|

Vaccine rollouts can't come out fast enough for the global labor market, especially in the US where sharp slowing in Friday's employment report made for a downbeat week. It was the US Beige Book on Wednesday, the Federal Reserve's compilation of anecdotal commentary, that foreshadowed the week's big disappointment.

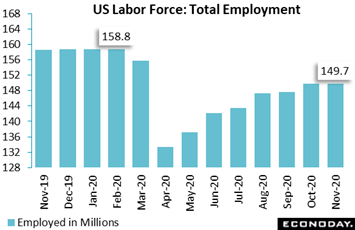

The Beige Book was right, describing the pace of the labor-market recovery as "incomplete" and "slow at best". In what is by far the lowest gain since May, nonfarm payrolls rose 245,000 in November which was less than half of Econoday's consensus for 500,000 though better, but not by much, than the low estimate of 200,000. The size of the monthly gain at 245,000, by comparison, is roughly what it was before the crisis hit, at 251,000 in February and averaging 227,500 in the four months heading into the pandemic. Weakness was broad including local government education which continued to trend lower, dropping 21,000 in the month. Contraction in education is a certain Covid effect also apparent in retail trade which shed 34,700 jobs reflecting restrictions and social distancing that are hitting the Christmas shopping season. Sectors that still posted growth but less of it included leisure and hospitality, rising only 31,000 following 270,000 and 413,000 in October and September, and also temporary help services, rising 32,200 in the month but well down from October's 123,000. For the record, those with jobs (including the self-employed and those not on payrolls) totaled 149.7 million in November; this is down 9.1 million from February and down 74,000 from October with the latter the first monthly decline of the recovery. The Beige Book was right, describing the pace of the labor-market recovery as "incomplete" and "slow at best". In what is by far the lowest gain since May, nonfarm payrolls rose 245,000 in November which was less than half of Econoday's consensus for 500,000 though better, but not by much, than the low estimate of 200,000. The size of the monthly gain at 245,000, by comparison, is roughly what it was before the crisis hit, at 251,000 in February and averaging 227,500 in the four months heading into the pandemic. Weakness was broad including local government education which continued to trend lower, dropping 21,000 in the month. Contraction in education is a certain Covid effect also apparent in retail trade which shed 34,700 jobs reflecting restrictions and social distancing that are hitting the Christmas shopping season. Sectors that still posted growth but less of it included leisure and hospitality, rising only 31,000 following 270,000 and 413,000 in October and September, and also temporary help services, rising 32,200 in the month but well down from October's 123,000. For the record, those with jobs (including the self-employed and those not on payrolls) totaled 149.7 million in November; this is down 9.1 million from February and down 74,000 from October with the latter the first monthly decline of the recovery.

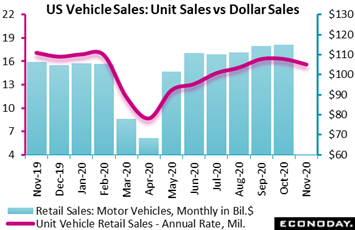

The employment report sets the tone for subsequent US data released over the course of the month, and the weakness can't be good news for retail sales during the very important month of November. Early hints of what to expect have been widely mixed with anecdotal news reports mostly pessimistic in contrast to Redbook's same-store sales index which literally exploded to the upside in the Black Friday week of November 28, jumping 9.2 percent compared to 2019's Black Friday week and adding to healthy gains earlier in the month. Not healthy, however, was November's drop in unit vehicle sales, also a leading indicator for retail sales and which fell to a 15.6 million annual rate from 16.3 million in October. Though November's rate is comparatively respectable for the pandemic, it nevertheless points to a monthly decline for motor vehicle sales as tracked in the government's retail sales report, the November edition of which will be released at mid-month, on December 16. A fair question, however, is whether labor-sparked weakness may prove to be isolated to the US as employment data from many other countries have been holding up better, including Canada where November employment growth, also released Friday, beat expectations at 62,100, a total roughly twice the size of monthly gains before the pandemic. The employment report sets the tone for subsequent US data released over the course of the month, and the weakness can't be good news for retail sales during the very important month of November. Early hints of what to expect have been widely mixed with anecdotal news reports mostly pessimistic in contrast to Redbook's same-store sales index which literally exploded to the upside in the Black Friday week of November 28, jumping 9.2 percent compared to 2019's Black Friday week and adding to healthy gains earlier in the month. Not healthy, however, was November's drop in unit vehicle sales, also a leading indicator for retail sales and which fell to a 15.6 million annual rate from 16.3 million in October. Though November's rate is comparatively respectable for the pandemic, it nevertheless points to a monthly decline for motor vehicle sales as tracked in the government's retail sales report, the November edition of which will be released at mid-month, on December 16. A fair question, however, is whether labor-sparked weakness may prove to be isolated to the US as employment data from many other countries have been holding up better, including Canada where November employment growth, also released Friday, beat expectations at 62,100, a total roughly twice the size of monthly gains before the pandemic.

