|

The development of a Covid vaccine by Pfizer and BioNTech has changed, if not the immediate economic outlook, then at least the outlook for next year. With infections rising sharply in Europe and North America, central bankers will be in no hurry to adjust policy as they watch how quickly the vaccine will be rolled out and how successful it proves. In economic data, indications of how quickly the vaccine is or is not affecting businesses and consumers will play out first in sentiment reports which is where we begin this week's rundown.

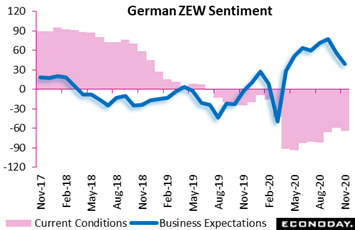

Measures of confidence are timely, yes, but haven't yet captured the effect of Monday's vaccine announcement. What we can gauge is where confidence was before the announcement, and here the answer is unmistakably unfavorable. Business expectations among financial analysts surveyed by Mannheim-based Centre for European Economic Research (ZEW) fell a sizable 17.1 points to 39.0, a second straight decline and the lowest reading since the initial lockdowns of April. Current conditions, already very weak, weakened further, down 4.8 points to minus 64.3 but still well up from the minus 90 readings of April and May. The slide in both gauges reflects the unexpectedly steep rise underway in infections and the resulting imposition of new containment measures in Germany and across much of Europe. Interestingly, the survey found neither the Brexit trade talks nor the U.S. presidential election having any significant impact on sentiment. Measures of confidence are timely, yes, but haven't yet captured the effect of Monday's vaccine announcement. What we can gauge is where confidence was before the announcement, and here the answer is unmistakably unfavorable. Business expectations among financial analysts surveyed by Mannheim-based Centre for European Economic Research (ZEW) fell a sizable 17.1 points to 39.0, a second straight decline and the lowest reading since the initial lockdowns of April. Current conditions, already very weak, weakened further, down 4.8 points to minus 64.3 but still well up from the minus 90 readings of April and May. The slide in both gauges reflects the unexpectedly steep rise underway in infections and the resulting imposition of new containment measures in Germany and across much of Europe. Interestingly, the survey found neither the Brexit trade talks nor the U.S. presidential election having any significant impact on sentiment.

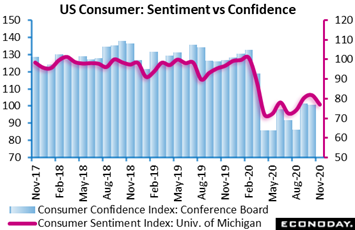

Unlike ZEW, the US presidential election did have a sizable effect on the University of Michigan's consumer sentiment report, at least among Republicans whose expectations fell noticeably which in turn pulled the preliminary November index 5 points lower to 77.0. This index had been climbing back from the low 70s in the initial phase of the crisis but has never come close to approaching the 100 level before the pandemic hit. Rising Covid infections in the US and related deaths were also factors behind the decline. This report at month-end will offer initial indications on the psychological effect of the vaccine news as will another report at month-end, the consumer confidence survey published by the Conference Board. Unlike ZEW, the US presidential election did have a sizable effect on the University of Michigan's consumer sentiment report, at least among Republicans whose expectations fell noticeably which in turn pulled the preliminary November index 5 points lower to 77.0. This index had been climbing back from the low 70s in the initial phase of the crisis but has never come close to approaching the 100 level before the pandemic hit. Rising Covid infections in the US and related deaths were also factors behind the decline. This report at month-end will offer initial indications on the psychological effect of the vaccine news as will another report at month-end, the consumer confidence survey published by the Conference Board.

