|

Global Economics will be taking the October 30 week off. The next article will be dated November 6, 2020

There are upside surprises in the week's global statistics, especially recovery in China and also exponential growth underway in US housing which, however, may be no positive at all. Clearly not favorable was the week's run of sentiment readings from Europe which are sagging due to Covid and not pointing to year-end acceleration for the continent.

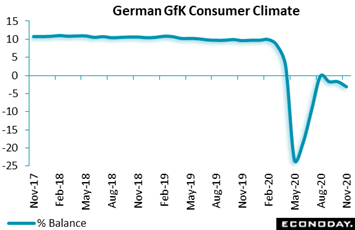

Germany's GfK survey confirmed that consumer sentiment is deteriorating and may worsen in November. October's consumer climate indicator was revised slightly lower to minus 1.7 versus September's minus 0.2, while the provisional indicator for November was on the soft side of expectations at minus 3.1. Details for October showed all three components posting fresh declines, reflecting rising Covid infections which 74 percent of respondents saw as a major threat. Economic expectations were hit particularly hard, sliding 17 points from September to 7.1. Confidence in a rapid economic recovery has also faded though this gauge is still nearly 21 points higher than October last year. Yet income expectations, down 6.3 points at 9.8, are 29 points short of this time last year. The drop here would no doubt have been sharper but for the relative resilience of the labor market courtesy of government support programs. The latest results suggest that the initial bounce-back in consumer sentiment may have already run its course. Moreover, with the number of daily Covid cases in Germany rising by more than 10,000 in the week (an unwanted first), consumer confidence may well post further losses over the near-term at least. Germany's GfK survey confirmed that consumer sentiment is deteriorating and may worsen in November. October's consumer climate indicator was revised slightly lower to minus 1.7 versus September's minus 0.2, while the provisional indicator for November was on the soft side of expectations at minus 3.1. Details for October showed all three components posting fresh declines, reflecting rising Covid infections which 74 percent of respondents saw as a major threat. Economic expectations were hit particularly hard, sliding 17 points from September to 7.1. Confidence in a rapid economic recovery has also faded though this gauge is still nearly 21 points higher than October last year. Yet income expectations, down 6.3 points at 9.8, are 29 points short of this time last year. The drop here would no doubt have been sharper but for the relative resilience of the labor market courtesy of government support programs. The latest results suggest that the initial bounce-back in consumer sentiment may have already run its course. Moreover, with the number of daily Covid cases in Germany rising by more than 10,000 in the week (an unwanted first), consumer confidence may well post further losses over the near-term at least.

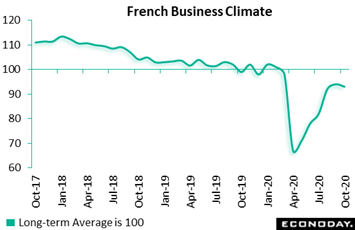

As consumer sentiment goes, so goes consumer spending; and as consumer spending goes, so goes business sentiment (at least in theory). Manufacturing sentiment in France has deteriorated slightly this month, to 93 from September's 94. This is the first decline since the recovery began back in May. The drop left the measure 8 points short of its pre-lockdown level in February, making for yet another sagging 'V' as tracked in the graph. October's dip masked another improvement in past output and reflected instead weaker overall order books and a markedly worse view of the outlook. Production expectations recorded significant declines and are back at levels early in the crisis. Accompanying data for services and the retail sector also posted their first setbacks of the recovery. As consumer sentiment goes, so goes consumer spending; and as consumer spending goes, so goes business sentiment (at least in theory). Manufacturing sentiment in France has deteriorated slightly this month, to 93 from September's 94. This is the first decline since the recovery began back in May. The drop left the measure 8 points short of its pre-lockdown level in February, making for yet another sagging 'V' as tracked in the graph. October's dip masked another improvement in past output and reflected instead weaker overall order books and a markedly worse view of the outlook. Production expectations recorded significant declines and are back at levels early in the crisis. Accompanying data for services and the retail sector also posted their first setbacks of the recovery.

