|

How much third-quarter GDP will bounce back should be nothing more than a secondary (if not tertiary) curiosity. Of much greater concern are labor markets where recoveries may not only be slowing but may have already run their course, while extending their course downward are most global inflation reports as well as production data. But GDP reports, however backward looking, will soon be grabbing all the headlines, so let's brush up.

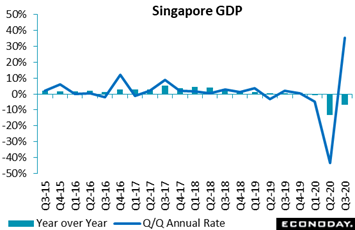

What to expect for coming GDP data was offered in the week by Singapore, a country ahead of others with its third-quarter report. GDP rebounded at a very substantial pace, at a 35.4 percent annual rate versus, however, 43.3 percent annual contraction in the second quarter. In year-over-year terms, contraction narrowed to 7.0 percent from 13.3 percent. All major sectors of Singapore's economy participated in the rebound including manufacturing and also services and especially construction which appears to have benefited the most from easing restrictions. But again, these bounces failed to reverse prior contraction. Note that advance GDP estimates are mainly computed using data from the first two months of the quarter. Revised GDP estimates for the quarter, incorporating more comprehensive data, are scheduled for publication in November. What to expect for coming GDP data was offered in the week by Singapore, a country ahead of others with its third-quarter report. GDP rebounded at a very substantial pace, at a 35.4 percent annual rate versus, however, 43.3 percent annual contraction in the second quarter. In year-over-year terms, contraction narrowed to 7.0 percent from 13.3 percent. All major sectors of Singapore's economy participated in the rebound including manufacturing and also services and especially construction which appears to have benefited the most from easing restrictions. But again, these bounces failed to reverse prior contraction. Note that advance GDP estimates are mainly computed using data from the first two months of the quarter. Revised GDP estimates for the quarter, incorporating more comprehensive data, are scheduled for publication in November.

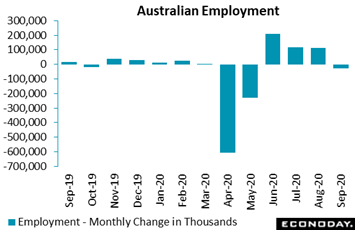

However spectacular upcoming GDP numbers may look, results for the subsequent quarter will be contained by a very difficult comparison with the third-quarter bounce and more fundamentally perhaps by the risk of tailing off improvement in global labor markets. This possibility was raised during the week by an unexpected rise in initial US jobless claims as it was also by a fall in Australian employment, down 29,500 in September to put a quick end to three months of post-virus recovery. Both full-time and part-time employment in Australia fell in September, by 20,100 and 9,400, respectively. After declines of nearly 1 million in April and May, employment remains well below pre-pandemic levels. However spectacular upcoming GDP numbers may look, results for the subsequent quarter will be contained by a very difficult comparison with the third-quarter bounce and more fundamentally perhaps by the risk of tailing off improvement in global labor markets. This possibility was raised during the week by an unexpected rise in initial US jobless claims as it was also by a fall in Australian employment, down 29,500 in September to put a quick end to three months of post-virus recovery. Both full-time and part-time employment in Australia fell in September, by 20,100 and 9,400, respectively. After declines of nearly 1 million in April and May, employment remains well below pre-pandemic levels.

