|

A busy week was headlined by international trade reports that are increasingly dominated by an evermore dominating China; inflation reports also filled the week where unwanted weakness is the consistent global theme. But however much the here and now, outside of China, is less than great, the promise of the soon to come vaccines is helping to keep spirits up. And that's where we'll start, with the latest sentiment data from Germany.

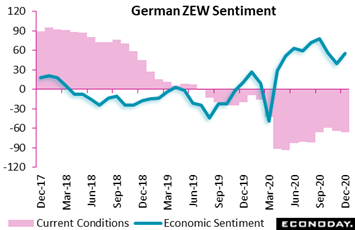

Covid-driven divergence between current conditions and economic sentiment (expectations) was the strong theme of the latest ZEW report, the former deteriorating further on lockdowns and the latter improving sharply on vaccine hopes. December's survey found a slight worsening in financial analysts' assessment of the current state of the German economy but a much more marked improvement in economic sentiment. The current conditions index slipped 2.2 points to a very weak minus 66.5, its second consecutive drop and a 5-month low as national lockdowns are extended. The measure now stands nearly 51 points short of its pre-pandemic level in February and more than 59 points below its long-run average. In contrast, economic sentiment (expectations) rose a solid 16.0 points to 55 though this reversed not even half of the cumulative 38.4 slide seen since September. Still, the sub-index is now 33.1 points above its long-term average and some 71.4 points stronger than the March low, reflecting the prospective German rollout of a vaccine over the next few months. Covid-driven divergence between current conditions and economic sentiment (expectations) was the strong theme of the latest ZEW report, the former deteriorating further on lockdowns and the latter improving sharply on vaccine hopes. December's survey found a slight worsening in financial analysts' assessment of the current state of the German economy but a much more marked improvement in economic sentiment. The current conditions index slipped 2.2 points to a very weak minus 66.5, its second consecutive drop and a 5-month low as national lockdowns are extended. The measure now stands nearly 51 points short of its pre-pandemic level in February and more than 59 points below its long-run average. In contrast, economic sentiment (expectations) rose a solid 16.0 points to 55 though this reversed not even half of the cumulative 38.4 slide seen since September. Still, the sub-index is now 33.1 points above its long-term average and some 71.4 points stronger than the March low, reflecting the prospective German rollout of a vaccine over the next few months.

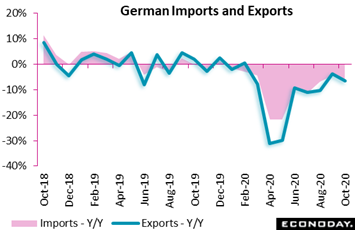

Vaccinations would appear certain to stimulate global trade going into which, however, was mostly stunted though improving, including in Germany. The nation's merchandise trade surplus rose to €18.2 billion in October from September's €17.6 billion; this was on the firm side of expectations and the largest surplus since February and just €2.0 billion below that month's pre-pandemic level. Exports were behind the improvement, rising 0.8 percent on the month to €104.8 billion for their sixth increase in a row that, however, still left a €7.7 billion shortfall versus February. Imports were up a subdued 0.3 percent at €86.6 billion, also their sixth advance in as many months, and stood €4.5 billion below their pre-lockdown mark. Vaccinations aside, both sides of Germany's balance sheet will be impacted by increasing lockdowns leaving prospects for the fourth quarter as a whole very unclear. But on the whole it was a good week for German economic data reflected in Econoday's consensus divergence index which rose 25 points to plus 20 to indicate that the week's results were tangibly above expectations. Vaccinations would appear certain to stimulate global trade going into which, however, was mostly stunted though improving, including in Germany. The nation's merchandise trade surplus rose to €18.2 billion in October from September's €17.6 billion; this was on the firm side of expectations and the largest surplus since February and just €2.0 billion below that month's pre-pandemic level. Exports were behind the improvement, rising 0.8 percent on the month to €104.8 billion for their sixth increase in a row that, however, still left a €7.7 billion shortfall versus February. Imports were up a subdued 0.3 percent at €86.6 billion, also their sixth advance in as many months, and stood €4.5 billion below their pre-lockdown mark. Vaccinations aside, both sides of Germany's balance sheet will be impacted by increasing lockdowns leaving prospects for the fourth quarter as a whole very unclear. But on the whole it was a good week for German economic data reflected in Econoday's consensus divergence index which rose 25 points to plus 20 to indicate that the week's results were tangibly above expectations.

