 5.860 million in July to easily exceed Econoday's consensus range. Up 8.7 percent on the year, resales have spiked up the last two reports and are back at the rising levels that were posted going into the virus. Also like new homes, resale gains are not coming at the expense of prices which are rising sharply, up 3.3 percent in July alone to a median $304,100. Year-on-year, the median is up 8.5 percent to nearly match the sales gain. And further acceleration for prices is indicated by supply which is bare, at only 3.1 months with just 1.5 million units on the market which is down 21.1 percent from a year ago. The National Association of Realtors reports that "heavy" buyer competition is taking out listings "quickly". Low interest rates and record prices in the stock market, along with comparatively steady rates of employment for higher wage earners, are all feeding this year's surprise housing boom.

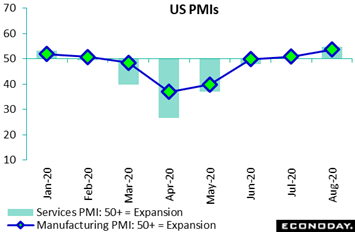

Housing is way in front of the US economy though the production side – both manufacturing and services – appears to be picking up the pace. Markit's US samples are now confirming what ISM's samples have already been reporting: very solid recovery underway. August's PMI flashes, offering early indications on the ongoing month, moved from the low 50s toward the mid 50s, now at 53.6 for manufacturing and 54.8 for services. Though comparisons are easy given the prior downturn, August's scores indicate slightly faster rates of monthly growth than before the crisis hit. Both the services and manufacturing samples reported gains in new orders which are getting a boost from client reopenings, while the reopening of global economies is giving a sharp boost to export orders. And both samples are reporting expansion in employment. These surveys aren't breaking new ground, as ISM's last reports, which were for the month of July, were at least as strong. Together they support expectations, however much dampened by the FOMC minutes, for a V-recovery. Housing is way in front of the US economy though the production side – both manufacturing and services – appears to be picking up the pace. Markit's US samples are now confirming what ISM's samples have already been reporting: very solid recovery underway. August's PMI flashes, offering early indications on the ongoing month, moved from the low 50s toward the mid 50s, now at 53.6 for manufacturing and 54.8 for services. Though comparisons are easy given the prior downturn, August's scores indicate slightly faster rates of monthly growth than before the crisis hit. Both the services and manufacturing samples reported gains in new orders which are getting a boost from client reopenings, while the reopening of global economies is giving a sharp boost to export orders. And both samples are reporting expansion in employment. These surveys aren't breaking new ground, as ISM's last reports, which were for the month of July, were at least as strong. Together they support expectations, however much dampened by the FOMC minutes, for a V-recovery.

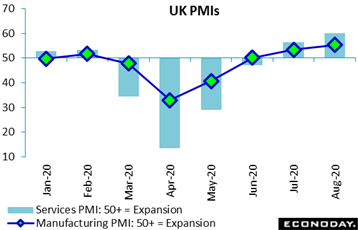

Good PMI news is also coming from the UK where August's flashes were surprisingly strong. The manufacturing PMI rose from July's 53.3 to a nearly three-year peak of 55.3, within which output, at 61.6, is the best in more than six years. Services followed suit, climbing from 56.5 to 60.1 for another six-year best. New orders are also at multi-year highs. Yet backlogs are being worked down and, importantly, employment in the samples continues to contract. Likewise, business sentiment dipped for the first time since March with some respondents citing concerns that the recovery will be slower than first expected. Nevertheless, the results on net are significantly stronger than expected and will dampen any speculation about additional easing from the Bank of England next month. Nonetheless, businesses in the UK are clearly concerned about the pace of recovery in demand as well as the potential fallout from the planned termination of current furlough arrangements in October. And with the post-Brexit trading relationship with the European Union as unclear as ever, August's PMIs very probably offer a misleadingly optimistic view of the UK economy. Good PMI news is also coming from the UK where August's flashes were surprisingly strong. The manufacturing PMI rose from July's 53.3 to a nearly three-year peak of 55.3, within which output, at 61.6, is the best in more than six years. Services followed suit, climbing from 56.5 to 60.1 for another six-year best. New orders are also at multi-year highs. Yet backlogs are being worked down and, importantly, employment in the samples continues to contract. Likewise, business sentiment dipped for the first time since March with some respondents citing concerns that the recovery will be slower than first expected. Nevertheless, the results on net are significantly stronger than expected and will dampen any speculation about additional easing from the Bank of England next month. Nonetheless, businesses in the UK are clearly concerned about the pace of recovery in demand as well as the potential fallout from the planned termination of current furlough arrangements in October. And with the post-Brexit trading relationship with the European Union as unclear as ever, August's PMIs very probably offer a misleadingly optimistic view of the UK economy.