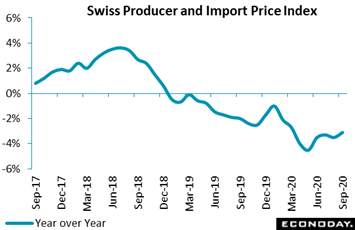

One set of data where comparison quirks have been comparatively limited and that offer a smoother look at all the troubles are prices, data that are sagging in most economies. Switzerland's combined producer and import price index did inch 0.1 percent higher on the month in September but the year-over-year rate remained deeply negative, at minus 3.1 percent. Though this is 4 tenths less deep than August and a 5-month high, it is still the 20th straight sub-zero showing. Prices at the domestic level have been in contraction as have import prices, the latter at 3.0 percent in September and underscoring not only weakness in global demand but, more specifically for the Swiss National Bank, the perpetual strength of the Swiss franc. One set of data where comparison quirks have been comparatively limited and that offer a smoother look at all the troubles are prices, data that are sagging in most economies. Switzerland's combined producer and import price index did inch 0.1 percent higher on the month in September but the year-over-year rate remained deeply negative, at minus 3.1 percent. Though this is 4 tenths less deep than August and a 5-month high, it is still the 20th straight sub-zero showing. Prices at the domestic level have been in contraction as have import prices, the latter at 3.0 percent in September and underscoring not only weakness in global demand but, more specifically for the Swiss National Bank, the perpetual strength of the Swiss franc.

Producer prices and import prices are both at the base of the price chain and offer advance indications of what to expect for the most important level of prices: what the consumer pays. Consumer prices in Italy were revised even lower in the final report for September, from annual contraction of 0.5 percent in the month's flash report to a record-equaling low of minus 0.6 percent. For Italy, this is the fifth straight month of CPI contraction, a streak that of course was triggered by virus lockdowns. September prices for processed food and alcohol contracted more deeply as they did for recreation and durable goods, offset only in part by easing contraction for energy as well as transport services. Producer prices and import prices are both at the base of the price chain and offer advance indications of what to expect for the most important level of prices: what the consumer pays. Consumer prices in Italy were revised even lower in the final report for September, from annual contraction of 0.5 percent in the month's flash report to a record-equaling low of minus 0.6 percent. For Italy, this is the fifth straight month of CPI contraction, a streak that of course was triggered by virus lockdowns. September prices for processed food and alcohol contracted more deeply as they did for recreation and durable goods, offset only in part by easing contraction for energy as well as transport services.

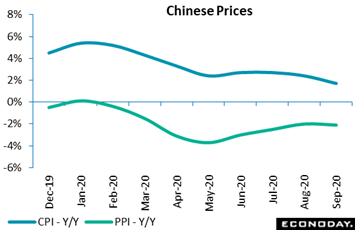

Ominous is a fair word to describe the risk that's unfolding: that deflationary pressures will lock interest rates at their lower bounds and limit even further what central banks can do to pull us out of this mess. Producer prices in China fell 2.1 percent on the year in September after dropping 2.0 percent in August. Fuel and power prices were down an annual 9.3 percent while prices of production materials fell 2.8 percent. Turning to consumer prices, they remained safely in the plus column at 1.7 percent though down sharply from August's 2.4 percent rate. Food prices remain very elevated at an annual 7.9 percent but this was down from 11.2 percent in August. Non-food inflation edged 1 tenth lower to no change at all from last year. Ominous is a fair word to describe the risk that's unfolding: that deflationary pressures will lock interest rates at their lower bounds and limit even further what central banks can do to pull us out of this mess. Producer prices in China fell 2.1 percent on the year in September after dropping 2.0 percent in August. Fuel and power prices were down an annual 9.3 percent while prices of production materials fell 2.8 percent. Turning to consumer prices, they remained safely in the plus column at 1.7 percent though down sharply from August's 2.4 percent rate. Food prices remain very elevated at an annual 7.9 percent but this was down from 11.2 percent in August. Non-food inflation edged 1 tenth lower to no change at all from last year.