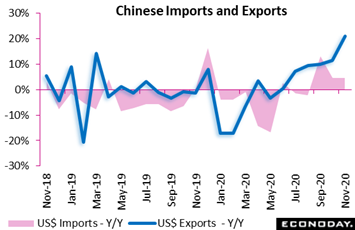

Well above expectations has been the trade performance of China, the one major economy that increasingly stands out for its strength. China's surplus in US dollar terms widened from $58.4 billion in October to a much higher-than-expected $75.4 billion in November for the best performance on record. Exports rose 21.1 percent year-over-year in November, strengthening from an increase of 11.4 percent in October and well above expectations, while imports rose 4.5 percent on the year, little changed from an increase of 4.7 percent previously and below expectations. Covid effects are stimulating demand for Chinese exports, whether personal protective gear or at-home electronics products. And despite US efforts to trim its deficit with China, the bilateral gap between the two nations keeps widening, to $37.3 billion in the month to represent nearly half of China's surplus. Well above expectations has been the trade performance of China, the one major economy that increasingly stands out for its strength. China's surplus in US dollar terms widened from $58.4 billion in October to a much higher-than-expected $75.4 billion in November for the best performance on record. Exports rose 21.1 percent year-over-year in November, strengthening from an increase of 11.4 percent in October and well above expectations, while imports rose 4.5 percent on the year, little changed from an increase of 4.7 percent previously and below expectations. Covid effects are stimulating demand for Chinese exports, whether personal protective gear or at-home electronics products. And despite US efforts to trim its deficit with China, the bilateral gap between the two nations keeps widening, to $37.3 billion in the month to represent nearly half of China's surplus.

Yet however strong China's economy is, it's not helping to lift prices in what is an ominous indication for global central bankers whose policy rates at best are mostly stuck at zero. China's consumer price index came in at minus 0.5 percent in November, which is down a full percentage point from plus 0.5 percent in October and the first negative annual showing since 2009. The month-over-month result was even worse, at minus 0.6 percent versus October's minus 0.3 percent. November's weakness was tied to food prices which fell 2.0 percent in a year-over-year reading that was skewed lower by a surge in pork prices this time last year amid a swine fever outbreak. In contrast, the change in non-food prices was more stable yet still in the negative column, though only just at minus 0.1 percent on the year. Producer prices in China were also released in the week and also below the zero line, at minus 1.5 percent on the year in November though improved from minus 2.1 percent in October. Fuel and power prices were down an annual 8.4 percent, production materials down 1.8 percent, and consumer goods down 0.8 percent. Producer prices in Japan were also released in the week, falling 1 tenth deeper into contraction at minus 2.2 percent; Japanese consumer prices will be a highlight (or likely lowlight) of the coming week. Yet however strong China's economy is, it's not helping to lift prices in what is an ominous indication for global central bankers whose policy rates at best are mostly stuck at zero. China's consumer price index came in at minus 0.5 percent in November, which is down a full percentage point from plus 0.5 percent in October and the first negative annual showing since 2009. The month-over-month result was even worse, at minus 0.6 percent versus October's minus 0.3 percent. November's weakness was tied to food prices which fell 2.0 percent in a year-over-year reading that was skewed lower by a surge in pork prices this time last year amid a swine fever outbreak. In contrast, the change in non-food prices was more stable yet still in the negative column, though only just at minus 0.1 percent on the year. Producer prices in China were also released in the week and also below the zero line, at minus 1.5 percent on the year in November though improved from minus 2.1 percent in October. Fuel and power prices were down an annual 8.4 percent, production materials down 1.8 percent, and consumer goods down 0.8 percent. Producer prices in Japan were also released in the week, falling 1 tenth deeper into contraction at minus 2.2 percent; Japanese consumer prices will be a highlight (or likely lowlight) of the coming week.

