|

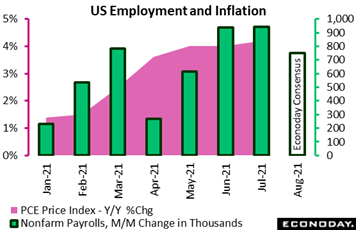

Forecasters are continuing to over-estimate the strength of global economic data, but this isn't keeping central banks from sounding hawkish or actually being hawkish. For the US, the two great pillars of monetary policy aren't raising new alarms: inflation isn't running away and employment growth appears to be in constructive recovery.

The most pressing question for Jerome Powell's speech to the annual Jackson Hole Forum on Friday was whether he would unmistakably signal the start of tapering. Maybe unmistakable was aiming too high but some hints were definitely there. High rates of inflation have led a rising number of Fed officials to call for tapering, though here Powell was less than hawkish, saying trimmed mean measures (which throw out highs and lows) indicate that the underlying trend is closer to the Fed's two percent target, not the 4.2 percent level that the Fed's main inflation guage, the PCE price index, is currently running at. When it comes to employment, Powell was more direct, pointing to "clear progress" though he warned that maximum employment is still a "considerable" ways off. In sum, it would probably take an unexpectedly weak August employment report or an exogenous event (sudden economic disaster) to kill the possibility of a tapering move at the September 21-22 FOMC. But quantitative easing is of course the mysterious half of Fed policy, the more direct and easily communicated monetary tool is the old-fashioned policy rate which Powell stressed -- unmistakably -- is not ready to be lifted any time soon. The most pressing question for Jerome Powell's speech to the annual Jackson Hole Forum on Friday was whether he would unmistakably signal the start of tapering. Maybe unmistakable was aiming too high but some hints were definitely there. High rates of inflation have led a rising number of Fed officials to call for tapering, though here Powell was less than hawkish, saying trimmed mean measures (which throw out highs and lows) indicate that the underlying trend is closer to the Fed's two percent target, not the 4.2 percent level that the Fed's main inflation guage, the PCE price index, is currently running at. When it comes to employment, Powell was more direct, pointing to "clear progress" though he warned that maximum employment is still a "considerable" ways off. In sum, it would probably take an unexpectedly weak August employment report or an exogenous event (sudden economic disaster) to kill the possibility of a tapering move at the September 21-22 FOMC. But quantitative easing is of course the mysterious half of Fed policy, the more direct and easily communicated monetary tool is the old-fashioned policy rate which Powell stressed -- unmistakably -- is not ready to be lifted any time soon.

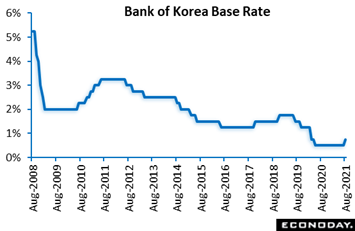

And old fashion is where the Bank of Korea comes in. Unlike other central banks, the BoK only dabbled in QE in what was a very initial and temporary response to last year's Covid onset. This central bank is now on easy street when it comes to telling the public what it's up to, having to adjust only a single policy base rate which, in the first such move of its kind in the global recovery, it lifted a notch, raising it 25 basis points to 0.75 percent. Ahead of the move, the consensus view was that rates would be left on hold due to pandemic uncertainty. This, however, was only the narrow majority view, with many also considering that a rate hike was in play given recent increases in headline inflation and concerns among senior officials that keeping rates too low for too long could raise the risk of financial instability. BoK Governor Lee Ju-yeol made it clear in recent weeks that he was in favor of beginning the withdrawal of policy accommodation.

The BoK's statement noted that strong export demand and investment have offset weakness in consumption spending associated with public health restrictions. Officials expressed confidence that consumption spending will rebound soon, helped by fiscal support and the domestic vaccine rollout, and that other areas of spending will remain strong. This all suggests that further rate hikes can be expeced from the BoK, that is if Covid developments don’t dictate otherwise.