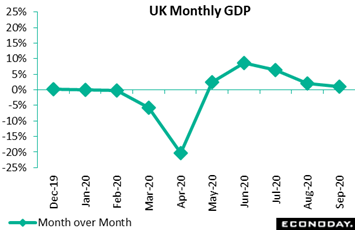

The vaccine's tangible impact on spending and output isn't likely to be appear until well into next year. What we do know is that the global recovery, going into inoculations, was still underway but visibly slowing, with the UK's monthly GDP breakdown offering a useful example. Real GDP rose 1.1 percent in September, a very strong showing on its own but the smallest rise of the last five months. The monthly advance was largely attributable to services where output was up 1.0 percent but below a 2.4 percent increase in August. Industrial production saw a 0.5 percent gain, up from 0.3 percent last time, but within which manufacturing increased just 0.2 percent. Construction posted a solid 2.9 percent monthly rate but agriculture, forestry and fishing dipped 0.1 percent. Though GDP stands nearly 23 percent above its April low, the UK recovery is far from complete. Growth was already slowing before the recent introduction of new lockdowns which will hit the economy hard through year-end. Quarterly GDP, after plunging 19.8 percent in the second quarter and rising 15.5 percent in the third quarter, is expected to contract during the fourth quarter. The vaccine's tangible impact on spending and output isn't likely to be appear until well into next year. What we do know is that the global recovery, going into inoculations, was still underway but visibly slowing, with the UK's monthly GDP breakdown offering a useful example. Real GDP rose 1.1 percent in September, a very strong showing on its own but the smallest rise of the last five months. The monthly advance was largely attributable to services where output was up 1.0 percent but below a 2.4 percent increase in August. Industrial production saw a 0.5 percent gain, up from 0.3 percent last time, but within which manufacturing increased just 0.2 percent. Construction posted a solid 2.9 percent monthly rate but agriculture, forestry and fishing dipped 0.1 percent. Though GDP stands nearly 23 percent above its April low, the UK recovery is far from complete. Growth was already slowing before the recent introduction of new lockdowns which will hit the economy hard through year-end. Quarterly GDP, after plunging 19.8 percent in the second quarter and rising 15.5 percent in the third quarter, is expected to contract during the fourth quarter.

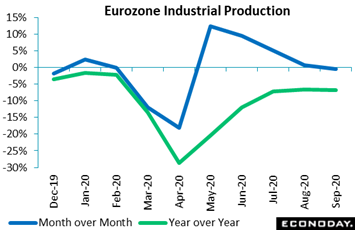

A special wild card for both the UK and the Eurozone will be the final resolution of Brexit, going into which Eurozone goods production was surprisingly weak. Following a 0.6 percent monthly rise in August, output fell 0.4 percent in September, its first decline since the recovery began in May. Annual growth slipped a tenth to minus 6.8 percent while the shortfall versus February's pre-lockdown level widened to 5.9 percent. September's unexpected setback was dominated by durable consumer goods which slumped 5.3 percent on the month. Energy also fell but there was better news elsewhere as consumer non-durables posted a gain as did capital goods and intermediates. Country data included gains for Germany, France and Spain but a sharp fall for Italy where production had been on the climb. September's report was probably not as soft as the headline suggests but the bottom line is that the rebound in Eurozone goods production has lost significant momentum in recent months. And new restrictions across much of the continent all but guarantee very poor showings for production through year end. A special wild card for both the UK and the Eurozone will be the final resolution of Brexit, going into which Eurozone goods production was surprisingly weak. Following a 0.6 percent monthly rise in August, output fell 0.4 percent in September, its first decline since the recovery began in May. Annual growth slipped a tenth to minus 6.8 percent while the shortfall versus February's pre-lockdown level widened to 5.9 percent. September's unexpected setback was dominated by durable consumer goods which slumped 5.3 percent on the month. Energy also fell but there was better news elsewhere as consumer non-durables posted a gain as did capital goods and intermediates. Country data included gains for Germany, France and Spain but a sharp fall for Italy where production had been on the climb. September's report was probably not as soft as the headline suggests but the bottom line is that the rebound in Eurozone goods production has lost significant momentum in recent months. And new restrictions across much of the continent all but guarantee very poor showings for production through year end.

The driving force of the global recovery (or at least the expected driving force) is the Chinese economy which has easily posted the best recovery numbers of the major economies. Yet this recovery may be tied more to exports than imports which is bad news for everyone else. Exports were up a stronger-than-expected 11.4 percent on the year in October, strengthening from an increase of 9.9 percent in September; yet imports slowed, up a lower-than-expected 4.7 percent following September's 13.2 percent rise. As seen in the graph, imports have underperformed exports since April. But for China's economy, or at least the trade balance, this is good news: the nation's trade surplus in US dollar terms widened from September's $37.00 billion to $58.44 billion. The driving force of the global recovery (or at least the expected driving force) is the Chinese economy which has easily posted the best recovery numbers of the major economies. Yet this recovery may be tied more to exports than imports which is bad news for everyone else. Exports were up a stronger-than-expected 11.4 percent on the year in October, strengthening from an increase of 9.9 percent in September; yet imports slowed, up a lower-than-expected 4.7 percent following September's 13.2 percent rise. As seen in the graph, imports have underperformed exports since April. But for China's economy, or at least the trade balance, this is good news: the nation's trade surplus in US dollar terms widened from September's $37.00 billion to $58.44 billion.

