|

Global stock markets soared following an uncertain outcome to the US election, one that may or may not be pointing to lesser or greater stimulus. But we'll get to that later. As far as concrete events go, it was a central bank down under that kicked off the week with a rate cut that was only the tip of the iceberg.

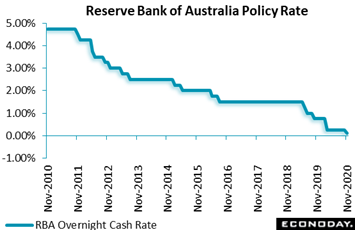

Saying the domestic economy will require support for "some time", the Reserve Bank of Australia cut its main policy rate on Tuesday by 15 basis points to a new low of 0.10 percent, in line with expectations and part of efforts to support job creation and economic recovery. This rate was last cut in April by 25 basis points as part of the bank's initial response to the pandemic. Among additional actions, the bank also cut its yield target for the 3-year Australian government bond by 15 basis points to 0.10 percent and, in a first, announced the purchase over the next six months of A$100 billion of government bonds in the 5- to 10- year maturity range. Though the statement said the economic recovery is now "under way", the RBA cautioned that it will take some time for output to return to pre-pandemic levels. Unemployment, though expected to fall gradually over the next two years, is likely to stay high in turn keeping wages and price pressures subdued, with officials forecasting underlying inflation to be 1.0 percent in 2021 and 1.5 percent in 2022, well below their 2 to 3 percent target range. Despite current economic weakness, bank officials made it clear that they are not interested in moving to negative rates, advising instead that quantitative easing will be their main policy tool in the period ahead, promising to increase these purchases if required and monitoring the impact they have on economic conditions. Saying the domestic economy will require support for "some time", the Reserve Bank of Australia cut its main policy rate on Tuesday by 15 basis points to a new low of 0.10 percent, in line with expectations and part of efforts to support job creation and economic recovery. This rate was last cut in April by 25 basis points as part of the bank's initial response to the pandemic. Among additional actions, the bank also cut its yield target for the 3-year Australian government bond by 15 basis points to 0.10 percent and, in a first, announced the purchase over the next six months of A$100 billion of government bonds in the 5- to 10- year maturity range. Though the statement said the economic recovery is now "under way", the RBA cautioned that it will take some time for output to return to pre-pandemic levels. Unemployment, though expected to fall gradually over the next two years, is likely to stay high in turn keeping wages and price pressures subdued, with officials forecasting underlying inflation to be 1.0 percent in 2021 and 1.5 percent in 2022, well below their 2 to 3 percent target range. Despite current economic weakness, bank officials made it clear that they are not interested in moving to negative rates, advising instead that quantitative easing will be their main policy tool in the period ahead, promising to increase these purchases if required and monitoring the impact they have on economic conditions.

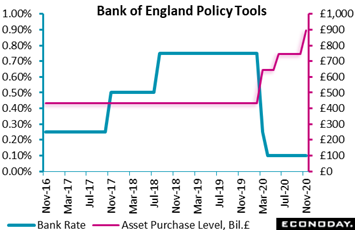

Unlike the RBA but like many other central banks, the Bank of England has been using bond purchases all along. The QE bar, last raised in June, was lifted by a further £150 billion to £895 billion of which gilts will account for £875 billion. This was on the high side of market expectations. Yet limited speculation about a cut in Bank Rate proved premature and the benchmark was held at the record 0.10 percent low where it was cut back in March. Weekly QE net asset purchases have been running close to £4.5 billion and at a constant pace will hit the former £745 billion ceiling by the end of the year. The official statement and minutes inevitably reflected growing concerns about the economic outlook, reinforced by the "soft" nationwide lockdown that is now in effect. The bank downgraded its near-term growth projection with fourth-quarter GDP seen posting renewed contraction of 2.0 percent. Against this backdrop, CPI inflation is expected to remain around 0.5 percent during much of the winter but is then seen rising quite sharply toward the 2 percent target as the effects of lower oil prices and July's temporary cut in value-added taxes dissipate. The minutes that accompanied Thursday's statement had a dovish tone, suggesting that should the second Covid wave prove difficult to contain, there could yet be more stimulus to come. Unlike the RBA but like many other central banks, the Bank of England has been using bond purchases all along. The QE bar, last raised in June, was lifted by a further £150 billion to £895 billion of which gilts will account for £875 billion. This was on the high side of market expectations. Yet limited speculation about a cut in Bank Rate proved premature and the benchmark was held at the record 0.10 percent low where it was cut back in March. Weekly QE net asset purchases have been running close to £4.5 billion and at a constant pace will hit the former £745 billion ceiling by the end of the year. The official statement and minutes inevitably reflected growing concerns about the economic outlook, reinforced by the "soft" nationwide lockdown that is now in effect. The bank downgraded its near-term growth projection with fourth-quarter GDP seen posting renewed contraction of 2.0 percent. Against this backdrop, CPI inflation is expected to remain around 0.5 percent during much of the winter but is then seen rising quite sharply toward the 2 percent target as the effects of lower oil prices and July's temporary cut in value-added taxes dissipate. The minutes that accompanied Thursday's statement had a dovish tone, suggesting that should the second Covid wave prove difficult to contain, there could yet be more stimulus to come.

