|

President's Trump's positive Covid test has added further uncertainty to what has been a year of uncertainty. What was certain after the lockdowns was that the global economy would begin to recover strongly. How strong for how long is the question we face now and for the US the emerging answer appears to be neither strong nor long enough.

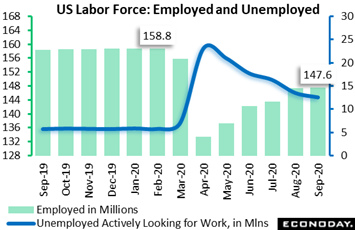

Slowing growth is the message from the September employment report. Looking at the total US labor force which includes those not on payrolls, employment rose 275,000 to 147.6 million. This is a strong monthly gain on its own but is down considerably from 3.8 million in August and an average monthly gain from August to May of 3.5 million. Against a pre-virus level of 158.8 million, growth at September's pace would need a very considerable time to return employment to pre-virus levels. Those actively looking for work in September fell 970,000 to 12.6 million to make for a still highly elevated unemployment rate of 7.9 percent. In a measure of Covid destruction, the total labor force (those with jobs and actively looking for jobs) came in at 160.1 million, which is 4.4 million short of where it was in February. Slowing growth is the message from the September employment report. Looking at the total US labor force which includes those not on payrolls, employment rose 275,000 to 147.6 million. This is a strong monthly gain on its own but is down considerably from 3.8 million in August and an average monthly gain from August to May of 3.5 million. Against a pre-virus level of 158.8 million, growth at September's pace would need a very considerable time to return employment to pre-virus levels. Those actively looking for work in September fell 970,000 to 12.6 million to make for a still highly elevated unemployment rate of 7.9 percent. In a measure of Covid destruction, the total labor force (those with jobs and actively looking for jobs) came in at 160.1 million, which is 4.4 million short of where it was in February.

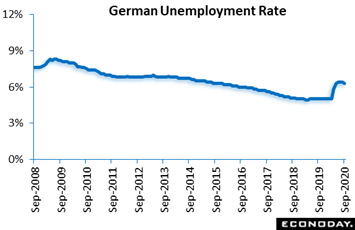

Rates of labor destruction have been far less severe in Europe where Germany leads September updates. The country's labor market continues to prove surprisingly resilient as those out of work fell 8,000 to 2.9 million to shave the unemployment rate by a tick, to a lower-than-expected 6.3 percent. And job prospects improved for a second straight month as vacancies rose 3,000 to 433,000 after a 4,000 increase in August. Government support moves — now extended into 2021 — combined with a sharp increase in part-time work have done much to hold in check what could have been rapidly rising job losses. Infections in Germany are on the rise but, in contrast to some other European countries, remain well below their previous peaks. So long as this remains the case, economic activity should continue to recover and limit pressure on firms to reduce headcount. Rates of labor destruction have been far less severe in Europe where Germany leads September updates. The country's labor market continues to prove surprisingly resilient as those out of work fell 8,000 to 2.9 million to shave the unemployment rate by a tick, to a lower-than-expected 6.3 percent. And job prospects improved for a second straight month as vacancies rose 3,000 to 433,000 after a 4,000 increase in August. Government support moves — now extended into 2021 — combined with a sharp increase in part-time work have done much to hold in check what could have been rapidly rising job losses. Infections in Germany are on the rise but, in contrast to some other European countries, remain well below their previous peaks. So long as this remains the case, economic activity should continue to recover and limit pressure on firms to reduce headcount.

