|

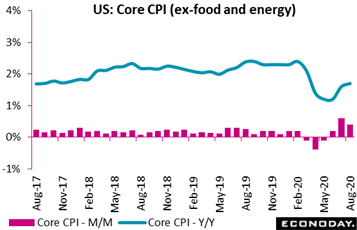

How much the labor market is coming back is the central question, overshadowing for central bankers and everyone else what improvement may or not be underway in inflation. Here, the week’s batch of data begin with US consumer prices where the core rate is posting some of its sharpest climbs on record.

The revival of the auto sector from its deep virus lows has been giving strong boosts to a variety of economic data, from industrial production to retail sales and now to the US CPI which in August hit the high-end of Econoday's consensus range, up 0.4 percent overall and also for the core. This is an especially strong gain for the core and follows July’s near record jump of 0.6 percent. Prices of used vehicles surged 5.4 percent in August, more than offsetting a flat reading for new vehicles and, alone, representing more than 40 percent of the core's increase. Otherwise many of August's readings were in fact soft: shelter up 0.1 percent as were medical care services and also food. Several areas that showed life were airline fares with a 1.2 percent gain along with energy, up 0.9 percent, as well as apparel, up 0.6 percent; turning back to autos finds maintenance and repair up 0.6 percent and vehicle insurance up 0.5 percent. Year-over-year rates rose 1 tenth for the total, at a subdued 1.3 percent, and 1 tenth for the core at 1.7 percent, the latter very closely watched and still well under the 2.4 percent level in the pre-virus month of February. The revival of the auto sector from its deep virus lows has been giving strong boosts to a variety of economic data, from industrial production to retail sales and now to the US CPI which in August hit the high-end of Econoday's consensus range, up 0.4 percent overall and also for the core. This is an especially strong gain for the core and follows July’s near record jump of 0.6 percent. Prices of used vehicles surged 5.4 percent in August, more than offsetting a flat reading for new vehicles and, alone, representing more than 40 percent of the core's increase. Otherwise many of August's readings were in fact soft: shelter up 0.1 percent as were medical care services and also food. Several areas that showed life were airline fares with a 1.2 percent gain along with energy, up 0.9 percent, as well as apparel, up 0.6 percent; turning back to autos finds maintenance and repair up 0.6 percent and vehicle insurance up 0.5 percent. Year-over-year rates rose 1 tenth for the total, at a subdued 1.3 percent, and 1 tenth for the core at 1.7 percent, the latter very closely watched and still well under the 2.4 percent level in the pre-virus month of February.

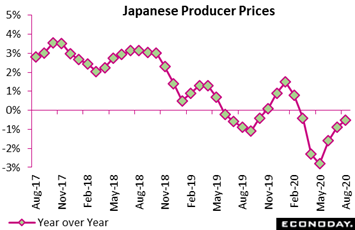

Improvement in US inflation is part of the modest climb underway across the global economy. Japanese producer prices are an example, easing to year-over-year contraction of 0.5 percent in August from 0.9 percent contraction in July. This is the sixth straight sub-zero score but the smallest since March, reflecting a less pronounced ‒ though still large ‒ fall in energy prices. Petroleum and coal prices fell 14.1 percent on the year in August after dropping 19.4 percent in June. The annual increase in food prices was steady at 0.6 percent, while utilities prices fell 2.9 percent on the year for the second month in a row. Transportation equipment was also steady, at 1.7 percent versus 1.8 percent. Yet on net, like the US CPI, the positives are equally balanced by negatives including the overall monthly rate which slowed by 4 tenths to a 0.2 percent gain. Improvement in US inflation is part of the modest climb underway across the global economy. Japanese producer prices are an example, easing to year-over-year contraction of 0.5 percent in August from 0.9 percent contraction in July. This is the sixth straight sub-zero score but the smallest since March, reflecting a less pronounced ‒ though still large ‒ fall in energy prices. Petroleum and coal prices fell 14.1 percent on the year in August after dropping 19.4 percent in June. The annual increase in food prices was steady at 0.6 percent, while utilities prices fell 2.9 percent on the year for the second month in a row. Transportation equipment was also steady, at 1.7 percent versus 1.8 percent. Yet on net, like the US CPI, the positives are equally balanced by negatives including the overall monthly rate which slowed by 4 tenths to a 0.2 percent gain.