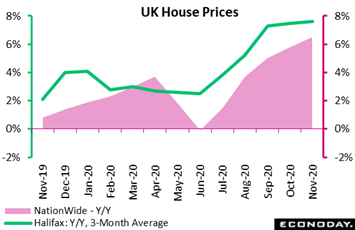

House prices are one area showing pronounced inflation in many countries, strength tied to low mortgage rates as well as pent-up lockdown demand and demographic changes tied to Covid. The Halifax index in the UK rose a surprisingly sharp 1.2 percent for a fifth straight monthly increase and the fourth time since June that prices have risen by more than 1 percent. Annual house price inflation, tracked here by the green line of the graph, edged a tick firmer to 7.6 percent, its highest mark since June 2016. As in October, the latest data reflected significantly stronger demand for larger homes and a move from urban to rural locations. More generally, overall UK mortgage approvals are at a 13-year high, getting a boost from the temporary increase in the Stamp Duty Land Tax threshold which expires at the end of March. The second lockdown which concluded last week would seem to have had little impact on market activity. The red area of the graph is Nationwide's index which, in UK data released in the prior week, stood at a 6.5 percent annual increase for the highest showing since January 2015. Economic data from the UK, despite lockdowns and the final and uncertain moves of Brexit, have been coming in much stronger than expectations, producing a score of plus 57 for Econoday's consensus divergence index. House prices are one area showing pronounced inflation in many countries, strength tied to low mortgage rates as well as pent-up lockdown demand and demographic changes tied to Covid. The Halifax index in the UK rose a surprisingly sharp 1.2 percent for a fifth straight monthly increase and the fourth time since June that prices have risen by more than 1 percent. Annual house price inflation, tracked here by the green line of the graph, edged a tick firmer to 7.6 percent, its highest mark since June 2016. As in October, the latest data reflected significantly stronger demand for larger homes and a move from urban to rural locations. More generally, overall UK mortgage approvals are at a 13-year high, getting a boost from the temporary increase in the Stamp Duty Land Tax threshold which expires at the end of March. The second lockdown which concluded last week would seem to have had little impact on market activity. The red area of the graph is Nationwide's index which, in UK data released in the prior week, stood at a 6.5 percent annual increase for the highest showing since January 2015. Economic data from the UK, despite lockdowns and the final and uncertain moves of Brexit, have been coming in much stronger than expectations, producing a score of plus 57 for Econoday's consensus divergence index.

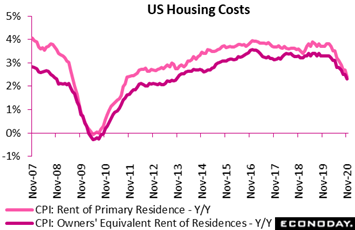

House prices in the US are showing very similar pressure to the UK yet, in a counter-intuitive twist, are not leading to higher costs for renters or perceived costs for homeowners. The US consumer price report came in soft as-expected in November, up only 0.2 percent on the month with no change in the annual rate at plus 1.2 percent. Rents held down prices, unchanged on the month and up only 2.4 percent on the year for the weakest showing in nearly 9 years. Rents make up 8 percent of the CPI while homeowners' equivalent rent, which track homeowners' estimated costs for renting their own homes, makes up a whopping 24 percent of the index. Like rents, this reading was also unchanged on the month and up 2.3 percent on the year for the lowest reading in more than 7 years. Such weakness was not happening during the subprime collapse a dozen years ago when home prices, as measured by the Case-Shiller 20-city index, fell nearly 20 percent at the same time, as seen on the graph, that the CPI measures were also tanking. Covid effects may be behind this anomaly as landlords may be reducing rents to accommodate their tenants in turn reducing what homeowner's would estimate their own rental costs would be. In any case, these two measures represent nearly 1/3 of all consumer prices and will act as a significant brake and a further source of frustration for the Federal Reserve and its elusive efforts to boost inflation. House prices in the US are showing very similar pressure to the UK yet, in a counter-intuitive twist, are not leading to higher costs for renters or perceived costs for homeowners. The US consumer price report came in soft as-expected in November, up only 0.2 percent on the month with no change in the annual rate at plus 1.2 percent. Rents held down prices, unchanged on the month and up only 2.4 percent on the year for the weakest showing in nearly 9 years. Rents make up 8 percent of the CPI while homeowners' equivalent rent, which track homeowners' estimated costs for renting their own homes, makes up a whopping 24 percent of the index. Like rents, this reading was also unchanged on the month and up 2.3 percent on the year for the lowest reading in more than 7 years. Such weakness was not happening during the subprime collapse a dozen years ago when home prices, as measured by the Case-Shiller 20-city index, fell nearly 20 percent at the same time, as seen on the graph, that the CPI measures were also tanking. Covid effects may be behind this anomaly as landlords may be reducing rents to accommodate their tenants in turn reducing what homeowner's would estimate their own rental costs would be. In any case, these two measures represent nearly 1/3 of all consumer prices and will act as a significant brake and a further source of frustration for the Federal Reserve and its elusive efforts to boost inflation.