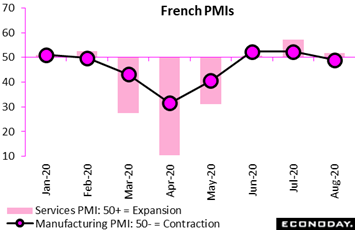

This is where the week's bad news starts to come in. Looking first at France, which had been leading the European recovery, August's PMIs came up short. Manufacturing is back under breakeven 50, falling more than 3 points to 49.0 as the output component, at 50.7, barely kept its head above water. Services fared better but, at 51.9, the flash was also sharply lower, down from July's 57.3 and indicative of no more than modest growth. Aggregate new business posted only a marginal increase and that masked falls in manufacturing and, in contrast to the PMI reports from the US, total overseas demand for French goods and services fell. Consequently, output would have been weaker but for backlogs which fell following five successive rises. As a result, overall headcount was cut for a sixth consecutive month and at a faster rate than in July. Firms at least remained optimistic about the year-ahead outlook but less so than prior months, likely reflecting worries about further outbreaks. Growth in France appears to have slowed markedly this month as new infections regularly set post-lockdown records. The outlook remains very uncertain and though President Macron has ruled out a second nationwide lockdown in favor of localized containment, it looks as if the virus, at least for now, will continue to hamper recovery prospects. This is where the week's bad news starts to come in. Looking first at France, which had been leading the European recovery, August's PMIs came up short. Manufacturing is back under breakeven 50, falling more than 3 points to 49.0 as the output component, at 50.7, barely kept its head above water. Services fared better but, at 51.9, the flash was also sharply lower, down from July's 57.3 and indicative of no more than modest growth. Aggregate new business posted only a marginal increase and that masked falls in manufacturing and, in contrast to the PMI reports from the US, total overseas demand for French goods and services fell. Consequently, output would have been weaker but for backlogs which fell following five successive rises. As a result, overall headcount was cut for a sixth consecutive month and at a faster rate than in July. Firms at least remained optimistic about the year-ahead outlook but less so than prior months, likely reflecting worries about further outbreaks. Growth in France appears to have slowed markedly this month as new infections regularly set post-lockdown records. The outlook remains very uncertain and though President Macron has ruled out a second nationwide lockdown in favor of localized containment, it looks as if the virus, at least for now, will continue to hamper recovery prospects.

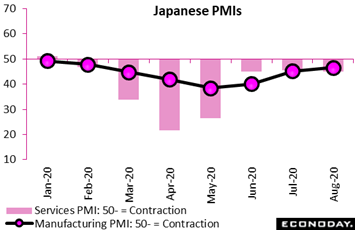

The most ominous PMI disappointment comes from Japan, an economy that has underperformed during the crisis. Aggregate activity is still contracting at a significant pace: at 46.6 for manufacturing and 45.0 for services, the former showing marginal improvement and the latter none at all. Respondents did report a smaller decline in export orders but steeper declines for output, new orders, and employment. Business sentiment was weaker as well. Input costs are falling after rising in July while selling prices are being cut at a sharper pace. Japan, remember was showing cracks going into the crisis underscored by the manufacturing PMI which has been under 50 since early last year. The most ominous PMI disappointment comes from Japan, an economy that has underperformed during the crisis. Aggregate activity is still contracting at a significant pace: at 46.6 for manufacturing and 45.0 for services, the former showing marginal improvement and the latter none at all. Respondents did report a smaller decline in export orders but steeper declines for output, new orders, and employment. Business sentiment was weaker as well. Input costs are falling after rising in July while selling prices are being cut at a sharper pace. Japan, remember was showing cracks going into the crisis underscored by the manufacturing PMI which has been under 50 since early last year.

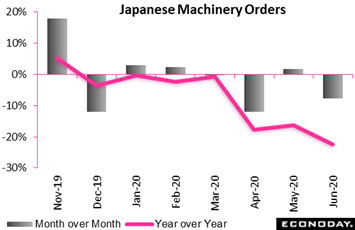

Machinery orders were also part of the week's disappointment for Japan, falling 7.6 percent on the month in June and 22.5 percent on the year (this series excludes orders for ships and orders from electric power companies). Yet the trouble in June wasn't due to manufacturing where orders rebounded 5.6 percent on the month, but to non-manufacturing where they fell 10.4 percent. On a quarterly basis, Japanese machinery orders plunged 12.9 percent following the first quarter's 0.7 percent decline. Officials expect orders to decline a further 1.9 percent in the third quarter.

