|

Global Economics will be taking the November 27 week off.

Next article will be dated December 4.

The recovery in October looks to have been solid for the global economy, benefiting from strength in China and improving cross-border trade. Retail spending was also solid in the month though, at least in the case of the UK, the gains may have been sparked by pre-buying ahead of a November shutdown. And in contrast to October, the month of November looks to have felt a sizably greater Covid effect. We'll start off with the most recent news first, none of it that great.

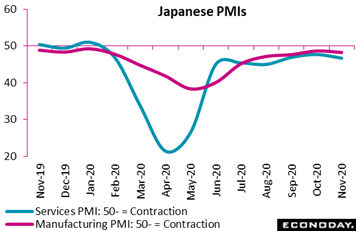

November PMI flashes will open the coming week on Monday but have already been upstaged by Japan's report which did not show much promise, indicating that the ongoing impact of the pandemic has remained substantial with aggregate activity contracting at a pace greater than October. The manufacturing flash came in at a sub-50 contractionary level of 48.3, down 4 tenths from October, while the services flash fell to 46.7, down from October's 47.7. Manufacturing respondents are reporting a bigger decline in output and new orders this month, a fall in new export orders, and weaker confidence about the outlook. The services sample reported smaller declines in output and new orders, a drop in new export orders and employment, and also weaker confidence about the outlook. Both samples reported price weakness, whether for inputs or final sales. November PMI flashes will open the coming week on Monday but have already been upstaged by Japan's report which did not show much promise, indicating that the ongoing impact of the pandemic has remained substantial with aggregate activity contracting at a pace greater than October. The manufacturing flash came in at a sub-50 contractionary level of 48.3, down 4 tenths from October, while the services flash fell to 46.7, down from October's 47.7. Manufacturing respondents are reporting a bigger decline in output and new orders this month, a fall in new export orders, and weaker confidence about the outlook. The services sample reported smaller declines in output and new orders, a drop in new export orders and employment, and also weaker confidence about the outlook. Both samples reported price weakness, whether for inputs or final sales.

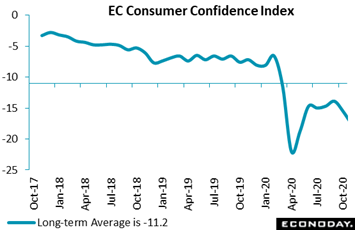

Another early indication on November conditions is consumer confidence from the European Commission. And Covid issues aren't helping the index which came in at minus 17.6 versus minus 15.5 for October. November's reading is the lowest since minus 18.8 in May, compares with minus 22.0 in the total lockdown of April, and against minus 6.6 in the pre-pandemic month of February. Italy during the week renewed restrictions in six regions, with lockdowns in Germany and France set to ease at month-end. Another early indication on November conditions is consumer confidence from the European Commission. And Covid issues aren't helping the index which came in at minus 17.6 versus minus 15.5 for October. November's reading is the lowest since minus 18.8 in May, compares with minus 22.0 in the total lockdown of April, and against minus 6.6 in the pre-pandemic month of February. Italy during the week renewed restrictions in six regions, with lockdowns in Germany and France set to ease at month-end.