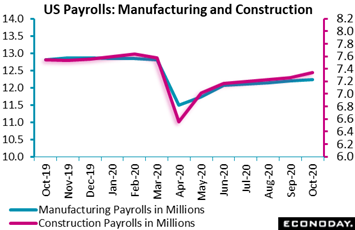

The US Federal Reserve also met in the week and though making no new moves, Jerome Powell did say that policy makers, in the event of a new economic downturn, are discussing possible changes to QE parameters including changes in composition (mix of Treasuries and mortgage-backed securities) and maturity duration. Like Europe, infection rates are moving higher in the US especially over the past couple of weeks, but indications of new troubles were not evident in the October employment report which mostly proved better than expected, that is showing only modest slowing in the rate of recovery. Nonfarm payrolls rose 638,000 versus 672,000 in September with big gains posted by retail, health care, leisure and hospitality, and also temporary help services, the latter a sign that employers are scrambling to fill vacancies. Not recovering, however, were local and state education where payrolls dropped sharply in what is likely an unfolding and unwanted virus effect; and recovering only modestly was factory payrolls, rising a lower-than-expected 38,000 and confirming mostly tepid employment indications from regional manufacturing reports. Construction payrolls, in contrast, were very strong, up 84,000 and consistent with the building surge now underway in residential housing. Relative to the pre-virus month of February, manufacturing payrolls are still down a very substantial 621,000 with construction payrolls, reflecting weakness in nonresidential construction, down 294,000. The US Federal Reserve also met in the week and though making no new moves, Jerome Powell did say that policy makers, in the event of a new economic downturn, are discussing possible changes to QE parameters including changes in composition (mix of Treasuries and mortgage-backed securities) and maturity duration. Like Europe, infection rates are moving higher in the US especially over the past couple of weeks, but indications of new troubles were not evident in the October employment report which mostly proved better than expected, that is showing only modest slowing in the rate of recovery. Nonfarm payrolls rose 638,000 versus 672,000 in September with big gains posted by retail, health care, leisure and hospitality, and also temporary help services, the latter a sign that employers are scrambling to fill vacancies. Not recovering, however, were local and state education where payrolls dropped sharply in what is likely an unfolding and unwanted virus effect; and recovering only modestly was factory payrolls, rising a lower-than-expected 38,000 and confirming mostly tepid employment indications from regional manufacturing reports. Construction payrolls, in contrast, were very strong, up 84,000 and consistent with the building surge now underway in residential housing. Relative to the pre-virus month of February, manufacturing payrolls are still down a very substantial 621,000 with construction payrolls, reflecting weakness in nonresidential construction, down 294,000.