Strong export demand together with strong import demand are big pluses for Hong Kong, whose trade reports this year, though inflated by easy comparisons with this time last year, do stand out. Hong Kong's exports rose 26.9 percent on the year in July after increasing 33.0 percent in June, while imports rose 26.1 percent after advancing 31.9 percent. Exports to mainland China and the US in July rose at close to the same pace as headline exports. A look at the graph shows that this year's rates of trade growth are far exceeding rates of trade contraction this time last year. Strong export demand together with strong import demand are big pluses for Hong Kong, whose trade reports this year, though inflated by easy comparisons with this time last year, do stand out. Hong Kong's exports rose 26.9 percent on the year in July after increasing 33.0 percent in June, while imports rose 26.1 percent after advancing 31.9 percent. Exports to mainland China and the US in July rose at close to the same pace as headline exports. A look at the graph shows that this year's rates of trade growth are far exceeding rates of trade contraction this time last year.

Judging from Hong Kong trade or Bank of Korea policy, one might get the impression that risks in Asia are all on the overheating side. But with Covid especially active in this region, quick reversals can't be ruled ouit. Retail sales in Australia fell 2.7 percent on the month in July after dropping 1.8 percent in June, with year-over-year growth (forget about easy comparisons) weakening from an increase of 2.9 percent to a decline of 3.1 percent. The monthly drop is the largest so far this year for Australia, reflecting the impact of public health restrictions that were in force in most of the country for all or part of the month in response to local Covid outbreaks. Sales fell particularly sharply in Australia's most populous state, New South Wales, dropping 8.9 percent on the month. Food retailing sales rose 2.3 percent in July, but sales fell on the month for other categories, with particularly large drops in sales for cafes, restaurants and takeaway food services, clothing, footwear and personal accessory retailing, and department stores. Restrictions have remained in force in New South Wales and have also been tightened elsewhere in recent weeks, suggesting that retail weakness is likely to continue. Judging from Hong Kong trade or Bank of Korea policy, one might get the impression that risks in Asia are all on the overheating side. But with Covid especially active in this region, quick reversals can't be ruled ouit. Retail sales in Australia fell 2.7 percent on the month in July after dropping 1.8 percent in June, with year-over-year growth (forget about easy comparisons) weakening from an increase of 2.9 percent to a decline of 3.1 percent. The monthly drop is the largest so far this year for Australia, reflecting the impact of public health restrictions that were in force in most of the country for all or part of the month in response to local Covid outbreaks. Sales fell particularly sharply in Australia's most populous state, New South Wales, dropping 8.9 percent on the month. Food retailing sales rose 2.3 percent in July, but sales fell on the month for other categories, with particularly large drops in sales for cafes, restaurants and takeaway food services, clothing, footwear and personal accessory retailing, and department stores. Restrictions have remained in force in New South Wales and have also been tightened elsewhere in recent weeks, suggesting that retail weakness is likely to continue.

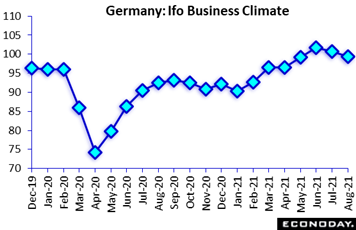

Covid is also still an issue of course in Europe including Germany where the vaccination rate has slowed over the last month or so. This is reflected in a fall in the GfK consumer survey and also the Ifo business survey which found overall economic sentiment deteriorating for a second month in a row. Ifo's headline climate indicator fell from 100.7 in July to 99.4 in August, a point short of the market consensus and a 3-month low. The was wholly attributable to the expectations component and masked a surprisingly large and seventh successive improvement in current conditions. Here, the sub-index rose from 100.4 to 101.4, its highest mark since May 2019. By contrast, expectations dropped a further 3.5 points to 97.5, their worst showing since February. Expectations have now declined 6.2 points since June and have fallen in three of the last five months as worries build about supply bottlenecks, not to mention the recent increase in Covid infections. Covid is also still an issue of course in Europe including Germany where the vaccination rate has slowed over the last month or so. This is reflected in a fall in the GfK consumer survey and also the Ifo business survey which found overall economic sentiment deteriorating for a second month in a row. Ifo's headline climate indicator fell from 100.7 in July to 99.4 in August, a point short of the market consensus and a 3-month low. The was wholly attributable to the expectations component and masked a surprisingly large and seventh successive improvement in current conditions. Here, the sub-index rose from 100.4 to 101.4, its highest mark since May 2019. By contrast, expectations dropped a further 3.5 points to 97.5, their worst showing since February. Expectations have now declined 6.2 points since June and have fallen in three of the last five months as worries build about supply bottlenecks, not to mention the recent increase in Covid infections.

