|

Central banks have played out their current options forcing the Federal Reserve to prepare everyone for future options, that is allowing inflation (should it indeed pick up) to overshoot the 2 percent line. Though lack of inflation has been the unsolved mystery of the last dozen years, and though the great pandemic at first deepened this theme, the outside risk of substantially rising price pressures shouldn't be overlooked.

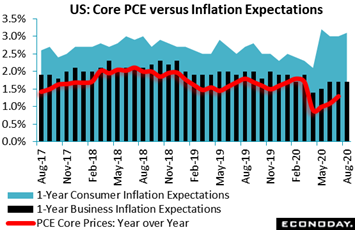

US inflation data have yet to post any frightening gains but there is some movement upward. The red line tracks PCE core prices (ex-food and energy), rising from a virus low of 0.9 percent in April to 1.3 percent in July. Though the level is still subdued, the slope of the curve is less than subdued and points, if the trend extends, to a test of 2 percent as early as year end. Central bankers stress the importance of inflation expectations as a leading indicator of future pressures, and here the story in the US is mixed. The graph's black columns of year-ahead expectations at the business level (tracked by the University of Michigan) held unchanged at 1.7 percent from June to August, yet the blue area of consumer expectations (tracked by the University of Michigan) are oddly elevated, at 3.1 percent in the latest reading. Is this a judgement by US consumers that government support and aggressive monetary policy are defying traditional prudence? Or is it a fear of shortages, resulting ultimately from contraction in the production of goods and services? US inflation data have yet to post any frightening gains but there is some movement upward. The red line tracks PCE core prices (ex-food and energy), rising from a virus low of 0.9 percent in April to 1.3 percent in July. Though the level is still subdued, the slope of the curve is less than subdued and points, if the trend extends, to a test of 2 percent as early as year end. Central bankers stress the importance of inflation expectations as a leading indicator of future pressures, and here the story in the US is mixed. The graph's black columns of year-ahead expectations at the business level (tracked by the University of Michigan) held unchanged at 1.7 percent from June to August, yet the blue area of consumer expectations (tracked by the University of Michigan) are oddly elevated, at 3.1 percent in the latest reading. Is this a judgement by US consumers that government support and aggressive monetary policy are defying traditional prudence? Or is it a fear of shortages, resulting ultimately from contraction in the production of goods and services?

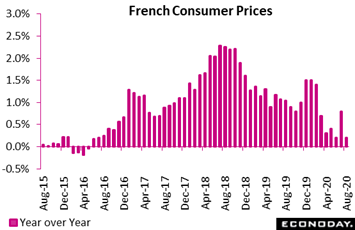

Yet global pressures at the consumer level aren't showing much lift at all, so far. Consumer prices in France were slightly weaker than expected in August, down 0.1 percent on the month to pull annual inflation, as tracked in the graph, down by 6 tenths to just 0.2 percent to match its lowest reading since May 2016. And it was a sharp fall in prices for manufactured goods that was behind the deceleration, at minus 0.2 percent in August versus plus 1.8 percent in July, a month when deferred sales appear to have given prices a momentary lift. With food at 0.8 percent and energy in the red at minus 7.1 percent, inflation in France doesn't look to be heating up very much anytime soon. Yet global pressures at the consumer level aren't showing much lift at all, so far. Consumer prices in France were slightly weaker than expected in August, down 0.1 percent on the month to pull annual inflation, as tracked in the graph, down by 6 tenths to just 0.2 percent to match its lowest reading since May 2016. And it was a sharp fall in prices for manufactured goods that was behind the deceleration, at minus 0.2 percent in August versus plus 1.8 percent in July, a month when deferred sales appear to have given prices a momentary lift. With food at 0.8 percent and energy in the red at minus 7.1 percent, inflation in France doesn't look to be heating up very much anytime soon.