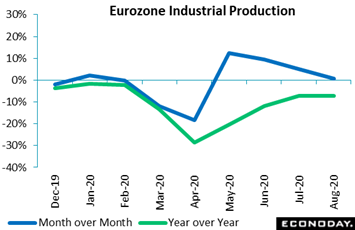

The week's data also included a run of mostly weak reports from the industrial economy, a sector that appears to be losing momentum at a fast pace. Industrial production in the Eurozone slowed once again in August, up only 0.7 percent for the smallest advance, and by some margin, since the recovery began back in May. Annual production edged lower to minus 7.2 percent. A special sign of weakness was a 1.6 percent monthly decline for capital goods, contraction not consistent with business optimism in future production. By country, Italy was strongly in the plus column at a monthly 7.7 percent with France solidly above zero at 1.3 percent, but Spain was no better than zero while industrial giant Germany was in contraction at minus 0.2 percent. This report is evidence that the recovery in Eurozone goods production was starting to run out of steam even before the latest round of localized lockdowns was introduced. This is particularly ominous since output in August was almost 6 percent below its pre-crisis level in February. The week's data also included a run of mostly weak reports from the industrial economy, a sector that appears to be losing momentum at a fast pace. Industrial production in the Eurozone slowed once again in August, up only 0.7 percent for the smallest advance, and by some margin, since the recovery began back in May. Annual production edged lower to minus 7.2 percent. A special sign of weakness was a 1.6 percent monthly decline for capital goods, contraction not consistent with business optimism in future production. By country, Italy was strongly in the plus column at a monthly 7.7 percent with France solidly above zero at 1.3 percent, but Spain was no better than zero while industrial giant Germany was in contraction at minus 0.2 percent. This report is evidence that the recovery in Eurozone goods production was starting to run out of steam even before the latest round of localized lockdowns was introduced. This is particularly ominous since output in August was almost 6 percent below its pre-crisis level in February.

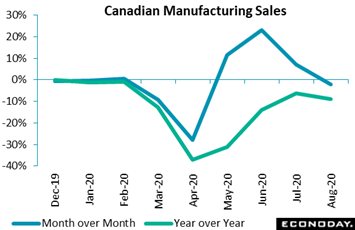

Showing a similar curve is manufacturing sales in Canada which unexpectedly lost ground in August. Following a 7.2 percent monthly jump in July, sales fell 2.0 percent for their first decline since April. The drop deepened annual contraction from minus 6.2 percent to minus 8.8 percent and widened the shortfall versus February's pre-pandemic level to 6.6 percent. August's decline was due to transportation equipment which slumped 13.7 percent on the back of a 12.5 percent drop in motor vehicles and a 25.0 percent nosedive in aerospace products and parts. The other main area of weakness was plastics and rubber products. On the positive side, wood products were particularly strong as were non-metallic mineral products and primary metals. Petroleum and coal products were up just 0.5 percent. Manufacturing sales are clearly slowing and, while still relatively low, rising infections warn that reacquiring lost momentum over coming months will not be easy for Canada. Showing a similar curve is manufacturing sales in Canada which unexpectedly lost ground in August. Following a 7.2 percent monthly jump in July, sales fell 2.0 percent for their first decline since April. The drop deepened annual contraction from minus 6.2 percent to minus 8.8 percent and widened the shortfall versus February's pre-pandemic level to 6.6 percent. August's decline was due to transportation equipment which slumped 13.7 percent on the back of a 12.5 percent drop in motor vehicles and a 25.0 percent nosedive in aerospace products and parts. The other main area of weakness was plastics and rubber products. On the positive side, wood products were particularly strong as were non-metallic mineral products and primary metals. Petroleum and coal products were up just 0.5 percent. Manufacturing sales are clearly slowing and, while still relatively low, rising infections warn that reacquiring lost momentum over coming months will not be easy for Canada.