Covid is also an issue for Italy where contagion readings are also elevated, yet Italy's economic data have been performing well above expectations. Business and manufacturing confidence did contract in August, but less so than expected. The former fell nearly 2 points to 114.2 for the first decline since November but only a 2-month low; it remains historically high and more than 15 points above its pre-pandamic level. Manufacturing confidence, at 113.4, likewise fell nearly 2 points and is at a 3-month low but also remains well above pre-pandemic levels. Consumer confidence is also above where it was in February last year and at 116.2 lost only 4 tenths in the month. These results may not be consistent with accelerating expansion but they are consistent with a limited loss of momentum. Covid is also an issue for Italy where contagion readings are also elevated, yet Italy's economic data have been performing well above expectations. Business and manufacturing confidence did contract in August, but less so than expected. The former fell nearly 2 points to 114.2 for the first decline since November but only a 2-month low; it remains historically high and more than 15 points above its pre-pandamic level. Manufacturing confidence, at 113.4, likewise fell nearly 2 points and is at a 3-month low but also remains well above pre-pandemic levels. Consumer confidence is also above where it was in February last year and at 116.2 lost only 4 tenths in the month. These results may not be consistent with accelerating expansion but they are consistent with a limited loss of momentum.

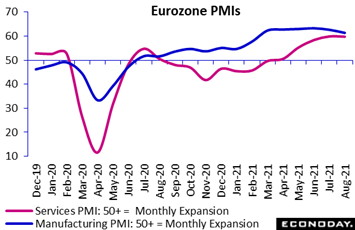

Slowing momentum is the wider signal from the round of August PMIs from Europe. The zone's manufacturing index eased from July's 62.8 to 61.5, a 6-month low but far above the breakeven level of 50. At 59.7, its services counterpart was barely changed from the previous period's 59.8. Aggregate new business across both samples similarly increased strongly but also failed to match July's pace. Still, backlogs climbed at a near-record rate and the rise in overall employment was the largest in 21 years. Concerns about the Delta variant were reflected in an easing in business confidence which, however, remained near record highs. Regionally in terms of composite output, growth in both France (55.9) and Germany (60.6) remained rapid but down versus July, a pattern also seen across the rest of the Eurozone. Slowing momentum is the wider signal from the round of August PMIs from Europe. The zone's manufacturing index eased from July's 62.8 to 61.5, a 6-month low but far above the breakeven level of 50. At 59.7, its services counterpart was barely changed from the previous period's 59.8. Aggregate new business across both samples similarly increased strongly but also failed to match July's pace. Still, backlogs climbed at a near-record rate and the rise in overall employment was the largest in 21 years. Concerns about the Delta variant were reflected in an easing in business confidence which, however, remained near record highs. Regionally in terms of composite output, growth in both France (55.9) and Germany (60.6) remained rapid but down versus July, a pattern also seen across the rest of the Eurozone.