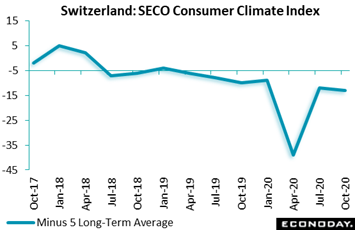

One set of indicators that central bankers focus on most is consumer assessments, whether on inflation or the overall economy. And with Covid coming back in force, focus on these indicators is certain to intensify. Improvement in Swiss consumer confidence has stalled according to the October quarterly survey from the State Secretariat of Economic Affairs (SECO). At a lower than expected minus 13, the headline was down 1 point versus July and well short of its minus 5 long-term average. There was little change in most of the main components, all of which were also short of their historical norm. Expectations about the economic outlook actually improved slightly but recent developments moved in the opposite direction. The labor market assessment was essentially flat with job security deteriorating. Buying intentions did firm marginally but remained weak while inflation expectations slid to their lowest level since July 2016. Swiss authorities did a good job of keeping the first Covid wave under control, but a surprisingly sharp surge in new cases since early September has forced the reintroduction of fresh nationwide restrictions that could well undermine readings in the next report. One set of indicators that central bankers focus on most is consumer assessments, whether on inflation or the overall economy. And with Covid coming back in force, focus on these indicators is certain to intensify. Improvement in Swiss consumer confidence has stalled according to the October quarterly survey from the State Secretariat of Economic Affairs (SECO). At a lower than expected minus 13, the headline was down 1 point versus July and well short of its minus 5 long-term average. There was little change in most of the main components, all of which were also short of their historical norm. Expectations about the economic outlook actually improved slightly but recent developments moved in the opposite direction. The labor market assessment was essentially flat with job security deteriorating. Buying intentions did firm marginally but remained weak while inflation expectations slid to their lowest level since July 2016. Swiss authorities did a good job of keeping the first Covid wave under control, but a surprisingly sharp surge in new cases since early September has forced the reintroduction of fresh nationwide restrictions that could well undermine readings in the next report.

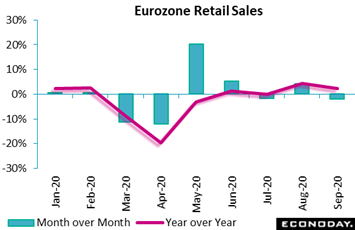

The result of last month's rise in infections, Eurozone retailers had a poor September. Following August's hefty 4.2 percent monthly spurt, sales volumes slumped a steeper-than-expected 2.0 percent for their worst performance since the fateful month of April. Annual growth slowed from 4.4 percent to 2.2 percent though sales were still 1.1 percent above their pre-pandemic level in February. September's monthly decline was broad-based with all of the major subsectors posting losses. Excluding auto fuel, non-food purchases were down 2.6 percent, unwinding only a portion of August's 5.4 percent bounce but meaning that sales have been little more than flat since June. Textiles, clothing and footwear were notably weak while mail order and internet sales also fared badly. Elsewhere, food, drink and tobacco decreased as did auto fuel. Regionally, national performances were mixed but the larger countries all struggled: France down 4.5 percent, Germany down 2.2 percent, and Spain down 0.4 percent. The result of last month's rise in infections, Eurozone retailers had a poor September. Following August's hefty 4.2 percent monthly spurt, sales volumes slumped a steeper-than-expected 2.0 percent for their worst performance since the fateful month of April. Annual growth slowed from 4.4 percent to 2.2 percent though sales were still 1.1 percent above their pre-pandemic level in February. September's monthly decline was broad-based with all of the major subsectors posting losses. Excluding auto fuel, non-food purchases were down 2.6 percent, unwinding only a portion of August's 5.4 percent bounce but meaning that sales have been little more than flat since June. Textiles, clothing and footwear were notably weak while mail order and internet sales also fared badly. Elsewhere, food, drink and tobacco decreased as did auto fuel. Regionally, national performances were mixed but the larger countries all struggled: France down 4.5 percent, Germany down 2.2 percent, and Spain down 0.4 percent.

Manufacturing has generally lagged recovery in retail spending across the global economy, in part the result of government stimulus aimed directly at supporting the consumer. Nevertheless industrial indications from Germany have been climbing, that is before the second wave. Manufacturers' orders rose 0.5 percent in September for the fifth monthly increase in a row though annual growth slipped from minus 1.6 percent to minus 1.9 percent. Compared with their pre-lockdown level in February, orders were down 2.6 percent. September's monthly advance reflected a 2.3 percent increase in domestic demand that masked a 0.8 percent drop in overseas orders; recovery in both remained incomplete with the former 3.4 percent below its pre-pandemic level and the latter 2.2 percent short. But there was plenty of good news especially for the key automotive industry which advanced 5.1 percent and stood 5.8 percent higher in September than in February. However, a 3.7 percent drop in machinery and equipment, a key sector centered in business investment, left an 8.2 percent shortfall. September's orders, Covid aside, point to headline improvement for industrial production in October; production data for September were also released in the week and, though rising on the month, were still 8.4 percent short of February. Manufacturing has generally lagged recovery in retail spending across the global economy, in part the result of government stimulus aimed directly at supporting the consumer. Nevertheless industrial indications from Germany have been climbing, that is before the second wave. Manufacturers' orders rose 0.5 percent in September for the fifth monthly increase in a row though annual growth slipped from minus 1.6 percent to minus 1.9 percent. Compared with their pre-lockdown level in February, orders were down 2.6 percent. September's monthly advance reflected a 2.3 percent increase in domestic demand that masked a 0.8 percent drop in overseas orders; recovery in both remained incomplete with the former 3.4 percent below its pre-pandemic level and the latter 2.2 percent short. But there was plenty of good news especially for the key automotive industry which advanced 5.1 percent and stood 5.8 percent higher in September than in February. However, a 3.7 percent drop in machinery and equipment, a key sector centered in business investment, left an 8.2 percent shortfall. September's orders, Covid aside, point to headline improvement for industrial production in October; production data for September were also released in the week and, though rising on the month, were still 8.4 percent short of February.

