|

Slowing improvement has been the unwelcome theme of recent economic data, results that have central banks along with central governments scrambling for new ideas to stimulate demand and keep businesses in place. Highlights in the week include spots of strength in manufacturing as well as capital goods and also housing, all balanced, however, by general weakness in Japan and lack of recovery in the US labor market. We'll start the week's rundown with confidence readings, mostly better with some points of strength.

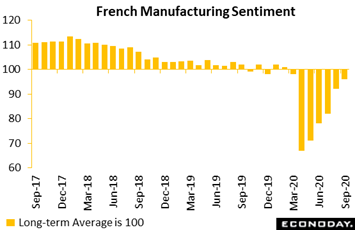

French manufacturing sentiment improved further in September as the business climate indicator rose from 92 in August to a higher than expected 96, its strongest mark since March but still 5 points short of its pre-lockdown level in February. The latest improvement mainly reflected gains in past output and order books though the latter, at minus 33, still remained well into the negative column. In services, the business climate was up 2 points to 95 with the economy-wide measure also 2 points higher to 92, nearly 40 points above April's record low but still 13 points below its pre-pandemic reading. This was easily its smallest rise since the upswing began in May. Other data from France in the week included flash PMIs for September which were only slightly positive for manufacturing and outright negative for services. On net, French data are warning that the easy part of the recovery is probably over and future progress, especially given the risk of greater virus restrictions, will be harder to come by. French manufacturing sentiment improved further in September as the business climate indicator rose from 92 in August to a higher than expected 96, its strongest mark since March but still 5 points short of its pre-lockdown level in February. The latest improvement mainly reflected gains in past output and order books though the latter, at minus 33, still remained well into the negative column. In services, the business climate was up 2 points to 95 with the economy-wide measure also 2 points higher to 92, nearly 40 points above April's record low but still 13 points below its pre-pandemic reading. This was easily its smallest rise since the upswing began in May. Other data from France in the week included flash PMIs for September which were only slightly positive for manufacturing and outright negative for services. On net, French data are warning that the easy part of the recovery is probably over and future progress, especially given the risk of greater virus restrictions, will be harder to come by.

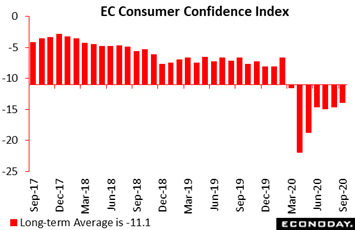

Consumer confidence in Europe is also improving but not by much, at minus 13.9 in September's flash versus minus 14.7 in August. Yet this is the best reading since March and lifts the index to only a half dozen points below its trend going into the pandemic. Yet this may prove a hard distance to cover given rising infection rates and talk of new lockdowns through much of Europe. This report is very timely, sampled between September 1 and 21. Consumer confidence in Europe is also improving but not by much, at minus 13.9 in September's flash versus minus 14.7 in August. Yet this is the best reading since March and lifts the index to only a half dozen points below its trend going into the pandemic. Yet this may prove a hard distance to cover given rising infection rates and talk of new lockdowns through much of Europe. This report is very timely, sampled between September 1 and 21.

