|

Rebound from the shut-down lows of the Spring may be easing in the global economy; growth is still on the rise but at a generally slowing rate. The Federal Reserve moved to head off slowing in the US recovery by vowing to keep monetary policy in maximum overdrive until “maximum” employment is reached (what would be a very long-term goal given Covid’s massive hit on the US labor market). But a major positive for the outlook is coming from China whose growth rates, in some contrast to the US, may be improving.

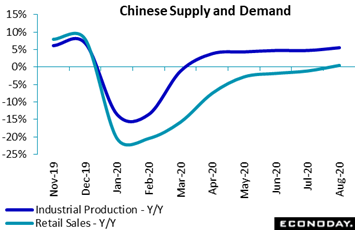

The pitch of improvement is modest but perceptible in China’s economic data with industrial production, benefiting from comparative export strength, continuing to lead the way, up solidly in August for year-on-year growth of 5.6 percent and an 8 tenths gain from July. August saw strong gains for steel production, utility output, as well as mining which, in contrast to many other countries, is up 1.6 percent on the year and out of contraction. Retail sales are also now out of contraction, up 0.5 percent in August versus July’s minus 1.1 percent. This is the first plus showing for annual retail sales this year for China, which of course was hit first by the virus. Leading August’s gains were home appliances, offering a sign of discretionary demand. The pitch of improvement is modest but perceptible in China’s economic data with industrial production, benefiting from comparative export strength, continuing to lead the way, up solidly in August for year-on-year growth of 5.6 percent and an 8 tenths gain from July. August saw strong gains for steel production, utility output, as well as mining which, in contrast to many other countries, is up 1.6 percent on the year and out of contraction. Retail sales are also now out of contraction, up 0.5 percent in August versus July’s minus 1.1 percent. This is the first plus showing for annual retail sales this year for China, which of course was hit first by the virus. Leading August’s gains were home appliances, offering a sign of discretionary demand.

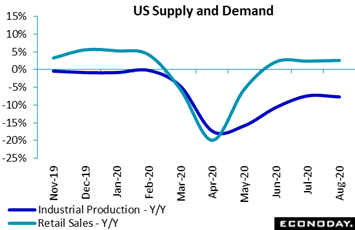

In the US, it’s been retail sales that have been leading industrial production, but here the paths are flat at best. Retail sales in August were 2.6 percent higher than August last year, slightly better than July’s 2.4 percent pace. But many components in the data were surprisingly soft especially vehicles and when excluding a number of volatile components, control-group sales posted an outright monthly decline. Turning to industrial production, a deeper decline was the year-on-year result for August, down 7.7 percent versus contraction of 7.4 percent in July. Mining output, in contrast to China, is far from recovery, contracting further in August to minus 17.9 percent and little better than where it was at the virus low in May of minus 19.1 percent. Compared to the pre-virus month of February, total production in August was down 7.3 percent, a difference that, based on August's move backward, won’t be made up anytime soon. In the US, it’s been retail sales that have been leading industrial production, but here the paths are flat at best. Retail sales in August were 2.6 percent higher than August last year, slightly better than July’s 2.4 percent pace. But many components in the data were surprisingly soft especially vehicles and when excluding a number of volatile components, control-group sales posted an outright monthly decline. Turning to industrial production, a deeper decline was the year-on-year result for August, down 7.7 percent versus contraction of 7.4 percent in July. Mining output, in contrast to China, is far from recovery, contracting further in August to minus 17.9 percent and little better than where it was at the virus low in May of minus 19.1 percent. Compared to the pre-virus month of February, total production in August was down 7.3 percent, a difference that, based on August's move backward, won’t be made up anytime soon.