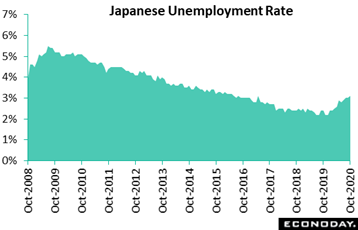

However much the US labor market has been gyrating this year, swings in other leading economies have remained comparatively limited, sometimes strikingly so. Unemployment in Japan edged only 1 tenth higher in October to 3.1 percent and was up only 6 tenths compared to pre-pandemic rates at the beginning of the year. This compares, for instance, to a 3.8 percentage point jump over the same period in the US rate ‒ which is more than six times the increase! Still October's results in Japan are a cause for concern: total year-over-year unemployment was up 510,000 versus 420,000 in October, while the number of employed was down by 930,000 versus October's 790,000. At their most recent policy meeting held in late October, officials at the Bank of Japan revised down their near-term growth forecasts, with the Japanese economy now expected to contract by 5.5 percent in the current fiscal year ending in March. Officials cautioned that risks are skewed to the downside and that any recovery is subject to high uncertainty associated with public health conditions. However much the US labor market has been gyrating this year, swings in other leading economies have remained comparatively limited, sometimes strikingly so. Unemployment in Japan edged only 1 tenth higher in October to 3.1 percent and was up only 6 tenths compared to pre-pandemic rates at the beginning of the year. This compares, for instance, to a 3.8 percentage point jump over the same period in the US rate ‒ which is more than six times the increase! Still October's results in Japan are a cause for concern: total year-over-year unemployment was up 510,000 versus 420,000 in October, while the number of employed was down by 930,000 versus October's 790,000. At their most recent policy meeting held in late October, officials at the Bank of Japan revised down their near-term growth forecasts, with the Japanese economy now expected to contract by 5.5 percent in the current fiscal year ending in March. Officials cautioned that risks are skewed to the downside and that any recovery is subject to high uncertainty associated with public health conditions.

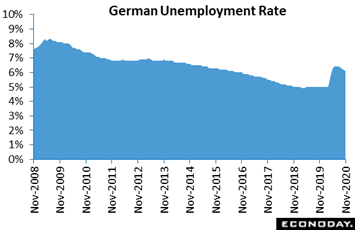

Another labor market where the damage has been contained is Germany whose unemployment rate actually dipped a tick for a second consecutive month to 6.1 percent in data for November, its lowest reading since April. In contrast to expectations for a renewed increase, joblessness fell a further 39,000 after falling 38,000 in October. Remarkably, despite Covid, unemployment has fallen some 122,000 to 2.817 million since it last increased in June. And job openings are beginning to build with vacancies up 11,000 after October's 18,000 increase. Another labor market where the damage has been contained is Germany whose unemployment rate actually dipped a tick for a second consecutive month to 6.1 percent in data for November, its lowest reading since April. In contrast to expectations for a renewed increase, joblessness fell a further 39,000 after falling 38,000 in October. Remarkably, despite Covid, unemployment has fallen some 122,000 to 2.817 million since it last increased in June. And job openings are beginning to build with vacancies up 11,000 after October's 18,000 increase.