Machinery orders were also part of the week's disappointment for Japan, falling 7.6 percent on the month in June and 22.5 percent on the year (this series excludes orders for ships and orders from electric power companies). Yet the trouble in June wasn't due to manufacturing where orders rebounded 5.6 percent on the month, but to non-manufacturing where they fell 10.4 percent. On a quarterly basis, Japanese machinery orders plunged 12.9 percent following the first quarter's 0.7 percent decline. Officials expect orders to decline a further 1.9 percent in the third quarter.

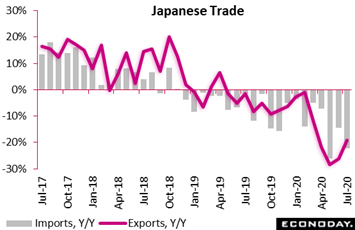

Trade data also illustrate how severely Japan is being hit by the crisis. Japan's merchandise trade balance did rise from a deficit of ¥269.3billion in June to a surplus of ¥11.6 billion in July, but only because imports fell even more sharply than exports. After dropping at a yearly pace of 26.2 percent in June, exports fell at a 19.2 percent pace in July. Imports fell 22.3 percent after dropping 14.4 percent. The smaller decline in exports was partly driven by a rebound in Chinese demand, with exports to China up 8.2 percent on the year in July after falling slightly in June. Demand elsewhere, however, remained weak, with exports to the US and the EU down 19.5 percent and 30.5 percent respectively, and exports to most other Asian countries also falling. Weakness in imports was broad-based across major trading partners, and also reflected another month of large year-on-year declines in both the volume and value of petroleum imports. Trade data also illustrate how severely Japan is being hit by the crisis. Japan's merchandise trade balance did rise from a deficit of ¥269.3billion in June to a surplus of ¥11.6 billion in July, but only because imports fell even more sharply than exports. After dropping at a yearly pace of 26.2 percent in June, exports fell at a 19.2 percent pace in July. Imports fell 22.3 percent after dropping 14.4 percent. The smaller decline in exports was partly driven by a rebound in Chinese demand, with exports to China up 8.2 percent on the year in July after falling slightly in June. Demand elsewhere, however, remained weak, with exports to the US and the EU down 19.5 percent and 30.5 percent respectively, and exports to most other Asian countries also falling. Weakness in imports was broad-based across major trading partners, and also reflected another month of large year-on-year declines in both the volume and value of petroleum imports.

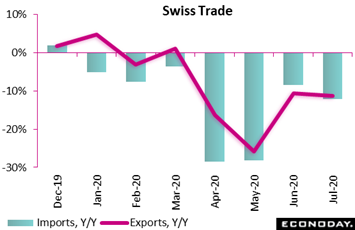

Though the worst of the global collapse in trade has hopefully passed, improvement is not proving dramatic. Switzerland's merchandise trade balance was in a CHF3.38 billion surplus in July, little changed from the CHF3.20 billion surplus in June but down from CHF3.66 billion posted in the same month last year. The yearly deterioration reflected slightly steeper falls in both exports (11.3 percent after 10.6 percent) and imports (12.1 percent after 8.5 percent). On a monthly basis, both sides of the balance sheet expanded although growth noticeably slowed: exports rose 1.1 percent versus June's 7.4 percent bounce while imports were up 2.5 percent following a 7.3 percent gain. Yet, outside of chemicals and pharmaceuticals, major exporting sectors posted increases on the back of solid demand from Asia and North America. There was also a third straight improvement in the real trade balance as export volumes increased 2.3 percent and their import counterpart only 1.1 percent. Consequently, and despite the ongoing strength of the Swiss franc, international trade made a small positive contribution to real GDP growth at the start of the current quarter. Though the worst of the global collapse in trade has hopefully passed, improvement is not proving dramatic. Switzerland's merchandise trade balance was in a CHF3.38 billion surplus in July, little changed from the CHF3.20 billion surplus in June but down from CHF3.66 billion posted in the same month last year. The yearly deterioration reflected slightly steeper falls in both exports (11.3 percent after 10.6 percent) and imports (12.1 percent after 8.5 percent). On a monthly basis, both sides of the balance sheet expanded although growth noticeably slowed: exports rose 1.1 percent versus June's 7.4 percent bounce while imports were up 2.5 percent following a 7.3 percent gain. Yet, outside of chemicals and pharmaceuticals, major exporting sectors posted increases on the back of solid demand from Asia and North America. There was also a third straight improvement in the real trade balance as export volumes increased 2.3 percent and their import counterpart only 1.1 percent. Consequently, and despite the ongoing strength of the Swiss franc, international trade made a small positive contribution to real GDP growth at the start of the current quarter.

