|

After the great stimulus surge of March and April, central bankers have largely stepped aside, stressing that economic direction will ultimately turn on the path of the pandemic. The latest week offers a clear example of just how much the recovery is being dictated by Covid; those where it's contained are doing better and those where it's not aren't doing much better at all.

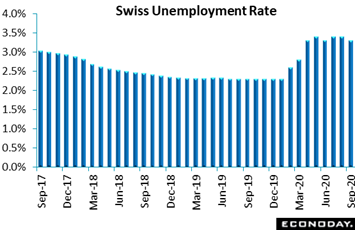

Switzerland's labor market saw unexpected improvement in September. At 3.3 percent, the jobless rate was a tick below August reflecting a 0.2 percent seasonally adjusted decline in the number of people out of work to 155,191. There was also further good news on job prospects as vacancies climbed 3.2 percent in the month to 31,688. In addition, the number of companies resorting to shorter working hours fell a sizable 25.4 percent. Boosted by government support measures, September's data are consistent with a very solid bounce back for third-quarter GDP growth. So long as the latest wave of coronavirus can be contained, and there were reports of rising rates in the country during the week, the Swiss economy should be on track for a decent run to year-end. Switzerland's labor market saw unexpected improvement in September. At 3.3 percent, the jobless rate was a tick below August reflecting a 0.2 percent seasonally adjusted decline in the number of people out of work to 155,191. There was also further good news on job prospects as vacancies climbed 3.2 percent in the month to 31,688. In addition, the number of companies resorting to shorter working hours fell a sizable 25.4 percent. Boosted by government support measures, September's data are consistent with a very solid bounce back for third-quarter GDP growth. So long as the latest wave of coronavirus can be contained, and there were reports of rising rates in the country during the week, the Swiss economy should be on track for a decent run to year-end.

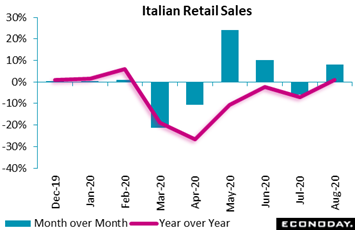

One country where Covid has been comparatively contained is Italy where retail sales bounced back in style during August. Following a 6.0 percent monthly slump in July, purchases jumped 8.2 percent to lift annual growth over the zero line, from minus 7.1 percent to plus 0.8 percent. The surprisingly sharp surge, driven by an easing in lockdown restrictions, left sales just 0.1 percent below February's pre-pandemic level. In volume terms, sales in the first two months of the third quarter were 11.8 percent above their mean level in April-June. This leaves the sector on course to make a sizably positive contribution to third-quarter GDP growth. One country where Covid has been comparatively contained is Italy where retail sales bounced back in style during August. Following a 6.0 percent monthly slump in July, purchases jumped 8.2 percent to lift annual growth over the zero line, from minus 7.1 percent to plus 0.8 percent. The surprisingly sharp surge, driven by an easing in lockdown restrictions, left sales just 0.1 percent below February's pre-pandemic level. In volume terms, sales in the first two months of the third quarter were 11.8 percent above their mean level in April-June. This leaves the sector on course to make a sizably positive contribution to third-quarter GDP growth.

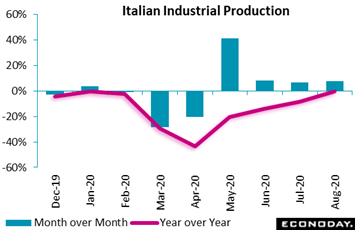

Strength on the demand side points to strength on the supply side which is what we see in Italy. Goods production had another very good month in August, up a larger-than-expected 7.7 percent to surpass the 7.0 percent gain posted in July. Year-over-year production rose from minus 8.3 percent to minus 0.3 percent and back to the pre-crisis trend. The increase puts output 1.8 percent above its level in February, implying that the recovery from the first wave of the coronavirus is now complete! Italian industry has responded well to new work rules, and so long as Covid can be contained, production should continue to progress over coming months, though probably at a more subdued pace. Strength on the demand side points to strength on the supply side which is what we see in Italy. Goods production had another very good month in August, up a larger-than-expected 7.7 percent to surpass the 7.0 percent gain posted in July. Year-over-year production rose from minus 8.3 percent to minus 0.3 percent and back to the pre-crisis trend. The increase puts output 1.8 percent above its level in February, implying that the recovery from the first wave of the coronavirus is now complete! Italian industry has responded well to new work rules, and so long as Covid can be contained, production should continue to progress over coming months, though probably at a more subdued pace.

