|

Labor market updates were positives in the week, especially for Germany but also for the US where, however, improvement does appear to be slowing. Inflation updates have generally been soft across global economies with improvement to any degree hard to find. On net, the week's results will keep up pressure for additional fiscal stimulus and perhaps keep alive talk of even more monetary stimulus (if that's possible).

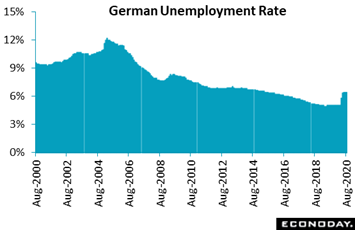

The first major report on labor conditions in August was posted on Tuesday by Germany, and once again the results were surprisingly robust. The country's unemployment rate held steady at 6.4 percent though the number of people out of work, at 2.9 million, continued to decline, down 9,000 following a 17,000 decline in July. This was the first back-to-back decrease since January and February. There was also cautiously good news on job prospects as vacancies were up 4,000 at 564,000 for their first increase since March last year. The German government in the prior week extended a stimulus plan that will top up pay for workers affected by the pandemic until the end of 2021. The first major report on labor conditions in August was posted on Tuesday by Germany, and once again the results were surprisingly robust. The country's unemployment rate held steady at 6.4 percent though the number of people out of work, at 2.9 million, continued to decline, down 9,000 following a 17,000 decline in July. This was the first back-to-back decrease since January and February. There was also cautiously good news on job prospects as vacancies were up 4,000 at 564,000 for their first increase since March last year. The German government in the prior week extended a stimulus plan that will top up pay for workers affected by the pandemic until the end of 2021.

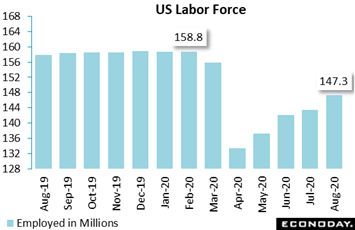

The US issued its employment report on Friday, and here the results were also favorable but not robust. After rising 1.7 million in July, nonfarm payrolls rose 1.4 million in August which was just shy of Econoday's consensus, while private payrolls (which exclude government) came in more than 300,000 below the consensus, at only 1.0 million. Government jobs increased by 344,000 in August, accounting for 1/4 of the monthly gain in total payrolls and reflecting the hiring of 238,000 temporary 2020 Census workers. Gauging the virus recovery, the total number of employed (which also includes those not on payrolls) came to 147.3 million in August, down 11.5 million from February's 158.8 million. At August's 1.4 million per-month pace, it would take another eight months at least before all the damage is made good. And extended improvement is uncertain as unemployment claims are still four to five times higher than normal, at 881,000 in the August 29 week. Also clouding the outlook were anecdotal warnings in the week, from both the Federal Reserve's Beige Book and Challenger's job-cut report, that furloughed workers are increasingly being laid off permanently due to soft demand. The US issued its employment report on Friday, and here the results were also favorable but not robust. After rising 1.7 million in July, nonfarm payrolls rose 1.4 million in August which was just shy of Econoday's consensus, while private payrolls (which exclude government) came in more than 300,000 below the consensus, at only 1.0 million. Government jobs increased by 344,000 in August, accounting for 1/4 of the monthly gain in total payrolls and reflecting the hiring of 238,000 temporary 2020 Census workers. Gauging the virus recovery, the total number of employed (which also includes those not on payrolls) came to 147.3 million in August, down 11.5 million from February's 158.8 million. At August's 1.4 million per-month pace, it would take another eight months at least before all the damage is made good. And extended improvement is uncertain as unemployment claims are still four to five times higher than normal, at 881,000 in the August 29 week. Also clouding the outlook were anecdotal warnings in the week, from both the Federal Reserve's Beige Book and Challenger's job-cut report, that furloughed workers are increasingly being laid off permanently due to soft demand.