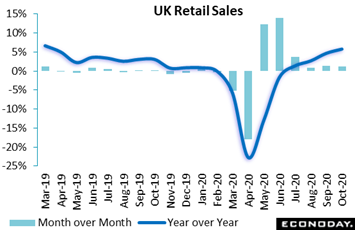

The UK imposed a lockdown earlier this month, the prospects of which may have helped retail sales in October. Sales volumes rose a monthly 1.2 percent following September's 1.4 percent rise to boost year-over-year growth from 4.7 percent to 5.8 percent, for the best showing since March 2019. Volumes now stand a very solid 6.7 percent above their pre-lockdown level in February. Easily the best performing subsector was non-store retailing (e-commerce) which saw a 6.4 percent surge, its strongest outturn since May. Household goods were also especially robust and contrasted with a fall for textiles, clothing and footwear. Ahead of the November 5 lockdown, UK consumers perhaps pulled forward their Christmas shopping which, though good for October, might point to a setback for November sales. In any event, private consumption continues to hold up much better than expected. Indeed, the UK economy as a whole has started to outperform forecasts as reflected in Econoday's economic consensus divergence index which tracks actual results relative to expected results and now stands at a very respectable plus 27. The UK imposed a lockdown earlier this month, the prospects of which may have helped retail sales in October. Sales volumes rose a monthly 1.2 percent following September's 1.4 percent rise to boost year-over-year growth from 4.7 percent to 5.8 percent, for the best showing since March 2019. Volumes now stand a very solid 6.7 percent above their pre-lockdown level in February. Easily the best performing subsector was non-store retailing (e-commerce) which saw a 6.4 percent surge, its strongest outturn since May. Household goods were also especially robust and contrasted with a fall for textiles, clothing and footwear. Ahead of the November 5 lockdown, UK consumers perhaps pulled forward their Christmas shopping which, though good for October, might point to a setback for November sales. In any event, private consumption continues to hold up much better than expected. Indeed, the UK economy as a whole has started to outperform forecasts as reflected in Econoday's economic consensus divergence index which tracks actual results relative to expected results and now stands at a very respectable plus 27.

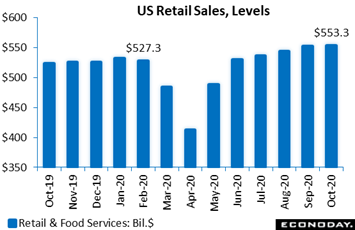

New restrictions in the US, despite rising Covid cases, have been limited though school closings are reappearing including for New York City in the week. Retail sales, which for the US are measured in currency terms, proved moderate but still solid in October, up 0.3 percent overall which was just shy of Econoday's consensus for 0.4 percent. Year-over-year, sales were up 5.7 percent in October and were up 4.9 percent relative to the pre-virus month of February, as tracked in dollar terms in the accompanying graph. These are very solid numbers that belie the lack of new fiscal stimulus and the expiration of extended unemployment benefits. Monthly data included strength for vehicles, up 0.4 percent, and once again outstanding strength for non-store retailers (e-commerce) which rose 3.1 percent. Year-over-year, these categories were up 10.7 and 29.1 percent respectively. Building materials are also doing very well this year, up 0.9 percent in October for year-over-year growth of 19.5 percent in an echo of exceptionally strong housing data coming from the US. Yet this report tracks the sale of goods; demand for services, which is not part of this report, has been very weak this year, weakness that has perhaps helped feed the gain for goods. However scrambled this year has been for consumer spending, retail on net has done well. New restrictions in the US, despite rising Covid cases, have been limited though school closings are reappearing including for New York City in the week. Retail sales, which for the US are measured in currency terms, proved moderate but still solid in October, up 0.3 percent overall which was just shy of Econoday's consensus for 0.4 percent. Year-over-year, sales were up 5.7 percent in October and were up 4.9 percent relative to the pre-virus month of February, as tracked in dollar terms in the accompanying graph. These are very solid numbers that belie the lack of new fiscal stimulus and the expiration of extended unemployment benefits. Monthly data included strength for vehicles, up 0.4 percent, and once again outstanding strength for non-store retailers (e-commerce) which rose 3.1 percent. Year-over-year, these categories were up 10.7 and 29.1 percent respectively. Building materials are also doing very well this year, up 0.9 percent in October for year-over-year growth of 19.5 percent in an echo of exceptionally strong housing data coming from the US. Yet this report tracks the sale of goods; demand for services, which is not part of this report, has been very weak this year, weakness that has perhaps helped feed the gain for goods. However scrambled this year has been for consumer spending, retail on net has done well.