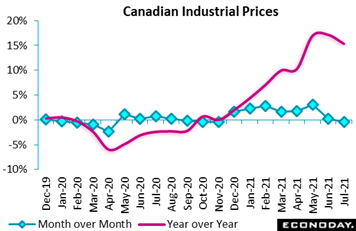

One area of stubborn concern in the PMI surveys is price pressure as both input costs and selling prices in the Eurozone data were among the most elevated on record. Though inflation readings in Canada have also been elevated, industrial product prices did fall an unexpected 0.4 percent in July. On the year, the IPPI was up 15.4 percent, nearly a point below expectations and marking a slowdown from June's 17.2 percent. July, however, was mostly a wood story. Declines were concentrated in just three of 21 commodity groups, led by a 23.0 percent plunge in wood product prices driven by a 37.7 percent drop in softwood lumber, the largest decrease on record. Lower demand was the driving force behind the decrease, as housing starts were down in the US, the largest purchaser of Canadian softwood. Excluding lumber and other wood products, producer prices in July would have risen 1.5 percent. Prices for iron and steel products climbed as did those for energy and petroleum products. Against the backdrop of ongoing supply chain disruptions, the risk of rising inflation expectations remains. One area of stubborn concern in the PMI surveys is price pressure as both input costs and selling prices in the Eurozone data were among the most elevated on record. Though inflation readings in Canada have also been elevated, industrial product prices did fall an unexpected 0.4 percent in July. On the year, the IPPI was up 15.4 percent, nearly a point below expectations and marking a slowdown from June's 17.2 percent. July, however, was mostly a wood story. Declines were concentrated in just three of 21 commodity groups, led by a 23.0 percent plunge in wood product prices driven by a 37.7 percent drop in softwood lumber, the largest decrease on record. Lower demand was the driving force behind the decrease, as housing starts were down in the US, the largest purchaser of Canadian softwood. Excluding lumber and other wood products, producer prices in July would have risen 1.5 percent. Prices for iron and steel products climbed as did those for energy and petroleum products. Against the backdrop of ongoing supply chain disruptions, the risk of rising inflation expectations remains.

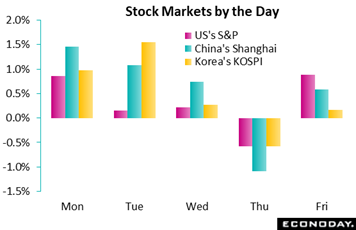

Investors bid up risk assets after Jerome Powell's comments on Friday which bridged the gap between too much recovery and certainty of immediate tapering and still considerable recovery with the possibility of immediate tapering. Chinese stocks were lifted through the week by stimulus indications from the People's Bank of China including promises on Tuesday to keep monetary policy stable and to boost credit growth for small business. Another big injection of reserves by the PBOC on Friday added to speculation that the central bank is set to cut required reserves to spur bank lending. A positive through the week, and one that had surprising legs, was US approval of the Pfizer/BioNTech Covid-19 vaccine, a formal move but one that's raised expectations for increased rates of vaccinations. South Korea's Kospi fell 0.6 percent on Thursday following the Bank of Korea's rate hike while also on Thursday, regional Fed presidents James Bullard and Robert Kaplan both reiterated their view that the Fed needs to start tapering asset purchases soon. Investors bid up risk assets after Jerome Powell's comments on Friday which bridged the gap between too much recovery and certainty of immediate tapering and still considerable recovery with the possibility of immediate tapering. Chinese stocks were lifted through the week by stimulus indications from the People's Bank of China including promises on Tuesday to keep monetary policy stable and to boost credit growth for small business. Another big injection of reserves by the PBOC on Friday added to speculation that the central bank is set to cut required reserves to spur bank lending. A positive through the week, and one that had surprising legs, was US approval of the Pfizer/BioNTech Covid-19 vaccine, a formal move but one that's raised expectations for increased rates of vaccinations. South Korea's Kospi fell 0.6 percent on Thursday following the Bank of Korea's rate hike while also on Thursday, regional Fed presidents James Bullard and Robert Kaplan both reiterated their view that the Fed needs to start tapering asset purchases soon.

Though Italy's sentiment results are consistent with limited loss of economic momentum, they beat expectations which is this country's consistent story reflected in Econoday's consensus divergence index which, at a level of 36, is very strong. But Italy is the exception with the week's news leaving the US at a marginal plus 6 and Canada at minus 3. France, pulled down by the country's PMI data, is at minus 13 for its lowest mark since early July. China is also at minus 13 while the UK, pulled down by weakness in prior weeks, is at minus 21. Eurozone data as whole are at minus 23 with Germany specifically at minus 24. Econoday's indexes have been shifting decidedly lower and point to the risk that economic forecasts, whether from central banks or private firms or international agencies, may have to be pulled lower.