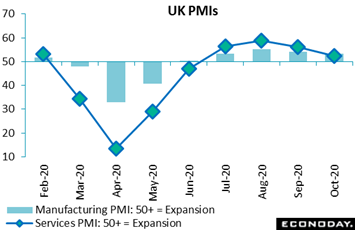

The week's calendar ended with a host of purchasing manager indexes, from Japan to Germany to the US and which on the whole are pointing to mostly steady but not improving conditions. PMIs from the UK showed slight deceleration, with manufacturing slowing nearly a point to a moderate 53.3 and services slowing more than 4 points to a less-than-moderate score of 52.3. Manufacturing details included slowing in output while services signaled trouble for the travel, leisure and hospitality industries. New orders were soft especially for services while employment in both samples was once again cut aggressively. October's flashes indicate a clear loss of momentum at the start of the fourth quarter for the UK economy, especially in services where new restrictions are having their greatest impact. Although retail spending seems to be holding up well, rising redundancies could soon change that and uncertainty over the post-Brexit trading relationship with the European Union will hardly boost confidence. The results should support speculation for more QE from the Bank of England at next month's policy meeting. The week's calendar ended with a host of purchasing manager indexes, from Japan to Germany to the US and which on the whole are pointing to mostly steady but not improving conditions. PMIs from the UK showed slight deceleration, with manufacturing slowing nearly a point to a moderate 53.3 and services slowing more than 4 points to a less-than-moderate score of 52.3. Manufacturing details included slowing in output while services signaled trouble for the travel, leisure and hospitality industries. New orders were soft especially for services while employment in both samples was once again cut aggressively. October's flashes indicate a clear loss of momentum at the start of the fourth quarter for the UK economy, especially in services where new restrictions are having their greatest impact. Although retail spending seems to be holding up well, rising redundancies could soon change that and uncertainty over the post-Brexit trading relationship with the European Union will hardly boost confidence. The results should support speculation for more QE from the Bank of England at next month's policy meeting.

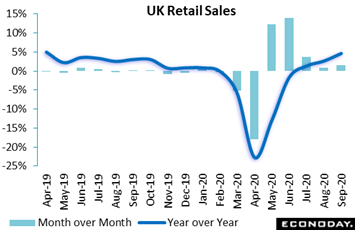

One of the features emerging in global economic data is comparative strength for spending on goods which appears to be benefiting from lack of spending on services. Retailers in the UK enjoyed a surprisingly strong September. Following a 0.9 percent monthly rise in August, sales climbed 1.5 percent on the month, easily outstripping market expectations. The big bounce boosted year-over-year growth from 2.7 percent to 4.7 percent, its highest reading since April last year and which put volumes 5.5 percent above their pre-lockdown level in February. Textiles and clothing jumped sharply in September while sales also rose for food and household goods. Online sales fell for a third straight month but still accounted for 27.5 percent of total retail sales, up from 20.1 percent in February. The September report puts third-quarter sales volumes a record 17.4 percent above their second-quarter level and so leaves the economy on track for an unprecedented rebound last quarter. Yet with parts of the country once again under lockdown, retail sales in the October report may well be less favorable. One of the features emerging in global economic data is comparative strength for spending on goods which appears to be benefiting from lack of spending on services. Retailers in the UK enjoyed a surprisingly strong September. Following a 0.9 percent monthly rise in August, sales climbed 1.5 percent on the month, easily outstripping market expectations. The big bounce boosted year-over-year growth from 2.7 percent to 4.7 percent, its highest reading since April last year and which put volumes 5.5 percent above their pre-lockdown level in February. Textiles and clothing jumped sharply in September while sales also rose for food and household goods. Online sales fell for a third straight month but still accounted for 27.5 percent of total retail sales, up from 20.1 percent in February. The September report puts third-quarter sales volumes a record 17.4 percent above their second-quarter level and so leaves the economy on track for an unprecedented rebound last quarter. Yet with parts of the country once again under lockdown, retail sales in the October report may well be less favorable.

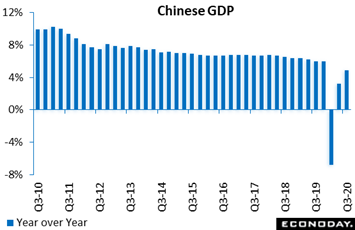

The week's unequivocally good news came from China, including September acceleration for retail sales and industrial production and which fed a stronger-than-expected showing for GDP. China's economy expanded 4.9 percent on the year in the third quarter, strengthening solidly from growth of 3.2 percent in the second quarter. On a quarter-to-quarter basis, GDP increased 2.7 percent after the second quarter's 11.5 percent rebound. People's Bank of China Governor Yi Gang expressed confidence about the near-term outlook, predicting that the economy will record annual growth of around 2.0 percent this year despite the sharp contraction suffered during the initial stages of the pandemic. This is broadly in line with the International Monetary Fund's forecast which were updated earlier this month. The week's unequivocally good news came from China, including September acceleration for retail sales and industrial production and which fed a stronger-than-expected showing for GDP. China's economy expanded 4.9 percent on the year in the third quarter, strengthening solidly from growth of 3.2 percent in the second quarter. On a quarter-to-quarter basis, GDP increased 2.7 percent after the second quarter's 11.5 percent rebound. People's Bank of China Governor Yi Gang expressed confidence about the near-term outlook, predicting that the economy will record annual growth of around 2.0 percent this year despite the sharp contraction suffered during the initial stages of the pandemic. This is broadly in line with the International Monetary Fund's forecast which were updated earlier this month.