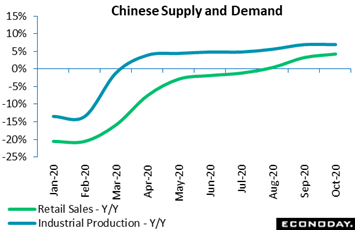

A country that on net has done well is China, posting consistently strong numbers and which is increasingly at the center of the global economy recovery. Industrial production in China has been especially strong with volumes up 0.78 percent on the month in October after rising 1.15 percent in September. Year-over-year, production held at a gain of 6.9 percent with the manufacturing component up 7.5 percent and, in special contrast to other economies, joined in the plus column by mining with a 3.5 percent rise. Retail sales in China have also been strong, up 0.68 percent on the month in currency terms after jumping 3.32 percent in September, and up 4.3 percent on the year, picking up from growth of 3.3 percent previously. The year-over-year sales increase was the third in a row and was broad-based across most major categories, including autos, clothing, furniture, building and decoration materials, communications equipment, and household non-durables. A country that on net has done well is China, posting consistently strong numbers and which is increasingly at the center of the global economy recovery. Industrial production in China has been especially strong with volumes up 0.78 percent on the month in October after rising 1.15 percent in September. Year-over-year, production held at a gain of 6.9 percent with the manufacturing component up 7.5 percent and, in special contrast to other economies, joined in the plus column by mining with a 3.5 percent rise. Retail sales in China have also been strong, up 0.68 percent on the month in currency terms after jumping 3.32 percent in September, and up 4.3 percent on the year, picking up from growth of 3.3 percent previously. The year-over-year sales increase was the third in a row and was broad-based across most major categories, including autos, clothing, furniture, building and decoration materials, communications equipment, and household non-durables.

Like China, Italy is a strong net exporter and despite substantial Covid effects the country's trade position has been on the climb, returning a seasonally adjusted surplus of €7.1 billion in data for September, up from €5.9 billion in August and easily the strongest showing of the year. The latest improvement was led by exports which rose 2.7 percent on the month for their fifth straight gain. Also contributing to the surplus were imports which declined 0.6 percent versus August for their first fall since April. Even so, exports were still 4.2 percent below their pre-lockdown level in February while imports were off 7.0 percent. That said, September's increase in exports was again reassuringly broad-based especially for capital goods but also including consumer goods. September's report puts Italy's third-quarter merchandise trade surplus at €19.2 billion, more than double the €9.5 billion recorded in the second quarter and which will almost certainly give a very useful boost to quarterly net exports. Like China, Italy is a strong net exporter and despite substantial Covid effects the country's trade position has been on the climb, returning a seasonally adjusted surplus of €7.1 billion in data for September, up from €5.9 billion in August and easily the strongest showing of the year. The latest improvement was led by exports which rose 2.7 percent on the month for their fifth straight gain. Also contributing to the surplus were imports which declined 0.6 percent versus August for their first fall since April. Even so, exports were still 4.2 percent below their pre-lockdown level in February while imports were off 7.0 percent. That said, September's increase in exports was again reassuringly broad-based especially for capital goods but also including consumer goods. September's report puts Italy's third-quarter merchandise trade surplus at €19.2 billion, more than double the €9.5 billion recorded in the second quarter and which will almost certainly give a very useful boost to quarterly net exports.