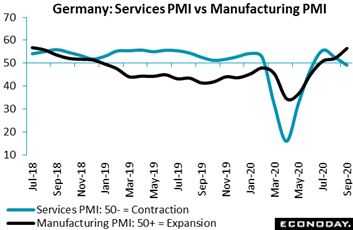

One area of Europe's economy that is suddenly improving is German manufacturing, at least based on September's flash PMI which jumped from 52.2 to a surprisingly high 56.6 for the best reading in more than two years. Strength in the report was broad based and was led by new orders which, boosted especially by export orders, posted its fastest rate of increase in more than 10 years. Recovery in the global auto sector is very likely contributing to this strength, strength that stands in contrast to Germany's service sector which, likely showing wear tied to Covid-containment measures, sank nearly 3 points to a sub-50 level of 49.1. Employment data in the two sectors were improved, rising slightly for services and contracting less severely for manufacturing. Germany will report September unemployment on Wednesday of the coming week. One area of Europe's economy that is suddenly improving is German manufacturing, at least based on September's flash PMI which jumped from 52.2 to a surprisingly high 56.6 for the best reading in more than two years. Strength in the report was broad based and was led by new orders which, boosted especially by export orders, posted its fastest rate of increase in more than 10 years. Recovery in the global auto sector is very likely contributing to this strength, strength that stands in contrast to Germany's service sector which, likely showing wear tied to Covid-containment measures, sank nearly 3 points to a sub-50 level of 49.1. Employment data in the two sectors were improved, rising slightly for services and contracting less severely for manufacturing. Germany will report September unemployment on Wednesday of the coming week.

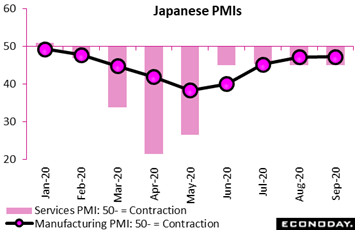

One country that hasn't shown much bounce at all is Japan, confirmed by September's PMIs that point to ongoing virus effects. The manufacturing index inched only 1 tenth higher to 47.3 while the output component fell 6 tenths to 45.2. Sub-50 readings indicate contraction and the deeper below 50, the greater the contraction. Services are also well below 50, at 45.6 overall with details showing broad weakness. Finding new stimulus is an ongoing concern for the Bank of Japan which has long been in maximum overdrive. One country that hasn't shown much bounce at all is Japan, confirmed by September's PMIs that point to ongoing virus effects. The manufacturing index inched only 1 tenth higher to 47.3 while the output component fell 6 tenths to 45.2. Sub-50 readings indicate contraction and the deeper below 50, the greater the contraction. Services are also well below 50, at 45.6 overall with details showing broad weakness. Finding new stimulus is an ongoing concern for the Bank of Japan which has long been in maximum overdrive.

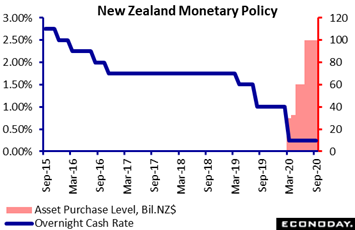

Finding new stimulus is also the big question for the Reserve Bank of New Zealand which left policy unchanged in the week while, however, reaffirming prior guidance that additional policy tools may be needed. These include a negative cash rate, purchases of foreign assets, and the provision of funding for bank lending, with officials directing RBNZ staff to prepare the latter to be ready for possible use by year-end. The official cash rate has been held at 0.25 percent since March with the upper limit for asset purchases at NZ$100 billion since July. Officials noted that economic activity in recent months has remained well below pre-pandemic levels, hampered by a re-tightening of public health restrictions in some parts of the country as well as ongoing foreign travel restrictions and by a weak global outlook. Policy, they said, will need to remain highly accommodative "for a long time to come". Finding new stimulus is also the big question for the Reserve Bank of New Zealand which left policy unchanged in the week while, however, reaffirming prior guidance that additional policy tools may be needed. These include a negative cash rate, purchases of foreign assets, and the provision of funding for bank lending, with officials directing RBNZ staff to prepare the latter to be ready for possible use by year-end. The official cash rate has been held at 0.25 percent since March with the upper limit for asset purchases at NZ$100 billion since July. Officials noted that economic activity in recent months has remained well below pre-pandemic levels, hampered by a re-tightening of public health restrictions in some parts of the country as well as ongoing foreign travel restrictions and by a weak global outlook. Policy, they said, will need to remain highly accommodative "for a long time to come".