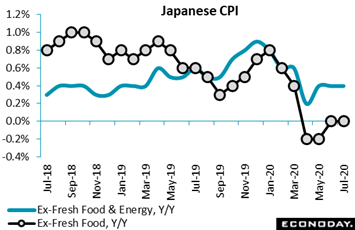

Like global trade, inflation is also expected to make a comeback but progress here has likewise been limited. And turning back to Japan, inflation isn't making any progress at all. Japan's headline consumer price index did advance 0.3 percent on the year in July but when excluding fresh food the result was dead zero for a second month in a row. When excluding both fresh food and energy, there was likewise no progress, unchanged but at least in the plus column at 0.4 percent. Housing costs and utilities were little changed in July which held down the core readings, while helping the headline was a small pick up in food price inflation, from 1.5 percent on the year to 1.7 percent, as well as a smaller yearly decline in transportation and communication prices, down 0.1 percent after falling 0.5 percent. The lack of CPI progress likely strengthens the case for additional stimulus from the Bank of Japan whose next policy meeting is scheduled for mid-September.

Like global trade, inflation is also expected to make a comeback but progress here has likewise been limited. And turning back to Japan, inflation isn't making any progress at all. Japan's headline consumer price index did advance 0.3 percent on the year in July but when excluding fresh food the result was dead zero for a second month in a row. When excluding both fresh food and energy, there was likewise no progress, unchanged but at least in the plus column at 0.4 percent. Housing costs and utilities were little changed in July which held down the core readings, while helping the headline was a small pick up in food price inflation, from 1.5 percent on the year to 1.7 percent, as well as a smaller yearly decline in transportation and communication prices, down 0.1 percent after falling 0.5 percent. The lack of CPI progress likely strengthens the case for additional stimulus from the Bank of Japan whose next policy meeting is scheduled for mid-September.

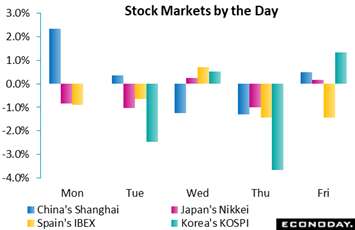

Asian markets opened the week mixed on Monday amid reports over the weekend that a review of the US-China Phase 1 deal had been postponed. Nevertheless, the Shanghai jumped 2.3 percent in contrast to the which Nikkei fell 0.8 percent on Monday to begin what would be a down week for the index. Having little impact was President Trump's announcement that further restrictions will be imposed on China's Huawei. It was the downbeat economic outlook in the FOMC minutes, and the repeated call for new fiscal stimulus, that held back the markets most during the week, contributing to wide declines across regions on Thursday. Not helping was Thursday's US jobless report where new claims rose back over 1 million, and also providing no help was the mixed batch of August PMIs on Friday. A central negative in the week was infection news including acceleration in France and Germany and also Spain where the IBEX fell 3.7 percent on the week and Korea where the Kospi fell 4.3 percent. Asian markets opened the week mixed on Monday amid reports over the weekend that a review of the US-China Phase 1 deal had been postponed. Nevertheless, the Shanghai jumped 2.3 percent in contrast to the which Nikkei fell 0.8 percent on Monday to begin what would be a down week for the index. Having little impact was President Trump's announcement that further restrictions will be imposed on China's Huawei. It was the downbeat economic outlook in the FOMC minutes, and the repeated call for new fiscal stimulus, that held back the markets most during the week, contributing to wide declines across regions on Thursday. Not helping was Thursday's US jobless report where new claims rose back over 1 million, and also providing no help was the mixed batch of August PMIs on Friday. A central negative in the week was infection news including acceleration in France and Germany and also Spain where the IBEX fell 3.7 percent on the week and Korea where the Kospi fell 4.3 percent.