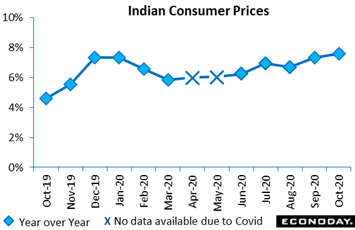

One economy that may be on the move is India which appears to be in the steepest part of its recovery. And in contrast to just about everywhere else, inflation is actually on the rise. India's consumer price index rose 7.61 percent on the year in October, picking up from 7.34 percent in September and moving further above the top of the Reserve Bank of India's 2.0 to 6.0 percent target range. The RBI left policy rates on hold at its most recent policy meeting last month, with officials saying that inflation pressures were reflecting pandemic supply shocks and will likely begin to moderate in coming months. Reflecting this assessment, officials re-affirmed their commitment to supporting the recovery through accommodative policy. One economy that may be on the move is India which appears to be in the steepest part of its recovery. And in contrast to just about everywhere else, inflation is actually on the rise. India's consumer price index rose 7.61 percent on the year in October, picking up from 7.34 percent in September and moving further above the top of the Reserve Bank of India's 2.0 to 6.0 percent target range. The RBI left policy rates on hold at its most recent policy meeting last month, with officials saying that inflation pressures were reflecting pandemic supply shocks and will likely begin to moderate in coming months. Reflecting this assessment, officials re-affirmed their commitment to supporting the recovery through accommodative policy.

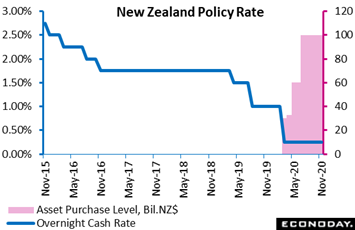

The question for central banks right now isn't about withdrawing stimulus (vaccine or not) but of course how to increase stimulus. Not wanting to move to rates any lower, the Reserve Bank of New Zealand left its official cash rate unchanged at 0.25 percent and also kept the upper limit for its asset purchase program at NZ$100 billion. But, saying further stimulus is needed, the bank introduced a new lending facility, the Funding for Lending Programme. Under the FLP the RBNZ, in an effort to boost credit flows to businesses and households, will provide long-term funding to domestic banks and eligible financial firms. The cost of these funds will be the official cash rate, with lenders able to access funds equal to 6.0 percent of their existing domestic balances. Though Covid's hit to New Zealand has been limited compared to other countries, the RBNZ said the economic impact has nevertheless been "very large and persistent"; officials expect inflation and employment to remain below target for "a prolonged period". The bank reaffirmed that monetary policy will need to remain highly accommodative for a long time and that further policy support will be provided if needed. The question for central banks right now isn't about withdrawing stimulus (vaccine or not) but of course how to increase stimulus. Not wanting to move to rates any lower, the Reserve Bank of New Zealand left its official cash rate unchanged at 0.25 percent and also kept the upper limit for its asset purchase program at NZ$100 billion. But, saying further stimulus is needed, the bank introduced a new lending facility, the Funding for Lending Programme. Under the FLP the RBNZ, in an effort to boost credit flows to businesses and households, will provide long-term funding to domestic banks and eligible financial firms. The cost of these funds will be the official cash rate, with lenders able to access funds equal to 6.0 percent of their existing domestic balances. Though Covid's hit to New Zealand has been limited compared to other countries, the RBNZ said the economic impact has nevertheless been "very large and persistent"; officials expect inflation and employment to remain below target for "a prolonged period". The bank reaffirmed that monetary policy will need to remain highly accommodative for a long time and that further policy support will be provided if needed.