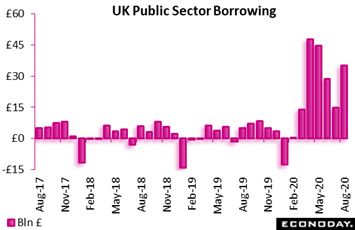

Like monetary policy, fiscal policy has also been at extremes, at least it is in the UK where government finances were deep in the red again in August as the swathe of economic support packages continued to hit both sides of the balance sheet. Following £14.72 billion in July, overall public sector net borrowing weighed in at £35.20 billion, broadly in line with expectations and more than £30 billion higher than a year ago. Excluding public sector banks, the red ink was a slightly bigger £35.92 billion and also up more than £30 billion on the year. Underlying borrowing in the first five months of the financial year was £173.7 billion, nearly £150 billion more than this time last year and the highest ever borrowing in any April to July period. The August data put underlying debt at £2,023.9 billion, fully £249.5 billion more than a year ago and 101.9 percent of GDP. On Thursday in the week, the Chancellor of the Exchequer announced a new package of employment measures — and if infections continue to rise, there could be yet more to come. Like monetary policy, fiscal policy has also been at extremes, at least it is in the UK where government finances were deep in the red again in August as the swathe of economic support packages continued to hit both sides of the balance sheet. Following £14.72 billion in July, overall public sector net borrowing weighed in at £35.20 billion, broadly in line with expectations and more than £30 billion higher than a year ago. Excluding public sector banks, the red ink was a slightly bigger £35.92 billion and also up more than £30 billion on the year. Underlying borrowing in the first five months of the financial year was £173.7 billion, nearly £150 billion more than this time last year and the highest ever borrowing in any April to July period. The August data put underlying debt at £2,023.9 billion, fully £249.5 billion more than a year ago and 101.9 percent of GDP. On Thursday in the week, the Chancellor of the Exchequer announced a new package of employment measures — and if infections continue to rise, there could be yet more to come.

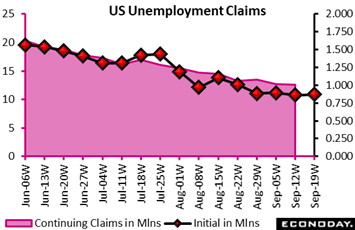

Public spending in the US is also at record highs, up nearly 50 percent to $6.054 trillion with one more month to go in the government's fiscal year (data scheduled for release in the second week of October). Talks for new stimulus, which have been going nowhere, could get going fast if the labor market begins to falter. Improvement certainly has slowed, in fact is at a standstill when it comes to initial jobless claims which have been narrowly confined within an 866,000 to 893,000 range the last four weeks. This is roughly four times where they were before the crisis and are hard evidence that businesses continue to go under. Continuing claims in lagging data for the September 12 week fell 167,000 to 12.580 million to lower the unemployment rate for insured workers by 1 tenth to 8.6 percent. This compares with 1.2 percent going into the pandemic. Public spending in the US is also at record highs, up nearly 50 percent to $6.054 trillion with one more month to go in the government's fiscal year (data scheduled for release in the second week of October). Talks for new stimulus, which have been going nowhere, could get going fast if the labor market begins to falter. Improvement certainly has slowed, in fact is at a standstill when it comes to initial jobless claims which have been narrowly confined within an 866,000 to 893,000 range the last four weeks. This is roughly four times where they were before the crisis and are hard evidence that businesses continue to go under. Continuing claims in lagging data for the September 12 week fell 167,000 to 12.580 million to lower the unemployment rate for insured workers by 1 tenth to 8.6 percent. This compares with 1.2 percent going into the pandemic.