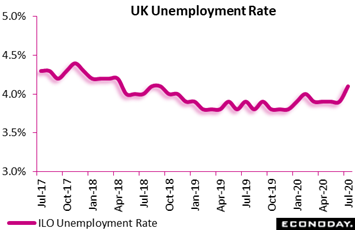

What else won’t be made up anytime soon will be the vast number of jobs lost in the US, at 11 million as estimated by Federal Reserve Chair Jerome Powell at his FOMC press conference. Labor destruction in North America has far exceeded that of Asia or Europe, the latest data coming from the UK where the ILO unemployment rate for July, up 2 tenths, came in at a very modest 4.1 percent. Employment was down only 12,000 to 32.979 million, leaving an actual increase of 202,000 versus a year ago as well as a 4 tenths rise to 76.5 percent for the employment rate. Yet the government has been supporting furloughed workers (about 10 percent of the workforce), and whether the schemes are extended will be an unfolding story. And whether the Bank of England moves into negative rates may be another story to follow, though officials held Bank Rate at 0.10 percent at the week’s meeting. Officials see the risk of a more persistent period of elevated unemployment developing and they noted the rapid decline underway in business investment plans. What else won’t be made up anytime soon will be the vast number of jobs lost in the US, at 11 million as estimated by Federal Reserve Chair Jerome Powell at his FOMC press conference. Labor destruction in North America has far exceeded that of Asia or Europe, the latest data coming from the UK where the ILO unemployment rate for July, up 2 tenths, came in at a very modest 4.1 percent. Employment was down only 12,000 to 32.979 million, leaving an actual increase of 202,000 versus a year ago as well as a 4 tenths rise to 76.5 percent for the employment rate. Yet the government has been supporting furloughed workers (about 10 percent of the workforce), and whether the schemes are extended will be an unfolding story. And whether the Bank of England moves into negative rates may be another story to follow, though officials held Bank Rate at 0.10 percent at the week’s meeting. Officials see the risk of a more persistent period of elevated unemployment developing and they noted the rapid decline underway in business investment plans.

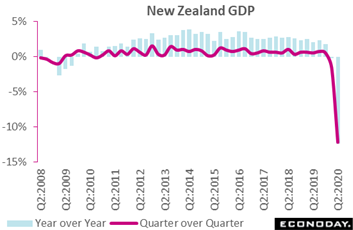

The Reserve Bank of New Zealand will be meeting in the coming week and though no change is expected in its policy cash rate, at 0.25 percent, an increase in QE would not be a total surprise. Data in the week were headlined by a record 12.2 percent quarterly fall in second-quarter GDP, putting New Zealand into technical recession following a 1.6 percent drop in the first quarter. This is the country’s first recession in 10 years and follows Australia’s 7.0 percent second-quarter drop and its first recession in nearly 30 years. Manufacturing output fell 13.0 percent on the quarter after the first quarter’s 2.2 percent decline, while service sector output fell 10.9 percent after dropping 1.0 percent. New Zealand's border has been closed to international travelers since March and remains closed, with strict restrictions in place through June and isolated restrictions appearing in August. RBNZ officials have noted that near-term visibility is clouded by public health concerns. The Reserve Bank of New Zealand will be meeting in the coming week and though no change is expected in its policy cash rate, at 0.25 percent, an increase in QE would not be a total surprise. Data in the week were headlined by a record 12.2 percent quarterly fall in second-quarter GDP, putting New Zealand into technical recession following a 1.6 percent drop in the first quarter. This is the country’s first recession in 10 years and follows Australia’s 7.0 percent second-quarter drop and its first recession in nearly 30 years. Manufacturing output fell 13.0 percent on the quarter after the first quarter’s 2.2 percent decline, while service sector output fell 10.9 percent after dropping 1.0 percent. New Zealand's border has been closed to international travelers since March and remains closed, with strict restrictions in place through June and isolated restrictions appearing in August. RBNZ officials have noted that near-term visibility is clouded by public health concerns.