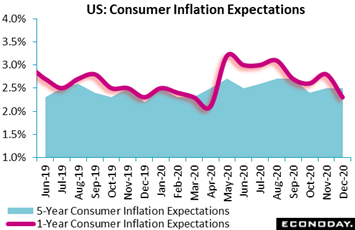

The Fed will be holding a policy meeting in the coming week when not only the CPI will be a major topic of discussion but also the University of Michigan's year-ahead measure of inflation expectations. This reading fell 5 tenths in the preliminary report for December to 2.3 percent for the sharpest monthly drop in 8-1/2 years and the most depressing level since 2.1 percent in the shutdown crisis of April. Fed officials, particularly Chair Jerome Powell, are centered on improving these expectations, saying they are the most important element in lifting inflation to target. But a hint that Covid may be at play, and that the sharp fall may prove only temporary, is that 5-year inflation expectations, spanning a time frame that would hopefully exclude Covid, were unchanged in the report at 2.5 percent. The Fed will be holding a policy meeting in the coming week when not only the CPI will be a major topic of discussion but also the University of Michigan's year-ahead measure of inflation expectations. This reading fell 5 tenths in the preliminary report for December to 2.3 percent for the sharpest monthly drop in 8-1/2 years and the most depressing level since 2.1 percent in the shutdown crisis of April. Fed officials, particularly Chair Jerome Powell, are centered on improving these expectations, saying they are the most important element in lifting inflation to target. But a hint that Covid may be at play, and that the sharp fall may prove only temporary, is that 5-year inflation expectations, spanning a time frame that would hopefully exclude Covid, were unchanged in the report at 2.5 percent.

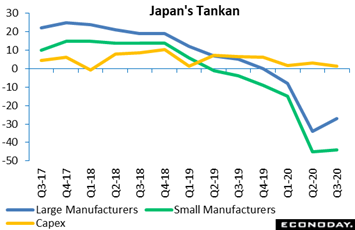

Aside from a full slate of central bank announcements, next week will also be heavy with indicators starting on Monday morning with Japan's Tankan survey for the fourth quarter. The results may well set the pace for the week's market openings in Asia and will reflect the play between expectations for medium-term relief from vaccinations and the impact of near-term lockdowns from rising Covid cases. In the prior report for the third quarter, sentiment remained deeply depressed among both large manufacturers and especially small manufacturers. Yet expectations for capital expenditures, reflecting hopes for an eventual end to the pandemic, held steady. Aside from a full slate of central bank announcements, next week will also be heavy with indicators starting on Monday morning with Japan's Tankan survey for the fourth quarter. The results may well set the pace for the week's market openings in Asia and will reflect the play between expectations for medium-term relief from vaccinations and the impact of near-term lockdowns from rising Covid cases. In the prior report for the third quarter, sentiment remained deeply depressed among both large manufacturers and especially small manufacturers. Yet expectations for capital expenditures, reflecting hopes for an eventual end to the pandemic, held steady.