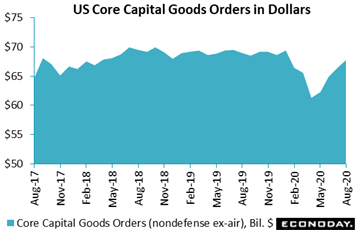

Whether manufacturing can continue to contribute to US payroll growth is in question following August's durable goods report where headline growth was a modest 0.4 percent on the month at the same time that unfilled orders fell 0.6 percent following even steeper declines in the prior two months. Weakness in August included motor vehicles where orders fell back from prior gains as they did for fabrications and electrical equipment. And once again cancellations, for the fifth time in six months, pulled down commercial aircraft orders. Yet indications from this report are not totally negative, far from it as strength is appearing where it's centered best, in core capital goods (nondefense ex-aircraft). Orders here rose 1.8 percent and, at $67.7 billion in August, are now 1.9 percent over February. This reading speaks to confidence and will favorably shift the discussion and outlook for business investment. Whether manufacturing can continue to contribute to US payroll growth is in question following August's durable goods report where headline growth was a modest 0.4 percent on the month at the same time that unfilled orders fell 0.6 percent following even steeper declines in the prior two months. Weakness in August included motor vehicles where orders fell back from prior gains as they did for fabrications and electrical equipment. And once again cancellations, for the fifth time in six months, pulled down commercial aircraft orders. Yet indications from this report are not totally negative, far from it as strength is appearing where it's centered best, in core capital goods (nondefense ex-aircraft). Orders here rose 1.8 percent and, at $67.7 billion in August, are now 1.9 percent over February. This reading speaks to confidence and will favorably shift the discussion and outlook for business investment.

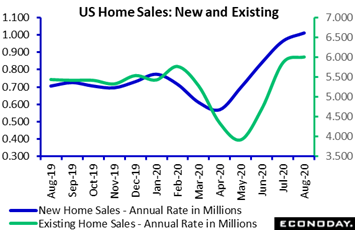

One sector contributing to US growth in a dramatic way is housing, particularly new home sales which, yes, are going through the roof. Sales surged 10.5 percent in August to a 1.011 million annual rate that — for a fifth month in a row — easily beat Econoday's consensus forecast. Compared to February, sales were up 41.2 percent and were 43.2 percent higher compared to August last year. That's 40 percent growth! Turning to resales, "Super-V" is how the National Association of Realtors (NAR) is describing this year's existing home sales recovery, jumping another 2.4 percent in August for year-over-year growth of 10.5 percent. The annual rate, at 6 million even in August, is already 4.2 percent above February's pre-virus rate of 5.760 million and 10.7 percent above January's 5.420 million. The list of factors behind this feeding frenzy include low mortgage rates, demographic shifts tied to Covid, record prices in the stock market, and comparatively limited employment damage to higher wage workers. How much a housing sector can contribute to an economy is playing out in 2020. One sector contributing to US growth in a dramatic way is housing, particularly new home sales which, yes, are going through the roof. Sales surged 10.5 percent in August to a 1.011 million annual rate that — for a fifth month in a row — easily beat Econoday's consensus forecast. Compared to February, sales were up 41.2 percent and were 43.2 percent higher compared to August last year. That's 40 percent growth! Turning to resales, "Super-V" is how the National Association of Realtors (NAR) is describing this year's existing home sales recovery, jumping another 2.4 percent in August for year-over-year growth of 10.5 percent. The annual rate, at 6 million even in August, is already 4.2 percent above February's pre-virus rate of 5.760 million and 10.7 percent above January's 5.420 million. The list of factors behind this feeding frenzy include low mortgage rates, demographic shifts tied to Covid, record prices in the stock market, and comparatively limited employment damage to higher wage workers. How much a housing sector can contribute to an economy is playing out in 2020.