**Contributing to this article were Jeremy Hawkins, Brian Jackson, Mace News, Max Sato, and Theresa Sheehan

A week that is expected to be capped by a very strong gain for US payrolls opens with July updates from Japan that are expected to show limited Covid effects: retail sales on Monday followed by unemployment and industrial production on Tuesday. A round of German updates will also highlight the week, beginning on Monday with consumer prices and then unemployment on Tuesday, both reports for August, and on Wednesday with retail sales for July. Expectations here are uneven as they are for Switzerland whose leading indicator will kick off the week on Monday followed late in the week by August consumer prices and second-quarter GDP. China’s PMIs could have outsized market impact if either the official CFLP, posted Tuesday, or the Caixan, posted Wednesday, slump further and dip below the breakeven 50 level to indicate outright contraction for the country’s manufacturing sector. Employment won’t be the only market-moving indicator posted in the US with consumer confidence on Tuesday, where a deep decline is expected, and ISM manufacturing on Wednesday where strong growth is the constant theme. Econoday's call for August nonfarm payrolls is 740,000 in what would follow 943,000 and 938,000 gains in July and June. Also of note will be August consumer prices from France and the Eurozone on Tuesday, first estimates for second-quarter GDP from India and Canada on Tuesday and the second quarter’s first GDP estimate from Australia on Wednesday.

Japanese Retail Sales for July (Sun 23:50 GMT; Mon 08:50 JST; Sun 19:50 EDT)

Consensus Forecast, Year over Year: 1.7%

Retail sales in July are expected to rise a year-over-year 1.7 percent versus June's subdued 0.1 percent pace that, nevertheless, was slightly better than expected.

KOF Swiss Leading Indicator for August (Mon 07:00 GMT; Mon 09:00 CEST; Mon 03:00 EDT)

Consensus Forecast: 122.5

KOF's leading indicator has fallen for two successive months with forecasters calling for a further decline in August, to 122.5 from July's 129.8.

German CPI, Preliminary for August (Mon 12:00 GMT; Mon 14:00 CEST; Mon 08:00 EDT)

Consensus Forecast, Month over Month: 0.1%

Consensus Forecast, Year over Year: 3.9%

Inflation accelerated much more sharply than expected in July, up 0.9 percent on the month for a 3.8 percent annual rate. For August, only a 0.1 percent monthly increase is expected which would, nevertheless, lift the annual rate to an expected 3.9 percent.

Japanese Unemployment Rate for July (Mon 23:30 GMT; Tue 08:30 JST; Mon 19:30 EDT)

Consensus Forecast, Unemployment Rate: 2.9%

Despite Covid restrictions, Japan's unemployment rate edged 1 tenth lower in June to a better-than-expected 2.9 percent with no change at that level the consensus for July.

Japanese Industrial Production for July (Mon 23:50 GMT; Tue 08:50 JST; Mon 19:50 EDT)

Consensus Forecast, Month over Month: -2.5%

Industrial production is expected to fall 2.5 percent on the month in July following a stronger-than-expected 6.2 percent jump in June that reflected that month's easing in Covid restrictions.

China: CFLP Manufacturing PMI for August (Tue 01:00 GMT; Tue 09:00 CST; Mon 21:00 EDT)

Consensus Forecast: 50.2

The government's official CFLP manufacturing PMI has been slowing noticeably, down 5 tenths in July and closer to the 50.0 breakeven line at 50.4. The consensus for August is 50.2.

French CPI, Preliminary August (Tue 06:45 GMT: Tue 08:45 CEST; Tue 02:45 EDT)

Consensus Forecast, Month over Month: 0.3%

Consensus Forecast, Year over Year: 1.6%

Consumer prices decelerated in July to a 1.2 percent annual rate from 1.5 percent in June. August's consensus is at 1.6 percent on the year and a 0.3 percent increase on the month.

German Unemployment Rate for August (Tue 07:55 GMT; Tue 09:55 CEST; Tue 03:55 EDT)

Consensus Forecast: 5.6%

After falling 2 tenths in July, Germany's unemployment rate is expected to fall another tenth in August to 5.6 percent.

Tue Aug-31 09:00 GMT

Eurozone HICP Flash for August (Tue 09:00 GMT; Tue 11:00 CEST; Tue 05:00 EDT)

Consensus Forecast, Year over Year: 2.8%

Underlying HICP

Consensus Forecast, Year over Year: 1.4%

The flash headline annual rate is seen rising 6 tenths in August to 2.8 percent. The underlying core rate is similarly expected to rise, up 7 tenths to 1.4 percent.