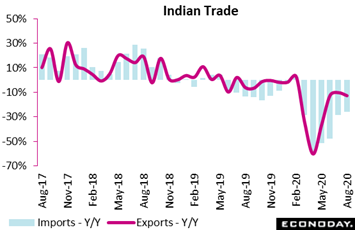

The Reserve Bank of India won’t be meeting until October but, given significant contraction underway in many of the country’s economic readings, calls for new accommodation are also likely to rise. India’s merchandise trade data for August didn’t show much improvement at all from July. Contraction in exports deepened slightly to a year-on-year 12.7 percent with import contraction little changed at 26.0 percent, the latter a very telling reading that underscores how weak India’s domestic conditions are. Imports and exports together, the August trade balance was in deficit at $6.77 billion versus July’s deficit of $4.83 billion. The Reserve Bank of India won’t be meeting until October but, given significant contraction underway in many of the country’s economic readings, calls for new accommodation are also likely to rise. India’s merchandise trade data for August didn’t show much improvement at all from July. Contraction in exports deepened slightly to a year-on-year 12.7 percent with import contraction little changed at 26.0 percent, the latter a very telling reading that underscores how weak India’s domestic conditions are. Imports and exports together, the August trade balance was in deficit at $6.77 billion versus July’s deficit of $4.83 billion.

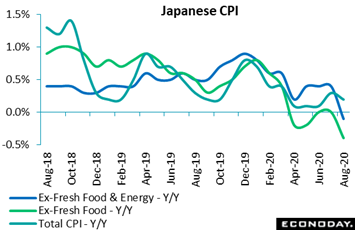

Central banks, looking for ways to be accommodative, may begin to follow the lead set by the US Fed, that is inflation averaging which, to make up for prior weakness and in contrast to targeting a specific level of inflation, embraces an overshoot. If this were to be used in Japan, there would no limit on how long the Bank of Japan would allow inflation to run hot. Japanese inflation data remained subdued in August, in the plus column at 0.2 percent overall but at year-on-year contraction of 0.4 percent when excluding food and contraction of 0.1 percent when excluding both food and energy which is the BoJ’s preferred measure. The decline in the core measures reflected price weakness for furniture, culture and recreation, and medical care. The BoJ, like the BoE, met during the week and likewise made no change in policy. Officials also reaffirmed their commitment to keep policy rates at or below current levels until they are confident that inflation will be sustainably above their 2.0 percent target level. At the post-meeting press conference, BoJ Governor Haruhiko Kuroda confirmed that he intends to remain in office for the remainder of his term after some suggestion that his position might have been impacted by the resignation of Prime Minister Shinzo Abe last month. Kuroda stressed that the BoJ will work closely with incoming Prime Minister Yoshihide Suga, suggesting that the change in leadership isn’t likely to impact monetary policy. Central banks, looking for ways to be accommodative, may begin to follow the lead set by the US Fed, that is inflation averaging which, to make up for prior weakness and in contrast to targeting a specific level of inflation, embraces an overshoot. If this were to be used in Japan, there would no limit on how long the Bank of Japan would allow inflation to run hot. Japanese inflation data remained subdued in August, in the plus column at 0.2 percent overall but at year-on-year contraction of 0.4 percent when excluding food and contraction of 0.1 percent when excluding both food and energy which is the BoJ’s preferred measure. The decline in the core measures reflected price weakness for furniture, culture and recreation, and medical care. The BoJ, like the BoE, met during the week and likewise made no change in policy. Officials also reaffirmed their commitment to keep policy rates at or below current levels until they are confident that inflation will be sustainably above their 2.0 percent target level. At the post-meeting press conference, BoJ Governor Haruhiko Kuroda confirmed that he intends to remain in office for the remainder of his term after some suggestion that his position might have been impacted by the resignation of Prime Minister Shinzo Abe last month. Kuroda stressed that the BoJ will work closely with incoming Prime Minister Yoshihide Suga, suggesting that the change in leadership isn’t likely to impact monetary policy.