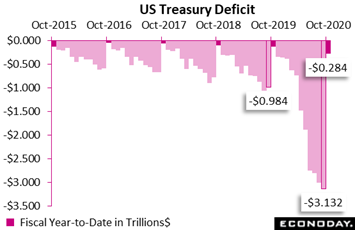

How much further central banks can go is only one question. The other is how much further governments can go given already very large deficits. The US Treasury budget deficit came in significantly deeper than expected in October, at $284 billion and up 111 percent year-over-year. October outlays, at $522 billion, were 37 percent higher than October last year, while receipts fell 3 percent to $238 billion. Outlays for income security jumped sharply as they did for Medicare and veterans benefits. On the receipts side, individual income taxes fell sharply to $109 billion while corporate taxes increased sharply but only to $9.2 billion. October is the first month of the government's 2021 fiscal year which in 2020 ended at a deficit of $3.132 trillion, more than three times as large as 2019's $984 billion. How much further central banks can go is only one question. The other is how much further governments can go given already very large deficits. The US Treasury budget deficit came in significantly deeper than expected in October, at $284 billion and up 111 percent year-over-year. October outlays, at $522 billion, were 37 percent higher than October last year, while receipts fell 3 percent to $238 billion. Outlays for income security jumped sharply as they did for Medicare and veterans benefits. On the receipts side, individual income taxes fell sharply to $109 billion while corporate taxes increased sharply but only to $9.2 billion. October is the first month of the government's 2021 fiscal year which in 2020 ended at a deficit of $3.132 trillion, more than three times as large as 2019's $984 billion.

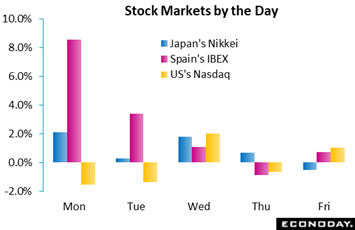

On the assumption that spending will increase and the US deficit deepen, Asian markets opened the week with strong gains after media networks declared Joe Biden the winner of the US presidential election. But it was news in the European hours that Pfizer and BioNTech have successfully developed a Covid vaccine that sent shares, or at least most shares, flying especially in Spain which has been especially hard hit by Covid. Retreating were stay-at-home shares, largely techs that led to a 1.5 percent decline for the US Nasdaq. Rotation out of techs extended to Tuesday as the Nasdaq fell another 1.4 percent, again in contrast to the body of the market which rose sharply. Christine Lagarde helped the market on Wednesday saying the European Central Bank will consider more asset purchases and low-cost lending as part of its policy review in December. By Thursday, vaccine enthusiasm started to fade amid increasing infection rates and hospitalizations across Europe and North America; also concerns were voiced that public skepticism over the vaccine may limit its uptake. Another negative were comments from the Federal Reserve's Jerome Powell who said the immediate economic impact of the vaccine will be limited and that its impact next year is uncertain. The best performer of the week was Spain's Ibex with a 13.3 percent jump that trimmed its year-to-date loss to 18.5 percent. On the assumption that spending will increase and the US deficit deepen, Asian markets opened the week with strong gains after media networks declared Joe Biden the winner of the US presidential election. But it was news in the European hours that Pfizer and BioNTech have successfully developed a Covid vaccine that sent shares, or at least most shares, flying especially in Spain which has been especially hard hit by Covid. Retreating were stay-at-home shares, largely techs that led to a 1.5 percent decline for the US Nasdaq. Rotation out of techs extended to Tuesday as the Nasdaq fell another 1.4 percent, again in contrast to the body of the market which rose sharply. Christine Lagarde helped the market on Wednesday saying the European Central Bank will consider more asset purchases and low-cost lending as part of its policy review in December. By Thursday, vaccine enthusiasm started to fade amid increasing infection rates and hospitalizations across Europe and North America; also concerns were voiced that public skepticism over the vaccine may limit its uptake. Another negative were comments from the Federal Reserve's Jerome Powell who said the immediate economic impact of the vaccine will be limited and that its impact next year is uncertain. The best performer of the week was Spain's Ibex with a 13.3 percent jump that trimmed its year-to-date loss to 18.5 percent.

How directly confidence readings correspond to actual spending is up for debate, but the risk that reports like ZEW or consumer sentiment begin to buckle again ‒ vaccine or not ‒ is critical for central banks whose rates are already at their lower bounds and whose asset purchases at extremes. Monetary policy of course is only half the picture and, maybe in its outright impact, the lesser half compared to fiscal policy, which in many countries is likewise already at extremes.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

The week opens with a bang: first the advance reading for third-quarter Japanese GDP followed by timely October updates on no less than Chinese industrial production and Chinese retail sales where growth for both is expected to be solid. The same combo ‒ industrial production and retail sales ‒ follow on Tuesday where similarly positive results are expected. Japan swings back into focus on Wednesday with the latest on the country's international trade followed on Friday by consumer prices, neither of which have been pleasant reading. One sector of data that has made for spectacular reading is US housing where updates on starts and permits will be posted on Wednesday. Key data from the UK will open on Wednesday with consumer prices followed on Friday by retail sales, the latter for October and which, in contrast to prior strength, may begin to see the effects of renewed lockdowns.