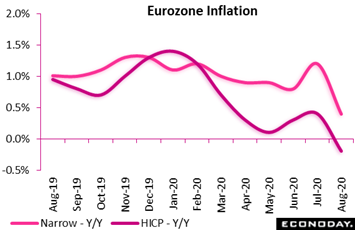

The greatest priority for policy makers is labor market recovery; getting inflation back up is a secondary goal. And the week's updates suggest that progress here, in contrast to employment, may not be improving. Eurozone inflation decelerated much more steeply than expected in August. At minus 0.2 percent for the harmonised flash, the annual rate was below the zero line and down 0.6 percentage points versus July. And at 0.4 percent, the rate for the narrowest measure was down 1.2 percentage points and at a record low. August's results, however, were skewed lower by a 3 percentage point cut in German value-added taxes that was implemented at the start of the month. Nonetheless, the European Central Bank must be worried especially by the core measure; pressure for additional easing may be getting a little more intense. The greatest priority for policy makers is labor market recovery; getting inflation back up is a secondary goal. And the week's updates suggest that progress here, in contrast to employment, may not be improving. Eurozone inflation decelerated much more steeply than expected in August. At minus 0.2 percent for the harmonised flash, the annual rate was below the zero line and down 0.6 percentage points versus July. And at 0.4 percent, the rate for the narrowest measure was down 1.2 percentage points and at a record low. August's results, however, were skewed lower by a 3 percentage point cut in German value-added taxes that was implemented at the start of the month. Nonetheless, the European Central Bank must be worried especially by the core measure; pressure for additional easing may be getting a little more intense.

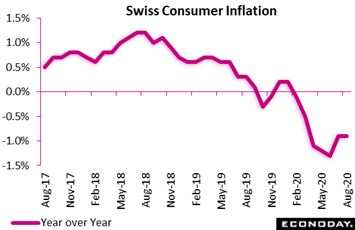

Switzerland is not part of the Eurozone and a look at inflation here helps clear away German VAT effects. And here too, consumer prices are not looking favorable, unchanged at an annual minus 0.9 percent in August for the seventh straight sub-zero result. The main downward pressure came from transport prices along with food and recreation, offsetting a seasonal rise in clothing and also gains for communication and education. Though there weren't any surprises in the August data, the Swiss National Bank must be increasingly concerned that the prolonged run of sub-zero inflation will eventually erode inflation expectations and, in turn, pull prices even lower. Switzerland is not part of the Eurozone and a look at inflation here helps clear away German VAT effects. And here too, consumer prices are not looking favorable, unchanged at an annual minus 0.9 percent in August for the seventh straight sub-zero result. The main downward pressure came from transport prices along with food and recreation, offsetting a seasonal rise in clothing and also gains for communication and education. Though there weren't any surprises in the August data, the Swiss National Bank must be increasingly concerned that the prolonged run of sub-zero inflation will eventually erode inflation expectations and, in turn, pull prices even lower.

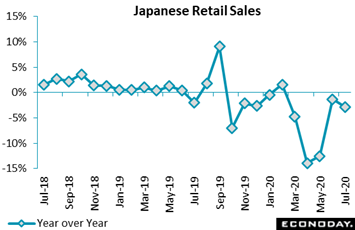

Inflation in Japan of course is also stubbornly weak, at an annual zero percent for the ex-food measure issued in mid-August. Also weak and presenting its own trouble for the Bank of Japan is consumer spending, down 2.8 percent on the year for retail sales in July after dropping 1.3 percent in June. New Covid-19 cases in Japan picked up appreciably in July, resulting in a re-tightening of restrictions in parts of the country. Weakness in the month was broad based including for food and beverages, machinery and equipment, and also apparel, though contraction for vehicles and food eased. Household spending data for July will be posted in the coming week and expectations, based on the retail sales report, are downbeat. Inflation in Japan of course is also stubbornly weak, at an annual zero percent for the ex-food measure issued in mid-August. Also weak and presenting its own trouble for the Bank of Japan is consumer spending, down 2.8 percent on the year for retail sales in July after dropping 1.3 percent in June. New Covid-19 cases in Japan picked up appreciably in July, resulting in a re-tightening of restrictions in parts of the country. Weakness in the month was broad based including for food and beverages, machinery and equipment, and also apparel, though contraction for vehicles and food eased. Household spending data for July will be posted in the coming week and expectations, based on the retail sales report, are downbeat.