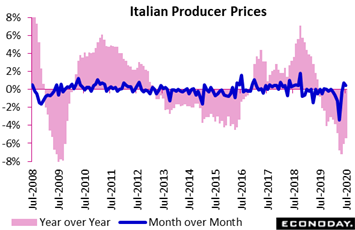

Expectations are not the only leading indicator for consumer prices; producer prices are as well and here there have been signals emerging that the deepest of the disinflationary hit has already passed. Italian producer prices rose for a second straight month in July, up 0.4 percent as tracked by the blue line following a 0.7 percent bounce in June. Contraction in the annual reading has been trimmed from as deep as minus 7.2 percent in May to minus 5.4 percent in July as tracked in the red columns. And it's these columns that suggest the price destruction during the pandemic has been less severe, or at least no more severe, than it was in 2009 during the financial crisis. Extended gains for the monthly reading could pull the annual rate for producer prices back toward the zero line, and perhaps quickly should oil prices continue their recovery. Expectations are not the only leading indicator for consumer prices; producer prices are as well and here there have been signals emerging that the deepest of the disinflationary hit has already passed. Italian producer prices rose for a second straight month in July, up 0.4 percent as tracked by the blue line following a 0.7 percent bounce in June. Contraction in the annual reading has been trimmed from as deep as minus 7.2 percent in May to minus 5.4 percent in July as tracked in the red columns. And it's these columns that suggest the price destruction during the pandemic has been less severe, or at least no more severe, than it was in 2009 during the financial crisis. Extended gains for the monthly reading could pull the annual rate for producer prices back toward the zero line, and perhaps quickly should oil prices continue their recovery.

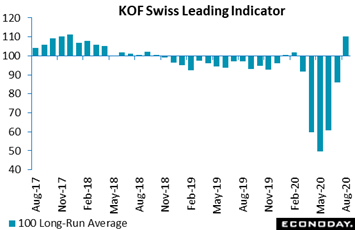

The pace of reinflation will move in step with the pace of economic recovery where V-shaped hopes were given a significant boost in the latest week, at least in Switzerland, courtesy of leading indicators. The index jumped from 86.0 in July to a much higher than expected 110.2 in August. This was the second largest rise on record and put the index at a multi-year high and well above its 100 long-run average. The gain reflected improved conditions in the manufacturing and hospitality sectors as well as stronger demand from overseas. Financial and insurance services also saw improvement. August's results are surprisingly strong though they likely reflect, at least in part, high levels of statistical noise only to be expected in the current environment. Nonetheless, the move back over 100 brings the KOF's index into line with many other indicators that have been pointing to a relatively rapid recovery in economic activity. The pace of reinflation will move in step with the pace of economic recovery where V-shaped hopes were given a significant boost in the latest week, at least in Switzerland, courtesy of leading indicators. The index jumped from 86.0 in July to a much higher than expected 110.2 in August. This was the second largest rise on record and put the index at a multi-year high and well above its 100 long-run average. The gain reflected improved conditions in the manufacturing and hospitality sectors as well as stronger demand from overseas. Financial and insurance services also saw improvement. August's results are surprisingly strong though they likely reflect, at least in part, high levels of statistical noise only to be expected in the current environment. Nonetheless, the move back over 100 brings the KOF's index into line with many other indicators that have been pointing to a relatively rapid recovery in economic activity.

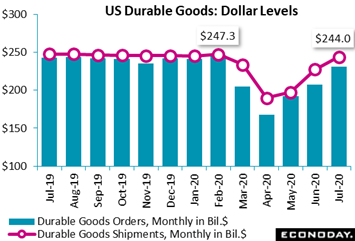

Global production in general has been lagging global demand during the initial phase of the recovery, making for a lopsided but still welcome V-recovery that is nearly complete. Boosted by motor vehicles, orders for US durable goods have just about recovered from the virus shock, jumping a very sharp 11.2 percent in July to exceed Econoday's consensus range. Turning to shipments and looking at levels, July's $244.0 billion was just about even now with February's $247.3 billion. Pent-up demand for vehicles has been leading the recovery, offsetting major trouble for commercial aircraft where orders have been in outright contraction in four the last five reports. But this report is about strength evident especially at the heart of the capital goods group as machinery orders continued to make gains, a rise that's a good sign for business investment. Core capital goods (nondefense ex-aircraft) have now very nearly recovered, with orders totaling $66.1 billion in July versus $66.5 billion in February. Global production in general has been lagging global demand during the initial phase of the recovery, making for a lopsided but still welcome V-recovery that is nearly complete. Boosted by motor vehicles, orders for US durable goods have just about recovered from the virus shock, jumping a very sharp 11.2 percent in July to exceed Econoday's consensus range. Turning to shipments and looking at levels, July's $244.0 billion was just about even now with February's $247.3 billion. Pent-up demand for vehicles has been leading the recovery, offsetting major trouble for commercial aircraft where orders have been in outright contraction in four the last five reports. But this report is about strength evident especially at the heart of the capital goods group as machinery orders continued to make gains, a rise that's a good sign for business investment. Core capital goods (nondefense ex-aircraft) have now very nearly recovered, with orders totaling $66.1 billion in July versus $66.5 billion in February.