Outside of US housing, the news was, on net, mostly downbeat. The Conference Board, which publishes the index of leading economic indicators, captured this theme, downplaying a sharp rise in the LEI in July that, however, was a smaller rise than June or May, underscoring the emerging theme of slowing recovery. Based on indications from the LEI, the Conference Board is warning that the pace of US economic growth "will weaken substantially" during the final months of 2020.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Sentiment readings are a key of the coming week, including Tuesday's Ifo and Friday's GfK reports from Germany, US consumer confidence on Tuesday, France's business climate indicator on Thursday, and EC economic sentiment on Friday. Given stubbornly high infection rates in both the US and Europe, no more than limited improvement is the general expectation. The status of recovery in US manufacturing, which is still climbing out of the crisis hole, will be updated on Wednesday with durable goods orders amid expectations for another month of improvement, though no improvement is the expectation for US goods trade to be posted on Friday. Holding prior improvement, following blistering gains, is the call for US new home sales on Tuesday which in prior reports have shown no virus effects. Indications on August retail sales in the UK will be offered with Tuesday's CBI distributive trades report with indications on Switzerland's general outlook posted on Friday with KOF leading indicators. Recovery for French consumer goods consumption is expected to slow in another report on Friday.

German Ifo Business Climate Indicator for August (Tue 08:00 GMT; Tue 10:00 CEST; Tue 04:00 EDT)

Consensus Forecast: 92.5

After three straight better-than-expected gains that lifted the economic sentiment reading close to its pre-virus level, a 92.5 score is expected for August which would compare with 90.5 in July.

UK CBI Distributive Trades for August (Tue 10:00 GMT; Tue 11:00 BST; Tue 06:00 EDT)

Consensus Forecast: 8

CBI's distributive trades report will offer an indication of what to expect for UK retail sales in August. After a far stronger-than-expected plus 4 in July, the consensus for August is plus 8.

US Consumer Confidence Index for August (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 93.0

Expectation readings sank sharply in July, driving the consumer confidence to a lower-than-expected 92.6 in July. Econoday's consensus for August, at 93.0, isn't looking for much improvement.

US New Home Sales for July (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast, Annual Rate: 774,000

New home sales have proven very resistant to virus issues, easily beating expectations for a third straight month in June at a 776,000 rate which is the best since the subprime bust of the last economic cycle. An annual rate of 774,000 is Econoday's consensus for July.

US Durable Goods Orders for July (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: 4.3%

Consensus Forecast: Ex-Transportation: 2.0%

Consensus Forecast: Core Capital Goods: 1.7%

Having revived in June and May, durable goods orders for July are expected to rise another 4.3 percent following June's better-than-expected 7.7 percent rebound (revised from 7.3 percent). Excluding transportation equipment, orders are expected to rise 2.0 percent with core capital goods orders seen up 1.7 percent.

French Business Climate Indicator for August (Thu 06:45 GMT; Thu 08:45 CEST; Thu 02:45 EDT)

Consensus Forecast, Manufacturing: 85

Manufacturing sentiment in August is seen at 85 which would follow July's 4-point gain to 82 that was still 19 points below February's pre-virus level.

US Initial Jobless Claims for August 22 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 987K

Initial jobless claims rose a higher-than-expected 135,000 and were back over 1 million at 1.106 million in the August 15 week. Econoday's consensus for the August 22 week is a dip back below 1 million at 987,000.

Germany: GfK Consumer Climate for September (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast: 2.0

A fourth month of improvement to plus 2.0 is the call for September's Gfk reading which for August rose more than 9 points to what was a better-than-expected minus 0.3 and well up from the deep virus low of minus 23.1 hit in May.

French Consumer Manufactured Goods Consumption for July (Fri 06:45 GMT; Fri 08:45 CEST; Fri 02:45 EDT)

Consensus Forecast, Month-to-Month: 3.2%

After surging from virus depths, monthly acceleration in consumer manufactured goods consumption is expected to slow in July, to a monthly gain of 3.2 percent following gains of 10.6 and 46.1 percent in June and May.

Switzerland: KOF Swiss Leading Indicator for August (Fri 07:00 GMT; Fri 09:00 CEST; Fri 03:00 EDT)

Consensus Forecast: 90.0

After improving sharply in July to what was a much better-than-expected 85.7, KOF's Swiss leading indicator is expected to rise to 90.0 in August.

Eurozone: EC Economic Sentiment for August (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast: 85.0

The European Commission's economic sentiment index, though still well under the long-term average of 100, has recovered in each of the last three reports with expectations for August at 85.0 versus July's 82.3.

US Goods Trade for July (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: -$73.0 billion

The US goods deficit is expected to widen to $73.0 billion in July versus $71.0 billion in June (revised from $70.6 billion). Exports have been recovering faster than imports though both were still deeply negative, at 24.4 percent for exports in June and 19.9 percent for imports.

|