Another country where Covid has been kept in relative check is Germany, success that is feeding acceleration for manufacturers orders which jumped 4.5 percent in August to exceed July's 3.3 percent gain. Orders have expanded every month since the record low seen in April and although they have yet to reattain their February level, the shortfall has been cut to only 3.6 percent. Annual growth now stands at minus 2.0 percent, up from July's minus 6.7 percent. German strength is centered in foreign demand, up 6.5 percent on the month with orders from its Eurozone partners up 14.6 percent. And orders in the auto sector, which is key to German health, are now 0.3 percent higher than in February. Another country where Covid has been kept in relative check is Germany, success that is feeding acceleration for manufacturers orders which jumped 4.5 percent in August to exceed July's 3.3 percent gain. Orders have expanded every month since the record low seen in April and although they have yet to reattain their February level, the shortfall has been cut to only 3.6 percent. Annual growth now stands at minus 2.0 percent, up from July's minus 6.7 percent. German strength is centered in foreign demand, up 6.5 percent on the month with orders from its Eurozone partners up 14.6 percent. And orders in the auto sector, which is key to German health, are now 0.3 percent higher than in February.

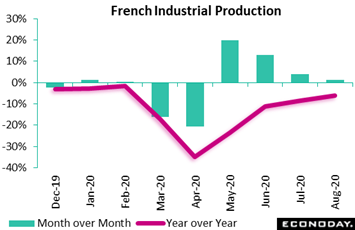

One country where infection rates have been climbing is France whose industrial recovery slowed noticeably in August. Following a 3.8 percent monthly rise in July, output increased 1.3 percent, little more than half the market consensus and the smallest advance since April. Annual growth did improve from minus 8.4 percent to minus 6.2 percent but production was still 6.3 percent short of its pre-lockdown level in February. Output of machinery fell sharply in the month though construction was a positive. In sum, French industry continues to rebound but the recovery is losing momentum; third-quarter industrial production is on course for a quarterly surge of 20 percent or more but much of this growth is tied to May and June when Covid cases were coming down. With new cases running at record highs and localized lockdowns being reimposed, the near term outlook is worrying. One country where infection rates have been climbing is France whose industrial recovery slowed noticeably in August. Following a 3.8 percent monthly rise in July, output increased 1.3 percent, little more than half the market consensus and the smallest advance since April. Annual growth did improve from minus 8.4 percent to minus 6.2 percent but production was still 6.3 percent short of its pre-lockdown level in February. Output of machinery fell sharply in the month though construction was a positive. In sum, French industry continues to rebound but the recovery is losing momentum; third-quarter industrial production is on course for a quarterly surge of 20 percent or more but much of this growth is tied to May and June when Covid cases were coming down. With new cases running at record highs and localized lockdowns being reimposed, the near term outlook is worrying.