The pace of consumer spending will of course determine how quickly the production side of the global economy recovers. German manufacturers had been posting sharp gains following the lifting of restrictions but these are slowing. Manufacturers' orders were up 2.8 percent in July which was a sizable gain but below expectations; yearly contraction, though up several percentage points, was still deep at 7.1 percent. And compared to the pre-virus month of February, orders were down more than 10 percent. Details for July included declines for both capital goods and consumer goods offset by a jump for the auto industry where orders were still 2.4 percent lower than February. Current levels of demand remain weak and without further gains, the outlook for German manufacturing output is a bit subdued. The pace of consumer spending will of course determine how quickly the production side of the global economy recovers. German manufacturers had been posting sharp gains following the lifting of restrictions but these are slowing. Manufacturers' orders were up 2.8 percent in July which was a sizable gain but below expectations; yearly contraction, though up several percentage points, was still deep at 7.1 percent. And compared to the pre-virus month of February, orders were down more than 10 percent. Details for July included declines for both capital goods and consumer goods offset by a jump for the auto industry where orders were still 2.4 percent lower than February. Current levels of demand remain weak and without further gains, the outlook for German manufacturing output is a bit subdued.

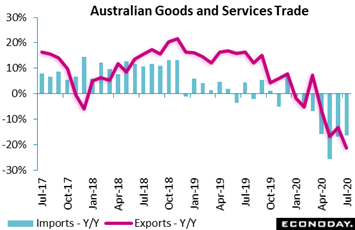

Data from Australia was heavy in the week, headlined by a quarterly 7.0 percent contraction in second-quarter GDP that followed the first quarter's 0.3 percent contraction to pull the country, for the first time in nearly 30 years, into recession. An eroding trade surplus is part of the problem, opening the third quarter at A$4.6 billion in July and down from A$8.1 billion in June. Imports were down 16.3 percent on the year with contraction for exports especially severe, at 21.4 percent versus June's 13.3 percent. Declines swept export categories likely reflecting the impact of recent trade restrictions imposed on Australia by Chinese authorities. Exports of rural goods have been a leading weakness with both non-rural exports as well as service exports also down. Turning back to imports, consumption goods and capital goods did improve but were offset by weaker results for intermediates and services. The Reserve Bank of Australia, which issued a statement on Tuesday, kept its policy rate unchanged at 0.25 percent but said "further monetary measures" could be adopted if necessary. Data from Australia was heavy in the week, headlined by a quarterly 7.0 percent contraction in second-quarter GDP that followed the first quarter's 0.3 percent contraction to pull the country, for the first time in nearly 30 years, into recession. An eroding trade surplus is part of the problem, opening the third quarter at A$4.6 billion in July and down from A$8.1 billion in June. Imports were down 16.3 percent on the year with contraction for exports especially severe, at 21.4 percent versus June's 13.3 percent. Declines swept export categories likely reflecting the impact of recent trade restrictions imposed on Australia by Chinese authorities. Exports of rural goods have been a leading weakness with both non-rural exports as well as service exports also down. Turning back to imports, consumption goods and capital goods did improve but were offset by weaker results for intermediates and services. The Reserve Bank of Australia, which issued a statement on Tuesday, kept its policy rate unchanged at 0.25 percent but said "further monetary measures" could be adopted if necessary.