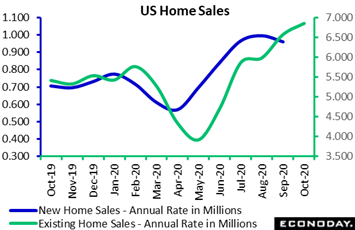

Sticking to the theme of favorable economic data, no data anywhere have shown the bursting "V" like home sales in the United States. Existing home sales continued to exceed expectations in October, up 4.3 percent to a 6.850 million annual rate that topped Econoday's consensus range and lifted year-over-year growth to 26.6 percent. Relative to the pre-pandemic month of February, existing home sales were up 18.9 percent. Prices have also been climbing, up 0.5 percent on the month for year-over-year appreciation of 15.5 percent. Confirmation of extremely bullish conditions is supply on the market which was down to only 2.5 months versus 2.7 months in September in data that usually trend in the 5-month area. Yet however thin supply is, it has yet to limit sales. Low interest rates and demographic changes tied to the pandemic are feeding what would appear to be unsustainable rates of growth, raising increasing questions over the effects of Federal Reserve policy. US data to watch in coming week will be new home sales which in the last report for September posted 32.1 percent annual growth. Sticking to the theme of favorable economic data, no data anywhere have shown the bursting "V" like home sales in the United States. Existing home sales continued to exceed expectations in October, up 4.3 percent to a 6.850 million annual rate that topped Econoday's consensus range and lifted year-over-year growth to 26.6 percent. Relative to the pre-pandemic month of February, existing home sales were up 18.9 percent. Prices have also been climbing, up 0.5 percent on the month for year-over-year appreciation of 15.5 percent. Confirmation of extremely bullish conditions is supply on the market which was down to only 2.5 months versus 2.7 months in September in data that usually trend in the 5-month area. Yet however thin supply is, it has yet to limit sales. Low interest rates and demographic changes tied to the pandemic are feeding what would appear to be unsustainable rates of growth, raising increasing questions over the effects of Federal Reserve policy. US data to watch in coming week will be new home sales which in the last report for September posted 32.1 percent annual growth.

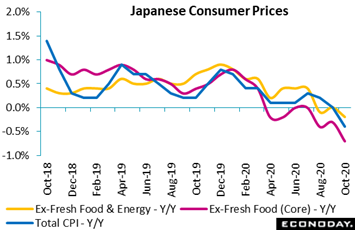

However much monetary policy may be raising values in the housing market or values in the financial markets, it hasn't been giving much lift at all to overall consumer prices. Japan once again offers the latest evidence. Price pressures weakened in October, with both headline and underlying measures falling and with most components weakening further. Japan's headline CPI fell 0.4 percent on the year in October after no change in September, and dropped 0.4 percent on the month after slipping 0.1 percent previously. Food price inflation slowed from 1.9 percent to 1.1 percent, while transportation and communication prices declined 0.9 percent. Core CPI, which excludes fresh food prices, fell 0.7 percent in October after dropping 0.3 percent in September, just below the consensus for a 0.6 percent decline, and fell 0.2 percent on the month after advancing 0.1 percent. The CPI excluding fresh food and energy prices declined 0.2 percent on the year in October after no change in September, and was flat on the month. Housing, utilities, clothes and footwear, medical care, and culture and recreation were among the categories to record weaker price changes. At its policy meeting last month, the Bank of Japan held its inflation forecasts mostly steady: core prices are expected fall 0.6 percent in fiscal year 2020 ending in March and then increase by 0.4 percent in fiscal year 2021 and by 0.7 percent in 2022. But progress towards the inflation target remains slow to say the very least and may well strengthen the case for additional policy measures. The BoJ's next policy meeting is set for mid-December. However much monetary policy may be raising values in the housing market or values in the financial markets, it hasn't been giving much lift at all to overall consumer prices. Japan once again offers the latest evidence. Price pressures weakened in October, with both headline and underlying measures falling and with most components weakening further. Japan's headline CPI fell 0.4 percent on the year in October after no change in September, and dropped 0.4 percent on the month after slipping 0.1 percent previously. Food price inflation slowed from 1.9 percent to 1.1 percent, while transportation and communication prices declined 0.9 percent. Core CPI, which excludes fresh food prices, fell 0.7 percent in October after dropping 0.3 percent in September, just below the consensus for a 0.6 percent decline, and fell 0.2 percent on the month after advancing 0.1 percent. The CPI excluding fresh food and energy prices declined 0.2 percent on the year in October after no change in September, and was flat on the month. Housing, utilities, clothes and footwear, medical care, and culture and recreation were among the categories to record weaker price changes. At its policy meeting last month, the Bank of Japan held its inflation forecasts mostly steady: core prices are expected fall 0.6 percent in fiscal year 2020 ending in March and then increase by 0.4 percent in fiscal year 2021 and by 0.7 percent in 2022. But progress towards the inflation target remains slow to say the very least and may well strengthen the case for additional policy measures. The BoJ's next policy meeting is set for mid-December.