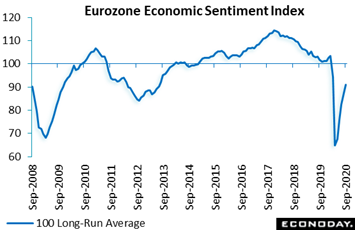

Measures of confidence have been steadily recovering in Europe, the latest indication coming from the economic sentiment index which made further progress in September. A fifth straight increase put the headline index at a stronger-than-expected 91.1, up from 87.5 in August. Even so, while the best result since March, September's result was still 12.3 points below its pre-lockdown level. The latest improvement was broad-based and driven by stronger sentiment in services which climbed to a 6-month peak. Industry also made a positive contribution as did the consumer sector. Regionally, pessimism eased significantly in France and Italy with smaller gains made in Germany and Spain. The September report is again in line with an ongoing pick-up in economic activity, though the month's improvement was the smallest since May. Policymakers should be relieved that the Eurozone economy is moving in the right direction though the broader picture remains highly uncertain. Measures of confidence have been steadily recovering in Europe, the latest indication coming from the economic sentiment index which made further progress in September. A fifth straight increase put the headline index at a stronger-than-expected 91.1, up from 87.5 in August. Even so, while the best result since March, September's result was still 12.3 points below its pre-lockdown level. The latest improvement was broad-based and driven by stronger sentiment in services which climbed to a 6-month peak. Industry also made a positive contribution as did the consumer sector. Regionally, pessimism eased significantly in France and Italy with smaller gains made in Germany and Spain. The September report is again in line with an ongoing pick-up in economic activity, though the month's improvement was the smallest since May. Policymakers should be relieved that the Eurozone economy is moving in the right direction though the broader picture remains highly uncertain.

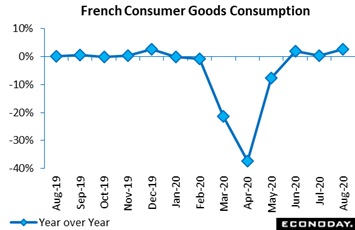

Confidence indications offer clues on what to expect for consumer spending where in France the latest news is surprisingly strong. Household spending on manufactured goods was up 2.6 percent in August, both on the month and, as tracked in the graph, on the year as well. Purchases now stand fully 4.2 percent above February. Textiles and clothing saw particularly robust growth and there were solid gains too for household durables and other engineered goods. Energy was weaker and transport equipment lost ground but only after strong gains in June and July. Food was up for the first time in three months. The buoyancy of the August data leaves consumer spending on a solid uptrend; average total goods purchased in July and August were nearly 20 percent above their mean level of the second quarter. Even a weak September would not stop the household sector from providing French GDP with a sizable third-quarter lift. Confidence indications offer clues on what to expect for consumer spending where in France the latest news is surprisingly strong. Household spending on manufactured goods was up 2.6 percent in August, both on the month and, as tracked in the graph, on the year as well. Purchases now stand fully 4.2 percent above February. Textiles and clothing saw particularly robust growth and there were solid gains too for household durables and other engineered goods. Energy was weaker and transport equipment lost ground but only after strong gains in June and July. Food was up for the first time in three months. The buoyancy of the August data leaves consumer spending on a solid uptrend; average total goods purchased in July and August were nearly 20 percent above their mean level of the second quarter. Even a weak September would not stop the household sector from providing French GDP with a sizable third-quarter lift.

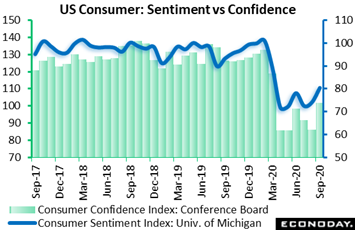

Let's turn back to confidence and take a look at the US where related indicators going into November's election are certain to be closely tracked. The consumer sentiment index edged higher in the second half of September to 80.4 for a 1.5 point gain from the mid-month score and a sizable 6.3 point gain from August. Yet like the rival consumer confidence index, the sentiment index remains deeply depressed, down more than 20 points versus February. Prospects for further recovery are certain to be affected by the expiration of special unemployment benefits, a factor still in negotiation in Washington and which pulled down personal income in August (in separately released data during week) a very steep 2.7 percent on the month. The preliminary consumer sentiment report for October, to be released on October 16, will offer early evidence on how stimulus efforts as well as President Trump's condition are impacting national spirits. Let's turn back to confidence and take a look at the US where related indicators going into November's election are certain to be closely tracked. The consumer sentiment index edged higher in the second half of September to 80.4 for a 1.5 point gain from the mid-month score and a sizable 6.3 point gain from August. Yet like the rival consumer confidence index, the sentiment index remains deeply depressed, down more than 20 points versus February. Prospects for further recovery are certain to be affected by the expiration of special unemployment benefits, a factor still in negotiation in Washington and which pulled down personal income in August (in separately released data during week) a very steep 2.7 percent on the month. The preliminary consumer sentiment report for October, to be released on October 16, will offer early evidence on how stimulus efforts as well as President Trump's condition are impacting national spirits.