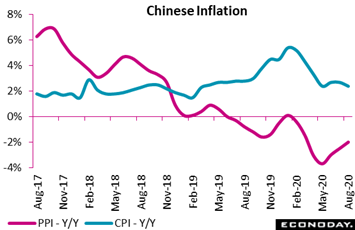

The fish-hook shape of Japan’s producer price recovery is also evident in the red line of the accompanying graph which tracks Chinese producer prices, contracting a year-over-year 2.0 percent in August for a 4 tenths improvement from 2.4 percent contraction in July. Fuel and power prices, like Japan, fell at a less pronounced rate, down 9.8 percent on the year after July’s 10.8 percent drop. And also very much like Japan, the monthly PPI slowed, here by 1 tenth to 0.3 percent growth. The blue line of the graph tracks Chinese consumer prices which, like the US, are still well below where they were in the pre-virus economy. The CPI was up 2.4 percent on the year in August, down from 2.7 percent in July with the monthly gain at 0.4 percent versus 0.6 percent previously. Food prices rose 11.2 percent on the year in August, moderating from 13.2 percent in July, while non-food inflation picked up very slightly from no change to up 0.1 percent. The fish-hook shape of Japan’s producer price recovery is also evident in the red line of the accompanying graph which tracks Chinese producer prices, contracting a year-over-year 2.0 percent in August for a 4 tenths improvement from 2.4 percent contraction in July. Fuel and power prices, like Japan, fell at a less pronounced rate, down 9.8 percent on the year after July’s 10.8 percent drop. And also very much like Japan, the monthly PPI slowed, here by 1 tenth to 0.3 percent growth. The blue line of the graph tracks Chinese consumer prices which, like the US, are still well below where they were in the pre-virus economy. The CPI was up 2.4 percent on the year in August, down from 2.7 percent in July with the monthly gain at 0.4 percent versus 0.6 percent previously. Food prices rose 11.2 percent on the year in August, moderating from 13.2 percent in July, while non-food inflation picked up very slightly from no change to up 0.1 percent.

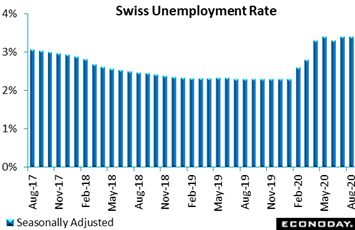

If global inflation can be described as weak but perhaps improving, the same would be fair to say for employment. The Swiss unemployment rate, in line with other European labor markets including Germany, has shown remarkably little damage, holding at 3.4 percent in August versus a pre-virus level of 2.3 percent. Adjusted unemployment was up only 638 people or 0.4 percent on the month at 156,152. There was also improvement in adjusted vacancies which climbed a solid 4.5 percent from July to 31,345. The August data were surprisingly positive and will bolster hopes for a relatively rapid recovery in Swiss economic activity. Yet, in a warning for all, the number of daily coronavirus cases in Switzerland has been rising since July and hit 400 in early September for the first time since mid-April. This follows a similar pattern seen across much of Europe. In response, the Swiss have tightened border controls and quarantine restrictions. If global inflation can be described as weak but perhaps improving, the same would be fair to say for employment. The Swiss unemployment rate, in line with other European labor markets including Germany, has shown remarkably little damage, holding at 3.4 percent in August versus a pre-virus level of 2.3 percent. Adjusted unemployment was up only 638 people or 0.4 percent on the month at 156,152. There was also improvement in adjusted vacancies which climbed a solid 4.5 percent from July to 31,345. The August data were surprisingly positive and will bolster hopes for a relatively rapid recovery in Swiss economic activity. Yet, in a warning for all, the number of daily coronavirus cases in Switzerland has been rising since July and hit 400 in early September for the first time since mid-April. This follows a similar pattern seen across much of Europe. In response, the Swiss have tightened border controls and quarantine restrictions.

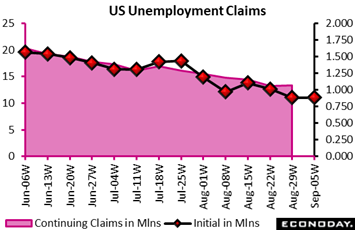

Infection rates in the US have been coming down which is a plus for the labor market where much improvement, however, is still needed. In fact, there was no improvement at all in the latest jobless claims report where initial filings were unchanged in the September 5 week at 884,000. This level, though the best of the recovery, is still 4 times higher than early in the year. Likewise, continuing claims in lagging data for the August 29 week rose 93,000 to 13.385 million in turn lifting the unemployment for insured workers 1 tenth in the wrong direction to 9.2 percent. Continuing claims remain very elevated, about 8 times higher than the 1.7 million average going into the virus. Infection rates in the US have been coming down which is a plus for the labor market where much improvement, however, is still needed. In fact, there was no improvement at all in the latest jobless claims report where initial filings were unchanged in the September 5 week at 884,000. This level, though the best of the recovery, is still 4 times higher than early in the year. Likewise, continuing claims in lagging data for the August 29 week rose 93,000 to 13.385 million in turn lifting the unemployment for insured workers 1 tenth in the wrong direction to 9.2 percent. Continuing claims remain very elevated, about 8 times higher than the 1.7 million average going into the virus.