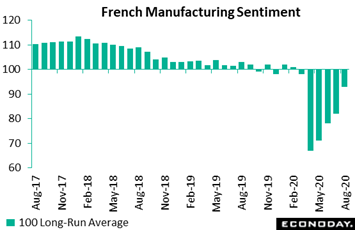

Many sentiment indexes have also been improving. French manufacturing sentiment, part of the business climate report, rose from 82 in July to a higher than expected 93, its best reading since March though still 8 points short of its pre-lockdown level in February. August's gain reflected wide improvement in current conditions, in particular for output which jumped sharply and is only just short of its long-run average along. Orders books are also making up solid ground. Yet these are readings on current conditions which contrast, as they do for many sentiment reports, with less bounce or no bounce for expectations. Hence, personal production expectations saw their first fall in three months and the general industry outlook was left essentially unchanged. Many sentiment indexes have also been improving. French manufacturing sentiment, part of the business climate report, rose from 82 in July to a higher than expected 93, its best reading since March though still 8 points short of its pre-lockdown level in February. August's gain reflected wide improvement in current conditions, in particular for output which jumped sharply and is only just short of its long-run average along. Orders books are also making up solid ground. Yet these are readings on current conditions which contrast, as they do for many sentiment reports, with less bounce or no bounce for expectations. Hence, personal production expectations saw their first fall in three months and the general industry outlook was left essentially unchanged.

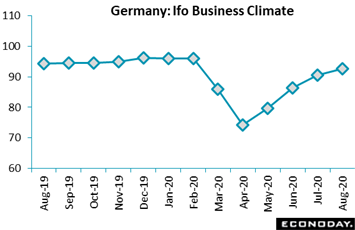

The Ifo from Germany is one survey where expectations are on the rise, at least a limited one. Business sentiment improved in August for a fourth straight month as respondents see economic recovery gaining at least some momentum in the coming months. The survey's overall business climate indicator rose from 90.4 in July to 92.6 in August, its highest level since February before authorities locked down the economy. The increase reflects gains in both the current conditions index, up more than 2 points to 87.9 in August, and also the expectations index, up more than a point to 97.5. Gains were broad-based across sectors especially services with manufacturing also doing better but still subdued. The Ifo from Germany is one survey where expectations are on the rise, at least a limited one. Business sentiment improved in August for a fourth straight month as respondents see economic recovery gaining at least some momentum in the coming months. The survey's overall business climate indicator rose from 90.4 in July to 92.6 in August, its highest level since February before authorities locked down the economy. The increase reflects gains in both the current conditions index, up more than 2 points to 87.9 in August, and also the expectations index, up more than a point to 97.5. Gains were broad-based across sectors especially services with manufacturing also doing better but still subdued.