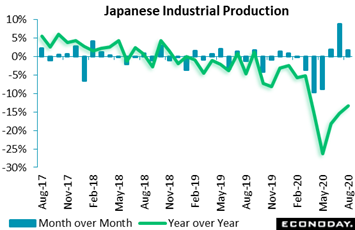

How confidence plays out may well determine how spending plays out which in turn will determine how soon we can expect the supply side of the economy to fully recover. In the important manufacturing sector of Japan, this outlook is not that bright. The industrial production index did rise 1.7 percent on the month in August for the third consecutive increase and just above the consensus. Yet the monthly gains haven't made much of a dent yet in year-over-year terms, with the index down 13.3 percent after dropping 15.5 percent in July. Output of motor vehicles and electronic parts and devices increased in August, partly offset by declines for production machinery and electrical machinery. The overall monthly increase fell noticeably short of official forecasts that output would expand 4.0 percent in August. Over the next two reports, officials expect production to expand sharply, forecasting monthly increases of 5.7 percent in September and 2.9 percent in October. How confidence plays out may well determine how spending plays out which in turn will determine how soon we can expect the supply side of the economy to fully recover. In the important manufacturing sector of Japan, this outlook is not that bright. The industrial production index did rise 1.7 percent on the month in August for the third consecutive increase and just above the consensus. Yet the monthly gains haven't made much of a dent yet in year-over-year terms, with the index down 13.3 percent after dropping 15.5 percent in July. Output of motor vehicles and electronic parts and devices increased in August, partly offset by declines for production machinery and electrical machinery. The overall monthly increase fell noticeably short of official forecasts that output would expand 4.0 percent in August. Over the next two reports, officials expect production to expand sharply, forecasting monthly increases of 5.7 percent in September and 2.9 percent in October.

Much like Japan, production in the US is still on an uphill climb. Factory orders in August did improve but there is still a ways to go, down 5.4 percent from a year ago for only 6 tenths of stalling improvement. And compared to February, orders were down 5.3 percent for what was also only 6 tenths of improvement. In a negative to watch, unfilled orders continued to fall steeply, down 0.6 percent in August and deepening the gap with February by 5 tenths to 6.1 percent. Cancellation of aircraft orders has been a major negative for the US factory sector. Much like Japan, production in the US is still on an uphill climb. Factory orders in August did improve but there is still a ways to go, down 5.4 percent from a year ago for only 6 tenths of stalling improvement. And compared to February, orders were down 5.3 percent for what was also only 6 tenths of improvement. In a negative to watch, unfilled orders continued to fall steeply, down 0.6 percent in August and deepening the gap with February by 5 tenths to 6.1 percent. Cancellation of aircraft orders has been a major negative for the US factory sector.