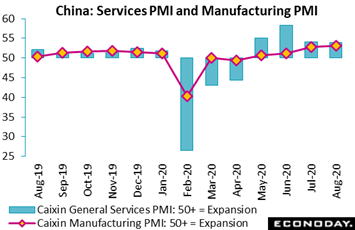

One country, however, that has been helping to offset weakness elsewhere has been China, which of course was hit first by the coronavirus and has since has been outperforming others. In fact, Caixan's manufacturing PMI is at a 9-year high, rising from 52.8 in July to 53.1 in August. Export orders posted their first increase of the year with overall orders up for a sixth straight month. Output likewise rose and payrolls were cut only slightly. Caixan's PMI for services was also released in the week, little changed at 54.0 for the fourth straight month over breakeven 50. These PMIs, along with official CFLP data also published in the week, suggest that China's recovery is at least keeping pace and may be gaining momentum. One country, however, that has been helping to offset weakness elsewhere has been China, which of course was hit first by the coronavirus and has since has been outperforming others. In fact, Caixan's manufacturing PMI is at a 9-year high, rising from 52.8 in July to 53.1 in August. Export orders posted their first increase of the year with overall orders up for a sixth straight month. Output likewise rose and payrolls were cut only slightly. Caixan's PMI for services was also released in the week, little changed at 54.0 for the fourth straight month over breakeven 50. These PMIs, along with official CFLP data also published in the week, suggest that China's recovery is at least keeping pace and may be gaining momentum.

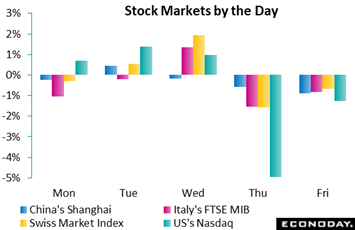

Markets opened a negative week on the defensive, posting declines through most of Asia after China's five largest banks warned on Monday that profits are likely to fall significantly due to spikes in bad loans. Holding back European markets early in the week was soft inflation news, first Italy and Germany on Monday followed on Tuesday by harmonised data, all raising talk of deflation and raising new questions perhaps for the European Central Bank. Swiss shares got a lift on Wednesday after Roche won regulatory approval for its Covid antigen test, but it was Zoom Video Communications, the ubiquitous online meeting tool, that was Wednesday's big news, jumping 41 percent on strong earnings and lifting mega-cap techs in what, however, would prove a headfake for the profit taking that would errupt on Thursday. There was no single piece of news that triggered Thursday's 5.0 percent fall on the Nasdaq, though rich price levels following this year's big run seem reason enough to justify at least some profit-taking. The Nasdaq sank another 1.3 percent on Friday to trim its year-to-date gain to a still very prodigious 26.1 percent. Markets opened a negative week on the defensive, posting declines through most of Asia after China's five largest banks warned on Monday that profits are likely to fall significantly due to spikes in bad loans. Holding back European markets early in the week was soft inflation news, first Italy and Germany on Monday followed on Tuesday by harmonised data, all raising talk of deflation and raising new questions perhaps for the European Central Bank. Swiss shares got a lift on Wednesday after Roche won regulatory approval for its Covid antigen test, but it was Zoom Video Communications, the ubiquitous online meeting tool, that was Wednesday's big news, jumping 41 percent on strong earnings and lifting mega-cap techs in what, however, would prove a headfake for the profit taking that would errupt on Thursday. There was no single piece of news that triggered Thursday's 5.0 percent fall on the Nasdaq, though rich price levels following this year's big run seem reason enough to justify at least some profit-taking. The Nasdaq sank another 1.3 percent on Friday to trim its year-to-date gain to a still very prodigious 26.1 percent.

Covid is still holding the global economy hostage but, on net, its grip is perhaps easing slightly as each week goes by. But the restructuring of global employment and what it means for subsistence jobs is still playing out, and this against the backdrop of limited additional stimulus. How much longer global stock markets can continue to price in strong rates of profit growth is more than just a question for investors, it's especially one for policy makers and whether a market reversal would threaten what economic progress has already been made.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Employment data will be limited in the upcoming week, centered on the Swiss unemployment rate on Wednesday where an increase is expected. Inflation data will include China's CPI on Wednesday followed by the US CPI on Friday amid forecasts for mixed results. Updates on the consumer will, like employment, be limited with Japanese household spending on Tuesday the most important report. In contrast, news on the supply side of the global economy will be very heavy: German industrial production on Monday as well as Japanese machinery orders and French industrial production both on Thursday. Policy announcements will be issued by the Bank of Canada on Wednesday followed on Thursday by the European Central bank. Opening the week will be Chinese merchandise trade on Monday and closing the week will be the US Treasury deficit late Friday.