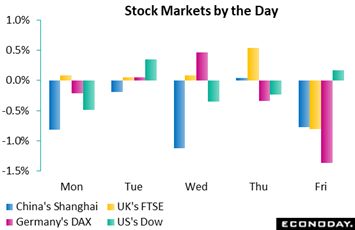

Most major Asian markets opened the week lower despite strong trade data from China. News that the US would impose sanctions on more Chinese officials over their Hong Kong crackdown weighed on markets as did prospects that Washington will delist Chinese companies which decline to submit to a 3-year audit and declare they are not owned or controlled by the Chinese government. News that the UK and EU had reached a side-deal on Northern Ireland failed to give risk appetite a lift on Tuesday, as prospects for a wider Brexit pact remained uncertain and focus turned to Prime Minister Boris Johnson's last-minute talks with European Commission President Ursula von der Leyen. On the pandemic front, the beginning of mass Covid-19 vaccinations in the UK was a plus, but weighing against it were reports that Germany might extend lockdown restrictions, a distinct negative for travel and leisure stocks which were Tuesday's worst performers. Wednesday was the worst day for the Shanghai, falling 1.1 percent after Chinese authorities banned more than 100 mobile apps found to include illegal content. Helping European shares were expectations that Thursday's European Central Bank policy meeting would produce new stimulus, which it did with a sharp increase in asset purchases via the pandemic emergency purchase programme from €1.35 trillion to €1.85 trillion, a €500 billion rise that matched the market consensus. News that EU leaders, after reaching a compromise with Hungary and Poland, finally agreed on a €1.8 trillion Covid recovery package failed to give a lift to European shares which instead were weighed down by building pessimism at week's end over a Brexit deal. And not helping US shares was the collapse of fiscal stimulus talks amid a deepening divide between the parties as Republicans took their efforts to scuttle the presidential election to the Supreme Court. Friday's Covid news in the US was mixed as Sanofi and GlaxSmithKline delayed rollout of their candidate while Pfizer and BioNTech received US approval to proceed with their vaccine. Most major Asian markets opened the week lower despite strong trade data from China. News that the US would impose sanctions on more Chinese officials over their Hong Kong crackdown weighed on markets as did prospects that Washington will delist Chinese companies which decline to submit to a 3-year audit and declare they are not owned or controlled by the Chinese government. News that the UK and EU had reached a side-deal on Northern Ireland failed to give risk appetite a lift on Tuesday, as prospects for a wider Brexit pact remained uncertain and focus turned to Prime Minister Boris Johnson's last-minute talks with European Commission President Ursula von der Leyen. On the pandemic front, the beginning of mass Covid-19 vaccinations in the UK was a plus, but weighing against it were reports that Germany might extend lockdown restrictions, a distinct negative for travel and leisure stocks which were Tuesday's worst performers. Wednesday was the worst day for the Shanghai, falling 1.1 percent after Chinese authorities banned more than 100 mobile apps found to include illegal content. Helping European shares were expectations that Thursday's European Central Bank policy meeting would produce new stimulus, which it did with a sharp increase in asset purchases via the pandemic emergency purchase programme from €1.35 trillion to €1.85 trillion, a €500 billion rise that matched the market consensus. News that EU leaders, after reaching a compromise with Hungary and Poland, finally agreed on a €1.8 trillion Covid recovery package failed to give a lift to European shares which instead were weighed down by building pessimism at week's end over a Brexit deal. And not helping US shares was the collapse of fiscal stimulus talks amid a deepening divide between the parties as Republicans took their efforts to scuttle the presidential election to the Supreme Court. Friday's Covid news in the US was mixed as Sanofi and GlaxSmithKline delayed rollout of their candidate while Pfizer and BioNTech received US approval to proceed with their vaccine.

The sharp gain underway in Chinese exports in contrast to imports is a recipe for national wealth but not for global wealth. Given that China's trading partners are still hurting, pressure may soon build for Beijing to stimulate domestic demand, specifically for foreign-made goods. Outside of China, national economies appear to be in limbo at year-end, as high Covid rates and related restrictions cloud the near-term outlook however much vaccines are lifting prospects for the eventual end to the pandemic.