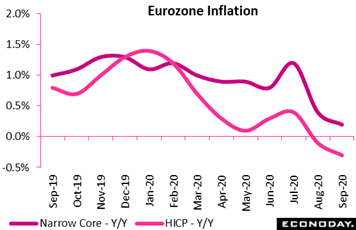

A developing negative for policy makers, especially in Europe, is the building appearance of deflation. Eurozone inflation unexpectedly decelerated last month, falling an annual 0.3 percent in September and down from August's minus 0.2 percent. Prices in Europe are being biased down by the 3 percentage point cut in German value-added taxes implemented at the start of July. Ireland's similar 2 percentage point reduction from the start of September is likewise having a negative effect. The narrowest gauge of inflation, which excludes energy, food, alcohol and tobacco, dropped from 0.4 percent to a new record low of just 0.2 percent. But VAT distortions aside, September's flash report paints an ominously weak picture, and to make matters worse, the ongoing slide seems to be undermining household inflation expectations which, according to the EU Commission, have now fallen for five months in a row. The European Central Bank has already indicated that it is discounting near-zero or negative inflation for the rest of 2020 but a sustained de-anchoring of inflation expectations would pose a much more serious problem for policy. The likelihood of additional monetary easing in 2020 may have just turned higher. A developing negative for policy makers, especially in Europe, is the building appearance of deflation. Eurozone inflation unexpectedly decelerated last month, falling an annual 0.3 percent in September and down from August's minus 0.2 percent. Prices in Europe are being biased down by the 3 percentage point cut in German value-added taxes implemented at the start of July. Ireland's similar 2 percentage point reduction from the start of September is likewise having a negative effect. The narrowest gauge of inflation, which excludes energy, food, alcohol and tobacco, dropped from 0.4 percent to a new record low of just 0.2 percent. But VAT distortions aside, September's flash report paints an ominously weak picture, and to make matters worse, the ongoing slide seems to be undermining household inflation expectations which, according to the EU Commission, have now fallen for five months in a row. The European Central Bank has already indicated that it is discounting near-zero or negative inflation for the rest of 2020 but a sustained de-anchoring of inflation expectations would pose a much more serious problem for policy. The likelihood of additional monetary easing in 2020 may have just turned higher.

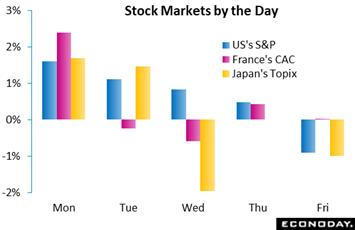

Global stocks were mixed, mostly down in Asia where markets were closed much of the week and with weekly gains in Europe and the US blunted on Friday following news of President Trump's positive Covid test and the soft US employment report. But markets did get off to a good start on Monday, especially cyclicals on Johnson & Johnson's report that its Covid vaccine was producing a "strong" immunity response in clinical trials. Europe fell back at mid-week on talk of new lockdown measures for France, Germany, the UK, and Spain. Positive comments from the White House during the week kept up expectations for a fiscal deal in the US, as did House Speaker Nancy Pelosi who said Trump’s illness has altered the dynamics of the talks in favor of a deal. Trading in Japan was halted on Thursday after the Tokyo Stock Exchange discovered a computer malfunction ahead of the session open; when trading resumed on Friday the Topix fell 1.0 percent to end the week 1.5 percent lower. France's CAC was unchanged on Friday to post a 2.0 percent weekly gain with the S&P 500 up 1.5 percent despite a 1.0 percent Friday decline. Markets were closed in China, Hong Kong, Korea, and Taiwan for national holidays late in the week. Global stocks were mixed, mostly down in Asia where markets were closed much of the week and with weekly gains in Europe and the US blunted on Friday following news of President Trump's positive Covid test and the soft US employment report. But markets did get off to a good start on Monday, especially cyclicals on Johnson & Johnson's report that its Covid vaccine was producing a "strong" immunity response in clinical trials. Europe fell back at mid-week on talk of new lockdown measures for France, Germany, the UK, and Spain. Positive comments from the White House during the week kept up expectations for a fiscal deal in the US, as did House Speaker Nancy Pelosi who said Trump’s illness has altered the dynamics of the talks in favor of a deal. Trading in Japan was halted on Thursday after the Tokyo Stock Exchange discovered a computer malfunction ahead of the session open; when trading resumed on Friday the Topix fell 1.0 percent to end the week 1.5 percent lower. France's CAC was unchanged on Friday to post a 2.0 percent weekly gain with the S&P 500 up 1.5 percent despite a 1.0 percent Friday decline. Markets were closed in China, Hong Kong, Korea, and Taiwan for national holidays late in the week.