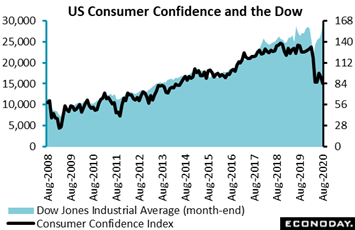

Respondents in business surveys are often top purchasers or top executives focused on the pace of incoming orders and the outlook for output. Respondents in consumer surveys, by contrast, are mostly concerned with keeping their jobs, a telling factor that has been holding down confidence readings in the US at their very deepest depths. The Conference Board's consumer confidence index fell nearly 9 points to an 84.8 level that fell short of Econoday's consensus range and was actually below April's virus low of 85.7. Concern over financial well-being was the report's unwelcome theme, indicated by a small and shrinking pool of optimists (those who see their incomes rising six months from now) at 12.7 percent and further below pessimists (who see their income falling) where the numbers are increasing, at 16.6 percent in August's report. But it was the jobs-hard-to-get reading that deserves the most attention; this jumped more than 5 percentage points to 25.2 which points to further payroll slowing for the monthly US employment report to be posted in the coming week. Remember it was the Conference Board in the prior week's US leading indicators report which warned that the pace of US economic growth "will weaken substantially" during the final months of the year, a possible outcome that isn't getting much play in this year's stock market. The accompanying graph tracks consumer confidence against the Dow Jones industrial average where increasing separation of the two is appearing. Respondents in business surveys are often top purchasers or top executives focused on the pace of incoming orders and the outlook for output. Respondents in consumer surveys, by contrast, are mostly concerned with keeping their jobs, a telling factor that has been holding down confidence readings in the US at their very deepest depths. The Conference Board's consumer confidence index fell nearly 9 points to an 84.8 level that fell short of Econoday's consensus range and was actually below April's virus low of 85.7. Concern over financial well-being was the report's unwelcome theme, indicated by a small and shrinking pool of optimists (those who see their incomes rising six months from now) at 12.7 percent and further below pessimists (who see their income falling) where the numbers are increasing, at 16.6 percent in August's report. But it was the jobs-hard-to-get reading that deserves the most attention; this jumped more than 5 percentage points to 25.2 which points to further payroll slowing for the monthly US employment report to be posted in the coming week. Remember it was the Conference Board in the prior week's US leading indicators report which warned that the pace of US economic growth "will weaken substantially" during the final months of the year, a possible outcome that isn't getting much play in this year's stock market. The accompanying graph tracks consumer confidence against the Dow Jones industrial average where increasing separation of the two is appearing.

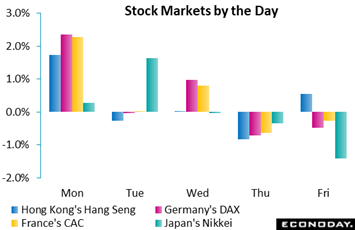

Major indexes extended their summer of fun with Asian shares opening the week on the upside especially for firms listed on China's tech-focused ChiNext exchange which introduced new IPO rules. Shares of newly-listed companies can now trade with no limits on daily gains or losses for the first five days and may then move 20 percent per day rather than the previous limit of 10 percent. Also helping Asian shares, as well as those in the US, were repeated reports that the US and China are nailing down phase one of their trade deal. European shares also had a good week including on Wednesday when Germany's governing parties agreed to extend payments to businesses and workers; France is expected to unveil its stimulus package next week. The Federal Reserve's move to allow an overshoot in inflation perhaps was too distant in aim and too abstract to make for much traction in Thursday's markets, while reports of Shinzo Abe's ill health, leading to his resignation as prime minister on Friday, pulled down Japanese shares late in the week. Under Abe's leadership, the Japanese government has strongly supported the Bank of Japan's policy of quantitative easing and approved substantial fiscal stimulus to offset the pandemic. Major indexes extended their summer of fun with Asian shares opening the week on the upside especially for firms listed on China's tech-focused ChiNext exchange which introduced new IPO rules. Shares of newly-listed companies can now trade with no limits on daily gains or losses for the first five days and may then move 20 percent per day rather than the previous limit of 10 percent. Also helping Asian shares, as well as those in the US, were repeated reports that the US and China are nailing down phase one of their trade deal. European shares also had a good week including on Wednesday when Germany's governing parties agreed to extend payments to businesses and workers; France is expected to unveil its stimulus package next week. The Federal Reserve's move to allow an overshoot in inflation perhaps was too distant in aim and too abstract to make for much traction in Thursday's markets, while reports of Shinzo Abe's ill health, leading to his resignation as prime minister on Friday, pulled down Japanese shares late in the week. Under Abe's leadership, the Japanese government has strongly supported the Bank of Japan's policy of quantitative easing and approved substantial fiscal stimulus to offset the pandemic.