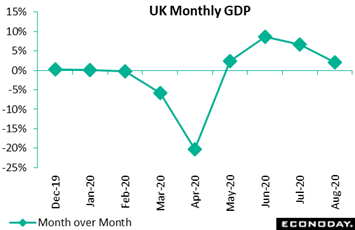

A similar Covid tale is playing in the United Kingdom where economic growth slowed again in August. Having decelerated to a 6.4 percent monthly rate in July, GDP in August expanded by a much smaller 2.1 percent. This is the smallest rise of the recovery and leaves total output, relative to February, down a very sizable 9.2 percent. Though production and construction both posted gains, services did most of the work getting a boost from the government's Eat Out to Help Out scheme which has now ended. Not ending, however, are additional lockdown measures which, in response to an ongoing surge in infections, are expected to be announced in the coming week. A similar Covid tale is playing in the United Kingdom where economic growth slowed again in August. Having decelerated to a 6.4 percent monthly rate in July, GDP in August expanded by a much smaller 2.1 percent. This is the smallest rise of the recovery and leaves total output, relative to February, down a very sizable 9.2 percent. Though production and construction both posted gains, services did most of the work getting a boost from the government's Eat Out to Help Out scheme which has now ended. Not ending, however, are additional lockdown measures which, in response to an ongoing surge in infections, are expected to be announced in the coming week.

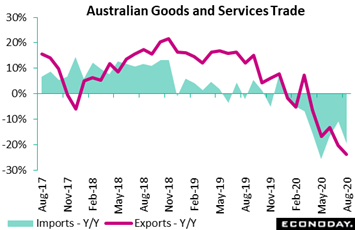

Covid's impact on cross-border trade has been substantial, magnifying what had been sharply declining trends going into the pandemic. The trade surplus for Australia, a strong exporting nation, narrowed to A$2.6 billion in August from A$4.7 billion in July for the smallest surplus in two years. Exports fell on the month while import growth slowed, with both recording another round of large year-on-year declines, at 19.7 percent for imports, in a reflection of subdued domestic demand, and 23.9 percent for exports in a reflection of subdued foreign demand. The Reserve Bank of Australia met in the week, taking no action but noting that the impact of Covid has been less severe than initially feared and that recovery is now underway in most of the country. But lockdown restrictions in the state of Victoria, home to 25 percent of Australia's economic activity, are a negative, part of what the RBA warns is a "bumpy and uneven" outlook. Covid's impact on cross-border trade has been substantial, magnifying what had been sharply declining trends going into the pandemic. The trade surplus for Australia, a strong exporting nation, narrowed to A$2.6 billion in August from A$4.7 billion in July for the smallest surplus in two years. Exports fell on the month while import growth slowed, with both recording another round of large year-on-year declines, at 19.7 percent for imports, in a reflection of subdued domestic demand, and 23.9 percent for exports in a reflection of subdued foreign demand. The Reserve Bank of Australia met in the week, taking no action but noting that the impact of Covid has been less severe than initially feared and that recovery is now underway in most of the country. But lockdown restrictions in the state of Victoria, home to 25 percent of Australia's economic activity, are a negative, part of what the RBA warns is a "bumpy and uneven" outlook.

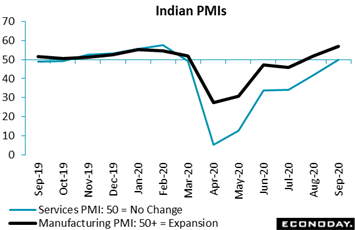

The Reserve Bank of India also met in the week in what was an upbeat meeting that cited emerging "impulses of growth" and easing contraction through much of the economy. With infections high but coming down, the RBI said the worst may be over in optimism confirmed by solid improvement for the country's purchasing managers indexes. India's services sector stabilized in September based on the related PMI which jumped 8 points to 49.8, virtually at the no-change 50 line for the best showing of the crisis. The country's manufacturing PMI, published in the prior week, jumped nearly 5 points to 56.8 for the best showing in eight years. Both reports showed improvement underway in orders and also selling prices. The Reserve Bank of India also met in the week in what was an upbeat meeting that cited emerging "impulses of growth" and easing contraction through much of the economy. With infections high but coming down, the RBI said the worst may be over in optimism confirmed by solid improvement for the country's purchasing managers indexes. India's services sector stabilized in September based on the related PMI which jumped 8 points to 49.8, virtually at the no-change 50 line for the best showing of the crisis. The country's manufacturing PMI, published in the prior week, jumped nearly 5 points to 56.8 for the best showing in eight years. Both reports showed improvement underway in orders and also selling prices.