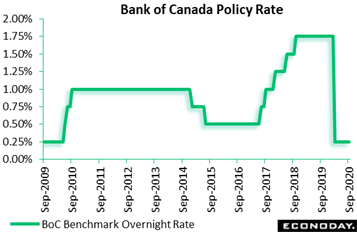

Emerging improvement in inflation and no better than stable conditions for employment won’t be shifting any views on monetary policy, where global stimulus looks to remain locked in top gear. As widely expected, the Bank of Canada kept policy unchanged at its September meeting, at 0.25 percent for the benchmark overnight rate. Forward guidance matched the July meeting statement as the central bank reiterated that it will hold policy steady until slack is absorbed and its 2 percent inflation target can be sustainably achieved. QE was similarly untouched, at least C$5 billion per week alongside provincial and corporate bond purchases. September’s policy statement was a little more optimistic than in July, noting that the rebound in household consumption and buoyancy of the housing market have exceeded expectations. Emerging improvement in inflation and no better than stable conditions for employment won’t be shifting any views on monetary policy, where global stimulus looks to remain locked in top gear. As widely expected, the Bank of Canada kept policy unchanged at its September meeting, at 0.25 percent for the benchmark overnight rate. Forward guidance matched the July meeting statement as the central bank reiterated that it will hold policy steady until slack is absorbed and its 2 percent inflation target can be sustainably achieved. QE was similarly untouched, at least C$5 billion per week alongside provincial and corporate bond purchases. September’s policy statement was a little more optimistic than in July, noting that the rebound in household consumption and buoyancy of the housing market have exceeded expectations.

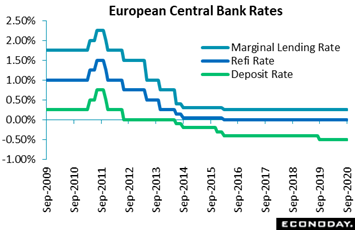

Results at the week’s European Central Bank meeting were also no surprise; guidance was not amended and key interest rates were again unchanged (marginal lending rate at 0.25 percent, refi rate at 0.00 percent, deposit rate at minus 0.50 percent). QE was also not changed, leaving monthly net purchases at €20 billion without any specified end-date and the temporary envelope, which still runs through year-end, at €120 billion. In addition, the pandemic emergency purchase programme (PEPP), now the main tool in the bank’s QE box, stays at €1.350 trillion with June 2021 retained as the earliest cut-off point. Potentially significantly for the FX markets, at her press conference ECB President Christine Lagarde repeated Chief Economist Philip Lane's belief that, for policy, exchange rates do indeed matter. Though noting that the bank doesn’t target exchange rates, she pointed to the euro's recent appreciation as adding to downside pressure on prices. Results at the week’s European Central Bank meeting were also no surprise; guidance was not amended and key interest rates were again unchanged (marginal lending rate at 0.25 percent, refi rate at 0.00 percent, deposit rate at minus 0.50 percent). QE was also not changed, leaving monthly net purchases at €20 billion without any specified end-date and the temporary envelope, which still runs through year-end, at €120 billion. In addition, the pandemic emergency purchase programme (PEPP), now the main tool in the bank’s QE box, stays at €1.350 trillion with June 2021 retained as the earliest cut-off point. Potentially significantly for the FX markets, at her press conference ECB President Christine Lagarde repeated Chief Economist Philip Lane's belief that, for policy, exchange rates do indeed matter. Though noting that the bank doesn’t target exchange rates, she pointed to the euro's recent appreciation as adding to downside pressure on prices.