**Contributing to this article were Jeremy Hawkins in London, Brian Jackson in Sydney, and Mace News in New York

A very heavy week of key data will open with Japan's fourth-quarter Tankan survey amid expectations for improvement from what were very weak showings in the third quarter. The week's most market-moving risks are on Wednesday with December's run of flash PMIs followed later on Wednesday and then on Thursday by no less than four major central bank announcements; yet even ahead of all this there will be a heavy run of news starting on Tuesday with November updates from China on industrial production and retail sales, both of which are expected to show strength. Industrial production from the US, which has not been nearly as strong as China, is also a Tuesday highlight followed on Wednesday by US retail sales for November and what will offer a definitive verdict on the success or failure of Black Friday. But it will be Japanese trade that opens Wednesday which will be followed by the great run of PMIs, starting with Japan followed by France, Germany and the UK. Expectations for these reports are widely mixed, reflecting the differing Covid effects on manufacturing and services. The US Federal Reserve will issue its policy announcement on Wednesday afternoon and there are no expectations of any changes, in line with expectations for Thursday announcements from the Bank of Japan and the Swiss National Bank. And though the consensus forecasts for Bank of England policy also see no change, the UK is facing the unique strain of Brexit risks. The week winds down on Friday with Japanese consumer prices, where greater disappointment is the theme, followed by Germany's Ifo survey which, in the prior two reports, faded significantly.

Japanese Tankan for Fourth Quarter (Mon 23:50 GMT; Mon 08:50 JST; Sun 18:50 EST)

Consensus Forecast, Large Manufacturers: -16

Consensus Forecast, Small Manufacturers: -37

Readings barely improved in the third quarter from record weakness in the second quarter. For the fourth quarter, forecasters see the index for large manufacturers improving to minus 16 from minus 27 to minus with the index for small manufacturers seen improving to minus 37 from a deeply contractionary minus 44.

Indian CPI for November (Mon 02:00 GMT; Mon 17:30 IST; Mon 07:00 EST)

Consensus Forecast, Year-over-Year: 7.10%

At 7.61 percent annually in October and 7.34 percent in September, consumer inflation moved further above the 6.0 percent policy ceiling and has been keeping the Reserve Bank of India from cutting rates further. A move back to a still elevated 7.10 percent is the consensus for November.

Chinese Industrial Production for November (Tue 02:00 GMT; Tue 10:00 CST; Mon 21:00 EST)

Consensus Forecast, Year over Year: 7.0%

The pace of recovery in industrial production held steady and strong in October, at 6.9 percent year-over-year with 7.0 percent the expectation for November.

Chinese Retail Sales for November (Tue 02:00 GMT; Tue 10:00 CST; Mon 21:00 EST)

Consensus Forecast, Year over Year: 5.0%

Year-over-year growth of 5.0 percent is expected for Chinese retail sales in November that would mark a significant rise from 4.3 percent in October and 3.3 percent in September.

Canadian Manufacturing Sales for October (Tue 13:30 GMT; Tue 08:30 EST)

Consensus Forecast, Month over Month: 0.6%

Manufacturing sales are expected to increase a monthly 0.6 percent in October after an as-expected 1.5 percent gain in September that, however, still left sales down 6.2 percent from a year ago and down 3.6 percent from February.

US Industrial Production for November (Tue 14:15 GMT; Tue 09:15 EST)

Consensus Forecast, Month over Month: 0.3%

US Manufacturing Output

Consensus Forecast, Month over Month: 0.4%

Industrial production is expected to increase 0.3 percent in November following October's 1.1 percent advance with manufacturing output seen up percent 0.4 following a 1.0 percent October rise. Despite strong gains in October, total production was still down 5.6 percent compared to February.

Japanese Merchandise Trade for November (Tue 23:50 GMT; Wed 08:50 JST; Tue 18:50 EST)

Consensus Forecast: ¥530.0 billion

Consensus Forecast, Imports Y/Y: -10.5%

Consensus Forecast, Exports Y/Y: 0.5%

Japanese trade has been improving noticeably, especially exports where year-over-year contraction narrowed to 0.2 percent in October. For November, exports are expected to increase 0.5 percent on the year with imports seen down 10.5 percent. November's surplus is expected to come in at ¥530.0 billion, down from October's larger-than-expected ¥872.9 billion.

Japanese PMI Flashes for December (Wed 00:30 GMT; Wed 09:30 JST; Tue 20:30 EST)

Consensus Forecast, Manufacturing: No consensus

Consensus Forecast, Services: No consensus

Japan's PMIs, since August, have been stuck in the mid-to-high 40s to indicate stubborn contraction, at 49.0 in November for manufacturing (revised from a 48.3 flash) and 47.8 for services (revised from 46.7). There are no consensus forecasts for December's flashes.