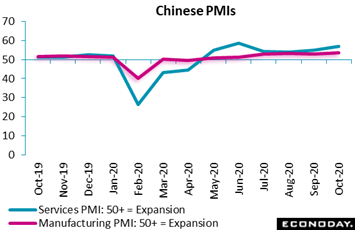

Of all the major global economies, none can compare with the limited Covid effects and quick bounce back by China. Markit's manufacturing PMI for China advanced from 53.0 in September to 53.6 in October ‒ this is its highest level since all the way back in January 2011 and indicates that the sector's recovery from the initial impact of the pandemic isn't slowing but accelerating. New orders and output rose for the eighth straight month and at a rising pace in October. Yet export orders fell back in the month, reflecting what respondents said was rising Covid cases among major trading partners. Payrolls increased but only slightly, though confidence about the 12-month outlook rose to its highest level since 2014. The corresponding PMI for the service sector increased from 54.8 in September to 56.8 in October, a sixth straight rise and the fastest pace since June. Like manufacturing, service-sector respondents reported acceleration in domestic orders in contrast to a decline in export orders. Payrolls rose for the third month in a row, while business confidence surged to its highest level since 2012. Of all the major global economies, none can compare with the limited Covid effects and quick bounce back by China. Markit's manufacturing PMI for China advanced from 53.0 in September to 53.6 in October ‒ this is its highest level since all the way back in January 2011 and indicates that the sector's recovery from the initial impact of the pandemic isn't slowing but accelerating. New orders and output rose for the eighth straight month and at a rising pace in October. Yet export orders fell back in the month, reflecting what respondents said was rising Covid cases among major trading partners. Payrolls increased but only slightly, though confidence about the 12-month outlook rose to its highest level since 2014. The corresponding PMI for the service sector increased from 54.8 in September to 56.8 in October, a sixth straight rise and the fastest pace since June. Like manufacturing, service-sector respondents reported acceleration in domestic orders in contrast to a decline in export orders. Payrolls rose for the third month in a row, while business confidence surged to its highest level since 2012.

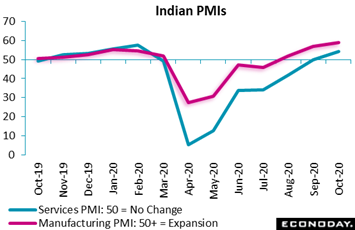

The above graph of China's PMIs offers similarities and contrasts to the adjacent graph from India. Both show a major Covid dip: China's occurring first, but a much deeper one for India. Also China's bounce back appeared much faster than that for India where, however, the news is now getting better. Markit's manufacturing PMI rose from 56.8 in September to 58.9 in October, indicating that the recovery in the sector has accelerated after authorities began lifting virus restrictions. This is the third straight month of expansion and the sharpest in more than 10 years. New orders and output posted 12- and 13-year highs, respectively, while export orders, in contrast to China, rose for a second month and at the fastest pace in nearly six years. Respondents also reported stronger confidence about the 12-month outlook, though the survey's measure of employment showed a further reduction in payrolls. India's PMI for services, at 54.1 versus September's 49.8, moved above the plus-50 expansion line for the first time since February. Service respondents reported the first increase in new orders of the pandemic, a smaller drop in export orders, and improved sentiment about the outlook. The survey's measure of employment indicated that payrolls were cut in October but some respondents, for the second month in a row, reported difficulty filling positions. The above graph of China's PMIs offers similarities and contrasts to the adjacent graph from India. Both show a major Covid dip: China's occurring first, but a much deeper one for India. Also China's bounce back appeared much faster than that for India where, however, the news is now getting better. Markit's manufacturing PMI rose from 56.8 in September to 58.9 in October, indicating that the recovery in the sector has accelerated after authorities began lifting virus restrictions. This is the third straight month of expansion and the sharpest in more than 10 years. New orders and output posted 12- and 13-year highs, respectively, while export orders, in contrast to China, rose for a second month and at the fastest pace in nearly six years. Respondents also reported stronger confidence about the 12-month outlook, though the survey's measure of employment showed a further reduction in payrolls. India's PMI for services, at 54.1 versus September's 49.8, moved above the plus-50 expansion line for the first time since February. Service respondents reported the first increase in new orders of the pandemic, a smaller drop in export orders, and improved sentiment about the outlook. The survey's measure of employment indicated that payrolls were cut in October but some respondents, for the second month in a row, reported difficulty filling positions.