Chinese Merchandise Trade Balance for August (Estimated for Monday, Release Time Not Set)

Consensus Forecast: US$47.00 billion

Consensus Forecast: Exports - Y/Y: 6.5%

Consensus Forecast: Imports - Y/Y: 0.7%

Exports rose at a strong 7.2 percent yearly pace in July to boost China's trade surplus to what was a higher-than-expected $62.33 billion. August's surplus is seen at $47.00 billion with exports expected to rise 6.5 percent and imports 0.7 percent.

German Industrial Production for July (Mon 06:00 GMT; Mon 08:00 CEST; Mon 02:00 EDT)

Consensus Forecast, Month over Month: 4.8%

A 4.8 percent monthly increase is expected for German industrial production in July following an 8.9 percent monthly jump in June that importantly was led by manufacturing.

Japanese Household Spending for July (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast - M/M: -2.3%

Consensus Forecast - Y/Y: -3.7%

Household spending for July is expected to fall 2.3 percent for yearly contraction of 3.7 percent to reverse what was a strong June report where yearly contraction was trimmed to 1.2 percent.

Chinese CPI for August (Tue 01:30 GMT; Tue 09:30 CST; Mon 21:30 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 2.4%

Chinese consumer prices are expected to increase 0.4 percent on the month and increase 2.4 percent on the year in August, which would compare with a 0.1 percent monthly decline in June and a 2.7 percent annual rate.

Swiss Unemployment Rate for August (Wed 05:45 GMT; Wed 07:45 CEST; Wed 01:45 EDT)

Consensus Forecast, Unadjusted: 3.4%

Unemployment in Switzerland has been very limited during the crisis and was at 3.2 percent for the unadjusted rate in July. For August, the consensus is a rise to 3.4 percent.

Bank of Canada Announcement (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Bank of Canada is expected to hold rates steady at plus 0.25 percent. The BoC has bond-buying programs in place including for corporate bonds.

Japanese Machinery Orders for July (Wed 23:50 GMT; Thu 08:50 JST; Wed 19:50 EDT)

Consensus Forecast, Month over Month: 2.0%

Machinery orders came in much weaker than expected in June, falling 7.6 percent with July's consensus calling for a 2.0 percent gain.

French Industrial Production for July (Thu 07:45 GMT; Thu 08:45 CEST; Thu 03:45 EDT)

Consensus Forecast, Month over Month: 5.1%

Industrial production rebounded 19.6 percent in June but was still 23.4 below the year-ago level. For July, a 5.1 percent increase is expected.

European Central Bank Policy Announcement (Thu 12:45 GMT; Thu 13:45 CEST; Thu 08:45 EDT)

Consensus Forecast, Refi Change: 0 basis points

Consensus Forecast, Level: 0.0%

With rates at zero and QE in place, the European Central Bank, despite concerns over weakness in inflation, is not expected to make any policy moves.

US Initial Jobless Claims for August 29 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 830,000

Initial jobless claims moved noticeably below 1 million in the August 29 week, at 881,000 for the lowest showing of the crisis with 830,000 the expectation for the September 5 week.

UK GDP for July (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 6.3%

GDP recovery is expected to extend to July, rising an expected 6.3 percent in the month following gains of 8.7 percent in June and 2.4 percent in May.

US CPI for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 1.2%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 1.6%

Inflation pressures took off in July reflecting wide increases where, however, comparisons were distorted by prior virus weakness. For core prices in August, forecasters see a 0.3 percent increase following July's 0.6 percent surge which was the sharpest in 29 years. The year-over-year rate for the core is seen unchanged at 1.6 percent.

US Treasury Budget for August (Fri 18:00 GMT; Fri 14:00 EDT)

Consensus Forecast: -$380.0 billion

Econoday's consensus for the Treasury's monthly deficit in August is $380.0 billion following a $63.0 billion deficit in July that lifted the fiscal-year-to-date deficit to $2.807 trillion, up 224 percent from the prior fiscal year.

|