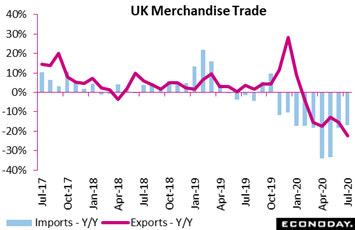

Central banks are sitting tight right now, not ready to dig deeper into their already depleted tool boxes. One risk to the outlook is international trade which, following three years of shuffling trade deals, was already slumping into contraction before the virus hit. One such country is the UK which was in the news all week as the Brexit curtain finally begins to come down. The country’s goods deficit widened from £6.55 billion in June to a 4-month high of £8.64 billion in July. The second successive increase in the red ink reflected a 0.9 percent monthly drop in exports compounded by a 5.8 percent jump in imports. The former are 4.7 percent below their pre-pandemic level in February and, as tracked by the red line, down 22.4 percent on the year. Imports are 10.1 percent short of their February mark and, as tracked in the blue columns, 16.9 percent weaker than in July 2019. The deterioration in the deficit reflected larger deficits with both the EU (£6.27 billion after £5.40 billion) and the rest of the world (£2.36 billion after £1.16 billion). Central banks are sitting tight right now, not ready to dig deeper into their already depleted tool boxes. One risk to the outlook is international trade which, following three years of shuffling trade deals, was already slumping into contraction before the virus hit. One such country is the UK which was in the news all week as the Brexit curtain finally begins to come down. The country’s goods deficit widened from £6.55 billion in June to a 4-month high of £8.64 billion in July. The second successive increase in the red ink reflected a 0.9 percent monthly drop in exports compounded by a 5.8 percent jump in imports. The former are 4.7 percent below their pre-pandemic level in February and, as tracked by the red line, down 22.4 percent on the year. Imports are 10.1 percent short of their February mark and, as tracked in the blue columns, 16.9 percent weaker than in July 2019. The deterioration in the deficit reflected larger deficits with both the EU (£6.27 billion after £5.40 billion) and the rest of the world (£2.36 billion after £1.16 billion).

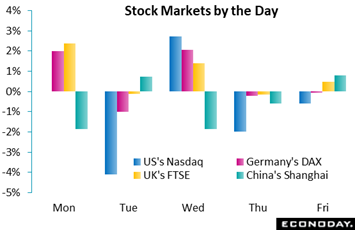

Consolidation for mega-cap techs played out for a second week as the ups and downs of the Nasdaq set the direction for Europe and Asia. In a replay of the prior Thursday’s 5.0 percent collapse, the Nasdaq dropped 4.1 percent on Tuesday with Apple down 6.7 percent, Microsoft down 5.4 percent, and Amazon down 4.4 percent. Yet the declines were quickly reversed on Wednesday as the Nasdaq rebounded 2.7 percent helped by a report that AstraZeneca, which rose 0.5 percent in London, may resume trials of its vaccine. But the momentum soon faded, in part on dimming fiscal hopes in the US after the Senate rejected a Republican stimulus bill. Worries over Brexit, heightened by new uncertainties over the Irish border, are a special focus though the FTSE, in inverse reaction to a sharp fall in the pound, rose 4.0 percent in the week. Consolidation for mega-cap techs played out for a second week as the ups and downs of the Nasdaq set the direction for Europe and Asia. In a replay of the prior Thursday’s 5.0 percent collapse, the Nasdaq dropped 4.1 percent on Tuesday with Apple down 6.7 percent, Microsoft down 5.4 percent, and Amazon down 4.4 percent. Yet the declines were quickly reversed on Wednesday as the Nasdaq rebounded 2.7 percent helped by a report that AstraZeneca, which rose 0.5 percent in London, may resume trials of its vaccine. But the momentum soon faded, in part on dimming fiscal hopes in the US after the Senate rejected a Republican stimulus bill. Worries over Brexit, heightened by new uncertainties over the Irish border, are a special focus though the FTSE, in inverse reaction to a sharp fall in the pound, rose 4.0 percent in the week.

Economic data are generally taking steps in the right direction, though slow ones that have yet to improve expectations for what looks to be an extended period of virus infirmity. For global central banks, including the Federal Reserve and its inflation-averaging plan, changes in employment are very likely to overshadow developments in inflation, barring that is any sustained surge.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week opens with Chinese industrial production and retail sales on Monday with the same August combo to be repeated in the US, first with production on Tuesday then sales on Wednesday. Employment data will include UK and Australian labour market reports on Tuesday and Thursday, respectively, and of course weekly jobless from the US also on Thursday. Consumer price data will be light: the UK on Wednesday and Japan on Friday. Trade data from Japan, which have been in steep contraction, will be posted on Tuesday, as will Germany's ZEW report, where sentiment has been recovering, and US housing starts and permits on Thursday which have been bouncing sharply higher. The week will also see a heavy run of central bank meetings where, however, no new stimulus is expected: the Bank of Japan and Federal Reserve both on Wednesday and the Bank of England on Thursday.

Chinese Industrial Production for August (Tue 02:00 GMT; Tue 10:00 CST; Mon 22:00 EDT)

Consensus Forecast, Year over Year: 5.1%

Industrial production is expected to build momentum in August, seen rising a year-over-year 5.1 percent following July's 4.8 percent which missed expectations for 5.1 percent.