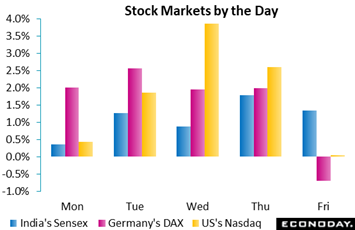

Stock markets took off in the week posting mid-to-high single digit percentage gains for most major indexes: 5.8 percent for India's Sensex, 8.0 percent for Germany's DAX, 9.1 percent for the US's Nasdaq. Some of the largest gains were posted on Wednesday and Thursday following what was a bewildering first take on the US election results, especially for the presidency though less so for the Senate. Early returns had the Republicans out in front on both though later returns, that is a flood of Covid-related mail-in ballots, appeared to lean toward the Democrats. Markets rallied into the election on the accepted notion that a "blue wave", a sweeping victory by the Democrats as indicated by many polls, would result in vast fiscal stimulus. The counter-intuitive wisdom to explain the rally immediately following the results was to forget about the loss of stimulus and focus instead on the great regulatory burden that a Democratic government would have imposed, especially on health care and energy. But one perhaps less counter-intuitive explanation is that the stock markets may well in fact be pricing in the possibility of the original assumption: a Democratic sweep. Such a sweep, however, would appear too early to call, not only for the presidency but especially for the Senate where Republicans do appear to have the edge but still not a lock. Vote counting is still underway but should the counting go entirely in favor of the Democrats and a split 50-50 senate is the result, then Kamala Harris would break the tie and presumably vote for a great flood of stimulus. If, however, the counting goes the Republican's way then, with the lower house apparently to be held Democrats despite some losses, more of the same would be in store: a split government at least until the next round of congressional elections in 2022. Stock markets took off in the week posting mid-to-high single digit percentage gains for most major indexes: 5.8 percent for India's Sensex, 8.0 percent for Germany's DAX, 9.1 percent for the US's Nasdaq. Some of the largest gains were posted on Wednesday and Thursday following what was a bewildering first take on the US election results, especially for the presidency though less so for the Senate. Early returns had the Republicans out in front on both though later returns, that is a flood of Covid-related mail-in ballots, appeared to lean toward the Democrats. Markets rallied into the election on the accepted notion that a "blue wave", a sweeping victory by the Democrats as indicated by many polls, would result in vast fiscal stimulus. The counter-intuitive wisdom to explain the rally immediately following the results was to forget about the loss of stimulus and focus instead on the great regulatory burden that a Democratic government would have imposed, especially on health care and energy. But one perhaps less counter-intuitive explanation is that the stock markets may well in fact be pricing in the possibility of the original assumption: a Democratic sweep. Such a sweep, however, would appear too early to call, not only for the presidency but especially for the Senate where Republicans do appear to have the edge but still not a lock. Vote counting is still underway but should the counting go entirely in favor of the Democrats and a split 50-50 senate is the result, then Kamala Harris would break the tie and presumably vote for a great flood of stimulus. If, however, the counting goes the Republican's way then, with the lower house apparently to be held Democrats despite some losses, more of the same would be in store: a split government at least until the next round of congressional elections in 2022.

What the markets are actually pricing in won't be clear until we see how they react to the actual ballot counts once they are known. Yet another unknown is how long and serpentine this path to election closure may prove. What is clear is that higher infection rates in Europe and the US are threatening to slow what has so far at least been a credible recovery from April's lockdowns. What also perhaps is clear is that China, ironically or not, may well prove to be the driving force of the global recovery.

**Jeremy Hawkins, Brian Jackson and Mace News contributed to this article

The week begins not on Monday but on Saturday with the release of Chinese merchandise trade data amid expectations for another strong report, whether for imports or exports. Monday sees the Swiss unemployment rate posted followed on Tuesday by Chinese consumer prices; other inflation data will be led by US consumer prices on Thursday. Industrial production will be posted on Tuesday from Italy and on Thursday from the Eurozone with Japanese machinery orders on Wednesday; no better than mixed results for these readings are expected. UK data will include Tuesday's labour market report and Thursday's preliminary GDP report for the third quarter. Sentiment data to watch opens with Germany's ZEW on Tuesday and US consumer sentiment on Friday; weakness for the former and little change for the latter are expected. After the prior week's rush of central bank updates, New Zealand's reserve bank will making an announcement on Wednesday.