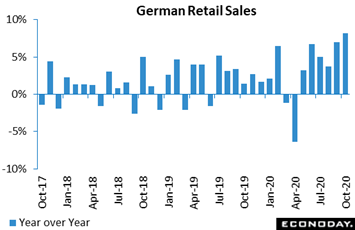

When people have jobs, people can spend money, so it should be no great surprise that retail sales in Germany have been on the upswing. Volumes in October jumped 2.6 percent for their best performance since May, in turn boosting yearly growth from 7.0 percent to 8.2 percent that put purchases 5.9 percent above their pre-lockdown level in February. Sales of food, drink and tobacco were up 7.3 percent on the year but were outpaced by non-food demand which expanded 9.0 percent. Internet and mail order again dominated, rising nearly 30 percent versus October 2019 while furnishings, household appliances and building supplies also enjoyed a particularly good month. Though October's rise put sales 1.9 percent above their third-quarter average, results in November will be held back by Germany's second nationwide lockdown that began at the start of the month. Although less aggressive than earlier in the year, the restrictions will inevitably reduce consumer traffic. When people have jobs, people can spend money, so it should be no great surprise that retail sales in Germany have been on the upswing. Volumes in October jumped 2.6 percent for their best performance since May, in turn boosting yearly growth from 7.0 percent to 8.2 percent that put purchases 5.9 percent above their pre-lockdown level in February. Sales of food, drink and tobacco were up 7.3 percent on the year but were outpaced by non-food demand which expanded 9.0 percent. Internet and mail order again dominated, rising nearly 30 percent versus October 2019 while furnishings, household appliances and building supplies also enjoyed a particularly good month. Though October's rise put sales 1.9 percent above their third-quarter average, results in November will be held back by Germany's second nationwide lockdown that began at the start of the month. Although less aggressive than earlier in the year, the restrictions will inevitably reduce consumer traffic.

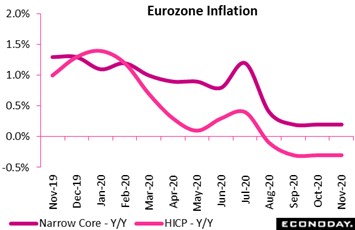

Lack of inflation may also be part of what's helping Germany's retail volumes, a country that, as part of its pandemic stimulus efforts, has cut value-added taxes. For the Eurozone as a whole, the harmonized index of consumer prices came in at an annual minus 0.3 percent in November, unchanged from both September and October for a nearly 6-year low. Inflation has now been sub-zero for four months in a row. The results have been biased down by not only Germany's VAT reduction, a 3 percentage point cut implemented in July, but also a 2 point cut in Ireland that went into effect in September. The Eurozone's narrowest core measure, which is also impacted by the VAT cuts and which excludes energy, food, alcohol and tobacco, also matched the previous period, at 0.2 percent and a record low. November's update reinforces concerns over inflation and will further firm market conviction that the European Central Bank will be easing again, somehow, when it meets in the coming week. Lack of inflation may also be part of what's helping Germany's retail volumes, a country that, as part of its pandemic stimulus efforts, has cut value-added taxes. For the Eurozone as a whole, the harmonized index of consumer prices came in at an annual minus 0.3 percent in November, unchanged from both September and October for a nearly 6-year low. Inflation has now been sub-zero for four months in a row. The results have been biased down by not only Germany's VAT reduction, a 3 percentage point cut implemented in July, but also a 2 point cut in Ireland that went into effect in September. The Eurozone's narrowest core measure, which is also impacted by the VAT cuts and which excludes energy, food, alcohol and tobacco, also matched the previous period, at 0.2 percent and a record low. November's update reinforces concerns over inflation and will further firm market conviction that the European Central Bank will be easing again, somehow, when it meets in the coming week.