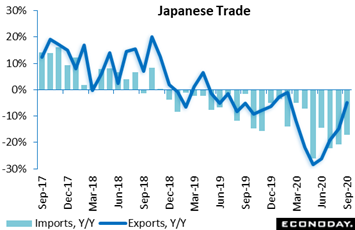

Showing less strength than China but still some improvement were the latest trade data from Japan. Contraction in Japanese exports narrowed to an annual 4.9 percent in September from August contraction of 14.8 percent, while contraction in imports, despite broad weakness among most categories, eased to 17.2 percent from 20.8 percent. The smaller decline in exports was partly driven by a small increase in exports to the US and by tangibly stronger demand from China, with exports to that destination up 14.0 percent on the year. Exports, however, to other major destinations fell further, including to the EU, Hong Kong, Taiwan, and Korea. Japan's trade surplus in the month, reflecting the greater improvement for exports, rose to ¥675.0 billion in September from ¥248.6 billion in August. Showing less strength than China but still some improvement were the latest trade data from Japan. Contraction in Japanese exports narrowed to an annual 4.9 percent in September from August contraction of 14.8 percent, while contraction in imports, despite broad weakness among most categories, eased to 17.2 percent from 20.8 percent. The smaller decline in exports was partly driven by a small increase in exports to the US and by tangibly stronger demand from China, with exports to that destination up 14.0 percent on the year. Exports, however, to other major destinations fell further, including to the EU, Hong Kong, Taiwan, and Korea. Japan's trade surplus in the month, reflecting the greater improvement for exports, rose to ¥675.0 billion in September from ¥248.6 billion in August.

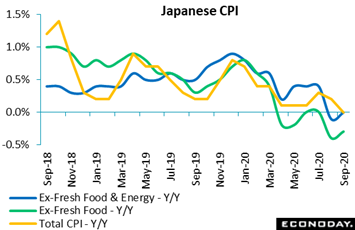

Japanese data that are not showing much if any improvement are consumer prices which remained subdued in September. Japan's headline consumer price index was unchanged on the year, weakening from an increase of 0.2 percent in August. Relatively strong price increases for clothes and footwear as well as furniture and household utensils were offset by large price declines for utilities and education; and though transportation and communication prices rose slightly, food price inflation slowed. When excluding fresh food, prices fell 0.3 percent after dropping 0.4 percent in August. The Bank of Japan's preferred measure of underlying inflation, which excludes fresh food and energy prices, was like the headline also unchanged on the year after August's 0.1 percent decline. At their policy meeting held last month, BoJ officials repeated that inflation remained close to zero and was expected to remain weak in the near-term and increase only gradually thereafter. September's results suggest that progress toward the bank's distant 2 percent goal isn't gaining any traction which strengthens the case for additional policy measures. The BoJ's next policy meeting will be a highlight of the upcoming week. Japanese data that are not showing much if any improvement are consumer prices which remained subdued in September. Japan's headline consumer price index was unchanged on the year, weakening from an increase of 0.2 percent in August. Relatively strong price increases for clothes and footwear as well as furniture and household utensils were offset by large price declines for utilities and education; and though transportation and communication prices rose slightly, food price inflation slowed. When excluding fresh food, prices fell 0.3 percent after dropping 0.4 percent in August. The Bank of Japan's preferred measure of underlying inflation, which excludes fresh food and energy prices, was like the headline also unchanged on the year after August's 0.1 percent decline. At their policy meeting held last month, BoJ officials repeated that inflation remained close to zero and was expected to remain weak in the near-term and increase only gradually thereafter. September's results suggest that progress toward the bank's distant 2 percent goal isn't gaining any traction which strengthens the case for additional policy measures. The BoJ's next policy meeting will be a highlight of the upcoming week.