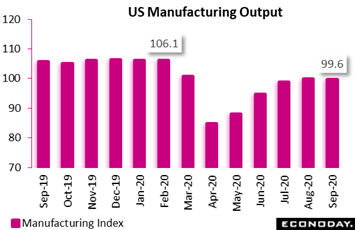

Backwards is also the signal from the U.S. where industrial production fell an unexpected 0.6 percent in data for September. Production remains 7.1 percent lower than February with manufacturing output, which fell 0.3 percent on the month, down 6.4 percent. Details included a 0.4 percent monthly decline in the production of machinery which, like capital goods in the Eurozone report, is a negative indication for business investment. This reading is down 7.8 percent compared to February. Vehicles were also a September negative, down 4.0 percent on the month and 5.5 percent short of February. Aircraft production, however, was a positive, up 6.7 percent on the month and, given Covid's impact on the travel industry, down a relatively moderate 4.8 percent from the beginning of the crisis. Overall, however, this report was certainly not positive, offering significant counterpoint to a US retail sales that unexpectedly (and inexplicably) shot higher in September. But US production needs more than just domestic demand for recovery, it needs foreign demand as well and here recovery has also been limited with goods exports down 6.9 percent from February in data released in the prior week. Backwards is also the signal from the U.S. where industrial production fell an unexpected 0.6 percent in data for September. Production remains 7.1 percent lower than February with manufacturing output, which fell 0.3 percent on the month, down 6.4 percent. Details included a 0.4 percent monthly decline in the production of machinery which, like capital goods in the Eurozone report, is a negative indication for business investment. This reading is down 7.8 percent compared to February. Vehicles were also a September negative, down 4.0 percent on the month and 5.5 percent short of February. Aircraft production, however, was a positive, up 6.7 percent on the month and, given Covid's impact on the travel industry, down a relatively moderate 4.8 percent from the beginning of the crisis. Overall, however, this report was certainly not positive, offering significant counterpoint to a US retail sales that unexpectedly (and inexplicably) shot higher in September. But US production needs more than just domestic demand for recovery, it needs foreign demand as well and here recovery has also been limited with goods exports down 6.9 percent from February in data released in the prior week.

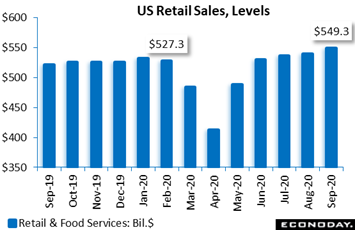

Since it's always bad luck to end our rundown on a down note, let's go ahead and take a look at that retail sales report which showed no ill effects at all from anything. September sales in the US jumped 1.9 percent on the month to easily exceed expectations. Core readings also easily beat expectations and included a 1.5 percent gain for the control group which is a specific input into GDP. Total sales have now exceeded their pre-virus level for four straight months and stand a remarkably solid 4.2 percent higher than February. Monthly gains swept September's components whether vehicles at 3.6 percent, or restaurants at 2.1 percent, or general merchandise at 1.8 percent. Clothing stores at 11.0 percent posted the highest monthly gain with department stores at 9.7 percent. Yes, this report will be lifting third-quarter GDP estimates, but how long the spending spree can last is the real question given extremely high levels of joblessness and a continued absence of new fiscal support. Since it's always bad luck to end our rundown on a down note, let's go ahead and take a look at that retail sales report which showed no ill effects at all from anything. September sales in the US jumped 1.9 percent on the month to easily exceed expectations. Core readings also easily beat expectations and included a 1.5 percent gain for the control group which is a specific input into GDP. Total sales have now exceeded their pre-virus level for four straight months and stand a remarkably solid 4.2 percent higher than February. Monthly gains swept September's components whether vehicles at 3.6 percent, or restaurants at 2.1 percent, or general merchandise at 1.8 percent. Clothing stores at 11.0 percent posted the highest monthly gain with department stores at 9.7 percent. Yes, this report will be lifting third-quarter GDP estimates, but how long the spending spree can last is the real question given extremely high levels of joblessness and a continued absence of new fiscal support.