Chinese Merchandise Trade Balance for October (Estimated for Saturday, Release Time Not Set)

Consensus Forecast: US$46.0 billion

Consensus Forecast: Exports - Y/Y: 9.3%

Consensus Forecast: Imports - Y/Y: 9.5%

Exports have been climbing strongly, up 9.9 percent on the year in September with a 9.3 percent increase expected for October. Imports jumped in September to annual growth of 13.2 percent and in October are seen at plus 9.5 percent. October's surplus is expected to come in at US$46.0 billion after September's $37.0 billion.

Swiss Unemployment Rate for October (Mon 06:45 GMT; Mon 07:45 CET; Mon 01:45 EST)

Consensus Forecast, Adjusted: 3.4%

Unemployment in Switzerland has been very limited during the crisis, actually edging lower in what were unexpectedly positive results for September. For October, the consensus for the adjusted rate is 3.4 percent versus September's 3.3 percent.

Chinese CPI for October (Tue 01:30 GMT; Tue 09:30 CST; Mon 20:30 EST)

Consensus Forecast, Year over Year: 0.8%

Chinese consumer prices are expected to slow noticeably in October, to plus 0.8 percent on the year which would compare with September's 1.7 percent annual rate.

UK Labour Market Report (Tue 07:00 GMT; Tue 02:00 EST)

Consensus Forecast, ILO Unemployment Rate for September: 4.8%

The ILO unemployment rate, in data for the three months to September, is expected to increase 3 tenths to 4.8 percent.

Italian Industrial Production for September (Tue 09:00 GMT; Tue 10:00 CET; Tue 04:00 EST)

Consensus Forecast, Month over Month: -0.1%

Italian industrial production has been on the climb, rising 7.7 percent on the month in August to exceed July's 7.0 percent rebound. For September, the expectation is a 0.1 percent dip.

Germany: ZEW Survey for November (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Current Conditions: -65.0

Consensus Forecast, Economic Sentiment: 40.0

Economic sentiment lost substantial ground in October, down more than 20 points to 56.1 with further deterioration expected for November where the consensus is 40.0. Current conditions, which also fell in the last report, is expected to fall to minus 65.0 from minus 59.5.

Reserve Bank of New Zealand Announcement (Wed 01:00 GMT; Wed 14:00 NZDT; Tue 20:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Reserve Bank of New Zealand is expected to leave its cash rate at 0.25 percent but officials may dig into their alternative tool box for further stimulus.

Japanese Machinery Orders for September (Tue 23:50 GMT; Wed 08:50 JST; Tue 18:50 EST)

Consensus Forecast, Month over Month: 0.2%

Machinery orders have been coming in better than expected but have still remained very weak, down 15.2 percent year-over-year in August. On a monthly basis, forecasters see orders rising 0.2 percent to match August's 0.2 percent gain.

UK Third-Quarter GDP Preliminary (Thu 07:00 GMT; Wed 02:00 EST)

Consensus Forecast, Quarter over Quarter: 15.8%

Consensus Forecast, Year over Year: -9.4%

The consensus for preliminary third-quarter GDP and the initial recovery from the second-quarter lockdowns is a quarterly gain of 15.8 percent for year-on-year contraction of 9.4 percent.

Eurozone Industrial Production for September (Thu 10:00 GMT; Thu 11:00 CET; Thu 05:00 EST)

Consensus Forecast, Month over Month: 0.9%

Eurozone industrial production slowed sharply in August to a monthly gain of 0.7 percent from 5.0 percent in July. A 0.9 percent increase is the forecast for September.

US CPI for October (Thu 01:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 1.3%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 1.7%

Prices of used vehicles have been on fire, in very sharp contrast to the bulk of other consumer prices which have been flat. After 0.2 percent gains both overall and for the core, another set of 0.2 percent increases are October's expectations for both. The year-over-year rate for the core is seen at 1.7 percent which would be unchanged from both August as well as September.

US Consumer Sentiment Index, Preliminary November (Fri 15:00 GMT; Fri 10:00 EST)

Consensus Forecast: 82.0

Consumer sentiment, in what will cover the initial part of the election drama, is expected to increase slightly to 82.0 versus October's final at 81.8 and preliminary reading of 81.2.

|