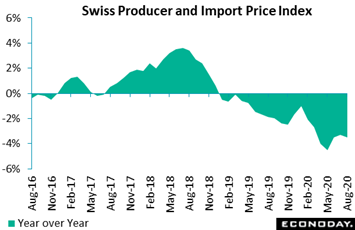

Lack of progress on inflation may strengthen the case for new monetary measures from the BoJ, but a dive deeper into negative rates, now at minus 0.1 percent for the policy rate, isn’t likely. The same is the case for the Swiss National Bank which meets on Thursday and whose policy rate is already at minus 0.75 percent. Inflation in Switzerland is as weak as anywhere, down 0.9 percent on the year in previously released CPI data for August and down 3.5 percent for August’s producer and import price index. The yearly rate has been below zero every month since the start of 2019. August’s fall consisted of a 2.2 percent yearly decline for producer prices that reflected lower chemical and pharmaceutical prices together with 6.1 percent contraction for import prices, also reflecting lower chemical and pharmaceutical prices and here underscoring the SNB’s biggest nemesis, the strength of the Swiss franc. Pipeline inflation pressures remain very soft and continue to pose a major problem for monetary policy. Lack of progress on inflation may strengthen the case for new monetary measures from the BoJ, but a dive deeper into negative rates, now at minus 0.1 percent for the policy rate, isn’t likely. The same is the case for the Swiss National Bank which meets on Thursday and whose policy rate is already at minus 0.75 percent. Inflation in Switzerland is as weak as anywhere, down 0.9 percent on the year in previously released CPI data for August and down 3.5 percent for August’s producer and import price index. The yearly rate has been below zero every month since the start of 2019. August’s fall consisted of a 2.2 percent yearly decline for producer prices that reflected lower chemical and pharmaceutical prices together with 6.1 percent contraction for import prices, also reflecting lower chemical and pharmaceutical prices and here underscoring the SNB’s biggest nemesis, the strength of the Swiss franc. Pipeline inflation pressures remain very soft and continue to pose a major problem for monetary policy.

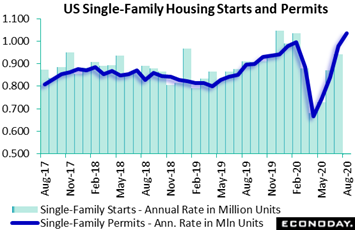

We end with the award for the best ‘V’, given this week to US single-family permits which, at an annual rate of 1.036 million in August, were 55.6 percent better than their April low. The August rate is already 4.2 percent above where it was in February. Actual single-family starts have been lagging, but only slightly, at a 1.021 million pace. Home builders, in their separately released housing market index, reported enormous sales gains underway, gains that may be at risk if homes can't be built fast enough. A highlight of the coming week’s calendar will be US new home sales for August which in July and June surged 24.7 and 20.2 percent respectively to pull total sales nearly 2 percent above where they were in February. We end with the award for the best ‘V’, given this week to US single-family permits which, at an annual rate of 1.036 million in August, were 55.6 percent better than their April low. The August rate is already 4.2 percent above where it was in February. Actual single-family starts have been lagging, but only slightly, at a 1.021 million pace. Home builders, in their separately released housing market index, reported enormous sales gains underway, gains that may be at risk if homes can't be built fast enough. A highlight of the coming week’s calendar will be US new home sales for August which in July and June surged 24.7 and 20.2 percent respectively to pull total sales nearly 2 percent above where they were in February.