Fueled by enormous monetary and fiscal stimulus, the global economy's rebound following the first-half shutdowns has been promising at times, led by a quick recovery for Chinese production and demand as well enormous gains for US employment in the late Spring and early Summer. But the good news since has been growing limited with the risk emerging perhaps that bad news, centered in Covid and its ceaseless effects, may begin to build once again.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The supply side of the global economy is the focus for the coming week, beginning with German manufacturers' orders on Tuesday and German industrial production on Wednesday. Expectations for both are for steady growth. Industrial production data late in the week are expected to show slowing growth, whether for the UK, France or Italy which will release their reports all on Friday. The UK will also post monthly GDP on Friday, and again slowing is the expectation. Steady and low is the expectation for Swiss unemployment on Thursday, while steady and weak is the expectation for Japanese household spending on Friday. Highlights of the week include a statement from the Reserve Bank of Australia on Tuesday and the Canadian labour force survey for Friday.

Reserve Bank of Australia Announcement (Tue 04:30 GMT; Tue 14:30 AEST; Mon 11:30 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

Expected to keep its policy rate steady and 0.25 percent, the Reserve Bank of Australia will offer updates on infection effects and the outlook for additional monetary tools. No rate action is expected.

German Manufacturers' Orders for August (Tue 06:00 GMT; Tue 08:00 CEST; Tue 02:00 EDT)

Consensus Forecast, Month over Month: 2.3%

Manufacturing orders are expected to rise 2.3 percent in August following July's 2.8 percent gain. German orders were down 7.1 percent on the year in July.

German Industrial Production for August (Wed 06:00 GMT; Wed 08:00 CEST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: 1.5%

A 1.5 percent monthly increase is expected for German industrial production in August following a lower-than-expected gain of 1.2 percent in July.

Swiss Unemployment Rate for August (Thu 05:45 GMT; Thu 07:45 CEST; Thu 01:45 EDT)

Consensus Forecast, Adjusted: 3.4%

Unemployment in Switzerland has been very limited during the crisis and was unchanged at 3.4 percent for the adjusted rate in August. For September, the consensus is also 3.4 percent.

US Initial Jobless Claims for October 3 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 819,000

California is now offline when it comes to claims data as it scrambles to limit unemployment fraud. With the weekly estimate for the US's largest state now frozen at a prior level of more than 260,000, forecasters see total initial claims easing slightly but not substantially to 819,000 in the October 3 week. This would compare with 837,000 in the prior week that saw only a small decline.

Japanese Household Spending for August (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast - Year over Year: -6.7%

After falling sharply in July amid heightened Covid cases, household spending for August is expected to be down 6.7 percent on the year following July contraction of 7.6 percent.

UK Industrial Production for August (Fri 06:00 GMT; Fri 07:00 BST; Fri 02:00 EDT)

Consensus Forecast, Month over Month: 2.5%

After posting a better-than-expected 5.2 percent rise in July, UK industrial production is expected to rise 2.5 percent in August.

UK Monthly GDP for August (Thu 06:00 GMT; Thu 07:00 BST; Thu 02:00 EDT)

Consensus Forecast, Month over Month: 4.6%

GDP recovery is expected to slow in August, rising an expected 4.6 percent on the month following a 6.6 percent gain in July.

French Industrial Production for August (Fri 06:45 GMT; Fri 08:45 CEST; Fri 02:45 EDT)

Consensus Forecast, Month over Month: 2.0%

Industrial production did rise 3.8 percent on the month in August but this was lower than expected and still left French production 7.1 percent below February. For August, a 2.0 percent increase is expected.

Italian Industrial Production for August (Fri 08:00 GMT; Fri 10:00 CEST; Fri 04:00 EDT)

Consensus Forecast, Month over Month: 1.2%

Italian industrial production is expected to rise 1.2 percent in August after rising an unexpectedly sharp 7.4 percent in July though still remaining 5.3 percent below its pre-Covid level of February.

Canadian Labour Force Survey for September (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Employment Change: 200,000

Consensus Forecast: Unemployment Rate: 9.9%

After August's 245,800 gain, an increase of 200,000 is expected for September; the unemployment rate is seen down 3 tenths to 9.9 percent.

|