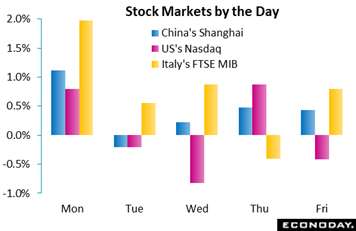

China's industrial production and retail sales data, and their indications of strength, gave the Shanghai a lift in a Monday session that in the US saw strength for the Nasdaq after Moderna reported a 94.5 percent efficacy rate for its Covid vaccine, offering the latest hope that the end of the pandemic is in sight. But markets were mixed at midweek as the play between vaccine prospects and rising Covid cases shifted toward the latter, a reminder that restrictions and partial lockdowns are substantial short-term risks for economic performance. Helping the markets during the week was increased stimulus talk, whether in the US amid reports that Senate Majority Leader Mitch McConnell and Senate Minority Leader Chuck Schumer are resuming negotiations or from Europe as market chatter rises for new asset purchases by the European Central Bank. Also raising talk of course are Donald Trump's continuing efforts at winning a second term, moves claiming pervasive voting fraud that, at least yet, haven't had much visible impact on share prices. The week's best performer was Italy's FTSE MIB, up 3.8 percent in a vaccine echo of sharp gains in the prior week for Spain's Ibex. China's industrial production and retail sales data, and their indications of strength, gave the Shanghai a lift in a Monday session that in the US saw strength for the Nasdaq after Moderna reported a 94.5 percent efficacy rate for its Covid vaccine, offering the latest hope that the end of the pandemic is in sight. But markets were mixed at midweek as the play between vaccine prospects and rising Covid cases shifted toward the latter, a reminder that restrictions and partial lockdowns are substantial short-term risks for economic performance. Helping the markets during the week was increased stimulus talk, whether in the US amid reports that Senate Majority Leader Mitch McConnell and Senate Minority Leader Chuck Schumer are resuming negotiations or from Europe as market chatter rises for new asset purchases by the European Central Bank. Also raising talk of course are Donald Trump's continuing efforts at winning a second term, moves claiming pervasive voting fraud that, at least yet, haven't had much visible impact on share prices. The week's best performer was Italy's FTSE MIB, up 3.8 percent in a vaccine echo of sharp gains in the prior week for Spain's Ibex.

Economic data appear to be at a pivot point, from comparatively favorable results in October to possibly unfavorable results in November. Vaccine progress of course brightens the longer outlook but isn't immediate enough to support ongoing economic activity, especially during new rounds of restrictions. How central banks react will be worth watching; should they move, the tool to turn to would appear to be, not negative rates, but more quantitative easing.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

The week is expected to open on down notes, specifically the PMI composite flashes from France and the UK where readings on services are expected to be pulled into deep lockdown contraction. Following the PMIs, the week will feature a run of sentiment data out of Europe all of which is also expected to show Covid-related declines: French business climate on Tuesday, German Ifo business climate also on Tuesday, and Germany GfK consumer climate on Thursday. US consumer confidence on Tuesday is also expected to decline, in part on Covid and in part on the US election. The week be heavy with US data highlighted by durable goods and international trade in goods, both on Wednesday and both expected to be consistent with slowing growth in contrast to new home sales which will also be posted on Wednesday and where substantial strength is the expectation. The week ends on Friday with the French CPI and the first inflation reading on the Covid-hit month of November.

French PMI Composite Flash for November (Mon 08:15 GMT; Mon 09:15 CET; Mon 03:15 EST)

Consensus Forecast, Composite: 34.6

Consensus Forecast, Manufacturing: 49.8

Consensus Forecast, Services: 38.0

Lockdowns are expected to depress France's services PMI in November, to a consensus 38.0 which would be the weakest showing since May. Manufacturing is expected to hold much more steady, at a consensus 49.8.