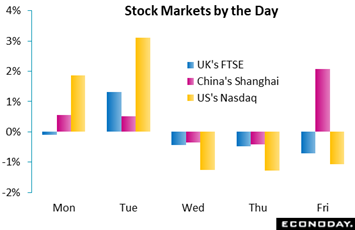

Europe opened the week a bit tense amid uncertainty over EU/UK Brexit talks. ECB President Christine Lagarde attracted attention on Monday noting the negative effect of the strong euro on Europe’s outlook. News that AstraZeneca and Oxford University had resumed vaccine trials offered wide support early in the week, while Europe was boosted at mid-week by talk that Prime Minister Boris Johnson would back down on his threat to upend the Brexit agreement. The Fed’s policy meeting, despite the greater pledge for accommodation, failed to lift US markets with statements from the Bank of Japan and Bank of England underlining the prospects for a slow global recovery. Europe on Friday was dominated by Covid again, amid rising cases in France and Spain and also the UK which imposed limited restrictions and was considering re-imposing broader lockdowns. In the US, tech stocks ended the week under pressure on news that the US will block downloads of Chinese social media firms’ TikTok and WeChat apps, raising worries about Chinese retaliation against US firms. On the week, the FTSE fell 0.4 percent, the Shanghai rose 2.4 percent, and the Nasdaq fell 0.6 percent. Europe opened the week a bit tense amid uncertainty over EU/UK Brexit talks. ECB President Christine Lagarde attracted attention on Monday noting the negative effect of the strong euro on Europe’s outlook. News that AstraZeneca and Oxford University had resumed vaccine trials offered wide support early in the week, while Europe was boosted at mid-week by talk that Prime Minister Boris Johnson would back down on his threat to upend the Brexit agreement. The Fed’s policy meeting, despite the greater pledge for accommodation, failed to lift US markets with statements from the Bank of Japan and Bank of England underlining the prospects for a slow global recovery. Europe on Friday was dominated by Covid again, amid rising cases in France and Spain and also the UK which imposed limited restrictions and was considering re-imposing broader lockdowns. In the US, tech stocks ended the week under pressure on news that the US will block downloads of Chinese social media firms’ TikTok and WeChat apps, raising worries about Chinese retaliation against US firms. On the week, the FTSE fell 0.4 percent, the Shanghai rose 2.4 percent, and the Nasdaq fell 0.6 percent.

A delicate and unwelcome pivot may be underway in the global economy: a move to lower rates of growth perhaps quicker than many expected and raising the risk that overall conditions could begin to weaken as year-end approaches. This is appearing right at the time that many government stimulus programs, especially in the UK and the US, are scheduled to wind down, an outcome that would only deepen such concerns.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The data highlight of the week will be September PMI flashes, the most closely watched to be posted in this sequence on Wednesday: France, Germany, the UK, and the US. Slight slowing is the net expectation, to what would be still moderate-to-solid rates of growth. Sentiment reports will also be very heavy opening with EC consumer confidence on Tuesday, GfK consumer climate on Wednesday, and both French business climate and German Ifo business climate on Thursday. The week ends with a run of data from the US: new home sales and durable goods orders and also jobless claims on Thursday which have been easing but where forecasters are calling for an increase in the latest week. The Reserve Bank of New Zealand meets on Wednesday and the Swiss National Bank of Thursday, but with rates for both already apparently limit down, policy options would appear to be limited.

Eurozone: EC Consumer Confidence Flash for September (Tue 14:00 GMT; Tue 16:00 CEST; Tue 10:00 EDT)

Consensus Forecast: -14.7

Recovery in consumer confidence has been slow, still in the negative column at minus 14.7 in August which is also the expectation for September.

Reserve Bank of New Zealand Announcement (Wed 02:00 GMT; Wed 14:00 NZDT; Tue 22:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Reserve Bank of New Zealand is expected to leave its cash rate at 0.25 percent but officials may dig into their alternative tool box for further stimulus.

Germany: GfK Consumer Climate for October (Wed 06:00 GMT; Wed 08:00 CEST; Wed 02:00 EDT)

Consensus Forecast: -1.0

GfK's survey for September, at minus 1.8, came in below expectations suggesting that German households were growing more cautious. Consensus for October is minus 1.0.