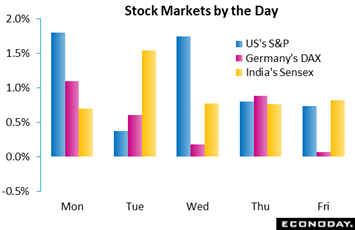

New US stimulus was the week's focus where positive expectations jumped Monday after House Speaker Nancy Pelosi said talks were making progress. But on Tuesday, President Trump upended those expectations by cutting off negotiations in a move, however, that he subsequently softened by targeting support for small businesses and airlines. Hopes for a broader relief package were boosted late in the week as both Trump and Pelosi said talks were back on; this was followed, however, by doubts from Republican Senate leader Mitch McConnell who said a deal before the November 3 election isn't likely. How the US election is affecting the markets is hard to read: President Trump appears to be making a quick Covid recovery but Joe Biden has a wide lead in the polls. Helping to support the Dax in the week was the 4.5 percent jump in German manufacturers orders while gains for India's services PMI helped boost the Sensex. Chinese markets were mostly closed for national holidays. New US stimulus was the week's focus where positive expectations jumped Monday after House Speaker Nancy Pelosi said talks were making progress. But on Tuesday, President Trump upended those expectations by cutting off negotiations in a move, however, that he subsequently softened by targeting support for small businesses and airlines. Hopes for a broader relief package were boosted late in the week as both Trump and Pelosi said talks were back on; this was followed, however, by doubts from Republican Senate leader Mitch McConnell who said a deal before the November 3 election isn't likely. How the US election is affecting the markets is hard to read: President Trump appears to be making a quick Covid recovery but Joe Biden has a wide lead in the polls. Helping to support the Dax in the week was the 4.5 percent jump in German manufacturers orders while gains for India's services PMI helped boost the Sensex. Chinese markets were mostly closed for national holidays.

If Covid rates can be held in check, as they are right now in Italy and Germany, the global economy could well accelerate going into year end. Yet if infections continue to rise, like they are in France and also the UK, the year-end push would appear certain to fizzle. And how the US election plays out and how it will impact the markets is, of course, anyone's guess.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week's most market-moving news is likely to be from the US on Friday, first with retail sales then industrial production. Opening the week on Monday will be Japanese machinery orders where, in the general theme of global data, slowing is the expectation. Chinese trade data is scheduled to follow on Tuesday in a report that, in contrast to trade data from most other countries, is expected to show another month of robust export growth. The UK labour market report will also be posted on Tuesday as will Germany's ZEW report which, for the latter, is expected to prove favorable once again. The CPI from the US will be Wednesday's highlight and modest results are the call with China's CPI to follow on Thursday amid similar expectations. Other price data will also follow on Thursday, this time from Switzerland where another month of persistent deflation is expected for the producer and import price index. US retail sales, which slowed in August, are expected to prove a bit better in September, while industrial production, which has been struggling to return to pre-virus levels, is also expected to post a moderate-to-solid gain. Also Friday, and a possible market mover, will be US consumer sentiment for a timely update on the psychological effects of the ongoing election and President Trump's Covid diagnosis. Another US report, where uncertain scheduling is at play, will be September's Treasury statement that will wind up the government's colossal fiscal year.

Japanese Machinery Orders for August (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Month over Month: -1.0%

Machinery orders came in better than expected in July, rising 6.3 percent with August's consensus, however, calling for a decline of 1.0 percent.

Chinese Merchandise Trade Balance for September (Estimated for Tuesday, Release Time Not Set)

Consensus Forecast, US$60.0 billion

Consensus Forecast, Imports - Y/Y: 0.2%

Consensus Forecast, Exports - Y/Y: 10.0%

Exports have been climbing strongly, up 9.5 percent on the year in August with an increase of 10.0 percent expected for September. Imports, in contrast, have seen soft, down 2.1 percent in August and seen up only 0.2 percent in September. September's surplus is seen at US$60.0 billion after August's larger-than-expected $58.93 billion.