French PMI Flashes for December (Wed 08:15 GMT; Wed 09:15 CET; Wed 03:15 EST)

Consensus Forecast, Manufacturing: 49.8

Consensus Forecast, Services: 39.3

France's PMIs slumped very steeply during the lockdown month of November and are expected to be only slightly improved in December. The consensus for manufacturing is 49.8 versus November's 46.9 (revised from 49.1) and for services the consensus is a deeply weak 39.3 versus 38.8 (revised from 38.0).

German PMI Flashes for December (Wed 08:30 GMT; Wed 09:30 CET; Wed 03:30 EST)

Consensus Forecast, Manufacturing: 56.2

Consensus Forecast, Services: 45.0

Manufacturing has been far out in front of the German PMIs, posting mid-to-high 50s growth in the prior three reports with December seen at 56.2. Services, in contrast, had been hovering near the no-change 50 level before falling sharply in November to 46.0 (revised from 46.2); December's consensus is 45.0.

UK PMI Flashes for December (Wed 09:30 GMT; Wed 04:30 EST)

Consensus Forecast, Manufacturing: 55.9

Consensus Forecast, Services: 50.4

November lockdowns pulled the services PMI below 50 with December expected to see stabilization, at a consensus 50.4 versus 47.6 (revised from 45.8). Manufacturing is seen at 55.9 versus November's 55.6 (revised from 55.2).

US Retail Sales for November (Wed 12:30 GMT; Wed 08:30 EST)

Consensus Forecast, Month over Month: -0.3%

Consensus Forecast, Ex-Vehicles & Gas: 0.2%

Consensus Forecast, Control Group: 0.2%

Retail sales, benefiting from service spending which has been weak and giving consumers more to spend, have been solid despite a drop off in fiscal stimulus and unemployment benefits not to mention stubbornly negative Covid effects. November indications have been uneven including a sharp drop in unit auto sales and mixed signals on the success of Black Friday; expectations are looking for a 0.3 percent decrease overall, a 0.2 percent increase excluding vehicles and gas, and also a 0.2 percent increase for the control group.

US Federal Reserve Announcement (Wed 19:00 GMT; Wed 14:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Policy Range: 0.0% to 0.25%

With rates at the lower bound and negative rates ruled out, the Federal Reserve isn't expected to change the target for its federal funds policy rate centered at 0.125 percent between a zero and 0.25 percent corridor. The Fed is already committed to aggressive quantitative easing.

Bank of Japan Announcement (Anytime Thursday)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: -0.1%

The Bank of Japan, since early 2016, has kept its policy rate unchanged at minus 0.1 percent which once again is the expectation for December. The BoJ is committed to aggressive accommodation; additional stimulus measures could be on the table.

Swiss National Bank Monetary Policy Assessment (Thu 7:30 GMT; Thu 09:30 CET; Thu 03:30 EST)

Consensus Forecast, Change: 0.0 basis points

Consensus Forecast, Level: -0.75%

The Swiss National Bank is expected to keep its key deposit rate at minus 0.75 percent. At its last meeting in September, the bank made no change in its policy rate but re-affirmed its commitment to intervene "more strongly" in the FX markets to hold down the Swiss franc.

Bank of England Announcement (Thu 12:00 GMT; Thu 07:00 EST)

Consensus Forecast, Change: 0 basis points

Consensus Forecast, Level: 0.10%

Consensus Forecast: Asset Purchase Level: £895 billion

Brexit uncertainty and Covid affects are raising significant risks for the UK economy and, in the Bank of England's November meeting, triggered a further £150 billion lift in QE to £895 billion (gilts accounting for £875 billion). No change for QE is the consensus for December's meeting with no change also seen for Bank Rate which is at 0.10 percent.

Japanese Consumer Price Index for October (Thu 23:30 GMT; Fri 08:30 JST; Thu 18:30 EST)

Consensus Forecast Ex-Food, Year over Year: -0.9%

Price pressures at the consumer level are expected to sink deeper below zero, to minus 0.9 percent for November's ex-food year-over-year rate versus October's worse-than-expected minus 0.7 percent.

German Ifo Business Climate Indicator for December (Fri 09:00 GMT; Fri 10:00 CET; Fri 04:00 EST)

Consensus Forecast: 90.1

The business climate indicator, reflecting Covid effects, went into retreat in both October and November and a bit more of the same is expected for December, at a consensus 90.1 versus November's 90.7.

|