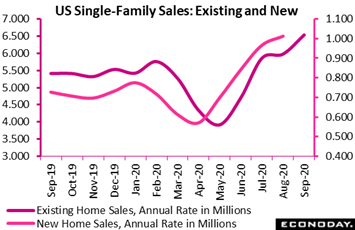

However much many of the 'V's in the economic graphs look a bit soft and lopsided, that's not the case for those coming out of the US housing sector. In yet the latest superlative, sales of existing homes shot 9.4 percent higher in September to a 6.540 million annual rate for the greatest monthly gain since the subprime bubble of 2006. This rate is now far past February's pre-pandemic 5.760 million. Low mortgage rates are fueling this year's vast surge though future gains look to limited by lack of supply, down 1.3 percent in the month to 1.470 million resales on the market. At September's sales rate, this equates to a very tiny and historically low 2.7 months of supply. Limited supply together with robust demand are positives for prices which rose 0.5 percent on the median to $311,800. This is up an eye-popping 14.8 percent from September last year. All regions in this great US bonanza are participating about evenly, up roughly 20 percent on the year for each of the four that are tracked. Though the Federal Reserve's latest Beige Book, released in the week ahead of next month's FOMC, described residential demand as no better than "steady", Jerome Powell will have to be especially nimble to once again dodge questions whether monetary policy is feeding another unsustainable (and potentially catastrophic) bubble. However much many of the 'V's in the economic graphs look a bit soft and lopsided, that's not the case for those coming out of the US housing sector. In yet the latest superlative, sales of existing homes shot 9.4 percent higher in September to a 6.540 million annual rate for the greatest monthly gain since the subprime bubble of 2006. This rate is now far past February's pre-pandemic 5.760 million. Low mortgage rates are fueling this year's vast surge though future gains look to limited by lack of supply, down 1.3 percent in the month to 1.470 million resales on the market. At September's sales rate, this equates to a very tiny and historically low 2.7 months of supply. Limited supply together with robust demand are positives for prices which rose 0.5 percent on the median to $311,800. This is up an eye-popping 14.8 percent from September last year. All regions in this great US bonanza are participating about evenly, up roughly 20 percent on the year for each of the four that are tracked. Though the Federal Reserve's latest Beige Book, released in the week ahead of next month's FOMC, described residential demand as no better than "steady", Jerome Powell will have to be especially nimble to once again dodge questions whether monetary policy is feeding another unsustainable (and potentially catastrophic) bubble.

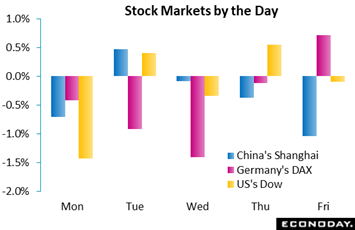

On-and-off hopes for last-minute stimulus in the US kept a floor under global equities in the week, though with no agreement reached by Friday the odds seem heavy that a package could be put in place before the November 3 presidential election. Equities got a more tangible lift from the bounce higher in Chinese GDP though it did little for the Shanghai which ended lower on Monday and down 1.7 percent on the week. Vaccine prospects, in contrast to actual virus news, were another positive: on Tuesday US biotech Moderna said it may get permission to roll out its vaccine in December, and AstraZeneca's North American vaccine trials were expected to resume. The most tangible negative in the week was current rates of infection as partial restrictions were reimposed in Ireland, the UK, France, Italy, Belgium and Switzerland. The week saw Germany's DAX losing 2.8 percent and the US's Dow down 0.9 percent. On-and-off hopes for last-minute stimulus in the US kept a floor under global equities in the week, though with no agreement reached by Friday the odds seem heavy that a package could be put in place before the November 3 presidential election. Equities got a more tangible lift from the bounce higher in Chinese GDP though it did little for the Shanghai which ended lower on Monday and down 1.7 percent on the week. Vaccine prospects, in contrast to actual virus news, were another positive: on Tuesday US biotech Moderna said it may get permission to roll out its vaccine in December, and AstraZeneca's North American vaccine trials were expected to resume. The most tangible negative in the week was current rates of infection as partial restrictions were reimposed in Ireland, the UK, France, Italy, Belgium and Switzerland. The week saw Germany's DAX losing 2.8 percent and the US's Dow down 0.9 percent.

A quick fade for the recovery would put renewed stress on global monetary policy which is already at an extreme and which in the US may already be creating unsustainable dislocations in the housing sector. One uncertainty that, barring a draw, looks to disappear is the election in the US, where an outcome, both for the president and congress, would define a new set of expectations, whether for fiscal stimulus or general economic recovery.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

Central banks will be busy in the week amid outside chances perhaps for new stimulus, if not rate cuts than increases in QE. The Bank of Canada will be posting its statement on Wednesday with the Bank of Japan and European Central Bank both on Thursday. For economic data, it will be a very busy week for the US starting with new home sales on Monday where yet another gain is the call; this will be followed on Tuesday by durable goods orders and consumer confidence, neither of which are expected to show much improvement. And expected to deepen yet further is the US goods deficit on Wednesday. But the highlight for the record books will be the US GDP report for the third quarter where a spectacular gain is expected to nearly match the catastrophic collapse of the second quarter. Confidence readings in Europe have been slumping as Covid has been rising; Germany's Ifo report will be posted on Monday and the EC economic sentiment report on Thursday, and both are expected to slip. Germany's unemployment rate on Thursday and Japanese industrial production on Friday will also be worth watching. Note that clocks will be moving backward in Europe as well as the UK on Sunday, October 25, followed in the subsequent week in the US and Canada on Sunday, November 1.