German PMI Composite Flash for November (Mon 08:30 GMT; Mon 09:30 CET; Mon 03:30 EST)

Consensus Forecast, Composite: 50.1

Consensus Forecast, Manufacturing: 56.0

Consensus Forecast, Services: 46.3

Manufacturing, posting mid-50s growth, has been far out in front of the German PMIs with November, despite the month's lockdowns, seen at a very strong 56.0. Services, in contrast, are expected to show some Covid effects, seen falling further below breakeven 50 to a consensus 46.3.

UK PMI Composite Flash for November (Mon 09:30 GMT; Mon 04:30 EST)

Consensus Forecast, Composite: 44.5

Consensus Forecast, Manufacturing: 50.0

Consensus Forecast, Services: 42.5

Substantial drop-offs, tied to lockdowns, are expected for the November PMIs, falling from the low-to-mid 50s to the low 40s for services and to the 50-breakeven level for manufacturing.

US PMI Composite Flash for November (Mon 14:45 GMT; Mon 09:45 EST)

Consensus Forecast, Composite: 55.6

Consensus Forecast, Manufacturing: 53.1

Consensus Forecast, Services: 55.8

Both the manufacturing and services samples for the US have been holding steady with services in the mid-to-high 50s and manufacturing in the mid-to-low 50s. More of the same is expected for November's flashes: Econoday's services consensus is 55.8 with manufacturing seen at 53.1.

French Business Climate Indicator for November (Tue 07:45 GMT; Tue 08:45 CET; Tue 02:45 EST)

Consensus Forecast, Manufacturing: 91

Manufacturing sentiment is expected to decrease to 91 in November versus October's lower-than-expected 93.

German Ifo Business Climate Indicator for November (Tue 09:00 GMT; Tue 10:00 CET; Tue 04:00 EST)

Consensus Forecast: 90.1

Economic sentiment has been flattening and edged lower in October to 92.7 which was still more than 3 points short of its pre-pandemic level. November's consensus, reflecting lockdown effects, is a move backward to 90.1.

US Consumer Confidence Index for November (Tue 15:00 GMT; Tue 10:00 EST)

Consensus Forecast: 98.0

Current job assessments were strong in October but not expectations, making for an unexpected decline in the consumer confidence index to 100.9. For November, Econoday's consensus is 98.0.

US Durable Goods Orders for October (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast: Month over Month: 0.9%

Consensus Forecast: Ex-Transportation - M/M: 0.4%

Consensus Forecast: Core Capital Goods Orders - M/M: 0.5%

Durable goods orders are expected to slow in October to a 0.9 percent increase following September's 1.9 percent gain. Core capital goods have been very solid in the US, at a 1.0 percent gain in September with October seen at a 0.5 percent gain.

US International Trade in Goods (Advance) for October (Wed 13:30 GMT; Wed 08:30 EST)

Consensus Forecast, Balance: -$80.8 billion

The US goods deficit (census basis) is expected to widen to $80.8 billion in October versus $79.4 billion in September. Goods imports were steady in September but up 2.7 percent from the pre-pandemic month of February; goods exports were up in September but down 11.0 percent versus February.

US New Home Sales for October (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Annual Rate: 970,000

New home sales have been soaring this year but did slow to a 959,000 annual rate in September from August's 994,000. Econoday's consensus for October is 970,000.

Germany: GfK Consumer Climate for November (Thu 07:00 GMT; Thu 08:00 CET; Thu 02:00 EST)

Consensus Forecast: -2.8

GfK's survey for October was lower than expected, at minus 3.1 with November's consensus at minus 2.8.

French CPI, Preliminary November (Fri 07:45 GMT: Fri 08:45 CET; Fri 02:45 EST)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 0.1%

Offering a very early reading on inflation in the month of November, French consumer prices are expected to post minimal 0.1 percent gains, both on the month and on the year.

|