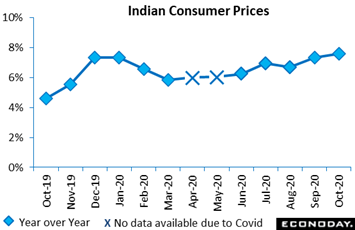

But, in what is perhaps good news hinting at the possibility of normalcy, lack of inflation isn't universal in the global economy, not in India anyway. The Reserve Bank of India, which met on Friday, left its benchmark repurchase rate unchanged at 4.00 percent. Although officials indicated they would like to ease policy further in order to provide additional support to economic recovery, persistently high inflation has tied their hands. Officials said key indicators are suggesting that India's recovery from the initial impact of the Covid-19 pandemic is "gaining traction". They also noted that rainfall pattens during the monsoon season have been favorable and suggest that the outlook for the agricultural sector is "bright". Officials forecast GDP to contract by 7.5 percent for the fiscal year ending March 2021 but expect activity to bounce back strongly in the following fiscal year, despite noting potential downside risks. Turning to the inflation outlook, officials noted that upward pressure has persisted and widened since their last policy meeting in October, with headline inflation moving further above RBI's target range of 2.0 to 6.0 percent. Officials attributed the price strength to a range of factors, including supply chain disruptions, excessive margins, and indirect taxes and they argue that further efforts are required to mitigate these factors. Yet, given the pandemic, they also indicated that they have no plans to raise rates, arguing that policy needs to remain accommodative for at least the next six months. But, in what is perhaps good news hinting at the possibility of normalcy, lack of inflation isn't universal in the global economy, not in India anyway. The Reserve Bank of India, which met on Friday, left its benchmark repurchase rate unchanged at 4.00 percent. Although officials indicated they would like to ease policy further in order to provide additional support to economic recovery, persistently high inflation has tied their hands. Officials said key indicators are suggesting that India's recovery from the initial impact of the Covid-19 pandemic is "gaining traction". They also noted that rainfall pattens during the monsoon season have been favorable and suggest that the outlook for the agricultural sector is "bright". Officials forecast GDP to contract by 7.5 percent for the fiscal year ending March 2021 but expect activity to bounce back strongly in the following fiscal year, despite noting potential downside risks. Turning to the inflation outlook, officials noted that upward pressure has persisted and widened since their last policy meeting in October, with headline inflation moving further above RBI's target range of 2.0 to 6.0 percent. Officials attributed the price strength to a range of factors, including supply chain disruptions, excessive margins, and indirect taxes and they argue that further efforts are required to mitigate these factors. Yet, given the pandemic, they also indicated that they have no plans to raise rates, arguing that policy needs to remain accommodative for at least the next six months.

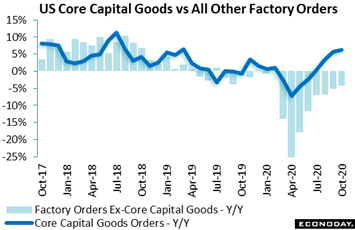

Sticking to the theme of normalcy, however much employment in the US may be slowing, business investment is rising quite strongly. The blue line of the accompanying graph tracks year-over-year change in core orders of capital goods (nondefense ex-aircraft); at $70.1 billion, orders were up 6.2 percent in October and were up 5.4 percent versus February. By contrast, the blue columns of the graph, which track all factory orders outside of core capital goods, were down 4.2 percent on the year and at $480.8 billion were, compared to February, down 4.5 percent. Telling a similar story are domestic orders for foreign-made capital goods, in this case excluding only related vehicles. Imports of capital goods climbed 2.5 percent in October to $56.9 billion and were up a very sizable 9.4 percent compared to February. And making this more striking is that measures of business investment outside of the US have not been showing this kind of strength at all, underscored by a 12.5 percent pandemic decline so far (relative to February) in foreign purchases of US capital goods. Should vaccine rollouts prove successful and timely, US businesses may, for productive output, be well positioned relative to their international competitors. Sticking to the theme of normalcy, however much employment in the US may be slowing, business investment is rising quite strongly. The blue line of the accompanying graph tracks year-over-year change in core orders of capital goods (nondefense ex-aircraft); at $70.1 billion, orders were up 6.2 percent in October and were up 5.4 percent versus February. By contrast, the blue columns of the graph, which track all factory orders outside of core capital goods, were down 4.2 percent on the year and at $480.8 billion were, compared to February, down 4.5 percent. Telling a similar story are domestic orders for foreign-made capital goods, in this case excluding only related vehicles. Imports of capital goods climbed 2.5 percent in October to $56.9 billion and were up a very sizable 9.4 percent compared to February. And making this more striking is that measures of business investment outside of the US have not been showing this kind of strength at all, underscored by a 12.5 percent pandemic decline so far (relative to February) in foreign purchases of US capital goods. Should vaccine rollouts prove successful and timely, US businesses may, for productive output, be well positioned relative to their international competitors.