Rising prices in the stock market, however indescribably bad 2020 has been for the global economy, could also be sending their own inflationary signal, that maximum stimulus from monetary policy together with substantial stimulus from government spending will make the long years of disinflation a thing of the past. This of course isn't the expectation of the policy makers who have been pouring in the stimulus and who, along with economics in general, have been struggling painfully over the past 12 years to understand inflation's causes and effects.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Japanese retail sales for July look to open the coming week on an uncertain note, expected to post slightly deeper contraction than June. Otherwise demand-side data will be light in contrast to the supply side where the news will be very heavy starting with Japanese industrial production, also released first thing Monday, followed later Monday by China's CFLP manufacturing PMI where another month of modest growth is expected. Solid growth is the expectation for Tuesday's ISM manufacturing report from the US with solid results also expected for German manufacturers' orders on Friday. The week's most important news will be on the labor market, starting with the August unemployment rate for Germany on Tuesday followed by August employment reports from Canada and the US on Friday where no more than modest slowing for both is the call. Consumer price data for August will be posted on Monday for Germany and for Europe on Tuesday with a policy announcement set for the Reserve Bank of Australia, also on Tuesday. If the week unfolds as expected, global production may get an upgrade though, for global employment, perhaps no upgrade at all.

Japanese Retail Sales for July (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Year over Year: -1.6%

Retail sales in June were down 1.2 percent year over year which was better than expected and much improved from 12.3 percent contraction in May. Yearly contraction of 1.6 percent is the expectation for July.

Japanese Industrial Production for July (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Month over Month: 5.8%

A percent monthly 5.8 increase is expected for industrial production in July which in June posted its first increase, at 2.7 percent, since the first of the year.

China: CFLP Manufacturing PMI for August (Mon 01:00 GMT; Mon 09:00 CST; Sun 21:00 EDT)

Consensus Forecast: 51.2

The government's official CFLP manufacturing PMI will open up China data for August, expected to extend a post-virus run in modest expansion at a consensus 51.2.

German Preliminary CPI for August (Mon 12:00 GMT; Mon 14:00 CEST; Mon 08:00 EDT)

Consensus Forecast, Month over Month: -0.2%

Consensus Forecast, Year over Year: 0.0%

Consumer prices fell 0.5 percent in July reflecting general price weakness but also a cut in value-added taxes. For August, forecasters see Germany's CPI decreasing 0.2 percent on the month for no year-on-year change versus July's 4-year low of minus 0.1 percent.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEST; Tue 00:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

Expected to keep its policy rate steady and 0.25 percent, the Reserve Bank of Australia will offer updates on infection effects and the general outlook. No rate action is expected.

German Unemployment Rate for August (Tue 07:55 GMT; Tue 09:55 CEST; Tue 03:55 EDT)

Consensus Forecast: 6.4%

Steady is the expectation for Germany's unemployment rate in August which in July held unchanged at 6.4 percent suggesting that Covid-19 effects were dissipating. For August the consensus is also 6.4 percent.

Eurozone HICP Flash for August (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Year over Year: 0.8%

Headline inflation in the Eurozone is expected to accelerate in August, to a year-on-year consensus of 0.8 percent versus 0.4 percent in July.

US: ISM Manufacturing Index for August (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 54.5

August's ISM manufacturing index is expected to accelerate further to 54.5 versus 54.2 in July that showed robust strength in new orders but continued contraction in hiring.

US Initial Jobless Claims for August 29 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 977,000

Initial jobless claims have been holding near the 1 million per week mark, at 1.006 million in the August 22 week and 1.068 million in the prior week. The consensus for the August 29 week is 977,000.

German Manufacturers' Orders for July (Fri 06:00 GMT; Fri 08:00 CEST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 6.2%

German orders jumped much more than expected in June, up 27.9 percent following a 10.4 percent recovery surge in May. For July, forecasters see another sizable increase, at 6.2 percent.

Canadian Labour Force Survey for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 315,000

Consensus Forecast: Unemployment Rate: 10.7%

Employment has beaten the consensus the last three reports though by narrowing margins. After July's 418,500 gain, an increase of is expected in August; the unemployment rate is seen up down tenths at 10.9 percent.

US Employment Report for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Change in Nonfarm Payrolls: 1.413 million

Consensus Forecast, Unemployment Rate: 9.9%

Recovery in the US labor market extended strongly into July but nevertheless slowed as nonfarm payrolls rose 1.763 million versus 4.791 million in June. A rise of 1.413 million is the expectation for August with the unemployment rate seen at 9.9 percent versus July's 10.2 percent.

|