German Ifo Business Climate Indicator for October (Mon 09:00 GMT; Mon 10:00 CET; Mon 05:00 EDT)

Consensus Forecast: 92.9

Economic sentiment has been rising and, at 93.4 in September, was just 2.5 points short of its pre-pandemic level. Yet October's consensus is for a step backward to 92.9.

US New Home Sales for September (Mon 14:00 GMT; Mon 10:00 EDT)

Consensus Forecast, Annual Rate: 1.016 million

New home sales have been soaring, easily beating Econoday's consensus the last five reports. After August's 1.011 million annual rate, Econoday's consensus for September is 1.016 million.

US Durable Goods Orders for September (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast: Month over Month: 0.4%

Consensus Forecast: Ex-Transportation - M/M: 0.4%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.5%

Recovery in durable goods orders is expected to hold steady in September, at a 0.4 percent monthly increase following August's 0.5 percent gain (revised from an initial 0.4 percent).

US Consumer Confidence Index for October (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 102.0

The consumer confidence shot higher in September to a far higher-than-expected 101.8 though the index still remained 30 points below where it was before the virus hit. For October, Econoday's consensus is for little change at 102.0.

US Goods Trade (Advance) for September (Wed 12:30 GMT; Wed 08:30 EDT)

Consensus Forecast, Balance: -$85.0 billion

The US goods deficit (census basis) is expected to deepen further to $85.0 billion in September versus $83.1 billion in August (revised from an initial $82.9 billion). Goods imports were down 4.0 percent year-over-year in September but were up 2.7 percent relative to the pre-virus month of February; goods exports were down 13.0 percent on the year and down 6.9 percent versus February.

Bank of Canada Announcement (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Bank of Canada is expected to hold rates steady at plus 0.25 percent. The BoC has bond-buying programs in place including for corporate bonds.

Bank of Japan Announcement (Anytime Thursday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

The Bank of Japan kept its policy rate unchanged at minus 0.1 percent at its September meeting which is the expectation for September. The BoJ is committed to aggressive accommodation; additional stimulus measures could be on the table.

German Unemployment Rate for October (Wed 08:55 GMT; Wed 09:55 CET; Wed 04:55 EDT)

Consensus Forecast: 6.4%

Reflecting government support programs, Germany's unemployment rate has held rock steady since May; and steady is the expectation for October, unchanged at 6.4 percent.

Eurozone: EC Economic Sentiment for October (Thu 10:00 GMT; Thu 11:00 CET; Thu 06:00 EDT)

Consensus Forecast: 89.6

The European Commission's economic sentiment index has recovered in each of the last five reports. But this is not the expectation for October, at a consensus 89.6 versus 91.1 in September.

US Initial Jobless Claims for October 24 week (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 758,000

Initial jobless claims ratcheted lower after California, which had suspended reporting, came back on line. Claims in the October 17 week fell sharply to 787,000 with Econoday's consensus for the October 24 week calling for further improvement to 758,000.

European Central Bank Policy Announcement (Thu 12:45 GMT; Thu 13:45 CET; Thu 08:45 EDT)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

With rates at zero and QE in place, the European Central Bank is not expected to make any policy moves.

US GDP: Third Quarter, Annual Rate (Thu 12:30 GMT; Thu 08:30 EDT)

Consensus Forecast: 30.9%

US Real Personal Consumption Expenditures

Consensus Forecast: 38.9%

GDP is expected to soar higher to annual growth of 30.9 percent following deeply severe contraction of 31.4 percent during the Covid lockdowns of the second quarter. Personal consumption expenditures are expected to rise at a 38.9 percent pace versus 33.2 percent contraction.

Japanese Industrial Production for September (Thu 23:50 GMT; Fri 08:50 JST; Thu 19:50 EDT)

Consensus Forecast, Month over Month: 3.1%

A percent monthly 3.1 increase is expected for industrial production in September which in August rose 1.7 percent. Year-over-year this index in August was still down 13.3 percent.

|