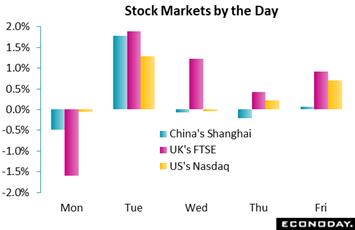

However high Covid cases may be rising (especially in the US) and however much the employment recovery may be slowing (yes, especially in the US) global stock markets continue to post solid results ‒ especially in the US! The pending rollout of the Pfizer-BioNTech vaccine was a plus throughout the week though Monday opened on the defensive amid reports that the Trump Administration may add two major Chinese firms, chip-maker SMIC and energy producer CNOOC, to a list of companies controlled by the Chinese military. Holding down the FTSE on Monday were worries over EU-UK Brexit talks though these worries, which tripped a fall in sterling, then started to give the FTSE a lift as the week unfolded. The week ended with Brexit still completely up in the air in contrast to tangible promise for a US fiscal deal as congressional and senate leaders on both sides, following the weak US employment report, sounded unusually accommodative; Democrats are proposing a package totaling in the $900 billion range. US indexes ended the week at record highs including the Nasdaq which posted a weekly gain of 2.1 percent for a year-to-date gain of no less than 38.9 percent. However high Covid cases may be rising (especially in the US) and however much the employment recovery may be slowing (yes, especially in the US) global stock markets continue to post solid results ‒ especially in the US! The pending rollout of the Pfizer-BioNTech vaccine was a plus throughout the week though Monday opened on the defensive amid reports that the Trump Administration may add two major Chinese firms, chip-maker SMIC and energy producer CNOOC, to a list of companies controlled by the Chinese military. Holding down the FTSE on Monday were worries over EU-UK Brexit talks though these worries, which tripped a fall in sterling, then started to give the FTSE a lift as the week unfolded. The week ended with Brexit still completely up in the air in contrast to tangible promise for a US fiscal deal as congressional and senate leaders on both sides, following the weak US employment report, sounded unusually accommodative; Democrats are proposing a package totaling in the $900 billion range. US indexes ended the week at record highs including the Nasdaq which posted a weekly gain of 2.1 percent for a year-to-date gain of no less than 38.9 percent.

The need for a US fiscal package is being made more urgent by the year-end runoff of emergency unemployment benefits, not to mention Covid which is hitting the US particularly hard right now. The play between vaccination immunity and ongoing Covid effects looks to be, by far, the dominant theme of the 2021 global economy, at least for the first half of the year. The question for investors, perhaps, is whether the stock market has or has yet to price in the post-Covid economy.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

Market-moving numbers open Monday in China with the November update on the nation's mighty trade situation; expectations are pointing to prodigious growth once again centered in exports. Chinese consumer price data follow on Wednesday and here, in line with global price trends, only limited strength is the expectation. Germany data could move the markets in the week beginning on Monday with the nation's industrial production report followed on Tuesday with analyst expectations as compiled by December's ZEW report ‒ across the board slowing is expected. Central bank meetings are set for Wednesday with the Bank of Canada followed on Thursday by the European Central Bank; no rate moves are expected but the banks' additional tools could offer some surprises. Japanese machinery orders, set for Tuesday, are always worth watching, however weak they've been, and likewise for Thursday's US consumer prices where weakness has been the uninterrupted theme. UK data, given the very final denouement of Brexit, will be coming to even sharper focus with Thursday to see GDP data for the month of October. The week ends with consumer sentiment on Friday and how US psychology has or has not been affected by vaccines and elections.