Japanese GDP Third-Quarter Advance (Sun 23:50 GMT; Mon 08:50 JST; Sun 18:50 EST)

Consensus Forecast, Quarter over Quarter: 4.4%

Consensus Forecast, Annual Rate: 18.9%

The advance estimate for third-quarter GDP is expected to rise a quarterly 4.4 percent and 18.9 percent on an annual basis. This would compare against record contraction in the second quarter of 7.9 percent and 28.1 percent annually.

Chinese Industrial Production for October (Mon 02:00 GMT; Mon 10:00 CST; Sun 21:00 EST)

Consensus Forecast, Year over Year: 6.5%

Industrial production is expected to be strong in October but not accelerate, seen rising a year-over-year 6.5 percent following September’s 6.9 percent.

Chinese Retail Sales for October (Mon 02:00 GMT; Mon 10:00 CST; Sun 21:00 EST)

Consensus Forecast, Year over Year: 4.8%

At a consensus of plus 4.8 percent, Chinese retail sales in October are expected to continue to improve from year-over-year growth of 3.3 percent in September.

US Retail Sales for October (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month over Month: 0.4%

Consensus Forecast, Ex-Vehicles & Gas: 0.5%

Consensus Forecast, Control Group: 0.4%

The drop off in US fiscal stimulus and unemployment benefits didn't hurt September retail sales which far surpassed expectations across all major readings. Forecasters see October sales posting less spectacular but still solid gains, rising 0.4 percent overall with ex-auto ex-gas seen up 0.5 percent and the control group up 0.4 percent.

US Industrial Production for October (Tue 14:15 GMT; Tue 09:15 EST)

Consensus Forecast, Month over Month: 0.9%

US Manufacturing Output

Consensus Forecast, Month over Month: 0.9%

Unexpected declines were the unexpected results of September's industrial production data, disappointments expected to be reversed in October where Econoday's consensus forecasts are monthly increases of 0.9 percent overall and for manufacturing.

Japanese Merchandise Trade for October (Tue 23:50 GMT; Wed 08:50 JST; Tue 18:50 EST)

Consensus Forecast: +¥250 billion

Consensus Forecast, Imports Y/Y: -9.0%

Consensus Forecast, Exports Y/Y: -4.5%

Contraction in Japanese trade has been deep but did ease in September with further improvement expected for October. Expectations for October are import contraction of 9.0 percent versus September's 17.2 percent and export contraction of 4.5 percent versus 4.9 percent with the net balance seen in surplus at ¥250 billion.

UK CPI for September (Wed 07:00 GMT; Wed 02:00 EST)

Consensus Forecast, Month over Month: -0.1%

Consensus Forecast, Year over Year: 0.6%

Consumer prices are seen slipping 0.1 percent on the month in October with the annual rate seen up 1 tenth at plus 0.6 percent.

US Housing Starts for October (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast, Annual Rate: 1.460 million

US Building Permits

Consensus Forecast: 1.560 million

Expectations for October starts are a sharp rise to a 1.460 million annual rate versus September's 1.415 million with permits, which have been exceptionally strong especially for single-family homes, seen rising further to 1.560 million versus 1.545 million (revised from 1.553 million).

Australian Labour Force Survey for October (Thu 00:30 GMT; Thu 11:30 AEDT; Wed 19:30 EST)

Consensus Forecast, Unemployment Rate: 7.1%

October’s consensus is 7.1 percent for the unemployment rate, up from 6.9 percent in September.

Japanese Consumer Price Index for October (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast Ex-Food, Year over Year: -0.6%

Price pressures at the consumer level are expected to slip further in October, to minus 0.6 percent year-over-year for the ex-food reading versus minus 0.3 percent in September.

UK Retail Sales for October (Fri 07:00 GMT; Fri 02:00 EST)

Consensus Forecast - M/M: 0.3%

UK retail sales have been climbing impressively though expectations for October call for slowing, to a month-over-month gain of 0.3 percent versus September's 1.5 percent increase.

Eurozone: EC Consumer Confidence Flash for November (Fri 15:00 GMT; Fri 16:00 CET; Fri 10:00 EST)

Consensus Forecast: -17.7

Consumer confidence fell back in October and, not helped by virus restrictions being put back in place, a consensus of minus 17.7 is expected for November. This would compare with October's weaker-than-expected minus 15.5.

|