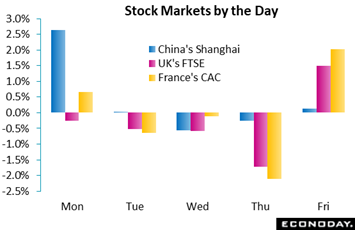

Plans in China authorizing economic reform, deregulation, and enhanced development in Shenzhen gave Chinese shares a big boost on Monday; yet other markets were mixed largely on fading hopes for new US stimulus which had fizzled completely (or nearly so) by week's end. News that Johnson & Johnson had suspended its vaccine trials after a patient became ill dampened recovery hopes on Tuesday and also depressed bond yields, which hurt bank stocks. Eli Lilly also suspended vaccine trials on Tuesday. Virus news remained in focus on Wednesday as authorities in the UK, France, the Netherlands were poised to impose new restrictions as cases reaccelerated across Europe. Also in focus all week were UK-EU Brexit negotiations amid sporadic optimism but new pessimism by Friday when Downing Street said there was "no point" and "no basis" for any further talks. Though a hard Brexit looks more than predictable, it didn't hurt either the FTSE or the CAC which both rallied strongly at week's end. Predicting how stock markets should move can be an unreliable business. Plans in China authorizing economic reform, deregulation, and enhanced development in Shenzhen gave Chinese shares a big boost on Monday; yet other markets were mixed largely on fading hopes for new US stimulus which had fizzled completely (or nearly so) by week's end. News that Johnson & Johnson had suspended its vaccine trials after a patient became ill dampened recovery hopes on Tuesday and also depressed bond yields, which hurt bank stocks. Eli Lilly also suspended vaccine trials on Tuesday. Virus news remained in focus on Wednesday as authorities in the UK, France, the Netherlands were poised to impose new restrictions as cases reaccelerated across Europe. Also in focus all week were UK-EU Brexit negotiations amid sporadic optimism but new pessimism by Friday when Downing Street said there was "no point" and "no basis" for any further talks. Though a hard Brexit looks more than predictable, it didn't hurt either the FTSE or the CAC which both rallied strongly at week's end. Predicting how stock markets should move can be an unreliable business.

Whether or not the global economy is beginning to sink backwards is one question, but there's no question at all that employment and prices and production are all suffering. Low interest rates and unlimited QE have done their share to limit damage, but less so for fiscal policy where spending programs are or already have run their course. And the answer to all this of course is a getting vaccine in place.

--Jeremy Hawkins, Brian Jackson, and Mace News contributed to this article

The week opens with a bang: third-quarter GDP from China which is expected to rise a useful but still moderate 3.3 percent. Monthly Chinese data will follow including both industrial production and retail sales where limited improvement is the call. Japanese trade data will also be posted Monday, and extending cross-border contraction, especially for imports, is the consensus. No improvement at all is the expectation for the week's sentiment data which are all packed on Thursday: Germany's GfK consumer climate, France's business climate, and the EC consumer confidence flash. And marginal slowing is the general consensus for Friday's monthly run of PMI flashes, opening with France followed by Germany and the UK and ending with the US. Inflation reports, from the UK and Japan, are likewise expected to show a notable lack of life in the week. Other data include another claims report from the US where new improvement is the hope as well as housing starts and permits from the US where explosive acceleration is expected.

Japanese Merchandise Trade for September (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast: +¥976 billion

Consensus Forecast, Imports Y/Y: -21.5%

Consensus Forecast, Exports Y/Y: -2.4%

Japanese trade continued to show deep contraction in August, at a year-over-year 20.8 percent for imports and 14.8 percent for exports. Expectations for September are import contraction of 21.5 percent and export contraction of 2.4 percent with the net balance seen in surplus at ¥976 billion.

Chinese Third-Quarter GDP (Estimated for Monday)

Consensus Forecast, Year over Year: 3.3%

Third-quarter GDP is expected to rise 3.3 percent on a year-over-year basis versus 3.2 percent growth in the second quarter that followed 6.8 percent contraction in the first quarter.

Chinese Industrial Production for September (Mon 02:00 GMT; Mon 10:00 CST; Sun 22:00 EDT)

Consensus Forecast, Year over Year: 5.7%

Industrial production in China is expected to build at least fractional momentum in September, seen rising a year-over-year 5.7 percent following August’s 5.6 percent which beat expectations for 4.8 percent.

Chinese Retail Sales for September (Tue 02:00 GMT; Tue 10:00 CST; Mon 22:00 EDT)

Consensus Forecast, Year over Year: 1.9%

At a consensus of plus 1.9 percent, Chinese retail sales in September are expected to continue to improve from year-over-year growth of 0.5 percent in August which, after three straight weaker-than-expected results, was better than expected.