Chinese Merchandise Trade Balance for November (Estimated for Monday, Release Time Not Set)

Consensus Forecast: US$53.0 billion

Consensus Forecast: Exports - Y/Y: 11.8%

Consensus Forecast: Imports - Y/Y: 6.3%

Exports have been climbing strongly, up 11.4 percent on the year in October with an increase of 11.8 percent expected for November. Imports were up an annual 4.7 percent in October and are seen in November at plus 6.3 percent. November's surplus is expected to come in at US$53.0 billion after October's $58.44 billion.

German Industrial Production for October (Mon 07:00 GMT; Mon 08:00 CET; Mon 02:00 EST)

Consensus Forecast, Month over Month: 0.7%

A percent 0.7 monthly increase is expected for German industrial production in October following a 1.6 percent rise in September. Year-over-year, production in September was still down 7.2 percent.

Germany: ZEW Survey for December (Tue 10:00 GMT; Tue 11:00 CET; Tue 05:00 EST)

Consensus Forecast, Current Conditions: -69.0

Consensus Forecast, Economic Sentiment: 35.0

Current conditions in Germany were still deeply below pre-pandemic levels in November, at minus 64.3 with further deterioration to minus 69.0 expected for December. Economic sentiment was also disappointing in October, falling sharply to plus 39.0 with November's consensus at plus 35.0.

Japanese Machinery Orders for October (Tue 23:50 GMT; Wed 08:50 JST; Tue 18:50 EST)

Consensus Forecast, Year over Year: -11.6%

Machinery orders fell back in September, down 11.5 percent on the year and are expected to be down 11.6 percent in October.

Chinese CPI for November (Wed 01:30 GMT; Wed 09:30 CST; Tue 20:30 EST)

Consensus Forecast, Year over Year: 0.8%

Chinese consumer prices are expected to increase 0.8 percent on the year in November, which would compare with a plus 0.5 percent annual rate in October.

Bank of Canada Announcement (Wed 15:00 GMT; Wed 10:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.25%

The Bank of Canada is expected to hold rates steady at plus 0.25 percent. The BoC has bond-buying programs in place including for corporate bonds.

UK GDP for October (Thu 07:00 GMT; Thu 02:00 EST)

Consensus Forecast, Month over Month: 0.7%

Recovery slowed more than expected in September, to a monthly 1.1 percent versus 2.1 percent in August. October's consensus is for further slowing to plus 0.7 percent.

European Central Bank Policy Announcement (Thu 12:45 GMT; Thu 13:45 CET; Thu 07:45 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.0%

There are outside predictions for a move to negative territory though the consensus is no change for the refi rate which is already at zero. For QE, a €500bn increase is the call.

US CPI for November (Thu 13:30 GMT; Thu 08:30 EST)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 1.1%

US CPI Core, Less Food & Energy

Consensus Forecast, Month over Month: 0.2%

Consensus Forecast, Year over Year: 1.6%

Consumer prices have been disappointingly soft, and no significant improvement is expected for November. Econoday's consensus for the overall monthly rate is up 0.1 percent versus November's no change with the core seen at plus 0.2 percent also versus no change in November. Annual rates are expected at 1.1 percent overall and 1.6 percent for the core which would compare with October's 1.2 and 1.6 percent, respectively.

US Consumer Sentiment Index, Preliminary December (Fri 15:00 GMT; Fri 10:00 EST)

Consensus Forecast: 76.0

Will vaccine progress give a badly needed lift to consumer sentiment? Econoday's forecasters say no, at a consensus 76.0 versus November's 76.9.

|