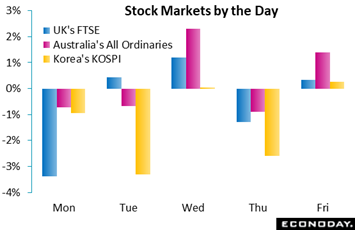

Talk of suspicious transactions sent bank stocks tumbling on Monday. Leaked documents from the US Financial Crimes Enforcement Network spoke of $2 trillion in dirty-money transactions, and said HSBC, Standard Chartered, Deutsche Bank, and Barclays were among the mega-banks that allowed the transactions to occur. Shares of major airlines were among Tuesday's worst performers, reflecting concerns that tighter travel restrictions, in response to rising infections in Europe, are set to be reimposed. UK stocks outperformed at mid-week on expectations for further fiscal stimulus including an extension of the government's job furlough scheme. Wednesday saw the Reserve Bank of New Zealand talking up new stimulus to come, while comments from a Reserve Bank of Australia official boosted speculation that the RBA may likewise consider new policy options at their approaching meeting in early October. Korea's Kospi was the worst performer in the week, falling 5.5 percent including a 3.3 percent drop on Tuesday tied to Covid worries and 2.6 percent dip on Thursday after North Korea killed a South Korean official. The Kospi is still higher year-to-date, at 3.7 percent which, outside of Shanghai's 5.6 percent and the Nasdaq's enormous 33.0 percent, is one of very best showings anywhere. Talk of suspicious transactions sent bank stocks tumbling on Monday. Leaked documents from the US Financial Crimes Enforcement Network spoke of $2 trillion in dirty-money transactions, and said HSBC, Standard Chartered, Deutsche Bank, and Barclays were among the mega-banks that allowed the transactions to occur. Shares of major airlines were among Tuesday's worst performers, reflecting concerns that tighter travel restrictions, in response to rising infections in Europe, are set to be reimposed. UK stocks outperformed at mid-week on expectations for further fiscal stimulus including an extension of the government's job furlough scheme. Wednesday saw the Reserve Bank of New Zealand talking up new stimulus to come, while comments from a Reserve Bank of Australia official boosted speculation that the RBA may likewise consider new policy options at their approaching meeting in early October. Korea's Kospi was the worst performer in the week, falling 5.5 percent including a 3.3 percent drop on Tuesday tied to Covid worries and 2.6 percent dip on Thursday after North Korea killed a South Korean official. The Kospi is still higher year-to-date, at 3.7 percent which, outside of Shanghai's 5.6 percent and the Nasdaq's enormous 33.0 percent, is one of very best showings anywhere.

Huge borrowing figures will be the norm for some time to come as will very low policy rates. How much they've contributed to the economic recovery would be only guesswork, at least that is outside of the financial markets and housing which have benefited greatly from all the stimulus. Perhaps the best news in the week was the strength in US capital goods orders, offering tangible evidence of underlying business confidence.

The US will open and close the week, the latter in style with the September employment report. The week gets rolling on Tuesday with US goods trade where a very deep deficit is expected to get even deeper in August, followed later in the day by consumer confidence which has yet to revive at all from the crisis. Key Japanese data, which have also failed to show much life, will be posted Wednesday: industrial production and retail sales, both for August and neither expected to show improvement. Wednesday will also see the beginning of September data from China, opening with the CFLP manufacturing index in what is expected to be another month of slow expansion. The progress of the recovery in Germany will also be updated on Wednesday, first with retail sales for August then unemployment for September. September inflation updates will come from the Eurozone on Wednesday followed by Switzerland on Thursday, a day that will also see Swiss data on August retail sales and September's SVME PMI with the latter expected to show improvement. Attention will shift back to the US beginning on Thursday with weekly jobless and the ISM manufacturing index followed on Friday by September employment where another month of slowing improvement is the expectation.

US Goods Trade (Advance) for August (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Balance: -$82.6 billion

The US goods deficit (census basis) is expected to deepen to a very large $82.6 billion in August versus $81.2 billion in July (revised from $79.3 billion). Goods imports were down 7.4 percent year-over-year in August and were down 0.9 percent relative to February; goods exports have been falling more steeply, down 15.7 percent on the year and down 16.4 percent versus February.