Indian Second-Quarter GDP (Tue 12:00 GMT; Tue 17:30 IST; Tue 08:00 EDT)

Consensus Forecast, Year over Year: 21.0%

Forecasters see second-quarter GDP (inflated by an easy comparison) coming in at year-over-year growth 21.0 percent versus growth of 1.6 percent in the first quarter.

Canadian Second-Quarter GDP (Tue 12:30 GMT; Tue 08:30 EDT)

Consensus Forecast, Annualized: 3.1%

A 3.1 percent annualized growth rate is the consensus for Canadian second-quarter GDP versus a 5.6 percent growth rate in the first quarter.

US Consumer Confidence Index for August (Tue 14:00 GMT; Tue 10:00 EDT)

Consensus Forecast: 123.0

July's 129.1 easily exceeded Econoday's high estimate for a second straight month but after the unexpected 11-point plunge in the rival consumer sentiment index, August's consensus for the consumer confidence index is a drop to 123.0.

Australian Second-Quarter GDP (Wed 01:30 GMT; Wed 11:30 AEST; Tue 21:30 EDT)

Consensus Forecast, Quarter over Quarter: 0.5%

Consensus Forecast, Year over Year: 9.2%

Second-quarter GDP is expected to rise a quarterly 0.5 percent versus a 1.8 percent rise in the first quarter. Year-over-year GDP is expected to rise 9.2 percent versus the first quarter's growth of 1.1 percent.

China: Caixin Manufacturing PMI for August (Wed 01:45 GMT; Wed 09:45 CST; Tue 21:45 EDT)

Consensus Forecast: 50.2

March's Caixan manufacturing PMI is expected to ease to 50.2 in August versus 50.3 in July and 50.6 in June.

German Retail Sales for July (Wed 06:00 GMT; Wed 08:00 CEST; Wed 02:00 EDT)

Consensus Forecast, Month over Month: -1.3%

Retail sales in July are expected to fall a monthly 1.3 percent after continuing to recover strongly in June when sales jumped 4.2 percent to more than double the market consensus.

US: ISM Manufacturing Index for August (Wed 14:00 GMT; Wed 10:00 EDT)

Consensus Forecast: 59.0

ISM manufacturing has been tracking at the very strong 60 line with a move lower to 59.0 the expectation for August.

Swiss CPI for August (Thu 06:30 GMT; Thu 08:30 CEST; Thu 02:30 EDT)

Consensus Forecast, Month over Month: 0.0%

Consensus Forecast, Year over Year: 0.8%

Consumer prices fell a monthly 0.1 percent in July which was expected as was the annual rate which rose a tenth to plus 0.7 percent. August's expectations are no change on the month for an annual rate of plus 0.8 percent.

Swiss Second-Quarter GDP (Thu 07:00 GMT; Thu 09:00 CEST; Thu 03:00 EDT)

Consensus Forecast, Quarter over Quarter: 1.9%

Consensus Forecast, Year over Year: 5.9%

Second-quarter GDP is expected to rise a quarterly 1.9 percent versus 0.5 percent contraction in the first quarter. On a year-over-year basis, GDP was also down 0.5 percent in the first quarter with this reading expected to accelerate to 5.9 percent in the second quarter.

China: Caixin Services PMI for August (Fri 01:45 GMT; Fri 09:45 CST; Thu 21:45 EDT)

Consensus Forecast: 52.3

March's Caixan services PMI is expected to firm ease noticeably to 52.3 in August versus July's 54.9.

Eurozone Retail Sales for July (Fri 09:00 GMT; Fri 11:00 CEST; Fri 05:00 EDT)

Consensus Forecast, Month over Month: -0.2%

Retail sales in July are expected to open the second quarter on a weak note at a monthly decline of 0.2 percent versus June's strong 1.5 percent rise.

US Employment Situation for August (Fri 12:30 GMT; Fri 08:30 EDT)

Consensus Forecast: Change in Nonfarm Payrolls: 740,000

Consensus Forecast: Unemployment Rate: 5.2%

A rise of 740,000 is Econoday's consensus for August nonfarm payrolls following exceptional monthly gains of 943,000 in July and 938,000 in June.

|