French PMI Composite Flash for September (Wed 07:15 GMT; Wed 09:15 CEST; Wed 03:15 EDT)

Consensus Forecast, Composite: 51.7

Consensus Forecast, Manufacturing: 50.5

Consensus Forecast, Services: 51.7

France's PMIs, having shot to the upper 50s in July, cooled off to the low 50s in August. Expectations for September are a move sideways for the composite and services, both at 51.7 medians, but a modest move higher for manufacturing, seen above the 50-threshold at 50.5.

German PMI Composite Flash for September (Wed 07:30 GMT; Wed 09:30 CEST; Wed 03:30 EDT)

Consensus Forecast, Composite: 53.0

Consensus Forecast, Manufacturing: 52.6

Consensus Forecast, Services: 53.0

A second straight month of moderate growth in the mid-to-low 50s is the expectation for September’s flashes, at a consensus 52.6 for German manufacturing and a consensus 53.0 for services.

UK PMI Composite Flash for September (Wed 08:30 GMT; Wed 09:30 BST; Wed 04:30 EDT)

Consensus Forecast, Composite: 56.0

Consensus Forecast, Manufacturing: 54.5

Consensus Forecast, Services: 56.0

Cooling is the expectation for UK’s PMIs which in August continued to climb strongly, to 58.8 for services (revised from a 60.1 flash) and 55.2 for manufacturing (revised from 55.3). Consensus forecasts for September’s flashes are 56.0 for services and 54.5 for manufacturing.

US PMI Composite Flash for September (Wed 13:45 GMT; Wed 09:45 EDT)

Consensus Forecast, Composite: 54.5

Consensus Forecast, Manufacturing: 53.2

Consensus Forecast, Services: 54.7

Both the manufacturing and services samples for the US moved from flat to solid growth in August. For September's flashes, forecasters see steady rates of growth; Econoday's manufacturing consensus is 53.2 with services seen at 54.7.

French Business Climate Indicator for September (Thu 06:45 GMT; Thu 08:45 CEST; Thu 02:45 EDT)

Consensus Forecast, Manufacturing: 95

Manufacturing sentiment in September is seen at 95 which would follow August's 11-point jump to what was a much higher-than-expected 93.

Swiss National Bank Monetary Policy Assessment (Thu 7:30 GMT; Thu 09:30 CEST; Thu 03:30 EDT)

Consensus Forecast, Change: 0.0 basis points

Consensus Forecast, Level: -0.75%

The Swiss National Bank is expected to keep its key deposit rate at minus 0.75 percent. At its last meeting in June, as the pandemic appeared to be easing, the bank made no change in its policy rate but strongly reaffirmed its commitment to intervene in the FX markets to hold down the Swiss franc.

German Ifo Business Climate Indicator for September (Thu 08:00 GMT; Thu 10:00 CEST; Thu 04:00 EDT)

Consensus Forecast: 93.8

After four straight gains that lifted the economic sentiment reading toward its pre-virus level of 96.0, September’s expectation is 93.8 which would compare with 92.6 in August.

US Jobless Claims for September 19 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 875,000

Initial jobless claims have been moving lower but slowly, down 33,000 in the September 12 to a still enormously swollen 860,000. Econoday’s consensus for the September 19 week is for a move back up, to 875,000.

US New Home Sales for August (Thu 14:00 GMT; Thu 10:00 EDT)

Consensus Forecast, Annual Rate: 880,000

New home sales have been literally surging, easily beating Econoday's consensus the last four reports. After July's 901,000 annual rate, Econoday's consensus for August is 880,000.

US Durable Goods Orders for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, M/M: 1.5%

Consensus Forecast, Ex-Transportation - M/M: 1.2%

Consensus Forecast, Core Capital Goods Orders - M/M: 1.7%

Durable goods orders are expected to slow in August to a 1.5 percent increase following July's 11.4 percent surge (revised from an initial 11.2 percent). But less slowing is seen for core capital goods (nondefense ex-aircraft) which are expected to ease only 2 tenths for a 1.7 percent monthly gain.

|