US Consumer Confidence Index for September (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 88.8

Consumer confidence was lower in August, at 84.8, than it was at the depth of the crisis in April when the index was at 85.7. Econoday's consensus for August is modest improvement to 88.8.

Japanese Industrial Production for August (Tue 23:50 GMT; Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Month over Month: 1.5%

A 1.5 percent monthly increase is expected for industrial production in August which in July rose a better-than-expected 8.0 percent.

Japanese Retail Sales for August (Tue 23:50 GMT: Wed 08:50 JST; Tue 19:50 EDT)

Consensus Forecast, Year over Year: -3.5%

Contraction in retail sales deepened in July, down a weaker-than-expected 2.8 percent on the year amid a re-tightening of virus restrictions. A yearly rate of minus 3.5 percent is the expectation for August.

China: CFLP Manufacturing PMI for September (Wed 01:00 GMT; Wed 09:00 CST; Tue 21:00 EDT)

Consensus Forecast: 51.2

The government's official CFLP manufacturing PMI will open up China data for the reporting month of September, expected to extend a post-virus run of modest expansion at a consensus 51.2.

German Retail Sales for August (Wed 06:00 GMT; Wed 08:00 CEST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: 0.2%

German retail sales, which fell 0.9 percent in July, are expected to rise in August but only slightly, at a consensus monthly gain of 0.2 percent.

German Unemployment Rate for September (Wed 07:55 GMT; Wed 09:55 CEST; Wed 03:55 EDT)

Consensus Forecast: 6.4%

Despite anecdotal reports of layoffs, Germany's unemployment rate has held rock steady since May. No change at 6.4 percent is the expectation for September.

Eurozone HICP Flash for September (Wed 09:00 GMT; Wed 11:00 CEST; Wed 05:00 EDT)

Consensus Forecast, Year over Year: 0.5%

Consumer inflation in the Eurozone is expected to turn higher in September, to a year-over-year consensus of 0.5 percent versus contraction of 0.2 percent in August.

Swiss CPI for September (Thu 06:30 GMT; Thu 08:30 CEST; Thu 02:30 EDT)

Consensus Forecast, Month over Month: -0.1%

Consensus Forecast, Year over Year: -0.8%

Consumer prices in Switzerland are seen in the negative column in September, down 0.1 percent on the month and down 0.8 percent on the year versus 0.9 percent contraction in August.

Swiss Retail Sales for August (Thu 06:30 GMT; Thu 08:30 CEST; Thu 02:30 EDT)

Consensus Forecast, Year over Year: 3.2%

At yearly growth of 4.1 percent, retail sales in Switzerland proved better than expected in July. For August, plus 3.2 percent is the expectation.

Switzerland: SVME PMI for September (Thu 07:30 GMT; Thu 09:30 CEST: Thu 3:30 EDT)

Consensus Forecast: 52.4

The September reading on Swiss manufacturing activity is expected to show continued recovery, at 52.4 for the SVME PMI versus September's as-expected 51.8.

US Initial Jobless Claims for September 26 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 853,000

Initial jobless claims haven't been moving much at all, hovering in the high 800,000 range the four prior weeks. After 870,000 in the September 19 week, Econoday’s consensus for the September 26 week is a move lower to 853,000.

US: ISM Manufacturing Index for September (Thu 14:00 GMT; Thu 10:00 EDT)

Consensus Forecast: 56.0

The ISM index, despite extended contraction in employment, has beaten Econoday's consensus for the last six reports, highlighting its greater strength relative to other manufacturing indications. For September, Econoday's consensus is no change at a solid 56.0.

US Employment Situation for September (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Change in Nonfarm Payrolls: 900,000

Consensus Forecast: Unemployment Rate: 8.2%

Recovery in the labor market slowed in August especially when excluding temporary Census jobs. A rise of 900,000 is the expectation for September nonfarm payrolls versus 1.371 million in August. The unemployment rate is seen down 2 tenths at 8.2 percent.

|