Chinese Retail Sales for August (Tue 02:00 GMT; Tue 10:00 CST; Mon 22:00 EDT)

Consensus Forecast, Year over Year: 0.1%

At a consensus of plus 0.1 percent, Chinese retail sales in August are expected to improve from year-over-year contraction of 1.1 percent in July which, for a third straight report, was weaker than expected.

UK Labour Market Report (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, ILO Unemployment Rate for July: 4.0%

The ILO employment rate, in data for the three months to July, is expected to rise 1 tenth to 4.0 percent.

Germany: ZEW Survey for September (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Current Conditions: -72.0

Consensus Forecast, Economic Sentiment: 69.8

Offsetting another weak reading for current conditions, at minus 81.3 in August, was sharp improvement in economic sentiment to plus 71.5. For September's ZEW, forecasters see current conditions improving about 10 points to minus 72.0 with expectations slightly lower at plus 69.8.

US Industrial Production for August (Tue 13:15 GMT; Tue 09:15 EDT)

Consensus Forecast, Month over Month: 1.2%

US Manufacturing Output

Consensus Forecast, Month over Month: 2.2%

US industrial production has been rebounding since the virus lockdowns of March and April but, in the last report for July, was still 8.4 percent below its pre-crisis level of February. For August, Econoday's consensus is a 1.2 percent increase overall with manufacturing seen up 2.2 percent.

Japanese Merchandise Trade for August (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast: -¥37.5 billion

Consensus Forecast, Exports Y/Y: -18.0%

Consensus Forecast, Imports Y/Y: -16.1%

Japanese trade has suffered deeply during the crisis, contracting a year-on-year 19.2 percent for exports in July and 22.3 percent for imports. Expectations for August are export contraction of 18.0 percent and import contraction of 16.1 percent with the net balance seen in deficit of ¥37.5 billion.

UK CPI for August (Wed 06:00 GMT; Wed 07:00 BST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: -0.5%

Consensus Forecast, Year over Year: 0.2%

Consumer prices, reflecting a cut in value-added taxes, are seen falling 0.5 percent on the month in August, reducing annual inflation from July's 1.0 percent to 0.2 percent.

US Retail Sales for August (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Month over Month: 1.0%

Consensus Forecast, Ex-Vehicles & Gas: 1.0%

Consensus Forecast, Control Group: 0.4%

Retail sales have been leading the virus recovery and, beginning in June and also for July, have exceeded their level in February. For August, forecasters see sales rising 1.0 percent with ex-auto ex-gas seen up 0.8 percent and the control group up 0.4 percent.

US Federal Reserve Policy Announcement (Wed 18:00 GMT; Wed 14:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Policy Range: 0.0% to 0.25%

The Federal Reserve isn't expect to change the target for its federal funds policy rate centered at 0.125 percent between a zero and 0.25 percent corridor. The Fed is already committed to aggressive quantitative easing.

Australian Labour Force Survey for August (Thu 00:30 GMT; Thu 11:30 AEST; Wed 21:30 EDT)

Consensus Forecast, Unemployment Rate: 7.7%

Consensus Forecast, Employment: -45,000

Employment in Australia started to rebounded in both June (210,800) and July (114,700) with August, however, expected to fall 45,000. The unemployment rate is seen rising 2 tenths to 7.7 percent.

Bank of Japan Announcement (Any time Thursday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

The Bank of Japan kept its policy rate unchanged at minus 0.1 percent at its July meeting which is the expectation for September. The BoJ is committed to aggressive accommodation.

Bank of England Announcement (Thu 11:00 GMT, Thu 12:00 BST; Thu 07:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

Consensus Forecast: Asset Purchase Level: £745 billion

No change in either Bank Rate (0.10 percent) or the QE ceiling (£745 billion) is expected on Thursday. Against a clear bias for easing, no policy changes were made at the last meeting in August.

US Housing Starts for August (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast, Annual Rate: 1.486 million

US Building Permits

Consensus Forecast: 1.530 million

Residential construction has been recovering quickly with starts near their pre-virus rate and permits already above their rate. Expectations for August starts are a 1.486 million rate versus July's 1.496 million with permits seen at 1.530 million versus 1.495 million.

US Jobless Claims for September 12 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 850,000

Initial jobless claims are now below the 1 million level, at 884,000 in each of the prior two reports. For the September 12 week, forecasters see claims coming in at 850,000.

Japanese Consumer Price Index for August (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast Ex-Food, Year over Year: -0.4%

Price pressures at the consumer level are expected to remain elusive, at year-over-year contraction of 0.4 percent in August versus no change in July.

|