UK Labour Market Report (Tue 06:00 GMT; Tue 07:00 BST; Tue 02:00 EDT)

Consensus Forecast, Claimant Count Unemployment Rate for September: 7.8%

Consensus Forecast, ILO Unemployment Rate for August: 4.3%

The claimant count unemployment rate for September is expected at 7.8 percent versus 7.6 percent in August. The ILO unemployment rate, in data for the three months to August, is expected to rise 2 tenths to 4.3 percent.

Germany: ZEW Survey for October (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Current Conditions: -60.0

Consensus Forecast, Economic Sentiment: 74.0

Forecasters see current conditions coming in at minus 60.0 in October after September's minus 66.2 which was better than expected. Economic sentiment, after September's 20-year high of 77.4, is seen at 74.0 in October.

US CPI for September (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 1.4%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 1.8%

If not for a price surge in used cars, improvement in consumer inflation would have been marginal in August. After 0.4 percent gains both overall and for the core (ex-food and energy), 0.2 percent increases for both are the expectations for September. The year-over-year rate for the core is seen at 1.8 percent versus 1.7 percent in August.

US Treasury Budget for September (Tue 18:00 GMT; Tue 14:00 EDT)

Consensus Forecast: -$97.5 billion

Econoday's consensus for the Treasury's monthly deficit in September is $97.5 billion following a $200.1 billion deficit in August that lifted the fiscal-year-to-date deficit to $3.007 trillion, up 182 percent from the prior fiscal year. Note that the report for September, which is the final month of the government's fiscal year, is often temporarily delayed due to year-end accounting requirements.

Eurozone Industrial Production for August (Wed 09:00 GMT; Wed 11:00 CEST; Wed 05:00 EDT)

Consensus Forecast, Month over Month: 0.5%

Consensus Forecast, Year over Year: -7.4%

Eurozone industrial production slowed in July to monthly growth of 4.1 percent from June's post-lockdown surge of 9.1 percent. A 0.5 percent increase is the forecast for August.

Chinese CPI for September (Thu 01:30 GMT; Thu 09:30 CST; Wed 21:30 EDT)

Consensus Forecast, Year over Year: 0.3%

Chinese consumer prices are expected to increase 0.3 percent on the month and increase 1.9 percent on the year in September, which would compare with a 0.4 percent monthly rise in August and a 2.4 percent annual rate.

Swiss Producer and Import Price Index for September (Thu 06:30 GMT; 08:30 CEST: 02:30 EDT)

Consensus Forecast, Month over Month: -0.2%

Consensus Forecast, Year over Year: -3.2%

A 0.2 percent decline is expected for September following a monthly 0.4 percent decrease in August. The year-on-year rate in September, at minus 3.5 percent in August, is expected at minus 3.2 percent.

US Initial Jobless Claims for September October 10 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 833,000

Forecasters see total initial claims coming in at 833,000 in the October 10 week versus 840,000 in the prior week which saw only a marginal decline.

US Retail Sales for September (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast, Month over Month: 0.7%

Consensus Forecast, Ex-Vehicles & Gas: 0.4%

Consensus Forecast, Control Group: 0.2%

Retail sales showed signs of stalling in August but expectations for September are mostly solid. Forecasters see September sales rising 0.7 percent with ex-auto ex-gas seen up 0.4 percent and the control group, which slipped into 0.2 percent contraction in August, up 0.2 percent.

US Industrial Production for September (Fri 13:15 GMT; Fri 09:15 EDT)

Consensus Forecast, Month over Month: 0.6%

US Manufacturing Production

Consensus Forecast, Month over Month: 0.8%

The post-shutdown rebound has slowed for US industrial production with August still 7.3 percent below the pre-crisis level of February. For September, Econoday's consensus is a monthly 0.6 percent increase overall, versus 0.4 percent in August, with manufacturing seen up 0.8 percent versus August's 1.0 percent.

US Consumer Sentiment Index, Preliminary October (Fri 14:00 GMT; Fri 10:00 EDT)

Consensus Forecast: 80.6

Consumer sentiment is expected to hold mostly steady in October, at a consensus 80.6 versus September's final of 80.4 and preliminary reading of 78.9.

|