US Housing Starts for September (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Annual Rate: 1.451 million

US Building Permits

Consensus Forecast: 1.500 million

Starts haven’t been able to keep pace with permits though both have been rising sharply amid a surge underway in new home sales. Expectations for September starts are a 1.451 million rate versus August's 1.416 million with permits seen at 1.500 million versus 1.470 million.

UK CPI for September (Wed 08:30 GMT; Wed 09:30 BST; Wed 04:30 EDT)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Year over Year: 0.5%

Consumer prices, reflecting government stimulus policies, are seen rising 0.4 percent on the month in September, increasing annual inflation from August's 0.2 percent to 0.5 percent.

Germany: GfK Consumer Climate for November (Thu 06:00 GMT; Thu 08:00 CEST; Thu 02:00 EDT)

Consensus Forecast: -2.8

GfK's survey for November, at a consensus of minus 2.8, is expected to show no improvement from October's minus 1.6.

French Business Climate Indicator for October (Thu 06:45 GMT; Thu 08:45 CEST; Thu 02:45 EDT)

Consensus Forecast, Manufacturing: 96

Manufacturing sentiment is expected to hold unchanged at 96 in October.

US Initial Jobless Claims for October 17 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 868,000

Initial jobless claims went in the wrong direction in the October 10 week, rising 53,000 to a much higher-than-expected 898,000. Expectations for the October 17 week — one that will track the sampling week of the October employment report — is for a decline to 868,000.

Eurozone: EC Consumer Confidence Flash for October (Thu 14:00 GMT; Thu 16:00 CEST; Thu 10:00 EDT)

Consensus Forecast: -14.6

Consumer confidence has been improving but slowly; the consensus for October is a reversal to minus 14.6 versus September's minus 13.9.

Japanese Consumer Price Index for September (Thu 23:30 GMT; Fri 08:30 JST; Thu 19:30 EDT)

Consensus Forecast Ex-Food, Year over Year: -0.4%

Price pressures at the consumer level are expected to remain dormant, unchanged in September at year-over-year contraction of 0.4 percent for the ex-food reading.

French PMI Composite Flash for October (Fri 07:15 GMT; Fri 09:15 CEST; Fri 03:15 EDT)

Consensus Forecast, Composite: 47.5

Consensus Forecast, Manufacturing: 51.0

Consensus Forecast, Services: 46.8

France's PMIs, having shot to the upper 50s in July, cooled off to the low 50s in August and fell down to the high 40s in September. Expectations for October are for a move back to the low 50s for manufacturing, at a consensus 51.0, with services still struggling at 46.8.

German PMI Composite Flash for October (Fri 07:30 GMT; Fri 09:30 CEST; Fri 03:30 EDT)

Consensus Forecast, Composite: 53.5

Consensus Forecast, Manufacturing: 55.5

Consensus Forecast, Services: 48.9

Manufacturing was far out in front in September, posting a September final of 56.4 and a flash of 56.6 in contrast to services which ended at 50.6 after dipping in the flash to 49.1. October's expectations are 55.5 for manufacturing and 48.9 for services.

UK PMI Composite Flash for October (Fri 08:30 GMT; Fri 09:30 BST; Fri 04:30 EDT)

Consensus Forecast, Composite: 54.1

Consensus Forecast, Manufacturing: 53.6

Consensus Forecast, Services: 54.6

Marginally slowing growth near the mid-50s is expected for the PMIs, at 53.6 for manufacturing and 54.6 for services.

US PMI Composite Flash for October (Fri 13:45 GMT; Fri 09:45 EDT)

Consensus Forecast, Composite: 54.2

Consensus Forecast, Manufacturing: 53.2

Consensus Forecast, Services: 54.6

Both the manufacturing and services samples for the US held steady in September, in the low to mid 50s. The consensus for October's flashes is more of the same, at 53.2 for manufacturing and with services seen at 54.6.

|